Key Insights

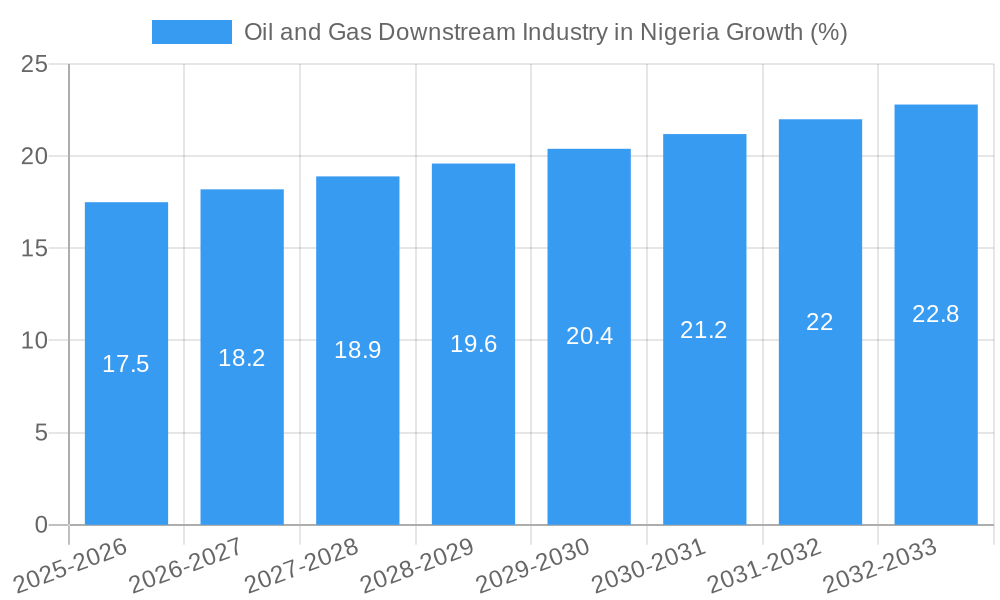

The Nigerian oil and gas downstream industry, encompassing refining, distribution, and end-user sectors, presents a complex landscape characterized by moderate growth and significant challenges. The market, currently valued in the hundreds of millions (a precise figure requires more granular data, but a reasonable estimate based on similar-sized African economies and a 3.5% CAGR would place it in this range), is projected to experience a compound annual growth rate (CAGR) of 3.5% from 2025 to 2033. This growth is fueled by increasing domestic energy demand driven by population growth and economic expansion, particularly in the transportation and aviation sectors. Key drivers include the expansion of gas stations and airport infrastructure, alongside investments in pipeline networks to improve distribution efficiency. However, several factors restrain market growth. These include aging refinery infrastructure, limited refining capacity resulting in significant fuel imports, and inconsistent government policies impacting investment and infrastructure development. The industry's reliance on foreign technology and expertise also adds to its vulnerability. Segment-wise, the gasoline segment likely dominates, followed by diesel, with jet fuel exhibiting moderate growth tied to air travel expansion. The distribution segment faces challenges related to pipeline maintenance and security, while the end-user segment is influenced by consumer purchasing power and government fuel subsidy policies.

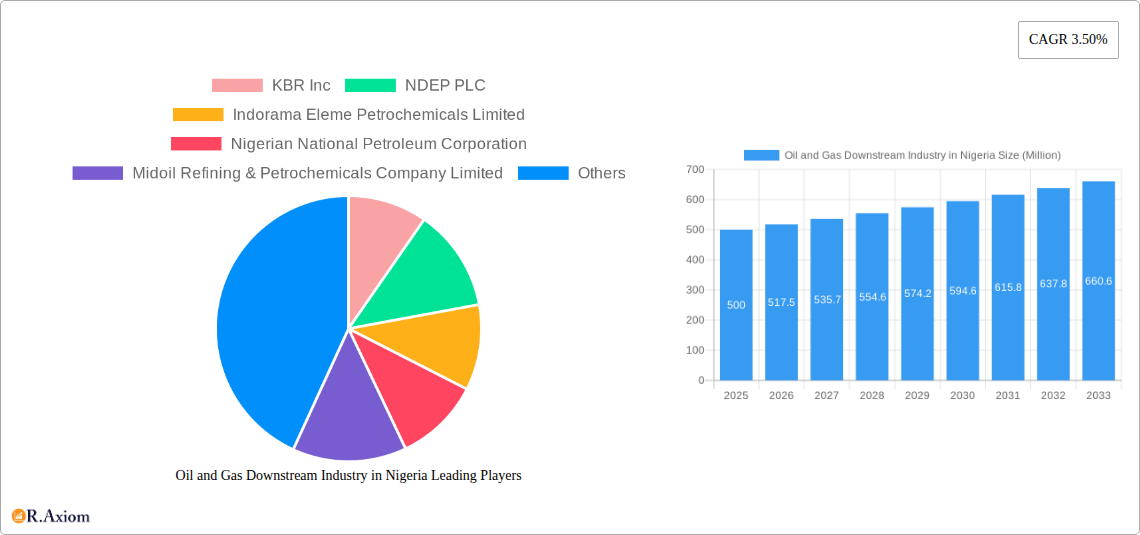

Competition in the Nigerian downstream oil and gas sector is a mix of international players like KBR Inc. and NDEP PLC, alongside local companies such as Indorama Eleme Petrochemicals Limited and the Nigerian National Petroleum Corporation. The presence of these diverse actors creates a dynamic market with opportunities and challenges. The sector requires strategic investments in refinery modernization, pipeline upgrades, and enhanced regulatory frameworks to unlock its full potential. Addressing infrastructure limitations, security concerns, and policy inconsistencies is crucial to foster sustainable growth and attract further investment. A focus on improving refining capacity and reducing dependence on fuel imports could significantly boost the sector's contribution to the Nigerian economy. Success will depend on collaboration between the government, private sector players, and international partners to create a more favorable and stable operating environment.

This detailed report provides a comprehensive analysis of Nigeria's oil and gas downstream industry, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand the market dynamics, growth drivers, and future potential of this vital sector. The report leverages rigorous data analysis and industry expertise to deliver actionable intelligence, forecasting market trends up to 2033 with a base year of 2025.

Oil and Gas Downstream Industry in Nigeria Market Concentration & Innovation

Nigeria's oil and gas downstream sector exhibits a concentrated market structure, with a few dominant players like the Nigerian National Petroleum Corporation (NNPC) holding significant market share. However, the landscape is evolving with increased private sector participation and the entry of new players. Innovation is driven by the need to improve refining efficiency, enhance product quality, and optimize distribution networks. The regulatory framework, while undergoing reforms, plays a crucial role in shaping market competition and investment decisions. Product substitutes, particularly biofuels, pose a growing challenge, while end-user trends, such as increasing demand for cleaner fuels, are shaping product development strategies. Mergers and acquisitions (M&A) activity has been moderate but is expected to increase with the anticipated growth in the sector. Deal values have averaged xx Million USD in recent years, with a significant transaction involving the acquisition of xx% of a refinery by a private entity in 2023. The market share of NNPC is estimated at 60% in 2025, while Indorama Eleme Petrochemicals Limited holds approximately 15%. The remaining share is distributed among several smaller players.

Oil and Gas Downstream Industry in Nigeria Industry Trends & Insights

The Nigerian oil and gas downstream market is characterized by fluctuating growth, primarily influenced by macroeconomic conditions, government policies, and global oil price volatility. The compound annual growth rate (CAGR) for the period 2019-2024 is estimated at xx%, with a projected CAGR of xx% from 2025-2033. Market penetration of refined petroleum products has increased steadily across the country, with higher penetration in urban centers compared to rural areas. Technological advancements, including automation in refineries and the adoption of digital technologies in supply chain management, are driving efficiency improvements and reducing operational costs. Consumer preferences are shifting towards higher-quality fuels and cleaner energy sources, prompting investments in upgrading refineries and expanding the biofuel market. Competitive dynamics are marked by intense rivalry among existing players and the emergence of new entrants. The Dangote refinery's commencement of operations is set to reshape the market landscape, while other smaller refineries are also projected to enter the market, increasing competition. The impact of increased refining capacity on market prices and product availability is projected to be substantial.

Dominant Markets & Segments in Oil and Gas Downstream Industry in Nigeria

Refining: Gasoline remains the dominant refined product segment, followed by diesel and jet fuel. The demand for gasoline is driven by the increasing number of vehicles on Nigerian roads. Diesel fuel is crucial for the transportation and industrial sectors. Jet fuel demand is closely tied to the growth of the aviation industry.

Distribution: Pipelines constitute the backbone of the distribution network, although challenges persist regarding their maintenance and efficiency. Refineries and distribution centers are concentrated in major cities, leading to uneven distribution across the country. Infrastructure development in the sector continues, but at a pace that's often deemed insufficient to meet demand and address existing bottlenecks.

End-Users: Gas stations are the primary end-users of refined petroleum products, with their density and location heavily impacting market access. Airports are another significant segment for jet fuel demand, with growth prospects linked to passenger numbers.

The Southern region currently dominates the market due to higher population density, greater industrial activity, and the location of major refineries and distribution infrastructure. Economic policies influencing fuel pricing, taxation, and investment incentives play a significant role in shaping market dynamics. Infrastructure development, encompassing pipeline expansion and improved storage facilities, is crucial for market growth, especially in less-developed areas.

Oil and Gas Downstream Industry in Nigeria Product Developments

Recent product innovations focus on improving fuel quality to meet stricter emission standards and enhancing blending capabilities to incorporate biofuels. The development of value-added petrochemical products from refinery by-products is another key area of focus. This aligns with the global trend towards cleaner energy and the diversification of revenue streams. The incorporation of advanced technologies like additive manufacturing and AI in refineries enhances efficiency and reduces wastage. Market fit is driven by aligning product specifications with regulatory requirements and consumer preferences for higher-quality fuels.

Report Scope & Segmentation Analysis

This report segments the Nigerian oil and gas downstream market by:

Refining: Gasoline, Diesel, and Jet Fuel – Each segment's growth is analyzed, considering factors like demand drivers, pricing trends, and import/export dynamics. The competitive intensity within each segment is assessed. Market sizes are projected at xx Million USD for Gasoline, xx Million USD for Diesel, and xx Million USD for Jet Fuel in 2025.

Distribution: Pipelines, Refineries, Distribution Centers – The analysis includes evaluating the capacity, efficiency, and geographical distribution of these infrastructure components. Expansion plans and investment trends are considered. Market size projections for this segment are estimated to be at xx Million USD in 2025.

End-Users: Gas Stations and Airports – The report examines the distribution network and the impact of consumer preferences on fuel demand. Market size projections for this segment are estimated to be at xx Million USD in 2025.

Key Drivers of Oil and Gas Downstream Industry in Nigeria Growth

Key growth drivers include increasing domestic demand for refined petroleum products driven by population growth and economic expansion. Government initiatives aimed at improving refining capacity and infrastructure development are also significant factors. The adoption of advanced technologies that enhance efficiency and reduce operational costs plays a crucial role. Furthermore, diversification into petrochemicals provides additional growth opportunities.

Challenges in the Oil and Gas Downstream Industry in Nigeria Sector

Challenges include inadequate refining capacity leading to high reliance on imported refined products. This results in substantial foreign exchange outflows. Regulatory uncertainties and bureaucratic hurdles pose significant obstacles to investment. Supply chain inefficiencies and logistical bottlenecks impede the smooth flow of products. Intense competition and fluctuating global oil prices are further challenges impacting profitability.

Emerging Opportunities in Oil and Gas Downstream Industry in Nigeria

Opportunities exist in expanding refining capacity through both public and private investments. The development of petrochemical industries to add value to by-products presents a significant opportunity. Investments in upgrading infrastructure, such as pipelines and storage facilities, are essential. Furthermore, exploring alternative fuels and cleaner energy solutions aligns with global sustainability trends.

Leading Players in the Oil and Gas Downstream Industry in Nigeria Market

- KBR Inc

- NDEP PLC

- Indorama Eleme Petrochemicals Limited

- Nigerian National Petroleum Corporation

- Midoil Refining & Petrochemicals Company Limited

Key Developments in Oil and Gas Downstream Industry in Nigeria Industry

August 2022: The Nigerian National Petroleum Company announced that the Dangote Refinery is expected to start commercial operations by mid-2023. This refinery has a refining capacity of 650,000 barrels per day, representing a significant expansion of Nigeria's refining capacity.

November 2022: Nigeria's Gasoline Integrated International announced plans to build a USD 68 million refinery on Tongeji Island, with an initial capacity of 100,000 liters per day, expandable to 400,000 liters per day. This signifies increased private sector investment in the refining sector.

Strategic Outlook for Oil and Gas Downstream Industry in Nigeria Market

The Nigerian oil and gas downstream market holds significant growth potential, driven by increasing domestic demand and ongoing investments in refining capacity. The completion of major refinery projects will reshape the market landscape, increasing competition and potentially leading to lower fuel prices. Strategic focus on infrastructure development, technological upgrades, and diversification into petrochemicals are crucial for realizing the full potential of the sector. Further regulatory reforms and improved supply chain management will contribute to the sector's overall growth and stability.

Oil and Gas Downstream Industry in Nigeria Segmentation

- 1. Refining

- 2. Petrochemical

- 3. Retail Sales

Oil and Gas Downstream Industry in Nigeria Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Downstream Industry in Nigeria REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector

- 3.4. Market Trends

- 3.4.1. Refining Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Downstream Industry in Nigeria Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refining

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical

- 5.3. Market Analysis, Insights and Forecast - by Retail Sales

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Refining

- 6. North America Oil and Gas Downstream Industry in Nigeria Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Refining

- 6.2. Market Analysis, Insights and Forecast - by Petrochemical

- 6.3. Market Analysis, Insights and Forecast - by Retail Sales

- 6.1. Market Analysis, Insights and Forecast - by Refining

- 7. South America Oil and Gas Downstream Industry in Nigeria Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Refining

- 7.2. Market Analysis, Insights and Forecast - by Petrochemical

- 7.3. Market Analysis, Insights and Forecast - by Retail Sales

- 7.1. Market Analysis, Insights and Forecast - by Refining

- 8. Europe Oil and Gas Downstream Industry in Nigeria Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Refining

- 8.2. Market Analysis, Insights and Forecast - by Petrochemical

- 8.3. Market Analysis, Insights and Forecast - by Retail Sales

- 8.1. Market Analysis, Insights and Forecast - by Refining

- 9. Middle East & Africa Oil and Gas Downstream Industry in Nigeria Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Refining

- 9.2. Market Analysis, Insights and Forecast - by Petrochemical

- 9.3. Market Analysis, Insights and Forecast - by Retail Sales

- 9.1. Market Analysis, Insights and Forecast - by Refining

- 10. Asia Pacific Oil and Gas Downstream Industry in Nigeria Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Refining

- 10.2. Market Analysis, Insights and Forecast - by Petrochemical

- 10.3. Market Analysis, Insights and Forecast - by Retail Sales

- 10.1. Market Analysis, Insights and Forecast - by Refining

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 KBR Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NDEP PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Indorama Eleme Petrochemicals Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nigerian National Petroleum Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Midoil Refining & Petrochemicals Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 KBR Inc

List of Figures

- Figure 1: Global Oil and Gas Downstream Industry in Nigeria Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Oil and Gas Downstream Industry in Nigeria Volume Breakdown (Million, %) by Region 2024 & 2032

- Figure 3: Nigeria Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 4: Nigeria Oil and Gas Downstream Industry in Nigeria Volume (Million), by Country 2024 & 2032

- Figure 5: Nigeria Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 6: Nigeria Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Refining 2024 & 2032

- Figure 8: North America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Refining 2024 & 2032

- Figure 9: North America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Refining 2024 & 2032

- Figure 10: North America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Refining 2024 & 2032

- Figure 11: North America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Petrochemical 2024 & 2032

- Figure 12: North America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Petrochemical 2024 & 2032

- Figure 13: North America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Petrochemical 2024 & 2032

- Figure 14: North America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Petrochemical 2024 & 2032

- Figure 15: North America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Retail Sales 2024 & 2032

- Figure 16: North America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Retail Sales 2024 & 2032

- Figure 17: North America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Retail Sales 2024 & 2032

- Figure 18: North America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Retail Sales 2024 & 2032

- Figure 19: North America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Country 2024 & 2032

- Figure 21: North America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Country 2024 & 2032

- Figure 23: South America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Refining 2024 & 2032

- Figure 24: South America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Refining 2024 & 2032

- Figure 25: South America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Refining 2024 & 2032

- Figure 26: South America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Refining 2024 & 2032

- Figure 27: South America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Petrochemical 2024 & 2032

- Figure 28: South America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Petrochemical 2024 & 2032

- Figure 29: South America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Petrochemical 2024 & 2032

- Figure 30: South America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Petrochemical 2024 & 2032

- Figure 31: South America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Retail Sales 2024 & 2032

- Figure 32: South America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Retail Sales 2024 & 2032

- Figure 33: South America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Retail Sales 2024 & 2032

- Figure 34: South America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Retail Sales 2024 & 2032

- Figure 35: South America Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 36: South America Oil and Gas Downstream Industry in Nigeria Volume (Million), by Country 2024 & 2032

- Figure 37: South America Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 38: South America Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Refining 2024 & 2032

- Figure 40: Europe Oil and Gas Downstream Industry in Nigeria Volume (Million), by Refining 2024 & 2032

- Figure 41: Europe Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Refining 2024 & 2032

- Figure 42: Europe Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Refining 2024 & 2032

- Figure 43: Europe Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Petrochemical 2024 & 2032

- Figure 44: Europe Oil and Gas Downstream Industry in Nigeria Volume (Million), by Petrochemical 2024 & 2032

- Figure 45: Europe Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Petrochemical 2024 & 2032

- Figure 46: Europe Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Petrochemical 2024 & 2032

- Figure 47: Europe Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Retail Sales 2024 & 2032

- Figure 48: Europe Oil and Gas Downstream Industry in Nigeria Volume (Million), by Retail Sales 2024 & 2032

- Figure 49: Europe Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Retail Sales 2024 & 2032

- Figure 50: Europe Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Retail Sales 2024 & 2032

- Figure 51: Europe Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Oil and Gas Downstream Industry in Nigeria Volume (Million), by Country 2024 & 2032

- Figure 53: Europe Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Country 2024 & 2032

- Figure 55: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Refining 2024 & 2032

- Figure 56: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume (Million), by Refining 2024 & 2032

- Figure 57: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Refining 2024 & 2032

- Figure 58: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Refining 2024 & 2032

- Figure 59: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Petrochemical 2024 & 2032

- Figure 60: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume (Million), by Petrochemical 2024 & 2032

- Figure 61: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Petrochemical 2024 & 2032

- Figure 62: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Petrochemical 2024 & 2032

- Figure 63: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Retail Sales 2024 & 2032

- Figure 64: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume (Million), by Retail Sales 2024 & 2032

- Figure 65: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Retail Sales 2024 & 2032

- Figure 66: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Retail Sales 2024 & 2032

- Figure 67: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 68: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume (Million), by Country 2024 & 2032

- Figure 69: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Country 2024 & 2032

- Figure 71: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Refining 2024 & 2032

- Figure 72: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume (Million), by Refining 2024 & 2032

- Figure 73: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Refining 2024 & 2032

- Figure 74: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Refining 2024 & 2032

- Figure 75: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Petrochemical 2024 & 2032

- Figure 76: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume (Million), by Petrochemical 2024 & 2032

- Figure 77: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Petrochemical 2024 & 2032

- Figure 78: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Petrochemical 2024 & 2032

- Figure 79: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Retail Sales 2024 & 2032

- Figure 80: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume (Million), by Retail Sales 2024 & 2032

- Figure 81: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Retail Sales 2024 & 2032

- Figure 82: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Retail Sales 2024 & 2032

- Figure 83: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 84: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume (Million), by Country 2024 & 2032

- Figure 85: Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 86: Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Region 2019 & 2032

- Table 3: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Refining 2019 & 2032

- Table 4: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Refining 2019 & 2032

- Table 5: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Petrochemical 2019 & 2032

- Table 6: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Petrochemical 2019 & 2032

- Table 7: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Retail Sales 2019 & 2032

- Table 8: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Retail Sales 2019 & 2032

- Table 9: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Region 2019 & 2032

- Table 11: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Country 2019 & 2032

- Table 13: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Refining 2019 & 2032

- Table 14: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Refining 2019 & 2032

- Table 15: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Petrochemical 2019 & 2032

- Table 16: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Petrochemical 2019 & 2032

- Table 17: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Retail Sales 2019 & 2032

- Table 18: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Retail Sales 2019 & 2032

- Table 19: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Country 2019 & 2032

- Table 21: United States Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mexico Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Refining 2019 & 2032

- Table 28: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Refining 2019 & 2032

- Table 29: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Petrochemical 2019 & 2032

- Table 30: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Petrochemical 2019 & 2032

- Table 31: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Retail Sales 2019 & 2032

- Table 32: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Retail Sales 2019 & 2032

- Table 33: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 37: Argentina Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Refining 2019 & 2032

- Table 42: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Refining 2019 & 2032

- Table 43: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Petrochemical 2019 & 2032

- Table 44: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Petrochemical 2019 & 2032

- Table 45: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Retail Sales 2019 & 2032

- Table 46: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Retail Sales 2019 & 2032

- Table 47: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Country 2019 & 2032

- Table 49: United Kingdom Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: United Kingdom Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 51: Germany Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Germany Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 53: France Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: France Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 55: Italy Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Italy Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 57: Spain Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Spain Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 59: Russia Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Russia Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 61: Benelux Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Benelux Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 63: Nordics Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Nordics Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Europe Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Europe Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 67: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Refining 2019 & 2032

- Table 68: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Refining 2019 & 2032

- Table 69: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Petrochemical 2019 & 2032

- Table 70: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Petrochemical 2019 & 2032

- Table 71: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Retail Sales 2019 & 2032

- Table 72: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Retail Sales 2019 & 2032

- Table 73: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Country 2019 & 2032

- Table 75: Turkey Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Turkey Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 77: Israel Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Israel Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 79: GCC Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: GCC Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 81: North Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: North Africa Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 83: South Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: South Africa Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 85: Rest of Middle East & Africa Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Rest of Middle East & Africa Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 87: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Refining 2019 & 2032

- Table 88: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Refining 2019 & 2032

- Table 89: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Petrochemical 2019 & 2032

- Table 90: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Petrochemical 2019 & 2032

- Table 91: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Retail Sales 2019 & 2032

- Table 92: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Retail Sales 2019 & 2032

- Table 93: Global Oil and Gas Downstream Industry in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Global Oil and Gas Downstream Industry in Nigeria Volume Million Forecast, by Country 2019 & 2032

- Table 95: China Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: China Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 97: India Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: India Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 99: Japan Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Japan Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 101: South Korea Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: South Korea Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 103: ASEAN Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: ASEAN Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 105: Oceania Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: Oceania Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

- Table 107: Rest of Asia Pacific Oil and Gas Downstream Industry in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Rest of Asia Pacific Oil and Gas Downstream Industry in Nigeria Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Downstream Industry in Nigeria?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Oil and Gas Downstream Industry in Nigeria?

Key companies in the market include KBR Inc, NDEP PLC, Indorama Eleme Petrochemicals Limited, Nigerian National Petroleum Corporation, Midoil Refining & Petrochemicals Company Limited.

3. What are the main segments of the Oil and Gas Downstream Industry in Nigeria?

The market segments include Refining, Petrochemical, Retail Sales.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector.

6. What are the notable trends driving market growth?

Refining Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector.

8. Can you provide examples of recent developments in the market?

August 2022: The Nigerian National Petroleum Company announced that the Dangote Refinery is expected to start commercial operations by mid-2023. The refinery project is one of the largest in Africa, with a refining capacity of 650,000 barrels per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Downstream Industry in Nigeria," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Downstream Industry in Nigeria report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Downstream Industry in Nigeria?

To stay informed about further developments, trends, and reports in the Oil and Gas Downstream Industry in Nigeria, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence