Key Insights

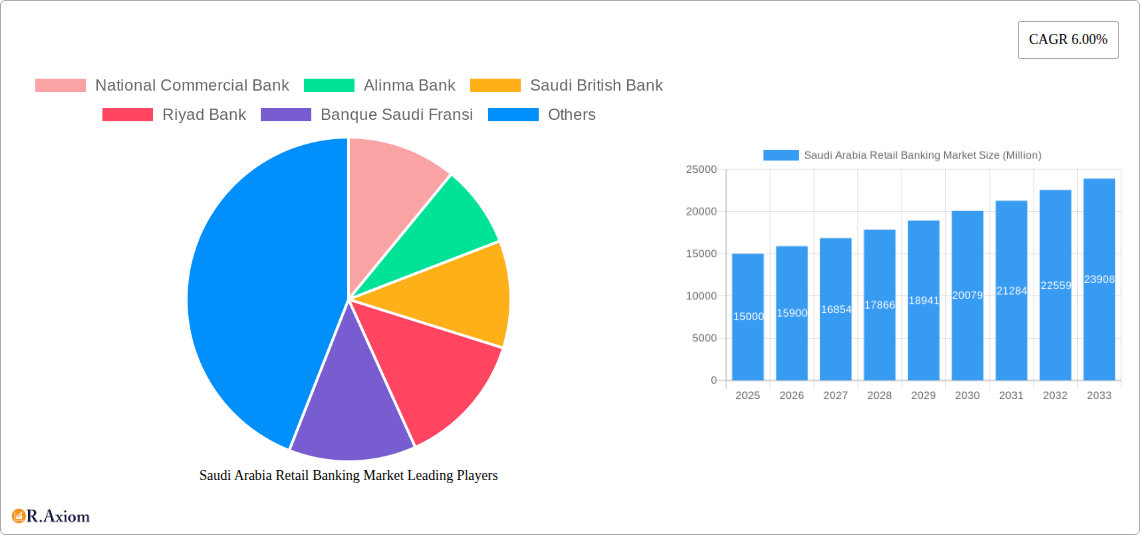

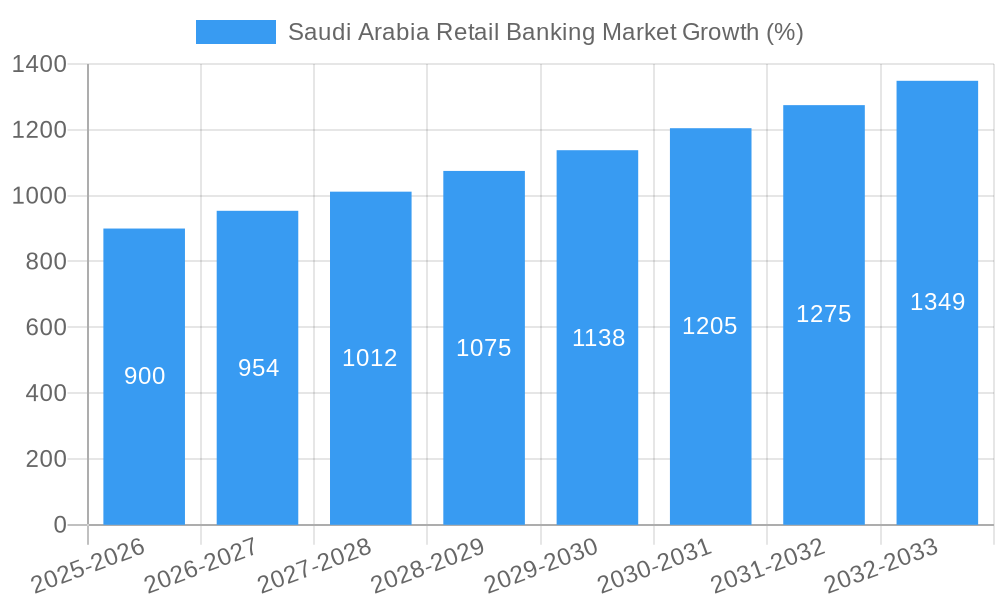

The Saudi Arabian retail banking market exhibits robust growth, projected to reach a substantial size driven by several key factors. The 6.00% CAGR (Compound Annual Growth Rate) from 2019 to 2033 indicates a consistent upward trajectory. This expansion is fueled by a burgeoning middle class with increasing disposable income, rapid urbanization leading to higher demand for financial services, and the government's Vision 2030 initiative, which promotes financial inclusion and diversification of the economy. Technological advancements, particularly in digital banking and fintech solutions, are further accelerating market growth, offering consumers greater convenience and accessibility. While competition among established players like National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, and Al Rajhi Bank remains intense, the market offers ample opportunities for innovation and expansion.

However, regulatory changes and potential economic fluctuations pose challenges. Maintaining customer trust and addressing cybersecurity concerns in the rapidly evolving digital landscape are crucial for sustained growth. Furthermore, the market's dependence on oil prices introduces a degree of vulnerability. Nonetheless, the long-term outlook remains positive, with significant potential for further growth driven by the ongoing digital transformation and the expanding financial inclusion initiatives within the Kingdom. The increasing adoption of mobile banking and online platforms, coupled with the government’s focus on attracting foreign investment, are expected to contribute significantly to the market's expansion in the coming years. Strategic partnerships and mergers and acquisitions are likely to shape the competitive landscape further.

This in-depth report provides a comprehensive analysis of the Saudi Arabia retail banking market, covering market size, segmentation, growth drivers, challenges, and opportunities from 2019 to 2033. The report offers invaluable insights for industry stakeholders, including banks, investors, and regulatory bodies, enabling informed strategic decision-making. With a focus on key players like National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, and Al Rajhi Bank (list not exhaustive), this report provides a granular understanding of the competitive landscape and future growth trajectories. The study period spans 2019-2033, with 2025 as the base and estimated year.

Saudi Arabia Retail Banking Market Concentration & Innovation

The Saudi Arabian retail banking market exhibits a moderate level of concentration, with a few large players dominating the market share. However, the market is witnessing increased competition due to the entry of new players and the expansion of existing ones. Innovation is a key driver, fueled by the Kingdom's Vision 2030 initiative, which promotes digital transformation and financial inclusion. Regulatory frameworks, while supportive of growth, also present challenges. The adoption of open banking and fintech solutions is reshaping the competitive landscape. Mergers and acquisitions (M&A) activity has been significant, with the recent merger of Samba Financial Group and NCB creating the largest banking entity in the Kingdom.

- Market Concentration: The top 5 banks hold approximately xx% of the market share (2024).

- Innovation Drivers: Digitalization, Fintech adoption, Open Banking initiatives, Government support for financial inclusion.

- Regulatory Framework: The Saudi Central Bank (SAMA) plays a pivotal role in shaping the regulatory landscape, influencing both opportunities and challenges for market players.

- M&A Activity: The recent NCB-Samba merger (USD 239.7 Billion assets) highlights the significant consolidation underway. The total value of M&A deals in the sector from 2019 to 2024 is estimated at xx Million.

- End-User Trends: Increasing adoption of digital banking channels, rising demand for personalized financial services, growing preference for mobile payments.

Saudi Arabia Retail Banking Market Industry Trends & Insights

The Saudi Arabian retail banking market is experiencing robust growth, driven by factors such as a young and growing population, rising disposable incomes, and increasing financial literacy. Technological disruptions, such as the rise of fintech and digital banking, are transforming the industry landscape, forcing traditional banks to adapt and innovate to remain competitive. Consumer preferences are shifting towards convenient, personalized, and digital-first banking experiences. The competitive dynamics are characterized by intense rivalry among established players and the emergence of disruptive fintech companies.

- Market Growth Drivers: Economic growth, increasing urbanization, rising disposable incomes, government initiatives promoting financial inclusion.

- Technological Disruptions: Rapid adoption of digital banking, mobile payments, and AI-powered solutions.

- Consumer Preferences: Demand for personalized financial advice, seamless digital experiences, and transparent pricing.

- Competitive Dynamics: Intense competition among established banks and the emergence of fintech companies.

- CAGR (2025-2033): xx%

- Market Penetration (2024): xx% of the adult population

Dominant Markets & Segments in Saudi Arabia Retail Banking Market

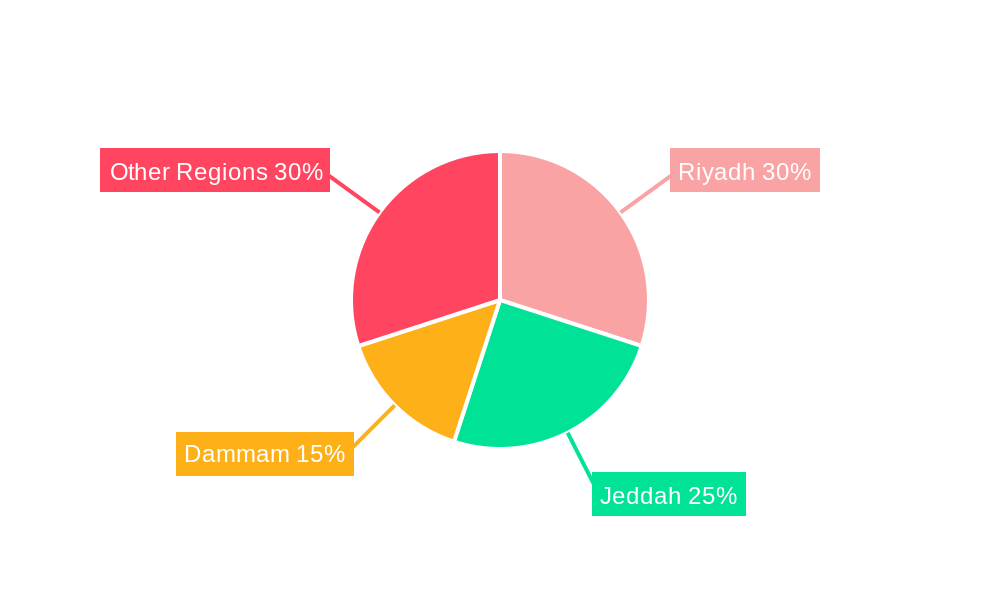

The Saudi Arabian retail banking market is largely concentrated in urban areas. Key drivers for dominance in these regions include higher population density, greater economic activity, and better infrastructure. The segment showing the highest growth is digital banking, driven by increased smartphone penetration and the younger demographic's affinity for digital solutions.

- Key Drivers for Dominant Regions: High population density, strong economic activity, developed infrastructure, favorable government policies.

- Dominant Segment: Digital Banking

- Detailed Dominance Analysis: xx% of retail banking transactions are now conducted through digital channels (2024). This is driven by government initiatives promoting digitalization and the convenience it offers to consumers.

Saudi Arabia Retail Banking Market Product Developments

Recent product innovations in the Saudi Arabian retail banking market include the expansion of digital banking platforms, personalized financial management tools, and the introduction of innovative lending products. These developments leverage technology such as AI and machine learning to enhance customer experience and operational efficiency. The market fit for these new products is strong, aligning with the evolving preferences of Saudi Arabian consumers and the government's push for digital transformation.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabian retail banking market by product type (e.g., deposits, loans, investment products), customer segment (e.g., individuals, small and medium enterprises), and distribution channel (e.g., branches, digital channels). Each segment's growth projections, market sizes, and competitive dynamics are analyzed to offer a thorough understanding of the market. Growth is projected to be strongest in the digital banking segment due to technological advancements and consumer demand. The competitive landscape is dynamic with both traditional players and Fintechs competing.

Key Drivers of Saudi Arabia Retail Banking Market Growth

Several factors contribute to the growth of the Saudi Arabian retail banking market. These include the country's robust economic growth, increasing financial inclusion initiatives by the government, and the expanding adoption of digital banking technologies. Furthermore, the rising young population and increasing disposable incomes are driving demand for a broader range of financial products and services.

Challenges in the Saudi Arabia Retail Banking Market Sector

The Saudi Arabian retail banking market faces several challenges, including the need for further financial literacy among the population, regulatory hurdles in the adoption of new technologies, and increasing competition from Fintech companies. The cybersecurity threat to digital banking presents a significant challenge. These factors collectively impact the market's overall growth potential.

Emerging Opportunities in Saudi Arabia Retail Banking Market

Several emerging opportunities exist for growth in the Saudi Arabian retail banking market. The expansion of Islamic banking products aligns with religious preferences and offers substantial growth potential. Furthermore, the growing adoption of open banking principles and partnerships with Fintechs provide significant opportunities for innovation and market expansion.

Leading Players in the Saudi Arabia Retail Banking Market Market

- National Commercial Bank

- Alinma Bank

- Saudi British Bank

- Riyad Bank

- Banque Saudi Fransi

- Arab National Bank

- Saudi Investment Bank

- Alawwal Bank

- Saudi National Bank

- Al Rajhi Bank

- List Not Exhaustive

Key Developments in Saudi Arabia Retail Banking Market Industry

- January 2022: Saudi National Bank announced the completion of the merger between Samba Financial Group and NCB, creating the largest banking entity in Saudi Arabia with assets exceeding USD 239.7 Billion. This significantly altered the market landscape and increased market concentration.

- February 2022: The Ministry of Municipal and Rural Affairs and Housing honored the Saudi National Bank for its community housing initiative, providing 500 housing units (361 fully furnished and 139 with purchasing cards) to beneficiaries of the housing development program (2017-2021). This highlights the bank's commitment to social initiatives and its positive impact on the community.

Strategic Outlook for Saudi Arabia Retail Banking Market Market

The Saudi Arabian retail banking market is poised for continued growth, driven by strong economic fundamentals, government support for financial inclusion, and the increasing adoption of digital technologies. Further expansion of Islamic banking, strategic partnerships with Fintech companies, and the development of innovative financial products will continue to shape the market landscape. The focus on digital transformation and customer-centric services will be crucial for success.

Saudi Arabia Retail Banking Market Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Industry

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Distributional Channel

- 3.1. Direct Sales

- 3.2. Distributor

Saudi Arabia Retail Banking Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Retail Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia

- 3.3. Market Restrains

- 3.3.1. Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia

- 3.4. Market Trends

- 3.4.1. Increase in Saudi Retail Mortgage Loans Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Retail Banking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Distributional Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 National Commercial Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alinma Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saudi British Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riyad Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Banque Saudi Fransi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arab National Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Investment Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alawwal Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi National Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Rajhi Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 National Commercial Bank

List of Figures

- Figure 1: Saudi Arabia Retail Banking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Retail Banking Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 4: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Distributional Channel 2019 & 2032

- Table 5: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 8: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Distributional Channel 2019 & 2032

- Table 9: Saudi Arabia Retail Banking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Retail Banking Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Saudi Arabia Retail Banking Market?

Key companies in the market include National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, Al Rajhi Bank**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Retail Banking Market?

The market segments include Product, Industry, Distributional Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia.

6. What are the notable trends driving market growth?

Increase in Saudi Retail Mortgage Loans Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia.

8. Can you provide examples of recent developments in the market?

February 2022: The Ministry of Municipal and Rural Affairs and Housing honored the Saudi National Bank for its efforts in serving the housing sector within the donor community after the bank announced the completion of the delivery of its community housing initiative, which resulted in the provision of 500 housing units to the beneficiaries of the housing development program from 2017 to 2021, including 361 fully-furnished housing units and 139 housing units, supported by purchasing cards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Retail Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Retail Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Retail Banking Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Retail Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence