Key Insights

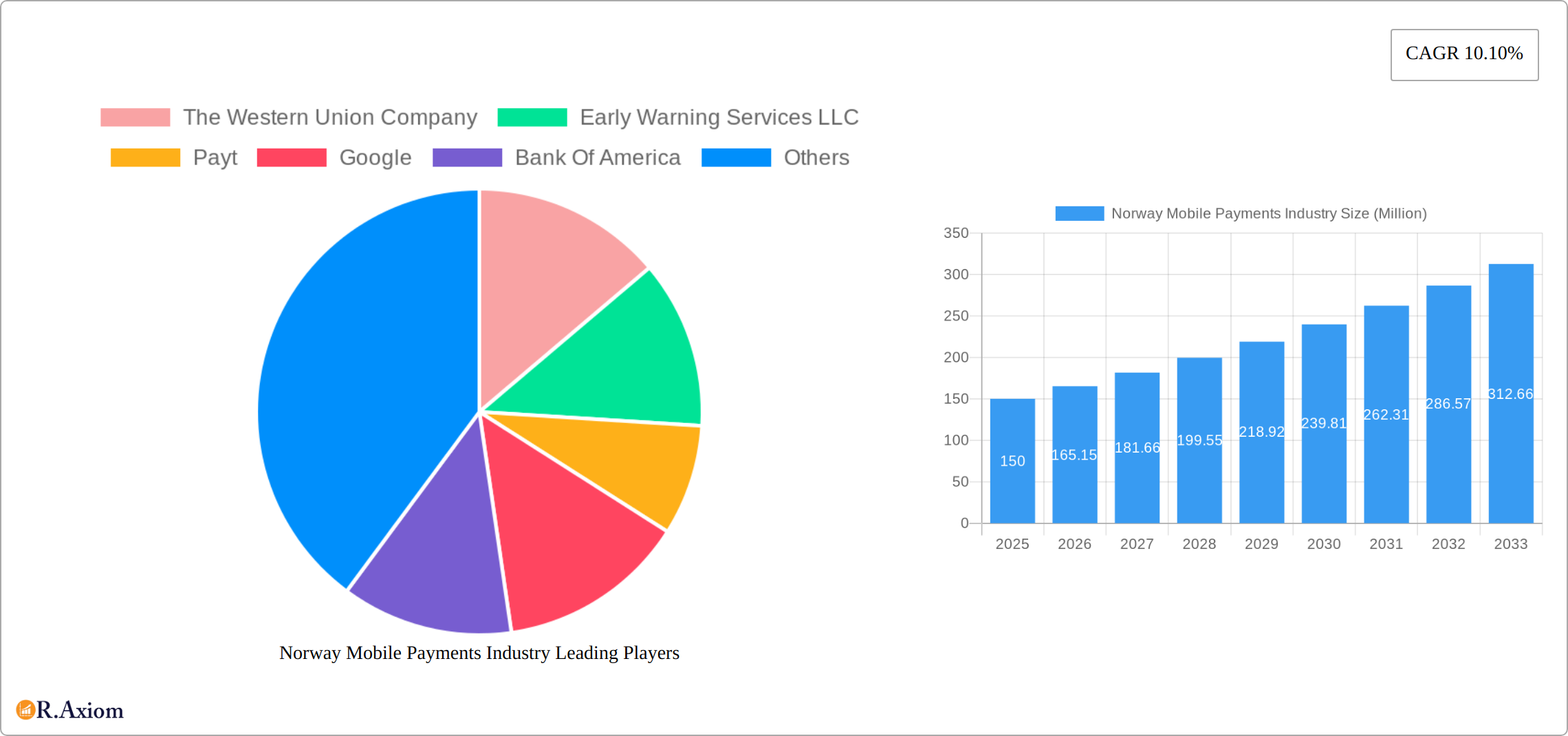

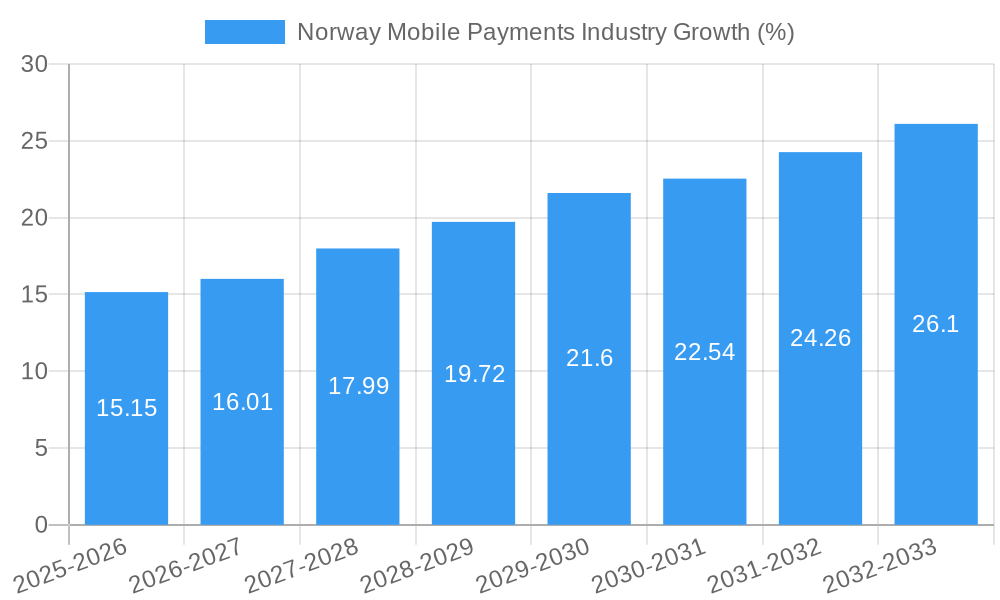

The Norwegian mobile payments market, valued at approximately 150 million in 2025, is projected to experience robust growth, fueled by a 10.10% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. Rising smartphone penetration and increasing digital literacy among Norwegians are creating a fertile ground for mobile payment adoption. The convenience and speed offered by mobile payment solutions, particularly contactless options like NFC and QR codes, are proving highly attractive to consumers, particularly within the retail and hospitality sectors. Furthermore, the proactive regulatory environment in Norway supporting digital financial transactions and the increasing integration of mobile payment functionalities within banking apps are further accelerating market growth. Government initiatives promoting cashless transactions and a technologically advanced infrastructure contribute to this positive trajectory.

However, despite the optimistic outlook, challenges remain. Security concerns surrounding mobile payments and the need for robust cybersecurity measures could potentially hinder wider adoption. The relatively small size of the Norwegian market compared to larger European economies might present limitations to extensive market expansion for some players. Furthermore, maintaining consistent user engagement and fostering trust in emerging payment technologies requires continuous innovation and consumer education. Nevertheless, given the ongoing digital transformation in Norway and the strong growth trajectory already established, the long-term prospects for the Norwegian mobile payments market remain exceptionally promising, especially considering the high per-capita income and tech-savviness of the Norwegian population. The dominance of specific payment providers and the potential for mergers and acquisitions in this dynamic landscape will also shape the market’s future trajectory.

Norway Mobile Payments Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Norway mobile payments industry, offering valuable insights for stakeholders including businesses, investors, and policymakers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. This report uses Million as the unit for all financial values.

Norway Mobile Payments Industry Market Concentration & Innovation

The Norwegian mobile payments market exhibits a moderate level of concentration, with a few dominant players alongside numerous smaller, niche operators. Innovation is driven by advancements in NFC and QR code technologies, coupled with increasing consumer demand for contactless and secure payment solutions. The regulatory framework, while generally supportive of innovation, faces ongoing adjustments to address evolving security concerns and data privacy regulations. Product substitutes, primarily traditional card payments, still hold significant market share, though their dominance is gradually declining. End-user trends indicate a strong preference for user-friendly interfaces and seamless integration with existing banking apps. M&A activities have been relatively limited in recent years, with a total estimated deal value of xx Million in the period 2019-2024, primarily involving smaller players consolidating their market position.

- Market Share: Vipps holds a significant market share, estimated at xx%, followed by other players such as PayPal and Apple Pay with combined xx% market share.

- M&A Activity: The reported M&A deal value from 2019-2024 is estimated to be around xx Million.

Norway Mobile Payments Industry Industry Trends & Insights

The Norwegian mobile payments market is experiencing robust growth, driven primarily by increasing smartphone penetration, rising adoption of contactless payment methods, and government initiatives promoting digitalization. Technological advancements such as improved security features, biometric authentication, and the integration of mobile payments into diverse applications are further accelerating market expansion. Consumer preferences are shifting towards convenient and secure payment solutions, leading to a decline in cash transactions. The competitive landscape is dynamic, with both established players and new entrants vying for market share through product innovation and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the mobile payment market is estimated to be xx% during the forecast period (2025-2033), with a market penetration rate projected to reach xx% by 2033.

Dominant Markets & Segments in Norway Mobile Payments Industry

The Norwegian mobile payments market is experiencing considerable growth across all segments, although Retail and Transportation sectors are currently leading in adoption. Proximity payments, enabled by NFC technology and banking app-based solutions, are gaining significant traction due to convenience and security.

- Dominant Payment Mode: Proximity Payment (xx Million) holds the largest market share. Remote payment via QR code and app-based solutions are showing strong growth.

- Dominant Technology: NFC technology dominates (xx Million), followed by Banking app-based solutions (xx Million)

- Dominant End-User: The Retail sector demonstrates high adoption rates due to increased consumer demand and merchant incentives, followed by Transportation. The Healthcare sector is also showing growth potential.

Key Drivers:

- Robust digital infrastructure: Norway boasts a well-developed digital infrastructure, supporting seamless mobile payment transactions.

- Government support for digitalization: Government initiatives are promoting digital financial inclusion, positively influencing mobile payments adoption.

- High smartphone penetration: High smartphone usage among the Norwegian population forms a strong foundation for mobile payment growth.

Norway Mobile Payments Industry Product Developments

Recent product innovations focus on enhancing security, user experience, and integration with other financial services. The introduction of biometric authentication, tokenization, and advanced fraud detection systems is making mobile payments increasingly secure. Several providers are integrating loyalty programs and rewards systems into their mobile payment platforms to enhance consumer engagement. The market is also witnessing the emergence of specialized mobile payment solutions tailored to specific industry verticals, such as healthcare and transportation.

Report Scope & Segmentation Analysis

This report segments the Norwegian mobile payments market by payment mode (Proximity Payment, Remote Payment), technology (NFC, QR Code, WAP & Card-Based, Banking App-based, Others), and end-user (Healthcare, Retail, Energy & Utilities, Hospitality & Transportation, Entertainment, Others). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail. For example, the proximity payment segment is expected to experience significant growth due to the increasing adoption of contactless payment methods, while the banking app-based segment shows considerable promise due to its integration with existing financial services.

Key Drivers of Norway Mobile Payments Industry Growth

Several factors are driving the growth of the Norwegian mobile payments market. These include increased smartphone penetration, rising consumer preference for contactless payments, and government support for digitalization. Technological advancements such as improved security features, biometric authentication, and the integration of mobile payments into various applications are also fueling market expansion. Furthermore, the increasing acceptance of mobile payments by merchants across different sectors contributes to this growth.

Challenges in the Norway Mobile Payments Industry Sector

The growth of the Norwegian mobile payments industry faces several challenges. Security concerns remain a major hurdle, necessitating robust security measures to prevent fraud and data breaches. Maintaining consumer trust is crucial, and overcoming skepticism towards digital payments is important for broader adoption. The competitive landscape is dynamic, with both established and new players vying for market share, intensifying competitive pressures. Regulatory changes and compliance requirements also pose challenges for industry players.

Emerging Opportunities in Norway Mobile Payments Industry

Several emerging opportunities exist in the Norwegian mobile payments sector. The integration of mobile payments with other financial services, such as lending and investment platforms, presents significant potential. The expansion of mobile payments into underserved segments, such as rural areas, offers opportunities for growth. The development of innovative payment solutions tailored to specific industry needs, such as micro-payments for public transportation, presents opportunities. Lastly, the increasing adoption of peer-to-peer payment platforms offers further scope for growth.

Leading Players in the Norway Mobile Payments Industry Market

- The Western Union Company

- Early Warning Services LLC

- Payt

- Bank Of America

- Intuit Pay

- PayPal

- Boku

- Alipay

- Apple Inc

Key Developments in Norway Mobile Payments Industry Industry

- April 2022: Westpay integrates Vipps payment solutions into its Swipe2Pay technology, expanding its payment options and market reach. This partnership significantly increases Westpay's transaction revenue and enhances the value proposition for both consumers and businesses.

Strategic Outlook for Norway Mobile Payments Industry Market

The Norwegian mobile payments market is poised for continued robust growth, driven by technological innovation, increasing consumer adoption, and government support. Future opportunities lie in expanding into new market segments, developing innovative payment solutions, and strengthening security measures to maintain consumer trust. The market's expansion is expected to be driven by the growing preference for contactless and secure payment methods and the increasing integration of mobile payments with other financial services.

Norway Mobile Payments Industry Segmentation

-

1. Payment Mode

- 1.1. Proximity Payment

- 1.2. Remote Payment

-

2. Technology

- 2.1. NFC

- 2.2. QR Code

- 2.3. WAP & Card-Based

- 2.4. Banking App-based

- 2.5. Others

-

3. End User

- 3.1. Healthcare

- 3.2. Retail

- 3.3. Energy & Utilities

- 3.4. Hospitality and Transporatation

- 3.5. Entertainment

- 3.6. Others

Norway Mobile Payments Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Norway Mobile Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of the Digitalization; Rise of Personal Financial Apps

- 3.3. Market Restrains

- 3.3.1. Security of the Data can Hinder the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Adoption of the Online Shopping among the Norwegian

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Payment Mode

- 5.1.1. Proximity Payment

- 5.1.2. Remote Payment

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. NFC

- 5.2.2. QR Code

- 5.2.3. WAP & Card-Based

- 5.2.4. Banking App-based

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Healthcare

- 5.3.2. Retail

- 5.3.3. Energy & Utilities

- 5.3.4. Hospitality and Transporatation

- 5.3.5. Entertainment

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Payment Mode

- 6. North America Norway Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Payment Mode

- 6.1.1. Proximity Payment

- 6.1.2. Remote Payment

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. NFC

- 6.2.2. QR Code

- 6.2.3. WAP & Card-Based

- 6.2.4. Banking App-based

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Healthcare

- 6.3.2. Retail

- 6.3.3. Energy & Utilities

- 6.3.4. Hospitality and Transporatation

- 6.3.5. Entertainment

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Payment Mode

- 7. Europe Norway Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Payment Mode

- 7.1.1. Proximity Payment

- 7.1.2. Remote Payment

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. NFC

- 7.2.2. QR Code

- 7.2.3. WAP & Card-Based

- 7.2.4. Banking App-based

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Healthcare

- 7.3.2. Retail

- 7.3.3. Energy & Utilities

- 7.3.4. Hospitality and Transporatation

- 7.3.5. Entertainment

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Payment Mode

- 8. Asia Pacific Norway Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Payment Mode

- 8.1.1. Proximity Payment

- 8.1.2. Remote Payment

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. NFC

- 8.2.2. QR Code

- 8.2.3. WAP & Card-Based

- 8.2.4. Banking App-based

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Healthcare

- 8.3.2. Retail

- 8.3.3. Energy & Utilities

- 8.3.4. Hospitality and Transporatation

- 8.3.5. Entertainment

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Payment Mode

- 9. Latin America Norway Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Payment Mode

- 9.1.1. Proximity Payment

- 9.1.2. Remote Payment

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. NFC

- 9.2.2. QR Code

- 9.2.3. WAP & Card-Based

- 9.2.4. Banking App-based

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Healthcare

- 9.3.2. Retail

- 9.3.3. Energy & Utilities

- 9.3.4. Hospitality and Transporatation

- 9.3.5. Entertainment

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Payment Mode

- 10. Middle East and Africa Norway Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Payment Mode

- 10.1.1. Proximity Payment

- 10.1.2. Remote Payment

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. NFC

- 10.2.2. QR Code

- 10.2.3. WAP & Card-Based

- 10.2.4. Banking App-based

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Healthcare

- 10.3.2. Retail

- 10.3.3. Energy & Utilities

- 10.3.4. Hospitality and Transporatation

- 10.3.5. Entertainment

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Payment Mode

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 The Western Union Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Early Warning Services LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Payt

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bank Of America

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Intuit Pay

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PayPal

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boku

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alipay

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Western Union Company

List of Figures

- Figure 1: Norway Mobile Payments Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Mobile Payments Industry Share (%) by Company 2024

List of Tables

- Table 1: Norway Mobile Payments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Mobile Payments Industry Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 3: Norway Mobile Payments Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Norway Mobile Payments Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Norway Mobile Payments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Norway Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Norway Mobile Payments Industry Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 8: Norway Mobile Payments Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Norway Mobile Payments Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Norway Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Norway Mobile Payments Industry Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 12: Norway Mobile Payments Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: Norway Mobile Payments Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Norway Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Norway Mobile Payments Industry Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 16: Norway Mobile Payments Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Norway Mobile Payments Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Norway Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Norway Mobile Payments Industry Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 20: Norway Mobile Payments Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: Norway Mobile Payments Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Norway Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Norway Mobile Payments Industry Revenue Million Forecast, by Payment Mode 2019 & 2032

- Table 24: Norway Mobile Payments Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Norway Mobile Payments Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Norway Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Mobile Payments Industry?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the Norway Mobile Payments Industry?

Key companies in the market include The Western Union Company, Early Warning Services LLC, Payt, Google, Bank Of America, Intuit Pay, PayPal, Boku, Alipay, Apple Inc.

3. What are the main segments of the Norway Mobile Payments Industry?

The market segments include Payment Mode, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of the Digitalization; Rise of Personal Financial Apps.

6. What are the notable trends driving market growth?

Growing Adoption of the Online Shopping among the Norwegian.

7. Are there any restraints impacting market growth?

Security of the Data can Hinder the Growth of the Market.

8. Can you provide examples of recent developments in the market?

April 2022 - Westpay has integrated Vipps payment solutions into the Swipe2Pay technology. Vipps is the obvious choice for in-store payments in the Norwegian market, as the first transactions have just been completed. Westpay has a cutting-edge technology platform with Swipe2Pay that enables new alternative payment methods in addition to conventional card-present payments. Additionally, this partnership will increase Westpay's transaction revenue while enhancing the value of Vipps and Westpay's services to consumers and businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Mobile Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Mobile Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Mobile Payments Industry?

To stay informed about further developments, trends, and reports in the Norway Mobile Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence