Key Insights

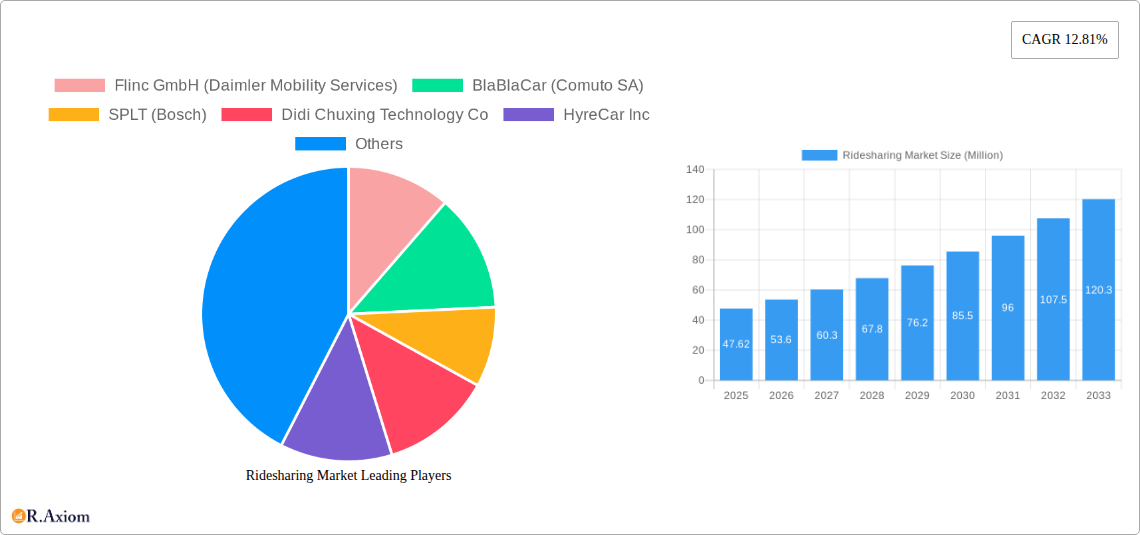

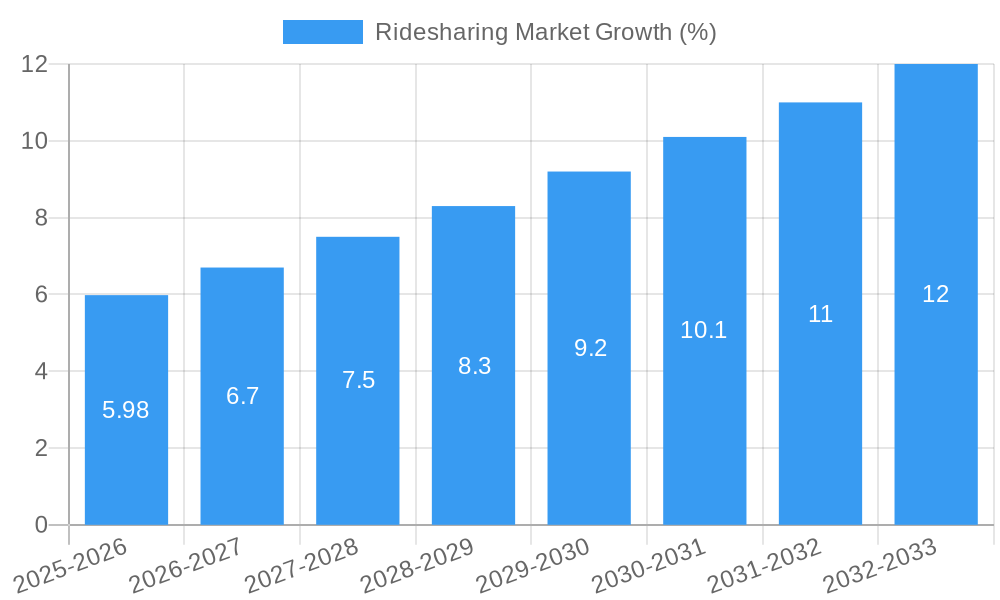

The ridesharing market, valued at $47.62 million in 2025, is projected to experience robust growth, driven by increasing urbanization, rising fuel prices, and growing environmental concerns. The market's Compound Annual Growth Rate (CAGR) of 12.81% from 2025 to 2033 indicates a significant expansion, reaching an estimated value of approximately $160 million by 2033. This growth is fueled by several key factors: the increasing adoption of app-based services offering convenience and affordability; the emergence of corporate ridesharing programs aimed at improving employee commute and reducing operational costs; and the continued innovation in technological advancements, such as enhanced ride-matching algorithms and improved safety features. The market segmentation reveals a strong preference for app-based solutions, indicating the significant role of mobile technology in shaping the ridesharing landscape. Geographic expansion, particularly in developing economies with burgeoning populations and increasing smartphone penetration, presents a substantial opportunity for further growth. However, regulatory hurdles, competition from traditional transportation methods, and concerns about driver safety and security remain challenges that need to be addressed to ensure sustained market expansion.

The competitive landscape is characterized by a mix of established players and emerging startups. Companies like Didi Chuxing and BlaBlaCar hold significant market share due to their extensive operations and brand recognition. However, smaller, innovative players continue to emerge, offering niche services and leveraging advancements in artificial intelligence and machine learning to improve efficiency and customer experience. The market's future hinges on the successful navigation of these challenges and opportunities, demanding strategic adaptation and ongoing innovation by both established and emerging players to effectively cater to the diverse needs of an increasingly demanding consumer base. The continued focus on sustainability and the integration of electric vehicles into ridesharing fleets are also key drivers expected to shape the market's future trajectory. Successful ridesharing companies will be those that effectively address safety concerns, offer affordable fares, and provide convenient, reliable service.

This in-depth report provides a comprehensive analysis of the Ridesharing Market, covering historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It delves into market dynamics, segmentation, key players, and emerging trends, offering actionable insights for industry stakeholders. The report leverages extensive data and analysis to provide a clear picture of the market's current state and future trajectory, focusing on key growth drivers and challenges.

Ridesharing Market Concentration & Innovation

The ridesharing market exhibits a dynamic interplay between established giants and emerging players, leading to varying levels of market concentration across different geographical regions and service segments. While companies like Didi Chuxing and Uber hold significant market shares in specific regions, the landscape is becoming increasingly fragmented due to the entry of numerous niche players and specialized services. Innovation is a key driver, with ongoing developments in areas such as autonomous vehicle technology, electric vehicle integration, and the application of AI for optimized routing and pricing strategies.

Regulatory frameworks play a crucial role, shaping market access and operational practices. Differing regulations across jurisdictions lead to variations in market structure and competitive intensity. The presence of alternative transportation modes, such as public transit and personal vehicles, presents a constant challenge, with the ridesharing industry competing for customer share based on factors like convenience, cost, and environmental considerations. Furthermore, the trend of mergers and acquisitions (M&A) is significant, with larger players acquiring smaller firms to consolidate market share and acquire innovative technologies. Recent M&A deals in the ridesharing market, though exact values remain unavailable (xx Million), indicate a high level of consolidation activity. Examples include Vride Inc's acquisition by Enterprise Holdings Inc. End-user trends, notably increased preference for convenient, on-demand transportation and growing environmental awareness, are also key influencing factors.

Ridesharing Market Industry Trends & Insights

The global ridesharing market is experiencing robust growth, fueled by several key factors. The increasing urbanization and the rising middle class are driving demand for convenient and affordable transportation solutions. The rising adoption of smartphones and the proliferation of mobile applications have made booking rides incredibly easy and user-friendly. Technological advancements such as AI-powered ride matching and route optimization are enhancing efficiency and reducing costs. The market is also witnessing a shift towards sustainable transportation options, with a growing number of companies offering electric vehicle rideshares. Despite the pandemic initially impacting the industry, the market has demonstrated resilience and continues to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration, especially in developing economies, is expected to increase significantly as the demand for convenient and affordable transport continues to rise. However, intense competition, regulatory hurdles, and the need to achieve profitability pose significant challenges.

Dominant Markets & Segments in Ridesharing Market

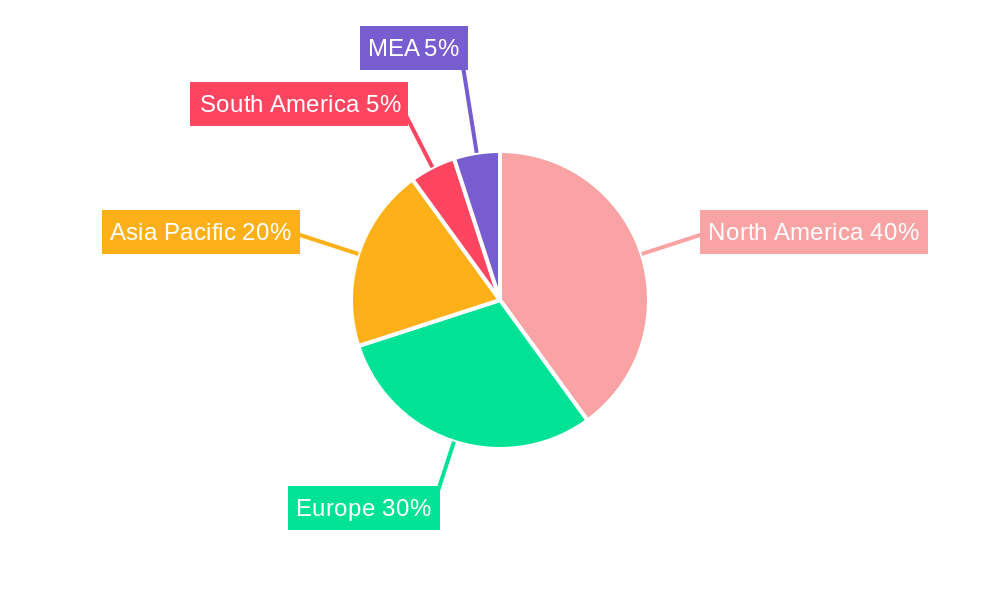

Leading Region/Country: North America and parts of Asia currently dominate the market, primarily due to high smartphone penetration, robust digital infrastructure, and favorable regulatory environments. However, rapid growth is anticipated in developing economies in Asia, Africa, and Latin America driven by increasing urbanization and rising middle-class incomes.

By Membership Type:

- Dynamic Ridesharing: This segment holds the largest market share owing to its flexibility and on-demand nature. Key drivers include increased smartphone penetration and the convenience of booking rides through mobile apps.

- Fixed Ridesharing: This segment is experiencing steady growth, driven by the need for reliable and cost-effective transportation options for commuters.

- Corporate Ridesharing: This segment shows promising growth potential due to increasing corporate adoption of ridesharing solutions for employee transportation and business travel.

By Service Type:

- App-Based Ridesharing: This overwhelmingly dominates the market due to its ease of use and accessibility.

- Web-Based Ridesharing: While less dominant, web-based platforms continue to serve a niche audience.

- Web and App Based: This segment captures a significant portion of the market, providing flexibility for users and companies.

Key drivers vary across segments and geographies but broadly include favorable economic policies that support digital growth, well-developed transportation infrastructure, and government initiatives promoting sustainable transportation. Further analysis reveals that the specific dominance of each segment is highly influenced by the existing transportation infrastructure, cultural habits, and regulatory environment in a particular region.

Ridesharing Market Product Developments

The ridesharing industry is witnessing continuous product innovation driven by technological advancements and evolving consumer preferences. Key developments include the integration of electric vehicles and autonomous driving technologies, the enhancement of ride-sharing apps with features like real-time tracking, fare estimates, and diverse payment options, and the development of specialized services catering to specific needs, such as corporate transportation, deliveries, and wheelchair-accessible rides. These innovations directly enhance the user experience, improve operational efficiency, and create competitive advantages. Market fit is largely determined by the ability of companies to adapt quickly to evolving technological trends, understand and address user demands, and navigate the complexities of a rapidly changing regulatory landscape.

Report Scope & Segmentation Analysis

This report comprehensively segments the ridesharing market based on membership type (Fixed, Dynamic, Corporate) and service type (Web-Based, App-Based, Web & App-Based). Each segment is analyzed in detail, providing growth projections, market sizes (values in Millions), and competitive dynamics. For example, the dynamic ridesharing segment is projected to experience significant growth due to its flexibility and convenience, while the corporate segment is expected to expand rapidly due to increased adoption by businesses. Growth projections vary depending on the specific segment and region, but overall, the market exhibits a strong potential for growth over the forecast period (2025-2033).

Key Drivers of Ridesharing Market Growth

Several factors are driving the growth of the ridesharing market. Technological advancements, particularly in mobile technology, GPS tracking, and AI-powered route optimization, enhance efficiency and convenience. Economic factors, including increasing urbanization, rising disposable incomes, and the need for cost-effective transportation, significantly contribute to market expansion. Furthermore, supportive regulatory environments that encourage innovation and competition are crucial drivers. Examples include government initiatives promoting sustainable transportation and the liberalization of ride-sharing regulations in various regions.

Challenges in the Ridesharing Market Sector

The ridesharing market faces several challenges. Regulatory hurdles, including licensing requirements and safety regulations, can increase operating costs and limit market entry. Supply chain disruptions, particularly related to the availability of vehicles, can negatively impact service reliability. Intense competition among established players and new entrants leads to price wars and pressure on profitability. These challenges, if not managed effectively, could significantly impact the overall market growth, potentially reducing the CAGR by xx% in certain regions.

Emerging Opportunities in Ridesharing Market

The ridesharing market presents significant opportunities. The expansion into underserved markets, especially in developing economies, offers substantial growth potential. The integration of new technologies, such as electric vehicles, autonomous driving, and drone delivery, promises increased efficiency and sustainability. Moreover, catering to specific customer needs, such as elderly care, healthcare transportation, and specialized logistics services, represents a significant untapped opportunity.

Leading Players in the Ridesharing Market Market

- Flinc GmbH (Daimler Mobility Services)

- BlaBlaCar (Comuto SA)

- SPLT (Bosch)

- Didi Chuxing Technology Co

- HyreCar Inc

- KINTO Join Limited

- Wunder Mobility Solutions GmbH

- Kangaride Canada Co

- GoMore

- Klaxit SAS (formerly Wayzup)

- Scoop Technologies Inc

- Vride Inc (Acquired by Enterprise Holdings Inc)

- CarpoolWorld (Datasphere Corporation)

- Via Transportation Inc

- Zimride Inc

Key Developments in Ridesharing Market Industry

- June 2022: Uber launched UberX Share, offering riders a 20% discount for sharing rides, boosting ridership and potentially impacting competitor strategies.

- February 2022: Avolon and AirAsia's partnership to create a Southeast Asian ridesharing platform using eVTOL aircraft signifies a major shift toward air-based ridesharing and potentially disrupts traditional ground-based services.

Strategic Outlook for Ridesharing Market Market

The ridesharing market exhibits strong growth potential driven by ongoing technological advancements, changing consumer preferences, and expansion into new markets. The integration of electric vehicles and autonomous technology, combined with the growing adoption of ridesharing services across various sectors, including corporate travel and logistics, will further shape the market landscape. Companies that adapt to these changes, develop innovative services, and efficiently manage regulatory challenges will be best positioned for success in this dynamic market. The potential for increased market penetration in developing economies and the emergence of new service models, such as subscription-based ridesharing, promise further growth and innovation.

Ridesharing Market Segmentation

-

1. Membership Type

- 1.1. Fixed Ridesharing

- 1.2. Dynamic Ridesharing

- 1.3. Corporate Ridesharing

-

2. Service Type

- 2.1. Web-Based

- 2.2. App-Based

- 2.3. Web and App Based

Ridesharing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Ridesharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services; Incentives and Rebates Provided by Governments in Major Markets

- 3.2.2 such as France; Increasing Cost of Vehicle Ownership and Environmental Benefits

- 3.3. Market Restrains

- 3.3.1. Technical Challenges Pertaining to CMP Technique

- 3.4. Market Trends

- 3.4.1. COVID-19 Has Posed Significant Threat to the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 5.1.1. Fixed Ridesharing

- 5.1.2. Dynamic Ridesharing

- 5.1.3. Corporate Ridesharing

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Web-Based

- 5.2.2. App-Based

- 5.2.3. Web and App Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 6. North America Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Membership Type

- 6.1.1. Fixed Ridesharing

- 6.1.2. Dynamic Ridesharing

- 6.1.3. Corporate Ridesharing

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Web-Based

- 6.2.2. App-Based

- 6.2.3. Web and App Based

- 6.1. Market Analysis, Insights and Forecast - by Membership Type

- 7. Europe Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Membership Type

- 7.1.1. Fixed Ridesharing

- 7.1.2. Dynamic Ridesharing

- 7.1.3. Corporate Ridesharing

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Web-Based

- 7.2.2. App-Based

- 7.2.3. Web and App Based

- 7.1. Market Analysis, Insights and Forecast - by Membership Type

- 8. Asia Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Membership Type

- 8.1.1. Fixed Ridesharing

- 8.1.2. Dynamic Ridesharing

- 8.1.3. Corporate Ridesharing

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Web-Based

- 8.2.2. App-Based

- 8.2.3. Web and App Based

- 8.1. Market Analysis, Insights and Forecast - by Membership Type

- 9. Australia and New Zealand Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Membership Type

- 9.1.1. Fixed Ridesharing

- 9.1.2. Dynamic Ridesharing

- 9.1.3. Corporate Ridesharing

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Web-Based

- 9.2.2. App-Based

- 9.2.3. Web and App Based

- 9.1. Market Analysis, Insights and Forecast - by Membership Type

- 10. Latin America Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Membership Type

- 10.1.1. Fixed Ridesharing

- 10.1.2. Dynamic Ridesharing

- 10.1.3. Corporate Ridesharing

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Web-Based

- 10.2.2. App-Based

- 10.2.3. Web and App Based

- 10.1. Market Analysis, Insights and Forecast - by Membership Type

- 11. Middle East and Africa Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Membership Type

- 11.1.1. Fixed Ridesharing

- 11.1.2. Dynamic Ridesharing

- 11.1.3. Corporate Ridesharing

- 11.2. Market Analysis, Insights and Forecast - by Service Type

- 11.2.1. Web-Based

- 11.2.2. App-Based

- 11.2.3. Web and App Based

- 11.1. Market Analysis, Insights and Forecast - by Membership Type

- 12. North America Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Flinc GmbH (Daimler Mobility Services)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 BlaBlaCar (Comuto SA)

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 SPLT (Bosch)

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Didi Chuxing Technology Co

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 HyreCar Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 KINTO Join Limited

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Wunder Mobility Solutions GmbH

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Kangaride Canada Co

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 GoMore

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Klaxit SAS (formerly Wayzup)

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Scoop Technologies Inc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Vride Inc (Acquired by Enterprise Holdings Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 CarpoolWorld (Datasphere Corporation)

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Via Transportation Inc

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Zimride Inc

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.1 Flinc GmbH (Daimler Mobility Services)

List of Figures

- Figure 1: Global Ridesharing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Ridesharing Market Revenue (Million), by Membership Type 2024 & 2032

- Figure 15: North America Ridesharing Market Revenue Share (%), by Membership Type 2024 & 2032

- Figure 16: North America Ridesharing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 17: North America Ridesharing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 18: North America Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Ridesharing Market Revenue (Million), by Membership Type 2024 & 2032

- Figure 21: Europe Ridesharing Market Revenue Share (%), by Membership Type 2024 & 2032

- Figure 22: Europe Ridesharing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 23: Europe Ridesharing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 24: Europe Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Ridesharing Market Revenue (Million), by Membership Type 2024 & 2032

- Figure 27: Asia Ridesharing Market Revenue Share (%), by Membership Type 2024 & 2032

- Figure 28: Asia Ridesharing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 29: Asia Ridesharing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 30: Asia Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Ridesharing Market Revenue (Million), by Membership Type 2024 & 2032

- Figure 33: Australia and New Zealand Ridesharing Market Revenue Share (%), by Membership Type 2024 & 2032

- Figure 34: Australia and New Zealand Ridesharing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 35: Australia and New Zealand Ridesharing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 36: Australia and New Zealand Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Ridesharing Market Revenue (Million), by Membership Type 2024 & 2032

- Figure 39: Latin America Ridesharing Market Revenue Share (%), by Membership Type 2024 & 2032

- Figure 40: Latin America Ridesharing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 41: Latin America Ridesharing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 42: Latin America Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Ridesharing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Ridesharing Market Revenue (Million), by Membership Type 2024 & 2032

- Figure 45: Middle East and Africa Ridesharing Market Revenue Share (%), by Membership Type 2024 & 2032

- Figure 46: Middle East and Africa Ridesharing Market Revenue (Million), by Service Type 2024 & 2032

- Figure 47: Middle East and Africa Ridesharing Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 48: Middle East and Africa Ridesharing Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Ridesharing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ridesharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 3: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Global Ridesharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Ridesharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 51: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 52: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 54: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 55: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 57: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 58: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 60: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 61: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 63: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 64: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Global Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 66: Global Ridesharing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 67: Global Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ridesharing Market?

The projected CAGR is approximately 12.81%.

2. Which companies are prominent players in the Ridesharing Market?

Key companies in the market include Flinc GmbH (Daimler Mobility Services), BlaBlaCar (Comuto SA), SPLT (Bosch), Didi Chuxing Technology Co, HyreCar Inc, KINTO Join Limited, Wunder Mobility Solutions GmbH, Kangaride Canada Co, GoMore, Klaxit SAS (formerly Wayzup), Scoop Technologies Inc, Vride Inc (Acquired by Enterprise Holdings Inc, CarpoolWorld (Datasphere Corporation), Via Transportation Inc, Zimride Inc.

3. What are the main segments of the Ridesharing Market?

The market segments include Membership Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services; Incentives and Rebates Provided by Governments in Major Markets. such as France; Increasing Cost of Vehicle Ownership and Environmental Benefits.

6. What are the notable trends driving market growth?

COVID-19 Has Posed Significant Threat to the Market.

7. Are there any restraints impacting market growth?

Technical Challenges Pertaining to CMP Technique.

8. Can you provide examples of recent developments in the market?

June 2022 - Uber has launched a new UberX Share service to share rides, which is remarkably similar to Uber's pre-pandemic carpooling feature, but with a monetary incentive. Riders who choose UberX Share will be paired with another co-rider traveling in the same direction. Uber will give riders a 20% reduction on the overall fee in exchange for the inconvenience and extra time spent on the road. Even if riders are not matched with a co-rider, they will receive an up-front discount on their ride.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ridesharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ridesharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ridesharing Market?

To stay informed about further developments, trends, and reports in the Ridesharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence