Key Insights

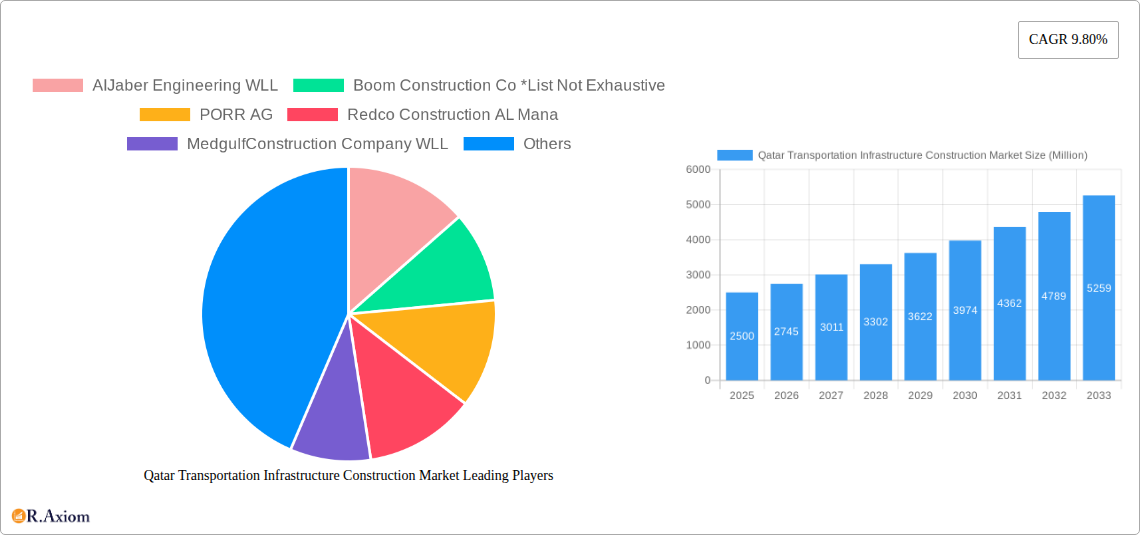

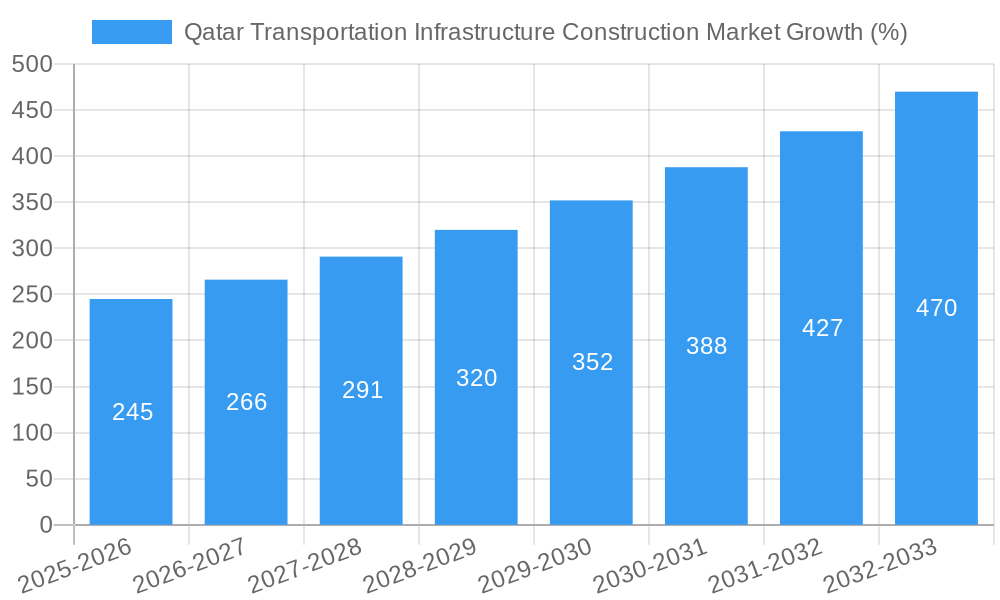

The Qatar Transportation Infrastructure Construction Market is experiencing robust growth, driven by the nation's ambitious infrastructure development plans and preparations for major events. The market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR of 9.8% and a known 2019-2024 historical period), is projected to reach $Y million by 2033. This significant expansion is fueled by continuous investments in road networks, railway systems, airport expansions, and port modernization. Government initiatives focused on sustainable transportation and smart city development further contribute to the market's dynamism. Key players like AIJaber Engineering WLL, Boom Construction Co, PORR AG, and others are actively involved, leveraging their expertise in executing large-scale projects. The market's segmentation across roads, railways, airways, and ports offers diverse opportunities, with road construction currently holding a substantial share due to ongoing highway expansions and the development of new transportation links.

However, the market's growth trajectory is not without challenges. Potential restraints include global economic fluctuations, material cost volatility, and the availability of skilled labor. Navigating these factors effectively is crucial for sustaining the market's impressive growth momentum. Furthermore, the market's future success hinges on the effective management of environmental impacts, adherence to stringent safety regulations, and the adoption of innovative construction technologies to enhance efficiency and sustainability. The sustained focus on diversification of the Qatari economy beyond oil and gas, with a strong emphasis on tourism and related infrastructure, is likely to maintain the high demand for transportation infrastructure projects in the coming years. The ongoing and future projects focusing on expansion and improvement of existing infrastructure point to sustained market growth.

Qatar Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar Transportation Infrastructure Construction Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, key players, and future growth prospects. The report leverages extensive data analysis to provide actionable insights and strategic recommendations.

Qatar Transportation Infrastructure Construction Market Market Concentration & Innovation

The Qatar transportation infrastructure construction market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise market share figures for each company are not publicly available, key players such as AIJaber Engineering WLL, Boom Construction Co, PORR AG, Redco Construction AL Mana, Medgulf Construction Company WLL, Gulf Contracting Company, Harinsa Construction Company Qatar WLL, AL Sariya Holding Group, Besix Group, Bojamhoor Trading and Construction Co WLL, Hamad bin Khalid Contracting Company WLL, and MIDMAC Contracting Co WLL contribute significantly to the overall market volume. The market is characterized by ongoing mergers and acquisitions (M&A) activity, with deal values fluctuating based on project size and strategic objectives. Recent M&A activity has been driven by a desire to consolidate market share and secure large-scale projects. Innovation in this sector is primarily focused on adopting advanced technologies like Building Information Modeling (BIM) and sustainable construction practices, improving efficiency and reducing environmental impact. Regulatory frameworks, such as those set by the Public Works Authority (Ashghal), significantly influence market dynamics, emphasizing safety, quality, and adherence to environmental standards. Product substitutes are limited, with the primary focus remaining on improving the quality and efficiency of existing infrastructure solutions. End-user trends are largely influenced by the Qatari government's ambitious infrastructure development plans, driving demand for robust and sustainable solutions.

Qatar Transportation Infrastructure Construction Market Industry Trends & Insights

The Qatar transportation infrastructure construction market is experiencing robust growth, driven primarily by significant government investments in expanding and modernizing its transportation networks. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting the continued expansion of projects across various modes of transport. Market penetration for new technologies, such as smart infrastructure solutions, is steadily increasing, though adoption rates vary across segments. Consumer preferences are heavily influenced by the government's focus on improving connectivity, accessibility, and sustainability. The competitive landscape is highly dynamic, with both local and international players vying for major projects. Technological disruptions are primarily focused on improving construction efficiency, sustainability, and safety. The increasing adoption of digital technologies such as BIM and IoT (Internet of Things) is transforming project management and operational efficiency. The market is witnessing strong growth in the adoption of sustainable building materials and practices, driven by government policies and environmental concerns. The market penetration of sustainable construction methods is estimated to reach xx% by 2033.

Dominant Markets & Segments in Qatar Transportation Infrastructure Construction Market

The Roads segment currently dominates the Qatar transportation infrastructure construction market, driven by the government's sustained investment in expanding and upgrading road networks to support the growing population and economic activities.

- Key Drivers for Road Segment Dominance:

- Extensive government investment in highway expansion and modernization projects.

- Growing urbanization and population requiring enhanced road infrastructure.

- Focus on improving traffic flow and reducing congestion within major cities.

- Development of new road networks in suburban areas to support urban expansion.

The other segments, namely Railways, Airways, and Ports, while showing promising growth potential, currently hold smaller market shares relative to the Roads segment. However, significant investments in the development of the Hamad International Airport, expansion of the port facilities, and the ongoing development of the rail network indicate substantial future growth for these sectors. The overall market is characterized by strong government support, creating a conducive environment for growth across all segments.

Qatar Transportation Infrastructure Construction Market Product Developments

Product innovations are largely centered around enhancing construction efficiency, sustainability, and safety. This includes the adoption of prefabricated components, advanced construction materials, and digital technologies like BIM for project planning and execution. These innovations deliver competitive advantages through reduced construction times, improved project quality, and enhanced cost-effectiveness. The market is witnessing increased adoption of sustainable construction materials and techniques aiming to reduce the environmental footprint of projects and achieve higher sustainability ratings.

Report Scope & Segmentation Analysis

This report segments the Qatar transportation infrastructure construction market by mode of transport: Roads, Railways, Airways, and Ports.

Roads: This segment represents the largest portion of the market, driven by continuous expansion and upgrades of road networks. Growth is projected at xx% CAGR during the forecast period. Competition is intense, with numerous companies vying for projects.

Railways: This segment is experiencing significant growth due to ongoing investment in rail infrastructure, including the Doha Metro. Growth is estimated at xx% CAGR.

Airways: This segment is characterized by expansion and modernization efforts at Hamad International Airport. Growth projections are moderate due to relatively lower frequency of large-scale projects.

Ports: This segment is growing steadily due to increased cargo traffic and port capacity expansion. Growth is anticipated at xx% CAGR.

Key Drivers of Qatar Transportation Infrastructure Construction Market Growth

The primary growth drivers for the Qatar transportation infrastructure construction market are substantial government investment in infrastructure development, rapid urbanization, the upcoming FIFA World Cup legacy projects, and the country's commitment to economic diversification. These factors combine to create a highly favorable environment for sustained market expansion. Technological advancements such as BIM and sustainable construction methods also contribute significantly to this growth by improving efficiency and sustainability in the sector.

Challenges in the Qatar Transportation Infrastructure Construction Market Sector

The main challenges facing the market include the global supply chain disruptions impacting material costs and availability, the potential for skilled labor shortages, and intense competition among contractors. These factors can lead to project cost overruns and delays. Strict regulatory requirements and environmental regulations also add to the complexity of project execution. The impact of these challenges on project timelines and budgets can be quantified through analysis of individual project data and industry reports. A xx% increase in material costs has been observed in recent years, impacting profitability.

Emerging Opportunities in Qatar Transportation Infrastructure Construction Market

The market presents significant opportunities in areas such as smart infrastructure, sustainable construction materials, and the application of innovative technologies to improve project efficiency. Demand for improved public transport solutions, coupled with the government’s focus on sustainable development, creates ample opportunities for companies specializing in green construction techniques. The increasing use of digital technologies presents opportunities to enhance project management, monitoring, and safety.

Leading Players in the Qatar Transportation Infrastructure Construction Market Market

- AIJaber Engineering WLL

- Boom Construction Co

- PORR AG

- Redco Construction AL Mana

- Medgulf Construction Company WLL

- Gulf Contracting Company

- Harinsa Construction Company Qatar WLL

- AL Sariya Holding Group

- Besix Group

- Bojamhoor Trading and Construction Co WLL

- Hamad bin Khalid Contracting Company WLL

- MIDMAC Contracting Co WLL

Key Developments in Qatar Transportation Infrastructure Construction Market Industry

- May 2023: Significant increase in cargo, livestock, and building materials movement through Qatari ports, indicating strong domestic economic growth. Double-digit growth in RORO (vehicles) and cattle observed at Hamad, Doha, and Al Ruwais ports. However, the number of ships calling at these ports decreased slightly compared to the previous month and the same month last year.

- April 2023: Ashghal (Public Works Authority) reports 60% completion of the Roads and Infrastructure Development Project in Al Mearad and Southwest Muaither - Package 6. Over 50% of planned roads are already open for traffic. The project's completion, expected in Q4 2023, will enhance infrastructure and traffic flow in the area, serving 853 plots.

Strategic Outlook for Qatar Transportation Infrastructure Construction Market Market

The Qatar transportation infrastructure construction market is poised for sustained growth, fueled by continuous government investment, population growth, and a focus on sustainable development. Opportunities exist for companies that can leverage technological advancements to improve efficiency, sustainability, and project delivery. The market's future growth will be shaped by the government's ongoing commitment to infrastructure development and the successful implementation of large-scale projects. This creates a positive outlook for both established and new market entrants capable of adapting to the evolving needs of the industry.

Qatar Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports

Qatar Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Qatar

Qatar Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Increasing Population Growth Boosting the Transportation Infrastructure Construction in Qatar

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AIJaber Engineering WLL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Boom Construction Co *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PORR AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Redco Construction AL Mana

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MedgulfConstruction Company WLL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gulf Contracting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Harinsa Construction Company Qatar WLL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AL Sariya Holding Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Besix Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bojamhoor Trading and Construction Co WLL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hamad bin Khalid Contracting Company WLL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MIDMAC Contracting Co WLL

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 AIJaber Engineering WLL

List of Figures

- Figure 1: Qatar Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: Qatar Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Qatar Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Qatar Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: Qatar Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Transportation Infrastructure Construction Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the Qatar Transportation Infrastructure Construction Market?

Key companies in the market include AIJaber Engineering WLL, Boom Construction Co *List Not Exhaustive, PORR AG, Redco Construction AL Mana, MedgulfConstruction Company WLL, Gulf Contracting Company, Harinsa Construction Company Qatar WLL, AL Sariya Holding Group, Besix Group, Bojamhoor Trading and Construction Co WLL, Hamad bin Khalid Contracting Company WLL, MIDMAC Contracting Co WLL.

3. What are the main segments of the Qatar Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Increasing Population Growth Boosting the Transportation Infrastructure Construction in Qatar.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

May 2023: According to official statistics, Qatar had a significant increase in the movement of cargo, livestock, and building materials via its ports on an annualized basis in April 2023, confirming the strong development trends in the domestic economy. According to data supplied by Mwani Qatar, the three ports of Hamad, Doha, and Al Ruwais experienced double-digit growth in RORO (vehicles) and cattle on a monthly basis throughout the study period. The number of ships calling in Qatar's three ports in April was 228, which was down 7.69% and 1.3% from the same month last year and from the previous month,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Qatar Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence