Key Insights

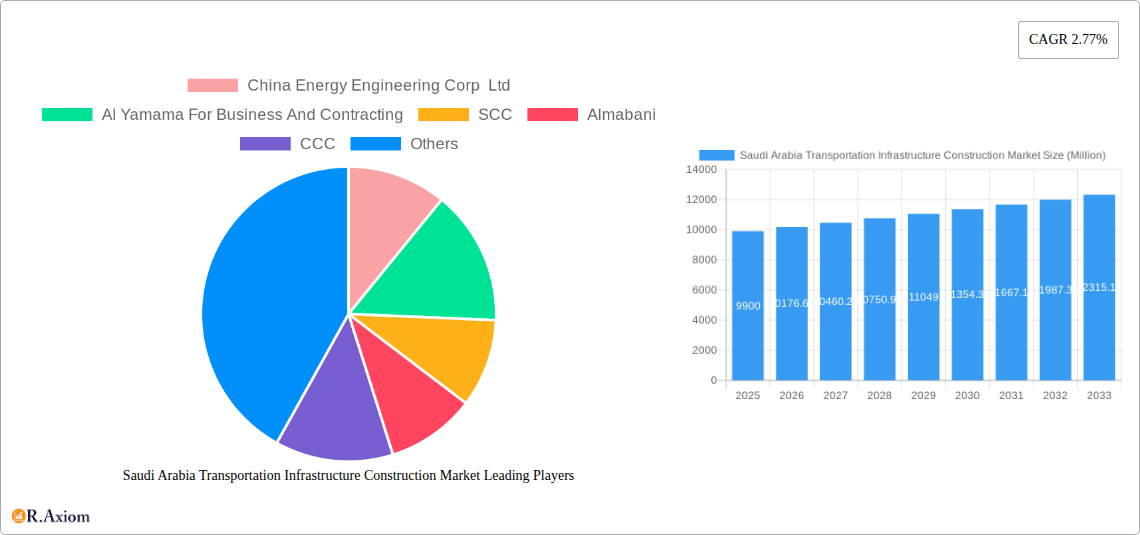

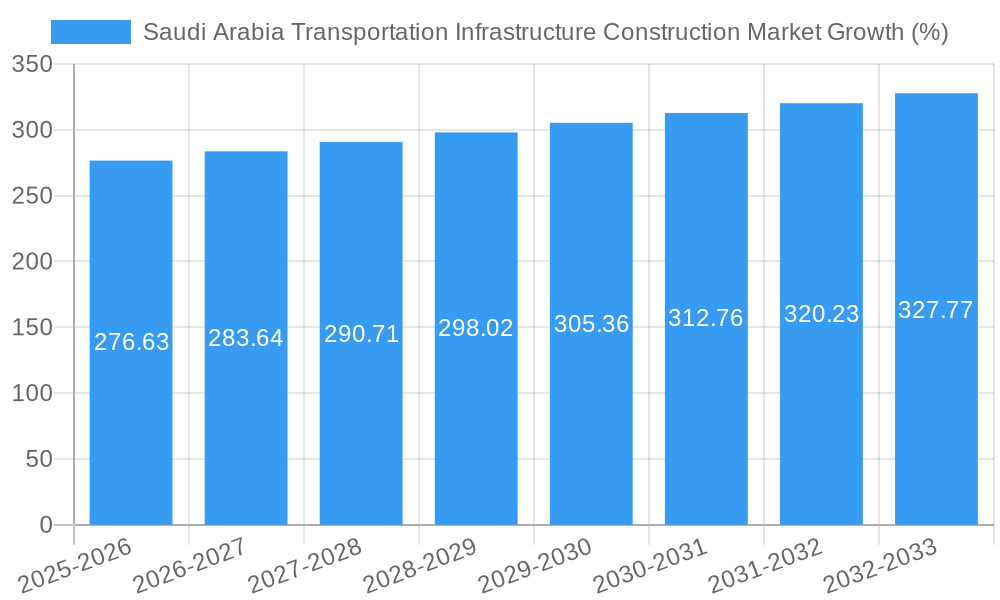

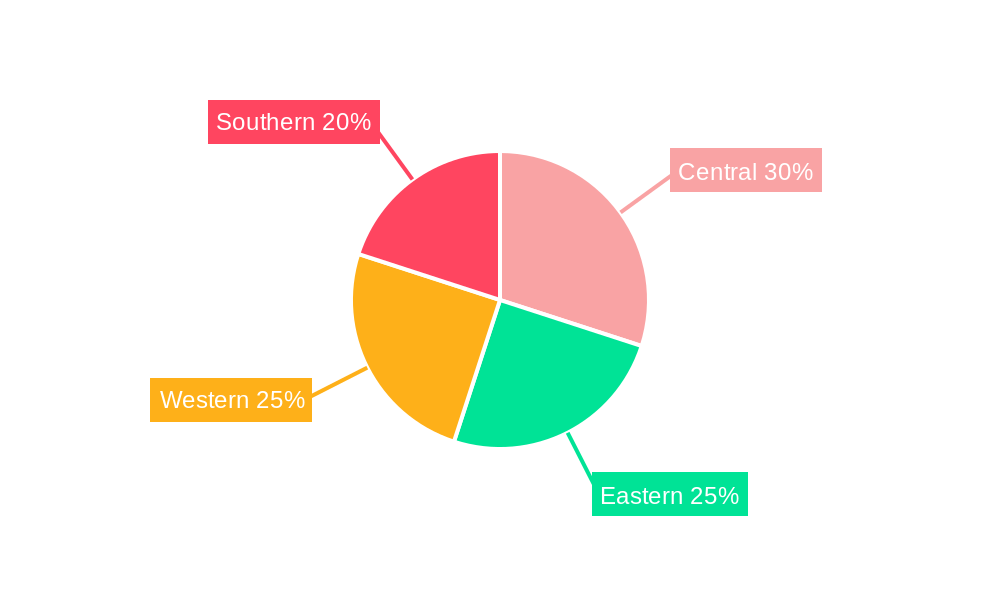

The Saudi Arabian transportation infrastructure construction market presents a robust growth opportunity, projected to reach a market size of $9.90 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 2.77% from 2025 to 2033. This expansion is fueled by significant government investments in upgrading and expanding the nation's transportation networks to support Vision 2030's ambitious economic diversification and sustainable development plans. Key drivers include the ongoing development of mega-projects like NEOM, Red Sea Project, and Qiddiya, necessitating extensive road, rail, airport, and waterway infrastructure improvements. Furthermore, increasing urbanization and a growing population are putting pressure on existing infrastructure, creating a substantial demand for new construction and modernization initiatives. While potential restraints such as global economic fluctuations and material cost volatility exist, the long-term outlook remains positive, driven by sustained government commitment and the strategic importance of well-developed transportation networks for Saudi Arabia's future economic success. The market is segmented by mode of transportation (roads, railways, airports, waterways), allowing for targeted investment and development strategies across different sectors. Leading players in this market include both international giants and prominent local contractors, underscoring the significance of both domestic and foreign expertise in shaping the nation's infrastructure landscape. Regional variations within Saudi Arabia (Central, Eastern, Western, Southern) reflect differing infrastructure needs and priorities, leading to specific development focuses within each region. The historical period (2019-2024) serves as a strong foundation for the robust forecast (2025-2033), indicating a continued trajectory of growth and substantial investment in the sector.

The competitive landscape is marked by a blend of international and local construction companies, indicating a healthy mix of global expertise and localized knowledge. The regional segmentation within Saudi Arabia allows for nuanced understanding of project demands, facilitating strategic resource allocation. The market's growth trajectory is expected to be relatively stable, reflecting the long-term commitment to infrastructure development by the Saudi Arabian government. While external economic factors may introduce some uncertainty, the fundamental drivers—namely Vision 2030 initiatives and population growth—are expected to sustain market expansion, creating promising opportunities for both established players and new entrants in the construction and engineering sectors. The focus on various transportation modes (road, rail, air, and water) reflects a comprehensive strategy to develop a multimodal transportation system that enhances efficiency and connectivity across the Kingdom.

This comprehensive report provides an in-depth analysis of the Saudi Arabia Transportation Infrastructure Construction Market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The study period is 2019–2033, with 2025 as the base and estimated year. The forecast period is 2025–2033, and the historical period is 2019–2024.

Saudi Arabia Transportation Infrastructure Construction Market Market Concentration & Innovation

The Saudi Arabian transportation infrastructure construction market exhibits a moderately concentrated landscape, with a few large multinational and domestic players holding significant market share. Key players like Bechtel, Fluor Corp, and CCC command substantial portions of the market, driven by their expertise, financial strength, and project execution capabilities. However, smaller, specialized firms also thrive, catering to niche segments and regional projects. Market share analysis reveals that the top 5 players account for approximately xx% of the total market revenue in 2025, while the remaining share is distributed among numerous smaller companies.

Innovation is a crucial driver within the sector. The Saudi Vision 2030 initiative fuels investments in advanced technologies, including smart city infrastructure, sustainable construction materials, and digital project management solutions. Regulatory frameworks, while supportive of development, often involve intricate permitting processes. Product substitutes are minimal, given the specialized nature of large-scale infrastructure projects. End-user trends indicate a strong preference for sustainable and efficient solutions, prompting increased adoption of green building technologies and intelligent transportation systems. M&A activity in recent years has been moderate, with deal values averaging around xx Million annually. Notable transactions include [Insert Specific M&A examples if available, otherwise state "Limited publicly available data restricts detailed analysis of recent M&A activity"].

Saudi Arabia Transportation Infrastructure Construction Market Industry Trends & Insights

The Saudi Arabia transportation infrastructure construction market exhibits robust growth, driven primarily by Vision 2030’s ambitious infrastructure development plans. The government's commitment to diversifying the economy and enhancing connectivity necessitates substantial investment in roads, railways, airports, and ports. This translates into a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025-2033). Market penetration of new technologies, like Building Information Modeling (BIM) and IoT-enabled infrastructure monitoring systems, is accelerating, enhancing project efficiency and reducing lifecycle costs. Consumer preferences lean towards technologically advanced transportation solutions, such as high-speed rail networks and smart traffic management systems. Competitive dynamics are shaped by factors like project bidding processes, technological capabilities, and access to funding. The market exhibits a blend of intense competition for large-scale projects and niche competition in specialized segments.

Dominant Markets & Segments in Saudi Arabia Transportation Infrastructure Construction Market

The road construction segment remains the dominant sector within the Saudi Arabia transportation infrastructure construction market, accounting for approximately xx% of the total market revenue in 2025. This is fueled by several key drivers:

- Expansion of the National Road Network: The government's ongoing efforts to expand and upgrade the national road network to support economic growth and facilitate ease of travel are a primary driver.

- Economic Development Initiatives: The rapid economic diversification and urban development across the country necessitate extensive road infrastructure projects in both urban and rural areas.

- Government Investment: Significant public funding, directly allocated to road development, is a crucial factor.

While roads dominate, the railway sector is witnessing significant growth, propelled by projects like the Haramain High-Speed Railway and the planned nationwide rail network. Airports also represent a substantial segment, with continuous expansions and upgrades to existing facilities and the construction of new airports to accommodate rising passenger traffic. Waterways play a smaller, but important role, with ongoing investments in port modernization and expansion to support maritime trade.

Saudi Arabia Transportation Infrastructure Construction Market Product Developments

Recent product innovations focus on sustainable and technologically advanced solutions. This includes the adoption of prefabricated construction techniques, the use of eco-friendly building materials, and the integration of smart technologies for real-time monitoring and management of infrastructure assets. These innovations enhance project efficiency, reduce environmental impact, and improve long-term operational performance. The market fit for these innovations is strong due to the government's emphasis on sustainable development and technological advancement.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia Transportation Infrastructure Construction Market by mode of transportation:

Roads: This segment includes the construction and maintenance of highways, expressways, local roads, and associated infrastructure like bridges and tunnels. The market size is estimated at xx Million in 2025 and is projected to grow at a CAGR of xx% during the forecast period. Competition in this segment is fierce, with numerous large and small players vying for projects.

Railways: This segment encompasses high-speed rail lines, commuter rail networks, and freight rail lines. The market size is expected to be xx Million in 2025, with a projected CAGR of xx% during the forecast period. The market is characterized by fewer, but larger players with specialized expertise.

Airports: This segment focuses on the construction, expansion, and modernization of airports, including runways, terminals, and supporting infrastructure. The market size is projected to reach xx Million by 2025 and grow at a CAGR of xx%. Competition in this segment is concentrated among a few large international players.

Waterways: This segment includes port construction, dredging, and waterway maintenance. The market size in 2025 is estimated to be xx Million and projected to grow at a CAGR of xx%. The competitive landscape consists of a mix of specialized and large-scale construction companies.

Key Drivers of Saudi Arabia Transportation Infrastructure Construction Market Growth

The Saudi Arabia transportation infrastructure construction market's growth is fueled by several key drivers. Vision 2030, with its emphasis on economic diversification and infrastructure development, is a cornerstone. This initiative translates into substantial government investment in large-scale transportation projects. Further fueling growth is the rapid urbanization and population increase, placing greater pressure on existing infrastructure and necessitating expansion. Technological advancements also contribute, with innovations in construction techniques, materials, and project management improving efficiency and sustainability. Finally, supportive government policies and regulatory frameworks facilitating private sector involvement are crucial.

Challenges in the Saudi Arabia Transportation Infrastructure Construction Market Sector

The sector faces challenges such as the potential for project delays due to complex regulatory processes and land acquisition issues. Supply chain disruptions can also impact project timelines and costs, while competition for skilled labor and specialized resources adds pressure. Fluctuations in global commodity prices pose risks to project budgets, and securing adequate financing for large-scale projects remains a constant challenge. The market’s dependency on oil prices also presents risks, though Vision 2030 aims to reduce this vulnerability.

Emerging Opportunities in Saudi Arabia Transportation Infrastructure Construction Market

Significant opportunities exist within the sector, driven by the ongoing implementation of Vision 2030. The increasing focus on sustainable infrastructure development presents an opportunity for companies offering green building technologies and solutions. The integration of smart technologies and digitalization in transportation infrastructure creates opportunities for firms providing advanced monitoring, management, and maintenance systems. Further growth is expected through public-private partnerships and increased private sector participation in infrastructure projects.

Leading Players in the Saudi Arabia Transportation Infrastructure Construction Market Market

- China Energy Engineering Corp Ltd

- Al Yamama For Business And Contracting

- SCC

- Almabani

- CCC

- Al-Rashid Trading & Contracting Company

- Jacobs

- Binyah

- Gilbane Building Co

- Mohammed Al Mojil Group Co

- CB&I LLC

- Afras For Trading And Contracting Company

- Fluor Corp

- Al Latifa Trading and Contracting

- Bechtel

- Tekfen Construction and Installation Co Inc

- Al-Ayuni

- Al-Jabreen Contracting Co

- China Railway Construction Corp Ltd

- AL Jazirah Engineers & Consultants

Key Developments in Saudi Arabia Transportation Infrastructure Construction Market Industry

- October 2022: Alstom announced plans to open a new regional office in Riyadh, signaling a stronger commitment to railway development in Saudi Arabia and the surrounding region. This strengthens the railway segment's competitive landscape.

- January 2023: RATP Dev secured a contract with the Royal Commission for AlUla for '360 Mobility' services. This development highlights the growing importance of integrated and intelligent transportation systems within the kingdom.

Strategic Outlook for Saudi Arabia Transportation Infrastructure Construction Market Market

The Saudi Arabia transportation infrastructure construction market exhibits significant growth potential driven by continued investment under Vision 2030, the expansion of urban areas, and the rising demand for efficient and sustainable transportation solutions. The focus on technological innovation, the adoption of green building practices, and increased private sector participation will further shape the market's trajectory. Companies positioned to leverage these trends, offering innovative solutions and effective project management capabilities, stand to benefit from this robust growth.

Saudi Arabia Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airports

- 1.4. Waterways

Saudi Arabia Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Increased investment in air infrastructure driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Central Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 China Energy Engineering Corp Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al Yamama For Business And Contracting

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SCC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Almabani

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 CCC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Al-Rashid Trading & Contracting Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Jacobs

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Binyah

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Gilbane Building Co

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mohammed Al Mojil Group Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 CB&I LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Afras For Trading And Contracting Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Fluor Corp

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Al Latifa Trading and Contracting

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Bechtel

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Tekfen Construction and Installation Co Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Al-Ayuni

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Al-Jabreen Contracting Co**List Not Exhaustive

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 China Railway Construction Corp Ltd

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 AL Jazirah Engineers & Consultants

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 China Energy Engineering Corp Ltd

List of Figures

- Figure 1: Saudi Arabia Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 10: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Transportation Infrastructure Construction Market?

The projected CAGR is approximately 2.77%.

2. Which companies are prominent players in the Saudi Arabia Transportation Infrastructure Construction Market?

Key companies in the market include China Energy Engineering Corp Ltd, Al Yamama For Business And Contracting, SCC, Almabani, CCC, Al-Rashid Trading & Contracting Company, Jacobs, Binyah, Gilbane Building Co, Mohammed Al Mojil Group Co, CB&I LLC, Afras For Trading And Contracting Company, Fluor Corp, Al Latifa Trading and Contracting, Bechtel, Tekfen Construction and Installation Co Inc, Al-Ayuni, Al-Jabreen Contracting Co**List Not Exhaustive, China Railway Construction Corp Ltd, AL Jazirah Engineers & Consultants.

3. What are the main segments of the Saudi Arabia Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Increased investment in air infrastructure driving the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

January 2023- RATP Dev announced that it has signed a contract with the Royal Commission for '360 Mobility' services for Al Ula. Under this contract, RATP Dev will assist RCU in developing the plans, policies, governance, and infrastructure, as well as the transportation assets, of AlUla's cutting-edge mobility network for residents and visitors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence