Key Insights

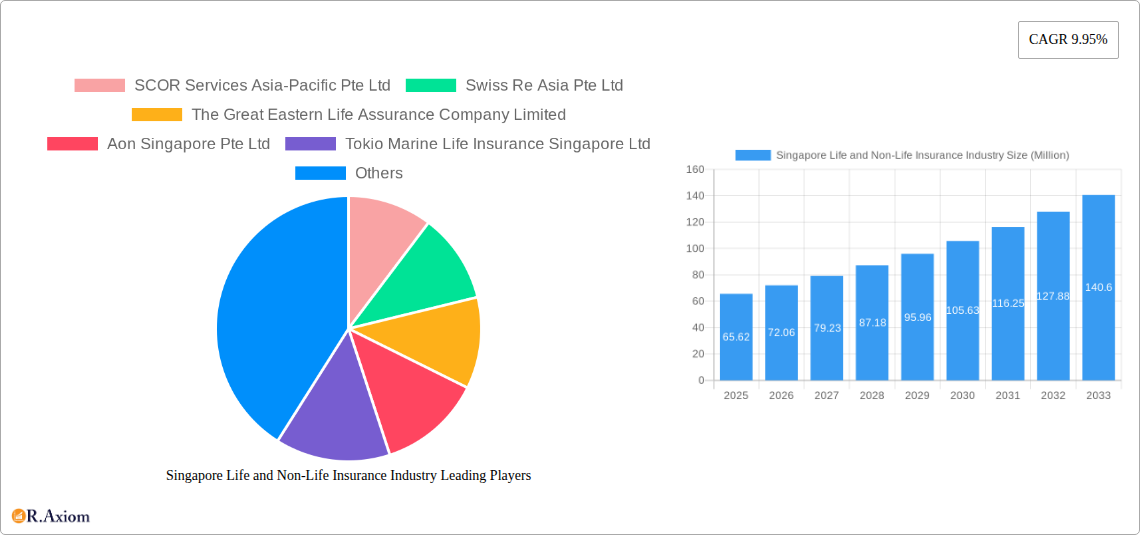

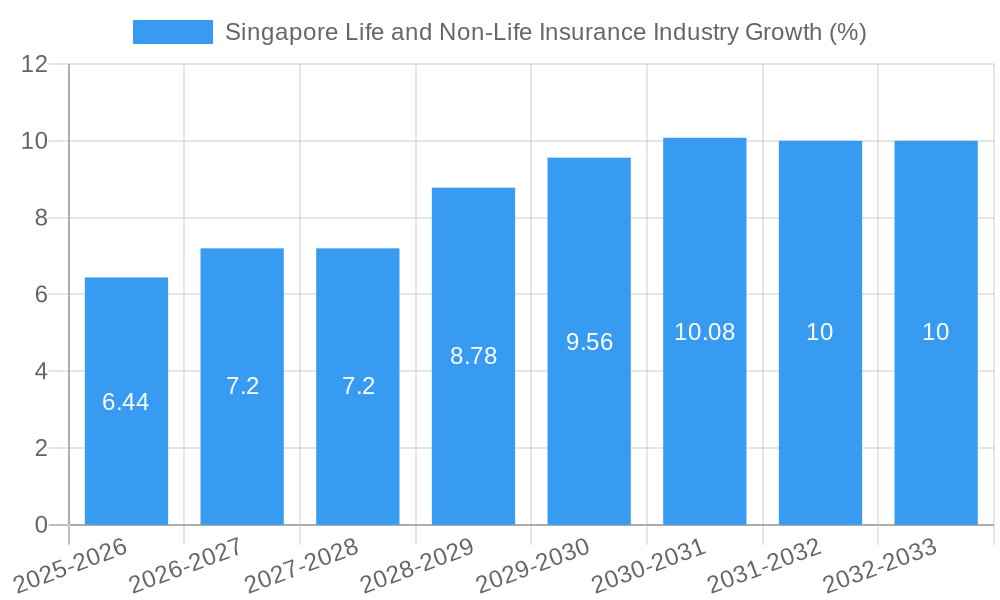

The Singapore life and non-life insurance market, valued at S$65.62 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.95% from 2025 to 2033. This significant growth is fueled by several key drivers. A rising middle class with increased disposable income is seeking greater financial security, leading to higher demand for both life and non-life insurance products. Government initiatives promoting financial literacy and encouraging insurance coverage further bolster market expansion. The increasing prevalence of chronic diseases and the growing awareness of healthcare costs are driving demand for health insurance, a substantial segment within the life insurance sector. Furthermore, the digitalization of insurance services, through online platforms and mobile applications, is enhancing accessibility and convenience, attracting a wider customer base. Competitive pricing strategies and innovative product offerings from established players like AIA Singapore, Great Eastern, and MSIG, alongside the entry of new players, contribute to the market's dynamism.

However, the market also faces certain constraints. Stringent regulatory requirements and compliance costs can impact profitability for insurance providers. Furthermore, the relatively small size of the Singaporean market presents limitations to overall expansion. The penetration rate of certain insurance products, particularly among specific demographic groups, remains relatively low. Addressing these challenges through targeted marketing campaigns and product diversification is crucial for sustained market growth. The segmentation of the market across insurance types (life and non-life), customer groups (corporate and individual), and distribution channels (direct, agency, banks, and others) presents opportunities for specialized service providers to target particular market niches. This diversification strategy is vital for sustained growth and profitability in the competitive Singaporean insurance landscape.

This comprehensive report provides an in-depth analysis of Singapore's life and non-life insurance industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The report leverages extensive data analysis, incorporating historical performance (2019-2024), current market estimations (2025), and future forecasts (2025-2033). Key industry stakeholders, including insurers, investors, and regulators, will find this report invaluable for strategic decision-making.

Singapore Life and Non-Life Insurance Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and mergers & acquisitions (M&A) activity within Singapore's life and non-life insurance sector. The report assesses market share distribution among key players and evaluates the impact of M&A activities on market dynamics. The study period covers 2019-2033, with 2025 serving as the base and estimated year.

Market Concentration: The Singaporean insurance market shows a high degree of concentration, with a few dominant players commanding significant market share. The top 5 insurers likely account for over xx% of the total market premium. Further analysis delves into market share fluctuations across the historical (2019-2024) and forecast (2025-2033) periods.

Innovation Drivers: Technological advancements such as AI, big data analytics, and InsurTech are driving innovation in product development, customer service, and operational efficiency. The regulatory environment, while robust, is also fostering innovation through supportive policies aimed at digitalization and financial inclusion.

Regulatory Framework: The Monetary Authority of Singapore (MAS) plays a crucial role in shaping the industry's regulatory landscape. The report analyzes the impact of regulations on market dynamics, including those impacting solvency, product pricing, and consumer protection.

Product Substitutes: The emergence of alternative risk management solutions, such as crowdfunding and peer-to-peer insurance, presents potential substitutes to traditional insurance offerings. The report evaluates the competitive threat posed by these substitutes and their potential impact on market growth.

End-User Trends: Shifting consumer preferences towards digital-first interactions, personalized products, and greater transparency are significantly influencing the insurance industry. The report analyzes these evolving preferences and their implications for insurers.

M&A Activities: The report analyzes significant M&A transactions during the study period (2019-2024), including deal values and their impact on market consolidation. For example, the February 2022 acquisition of AXA Insurance Pte Limited by HSBC highlights the ongoing consolidation within the sector. The report projects future M&A activity based on prevailing market dynamics.

Singapore Life and Non-Life Insurance Industry Industry Trends & Insights

This section explores key trends and insights shaping Singapore's life and non-life insurance industry. The analysis includes market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, utilizing a combination of qualitative and quantitative data to provide a holistic view of the market landscape. The report provides detailed analysis of Compound Annual Growth Rate (CAGR) and market penetration rate across various segments. Analysis of specific data points include projected growth for specific segments such as Life Insurance seeing a CAGR of xx% and Non-Life insurance with a CAGR of xx% for the forecast period (2025-2033). Factors such as rising health consciousness, increasing affluence, and government initiatives supporting insurance penetration are contributing to the growth of the market.

The rapid adoption of digital technologies is transforming the sector, leading to enhanced customer experience, improved operational efficiencies, and the emergence of new business models. Moreover, evolving consumer preferences are driving demand for personalized insurance products tailored to specific needs and risk profiles. The competitive landscape is characterized by both established players and emerging InsurTech companies vying for market share, creating a dynamic and innovative environment.

Dominant Markets & Segments in Singapore Life and Non-Life Insurance Industry

This section identifies the dominant segments within Singapore's life and non-life insurance industry, analyzing key drivers for their dominance. The segmentation focuses on Insurance Type (Life, Non-Life), Group (Corporate, Individual), and Distribution Channel (Direct, Agency, Banks, Other).

Insurance Type: Both life and non-life insurance segments contribute significantly to the overall market, with life insurance likely holding a larger market share due to factors such as increasing awareness of long-term financial security needs.

Group: The corporate segment is expected to demonstrate robust growth driven by employers offering group insurance plans as employee benefits. The individual segment will continue to be a significant contributor, driven by increasing personal risk awareness and financial planning.

Distribution Channel: Agency channels likely maintain a substantial market share due to their established networks and personal relationships with customers. However, the direct and bank channels are witnessing increasing growth fueled by digitalization and enhanced customer convenience.

Key Drivers:

- Economic policies: Government initiatives promoting financial literacy and encouraging insurance penetration are pivotal.

- Infrastructure: Robust digital infrastructure facilitates the growth of online and mobile-based insurance platforms.

- Consumer behavior: Rising awareness about insurance products and risk management is driving increased demand.

Singapore Life and Non-Life Insurance Industry Product Developments

Recent years have witnessed significant product innovation in Singapore's insurance sector, driven by technological advancements and changing consumer preferences. Insurers are increasingly leveraging data analytics to offer personalized and customized products tailored to individual needs. The integration of InsurTech solutions such as AI-powered chatbots and digital platforms is improving customer experience and operational efficiency. These developments aim to enhance competitiveness and better meet evolving market demands. These innovations include parametric insurance, microinsurance, and personalized health insurance plans.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Singapore life and non-life insurance market, segmented by insurance type (life and non-life), group (corporate and individual), and distribution channel (direct, agency, banks, and others). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly examined. For instance, the agency channel is predicted to experience xx Million growth in the forecast period, while the direct channel is projected to grow by xx Million, indicating the ongoing shift towards digital distribution. The individual life insurance segment shows xx% higher growth compared to the corporate segment.

Key Drivers of Singapore Life and Non-Life Insurance Industry Growth

Several key factors are driving the growth of Singapore's life and non-life insurance industry. Firstly, strong economic growth leads to increased disposable income, making insurance more accessible. Government regulations supporting financial inclusion and insurance penetration further bolster the market. Technological advancements, including InsurTech solutions, are optimizing operations and improving customer experience. Finally, rising health awareness, particularly among the growing elderly population, fuels demand for health insurance products.

Challenges in the Singapore Life and Non-Life Insurance Industry Sector

The Singaporean insurance industry faces challenges such as increasing competition from both established players and emerging InsurTech firms. Regulatory compliance requirements can be complex and costly, while maintaining sufficient capital reserves amid evolving risk profiles is crucial. Furthermore, cybersecurity threats and data protection concerns are increasingly important aspects to consider. These challenges necessitate robust risk management strategies and continuous adaptation to changing market dynamics. For example, stringent regulations on data privacy could lead to an estimated xx Million reduction in marketing expenses for insurers in the coming years.

Emerging Opportunities in Singapore Life and Non-Life Insurance Industry

The Singaporean insurance market offers significant growth opportunities. The rise of InsurTech provides potential for innovative product development and improved operational efficiency. Growing demand for health insurance, driven by an aging population and rising health consciousness, creates significant opportunities. The increasing adoption of digital channels presents opportunities to enhance customer engagement and distribution reach. Finally, partnerships between traditional insurers and InsurTech startups offer significant potential for mutual growth.

Leading Players in the Singapore Life and Non-Life Insurance Industry Market

- SCOR Services Asia-Pacific Pte Ltd

- Swiss Re Asia Pte Ltd

- The Great Eastern Life Assurance Company Limited

- Aon Singapore Pte Ltd

- Tokio Marine Life Insurance Singapore Ltd

- MSIG Insurance (Singapore) Pte Ltd

- Liberty Insurance Pte Ltd

- Aviva Ltd

- AIA Singapore Private Limited

- Swiss Life (Singapore) Pte Ltd

Key Developments in Singapore Life and Non-Life Insurance Industry Industry

- October 2022: DocDoc partnered with QBE Singapore to launch a new group health insurance product, showcasing the growing collaboration between InsurTech and traditional insurers.

- February 2022: HSBC's acquisition of AXA Singapore highlights ongoing consolidation within the market and increased foreign investment.

Strategic Outlook for Singapore Life and Non-Life Insurance Industry Market

The Singapore life and non-life insurance market is poised for continued growth, driven by a combination of economic growth, supportive government policies, technological innovation, and evolving consumer preferences. The increasing adoption of digital technologies, coupled with the emergence of innovative insurance products, will shape the future competitive landscape. Strategic partnerships and mergers & acquisitions will continue to play a crucial role in market consolidation and expansion. The potential for InsurTech to further disrupt the industry, while also presenting collaborative opportunities for traditional insurers, underscores a dynamic and evolving market outlook.

Singapore Life and Non-Life Insurance Industry Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-life Insurance

-

1.1. Life Insurance

-

2. Distribution channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Singapore Life and Non-Life Insurance Industry Segmentation By Geography

- 1. Singapore

Singapore Life and Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Increase in GDP Per Capita of the Finance and Insurance Industry is Anticipated to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Life and Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SCOR Services Asia-Pacific Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Swiss Re Asia Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Great Eastern Life Assurance Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aon Singapore Pte Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tokio Marine Life Insurance Singapore Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MSIG Insurance (Singapore) Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Liberty Insurance Pte Ltd**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aviva Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AIA Singapore Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Swiss Life (Singapore) Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SCOR Services Asia-Pacific Pte Ltd

List of Figures

- Figure 1: Singapore Life and Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Life and Non-Life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 4: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 7: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 8: Singapore Life and Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Life and Non-Life Insurance Industry?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Singapore Life and Non-Life Insurance Industry?

Key companies in the market include SCOR Services Asia-Pacific Pte Ltd, Swiss Re Asia Pte Ltd, The Great Eastern Life Assurance Company Limited, Aon Singapore Pte Ltd, Tokio Marine Life Insurance Singapore Ltd, MSIG Insurance (Singapore) Pte Ltd, Liberty Insurance Pte Ltd**List Not Exhaustive, Aviva Ltd, AIA Singapore Private Limited, Swiss Life (Singapore) Pte Ltd.

3. What are the main segments of the Singapore Life and Non-Life Insurance Industry?

The market segments include Insurance Type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Increase in GDP Per Capita of the Finance and Insurance Industry is Anticipated to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

Oct 2022: The Singapore-based digital health insurance platform DocDoc partnered with QBE Singapore to launch a new group health insurance product in the country. QBE is a leading provider of professional insurance and special expert services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Life and Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Life and Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Life and Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Singapore Life and Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence