Key Insights

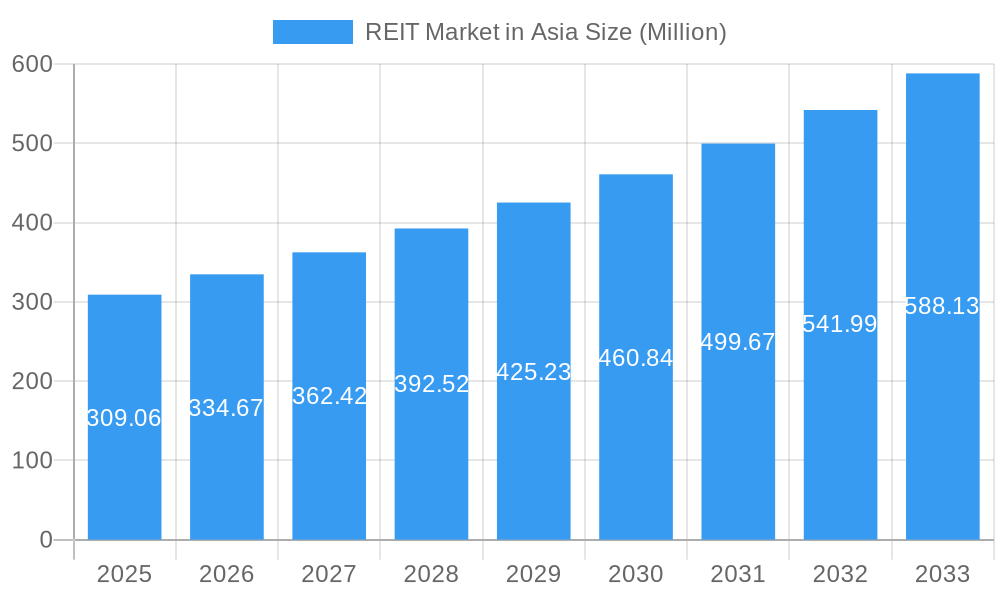

The Asia REIT market, valued at $309.06 million in 2025, is projected to experience robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and a burgeoning middle class fueling demand for retail and commercial spaces. This expansion is further supported by supportive government policies promoting real estate investment and infrastructure development across various Asian nations. Key players like Link REIT, Goodman Group, and Scentre Group are capitalizing on these trends, expanding their portfolios and driving market competition. However, economic volatility in certain regions and potential regulatory changes present challenges to sustained growth. The market's segmentation likely includes office, retail, residential, and industrial REITs, with retail REITs potentially dominating given the strong consumer spending growth in many Asian economies. The 8.24% CAGR projected through 2033 suggests significant long-term potential, although regional variations are anticipated. Factors like interest rate fluctuations and macroeconomic conditions will influence the market's trajectory in the coming years.

REIT Market in Asia Market Size (In Million)

The forecast period of 2025-2033 presents both opportunities and risks for investors. While the overall market growth outlook is positive, careful consideration of specific regional markets and individual REIT performance is crucial. Diversification within the sector and a thorough understanding of local economic conditions are vital for successful investment strategies. The historical data from 2019-2024, while not explicitly provided, likely shows a fluctuating growth pattern influenced by global and regional economic events. Analyzing this historical context alongside the projected CAGR will provide a more comprehensive view of investment prospects in the Asia REIT market. The competitive landscape, characterized by both established international players and local market leaders, demands strategic planning and adaptability.

REIT Market in Asia Company Market Share

REIT Market in Asia: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia REIT market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and emerging opportunities, empowering stakeholders to make informed strategic decisions. With a focus on key players like Link REIT, Goodman Group, Scentre Group, and others, this report is an essential resource for investors, industry professionals, and anyone seeking to understand the complexities of the Asian REIT landscape. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033, building upon historical data from 2019-2024.

REIT Market in Asia: Market Concentration & Innovation

The Asian REIT market exhibits a moderate level of concentration, with a few dominant players commanding significant market share. While precise market share figures for each company are xx, Link REIT and Goodman Group, for example, are known for their substantial portfolios and market influence. However, the market is also characterized by a considerable number of smaller players, leading to competitive dynamics. Innovation in the REIT sector is driven by several factors, including:

- Technological advancements: Proptech solutions are streamlining operations, enhancing tenant experiences, and improving asset management efficiency.

- Sustainability initiatives: Growing environmental consciousness is driving the adoption of green building practices and energy-efficient technologies within REIT portfolios. Examples include Sabana Industrial REIT's March 2023 agreement with Keppel EaaS to implement sustainability solutions.

- Regulatory frameworks: Governments across Asia are implementing policies that influence the attractiveness of REIT investments, impacting market growth and investment flows.

- M&A activities: Mergers and acquisitions play a significant role in shaping market concentration and driving innovation. While precise deal values are xx for many transactions, the large-scale acquisition of commercial assets in India in May 2023, involving Brookfield and GIC (USD 1.4 Billion), highlights the significant activity in this area.

- Product substitution: While direct substitution is limited, the competition comes from other investment vehicles offering similar risk-return profiles.

- End-user trends: Demand for specific property types (e.g., logistics, data centers) is shaping investment strategies and portfolio diversification.

REIT Market in Asia: Industry Trends & Insights

The Asian REIT market is experiencing robust growth, driven by several key trends. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%. Market penetration is increasing across various segments, with significant growth observed in logistics and data centers due to the rise of e-commerce and digitalization. Technological disruptions, particularly in areas such as property technology (PropTech) and data analytics, are reshaping how REITs operate and manage their assets. Consumer preferences are shifting towards sustainable and technologically advanced properties, influencing investment strategies and development priorities. Competitive dynamics are characterized by both consolidation through M&A and the emergence of new players. The market is also witnessing increasing competition from alternative investment vehicles. Growth is further fueled by urbanization, rising middle classes, and expanding economies across various Asian markets. However, macroeconomic factors and geopolitical uncertainties can influence investment decisions and overall market performance.

Dominant Markets & Segments in REIT Market in Asia

While the entire Asian market is experiencing growth, several regions and segments stand out as particularly dominant.

- Leading Region/Country: xx (likely China, Japan, or Singapore given their market size and established REIT sectors).

Key Drivers of Dominance:

- Strong economic growth: Robust economic expansion in the leading region creates a favorable environment for real estate investment.

- Favorable government policies: Supportive regulatory frameworks encourage REIT development and investment.

- Developed infrastructure: Well-developed infrastructure facilitates efficient property management and enhances investment appeal.

- Large and growing population: A significant population base provides a substantial tenant pool and drives demand for real estate.

The dominance analysis suggests that while other nations are growing, established markets benefit from mature regulatory frameworks, robust economies, and a higher level of investor confidence.

REIT Market in Asia: Product Developments

Recent product developments within the Asian REIT market focus on incorporating sustainable practices, leveraging technology for efficient management, and adapting to evolving consumer preferences. The integration of smart building technologies, such as energy-efficient systems and IoT-enabled solutions, is gaining traction. Green certifications are becoming increasingly important in attracting tenants and investors. The market shows a shift towards diversified portfolios, catering to specific sectors like data centers and logistics, alongside traditional commercial and residential properties. This diversification is a direct response to market changes and growing demand.

Report Scope & Segmentation Analysis

This report segments the Asian REIT market in several ways, including:

By Property Type: Office, Retail, Residential, Industrial (including logistics and data centers), Hospitality. Each segment exhibits different growth trajectories and competitive dynamics, driven by varying demand factors. Market sizes vary significantly across segments, with the xx segment currently dominating.

By Geography: Major Asian countries are analyzed individually, offering regional-specific insights.

Key Drivers of REIT Market in Asia Growth

Several factors are propelling the growth of the Asian REIT market:

- Expanding economies and rising middle class: Increased disposable income and urbanization fuels demand for commercial and residential real estate.

- Government support and favorable regulatory frameworks: Policies promoting REIT investment contribute to market expansion.

- Technological advancements: Proptech solutions improve efficiency, transparency, and tenant experiences, driving innovation and investment.

- Infrastructure development: Investment in infrastructure enhances the appeal of real estate assets.

Challenges in the REIT Market in Asia Sector

The Asian REIT market faces several challenges:

- Economic uncertainties: Global economic volatility and regional downturns can impact investment sentiment.

- Geopolitical risks: Regional conflicts and political instability can disrupt market stability.

- Competition from alternative investment options: Competition from other asset classes limits growth.

- Regulatory hurdles and bureaucratic processes: Navigating complex regulations can slow down development and investment.

Emerging Opportunities in REIT Market in Asia

Several opportunities exist within the Asian REIT market:

- Growth in e-commerce and logistics: The rise of e-commerce boosts demand for logistics and warehousing space.

- Expansion of data centers: Increasing digitalization fuels demand for data center infrastructure.

- Focus on sustainable and green buildings: Investors are prioritizing environmentally friendly properties.

- Demand for senior living facilities: An aging population creates opportunities in this sector.

Leading Players in the REIT Market in Asia Market

Key Developments in REIT Market in Asia Industry

May 2023: Brookfield India Real Estate Investment Trust (REIT) and Singapore’s sovereign wealth fund GIC formed a partnership to acquire two large commercial assets (6.5 million sq ft) in India for approximately USD 1.4 billion. This deal signifies significant investment in the Indian commercial real estate market and highlights the growing interest from global investors.

March 2023: Sabana Industrial REIT partnered with Keppel EaaS to implement sustainability initiatives across its portfolio. This demonstrates the growing importance of ESG (Environmental, Social, and Governance) factors in the REIT sector.

Strategic Outlook for REIT Market in Asia Market

The Asian REIT market is poised for continued growth, driven by urbanization, technological advancements, and favorable government policies. Opportunities lie in developing sustainable and technologically advanced properties, catering to specific sector needs, and expanding into emerging markets. However, navigating economic uncertainties and geopolitical risks remains crucial for long-term success. The market will likely see increased consolidation through M&A activity, further driving market concentration and efficiency. The focus on sustainability and technological integration will define the strategic direction of the Asian REIT market in the coming years.

REIT Market in Asia Segmentation

-

1. Type

- 1.1. Industrial

- 1.2. Commercial

- 1.3. Residential

-

2. Application

- 2.1. Warehouses and communication centers

- 2.2. Self-storage facilities and data centers

- 2.3. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Australia

- 3.3. Japan

- 3.4. India

- 3.5. Singapore

- 3.6. South Korea

- 3.7. Malaysia

- 3.8. Rest of Asia-Pacific

REIT Market in Asia Segmentation By Geography

- 1. China

- 2. Australia

- 3. Japan

- 4. India

- 5. Singapore

- 6. South Korea

- 7. Malaysia

- 8. Rest of Asia Pacific

REIT Market in Asia Regional Market Share

Geographic Coverage of REIT Market in Asia

REIT Market in Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Urbanization is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growth in Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial

- 5.1.2. Commercial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Warehouses and communication centers

- 5.2.2. Self-storage facilities and data centers

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Australia

- 5.3.3. Japan

- 5.3.4. India

- 5.3.5. Singapore

- 5.3.6. South Korea

- 5.3.7. Malaysia

- 5.3.8. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Australia

- 5.4.3. Japan

- 5.4.4. India

- 5.4.5. Singapore

- 5.4.6. South Korea

- 5.4.7. Malaysia

- 5.4.8. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Industrial

- 6.1.2. Commercial

- 6.1.3. Residential

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Warehouses and communication centers

- 6.2.2. Self-storage facilities and data centers

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Australia

- 6.3.3. Japan

- 6.3.4. India

- 6.3.5. Singapore

- 6.3.6. South Korea

- 6.3.7. Malaysia

- 6.3.8. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Australia REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Industrial

- 7.1.2. Commercial

- 7.1.3. Residential

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Warehouses and communication centers

- 7.2.2. Self-storage facilities and data centers

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Australia

- 7.3.3. Japan

- 7.3.4. India

- 7.3.5. Singapore

- 7.3.6. South Korea

- 7.3.7. Malaysia

- 7.3.8. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Industrial

- 8.1.2. Commercial

- 8.1.3. Residential

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Warehouses and communication centers

- 8.2.2. Self-storage facilities and data centers

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Australia

- 8.3.3. Japan

- 8.3.4. India

- 8.3.5. Singapore

- 8.3.6. South Korea

- 8.3.7. Malaysia

- 8.3.8. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. India REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Industrial

- 9.1.2. Commercial

- 9.1.3. Residential

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Warehouses and communication centers

- 9.2.2. Self-storage facilities and data centers

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Australia

- 9.3.3. Japan

- 9.3.4. India

- 9.3.5. Singapore

- 9.3.6. South Korea

- 9.3.7. Malaysia

- 9.3.8. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Singapore REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Industrial

- 10.1.2. Commercial

- 10.1.3. Residential

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Warehouses and communication centers

- 10.2.2. Self-storage facilities and data centers

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Australia

- 10.3.3. Japan

- 10.3.4. India

- 10.3.5. Singapore

- 10.3.6. South Korea

- 10.3.7. Malaysia

- 10.3.8. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Korea REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Industrial

- 11.1.2. Commercial

- 11.1.3. Residential

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Warehouses and communication centers

- 11.2.2. Self-storage facilities and data centers

- 11.2.3. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Australia

- 11.3.3. Japan

- 11.3.4. India

- 11.3.5. Singapore

- 11.3.6. South Korea

- 11.3.7. Malaysia

- 11.3.8. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Malaysia REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Industrial

- 12.1.2. Commercial

- 12.1.3. Residential

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Warehouses and communication centers

- 12.2.2. Self-storage facilities and data centers

- 12.2.3. Other Applications

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. Australia

- 12.3.3. Japan

- 12.3.4. India

- 12.3.5. Singapore

- 12.3.6. South Korea

- 12.3.7. Malaysia

- 12.3.8. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Asia Pacific REIT Market in Asia Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Industrial

- 13.1.2. Commercial

- 13.1.3. Residential

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Warehouses and communication centers

- 13.2.2. Self-storage facilities and data centers

- 13.2.3. Other Applications

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. Australia

- 13.3.3. Japan

- 13.3.4. India

- 13.3.5. Singapore

- 13.3.6. South Korea

- 13.3.7. Malaysia

- 13.3.8. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Link REIT

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Goodman Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Scentre Group

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Dexus

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Nippon Building Fund

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mirvac

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Japan RE Investment Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 GPT

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Stockland

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Capital Land Mall Trust

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Ascendas REIT

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Japan Retail Fund**List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Link REIT

List of Figures

- Figure 1: REIT Market in Asia Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: REIT Market in Asia Share (%) by Company 2025

List of Tables

- Table 1: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 2: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 3: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 4: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 5: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: REIT Market in Asia Revenue Million Forecast, by Region 2020 & 2033

- Table 8: REIT Market in Asia Volume Billion Forecast, by Region 2020 & 2033

- Table 9: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 10: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 11: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 12: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 13: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 16: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 17: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 18: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 19: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 20: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 21: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 24: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 25: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 26: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 27: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 28: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 29: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 32: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 33: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 34: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 35: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 36: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 37: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 40: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 41: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 42: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 43: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 44: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 45: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 48: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 49: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 50: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 51: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 52: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 53: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 56: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 57: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 58: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 59: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 60: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 61: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 63: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 64: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 65: REIT Market in Asia Revenue Million Forecast, by Type 2020 & 2033

- Table 66: REIT Market in Asia Volume Billion Forecast, by Type 2020 & 2033

- Table 67: REIT Market in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 68: REIT Market in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 69: REIT Market in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 70: REIT Market in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 71: REIT Market in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 72: REIT Market in Asia Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the REIT Market in Asia?

The projected CAGR is approximately 8.24%.

2. Which companies are prominent players in the REIT Market in Asia?

Key companies in the market include Link REIT, Goodman Group, Scentre Group, Dexus, Nippon Building Fund, Mirvac, Japan RE Investment Corporation, GPT, Stockland, Capital Land Mall Trust, Ascendas REIT, Japan Retail Fund**List Not Exhaustive.

3. What are the main segments of the REIT Market in Asia?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 309.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

Growth in Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Urbanization is Driving the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Brookfield India Real Estate Investment Trust (REIT) and Singapore’s sovereign wealth fund GIC set up a strategic platform to acquire two large commercial assets totaling 6.5 million sq ft from Brookfield Asset Management’s private real estate funds in an equal partnership. The acquisition includes commercial properties in Brookfield’s Downtown Powai, Mumbai, and Candor TechSpace, Sector 48, Gurugram, for a combined enterprise value of around USD 1.4 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "REIT Market in Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the REIT Market in Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the REIT Market in Asia?

To stay informed about further developments, trends, and reports in the REIT Market in Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence