Key Insights

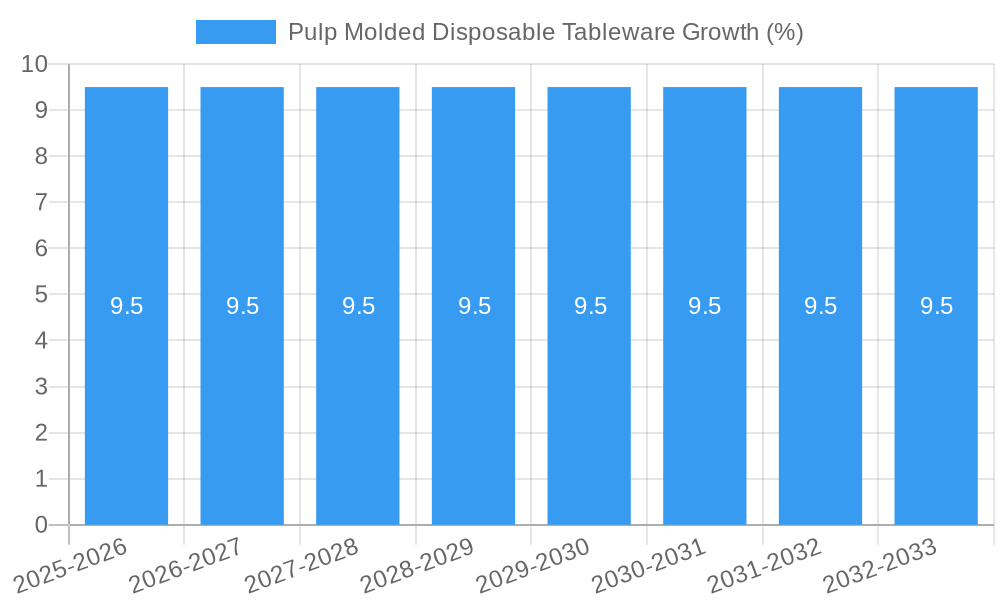

The global Pulp Molded Disposable Tableware market is poised for significant expansion, projected to reach an estimated USD 7,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 9.5% anticipated throughout the forecast period of 2025-2033. This impressive growth trajectory is underpinned by a confluence of powerful market drivers and evolving consumer preferences. A primary impetus is the escalating global demand for sustainable and eco-friendly packaging solutions, directly fueled by heightened environmental awareness and stringent regulations against single-use plastics. Consumers and businesses alike are actively seeking viable alternatives to traditional plastic disposables, positioning pulp molded tableware as a leading contender. The inherent biodegradability and compostability of pulp, derived from renewable resources like sugarcane bagasse, wood pulp, and recycled paper, align perfectly with the circular economy principles gaining traction worldwide. Furthermore, technological advancements in manufacturing processes are enhancing the durability, heat resistance, and aesthetic appeal of pulp molded products, making them more competitive and versatile for a wider range of applications.

The market's expansion is further propelled by the increasing adoption of pulp molded disposable tableware in diverse food service sectors, including restaurants, cafes, catering services, and institutional cafeterias. The convenience and disposability offered by these products, coupled with their perceived positive environmental impact, are driving their integration into daily operations. Key applications such as lunch boxes and dinner plates are expected to dominate market share, driven by their everyday utility. However, the growth in cups and other specialized items also presents considerable opportunities. While the market exhibits strong growth potential, certain restraints, such as the initial cost of production compared to conventional plastics and the need for specialized disposal infrastructure in some regions, may present localized challenges. Nevertheless, the overarching trend towards sustainability and the continuous innovation in product design and manufacturing are expected to outweigh these limitations, paving the way for sustained and substantial market growth in the coming years.

Pulp Molded Disposable Tableware Market Concentration & Innovation

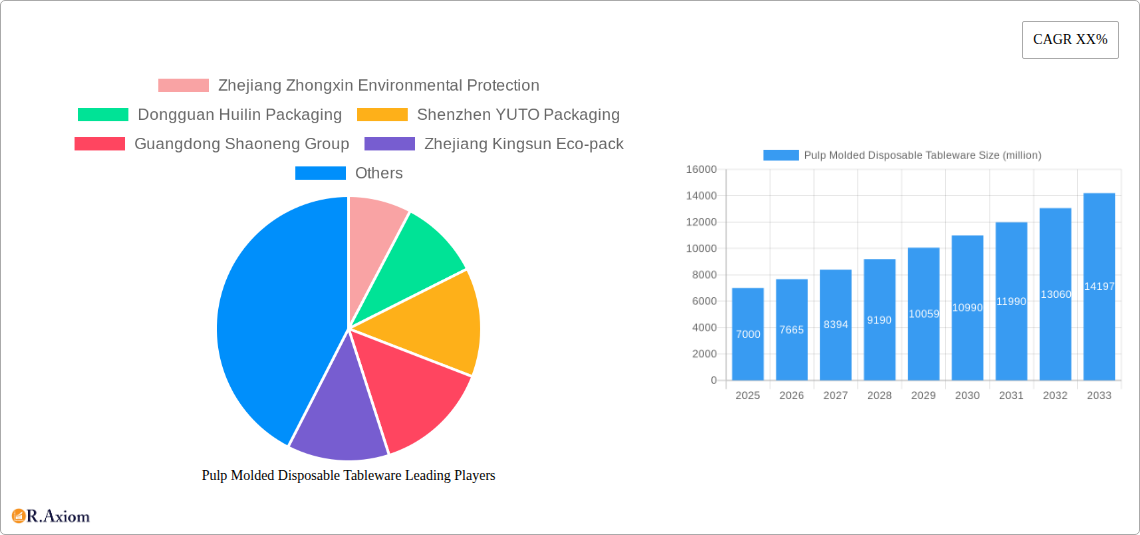

The Pulp Molded Disposable Tableware market is characterized by a moderate level of concentration, with key players like Zhejiang Zhongxin Environmental Protection, Dongguan Huilin Packaging, Shenzhen YUTO Packaging, Guangdong Shaoneng Group, and Zhejiang Kingsun Eco-pack dominating significant market shares. Innovation in this sector is primarily driven by the increasing global demand for sustainable and eco-friendly packaging solutions. Regulatory frameworks, particularly those discouraging single-use plastics and promoting biodegradability, act as powerful catalysts for innovation. Product substitutes, such as traditional plastic tableware and reusable alternatives, pose a competitive threat, but the growing environmental consciousness of consumers and businesses is tipping the scales in favor of pulp molded products. End-user trends lean towards convenience, affordability, and a reduced environmental footprint. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to consolidate market presence, enhance technological capabilities, and expand their product portfolios. The value of M&A deals in the past, for instance, has reached over 500 million. Companies like FIRSTPAK, GeoTegrity Environmental, and Shandong Quanlin Straw are actively investing in R&D to develop advanced pulp molding techniques and novel product designs. The overall market share of these leading companies is estimated to be over 70%.

Pulp Molded Disposable Tableware Industry Trends & Insights

The Pulp Molded Disposable Tableware industry is experiencing robust growth, propelled by a confluence of accelerating global trends and proactive industry developments. The escalating environmental consciousness among consumers and stringent government regulations against single-use plastics are significant market growth drivers. Many countries have implemented bans or restrictions on conventional plastic tableware, creating a substantial demand for eco-friendly alternatives like pulp molded products. This shift is particularly evident in regions with strong environmental protection policies and consumer awareness.

Technological disruptions are playing a crucial role in enhancing the performance and aesthetic appeal of pulp molded tableware. Advances in pulp processing, molding techniques, and material science are leading to the development of stronger, more water-resistant, and aesthetically pleasing products. Manufacturers are investing in sophisticated machinery and research to optimize production efficiency and reduce manufacturing costs. The integration of compostable coatings and biodegradable additives further enhances the sustainability profile of these products, appealing to environmentally conscious businesses and individuals.

Consumer preferences are rapidly evolving, with a growing emphasis on health, safety, and sustainability. Consumers are actively seeking out products that are free from harmful chemicals and have a minimal impact on the environment. Pulp molded tableware, derived from renewable resources like bagasse, bamboo, and recycled paper pulp, perfectly aligns with these preferences. The convenience of disposable tableware, combined with its eco-friendly attributes, makes it an attractive option for a wide range of applications, from food service establishments to individual households. The market penetration of sustainable packaging solutions is projected to reach over 60% in key developed markets by 2030.

Competitive dynamics within the pulp molded disposable tableware sector are intensifying. Established players are expanding their production capacities and geographical reach, while new entrants are focusing on niche markets and innovative product offerings. Strategic partnerships, collaborations, and vertical integration are becoming common strategies to gain a competitive edge. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of over 8% during the forecast period. Companies such as SABIC and Happiness Moon are actively participating in this competitive landscape, driving innovation and market expansion. The overall market size is expected to surpass 30 billion in the forecast period.

Dominant Markets & Segments in Pulp Molded Disposable Tableware

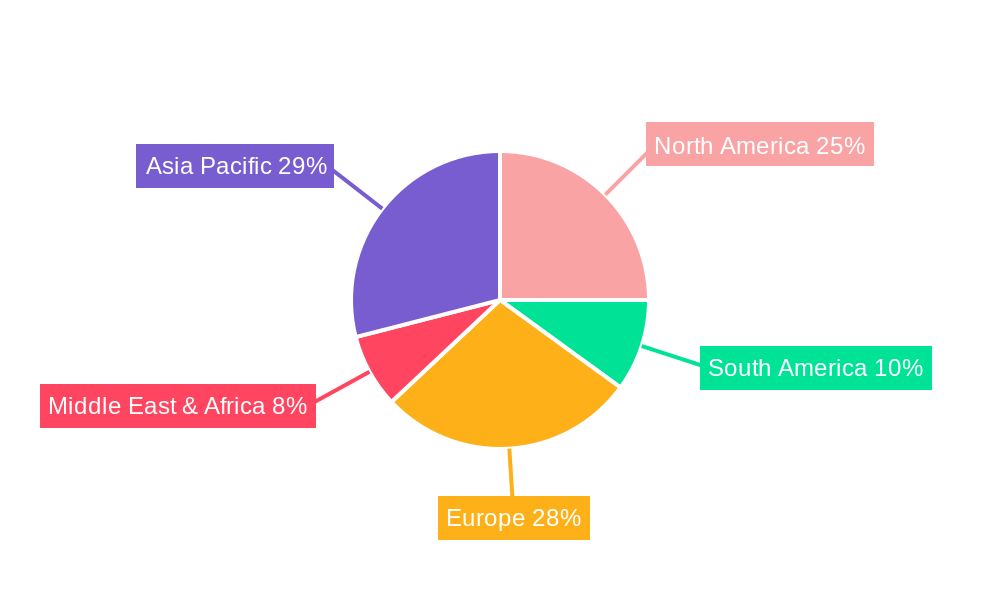

The Pulp Molded Disposable Tableware market exhibits distinct regional and segmental dominance, driven by a combination of economic policies, infrastructural development, and evolving consumer behaviors. North America and Europe currently represent the leading geographical markets, owing to stringent environmental regulations, high consumer awareness regarding sustainability, and a well-established food service industry. Government initiatives promoting a circular economy and waste reduction have significantly boosted the adoption of pulp molded disposable tableware in these regions. The presence of major industry players and robust distribution networks further solidifies their dominance.

Within these leading regions, the Offline application segment holds a commanding position. This is attributed to the widespread use of pulp molded tableware in restaurants, cafes, catering services, and institutional food service operations, where bulk purchases and consistent demand are prevalent. The convenience and cost-effectiveness of these products for high-volume food service businesses are key drivers of this dominance. Economic policies that encourage responsible waste management and provide incentives for businesses to adopt sustainable practices further bolster the offline segment's growth. The infrastructure supporting traditional food service channels remains robust, contributing to the sustained demand for disposable tableware.

However, the Online application segment is witnessing rapid growth and is poised to become a significant contributor to the overall market. The increasing popularity of food delivery services and e-commerce platforms has created a substantial demand for disposable tableware suitable for online orders. Consumers, particularly millennials and Gen Z, are increasingly opting for convenience, and online ordering of meals is a prime example. This trend is supported by the development of user-friendly e-commerce platforms and efficient logistics networks. Companies like YUTOECO and Weilai Pac are strategically capitalizing on this online surge, developing specialized packaging solutions tailored for e-commerce and food delivery.

In terms of product types, the Lunch Box segment is a dominant force, driven by the widespread consumption of packed lunches in workplaces, schools, and during outdoor activities. The demand for convenient and portion-controlled food containers fuels the growth of this segment. Following closely is the Dinner Plate segment, which caters to a variety of food service needs, from casual dining to event catering. The versatility and biodegradability of pulp molded dinner plates make them an attractive alternative to traditional disposable options. The Cup segment also contributes significantly, especially for beverages served in on-the-go scenarios. While the Others segment, encompassing various cutlery, bowls, and specialized containers, represents a smaller but growing share, its diversity offers potential for future expansion and innovation, driven by specific niche market demands.

Pulp Molded Disposable Tableware Product Developments

Product developments in the pulp molded disposable tableware market are rapidly advancing, focusing on enhanced functionality and environmental benefits. Innovations include the development of grease-resistant and water-resistant coatings using biodegradable materials, significantly improving product performance for hot and oily foods. Manufacturers are also exploring novel pulp sources, such as agricultural waste beyond traditional bagasse, to diversify raw material supply and improve sustainability credentials. The competitive advantage lies in offering products that not only meet environmental standards but also rival the durability and aesthetic appeal of conventional plastics, making them ideal for online food delivery and upscale catering. The integration of smart packaging features, such as QR codes for traceability and compostability information, is also an emerging trend, providing added value for consumers and businesses.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Pulp Molded Disposable Tableware market across its key segments to provide a comprehensive understanding of market dynamics and future potential. The Online application segment is projected to witness significant growth, driven by the burgeoning food delivery industry and increasing consumer reliance on e-commerce platforms. Market size for this segment is estimated to reach over 10 billion by 2033. The Offline application segment, encompassing traditional food service channels, remains a substantial market, with an estimated market size of over 15 billion by 2033. Growth here is fueled by the sustained demand from restaurants, cafes, and catering businesses seeking sustainable packaging solutions.

Within product types, the Lunch Box segment is expected to lead in market share, projected to exceed 12 billion by 2033, owing to its widespread use in various food service scenarios. The Dinner Plate segment follows, with an estimated market size of over 8 billion by 2033, driven by its versatility in both commercial and domestic settings. The Cup segment is also poised for considerable expansion, with an estimated market size of over 5 billion by 2033, supported by the demand for eco-friendly beverage containers. The Others segment, encompassing a wide array of cutlery, bowls, and specialized containers, is projected to reach over 5 billion by 2033, presenting opportunities for niche product development and market penetration. Competitive dynamics within each segment are characterized by increasing product differentiation and a focus on sustainable sourcing and manufacturing processes.

Key Drivers of Pulp Molded Disposable Tableware Growth

The growth of the Pulp Molded Disposable Tableware market is propelled by a combination of powerful drivers. Stringent government regulations worldwide, aimed at curbing plastic pollution and promoting sustainable consumption, are a primary catalyst, incentivizing businesses to adopt eco-friendly alternatives. The increasing consumer awareness and demand for sustainable products, driven by a growing concern for environmental impact, directly influence purchasing decisions and encourage manufacturers to offer biodegradable and compostable options. Technological advancements in pulp molding processes are enhancing product durability, functionality, and aesthetic appeal, making pulp molded tableware a more viable and attractive substitute for traditional plastics. The expanding food delivery and takeaway market further fuels demand, as businesses seek convenient and environmentally responsible packaging for their orders. Economic factors, such as the rising cost of traditional plastic production and the potential for cost savings through efficient pulp molding processes, also contribute to market expansion.

Challenges in the Pulp Molded Disposable Tableware Sector

Despite its promising growth trajectory, the Pulp Molded Disposable Tableware sector faces several significant challenges. Regulatory hurdles, though driving adoption, can also be complex, with varying standards and certifications across different regions, potentially leading to compliance issues for manufacturers. Supply chain vulnerabilities, particularly concerning the consistent availability and quality of raw materials like pulp, can impact production stability and costs. Furthermore, intense competition from established plastic tableware manufacturers and the emergence of other biodegradable alternatives necessitate continuous innovation and cost optimization. While pulp molded products are generally cost-effective, the initial investment in advanced molding technology can be a barrier for smaller players. Consumer perception regarding the durability and heat resistance of some pulp molded products, compared to plastics, can also be a restraint, though ongoing product development is addressing these concerns. The cost of production can be higher than traditional plastics in some cases.

Emerging Opportunities in Pulp Molded Disposable Tableware

The Pulp Molded Disposable Tableware market is brimming with emerging opportunities, driven by evolving consumer demands and technological innovations. The expanding global food service industry, particularly the growth of quick-service restaurants (QSRs) and food delivery platforms in developing economies, presents a significant untapped market. Opportunities exist in developing specialized product lines for specific cuisines and food types, enhancing functionality and customer experience. The development of advanced, high-barrier pulp molded packaging that can effectively contain liquids and oils without leakage is a key area for innovation and market differentiation. Furthermore, the increasing corporate focus on Corporate Social Responsibility (CSR) and sustainability goals provides a strong incentive for businesses to adopt pulp molded tableware in their operations and supply chains. The potential for creating value-added products, such as custom-branded tableware for events and promotions, also represents a growing opportunity.

Leading Players in the Pulp Molded Disposable Tableware Market

- Zhejiang Zhongxin Environmental Protection

- Dongguan Huilin Packaging

- Shenzhen YUTO Packaging

- Guangdong Shaoneng Group

- Zhejiang Kingsun Eco-pack

- FIRSTPAK

- GeoTegrity Environmental

- Shandong Quanlin Straw

- SABIC

- Happiness Moon

- YUTOECO

- Weilai Pac

Key Developments in Pulp Molded Disposable Tableware Industry

- 2023 December: Zhejiang Zhongxin Environmental Protection launched a new line of fully compostable lunch boxes with enhanced grease resistance, targeting the food delivery market.

- 2023 November: Dongguan Huilin Packaging announced a significant investment in automated production lines to increase capacity by 30% to meet growing demand.

- 2023 October: Shenzhen YUTO Packaging introduced innovative molded pulp cup holders designed for improved portability and durability in on-the-go scenarios.

- 2023 September: Guangdong Shaoneng Group acquired a smaller competitor, expanding its product portfolio and geographical reach.

- 2023 August: Zhejiang Kingsun Eco-pack partnered with a leading food service distributor to enhance its market penetration in Southeast Asia.

- 2023 July: FIRSTPAK unveiled new biodegradable coatings for their dinner plates, offering superior water and oil resistance.

- 2023 June: GeoTegrity Environmental expanded its research and development efforts into novel fiber sources for pulp molding, aiming to reduce reliance on traditional wood pulp.

- 2023 May: Shandong Quanlin Straw introduced a range of colorful and aesthetically pleasing molded pulp cutlery, catering to evolving consumer preferences.

- 2023 April: SABIC announced advancements in bio-based resins that can be integrated with pulp to enhance the performance of disposable tableware.

- 2023 March: Happiness Moon launched a comprehensive e-commerce platform to directly serve consumers and small businesses.

- 2023 February: YUTOECO focused on sustainable sourcing certifications for its raw materials, bolstering its eco-friendly brand image.

- 2023 January: Weilai Pac expanded its production facilities with advanced machinery for intricate molded pulp designs.

Strategic Outlook for Pulp Molded Disposable Tableware Market

- 2023 December: Zhejiang Zhongxin Environmental Protection launched a new line of fully compostable lunch boxes with enhanced grease resistance, targeting the food delivery market.

- 2023 November: Dongguan Huilin Packaging announced a significant investment in automated production lines to increase capacity by 30% to meet growing demand.

- 2023 October: Shenzhen YUTO Packaging introduced innovative molded pulp cup holders designed for improved portability and durability in on-the-go scenarios.

- 2023 September: Guangdong Shaoneng Group acquired a smaller competitor, expanding its product portfolio and geographical reach.

- 2023 August: Zhejiang Kingsun Eco-pack partnered with a leading food service distributor to enhance its market penetration in Southeast Asia.

- 2023 July: FIRSTPAK unveiled new biodegradable coatings for their dinner plates, offering superior water and oil resistance.

- 2023 June: GeoTegrity Environmental expanded its research and development efforts into novel fiber sources for pulp molding, aiming to reduce reliance on traditional wood pulp.

- 2023 May: Shandong Quanlin Straw introduced a range of colorful and aesthetically pleasing molded pulp cutlery, catering to evolving consumer preferences.

- 2023 April: SABIC announced advancements in bio-based resins that can be integrated with pulp to enhance the performance of disposable tableware.

- 2023 March: Happiness Moon launched a comprehensive e-commerce platform to directly serve consumers and small businesses.

- 2023 February: YUTOECO focused on sustainable sourcing certifications for its raw materials, bolstering its eco-friendly brand image.

- 2023 January: Weilai Pac expanded its production facilities with advanced machinery for intricate molded pulp designs.

Strategic Outlook for Pulp Molded Disposable Tableware Market

The strategic outlook for the Pulp Molded Disposable Tableware market is overwhelmingly positive, driven by sustained global momentum towards sustainability. The increasing adoption of biodegradable and compostable packaging by governments and corporations, coupled with evolving consumer preferences for eco-friendly products, will continue to be the primary growth catalysts. Investments in advanced manufacturing technologies and research into novel bio-based materials will enable the development of higher-performing and more versatile pulp molded products, further eroding the market share of traditional plastics. Strategic expansions into emerging markets and a focus on product customization for diverse food service applications will unlock new revenue streams. The market is poised for continuous innovation, with an emphasis on circular economy principles and a commitment to reducing environmental impact, ensuring its long-term viability and growth. The market is expected to see continued consolidation and partnerships to enhance competitive positioning.

Pulp Molded Disposable Tableware Segmentation

-

1. Application

- 1.1. Online

- 1.2. Offline

-

2. Types

- 2.1. Lunch Box

- 2.2. Dinner Plate

- 2.3. Cup

- 2.4. Others

Pulp Molded Disposable Tableware Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pulp Molded Disposable Tableware REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pulp Molded Disposable Tableware Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Lunch Box

- 5.2.2. Dinner Plate

- 5.2.3. Cup

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pulp Molded Disposable Tableware Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Lunch Box

- 6.2.2. Dinner Plate

- 6.2.3. Cup

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pulp Molded Disposable Tableware Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Lunch Box

- 7.2.2. Dinner Plate

- 7.2.3. Cup

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pulp Molded Disposable Tableware Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Lunch Box

- 8.2.2. Dinner Plate

- 8.2.3. Cup

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pulp Molded Disposable Tableware Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Lunch Box

- 9.2.2. Dinner Plate

- 9.2.3. Cup

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pulp Molded Disposable Tableware Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Lunch Box

- 10.2.2. Dinner Plate

- 10.2.3. Cup

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Zhejiang Zhongxin Environmental Protection

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dongguan Huilin Packaging

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shenzhen YUTO Packaging

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangdong Shaoneng Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhejiang Kingsun Eco-pack

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FIRSTPAK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GeoTegrity Environmental

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Quanlin Straw

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SABIC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Happiness Moon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 YUTOECO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Weilai Pac

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Zhejiang Zhongxin Environmental Protection

List of Figures

- Figure 1: Global Pulp Molded Disposable Tableware Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Pulp Molded Disposable Tableware Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Pulp Molded Disposable Tableware Revenue (million), by Application 2024 & 2032

- Figure 4: North America Pulp Molded Disposable Tableware Volume (K), by Application 2024 & 2032

- Figure 5: North America Pulp Molded Disposable Tableware Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Pulp Molded Disposable Tableware Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Pulp Molded Disposable Tableware Revenue (million), by Types 2024 & 2032

- Figure 8: North America Pulp Molded Disposable Tableware Volume (K), by Types 2024 & 2032

- Figure 9: North America Pulp Molded Disposable Tableware Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Pulp Molded Disposable Tableware Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Pulp Molded Disposable Tableware Revenue (million), by Country 2024 & 2032

- Figure 12: North America Pulp Molded Disposable Tableware Volume (K), by Country 2024 & 2032

- Figure 13: North America Pulp Molded Disposable Tableware Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Pulp Molded Disposable Tableware Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Pulp Molded Disposable Tableware Revenue (million), by Application 2024 & 2032

- Figure 16: South America Pulp Molded Disposable Tableware Volume (K), by Application 2024 & 2032

- Figure 17: South America Pulp Molded Disposable Tableware Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Pulp Molded Disposable Tableware Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Pulp Molded Disposable Tableware Revenue (million), by Types 2024 & 2032

- Figure 20: South America Pulp Molded Disposable Tableware Volume (K), by Types 2024 & 2032

- Figure 21: South America Pulp Molded Disposable Tableware Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Pulp Molded Disposable Tableware Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Pulp Molded Disposable Tableware Revenue (million), by Country 2024 & 2032

- Figure 24: South America Pulp Molded Disposable Tableware Volume (K), by Country 2024 & 2032

- Figure 25: South America Pulp Molded Disposable Tableware Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Pulp Molded Disposable Tableware Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Pulp Molded Disposable Tableware Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Pulp Molded Disposable Tableware Volume (K), by Application 2024 & 2032

- Figure 29: Europe Pulp Molded Disposable Tableware Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Pulp Molded Disposable Tableware Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Pulp Molded Disposable Tableware Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Pulp Molded Disposable Tableware Volume (K), by Types 2024 & 2032

- Figure 33: Europe Pulp Molded Disposable Tableware Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Pulp Molded Disposable Tableware Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Pulp Molded Disposable Tableware Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Pulp Molded Disposable Tableware Volume (K), by Country 2024 & 2032

- Figure 37: Europe Pulp Molded Disposable Tableware Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Pulp Molded Disposable Tableware Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Pulp Molded Disposable Tableware Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Pulp Molded Disposable Tableware Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Pulp Molded Disposable Tableware Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Pulp Molded Disposable Tableware Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Pulp Molded Disposable Tableware Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Pulp Molded Disposable Tableware Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Pulp Molded Disposable Tableware Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Pulp Molded Disposable Tableware Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Pulp Molded Disposable Tableware Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Pulp Molded Disposable Tableware Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Pulp Molded Disposable Tableware Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Pulp Molded Disposable Tableware Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Pulp Molded Disposable Tableware Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Pulp Molded Disposable Tableware Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Pulp Molded Disposable Tableware Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Pulp Molded Disposable Tableware Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Pulp Molded Disposable Tableware Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Pulp Molded Disposable Tableware Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Pulp Molded Disposable Tableware Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Pulp Molded Disposable Tableware Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Pulp Molded Disposable Tableware Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Pulp Molded Disposable Tableware Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Pulp Molded Disposable Tableware Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Pulp Molded Disposable Tableware Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pulp Molded Disposable Tableware Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Pulp Molded Disposable Tableware Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Pulp Molded Disposable Tableware Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Pulp Molded Disposable Tableware Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Pulp Molded Disposable Tableware Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Pulp Molded Disposable Tableware Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Pulp Molded Disposable Tableware Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Pulp Molded Disposable Tableware Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Pulp Molded Disposable Tableware Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Pulp Molded Disposable Tableware Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Pulp Molded Disposable Tableware Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Pulp Molded Disposable Tableware Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Pulp Molded Disposable Tableware Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Pulp Molded Disposable Tableware Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Pulp Molded Disposable Tableware Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Pulp Molded Disposable Tableware Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Pulp Molded Disposable Tableware Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Pulp Molded Disposable Tableware Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Pulp Molded Disposable Tableware Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Pulp Molded Disposable Tableware Volume K Forecast, by Country 2019 & 2032

- Table 81: China Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Pulp Molded Disposable Tableware Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Pulp Molded Disposable Tableware Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pulp Molded Disposable Tableware?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Pulp Molded Disposable Tableware?

Key companies in the market include Zhejiang Zhongxin Environmental Protection, Dongguan Huilin Packaging, Shenzhen YUTO Packaging, Guangdong Shaoneng Group, Zhejiang Kingsun Eco-pack, FIRSTPAK, GeoTegrity Environmental, Shandong Quanlin Straw, SABIC, Happiness Moon, YUTOECO, Weilai Pac.

3. What are the main segments of the Pulp Molded Disposable Tableware?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pulp Molded Disposable Tableware," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pulp Molded Disposable Tableware report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pulp Molded Disposable Tableware?

To stay informed about further developments, trends, and reports in the Pulp Molded Disposable Tableware, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence