Key Insights

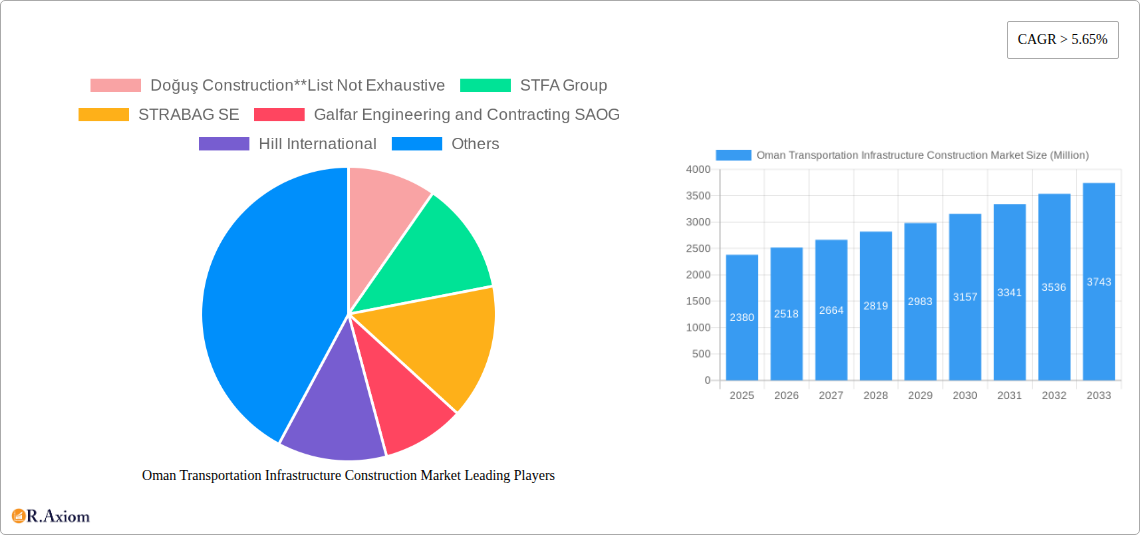

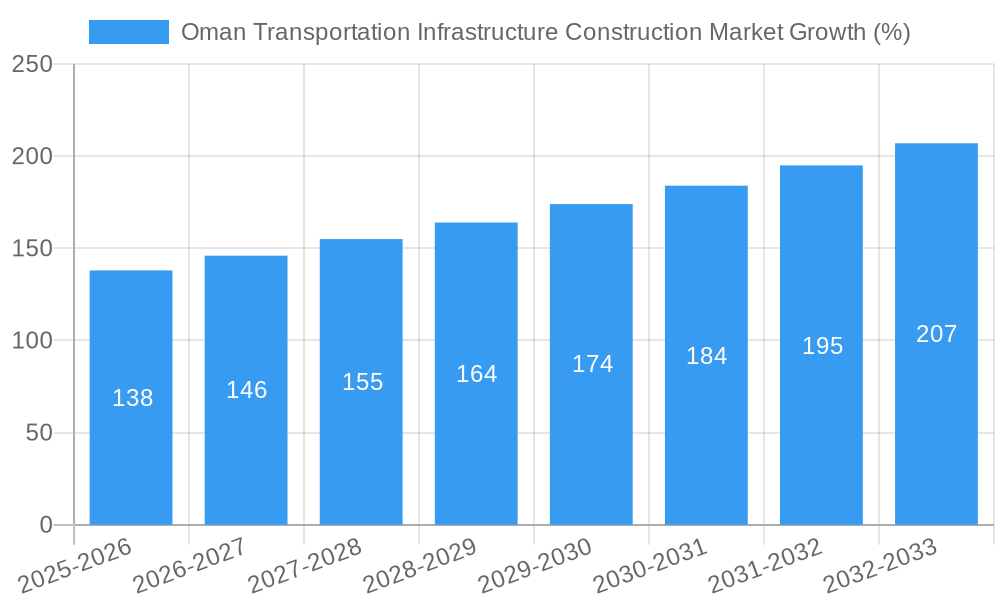

The Oman Transportation Infrastructure Construction market, valued at $2.38 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5.65% from 2025 to 2033. This expansion is fueled by Oman's strategic investments in upgrading its transport network to support economic diversification and enhance connectivity. Key drivers include government initiatives focused on developing robust road, rail, and port infrastructure to facilitate trade and tourism. The increasing emphasis on sustainable transportation solutions, including the adoption of environmentally friendly materials and construction techniques, further contributes to market growth. While specific details regarding market restraints are unavailable, potential challenges could include fluctuating global commodity prices, potential labor shortages, and the need for effective project management to meet ambitious deadlines. The market is segmented by mode of transport, comprising air, railways, roadways, ports, and inland waterways, each presenting unique growth opportunities. Major players like Doğuş Construction, STFA Group, STRABAG SE, and others are actively involved, contributing to the competitive landscape. The sustained focus on infrastructure development ensures a positive outlook for the Oman Transportation Infrastructure Construction market throughout the forecast period.

The significant investments in Oman's transportation infrastructure are transforming the country's logistics capabilities and supporting economic expansion. The government's commitment to modernizing the transport network is attracting both domestic and international players, fostering competition and innovation. While specific data on segmental market shares are unavailable, it is expected that road construction will likely dominate due to its extensive network and ongoing expansion projects. However, the growing emphasis on multimodal transportation signifies the increasing importance of ports and inland waterways development, along with rail improvements. The long-term growth prospects are strong, driven by government spending, and the market is expected to experience considerable expansion in the coming years, making it an attractive sector for investors and businesses in the construction industry.

Oman Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman Transportation Infrastructure Construction Market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, growth drivers, challenges, and emerging opportunities. The report leverages extensive primary and secondary research, incorporating detailed financial data and expert analysis to deliver actionable intelligence.

Oman Transportation Infrastructure Construction Market Market Concentration & Innovation

The Oman transportation infrastructure construction market exhibits a moderately concentrated landscape, with a few large multinational players and several significant local contractors vying for market share. Major players like Doğuş Construction, STFA Group, STRABAG SE, Galfar Engineering and Contracting SAOG, Hill International, Bechtel, Consolidated Contractors Company, Desert Line Group, and Khalid Bin Ahmed & Sons LLC, hold significant portions of the market. However, the presence of numerous smaller, specialized firms fosters competition and innovation.

Market share analysis reveals that the top five players collectively account for approximately xx% of the market (2024). Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging approximately USD xx Million annually (2019-2024). Innovation is driven by government initiatives promoting sustainable infrastructure development, advancements in construction technologies (e.g., BIM, prefabrication), and the increasing adoption of digital solutions for project management and monitoring. Regulatory frameworks, while generally supportive of infrastructure development, face ongoing revisions to enhance transparency and efficiency. Substitute products are limited, given the specialized nature of large-scale infrastructure projects, although material choices and construction methods are subject to continuous improvement. End-user trends favor resilient, environmentally friendly, and technologically advanced infrastructure solutions.

Oman Transportation Infrastructure Construction Market Industry Trends & Insights

The Oman transportation infrastructure construction market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including substantial government investments in transportation infrastructure, particularly in road networks, railway expansion, and port modernization. Technological advancements, such as the increased use of Building Information Modeling (BIM) and advanced materials, are enhancing project efficiency and reducing construction timelines. Growing urbanization, increasing tourism, and the government's commitment to diversifying the economy are further driving demand for enhanced transport connectivity. The market penetration of advanced technologies, like intelligent transportation systems, is steadily increasing, driven by the need for efficient traffic management and optimized logistics. However, competitive pressures, coupled with global economic fluctuations and potential material cost volatility, present challenges to market expansion. Consumer preferences increasingly lean towards sustainable and resilient infrastructure that minimizes environmental impact.

Dominant Markets & Segments in Oman Transportation Infrastructure Construction Market

The Roadways segment currently dominates the Oman transportation infrastructure construction market, accounting for approximately xx% of the total market value in 2024. This dominance is driven by:

- Extensive Road Network Expansion: The government's ongoing focus on improving and expanding the national road network, including major projects like the dualization of the Adam-Thamrait Road, fuels significant investment in this sector.

- Economic Development: Improved road connectivity is critical for supporting economic growth, facilitating trade, and enhancing access to resources.

- Tourism Growth: An improved road network is instrumental in attracting tourism, a key component of Oman's economic diversification strategy.

The Ports and Inland Waterways segment is also experiencing noteworthy growth, driven by Oman's strategic location and its ambition to become a regional logistics hub. The Air and Railways segments, while comparatively smaller, hold significant long-term potential, spurred by increasing air passenger traffic and the recently announced UAE-Oman joint railway project. The government's infrastructure investment plan plays a crucial role in the dominance of the Roadways segment, while strategic location and regional trade ambitions influence the growth potential of Ports and Inland Waterways.

Oman Transportation Infrastructure Construction Market Product Developments

Recent product innovations within the Oman transportation infrastructure construction market focus on sustainable and technologically advanced solutions. This includes the adoption of eco-friendly materials, incorporating smart technologies for traffic management and infrastructure monitoring, and utilizing prefabrication techniques for faster and more efficient construction. These innovations aim to improve project efficiency, reduce environmental impact, and enhance the overall performance and longevity of infrastructure assets. The market fit for these products is strong, driven by government policies and the increasing demand for resilient and technologically advanced infrastructure.

Report Scope & Segmentation Analysis

This report segments the Oman transportation infrastructure construction market by mode of transport:

Air: This segment encompasses the construction and expansion of airports, runways, and related infrastructure. Growth is projected to be moderate, driven by increasing air passenger traffic. The competitive landscape is relatively concentrated, with several major international and domestic players.

Railways: This segment includes the construction of new railway lines and upgrades to existing networks. Growth is poised for significant acceleration following the UAE-Oman railway agreement. The competitive landscape is expected to become more dynamic with increased foreign investment.

Roadways: This is the largest segment, covering the construction and maintenance of roads, bridges, and tunnels. Growth is robust and driven by continuous government investment and the needs of economic expansion. Competition is high amongst a mix of international and local contractors.

Ports and Inland Waterways: This segment focuses on the development of port facilities, inland waterways, and associated infrastructure. Growth is strong, stimulated by Oman's strategic location and efforts to become a regional logistics hub. Competition is moderate, with both specialized and general construction firms vying for projects.

Key Drivers of Oman Transportation Infrastructure Construction Market Growth

Several key factors propel the growth of the Oman transportation infrastructure construction market. These include:

- Government Investment: Substantial public spending on infrastructure projects, including the expansion of roads, railways, and ports, fuels the market’s expansion.

- Economic Diversification: Efforts to diversify the economy beyond oil and gas necessitate significant investments in infrastructure to facilitate growth in other sectors.

- Tourism Development: Growing tourism requires improved transportation networks to connect key destinations and improve accessibility.

- Regional Connectivity: Oman's strategic location makes enhancing connectivity with neighboring countries crucial for trade and economic integration.

Challenges in the Oman Transportation Infrastructure Construction Market Sector

Challenges hindering the Oman transportation infrastructure construction market include:

- Geopolitical Factors: Regional instability and global economic uncertainty can impact investment flows and project timelines.

- Supply Chain Disruptions: Global supply chain issues may affect the availability and cost of construction materials.

- Labor Shortages: A shortage of skilled labor can impact project delivery and timelines, potentially increasing costs.

- Environmental Concerns: Balancing infrastructure development with environmental protection poses a significant challenge.

Emerging Opportunities in Oman Transportation Infrastructure Construction Market

Emerging opportunities include:

- Sustainable Infrastructure: Growing demand for environmentally friendly construction practices presents opportunities for companies adopting green technologies.

- Smart City Initiatives: The development of smart cities in Oman will create opportunities for projects involving smart transportation systems and infrastructure.

- Public-Private Partnerships (PPPs): Increased use of PPPs to finance large infrastructure projects creates opportunities for private sector involvement.

- Technological Advancements: The adoption of advanced construction technologies like BIM and 3D printing can improve efficiency and reduce costs.

Leading Players in the Oman Transportation Infrastructure Construction Market Market

- Doğuş Construction

- STFA Group

- STRABAG SE

- Galfar Engineering and Contracting SAOG

- Hill International

- Bechtel

- Consolidated Contractors Company

- Desert Line Group

- Khalid Bin Ahmed & Sons LLC

Key Developments in Oman Transportation Infrastructure Construction Market Industry

- February 2023: UAE and Oman signed an agreement to launch a joint railway company with an investment of about USD 3 Billion to link the two Gulf countries. This significantly boosts the railway segment's growth prospects.

- March 2023: The Government of Oman announced plans to expand nine existing roads, including the dualization of the 437 km Adam-Thamrait Road. This reinforces the continued dominance of the roadways segment.

Strategic Outlook for Oman Transportation Infrastructure Construction Market Market

The Oman transportation infrastructure construction market presents a strong outlook for continued growth over the forecast period. Government commitment to substantial infrastructure investment, coupled with ongoing economic diversification and the pursuit of regional connectivity, creates a favorable environment for market expansion. The adoption of sustainable and technologically advanced solutions will further drive growth, attracting both domestic and international players. The integration of smart technologies, the increasing use of PPPs, and continued investment in key segments, notably roadways and ports, will ensure this sector's continued growth and evolution in the coming years.

Oman Transportation Infrastructure Construction Market Segmentation

-

1. Mode of Transport

- 1.1. Air

- 1.2. Railways

- 1.3. Roadways

- 1.4. Ports and Inland Waterways

Oman Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Oman

Oman Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market

- 3.3. Market Restrains

- 3.3.1. Delay in project approvals; High cost of materials

- 3.4. Market Trends

- 3.4.1. Growing urban population driving the growth of transportation infrastructure.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Air

- 5.1.2. Railways

- 5.1.3. Roadways

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Doğuş Construction**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 STFA Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STRABAG SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Galfar Engineering and Contracting SAOG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hill International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bechtel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Consolidated Contractors Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Desert Line Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Khalid Bin Ahmed & Sons LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Doğuş Construction**List Not Exhaustive

List of Figures

- Figure 1: Oman Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 3: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 6: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Transportation Infrastructure Construction Market?

The projected CAGR is approximately > 5.65%.

2. Which companies are prominent players in the Oman Transportation Infrastructure Construction Market?

Key companies in the market include Doğuş Construction**List Not Exhaustive, STFA Group, STRABAG SE, Galfar Engineering and Contracting SAOG, Hill International, Bechtel, Consolidated Contractors Company, Desert Line Group, Khalid Bin Ahmed & Sons LLC.

3. What are the main segments of the Oman Transportation Infrastructure Construction Market?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market.

6. What are the notable trends driving market growth?

Growing urban population driving the growth of transportation infrastructure..

7. Are there any restraints impacting market growth?

Delay in project approvals; High cost of materials.

8. Can you provide examples of recent developments in the market?

March 2023: The Government of Oman plans to expand nine existing roads, including the dualisation of the 437 km Adam-Thamrait Road, which connects the Ad Dakhiliyah and Dhofar governorates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Oman Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence