Key Insights

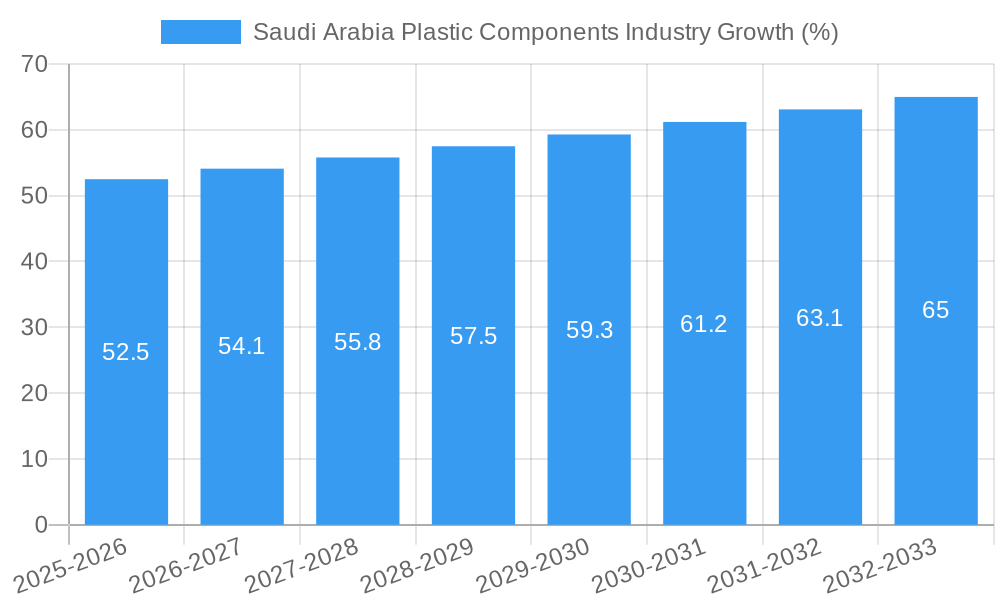

The Saudi Arabian plastic components industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning construction sector, driven by significant infrastructure development and rising urbanization, constitutes a major consumer of plastic components in building materials, piping, and insulation. Simultaneously, the burgeoning consumer goods sector, including packaging and household items, contributes substantially to market demand. Further growth is stimulated by advancements in the life sciences and aerospace industries, which rely increasingly on lightweight, durable, and specialized plastic components. While the industry faces challenges such as fluctuating oil prices (impacting raw material costs) and environmental concerns regarding plastic waste, these are partially mitigated by increasing adoption of recycled plastics and sustainable manufacturing practices. The segmentation of the market reveals significant opportunities across various product types, including sheets, films, plates, tubes, containers, and specialized applications in textiles and floor coverings. Major players like National Plastic Factory, Estechtab, and Arabian Plastics Industrial Company Limited (APICO) are well-positioned to capitalize on this growth, alongside other prominent companies within the Saudi market.

The market's segmentation by end-user industry highlights its diversified nature. Building and construction remains the dominant segment, followed by the consumer goods sector. However, the life sciences and aerospace industries represent high-growth segments with significant future potential, driven by the adoption of advanced plastic materials in medical devices and aerospace applications. The regional concentration in Saudi Arabia presents both an opportunity and a challenge. The strong domestic market offers immediate growth potential, while dependence on regional factors like oil prices and government policies adds a degree of vulnerability. A focus on innovation, sustainable practices, and strategic partnerships will be crucial for players to achieve sustained success in this dynamic market. The forecast period of 2025-2033 presents a significant window for market expansion, offering substantial opportunities for both established players and new entrants. The historical data from 2019-2024 provides a valuable baseline for analyzing past trends and informing future projections.

Saudi Arabia Plastic Components Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia plastic components industry, covering market size, segmentation, growth drivers, challenges, and opportunities from 2019 to 2033. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering valuable insights for industry stakeholders, investors, and businesses operating within or planning to enter this dynamic market. The report uses Million (M) as the unit for all monetary values.

Saudi Arabia Plastic Components Industry Market Concentration & Innovation

The Saudi Arabian plastic components market displays a moderately concentrated structure, with several key players holding substantial market share. Prominent companies such as National Plastic Factory, Estechtab, and Arabian Plastics Industrial Company Limited (APICO) represent a significant portion of the market, estimated at xx% in 2025. However, a diverse range of smaller companies also contribute significantly, particularly within specialized niches like household goods and textile fabrics. This dynamic market structure reflects both established industry leaders and a vibrant ecosystem of smaller, specialized businesses.

Innovation within the Saudi Arabian plastic components industry is fueled by a confluence of factors:

- Government Initiatives: Saudi Arabia's strategic focus on industrial diversification and localization, notably through Vision 2030, actively promotes innovation in materials science, manufacturing processes, and product design. Government support manifests in various forms, including funding for R&D, tax incentives, and streamlined regulatory processes.

- Technological Advancements: The integration of advanced technologies, including additive manufacturing (3D printing), automation, and robotics, is significantly enhancing production efficiency, enabling the creation of highly complex components, and reducing manufacturing costs. This technological push allows for greater customization and responsiveness to market demands.

- Sustainability Focus: Growing environmental awareness and regulatory pressure are driving the development and adoption of biodegradable and recycled plastics. Companies are increasingly investing in sustainable solutions, improving their environmental footprint, and meeting evolving consumer preferences.

While the regulatory landscape generally supports industrial growth, stringent environmental regulations influence material selection and waste management practices. Competition from substitute materials like metal and wood exists, particularly in niche applications. Nevertheless, the inherent cost-effectiveness and versatility of plastic components maintain their dominance across numerous sectors. Mergers and acquisitions (M&A) activity, while moderate in recent years (estimated at xx Million in 2019-2024), is projected to increase as larger players seek to consolidate market share and expand their product portfolios. This consolidation trend aligns with end-user demands for lighter, more durable, and cost-effective materials, supporting the continued growth of the plastic components sector.

Saudi Arabia Plastic Components Industry Industry Trends & Insights

The Saudi Arabian plastic components market is projected to experience robust growth throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key factors:

- Expanding construction sector: The booming construction industry, driven by large-scale infrastructure projects, is a significant driver of demand for plastic components in building and construction applications.

- Growth of the consumer goods sector: Rising disposable incomes and a growing population are boosting demand for consumer goods, leading to increased consumption of plastic components in various products.

- Government initiatives to support manufacturing: The Kingdom's Vision 2030 initiative emphasizes industrial diversification and localization, creating favorable conditions for the growth of the plastic components industry.

- Technological advancements: The adoption of automation and advanced materials is improving efficiency and enhancing product quality, leading to increased market penetration.

- Increased demand for specialized plastic components: The emergence of niche applications in sectors like aerospace and life sciences is driving demand for specialized, high-performance plastic components.

Competitive dynamics within the market are intense, with both domestic and international players vying for market share. The market is characterized by both price competition and competition based on product differentiation, quality, and innovation.

Dominant Markets & Segments in Saudi Arabia Plastic Components Industry

The Saudi Arabian plastic components market exhibits significant geographical diversity, with strong demand across various regions. However, major urban centers and established industrial hubs remain the most significant contributors to overall market growth, reflecting the concentration of manufacturing, consumer markets, and infrastructure development.

Dominant Product Types:

- Sheets, Film, and Plates: This segment retains the largest market share due to its extensive use in packaging, construction, signage, and a broad range of other applications.

- Containers: The robust growth of the food and beverage sector and the increasing reliance on plastic packaging significantly boost this segment's performance.

- Household Articles: The expanding middle class, rising urbanization, and increased disposable incomes contribute to sustained growth in the demand for plastic household items.

Dominant End-user Industries:

- Building and Construction: This sector remains a dominant end-user due to the widespread use of plastic components in construction materials, piping systems, and insulation applications.

- Consumer Goods: The thriving consumer goods sector, coupled with the packaging industry's substantial demand for plastic components, ensures significant market growth.

- Food and Beverage: Stringent hygiene regulations and the need for lightweight, durable, and cost-effective packaging are key drivers for this segment's expansion.

This market dominance is driven by supportive government policies, investments in infrastructure, and a robust local manufacturing base. While these segments are expected to maintain their leading positions, other segments, such as aerospace and life sciences, are projected to exhibit faster growth rates in the coming years, driven by specific technological and market developments.

Saudi Arabia Plastic Components Industry Product Developments

Recent product innovations focus on enhancing material properties, such as improved strength, durability, and chemical resistance, along with eco-friendly solutions like biodegradable plastics. Advanced manufacturing techniques like injection molding and extrusion are widely utilized, contributing to the production of precise and complex components. These innovations enhance product functionality, expand application possibilities across diverse sectors, and offer competitive advantages to manufacturers. The market is seeing a move towards specialized plastics with improved performance characteristics to cater to evolving industry needs.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Saudi Arabia plastic components market, categorized by product type (Sheets, Film, and Plates; Tubes; Containers; Household Articles; Floor Cover and Wall Cover; Textile Fabrics; Other Products) and end-user industry (Building and Construction; Consumer Goods; Life Sciences; Aerospace; Food and Beverage; Other Applications). A detailed analysis of each segment's market size is presented for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering granular growth projections and a comprehensive competitive landscape assessment. Growth trajectories within specific segments are carefully analyzed considering the interplay of government regulations, technological advancements, evolving consumer preferences, and competitive dynamics.

Key Drivers of Saudi Arabia Plastic Components Industry Growth

The growth of the Saudi Arabian plastic components industry is propelled by several key factors: Government initiatives promoting industrial diversification and localization under Vision 2030, rapid urbanization and significant infrastructure development projects, the expansion of the consumer goods sector, and the widespread adoption of advanced manufacturing technologies. The increasing demand for lightweight, durable, and cost-effective materials across various industries is a critical contributor to market expansion. The favorable investment climate created by Vision 2030's focus on diversifying the national economy beyond oil is a powerful catalyst for further growth.

Challenges in the Saudi Arabia Plastic Components Industry Sector

The industry faces several challenges, including volatility in raw material prices (especially oil-based feedstocks), increasing environmental concerns surrounding plastic waste management, and the need to develop a skilled workforce to meet the demands of advanced manufacturing technologies. Competition from established international players and stringent quality standards add further complexity. These challenges are estimated to impact overall market growth by approximately xx% over the forecast period. Addressing these issues through strategic investments in technology, sustainable practices, and workforce development will be crucial for continued industry success.

Emerging Opportunities in Saudi Arabia Plastic Components Industry

Emerging opportunities include the growing demand for specialized plastic components in sectors such as aerospace and medical devices. Furthermore, the increasing focus on sustainability opens avenues for biodegradable and recycled plastic materials. The adoption of Industry 4.0 technologies (automation, robotics, AI) offers potential for enhanced efficiency and innovation. These opportunities represent significant potential for market expansion and innovation in the coming years.

Leading Players in the Saudi Arabia Plastic Components Industry Market

- National Plastic Factory

- Estechtab

- Arabian Plastics Industrial Company Limited (APICO)

- ENPI Group

- Rowad National Plastic Company Ltd

- Zamil Plastics Industries Limited

- Tamam Plastic Factory

- Takween Advanced Industries

- Saudi Can Co Ltd

- PCC

- Al Watania Plastics

- Rayan Plastic Factory Company

- Saudi Plastic Products Company Ltd

Key Developments in Saudi Arabia Plastic Components Industry Industry

- January 2023: National Plastic Factory announces expansion of its production facility, increasing capacity by xx Million.

- June 2022: New environmental regulations regarding plastic waste management are implemented, impacting manufacturing practices.

- October 2021: A major M&A deal involving two prominent players reshapes the market landscape.

- March 2020: Significant investment in automated manufacturing technology is announced by a key player.

Strategic Outlook for Saudi Arabia Plastic Components Industry Market

The Saudi Arabian plastic components industry is poised for sustained growth driven by infrastructure development, economic diversification, and technological advancements. The focus on sustainable practices presents opportunities for innovative materials and processes. Strategic investments in automation and research and development will be crucial for companies to maintain competitiveness and capitalize on the market's potential. The expanding end-user sectors and supportive government policies ensure a positive outlook for the future.

Saudi Arabia Plastic Components Industry Segmentation

-

1. Product Type

- 1.1. Sheets, Film, and Plates

- 1.2. Tubes

- 1.3. Containers

- 1.4. Household Articles

- 1.5. Floor Cover and Wall Cover

- 1.6. Textile Fabrics

- 1.7. Other Products

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Consumer Goods

- 2.3. Life Sciences

- 2.4. Aerospace

- 2.5. Food and Beverage

- 2.6. Other Applications

Saudi Arabia Plastic Components Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Plastic Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Government Spending on Construction Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1 Sheets

- 3.4.2 Film

- 3.4.3 and Plates to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Plastic Components Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sheets, Film, and Plates

- 5.1.2. Tubes

- 5.1.3. Containers

- 5.1.4. Household Articles

- 5.1.5. Floor Cover and Wall Cover

- 5.1.6. Textile Fabrics

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Consumer Goods

- 5.2.3. Life Sciences

- 5.2.4. Aerospace

- 5.2.5. Food and Beverage

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 National Plastic Factory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Estechtab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Plastics Industrial Company Limited (APICO)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENPI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rowad National Plastic Company Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zamil Plastics Industries Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tamam Plastic Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takween Advanced Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Can Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PCC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Watania Plastics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rayan Plastic Factory Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saudi Plastic Products Company Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 National Plastic Factory

List of Figures

- Figure 1: Saudi Arabia Plastic Components Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Plastic Components Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2019 & 2032

- Table 5: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2019 & 2032

- Table 7: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 11: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2019 & 2032

- Table 13: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2019 & 2032

- Table 15: Saudi Arabia Plastic Components Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Plastic Components Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Saudi Arabia Plastic Components Industry?

Key companies in the market include National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, Saudi Plastic Products Company Ltd.

3. What are the main segments of the Saudi Arabia Plastic Components Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Spending on Construction Activities; Other Drivers.

6. What are the notable trends driving market growth?

Sheets. Film. and Plates to Dominate the market.

7. Are there any restraints impacting market growth?

; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Plastic Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Plastic Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Plastic Components Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Plastic Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence