Key Insights

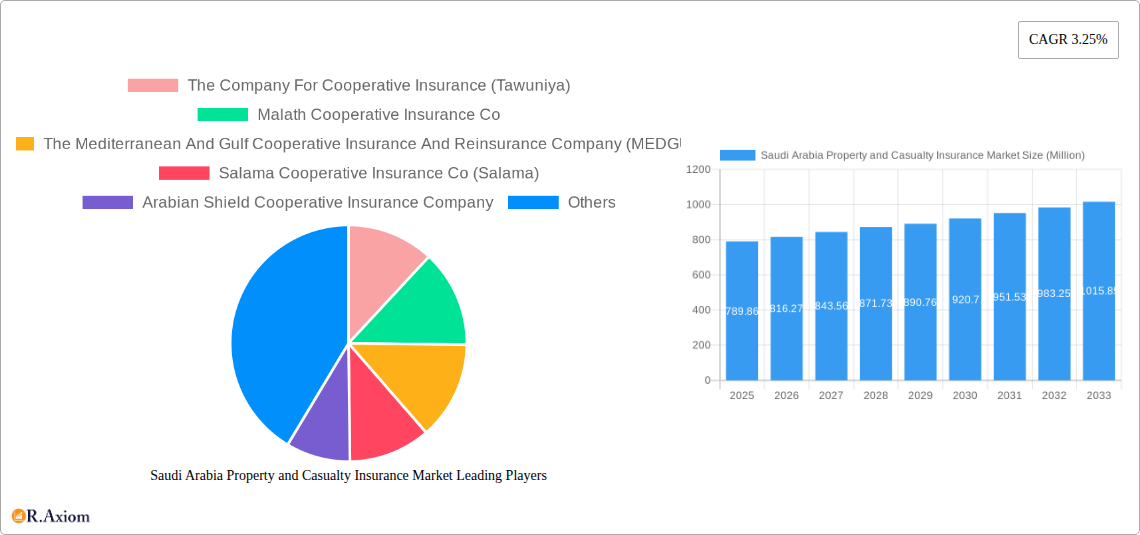

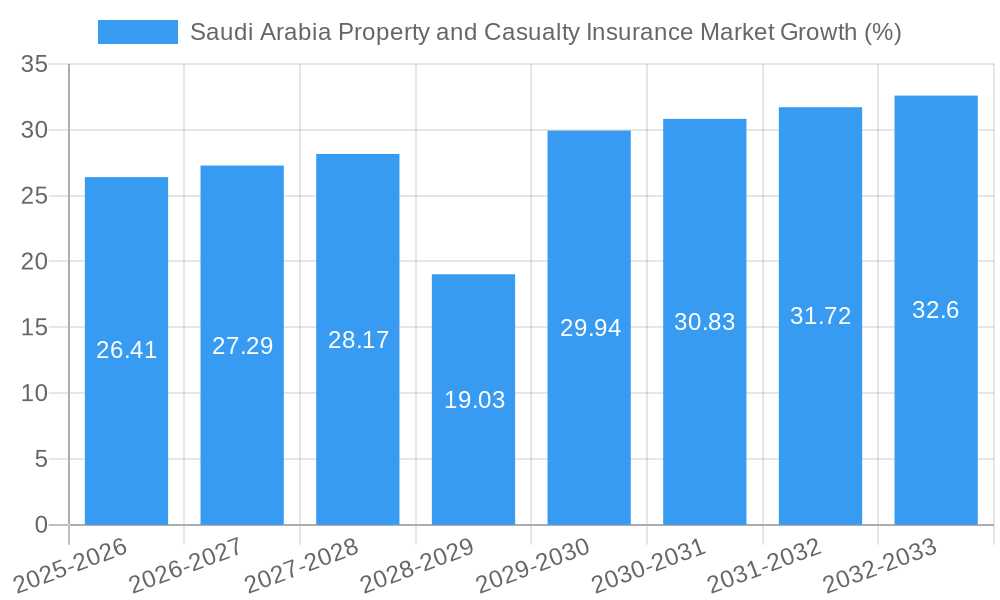

The Saudi Arabia property and casualty (P&C) insurance market exhibits robust growth potential, with a market size of $789.86 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 3.25% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the Kingdom's ambitious Vision 2030 initiative is driving significant infrastructure development and economic diversification, leading to increased demand for property and casualty insurance. Secondly, rising awareness of risk management and the increasing penetration of insurance products among both individuals and businesses contribute to market expansion. Furthermore, government regulations promoting financial inclusion and insurance penetration are creating a more favorable environment for insurers. Competition among established players like The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, and MEDGULF, alongside newer entrants, is fostering innovation and driving down premiums, making insurance more accessible.

However, the market also faces challenges. Fluctuations in oil prices, a key component of the Saudi Arabian economy, can indirectly impact insurance demand. Moreover, the relatively low insurance penetration rate compared to other developed markets presents an opportunity but also necessitates continued efforts in consumer education and awareness campaigns to drive wider adoption. The market segmentation is likely diverse, encompassing various property types (residential, commercial, industrial), liability coverages, and motor insurance, with potential sub-segments emerging based on specialized risks and evolving customer needs. The forecast period (2025-2033) suggests continued growth, though at a moderate pace, reflecting a mature but expanding market characterized by gradual penetration increases and ongoing economic development.

Saudi Arabia Property and Casualty Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Saudi Arabia Property and Casualty Insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It leverages rigorous data analysis and expert insights to illuminate market trends, challenges, and opportunities. This report uses Million (M) for all values.

Saudi Arabia Property and Casualty Insurance Market Concentration & Innovation

This section analyzes the competitive landscape of the Saudi Arabian Property and Casualty Insurance market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is moderately concentrated, with several key players holding significant market share. The top five companies—The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), and Arabian Shield Cooperative Insurance Company—account for approximately xx% of the market in 2024.

- Market Share: Tawuniya holds the largest market share at approximately xx% in 2024, followed by Malath at xx%, MEDGULF at xx%, Salama at xx%, and Arabian Shield at xx%. These figures are estimates based on available data. The remaining market share is distributed among numerous smaller players.

- Innovation Drivers: Technological advancements, such as Insurtech solutions and digital distribution channels, are driving innovation. The increasing demand for customized insurance products tailored to specific customer needs is another key driver.

- Regulatory Frameworks: The recent establishment of the Insurance Authority (IA) is expected to significantly impact market dynamics, promoting greater transparency and efficiency.

- M&A Activity: The Saudi Arabian Property and Casualty Insurance market has witnessed a moderate level of M&A activity in recent years. The total value of deals concluded between 2019 and 2024 is estimated at xx Million. These activities are likely to increase with the expected consolidation of the industry.

- Product Substitutes: While traditional insurance remains dominant, the emergence of alternative risk management strategies poses some level of substitutive threat.

- End-User Trends: Increasing awareness of insurance benefits and a growing middle class are driving demand, particularly in areas like motor and health insurance.

Saudi Arabia Property and Casualty Insurance Market Industry Trends & Insights

The Saudi Arabian Property and Casualty Insurance market is characterized by robust growth, driven by factors including economic expansion, increasing urbanization, infrastructure development, and a burgeoning middle class. The market is experiencing a transition towards digitalization and Insurtech adoption, leading to improved efficiency and customer experience. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, with market penetration expected to reach xx% by 2033. Consumer preferences are shifting towards comprehensive, value-added insurance packages and online distribution channels. The competitive landscape is intensely dynamic, with existing players vying for market share through innovation, expansion, and strategic partnerships.

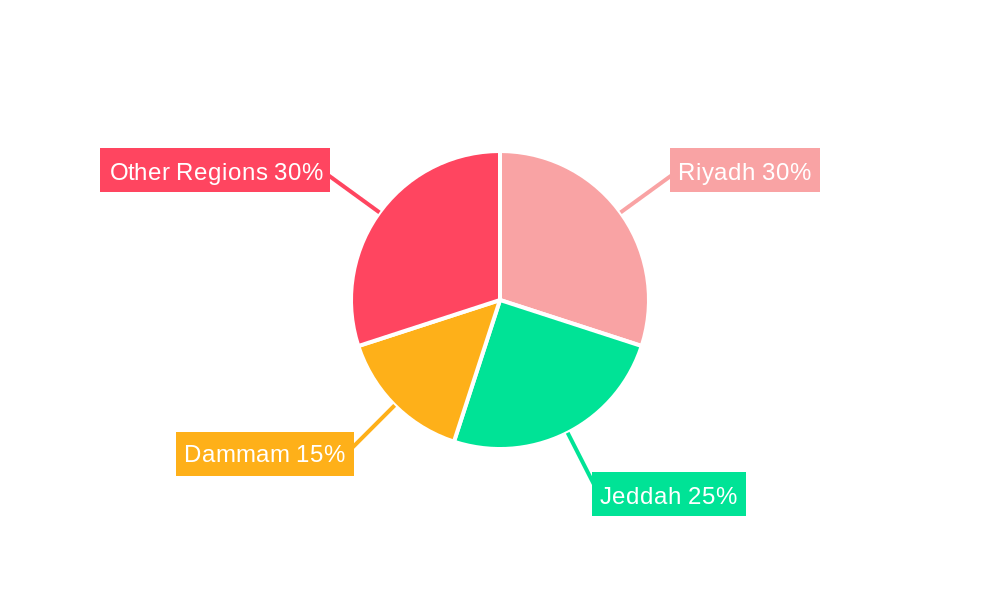

Dominant Markets & Segments in Saudi Arabia Property and Casualty Insurance Market

The Saudi Arabian Property and Casualty Insurance market is largely driven by the urban centers of Riyadh, Jeddah, and Dammam, reflecting high population density and economic activity.

- Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting economic diversification and infrastructure development are boosting insurance demand.

- Infrastructure Development: Large-scale infrastructure projects contribute to a rise in construction and property insurance needs.

- Population Growth: A rapidly growing population, especially in urban areas, increases demand for personal and commercial insurance.

- Government Regulations: The new Insurance Authority will likely lead to further market expansion.

- Detailed Dominance Analysis: While precise regional breakdowns are unavailable due to xx, the aforementioned urban areas account for a significant portion of the overall market volume. The motor insurance segment is expected to continue its strong growth, with xx% of total market value in 2025.

Saudi Arabia Property and Casualty Insurance Market Product Developments

The Saudi Arabian Property and Casualty Insurance market is witnessing the adoption of innovative insurance products and services, driven by technological advancements. Insurtech solutions such as telematics, AI-driven underwriting, and digital claims processing are improving efficiency, risk management, and customer experience. New products tailored to specific needs, like specialized construction insurance and cyber risk coverage are gaining traction. The market fit for these products is strong due to the evolving risks faced by businesses and individuals.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabian Property and Casualty Insurance market based on product type (motor, health, property, liability, etc.), distribution channel (direct, brokers, agents), and customer type (individual, corporate). Each segment demonstrates unique growth trajectories and competitive dynamics. The motor insurance segment is the largest and fastest-growing segment, followed by property insurance and health insurance. Growth projections for each segment vary, with motor and health insurance showing the highest growth rates during the forecast period. Competitive dynamics vary across segments; for example, motor insurance features intense competition amongst numerous players, while specialized insurance lines present more niche opportunities.

Key Drivers of Saudi Arabia Property and Casualty Insurance Market Growth

The Saudi Arabian Property and Casualty Insurance market's growth is propelled by several factors: Firstly, a burgeoning middle class is driving demand for personal insurance products. Secondly, robust economic growth fuels higher insurance penetration within the corporate sector. Thirdly, government initiatives promoting financial inclusion and digitalization create an enabling environment for market expansion. Finally, the recent establishment of the Insurance Authority is expected to enhance market transparency and efficiency, fostering growth.

Challenges in the Saudi Arabia Property and Casualty Insurance Market Sector

The Saudi Arabian Property and Casualty Insurance market faces several challenges: Stringent regulatory compliance requirements demand significant investment from companies. Additionally, the market faces potential talent shortages in highly skilled roles, limiting growth potential. Competition is intense, creating pressure on pricing and profitability, and the lack of comprehensive historical data affects effective market forecasting.

Emerging Opportunities in Saudi Arabia Property and Casualty Insurance Market

Several opportunities exist within the Saudi Arabian Property and Casualty Insurance market. The expanding digitalization of the economy presents a major opportunity for Insurtech firms and existing players to streamline processes. Furthermore, there's considerable potential for growth in niche insurance sectors like cyber insurance and specialized risk coverage. The rising demand for tailored and innovative products creates significant opportunities for insurance providers to expand their portfolios.

Leading Players in the Saudi Arabia Property and Casualty Insurance Market Market

- The Company For Cooperative Insurance (Tawuniya)

- Malath Cooperative Insurance Co

- The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- Salama Cooperative Insurance Co (Salama)

- Arabian Shield Cooperative Insurance Company

- Saudi Arabian Cooperative Insurance Company (Saico)

- Gulf Union Al Ahlia Cooperative Insurance Co

- Allianz Saudi Fransi Cooperative Insurance Company

- Al-Etihad Co-operative Insurance Co

- Al Sagr Cooperative Insurance Company

- (List Not Exhaustive)

Key Developments in Saudi Arabia Property and Casualty Insurance Market Industry

- August 2023: The Saudi Cabinet approved the establishment of the Insurance Authority (IA), a unified and independent regulator for the insurance sector. This is expected to significantly improve market regulation and transparency.

- January 2023: MEDGULF received confirmation of its business's Sharia compliance, enhancing its appeal to a significant segment of the market.

Strategic Outlook for Saudi Arabia Property and Casualty Insurance Market Market

The Saudi Arabian Property and Casualty Insurance market is poised for significant growth over the forecast period. The combination of economic expansion, increasing insurance awareness, technological advancements, and supportive regulatory reforms creates a favorable environment for sustained market expansion. Companies that successfully adapt to the changing landscape, embrace innovation, and cater to evolving customer preferences are expected to experience substantial growth. The market's strong fundamentals suggest a positive outlook for both established players and new entrants.

Saudi Arabia Property and Casualty Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Motor

- 1.2. Property / Fire

- 1.3. Marine

- 1.4. Aviation

- 1.5. Energy

- 1.6. Engineering

- 1.7. Accident & Liability and Other

-

2. Distribution Channel

- 2.1. Insurance Agency

- 2.2. Bancassurance

- 2.3. Brokers

- 2.4. Direct Sales

- 2.5. Others

Saudi Arabia Property and Casualty Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Property and Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization

- 3.4. Market Trends

- 3.4.1. Motor Insurance Growth Triggered By Changing Regulatory Landscape

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Motor

- 5.1.2. Property / Fire

- 5.1.3. Marine

- 5.1.4. Aviation

- 5.1.5. Energy

- 5.1.6. Engineering

- 5.1.7. Accident & Liability and Other

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Agency

- 5.2.2. Bancassurance

- 5.2.3. Brokers

- 5.2.4. Direct Sales

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Malath Cooperative Insurance Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Salama Cooperative Insurance Co (Salama)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Shield Cooperative Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Arabian Cooperative Insurance Company (Saico)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Union Al Ahlia Cooperative Insurance Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz Saudi Fransi Cooperative Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Etihad Co-operative Insurance Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Sagr Cooperative Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

List of Figures

- Figure 1: Saudi Arabia Property and Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Property and Casualty Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 4: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Insurance Type 2019 & 2032

- Table 5: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 10: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Insurance Type 2019 & 2032

- Table 11: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Property and Casualty Insurance Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Saudi Arabia Property and Casualty Insurance Market?

Key companies in the market include The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), Arabian Shield Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (Saico), Gulf Union Al Ahlia Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Al-Etihad Co-operative Insurance Co, Al Sagr Cooperative Insurance Company**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Property and Casualty Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 789.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization.

6. What are the notable trends driving market growth?

Motor Insurance Growth Triggered By Changing Regulatory Landscape.

7. Are there any restraints impacting market growth?

Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization.

8. Can you provide examples of recent developments in the market?

August 2023: The Saudi Cabinet approved the establishment of a new unified and independent regulator for the insurance sector, the Insurance Authority (IA). The Insurance Authority will report directly to the Prime Minister.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Property and Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Property and Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Property and Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Property and Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence