Key Insights

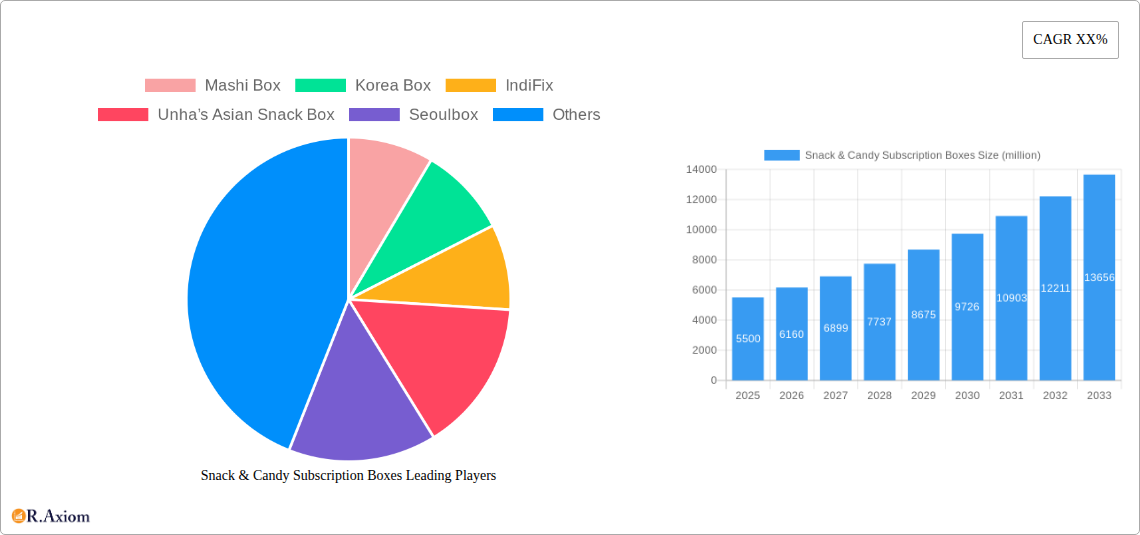

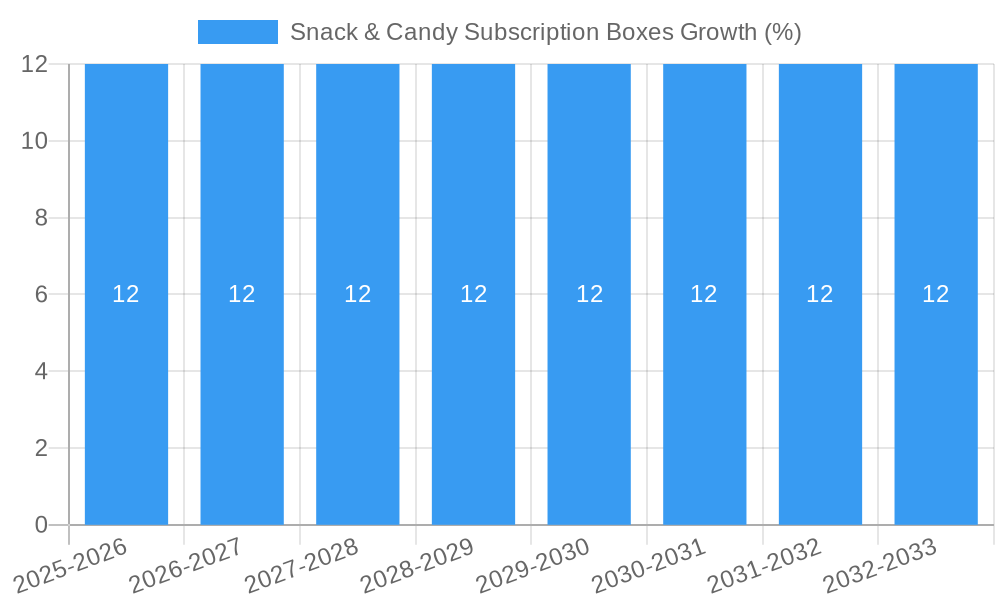

The global Snack & Candy Subscription Box market is experiencing robust growth, projected to reach an estimated market size of USD 5,500 million in 2025. This expansion is driven by a confluence of factors, including the increasing consumer demand for novel and curated snacking experiences, the convenience offered by direct-to-doorstep delivery, and the growing popularity of international and niche snack varieties. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of 12% during the forecast period of 2025-2033, indicating sustained and strong market momentum. Key drivers include the desire for authentic culinary exploration, the rise of e-commerce and digital subscription models, and the strategic marketing efforts by prominent players like Bokksu, TokyoTreat, and Sakuraco, who are effectively leveraging social media to build brand awareness and engage a global customer base. The "Sweets" and "Snacks" segments are expected to dominate, catering to diverse consumer preferences for indulgent treats and everyday munchies.

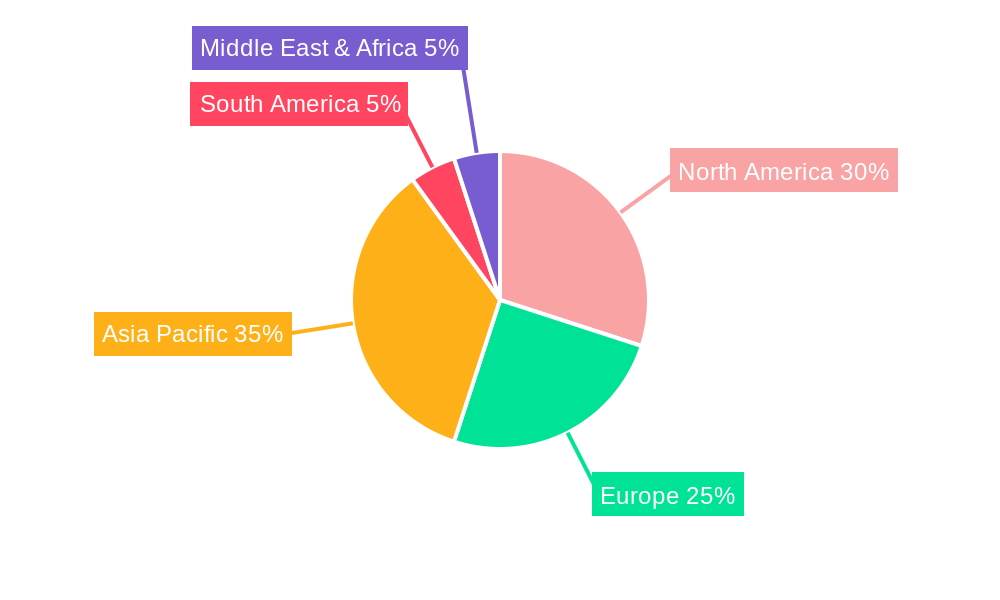

Further analysis reveals a dynamic competitive landscape with a wide array of players, from large-scale operations like Glico and Japan Centre to specialized providers such as Unha’s Asian Snack Box and My Ramen Box. This diversity fosters innovation and caters to specific consumer niches, including those seeking Japanese, Korean, or other regional delicacies. While the market presents significant opportunities, certain restraints, such as intense competition and potential supply chain disruptions, warrant careful consideration. However, the overarching trend towards personalized consumption and the exploration of global flavors are powerful tailwinds. Emerging markets in Asia Pacific, particularly China and South Korea, alongside established markets in North America and Europe, are expected to be key growth regions. The convenience, discoverability, and element of surprise inherent in subscription boxes continue to resonate with consumers seeking more engaging ways to indulge their snack and candy cravings, positioning the market for continued expansion.

Here's an SEO-optimized, detailed report description for Snack & Candy Subscription Boxes, incorporating high-traffic keywords and adhering to your specified structure and content requirements.

Snack & Candy Subscription Boxes Market Concentration & Innovation

The global Snack & Candy Subscription Boxes market exhibits moderate concentration, with a dynamic interplay between established players and emerging niche providers. Innovation is a key differentiator, driven by evolving consumer tastes, a desire for unique global flavors, and the integration of personalized experiences. Key innovation drivers include the curation of exclusive or hard-to-find snacks, the introduction of themed boxes (e.g., Japanese Kit Kats, Korean Ramyeon), and the adoption of sustainable packaging solutions. Regulatory frameworks, particularly concerning food safety and import/export regulations for international snack boxes, significantly influence market entry and operational strategies. Product substitutes, such as direct retail purchases of individual snacks and the rise of general lifestyle subscription boxes that may include snacks, pose a constant challenge, necessitating continuous value addition. End-user trends lean towards convenience, discovery, and the experiential aspect of unboxing, with a growing demand for healthier or allergen-free options. Merger and acquisition (M&A) activities, while not always at multi-million dollar figures for individual transactions in this segment, are strategically important for market consolidation and the acquisition of proprietary sourcing networks or loyal customer bases. For instance, strategic partnerships to secure exclusive distribution rights for popular candies like Glico products can represent significant, albeit often undisclosed, value. The overall M&A landscape is characterized by smaller, targeted acquisitions aimed at enhancing product portfolios and expanding geographical reach.

Snack & Candy Subscription Boxes Industry Trends & Insights

The Snack & Candy Subscription Boxes industry is experiencing robust growth, fueled by an insatiable global appetite for novel taste experiences and the convenience of curated deliveries. This market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period of 2025–2033. Market penetration continues to rise as more consumers, across both Personal and Enterprise segments, embrace subscription models for their dietary indulgences. Technological disruptions are playing a pivotal role, with e-commerce platforms providing seamless ordering and delivery, while data analytics enable businesses to personalize box contents based on individual preferences and past purchase history. The rise of social media influencers and unboxing videos has further amplified consumer interest, creating viral marketing opportunities for brands like TokyoTreat, Bokksu, and Japan Crate. Consumer preferences are increasingly diverse, ranging from a demand for authentic international flavors, exemplified by the popularity of boxes featuring Korean snacks from Korea Box and IndiFix, to a growing interest in healthier alternatives and artisanal confections. The competitive dynamics are intense, with companies like Mashi Box, Unha’s Asian Snack Box, and Seoulbox vying for market share by differentiating through unique product sourcing, thematic curation, and exceptional customer service. The ability to consistently deliver high-quality, exciting, and relevant snack assortments is paramount. Furthermore, the industry is witnessing a trend towards niche specialization, catering to specific dietary needs or cultural preferences, such as those offered by Snakku and Freedom Japanese Market. The strategic importance of supply chain management, particularly for sourcing unique items from markets like Japan (KitKat Japan, Japan Centre) and Asia, is critical for maintaining product diversity and availability. The estimated market size for 2025 is valued at over $1,500 million, with projections indicating significant expansion in the coming years.

Dominant Markets & Segments in Snack & Candy Subscription Boxes

The Snack & Candy Subscription Boxes market demonstrates significant dominance in several key regions and segments, driven by distinct economic policies, evolving consumer infrastructure, and cultural affinities. Asia-Pacific, particularly Japan and South Korea, emerges as a leading region due to its rich and diverse confectionery culture and high adoption rates of subscription services. Countries like Japan, with its vast array of unique snacks and candies from brands like Glico, Shogun Candy, and KitKat Japan, are central to global sourcing and consumer interest. The Personal application segment currently holds the largest market share, accounting for an estimated 70% of the total market value in 2025. This dominance is attributed to individual consumers seeking novelty, convenience, and a global culinary adventure from their homes. The Sweets type segment also commands a substantial portion of the market, driven by impulse purchases and the inherent pleasure associated with confectionery.

Key Drivers in the Personal Segment:

- Increased Disposable Income: Growing disposable incomes in emerging economies translate into higher spending on discretionary items like subscription boxes.

- Social Media Influence: Viral unboxing videos and influencer endorsements from platforms like Instagram and TikTok popularize specific brands and products, driving demand.

- Desire for Novelty and Discovery: Consumers actively seek new taste experiences and unique products not readily available in their local markets.

- Convenience and Curation: The ease of receiving a pre-selected assortment of snacks directly to one's doorstep is a significant draw.

Dominance Analysis of Sweets Segment: The overwhelming popularity of sugary treats and candies worldwide underpins the dominance of the "Sweets" segment. Companies like Tokyo Okashi Box, Candy Japan, and Sushi Candy thrive by offering an enticing variety of chocolates, gummies, hard candies, and other sugary delights. The emotional connection and nostalgic appeal of familiar and new sweet treats contribute to sustained consumer interest. Furthermore, the "Sweets" segment benefits from being a relatively low-barrier-to-entry category for new product development and sourcing, allowing for rapid introduction of trending items. The ability to source exclusive Japanese Kit Kat flavors or popular Korean jellies provides a significant competitive edge for subscription boxes focusing on this segment. The market value for the Sweets segment is projected to exceed $1,200 million by 2033.

The Enterprise application segment, though smaller, is a rapidly growing area, driven by corporate gifting, employee appreciation programs, and event catering. Companies are increasingly utilizing personalized snack boxes from providers like MunchPak and WowBox as a way to foster employee morale and impress clients. This segment is projected to grow at a CAGR of 9.2% from 2025–2033. The "Snacks" type segment, encompassing savory items, baked goods, and healthier alternatives, is also gaining traction, reflecting a broader shift in consumer preferences towards balanced snacking.

Snack & Candy Subscription Boxes Product Developments

Product development in the Snack & Candy Subscription Boxes market is characterized by a relentless pursuit of novelty and personalization. Companies are innovating by curating exclusive or limited-edition items from sought-after global markets, such as premium Japanese Kit Kat varieties from KitKat Japan or artisanal Japanese candies. The integration of technology allows for enhanced customization, enabling subscribers to tailor boxes based on dietary restrictions (e.g., gluten-free, vegan) or flavor preferences. Competitive advantages are being forged through strategic partnerships with manufacturers like Glico and unique sourcing networks that provide access to rare treats. The market is also seeing the introduction of themed boxes, like those focusing on ramen from My Ramen Box, or culturally specific assortments from brands such as Sakuraco and ZenPop, catering to niche interests and enhancing the unboxing experience.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Snack & Candy Subscription Boxes market across critical segmentation parameters. The study encompasses the Enterprise application segment, catering to corporate needs for gifting and employee benefits, projected to reach a market size of over $450 million by 2033 with a robust CAGR. The Personal application segment, constituting the majority of the market, is driven by individual consumer demand for discovery and convenience, expected to exceed $1,050 million by 2033.

In terms of product types, the Sweets segment dominates, leveraging the universal appeal of confectionery and projected to grow substantially, reaching over $1,200 million by 2033. The Snacks segment, encompassing savory and healthier options, is experiencing accelerated growth due to evolving dietary trends and a projected market size of over $300 million by 2033. The Others segment, including beverages and unique culinary items, represents a smaller but innovation-rich area with projected growth mirroring the overall market.

Key Drivers of Snack & Candy Subscription Boxes Growth

The growth of the Snack & Candy Subscription Boxes market is propelled by several interconnected factors. The increasing globalization of food trends, coupled with a growing consumer desire for authentic international flavors, is a primary catalyst. Technological advancements in e-commerce and logistics have made it easier for companies like Bokksu and Japan Centre to offer seamless subscription services worldwide. The rise of social media, particularly influencer marketing and user-generated content such as unboxing videos, creates significant organic reach and demand. Furthermore, economic stability and rising disposable incomes in many regions allow consumers to allocate more resources to discretionary spending, including curated snack experiences. Regulatory support for e-commerce and trade agreements facilitating the import and export of food products also contribute positively.

Challenges in the Snack & Candy Subscription Boxes Sector

Despite strong growth, the Snack & Candy Subscription Boxes sector faces several challenges. Navigating complex and varying international food safety regulations and import/export duties across different countries can be a significant hurdle for companies like Unha’s Asian Snack Box and Snakku. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of sourcing unique snacks, leading to potential fulfillment issues for providers like Freedom Japanese Market. Intense competition from both established subscription box players and direct-to-consumer snack brands necessitates continuous innovation and competitive pricing. Moreover, managing customer churn, a common challenge in subscription models, requires ongoing efforts in customer engagement and value delivery to retain subscribers of services like Mashi Box and Korea Box.

Emerging Opportunities in Snack & Candy Subscription Boxes

Emerging opportunities in the Snack & Candy Subscription Boxes market lie in catering to the growing demand for healthier and niche dietary options, such as plant-based or organic snacks. The expansion into under-served geographical markets, particularly in developing economies with a burgeoning middle class, presents significant untapped potential. Leveraging data analytics to offer hyper-personalized subscription experiences, moving beyond broad categories to highly specific taste profiles, is another key opportunity for brands like TokyoTreat and Bokksu. Furthermore, strategic partnerships with food bloggers, lifestyle influencers, and even physical retailers for pop-up experiences can broaden market reach. The integration of eco-friendly and sustainable packaging solutions is also becoming an increasingly important differentiator, appealing to environmentally conscious consumers.

Leading Players in the Snack & Candy Subscription Boxes Market

- Mashi Box

- Korea Box

- IndiFix

- Unha’s Asian Snack Box

- Seoulbox

- Shogun Candy

- My Ramen Box

- KitKat Japan

- Japan Creat

- TokyoTreat

- Glico

- Japan Crate

- Japan Candy Box

- Kawaii Box

- Manga Spice Café

- Snakku

- Freedom Japanese Market

- Kizuna Box

- Bokksu

- MunchPak

- YumeTwins

- ZenPop

- NihonBox

- Tokyo Okashi Box

- Sakuraco

- Japan Centre

- WowBox

- Sushi Candy

- Candy Japan

Key Developments in Snack & Candy Subscription Boxes Industry

- 2023: Bokksu announces a strategic partnership with a leading Japanese confectionery manufacturer to exclusively source a new line of seasonal matcha-flavored snacks.

- 2023: TokyoTreat expands its product offerings to include a dedicated "Vegan & Allergy-Friendly" box, addressing growing consumer demand for specialized dietary options.

- 2022: Japan Crate acquires a smaller competitor, Manga Spice Café, to broaden its reach into the anime and manga merchandise-snack crossover market.

- 2022: Glico launches a new global e-commerce platform, allowing direct purchase of popular Pocky flavors and other confections, impacting the sourcing strategies of subscription boxes.

- 2021: Seoulbox introduces an AI-powered personalization engine, enabling subscribers to fine-tune their monthly box contents based on extensive taste profiles.

- 2021: KitKat Japan announces a limited-edition release of regional flavors only available through select international subscription services, driving significant demand.

- 2020: The COVID-19 pandemic accelerates the adoption of home delivery and subscription services, boosting market penetration for companies like MunchPak and WowBox.

Strategic Outlook for Snack & Candy Subscription Boxes Market

The strategic outlook for the Snack & Candy Subscription Boxes market remains overwhelmingly positive, driven by continued global interest in culinary exploration and the inherent convenience of subscription models. Future growth catalysts will include further personalization through AI and data analytics, enabling hyper-tailored customer experiences. Expansion into emerging markets with rising disposable incomes and a growing appetite for international products presents a significant opportunity for players like Korea Box and IndiFix. Strategic alliances with key international food producers will be crucial for securing unique and exclusive product offerings, a core competitive advantage for companies like Bokksu and TokyoTreat. Emphasis on sustainable practices, from sourcing to packaging, will also become increasingly important for brand loyalty and market differentiation. The market's ability to adapt to evolving consumer preferences for healthier, ethically sourced, and diverse snack options will be key to sustained success.

Snack & Candy Subscription Boxes Segmentation

-

1. Application

- 1.1. Enterprise

- 1.2. Personal

-

2. Types

- 2.1. Sweets

- 2.2. Snacks

- 2.3. Others

Snack & Candy Subscription Boxes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Snack & Candy Subscription Boxes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Snack & Candy Subscription Boxes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise

- 5.1.2. Personal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sweets

- 5.2.2. Snacks

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Snack & Candy Subscription Boxes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Enterprise

- 6.1.2. Personal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sweets

- 6.2.2. Snacks

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Snack & Candy Subscription Boxes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Enterprise

- 7.1.2. Personal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sweets

- 7.2.2. Snacks

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Snack & Candy Subscription Boxes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Enterprise

- 8.1.2. Personal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sweets

- 8.2.2. Snacks

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Snack & Candy Subscription Boxes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Enterprise

- 9.1.2. Personal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sweets

- 9.2.2. Snacks

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Snack & Candy Subscription Boxes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Enterprise

- 10.1.2. Personal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sweets

- 10.2.2. Snacks

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mashi Box

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Korea Box

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IndiFix

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unha’s Asian Snack Box

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seoulbox

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shogun Candy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 My Ramen Box

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KitKat Japan

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Japan Creat

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TokyoTreat

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Glico

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Japan Crate

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Japan Candy Box

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kawaii Box

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Manga Spice Café

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Snakku

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Freedom Japanese Market

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Kizuna Box

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Bokksu

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 MunchPak

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Tokyo Treat

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 YumeTwins

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 ZenPop

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 NihonBox

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Tokyo Okashi Box

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Sakuraco

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Japan Centre

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 WowBox

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Sushi Candy

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Candy Japan

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 Mashi Box

List of Figures

- Figure 1: Global Snack & Candy Subscription Boxes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Snack & Candy Subscription Boxes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Snack & Candy Subscription Boxes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Snack & Candy Subscription Boxes Revenue (million), by Types 2024 & 2032

- Figure 5: North America Snack & Candy Subscription Boxes Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Snack & Candy Subscription Boxes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Snack & Candy Subscription Boxes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Snack & Candy Subscription Boxes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Snack & Candy Subscription Boxes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Snack & Candy Subscription Boxes Revenue (million), by Types 2024 & 2032

- Figure 11: South America Snack & Candy Subscription Boxes Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Snack & Candy Subscription Boxes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Snack & Candy Subscription Boxes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Snack & Candy Subscription Boxes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Snack & Candy Subscription Boxes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Snack & Candy Subscription Boxes Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Snack & Candy Subscription Boxes Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Snack & Candy Subscription Boxes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Snack & Candy Subscription Boxes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Snack & Candy Subscription Boxes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Snack & Candy Subscription Boxes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Snack & Candy Subscription Boxes Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Snack & Candy Subscription Boxes Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Snack & Candy Subscription Boxes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Snack & Candy Subscription Boxes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Snack & Candy Subscription Boxes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Snack & Candy Subscription Boxes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Snack & Candy Subscription Boxes Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Snack & Candy Subscription Boxes Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Snack & Candy Subscription Boxes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Snack & Candy Subscription Boxes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Snack & Candy Subscription Boxes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Snack & Candy Subscription Boxes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Snack & Candy Subscription Boxes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Snack & Candy Subscription Boxes?

Key companies in the market include Mashi Box, Korea Box, IndiFix, Unha’s Asian Snack Box, Seoulbox, Shogun Candy, My Ramen Box, KitKat Japan, Japan Creat, TokyoTreat, Glico, Japan Crate, Japan Candy Box, Kawaii Box, Manga Spice Café, Snakku, Freedom Japanese Market, Kizuna Box, Bokksu, MunchPak, Tokyo Treat, YumeTwins, ZenPop, NihonBox, Tokyo Okashi Box, Sakuraco, Japan Centre, WowBox, Sushi Candy, Candy Japan.

3. What are the main segments of the Snack & Candy Subscription Boxes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Snack & Candy Subscription Boxes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Snack & Candy Subscription Boxes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Snack & Candy Subscription Boxes?

To stay informed about further developments, trends, and reports in the Snack & Candy Subscription Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence