Key Insights

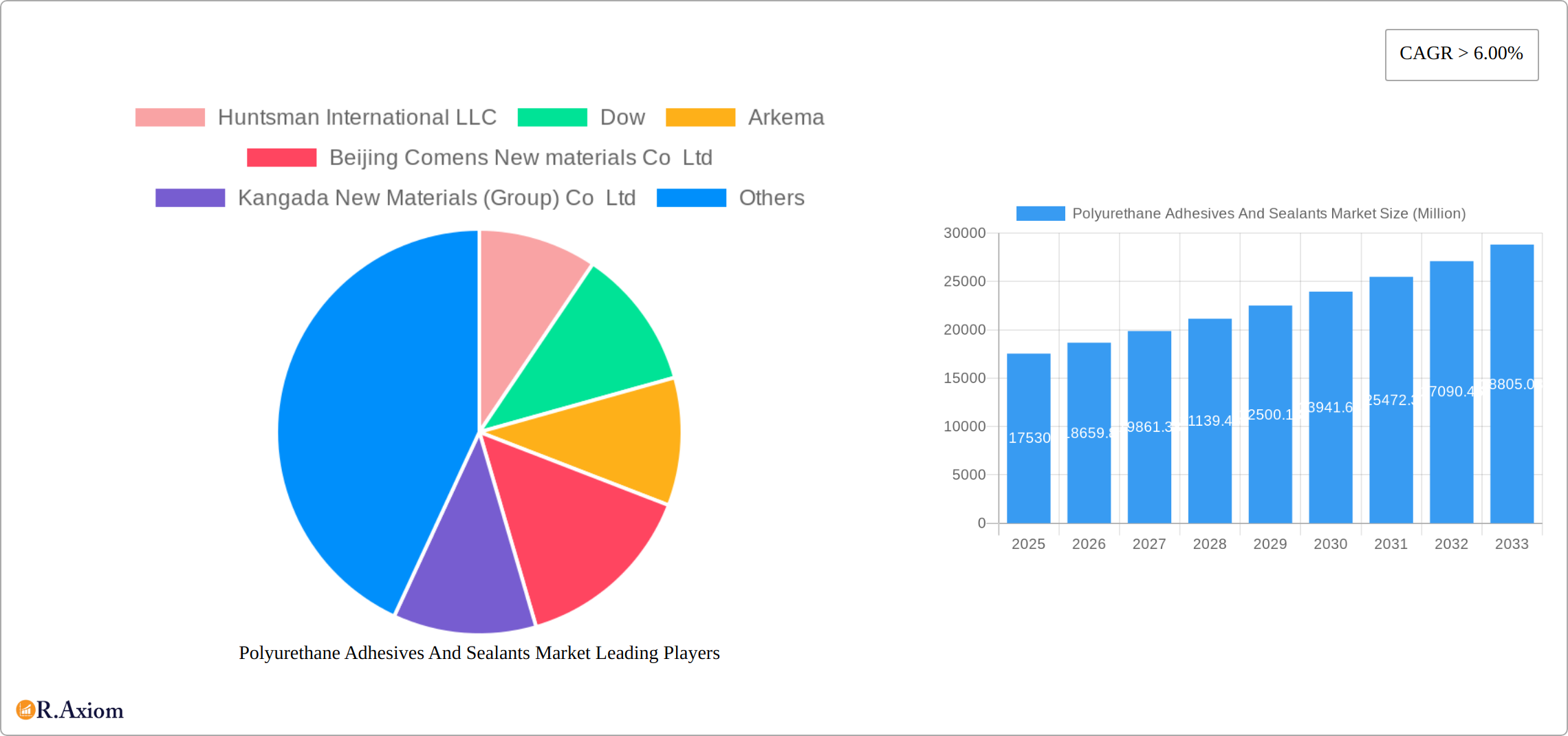

The global Polyurethane Adhesives and Sealants market is experiencing robust growth, projected to reach a value of $17.53 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning construction industry, particularly in developing economies experiencing rapid urbanization, fuels significant demand for high-performance adhesives and sealants. Furthermore, the automotive and transportation sectors' increasing adoption of lightweight materials and advanced joining techniques contributes to market growth. The healthcare industry's need for reliable and biocompatible adhesives in medical devices and pharmaceutical packaging further strengthens market demand. Technological advancements, such as the development of water-based and bio-based polyurethane adhesives, are also driving market expansion by addressing environmental concerns and offering superior performance characteristics in specific applications. However, fluctuating raw material prices and stringent regulatory requirements related to volatile organic compounds (VOCs) pose challenges to market growth. The market is segmented by technology (water-based, solvent-based, hot-melt, and others including bio-based and nano-PU adhesives) and end-user industry (building & construction, healthcare, automotive, packaging, footwear & leather, electrical & electronics, and others). Major players like Huntsman, Dow, Arkema, and 3M are actively shaping the market through innovation and strategic partnerships.

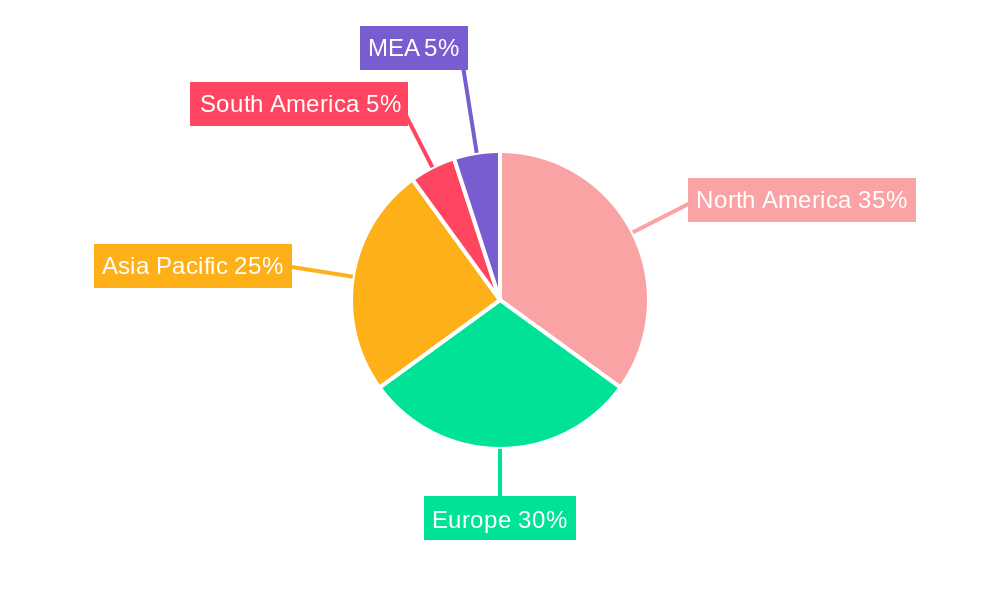

Regional market dynamics exhibit variations. North America and Europe currently hold substantial market shares, driven by established industries and strong regulatory frameworks. However, the Asia-Pacific region is expected to witness the fastest growth, fueled by robust infrastructure development and increasing industrialization in countries like China and India. The South American and Middle Eastern & African markets are also projected to experience moderate growth, albeit at a slower pace compared to the Asia-Pacific region. The competitive landscape is characterized by the presence of both established multinational corporations and regional players, leading to intense competition focused on product innovation, cost optimization, and expansion into new geographical markets. Overall, the polyurethane adhesives and sealants market presents significant opportunities for growth, driven by favorable macro-economic trends and continuous technological advancements.

Polyurethane Adhesives and Sealants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Polyurethane Adhesives and Sealants market, offering valuable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, technological advancements, and growth opportunities. The report incorporates detailed segmentation analysis across technology and end-user industries, providing actionable intelligence for strategic decision-making.

Polyurethane Adhesives And Sealants Market Market Concentration & Innovation

The global polyurethane adhesives and sealants market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Huntsman International LLC, Dow, Arkema, and 3M are among the leading companies, leveraging extensive R&D and strong distribution networks to maintain their dominance. However, regional players like Beijing Comens New materials Co Ltd and Kangada New Materials (Group) Co Ltd are also gaining traction, particularly in the Asia-Pacific region. The market share of the top five players is estimated to be around xx% in 2025.

Innovation is a key driver, with companies focusing on developing sustainable, high-performance adhesives and sealants. The rising demand for eco-friendly products is propelling the development of bio-based polyurethane adhesives, while advancements in nanotechnology are leading to the creation of nano-PU adhesives with enhanced properties. Regulatory frameworks, particularly those concerning VOC emissions and environmental sustainability, significantly influence product development and market trends. Substitutes, such as epoxy and silicone-based adhesives, pose a competitive threat, but polyurethane's versatility and superior performance in many applications maintain its leading position.

Mergers and acquisitions (M&A) activities are frequent, reflecting the dynamic nature of the market. Recent deals have primarily focused on expanding product portfolios, strengthening geographical reach, and acquiring specialized technologies. The total value of M&A deals in the polyurethane adhesives and sealants market between 2019 and 2024 is estimated at xx Million.

Polyurethane Adhesives And Sealants Market Industry Trends & Insights

The global polyurethane adhesives and sealants market is experiencing robust growth, driven by increasing demand from various end-user industries. The construction sector, particularly in developing economies, is a major growth driver, fueled by rising infrastructure investments and urbanization. The automotive and transportation industry's need for lightweight and durable components also contributes significantly to market expansion. Furthermore, the packaging industry's continuous search for efficient and sustainable solutions boosts demand for polyurethane-based adhesives.

Technological disruptions, such as the emergence of bio-based and nano-PU adhesives, are reshaping the market landscape. Consumer preferences are shifting towards sustainable and environmentally friendly products, pushing manufacturers to develop eco-conscious solutions. Competitive dynamics are intense, with companies engaging in aggressive pricing strategies, product differentiation, and innovation to gain market share. The market is anticipated to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various regions. The market size is projected to reach xx Million by 2033.

Dominant Markets & Segments in Polyurethane Adhesives And Sealants Market

The building and construction sector represents the largest end-user segment, accounting for approximately xx% of the total market revenue in 2025. This dominance is driven by the extensive use of polyurethane adhesives and sealants in various construction applications, including bonding, sealing, and insulation. The Asia-Pacific region is the leading market, fueled by rapid infrastructure development and economic growth in countries like China and India.

- Key Drivers for Building and Construction:

- Robust infrastructure investments

- Growing urbanization and construction activities

- Favorable government policies and regulations

- Rising demand for energy-efficient buildings

The solvent-based technology segment holds the largest market share due to its established performance characteristics and cost-effectiveness. However, the water-based segment is experiencing significant growth due to increasing environmental concerns and stricter regulations.

- Dominant Technology: Solvent-based

- Dominant End-User: Building and Construction

- Dominant Region: Asia-Pacific

The dominance of these segments is expected to continue throughout the forecast period, although the growth rate of water-based technology and other end-user segments, like healthcare and automotive, is projected to be higher.

Polyurethane Adhesives And Sealants Market Product Developments

Recent product developments highlight a trend towards eco-friendly and high-performance adhesives and sealants. The introduction of bio-based PUR adhesives demonstrates the industry's commitment to sustainability, while advancements in nano-PU adhesives offer superior bonding strength and durability. Companies are focusing on developing specialized adhesives for specific applications, enhancing product performance and improving market fit. The competitive advantage lies in offering innovative solutions that cater to evolving customer needs and regulatory requirements.

Report Scope & Segmentation Analysis

This report segments the polyurethane adhesives and sealants market based on technology (water-based, solvent-based, hot-melt, and other technologies) and end-user industry (building and construction, healthcare, automotive and transportation, packaging, footwear and leather, electrical and electronics, and other end-user industries). Each segment's market size, growth projections, and competitive dynamics are analyzed. Water-based technology is projected to experience the fastest growth due to its eco-friendly nature. The building and construction segment will continue to dominate, but the automotive and healthcare sectors are expected to show strong growth potential.

Key Drivers of Polyurethane Adhesives And Sealants Market Growth

Several factors drive the growth of the polyurethane adhesives and sealants market. Increasing construction activities globally, particularly in developing economies, create significant demand. The automotive industry's focus on lightweight vehicles and the rising need for durable and efficient packaging solutions also contribute to market expansion. Technological advancements, such as the development of bio-based and high-performance adhesives, further propel market growth. Favorable government regulations and policies supporting sustainable materials also boost the market.

Challenges in the Polyurethane Adhesives And Sealants Market Sector

The polyurethane adhesives and sealants market faces challenges, including fluctuating raw material prices, stringent environmental regulations, and intense competition. Supply chain disruptions can impact production and availability, while stringent regulations regarding VOC emissions necessitate continuous product innovation. The presence of substitute materials, like epoxy and silicone-based adhesives, also exerts competitive pressure, necessitating differentiation through superior performance and cost-effectiveness.

Emerging Opportunities in Polyurethane Adhesives And Sealants Market

Emerging opportunities exist in the development and adoption of sustainable and high-performance polyurethane adhesives and sealants. The growing demand for eco-friendly products presents significant growth potential for bio-based and recycled-content solutions. Advancements in nanotechnology offer opportunities to create adhesives with enhanced properties. Expanding into niche markets, such as the aerospace and renewable energy sectors, also presents lucrative growth prospects.

Leading Players in the Polyurethane Adhesives And Sealants Market Market

- Huntsman International LLC

- Dow

- Arkema

- Beijing Comens New materials Co Ltd

- Kangada New Materials (Group) Co Ltd

- Sika AG

- MAPEI SpA

- Henkel AG & Co KGaA

- Jowat SE

- Pidilite Industries Ltd

- 3M

- Soudal Holding NV

- Hubei Huitian New Materials Co Ltd

- H B Fuller Company

- NANPAO RESINS CHEMICAL GROUP

Key Developments in Polyurethane Adhesives And Sealants Market Industry

- November 2023: Henkel introduced the first bio-based PUR adhesives for load-bearing timber construction (Loctite engineered wood adhesives, HB S ECO, and CR 821 ECO), reducing CO2eq emissions by more than 60%. This significantly impacts the market by increasing the adoption of sustainable adhesives in the construction sector.

- March 2023: Bostik expanded its R&D facilities with a new technology lab in Shanghai. This expansion strengthens Bostik's position in the Asia-Pacific market and facilitates innovation in polyurethane adhesives and sealants.

Strategic Outlook for Polyurethane Adhesives And Sealants Market Market

The polyurethane adhesives and sealants market is poised for continued growth, driven by technological advancements, rising demand from key end-user industries, and increasing focus on sustainability. Opportunities abound in developing bio-based and high-performance adhesives, expanding into new geographical markets, and catering to the specific needs of emerging applications. Companies that prioritize innovation, sustainability, and customer-centricity are best positioned to capitalize on the market's growth potential.

Polyurethane Adhesives And Sealants Market Segmentation

-

1. Technology

- 1.1. Water-based

- 1.2. Solvent-based

- 1.3. Hot-melt

- 1.4. Other Te

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Healthcare

- 2.3. Automotive and Transportation

- 2.4. Packaging

- 2.5. Footwear and Leather

- 2.6. Electrical and Electronics

- 2.7. Other En

Polyurethane Adhesives And Sealants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Thailand

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Turkey

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Qatar

- 5.4. United Arab Emirates

- 5.5. Egypt

- 5.6. Algeria

- 5.7. Rest of Middle East and Africa

Polyurethane Adhesives And Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from the Construction Industry in the Asian Region; Growth in the Packaging Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stricter Regulations on Hazardous Materials and Environmental Concerns; Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Building and Construction Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Water-based

- 5.1.2. Solvent-based

- 5.1.3. Hot-melt

- 5.1.4. Other Te

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Healthcare

- 5.2.3. Automotive and Transportation

- 5.2.4. Packaging

- 5.2.5. Footwear and Leather

- 5.2.6. Electrical and Electronics

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Asia Pacific Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Water-based

- 6.1.2. Solvent-based

- 6.1.3. Hot-melt

- 6.1.4. Other Te

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building and Construction

- 6.2.2. Healthcare

- 6.2.3. Automotive and Transportation

- 6.2.4. Packaging

- 6.2.5. Footwear and Leather

- 6.2.6. Electrical and Electronics

- 6.2.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. North America Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Water-based

- 7.1.2. Solvent-based

- 7.1.3. Hot-melt

- 7.1.4. Other Te

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building and Construction

- 7.2.2. Healthcare

- 7.2.3. Automotive and Transportation

- 7.2.4. Packaging

- 7.2.5. Footwear and Leather

- 7.2.6. Electrical and Electronics

- 7.2.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Water-based

- 8.1.2. Solvent-based

- 8.1.3. Hot-melt

- 8.1.4. Other Te

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building and Construction

- 8.2.2. Healthcare

- 8.2.3. Automotive and Transportation

- 8.2.4. Packaging

- 8.2.5. Footwear and Leather

- 8.2.6. Electrical and Electronics

- 8.2.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Water-based

- 9.1.2. Solvent-based

- 9.1.3. Hot-melt

- 9.1.4. Other Te

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building and Construction

- 9.2.2. Healthcare

- 9.2.3. Automotive and Transportation

- 9.2.4. Packaging

- 9.2.5. Footwear and Leather

- 9.2.6. Electrical and Electronics

- 9.2.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Water-based

- 10.1.2. Solvent-based

- 10.1.3. Hot-melt

- 10.1.4. Other Te

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Building and Construction

- 10.2.2. Healthcare

- 10.2.3. Automotive and Transportation

- 10.2.4. Packaging

- 10.2.5. Footwear and Leather

- 10.2.6. Electrical and Electronics

- 10.2.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Polyurethane Adhesives And Sealants Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Huntsman International LLC

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Dow

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Arkema

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Beijing Comens New materials Co Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Kangada New Materials (Group) Co Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sika AG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 MAPEI SpA

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Henkel AG & Co KGaA

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Jowat SE

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Pidilite Industries Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 3M

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Soudal Holding NV*List Not Exhaustive

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Hubei Huitian New Materials Co Ltd

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 H B Fuller Company

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 NANPAO RESINS CHEMICAL GROUP

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 Huntsman International LLC

List of Figures

- Figure 1: Global Polyurethane Adhesives And Sealants Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue (Million), by Technology 2024 & 2032

- Figure 15: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue Share (%), by Technology 2024 & 2032

- Figure 16: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Asia Pacific Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: North America Polyurethane Adhesives And Sealants Market Revenue (Million), by Technology 2024 & 2032

- Figure 21: North America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Technology 2024 & 2032

- Figure 22: North America Polyurethane Adhesives And Sealants Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: North America Polyurethane Adhesives And Sealants Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: North America Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 25: North America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Polyurethane Adhesives And Sealants Market Revenue (Million), by Technology 2024 & 2032

- Figure 27: Europe Polyurethane Adhesives And Sealants Market Revenue Share (%), by Technology 2024 & 2032

- Figure 28: Europe Polyurethane Adhesives And Sealants Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Europe Polyurethane Adhesives And Sealants Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Europe Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: South America Polyurethane Adhesives And Sealants Market Revenue (Million), by Technology 2024 & 2032

- Figure 33: South America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Technology 2024 & 2032

- Figure 34: South America Polyurethane Adhesives And Sealants Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: South America Polyurethane Adhesives And Sealants Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: South America Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 37: South America Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue (Million), by Technology 2024 & 2032

- Figure 39: Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue Share (%), by Technology 2024 & 2032

- Figure 40: Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 51: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Indonesia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Malaysia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Thailand Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Vietnam Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 63: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 64: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: United States Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Canada Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Mexico Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 69: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 70: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 71: Germany Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: United Kingdom Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: France Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Italy Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Spain Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Russia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Turkey Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: NORDIC Countries Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Rest of Europe Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 81: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 82: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 83: Brazil Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Argentina Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 85: Colombia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Rest of South America Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 87: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 88: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 89: Global Polyurethane Adhesives And Sealants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Saudi Arabia Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 91: South Africa Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Qatar Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 93: United Arab Emirates Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Egypt Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 95: Algeria Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Middle East and Africa Polyurethane Adhesives And Sealants Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurethane Adhesives And Sealants Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Polyurethane Adhesives And Sealants Market?

Key companies in the market include Huntsman International LLC, Dow, Arkema, Beijing Comens New materials Co Ltd, Kangada New Materials (Group) Co Ltd, Sika AG, MAPEI SpA, Henkel AG & Co KGaA, Jowat SE, Pidilite Industries Ltd, 3M, Soudal Holding NV*List Not Exhaustive, Hubei Huitian New Materials Co Ltd, H B Fuller Company, NANPAO RESINS CHEMICAL GROUP.

3. What are the main segments of the Polyurethane Adhesives And Sealants Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from the Construction Industry in the Asian Region; Growth in the Packaging Industry; Other Drivers.

6. What are the notable trends driving market growth?

Building and Construction Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Stricter Regulations on Hazardous Materials and Environmental Concerns; Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

November 2023: Henkel introduced the first bio-based PUR adhesives for load-bearing timber construction. The new Loctite engineered wood adhesives, HB S ECO, and CR 821 ECO reduce CO2eq emissions by more than 60% compared to fossil-based alternatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyurethane Adhesives And Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyurethane Adhesives And Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyurethane Adhesives And Sealants Market?

To stay informed about further developments, trends, and reports in the Polyurethane Adhesives And Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence