Key Insights

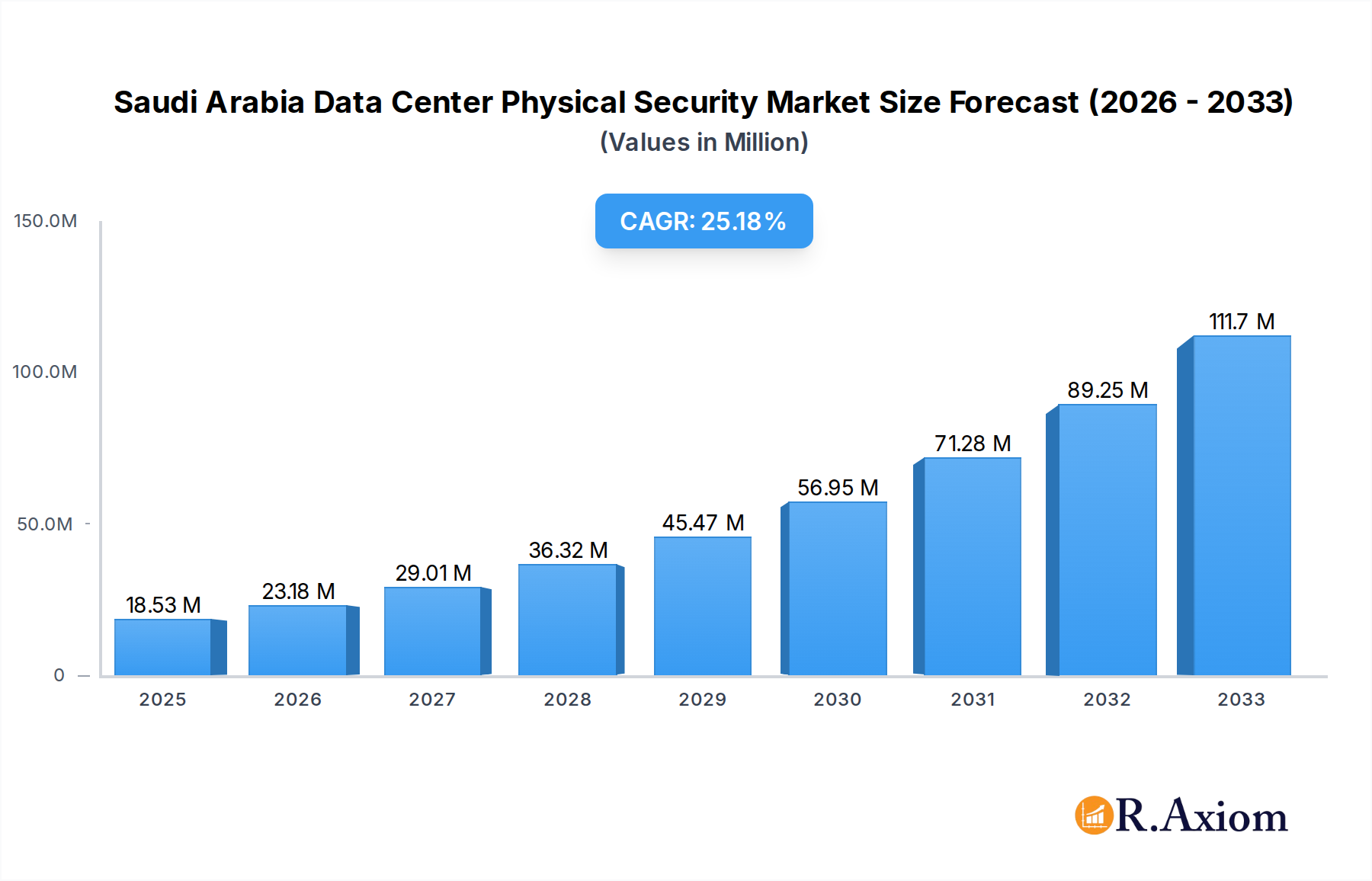

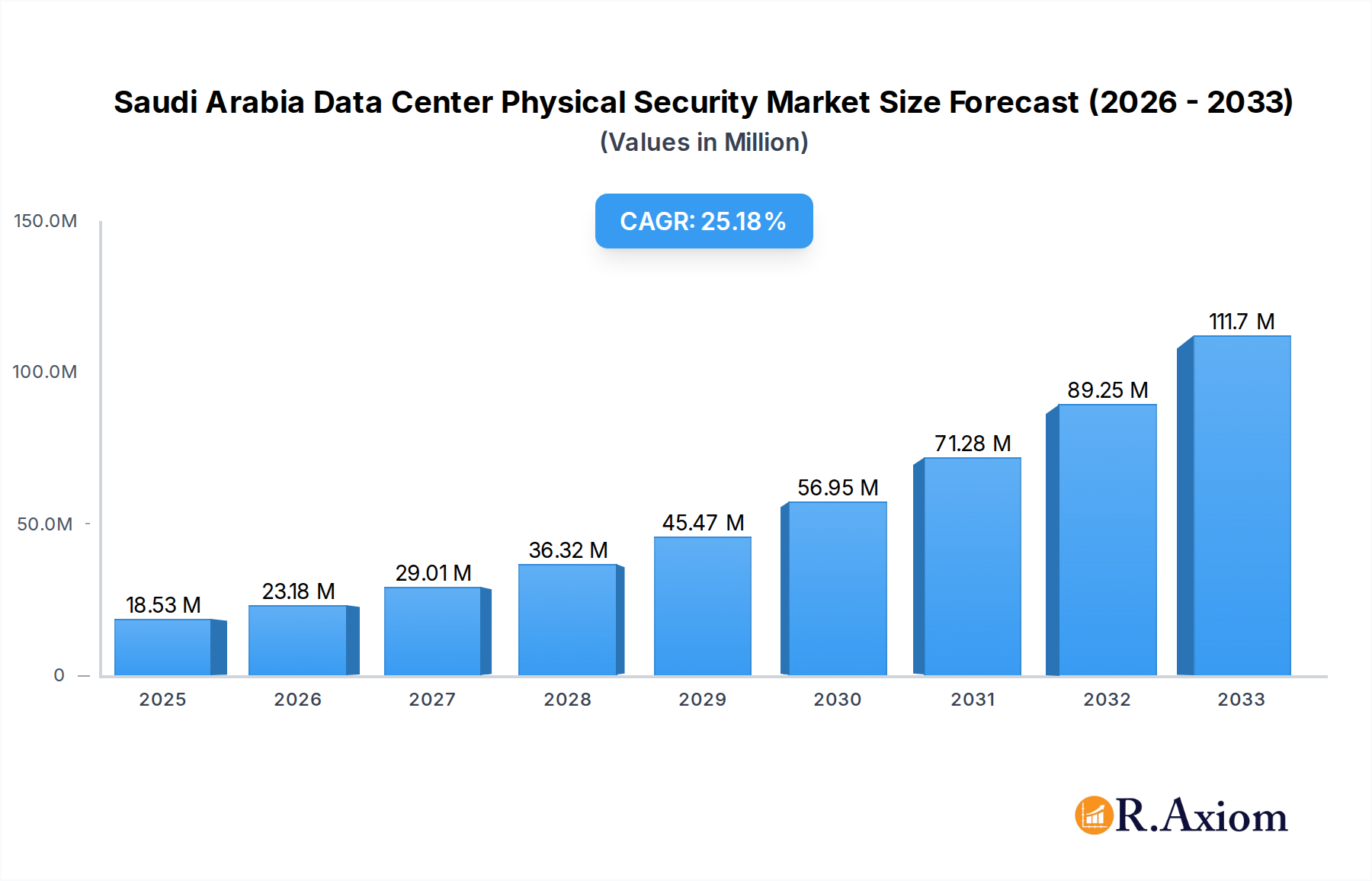

The Saudi Arabia Data Center Physical Security Market is poised for exceptional growth, projected to reach $18.53 Million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 25.20% from 2019-2033. This robust expansion is driven by a confluence of factors critical to the Kingdom's digital transformation initiatives. The increasing adoption of cloud computing, the proliferation of IoT devices, and the burgeoning demand for advanced IT infrastructure are necessitating enhanced physical security measures for data centers. Government investments in digital services and smart city projects, coupled with a growing emphasis on data privacy and compliance regulations, further fuel this market's trajectory. Key solution segments like video surveillance and access control are witnessing significant uptake, as organizations prioritize comprehensive security frameworks to protect sensitive data and critical infrastructure from evolving threats.

Saudi Arabia Data Center Physical Security Market Market Size (In Million)

The market is characterized by a dynamic interplay of trends and restraints. Leading companies are investing heavily in research and development to offer sophisticated, integrated security solutions, including AI-powered analytics and biometric authentication. Service types such as consulting and professional services are gaining prominence as businesses seek expert guidance in designing and implementing effective data center security strategies. However, challenges such as the high initial investment costs for advanced security systems and the shortage of skilled cybersecurity professionals present potential headwinds. Despite these, the overarching trend of digitalization and the strategic importance of data centers in Saudi Arabia's Vision 2030 underscore a highly optimistic outlook for the physical security market, with significant opportunities for innovation and market penetration across various end-user industries like BFSI, IT and Telecommunication, and Government sectors.

Saudi Arabia Data Center Physical Security Market Company Market Share

This in-depth report offers a detailed examination of the Saudi Arabia Data Center Physical Security Market, providing critical insights into its current landscape, future trajectory, and key growth drivers. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry stakeholders, including technology providers, system integrators, end-users, and investors seeking to understand the evolving market dynamics. Leveraging high-traffic keywords such as "Saudi Arabia data center security," "physical security solutions," "access control," "video surveillance," and "enterprise security," this analysis is optimized for maximum search visibility and engagement within the cybersecurity and infrastructure sectors.

Saudi Arabia Data Center Physical Security Market Market Concentration & Innovation

The Saudi Arabia Data Center Physical Security Market is characterized by a moderate to high level of concentration, with a few key players dominating the landscape. Major companies like Honeywell International Inc., Johnson Controls International, and Siemens AG command significant market share due to their extensive product portfolios, established brand reputation, and strong existing customer relationships. Innovation is a primary driver of market growth, fueled by the increasing demand for advanced security solutions capable of protecting sensitive data and critical infrastructure. Regulatory frameworks, such as those promoting data localization and cybersecurity standards, are also shaping the market by mandating higher levels of physical security for data centers. Product substitutes, while present in less sophisticated security measures, are increasingly being outperformed by integrated, intelligent physical security systems. End-user trends highlight a growing preference for cloud-based security management and AI-powered threat detection. Mergers and Acquisitions (M&A) activity, valued in the tens of millions, is observed as companies seek to consolidate market position, acquire new technologies, and expand their service offerings. For instance, Securitas Technology's strategic acquisitions have bolstered its capabilities. The market share of leading vendors is estimated to be between 15% and 25%.

Saudi Arabia Data Center Physical Security Market Industry Trends & Insights

The Saudi Arabia Data Center Physical Security Market is experiencing robust growth, propelled by a confluence of escalating digital transformation initiatives and a heightened awareness of cybersecurity threats. The Kingdom's ambitious Vision 2030 plan is a significant catalyst, driving substantial investment in digital infrastructure, including the expansion of data centers to support burgeoning cloud computing, AI, and IoT deployments. This surge in data center construction and modernization necessitates sophisticated physical security measures to safeguard these critical assets. The CAGR for the Saudi Arabia Data Center Physical Security Market is projected to be approximately 12% during the forecast period (2025-2033). Technological disruptions, particularly advancements in artificial intelligence (AI) and machine learning (ML) integrated into video surveillance and access control systems, are transforming the market. AI-powered analytics enable proactive threat detection, anomaly identification, and intelligent response, moving beyond traditional reactive security measures. Consumer preferences are shifting towards integrated security platforms that offer seamless management of various security components, from perimeter defense to internal access control and video monitoring. This demand for unified solutions is pushing vendors to develop comprehensive portfolios. Competitive dynamics are intensifying, with both global security giants and specialized local players vying for market share. Companies are differentiating themselves through innovative product features, enhanced service offerings, and strategic partnerships. The market penetration of advanced physical security solutions is steadily increasing as organizations recognize the indispensable role of robust security in maintaining operational continuity and protecting sensitive data from physical breaches. The total market value is estimated to reach over $800 Million by 2025.

Dominant Markets & Segments in Saudi Arabia Data Center Physical Security Market

The IT and Telecommunication sector is the dominant end-user segment within the Saudi Arabia Data Center Physical Security Market, accounting for an estimated 35% of the market share. This dominance is directly attributable to the Kingdom's aggressive push towards digital transformation, the proliferation of hyperscale and colocation data centers, and the critical need to secure vast amounts of sensitive data processed and stored by telecommunication providers and cloud service operators. The economic policies supporting the growth of the digital economy, coupled with significant infrastructure development, further underscore the importance of robust data center security for this sector.

Solution Type Dominance:

- Video Surveillance emerges as the leading solution type, capturing approximately 40% of the market. The increasing adoption of high-definition cameras, AI-powered analytics for intrusion detection and facial recognition, and the need for comprehensive monitoring of data center perimeters and internal areas are key drivers.

- Access Control Solutions follow closely, representing around 30% of the market. Advanced biometric systems, multi-factor authentication, and intelligent access management are crucial for preventing unauthorized entry into sensitive data center environments.

Service Type Dominance:

- Professional Services, including installation, maintenance, and support, hold a significant share of around 50%. The complexity of modern integrated security systems necessitates expert deployment and ongoing management, making these services indispensable for data center operators.

- System Integration Services are also crucial, representing approximately 30% of the market, as organizations seek seamless integration of disparate security systems into a unified management platform.

End User Dominance:

- IT and Telecommunication is the primary end-user, driving demand due to the sheer volume of data centers and the critical nature of their operations.

- The Government sector is a rapidly growing segment, with increasing investments in secure government data facilities and critical national infrastructure protection, representing approximately 20% of the market.

Geographic Dominance:

- Riyadh is the leading city in terms of data center development and, consequently, physical security market penetration, driven by its status as the capital and a major business hub.

Saudi Arabia Data Center Physical Security Market Product Developments

Product innovation in the Saudi Arabia Data Center Physical Security Market is focused on enhancing intelligence, automation, and integration. Manufacturers are developing advanced video analytics that can detect loitering, identify tailgating, and alert security personnel to unusual activity in real-time. Access control solutions are evolving to incorporate more sophisticated biometric technologies and mobile credentialing for enhanced convenience and security. The competitive advantage lies in solutions that offer seamless integration with broader building management and IT security systems, providing a holistic view of security posture.

Report Scope & Segmentation Analysis

The Saudi Arabia Data Center Physical Security Market is comprehensively segmented across key areas to provide granular market intelligence. The Solution Type segment includes Video Surveillance, Access Control Solutions, and Others (e.g., Intrusion Detection Systems, Perimeter Security). Growth projections for Video Surveillance are strong, driven by AI integration, while Access Control is boosted by the demand for multi-layered authentication. The Service Type segment encompasses Consulting Services, Professional Services, and Others (System Integration Services). Professional Services are expected to see sustained growth due to the complexity of deployments and ongoing maintenance needs. The End User segment comprises IT and Telecommunication, BFSI, Government, Healthcare, and Other End Users. The IT and Telecommunication segment leads in market size and growth, fueled by digital transformation, with the Government sector showing significant future potential.

Key Drivers of Saudi Arabia Data Center Physical Security Market Growth

Several key factors are driving the growth of the Saudi Arabia Data Center Physical Security Market. The aggressive digital transformation agenda outlined in Vision 2030, which includes substantial investments in cloud computing and AI infrastructure, necessitates enhanced data center security. Increased awareness of cybersecurity threats, both physical and cyber, is prompting organizations to fortify their data center defenses. Government initiatives promoting data localization and cloud adoption are creating a sustained demand for new and upgraded data center facilities, directly impacting the physical security market. Furthermore, the growing adoption of advanced technologies like AI-powered video analytics and biometric access control is enhancing the efficacy and appeal of sophisticated security solutions.

Challenges in the Saudi Arabia Data Center Physical Security Market Sector

Despite its robust growth, the Saudi Arabia Data Center Physical Security Market faces certain challenges. The initial high cost of implementing advanced physical security systems can be a barrier for some smaller organizations. A shortage of skilled cybersecurity professionals capable of deploying and managing these complex systems can also hinder market expansion. Furthermore, rapid technological advancements require continuous investment in upgrades and training, which can strain IT budgets. Ensuring interoperability between different security solutions from various vendors can also present integration challenges.

Emerging Opportunities in Saudi Arabia Data Center Physical Security Market

Emerging opportunities in the Saudi Arabia Data Center Physical Security Market are abundant. The increasing adoption of edge computing and distributed data center architectures presents new avenues for security solution providers. The demand for integrated physical and cybersecurity solutions is growing, creating opportunities for companies that can offer unified platforms. Furthermore, the Kingdom's focus on developing smart cities and smart infrastructure will lead to a proliferation of data centers and a corresponding demand for advanced physical security. The growing trend towards hybrid and multi-cloud environments also necessitates robust, adaptable security solutions.

Leading Players in the Saudi Arabia Data Center Physical Security Market Market

- LenelS

- Honeywell International Inc.

- Convergint Technologies LLC

- Johnson Controls International

- Securitas Technology

- Siemens AG

- Schneider Electric SE

- Ctelecoms

- Bosch Sicherheitssysteme GmbH

- 3S System Security Solutions Co

Key Developments in Saudi Arabia Data Center Physical Security Market Industry

- September 2023: Johnson Controls announced its new OpenBlue Service, ensuring security device performance. It is designed to help customers improve building safety, manage risk, and maximize the value of investments made in security technology.

- August 2023: Metrasens partnered with systems integrator Convergint. Through this partnership, Metrasens is expected to provide its customers with advanced detection systems via Convergint's portfolio offerings.

Strategic Outlook for Saudi Arabia Data Center Physical Security Market Market

The strategic outlook for the Saudi Arabia Data Center Physical Security Market remains exceptionally positive. The sustained government investment in digital infrastructure, coupled with the continuous growth of data consumption and the adoption of advanced technologies like AI and IoT, will continue to fuel demand for sophisticated physical security solutions. Companies that can offer integrated, intelligent, and scalable security platforms, backed by strong professional services and support, are well-positioned for significant growth. The market is expected to witness further consolidation through strategic partnerships and acquisitions as players aim to expand their offerings and market reach. The focus on robust data protection and compliance with evolving regulatory standards will remain paramount, driving innovation and investment in this critical sector.

Saudi Arabia Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others (

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT and Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Saudi Arabia Data Center Physical Security Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Data Center Physical Security Market Regional Market Share

Geographic Coverage of Saudi Arabia Data Center Physical Security Market

Saudi Arabia Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. Operational and Return On Investment Concerns

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Data Center Physical Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others (

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT and Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LenelS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Convergint Technologies LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Securitas Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ctelecoms

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bosch Sicherheitssysteme GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3S System Security Solutions Co *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LenelS

List of Figures

- Figure 1: Saudi Arabia Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Data Center Physical Security Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 6: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Saudi Arabia Data Center Physical Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Data Center Physical Security Market?

The projected CAGR is approximately 25.20%.

2. Which companies are prominent players in the Saudi Arabia Data Center Physical Security Market?

Key companies in the market include LenelS, Honeywell International Inc, Convergint Technologies LLC, Johnson Controls International, Securitas Technology, Siemens AG, Schneider Electric SE, Ctelecoms, Bosch Sicherheitssysteme GmbH, 3S System Security Solutions Co *List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Operational and Return On Investment Concerns.

8. Can you provide examples of recent developments in the market?

September 2023: Johnson Controls announced its new OpenBlue Service, ensuring security device performance. It is designed to help customers improve building safety, manage risk, and maximize the value of investments made in security technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence