Key Insights

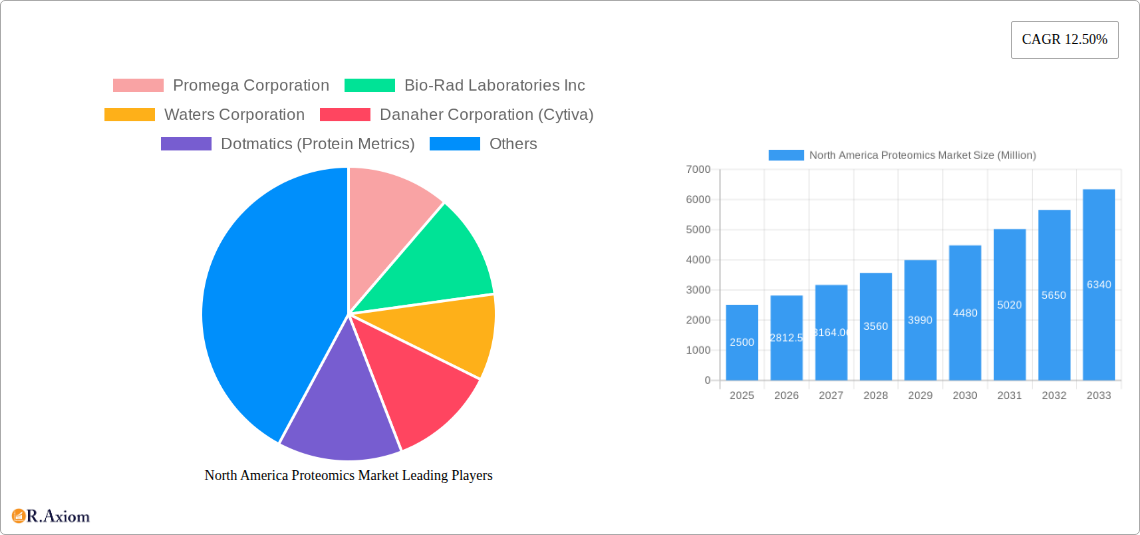

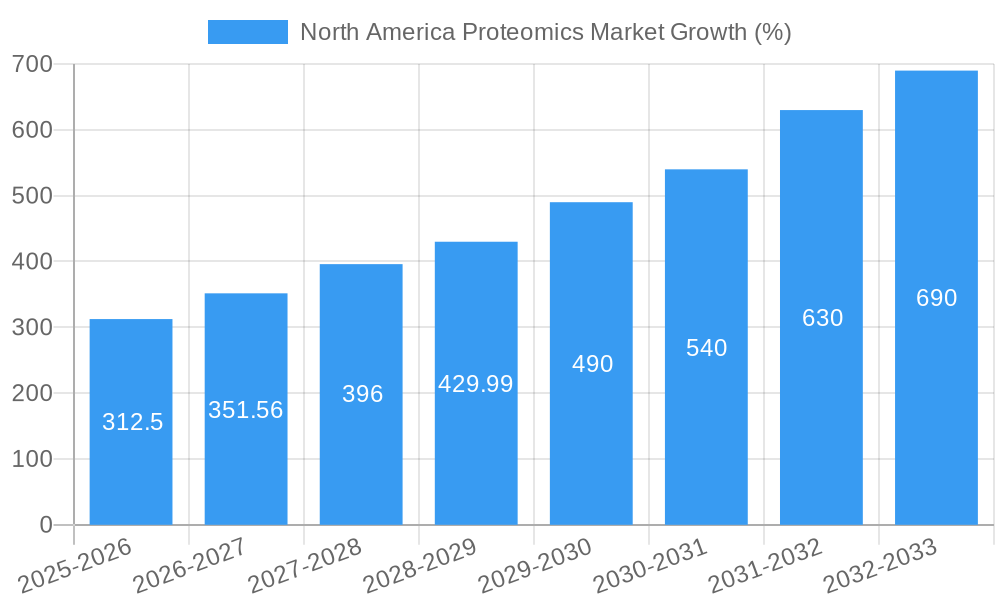

The North America proteomics market is experiencing robust growth, driven by the increasing prevalence of chronic diseases, the rising demand for personalized medicine, and significant advancements in proteomics technologies. The market's substantial size, estimated at $XX million in 2025, reflects the widespread adoption of proteomics in various applications, particularly clinical diagnostics and drug discovery. A compound annual growth rate (CAGR) of 12.50% from 2025 to 2033 projects significant expansion, indicating a promising future for this sector. Key growth drivers include the development of sophisticated instrumentation, including mass spectrometry and chromatography, along with the proliferation of bioinformatics software and services enabling efficient data analysis. The increasing accessibility of high-throughput screening technologies further accelerates market expansion.

Market segmentation reveals strong performance across instrumentation technologies, services and software, and reagents. Within applications, clinical diagnostics and drug discovery are the leading segments, propelled by their crucial roles in disease diagnosis, biomarker identification, and targeted therapeutic development. While significant market opportunities exist, potential restraints include the high cost of proteomics technologies and the complexity of data analysis. However, ongoing research and development efforts aimed at improving technology accessibility and streamlining data interpretation are likely to mitigate these challenges. Leading companies like Thermo Fisher Scientific, Danaher Corporation (Cytiva), and Bio-Rad Laboratories are actively contributing to market expansion through technological innovations and strategic acquisitions. The strong presence of these established players and the emergence of innovative companies in the field promises sustained growth for the North American proteomics market in the coming years.

North America Proteomics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America proteomics market, offering actionable insights for stakeholders across the industry. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report delves into market size, segmentation, growth drivers, challenges, and opportunities, providing a clear picture of the current landscape and future projections.

North America Proteomics Market Concentration & Innovation

The North America proteomics market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. However, the presence of smaller, specialized companies indicates a dynamic competitive environment. Innovation is a key driver, fueled by advancements in mass spectrometry, liquid chromatography, and bioinformatics. Regulatory frameworks, such as those from the FDA, play a crucial role in shaping the market, particularly for clinical diagnostics applications. Product substitutes, while limited, include traditional biochemical techniques, which remain relevant in certain niche applications. End-user trends reflect a growing focus on personalized medicine and biomarker discovery, stimulating demand. Mergers and acquisitions (M&A) activity has been notable, with deal values in the range of xx Million to xx Million over the past five years, as larger companies seek to expand their product portfolios and market reach. Examples include:

- Market Share: Thermo Fisher Scientific, Danaher Corporation (Cytiva), and Bio-Rad Laboratories Inc. collectively hold an estimated xx% market share.

- M&A Activities: The acquisition of smaller, specialized companies by larger players is a recurring trend, driving consolidation in the market.

North America Proteomics Market Industry Trends & Insights

The North America proteomics market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors: the increasing prevalence of chronic diseases, escalating demand for personalized medicine, advancements in mass spectrometry and other related technologies, and the rising adoption of proteomics in drug discovery. Technological disruptions, particularly in areas such as spatial proteomics and single-cell proteomics, are creating exciting new opportunities. Consumer preferences, though less directly impactful than in other industries, are subtly shifting towards solutions that offer greater speed, accuracy, and cost-effectiveness. Competitive dynamics are characterized by intense innovation and strategic alliances, with companies seeking to differentiate their offerings through technological superiority, comprehensive service packages, and robust intellectual property portfolios. The market penetration of proteomics technologies in clinical diagnostics and drug discovery continues to rise, indicating a bright future for this sector. The market is expected to reach xx Million by 2033.

Dominant Markets & Segments in North America Proteomics Market

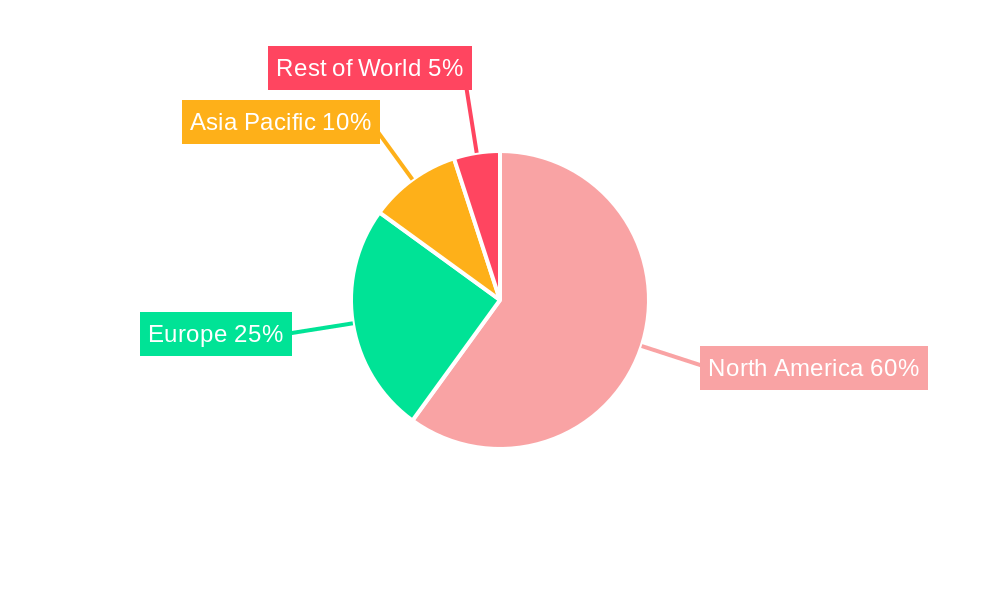

The United States constitutes the dominant market within North America, accounting for the majority of proteomics revenue. This dominance is attributed to factors such as advanced healthcare infrastructure, substantial research funding, a robust biotechnology industry, and a high concentration of pharmaceutical companies.

Type:

- Instrumentation Technology: This segment is currently the largest, driven by continuous improvements in mass spectrometers and other high-throughput instruments.

- Other Instrumentation Technologies: This includes a variety of supporting equipment.

- Services and Software: A rapidly growing sector fueled by the need for data analysis and interpretation.

- Bioinformatics Software and Services: This segment is experiencing significant growth due to the increasing complexity of proteomics data.

- Reagents: Constitutes a substantial market driven by the consumption of consumables in proteomics workflows.

Application:

- Clinical Diagnostics: This segment is witnessing strong growth as proteomics finds wider application in early disease detection and personalized medicine.

- Drug Discovery: A significant segment driven by the use of proteomics for identifying drug targets and assessing drug efficacy.

- Other Applications: This includes research in fields such as agriculture and environmental science.

North America Proteomics Market Product Developments

Recent product innovations focus on improving the speed, sensitivity, and throughput of proteomics workflows. Miniaturization, automation, and improved software solutions are prominent trends. New instruments are designed for higher sensitivity and better data quality, while software platforms aim to simplify data analysis and interpretation. These developments contribute to improved accessibility, cost-effectiveness, and the ability to address complex research questions in various sectors. The market is witnessing the emergence of integrated platforms that combine multiple technologies into a single workflow, which enhances efficiency and streamlines operations.

Report Scope & Segmentation Analysis

This report comprehensively segments the North America proteomics market by type (Instrumentation Technology, Other Instrumentation Technologies, Services and Software, Bioinformatics Software and Services, Reagents) and application (Clinical Diagnostics, Drug Discovery, Other Applications). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed, providing a granular understanding of the market landscape. For instance, the instrumentation technology segment is expected to witness significant growth due to ongoing technological advancements and increasing demand. The services and software segment's rapid expansion is driven by the need for sophisticated data analysis capabilities. The clinical diagnostics application segment displays particularly strong growth potential, fueled by increasing adoption of proteomics in personalized medicine.

Key Drivers of North America Proteomics Market Growth

Several factors drive the North America proteomics market's growth: increasing prevalence of chronic diseases fueling demand for diagnostic tools; rising investments in research and development, especially in areas like personalized medicine and biomarker discovery; technological advancements in mass spectrometry and related technologies improving the accuracy and efficiency of proteomics workflows; growing adoption of proteomics in the pharmaceutical industry for drug discovery and development; supportive regulatory frameworks and increased government funding for research initiatives.

Challenges in the North America Proteomics Market Sector

The North America proteomics market faces challenges, including the high cost of instrumentation and software, complex data analysis requirements demanding specialized expertise, a shortage of skilled professionals, and regulatory hurdles in clinical applications. Supply chain disruptions and competition from established players can also hinder market growth. These challenges translate to increased costs for researchers and potential delays in clinical diagnostics implementation, though technological innovation is actively working to mitigate some of these issues.

Emerging Opportunities in North America Proteomics Market

The growing integration of proteomics with other "-omics" technologies (genomics, transcriptomics, metabolomics) presents considerable opportunities. The expansion of spatial proteomics and single-cell proteomics, offering deeper biological insights, also provides lucrative market avenues. Further, the development of user-friendly software and cloud-based solutions will accelerate the adoption of proteomics across various research fields and clinical settings. Finally, the emergence of new applications in diverse fields, such as food safety and environmental monitoring, offer substantial growth potential.

Leading Players in the North America Proteomics Market Market

- Promega Corporation

- Bio-Rad Laboratories Inc

- Waters Corporation

- Danaher Corporation (Cytiva)

- Dotmatics (Protein Metrics)

- Thermo Fisher Scientific Inc

- Seer Inc

- Merck KGaA (Sigma-Aldrich)

- Agilent Technologies Inc

- Creative Proteomics

- Bruker Corporation

Key Developments in North America Proteomics Market Industry

- May 2022: Ionpath received a strategic investment from Thermo Fisher Scientific to support spatial proteomics innovation.

- January 2023: Bruker made a majority-ownership investment in Biognosys, leading to plans for a new advanced US proteomics CRO facility.

Strategic Outlook for North America Proteomics Market Market

The North America proteomics market is poised for sustained growth, driven by continuous technological advancements, increasing adoption across diverse applications, and supportive regulatory environments. The convergence of proteomics with other omics technologies and the expansion into new areas like spatial proteomics will create significant opportunities for innovation and expansion. The market's future success hinges on overcoming the challenges related to cost, data analysis, and expertise, emphasizing the need for accessible solutions and continued investment in workforce development.

North America Proteomics Market Segmentation

-

1. Type

-

1.1. Instrumentation Technology

- 1.1.1. Spectroscopy

- 1.1.2. Chromatography

- 1.1.3. Electrophoresis

- 1.1.4. Protein Microarrays

- 1.1.5. X-Ray Crystallography

- 1.1.6. Other Instrumentation Technologies

-

1.2. Services and Software

- 1.2.1. Core Proteomics Services

- 1.2.2. Bioinformatics Software and Services

- 1.3. Reagents

-

1.1. Instrumentation Technology

-

2. Application

- 2.1. Clinical Diagnostics

- 2.2. Drug Discovery

- 2.3. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Proteomics Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Proteomics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Drug Discovery is Expected to Witness Highest CAGR in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Instrumentation Technology

- 5.1.1.1. Spectroscopy

- 5.1.1.2. Chromatography

- 5.1.1.3. Electrophoresis

- 5.1.1.4. Protein Microarrays

- 5.1.1.5. X-Ray Crystallography

- 5.1.1.6. Other Instrumentation Technologies

- 5.1.2. Services and Software

- 5.1.2.1. Core Proteomics Services

- 5.1.2.2. Bioinformatics Software and Services

- 5.1.3. Reagents

- 5.1.1. Instrumentation Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Diagnostics

- 5.2.2. Drug Discovery

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Instrumentation Technology

- 6.1.1.1. Spectroscopy

- 6.1.1.2. Chromatography

- 6.1.1.3. Electrophoresis

- 6.1.1.4. Protein Microarrays

- 6.1.1.5. X-Ray Crystallography

- 6.1.1.6. Other Instrumentation Technologies

- 6.1.2. Services and Software

- 6.1.2.1. Core Proteomics Services

- 6.1.2.2. Bioinformatics Software and Services

- 6.1.3. Reagents

- 6.1.1. Instrumentation Technology

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Clinical Diagnostics

- 6.2.2. Drug Discovery

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Instrumentation Technology

- 7.1.1.1. Spectroscopy

- 7.1.1.2. Chromatography

- 7.1.1.3. Electrophoresis

- 7.1.1.4. Protein Microarrays

- 7.1.1.5. X-Ray Crystallography

- 7.1.1.6. Other Instrumentation Technologies

- 7.1.2. Services and Software

- 7.1.2.1. Core Proteomics Services

- 7.1.2.2. Bioinformatics Software and Services

- 7.1.3. Reagents

- 7.1.1. Instrumentation Technology

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Clinical Diagnostics

- 7.2.2. Drug Discovery

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Instrumentation Technology

- 8.1.1.1. Spectroscopy

- 8.1.1.2. Chromatography

- 8.1.1.3. Electrophoresis

- 8.1.1.4. Protein Microarrays

- 8.1.1.5. X-Ray Crystallography

- 8.1.1.6. Other Instrumentation Technologies

- 8.1.2. Services and Software

- 8.1.2.1. Core Proteomics Services

- 8.1.2.2. Bioinformatics Software and Services

- 8.1.3. Reagents

- 8.1.1. Instrumentation Technology

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Clinical Diagnostics

- 8.2.2. Drug Discovery

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Proteomics Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Promega Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bio-Rad Laboratories Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Waters Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danaher Corporation (Cytiva)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dotmatics (Protein Metrics)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Thermo Fisher Scientific Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Seer Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Merck KGaA (Sigma-Aldrich)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Agilent Technologies Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Creative Proteomics

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Bruker Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Promega Corporation

List of Figures

- Figure 1: North America Proteomics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Proteomics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Proteomics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Proteomics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Proteomics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Proteomics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America Proteomics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Proteomics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: North America Proteomics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Proteomics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: North America Proteomics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Proteomics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Proteomics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Proteomics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America Proteomics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Proteomics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Proteomics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Proteomics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Proteomics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Proteomics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Proteomics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Proteomics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America Proteomics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Proteomics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: North America Proteomics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Proteomics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: North America Proteomics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Proteomics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: North America Proteomics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Proteomics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: North America Proteomics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Proteomics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 31: North America Proteomics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America Proteomics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 33: North America Proteomics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Proteomics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Proteomics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Proteomics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: North America Proteomics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Proteomics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 39: North America Proteomics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Proteomics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 41: North America Proteomics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Proteomics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 43: North America Proteomics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Proteomics Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Proteomics Market?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the North America Proteomics Market?

Key companies in the market include Promega Corporation, Bio-Rad Laboratories Inc, Waters Corporation, Danaher Corporation (Cytiva), Dotmatics (Protein Metrics), Thermo Fisher Scientific Inc, Seer Inc , Merck KGaA (Sigma-Aldrich), Agilent Technologies Inc, Creative Proteomics, Bruker Corporation.

3. What are the main segments of the North America Proteomics Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Personalized Medicine; Increasing R&D Expenditure and Government Funding for Proteomics; Technological Advancements.

6. What are the notable trends driving market growth?

Drug Discovery is Expected to Witness Highest CAGR in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

January 2023: Bruker made a majority-ownership investment in Biognosys. With Bruker's investments, Biognosys plans to open advanced United States proteomics CRO facility for proteomics biomarker and drug discovery and development and pharmacoproteomics clinical trial support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Proteomics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Proteomics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Proteomics Market?

To stay informed about further developments, trends, and reports in the North America Proteomics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence