Key Insights

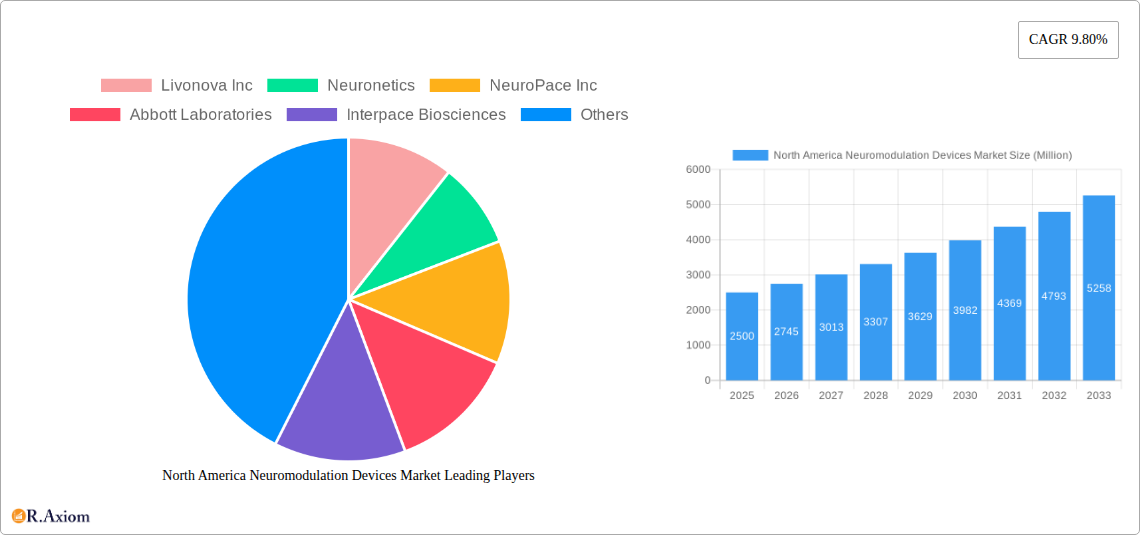

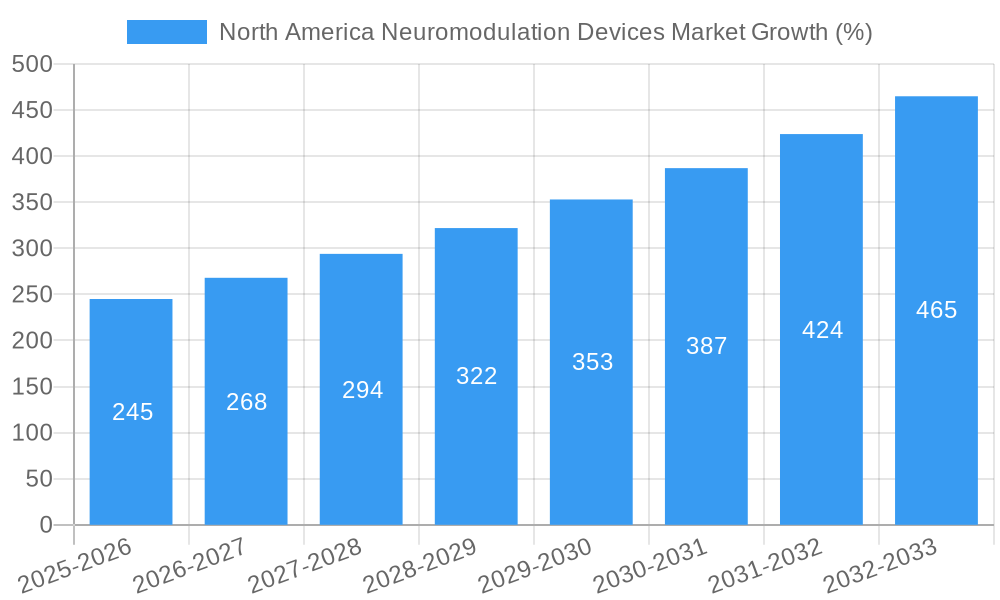

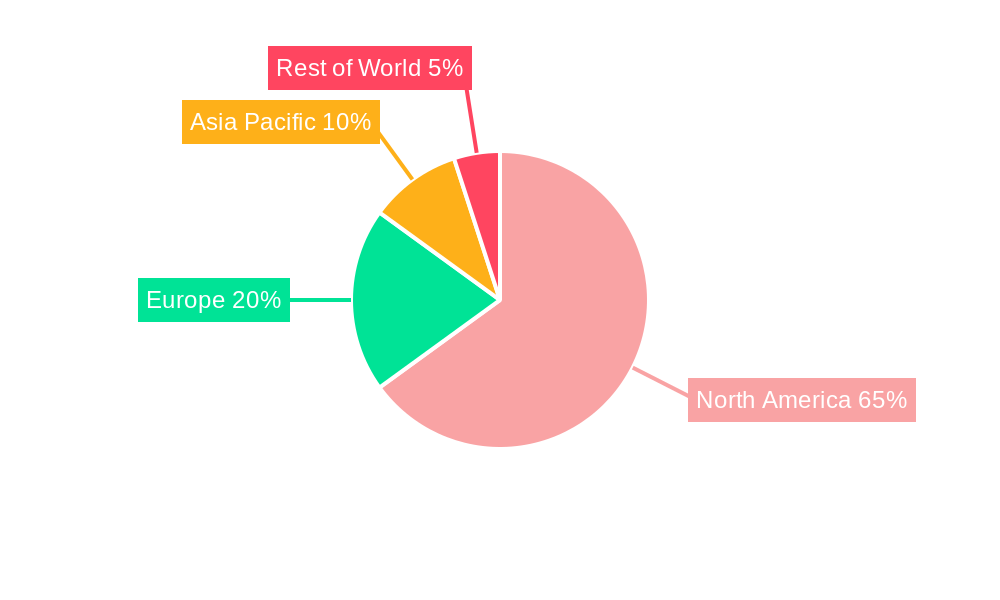

The North America neuromodulation devices market is experiencing robust growth, driven by the increasing prevalence of neurological disorders like Parkinson's disease, epilepsy, and chronic pain, coupled with advancements in device technology and minimally invasive surgical techniques. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR of 9.80% and a study period from 2019-2033), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several factors: an aging population susceptible to neurological conditions, rising healthcare expenditure, and growing awareness among patients and physicians regarding the benefits of neuromodulation therapies. The segment of implantable devices holds a larger market share compared to external devices, owing to their efficacy in providing long-term therapeutic benefits. Within applications, Parkinson's disease and chronic pain management are currently the leading segments, although epilepsy and dystonia are expected to witness considerable growth due to increasing research and development in targeted neuromodulation solutions. The competitive landscape is characterized by a mix of established players like Medtronic PLC and Boston Scientific Corporation and emerging companies focusing on innovative device technologies and improved treatment outcomes.

The United States dominates the North American market, accounting for a substantial portion of overall sales due to advanced healthcare infrastructure, higher adoption rates of advanced therapies, and increased research funding. However, Canada and Mexico are also projected to demonstrate moderate growth, driven by increasing healthcare investments and rising prevalence of neurological disorders in these regions. Restrictive regulatory pathways and high device costs remain key restraints, although ongoing innovation and cost-effective solutions are likely to mitigate these challenges over time. The market's future trajectory hinges on the successful development of next-generation devices with enhanced features, improved safety profiles, and targeted therapies, alongside greater insurance coverage and reimbursement policies to increase affordability and accessibility.

This detailed report provides a comprehensive analysis of the North America Neuromodulation Devices market, offering invaluable insights for stakeholders, investors, and industry professionals. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, growth drivers, challenges, and future opportunities. Key players such as Medtronic PLC, Abbott Laboratories, Boston Scientific Corporation, and others are analyzed, along with detailed segmentations across device types and applications.

North America Neuromodulation Devices Market Market Concentration & Innovation

The North American neuromodulation devices market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Medtronic PLC, Abbott Laboratories, and Boston Scientific Corporation are prominent examples, collectively commanding an estimated xx% of the market in 2025. However, the market also features several smaller, innovative companies actively contributing to market growth.

Innovation Drivers:

- Significant investments in R&D by leading companies are fueling the development of advanced neuromodulation devices with enhanced functionalities and improved efficacy.

- The increasing prevalence of neurological disorders is driving demand for effective treatment options, stimulating innovation in device design and therapy protocols.

- Technological advancements, including the integration of AI and machine learning in device programming and data analysis, are enhancing the personalization and effectiveness of neuromodulation therapies.

Regulatory Frameworks & Product Substitutes:

Stringent regulatory frameworks, primarily overseen by the FDA, ensure the safety and efficacy of neuromodulation devices. The approval process impacts market entry timelines and overall market dynamics. While few direct substitutes exist, alternative treatment approaches, such as pharmacological interventions, create competitive pressure.

End-User Trends & M&A Activities:

End-user preferences are increasingly shifting towards minimally invasive procedures and personalized treatment plans. The market has witnessed several significant mergers and acquisitions (M&A) in recent years, reflecting the strategic importance of this sector. While precise M&A deal values are confidential and vary greatly, the total value of deals in the historical period (2019-2024) is estimated at approximately xx Million. These activities aim to expand market reach, enhance product portfolios, and access new technologies.

North America Neuromodulation Devices Market Industry Trends & Insights

The North America neuromodulation devices market is experiencing robust growth, driven by the increasing prevalence of neurological and chronic pain disorders, along with technological advancements. The market is estimated to achieve a CAGR of xx% during the forecast period (2025-2033). Market penetration varies considerably across different applications, with higher rates observed in well-established segments like Parkinson's disease and epilepsy.

Technological advancements, such as closed-loop systems and advanced stimulation techniques, are transforming the landscape. Closed-loop systems adapt stimulation parameters in real-time based on patient responses, optimizing therapeutic benefits and minimizing side effects. However, this advanced technology often commands higher device costs, limiting wider adoption.

Consumer preferences are heavily influenced by the safety and efficacy of treatments, the invasiveness of procedures, and the long-term cost implications. The competitive dynamics are characterized by both fierce rivalry among established players and the emergence of innovative startups. The entry of new players is continuously shaping the pricing strategies, product features, and service offerings of established companies.

Dominant Markets & Segments in North America Neuromodulation Devices Market

The United States currently dominates the North American neuromodulation devices market, driven by factors such as high healthcare expenditure, a large aging population, and substantial investments in healthcare infrastructure. Canada presents a significant, albeit smaller, market.

Dominant Segments:

Device Type: Implantable devices, specifically deep brain stimulators (DBS) and spinal cord stimulators (SCS), account for a significant majority of the market share. External devices are gaining traction, particularly for pain management applications, offering non-invasive alternatives with shorter treatment durations.

Application: Parkinson's disease and epilepsy are the largest application segments, followed by chronic pain management (including diabetic neuropathy, and other conditions) and depression. The dystonia segment is expected to show significant growth in the forecast period. The market for other applications is also steadily expanding, demonstrating promising avenues for future expansion.

Key Drivers:

- High prevalence of neurological disorders across North America.

- Growing demand for effective and minimally invasive treatments.

- Favorable reimbursement policies for neuromodulation therapies.

- Advances in neurostimulation technologies with better treatment outcomes.

North America Neuromodulation Devices Market Product Developments

Recent years have witnessed significant advancements in neuromodulation device technology, focusing on improved precision, personalization, and minimally invasive procedures. Closed-loop systems, advanced stimulation patterns, and wireless technologies are transforming the field, enabling more targeted and effective treatments. The integration of advanced data analytics and machine learning tools allows clinicians to monitor device performance and adjust therapies in real-time. These improvements are enhancing patient outcomes while simultaneously enhancing competitive advantages for companies.

Report Scope & Segmentation Analysis

This report segments the North America Neuromodulation Devices market across device type and application:

Device Type:

Implantable Devices: This segment comprises deep brain stimulators (DBS), spinal cord stimulators (SCS), vagus nerve stimulators (VNS), and other implantable devices. This segment is projected to maintain a substantial share of the market, driven by the efficacy of these therapies for chronic conditions. Market competition in this segment is intense, with major players continuously investing in technological advancements and product differentiation.

External Devices: This segment encompasses external neurostimulators, transcutaneous electrical nerve stimulation (TENS) devices, and other external devices. The growth of this segment is being driven by increasing demand for non-invasive alternatives, particularly for the treatment of acute pain conditions. This segment is expected to show moderate growth driven by an increase in demand for minimally invasive procedures.

Application:

- Parkinson's Disease: This remains a major application segment with steady growth.

- Epilepsy: This segment shows significant market share and will continue to grow.

- Depression: Growth in this segment is expected with advances in treatment efficacy.

- Dystonia: This segment is experiencing increasing adoption rates.

- Pain Management: This includes a variety of applications and holds considerable market potential.

- Other Applications: This category encompasses various neurological disorders and is expected to show growth driven by the continuous research & development in neuro-modulation techniques.

Key Drivers of North America Neuromodulation Devices Market Growth

Several key factors drive the growth of the North America neuromodulation devices market:

Technological advancements: Innovation in device design, stimulation techniques (e.g., closed-loop systems), and miniaturization leads to improved efficacy, patient comfort, and reduced invasiveness.

Rising prevalence of neurological disorders: An aging population and increased awareness of these disorders are leading to a greater demand for effective treatments.

Favorable regulatory environment: FDA approvals and supportive reimbursement policies are crucial for market expansion.

Challenges in the North America Neuromodulation Devices Market Sector

Despite significant growth, challenges persist:

- High device costs: The prices of many neuromodulation devices significantly impact accessibility and affordability.

- Complex regulatory pathways: The rigorous FDA approval processes can prolong time-to-market and limit product availability.

- Competition: The presence of established players and emerging companies creates a competitive environment. The competition for market share and the impact of price wars can negatively affect profitability.

Emerging Opportunities in North America Neuromodulation Devices Market

Emerging opportunities include:

- Expansion into new therapeutic areas, including anxiety and obsessive-compulsive disorder (OCD).

- Development of personalized neuromodulation therapies tailored to individual patient needs.

- Leveraging advancements in AI and machine learning for more precise and effective stimulation techniques.

Leading Players in the North America Neuromodulation Devices Market Market

- Livonova Inc

- Neuronetics

- NeuroPace Inc

- Abbott Laboratories

- Interpace Biosciences

- Nevro Corp

- NeuroSigma Inc

- Medtronic PLC

- Synapse Biomedical Inc

- Boston Scientific Corporation

- EndoStim Inc

Key Developments in North America Neuromodulation Devices Market Industry

July 2022: DyAnsys received U.S. FDA approval for its percutaneous electrical neurostimulation (PENS) device, First Relief, to treat diabetic neuropathic pain. This approval expands treatment options for chronic pain and may stimulate competition in the pain management segment.

February 2022: Precisis GmbH received Breakthrough Device Designation from the FDA for its EASEE brain stimulator. This designation accelerates the development and approval process, potentially bringing a novel neuromodulation technology to the market sooner.

Strategic Outlook for North America Neuromodulation Devices Market Market

The North America neuromodulation devices market is poised for continued expansion, driven by technological advancements, growing prevalence of neurological disorders, and favorable regulatory environments. Strategic investments in R&D, partnerships, and strategic acquisitions will play key roles in driving future growth. The focus on minimally invasive techniques, personalized therapies, and improved patient outcomes will shape the market landscape in the years to come. Companies that effectively adapt to these trends and deliver superior patient value are expected to thrive in this dynamic market.

North America Neuromodulation Devices Market Segmentation

-

1. Device Type

-

1.1. Implantable Devices

- 1.1.1. Vagus Nerve Stimulators

- 1.1.2. Spinal Cord Stimulators

- 1.1.3. Deep Brain Stimulators

- 1.1.4. Gastric Electric Stimulators

- 1.1.5. Other Implantable Devices

-

1.2. External Devices

- 1.2.1. Transcranial Magnetic Stimulation (TMS)

- 1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 1.2.3. Other External Devices

-

1.1. Implantable Devices

-

2. Application

- 2.1. Parkinson's Disease

- 2.2. Epilepsy

- 2.3. Depression

- 2.4. Dystonia

- 2.5. Pain Management

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Neuromodulation Devices Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Neuromodulation Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Neurological Diseases; Rising Demand for Minimally Invasive Technologies

- 3.3. Market Restrains

- 3.3.1. High Cost of Neurological Disease Treatments; Shortage of Skilled Healthcare Professionals

- 3.4. Market Trends

- 3.4.1. Pain Management Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Implantable Devices

- 5.1.1.1. Vagus Nerve Stimulators

- 5.1.1.2. Spinal Cord Stimulators

- 5.1.1.3. Deep Brain Stimulators

- 5.1.1.4. Gastric Electric Stimulators

- 5.1.1.5. Other Implantable Devices

- 5.1.2. External Devices

- 5.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 5.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 5.1.2.3. Other External Devices

- 5.1.1. Implantable Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Parkinson's Disease

- 5.2.2. Epilepsy

- 5.2.3. Depression

- 5.2.4. Dystonia

- 5.2.5. Pain Management

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Implantable Devices

- 6.1.1.1. Vagus Nerve Stimulators

- 6.1.1.2. Spinal Cord Stimulators

- 6.1.1.3. Deep Brain Stimulators

- 6.1.1.4. Gastric Electric Stimulators

- 6.1.1.5. Other Implantable Devices

- 6.1.2. External Devices

- 6.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 6.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 6.1.2.3. Other External Devices

- 6.1.1. Implantable Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Parkinson's Disease

- 6.2.2. Epilepsy

- 6.2.3. Depression

- 6.2.4. Dystonia

- 6.2.5. Pain Management

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Canada North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Implantable Devices

- 7.1.1.1. Vagus Nerve Stimulators

- 7.1.1.2. Spinal Cord Stimulators

- 7.1.1.3. Deep Brain Stimulators

- 7.1.1.4. Gastric Electric Stimulators

- 7.1.1.5. Other Implantable Devices

- 7.1.2. External Devices

- 7.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 7.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 7.1.2.3. Other External Devices

- 7.1.1. Implantable Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Parkinson's Disease

- 7.2.2. Epilepsy

- 7.2.3. Depression

- 7.2.4. Dystonia

- 7.2.5. Pain Management

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Mexico North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Implantable Devices

- 8.1.1.1. Vagus Nerve Stimulators

- 8.1.1.2. Spinal Cord Stimulators

- 8.1.1.3. Deep Brain Stimulators

- 8.1.1.4. Gastric Electric Stimulators

- 8.1.1.5. Other Implantable Devices

- 8.1.2. External Devices

- 8.1.2.1. Transcranial Magnetic Stimulation (TMS)

- 8.1.2.2. Transcutaneous Electrical Nerve Stimulation (TENS)

- 8.1.2.3. Other External Devices

- 8.1.1. Implantable Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Parkinson's Disease

- 8.2.2. Epilepsy

- 8.2.3. Depression

- 8.2.4. Dystonia

- 8.2.5. Pain Management

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. United States North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Neuromodulation Devices Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Livonova Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Neuronetics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 NeuroPace Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Abbott Laboratories

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Interpace Biosciences

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Nevro Corp

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 NeuroSigma Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Medtronic PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Synapse Biomedical Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Boston Scientific Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 EndoStim Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Livonova Inc

List of Figures

- Figure 1: North America Neuromodulation Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Neuromodulation Devices Market Share (%) by Company 2024

List of Tables

- Table 1: North America Neuromodulation Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Neuromodulation Devices Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2019 & 2032

- Table 5: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: North America Neuromodulation Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Neuromodulation Devices Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: United States North America Neuromodulation Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Neuromodulation Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Neuromodulation Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Neuromodulation Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Neuromodulation Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Neuromodulation Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Neuromodulation Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Neuromodulation Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 22: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2019 & 2032

- Table 23: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 30: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2019 & 2032

- Table 31: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 35: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: North America Neuromodulation Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 38: North America Neuromodulation Devices Market Volume K Tons Forecast, by Device Type 2019 & 2032

- Table 39: North America Neuromodulation Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Neuromodulation Devices Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: North America Neuromodulation Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Neuromodulation Devices Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 43: North America Neuromodulation Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Neuromodulation Devices Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Neuromodulation Devices Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Neuromodulation Devices Market?

Key companies in the market include Livonova Inc, Neuronetics, NeuroPace Inc, Abbott Laboratories, Interpace Biosciences, Nevro Corp, NeuroSigma Inc, Medtronic PLC, Synapse Biomedical Inc, Boston Scientific Corporation, EndoStim Inc.

3. What are the main segments of the North America Neuromodulation Devices Market?

The market segments include Device Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Neurological Diseases; Rising Demand for Minimally Invasive Technologies.

6. What are the notable trends driving market growth?

Pain Management Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Neurological Disease Treatments; Shortage of Skilled Healthcare Professionals.

8. Can you provide examples of recent developments in the market?

July 2022: DyAnsys received U.S. FDA approval for its percutaneous electrical neurostimulation (PENS) device, called First Relief, to treat diabetic neuropathic pain. First Relief is intended for symptomatic Relief of chronic, intractable pain related to diabetic peripheral neuropathy through multiple treatments for up to 56 days.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Neuromodulation Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Neuromodulation Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Neuromodulation Devices Market?

To stay informed about further developments, trends, and reports in the North America Neuromodulation Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence