Key Insights

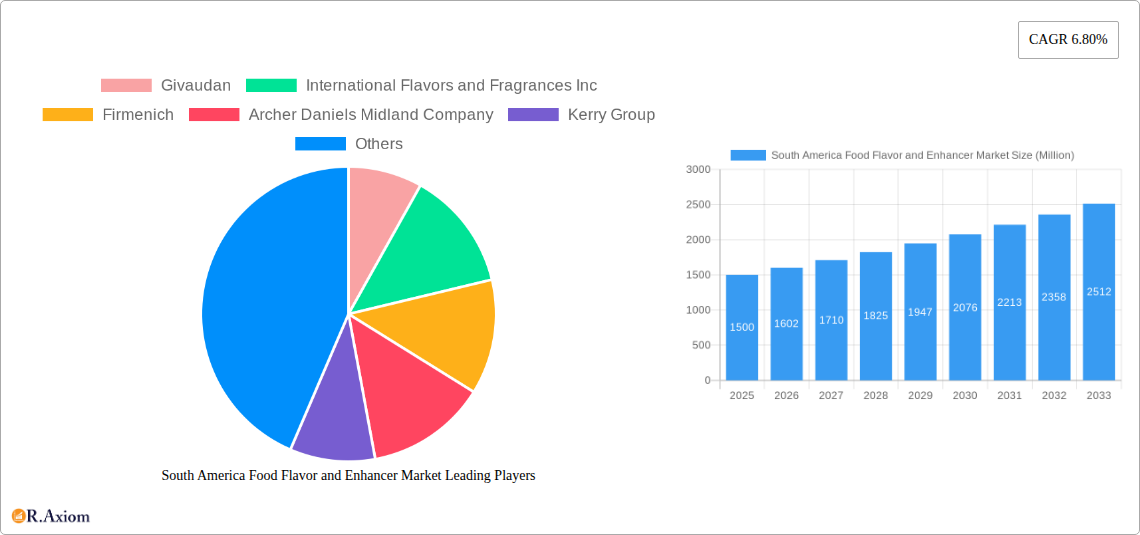

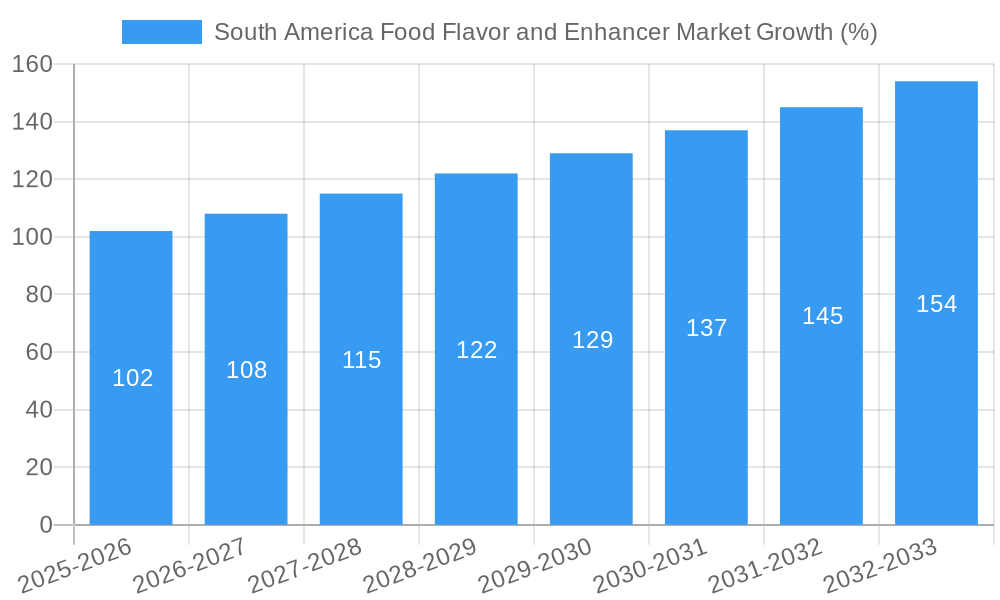

The South American food flavor and enhancer market is experiencing robust growth, projected to reach a significant value by 2033. Driven by increasing consumer demand for processed and convenient foods, coupled with a burgeoning food and beverage industry in the region, this market is poised for continued expansion. The preference for diverse flavor profiles and the rising disposable incomes within key South American countries like Brazil and Argentina are major contributing factors. The market is segmented by type (natural and nature-identical flavors) and application (bakery, confectionery, dairy, beverages, processed foods, and others), with a significant portion of demand stemming from the bakery and confectionery sectors. Key players like Givaudan, IFF, Firmenich, and ADM are actively competing within this dynamic market, continuously innovating to cater to evolving consumer preferences and expanding their product portfolios to capture market share. The growing adoption of clean-label products and the increasing focus on health and wellness are also impacting market trends, prompting manufacturers to explore natural flavor options and reduce reliance on artificial additives. While supply chain challenges and fluctuating raw material prices may pose some constraints, the overall outlook for the South American food flavor and enhancer market remains positive, indicating a substantial opportunity for growth and investment in the coming years.

The forecast period of 2025-2033 showcases a promising trajectory for the South American food flavor and enhancer market. Brazil and Argentina, as the largest economies in the region, represent significant consumption hubs, fueling market expansion. However, other South American countries also exhibit growth potential, suggesting a wider market reach. The CAGR of 6.80% indicates a steady and consistent growth rate, aligning with global trends in the food processing industry. The market’s segmentation reflects a clear understanding of consumer needs and product preferences, allowing companies to tailor their offerings effectively. The presence of major global players reinforces the market's attractiveness and indicates a competitive landscape where innovation and quality are paramount. Understanding consumer preferences and market trends will be critical for companies seeking to establish a strong presence within this growing South American market.

South America Food Flavor and Enhancer Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Food Flavor and Enhancer Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and forecasts extending to 2033. This report leverages extensive primary and secondary research to deliver actionable intelligence on market size, segmentation, growth drivers, challenges, and emerging opportunities. Key players such as Givaudan, International Flavors and Fragrances Inc, Firmenich, Archer Daniels Midland Company, Kerry Group, Symrise AG, Corbion NV, and Takasago International Corporation are profiled, providing a competitive landscape analysis. The report is structured to deliver concise, impactful information for efficient strategic planning.

South America Food Flavor and Enhancer Market Market Concentration & Innovation

The South American food flavor and enhancer market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Givaudan, International Flavors & Fragrances (IFF), and Firmenich, for example, collectively account for an estimated xx% of the market in 2025. However, regional players and smaller specialized companies also contribute significantly, particularly in niche segments.

Innovation is a key driver, fueled by consumer demand for healthier, more natural, and diverse flavor profiles. This is reflected in the increasing adoption of natural and nature-identical flavors, as well as the development of customized flavor solutions tailored to regional palates. Regulatory frameworks, such as those concerning food additives and labeling, significantly impact market dynamics. The prevalence of stringent regulations pushes companies towards developing cleaner label ingredients. Product substitutes, such as herbs and spices, pose a competitive challenge, yet the convenience and consistency of commercial flavor enhancers maintain a robust market demand. M&A activity in the sector has been moderate, with deal values averaging approximately xx Million in recent years, driven primarily by companies seeking to expand their product portfolios and geographical reach. End-user trends, such as the rising popularity of processed foods and convenient meal solutions, propel market growth.

South America Food Flavor and Enhancer Market Industry Trends & Insights

The South American food flavor and enhancer market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: rising disposable incomes, increasing urbanization, changing consumer preferences towards convenient and ready-to-eat foods, and the expansion of the food processing and beverage industries. Technological advancements, particularly in flavor creation and delivery systems, are enhancing the quality and functionality of flavor enhancers. Consumer preferences are shifting towards cleaner labels, healthier ingredients, and unique flavor experiences, driving demand for natural and organic flavors. Competitive dynamics are shaped by both global and regional players vying for market share. Market penetration of nature-identical flavors is gradually increasing, while flavors continue to dominate the market with an estimated xx% market share in 2025. The increasing demand for ethnic flavors within South America is pushing the industry to develop products that meet diverse consumer preferences.

Dominant Markets & Segments in South America Food Flavor and Enhancer Market

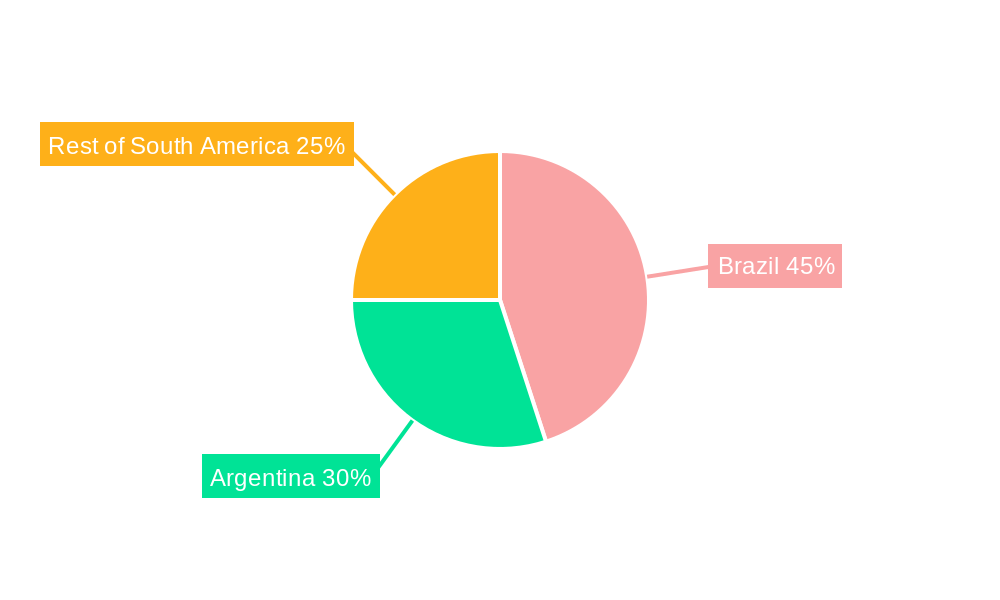

Leading Region/Country: Brazil holds the largest market share within South America, due to its large population, significant food processing industry, and robust economic growth. Other significant markets include Argentina, Mexico and Colombia.

Dominant Segments:

- By Type: Flavors currently hold the dominant position in the market, driven by their widespread application across diverse food categories. However, nature-identical flavors are witnessing strong growth due to increasing demand for "natural" ingredients.

- By Application: The processed food segment represents the largest application area, followed closely by beverages. The bakery and confectionery segments also contribute significantly to market growth, largely due to strong consumption patterns in the region. Dairy applications show moderate growth potential, while other applications comprise niche segments such as pet food and pharmaceuticals.

Key Drivers for Dominance:

- Brazil: Strong economic growth, high consumption of processed foods and beverages, and well-established food processing infrastructure.

- Argentina: Relatively high per capita income and established food and beverage industry.

- Mexico & Colombia: Growing middle class and shifting consumer preferences towards convenient foods.

South America Food Flavor and Enhancer Market Product Developments

Recent product innovations focus on clean label ingredients, natural and nature-identical flavors, and customized flavor solutions tailored to specific regional preferences. Companies are leveraging advanced technologies such as fermentation and enzymatic processes to develop sustainable and high-quality flavors. These developments reflect a growing consumer focus on health and wellness, which creates a strong market fit for clean and natural products. Furthermore, there's an increasing focus on flavors designed to enhance taste without masking the natural flavors of ingredients.

Report Scope & Segmentation Analysis

This report segments the South America food flavor and enhancer market by Type (Flavors, Nature-Identical Flavors) and Application (Bakery, Confectionery, Dairy, Beverages, Processed Food, Other Applications). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. Flavors are projected to maintain the highest market share across the forecast period, driven by their wide use and versatile applications. Nature-identical flavors are expected to show faster growth than flavors due to increasing consumer preference for clean-label products. Within applications, processed foods are forecast to continue dominating, primarily due to high consumption and the use of flavors for taste enhancement and masking undesirable tastes.

Key Drivers of South America Food Flavor and Enhancer Market Growth

Several factors contribute to the market's growth. The rising disposable incomes in many South American countries fuel increased spending on processed foods and beverages. The expanding food processing and beverage industries create a large market for flavor enhancers. Furthermore, changing lifestyles and a growing preference for convenient foods are key drivers. Finally, the introduction of new technologies in flavor production and application enhances efficiency and quality, driving market expansion.

Challenges in the South America Food Flavor and Enhancer Market Sector

The market faces challenges such as fluctuating raw material prices, which impact the cost of production and profitability. Supply chain disruptions can significantly affect production and distribution. Moreover, stringent regulatory requirements for food additives and labeling impose compliance costs on businesses and could hinder market entry for smaller players. The intensity of competition from established international players represents another significant challenge for regional businesses.

Emerging Opportunities in South America Food Flavor and Enhancer Market

Growing demand for healthy and functional foods creates opportunities for companies to develop and market flavors that cater to this segment. The rising popularity of ethnic cuisines and unique flavor profiles presents opportunities to expand the flavor portfolio and reach new markets. The adoption of sustainable and eco-friendly practices in flavor production offers a competitive advantage and appeals to environmentally conscious consumers.

Leading Players in the South America Food Flavor and Enhancer Market Market

- Givaudan

- International Flavors and Fragrances Inc

- Firmenich

- Archer Daniels Midland Company

- Kerry Group

- Symrise AG

- Corbion NV

- Takasago International Corporation

- *List Not Exhaustive

Key Developments in South America Food Flavor and Enhancer Market Industry

- January 2023: Givaudan launched a new range of natural flavors targeting the growing demand for clean-label products.

- October 2022: IFF acquired a smaller regional flavor company to strengthen its presence in the South American market.

- May 2022: Symrise partnered with a local distributor to increase market reach and penetration.

- (Further developments will be added in the final report)

Strategic Outlook for South America Food Flavor and Enhancer Market Market

The South American food flavor and enhancer market is poised for continued growth, driven by favorable economic trends, evolving consumer preferences, and ongoing innovation in flavor technologies. Companies that focus on sustainability, clean-label ingredients, and customized flavor solutions are expected to gain a competitive edge. Opportunities exist in expanding into niche segments, such as functional foods and beverages, and exploring new flavor profiles to cater to diverse consumer preferences across the region. The future market potential is substantial, with significant scope for expansion and growth in both established and emerging markets across South America.

South America Food Flavor and Enhancer Market Segmentation

-

1. Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Synthetic Flavors

- 1.1.3. Nature Identical Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy

- 2.4. Beverages

- 2.5. Processed Food

- 2.6. Other Applications

-

3. Geography

- 3.1. South America

- 3.2. Brazil

- 3.3. Argentina

- 3.4. Rest of South America

South America Food Flavor and Enhancer Market Segmentation By Geography

- 1. South America

- 2. Brazil

- 3. Argentina

- 4. Rest of South America

South America Food Flavor and Enhancer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Brazil Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Synthetic Flavors

- 5.1.1.3. Nature Identical Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy

- 5.2.4. Beverages

- 5.2.5. Processed Food

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.2. Brazil

- 5.3.3. Argentina

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South America South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flavors

- 6.1.1.1. Natural Flavors

- 6.1.1.2. Synthetic Flavors

- 6.1.1.3. Nature Identical Flavors

- 6.1.2. Flavor Enhancers

- 6.1.1. Flavors

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Confectionery

- 6.2.3. Dairy

- 6.2.4. Beverages

- 6.2.5. Processed Food

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South America

- 6.3.2. Brazil

- 6.3.3. Argentina

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flavors

- 7.1.1.1. Natural Flavors

- 7.1.1.2. Synthetic Flavors

- 7.1.1.3. Nature Identical Flavors

- 7.1.2. Flavor Enhancers

- 7.1.1. Flavors

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Confectionery

- 7.2.3. Dairy

- 7.2.4. Beverages

- 7.2.5. Processed Food

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South America

- 7.3.2. Brazil

- 7.3.3. Argentina

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Argentina South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flavors

- 8.1.1.1. Natural Flavors

- 8.1.1.2. Synthetic Flavors

- 8.1.1.3. Nature Identical Flavors

- 8.1.2. Flavor Enhancers

- 8.1.1. Flavors

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Confectionery

- 8.2.3. Dairy

- 8.2.4. Beverages

- 8.2.5. Processed Food

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South America

- 8.3.2. Brazil

- 8.3.3. Argentina

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flavors

- 9.1.1.1. Natural Flavors

- 9.1.1.2. Synthetic Flavors

- 9.1.1.3. Nature Identical Flavors

- 9.1.2. Flavor Enhancers

- 9.1.1. Flavors

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Confectionery

- 9.2.3. Dairy

- 9.2.4. Beverages

- 9.2.5. Processed Food

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South America

- 9.3.2. Brazil

- 9.3.3. Argentina

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Brazil South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Givaudan

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 International Flavors and Fragrances Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Firmenich

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Archer Daniels Midland Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kerry Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Symrise AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Corbion NV

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Takasago International Corporation*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Givaudan

List of Figures

- Figure 1: South America Food Flavor and Enhancer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Food Flavor and Enhancer Market Share (%) by Company 2024

List of Tables

- Table 1: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Food Flavor and Enhancer Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the South America Food Flavor and Enhancer Market?

Key companies in the market include Givaudan, International Flavors and Fragrances Inc, Firmenich, Archer Daniels Midland Company, Kerry Group, Symrise AG, Corbion NV, Takasago International Corporation*List Not Exhaustive.

3. What are the main segments of the South America Food Flavor and Enhancer Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Brazil Dominates the Market.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Food Flavor and Enhancer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Food Flavor and Enhancer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Food Flavor and Enhancer Market?

To stay informed about further developments, trends, and reports in the South America Food Flavor and Enhancer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence