Key Insights

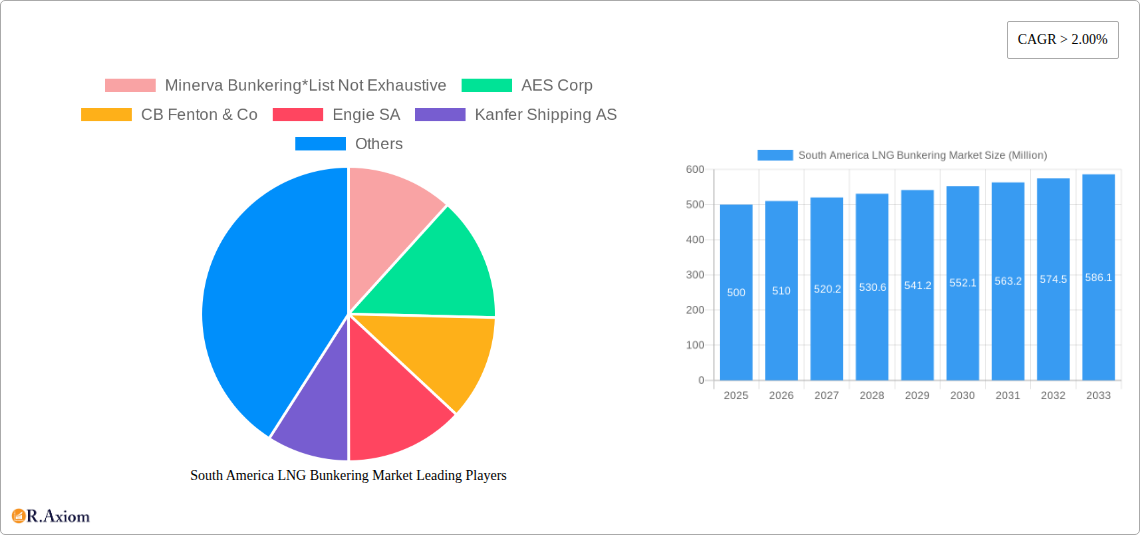

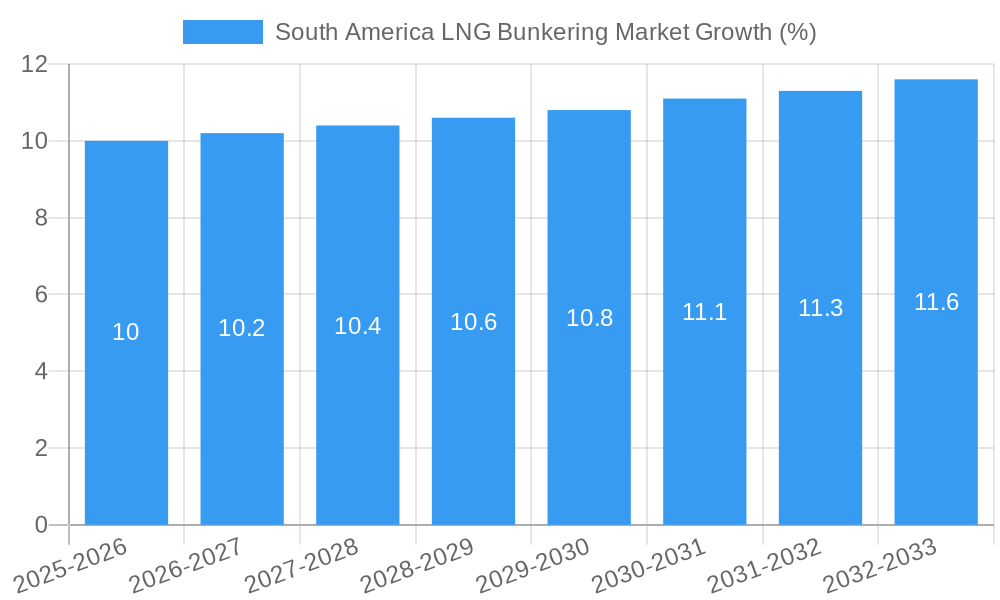

The South American LNG bunkering market, currently valued at approximately $500 million (estimated based on a global market size and regional proportion), is projected to experience robust growth with a CAGR exceeding 2.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing adoption of LNG as a cleaner marine fuel driven by stricter environmental regulations (IMO 2020 and beyond) is a significant driver. Secondly, Brazil and Argentina, the largest economies in South America, are witnessing substantial investments in port infrastructure and the expansion of their LNG import terminals, supporting the growth of bunkering activities. Finally, the growth of regional shipping, particularly in the tanker, container, and bulk cargo sectors, provides a strong demand base for LNG bunkering services. However, challenges remain, including the relatively high initial investment costs associated with LNG bunkering infrastructure and the need for further development of the LNG supply chain to ensure reliable and cost-effective fuel availability.

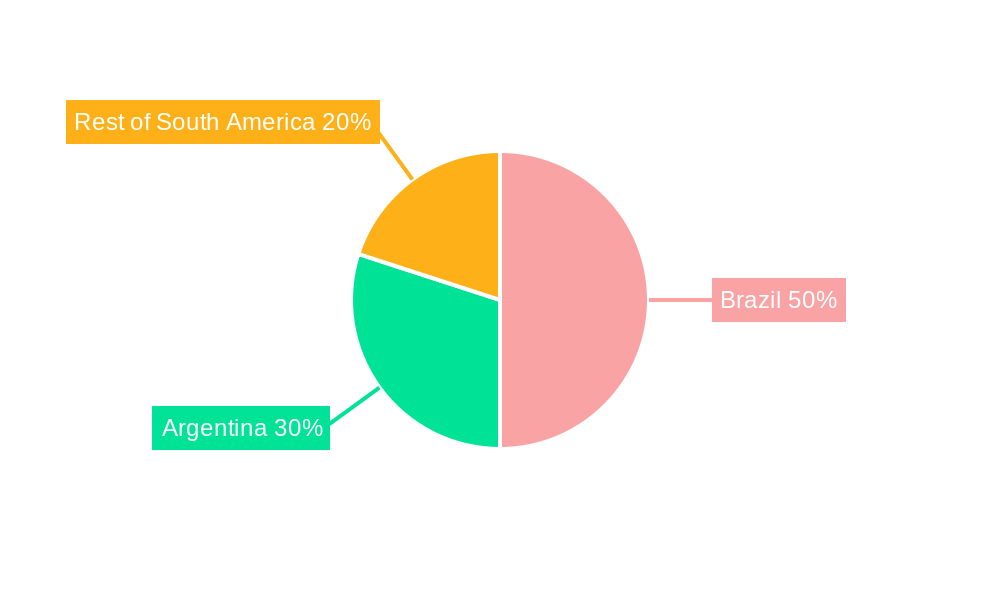

Despite these constraints, the market outlook remains positive. The continued focus on decarbonization within the maritime industry, coupled with supportive government policies promoting cleaner fuels, will propel the adoption of LNG bunkering. Moreover, the emergence of innovative bunkering solutions, such as smaller-scale LNG bunkering vessels and the development of strategic partnerships among key players (Minerva Bunkering, AES Corp, CB Fenton & Co, Engie SA, Kanfer Shipping AS, Avenir LNG Ltd, and others), will further contribute to market growth. The segment breakdown shows substantial demand across all end-user categories – Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV – with significant potential for growth in the "Others" segment as new applications for LNG emerge. The market's focus remains on Brazil and Argentina, with further expansion anticipated in other South American countries as infrastructure develops and LNG becomes more widely accessible.

This in-depth report provides a comprehensive analysis of the South America LNG bunkering market, covering the period 2019-2033. It offers valuable insights into market dynamics, growth drivers, challenges, and opportunities, equipping stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis and industry expertise to provide a clear and concise overview of this rapidly evolving market. The Base Year is 2025, with an Estimated Year of 2025 and a Forecast Period of 2025-2033. The Historical Period covered is 2019-2024.

South America LNG Bunkering Market Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory environment influencing the South American LNG bunkering market. The market concentration is currently considered moderately fragmented, with several key players vying for market share. However, mergers and acquisitions (M&A) activities, while not reaching a fever pitch (xx Million in total deal value for 2019-2024), are indicative of a consolidating trend, particularly in the small-scale LNG bunkering segment. Market share data reveals that a few large players hold significant positions, but smaller companies are showing promising growth, driven primarily by innovative small-scale LNG solutions and strategic partnerships.

- Market Share: Minerva Bunkering holds an estimated xx% market share in 2025, followed by AES Corp with xx% and Engie SA with xx%.

- M&A Activity: The observed M&A activity, while not extensive, demonstrates a clear inclination towards strengthening market positions and expanding geographic reach.

Regulatory frameworks are evolving to support the adoption of LNG as a marine fuel. The emergence of stringent environmental regulations, particularly concerning sulfur emissions, is a key factor driving market growth. However, a lack of uniform standards across countries presents a challenge. Product substitutes, such as methanol and ammonia, are gaining traction, yet LNG currently retains a significant competitive advantage due to its established infrastructure and availability. End-user trends, such as the increasing preference for cleaner fuels by shipping companies, are also pivotal.

South America LNG Bunkering Market Industry Trends & Insights

The South America LNG bunkering market is experiencing robust growth, driven by stringent environmental regulations and the increasing availability of LNG as a fuel source. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of LNG as a marine fuel is currently at xx% in 2025, projected to reach xx% by 2033. This growth trajectory is largely attributed to multiple factors. Stringent environmental regulations mandate a transition from high-sulfur fuels, creating substantial demand for cleaner alternatives. The expansion of LNG infrastructure, including terminals and bunkering facilities, is also boosting market growth. Technological advancements in LNG bunkering technologies, such as the development of smaller-scale LNG carriers and bunkering vessels, are making LNG bunkering more accessible to smaller vessels. Furthermore, increasing consumer preference for environmentally friendly shipping solutions drives market growth. However, the competitive landscape is complex, with several major players competing for market share, leading to price pressures and the need for continuous innovation to remain competitive.

Dominant Markets & Segments in South America LNG Bunkering Market

While the entire South American market shows potential, Brazil and Argentina are currently dominant owing to their substantial shipping activity and existing LNG infrastructure. These countries benefit from favorable economic policies promoting cleaner fuel adoption, and the existing robust infrastructure facilitates efficient LNG bunkering operations.

- Brazil: Strong economic growth, large port infrastructure and higher demand from the Tanker Fleet segment underpin Brazil's leading position.

- Argentina: Significant investments in LNG infrastructure, and government initiatives supporting LNG adoption are key drivers of growth within the Argentina Market.

Within the end-user segments, the Tanker Fleet currently dominates the market, owing to its large vessel size and long voyages, making LNG bunkering economically viable. However, the Container Fleet segment is poised for significant growth, given the rising volume of container shipping and environmental regulations targeting this sector.

- Tanker Fleet: High fuel consumption, long-distance voyages, and early adoption of LNG fuels drive the segment’s dominance.

- Container Fleet: Increasing container shipping volumes and regulatory pressure are pushing this segment toward LNG adoption.

- Bulk and General Cargo Fleet: This segment's growth is driven by increasing demand for environmentally friendly shipping solutions.

- Ferries and OSV: This sector is exhibiting gradual adoption influenced by specific port regulations and environmental concerns.

- Others: This segment encompasses smaller vessels, where the adoption rate is relatively slower due to the cost barrier of LNG infrastructure.

South America LNG Bunkering Market Product Developments

The South American LNG bunkering market is witnessing significant product innovations focusing on enhancing efficiency and reducing costs. Technological advancements in LNG bunkering technologies include the development of smaller-scale LNG carriers and bunkering vessels, which improve accessibility to smaller ports and vessels. This aligns with a wider market trend towards more efficient and environmentally responsible bunkering solutions, and ultimately contributes to overall market expansion.

Report Scope & Segmentation Analysis

This report segments the South America LNG bunkering market by end-user: Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others. Each segment is analyzed based on its market size, growth rate, and competitive landscape. Growth projections indicate strong expansion across all segments, driven by environmental regulations and increasing accessibility of LNG bunkering services. However, growth rates vary significantly depending on factors such as vessel type, operational profile, and port infrastructure availability. The competitive dynamics within each segment are influenced by factors like vessel size, fuel efficiency, and the capacity to serve various ports.

Key Drivers of South America LNG Bunkering Market Growth

Several key factors propel the growth of the South American LNG bunkering market. Stringent environmental regulations, such as those aimed at reducing sulfur emissions, are incentivizing the adoption of cleaner marine fuels. Government policies supporting the development of LNG infrastructure, including terminals and bunkering facilities, are also crucial. The increasing availability and affordability of LNG are attractive to shipping companies. Furthermore, technological advancements in LNG bunkering technologies and increasing consumer awareness of environmental issues further boost market expansion.

Challenges in the South America LNG Bunkering Market Sector

Despite the significant growth potential, the South American LNG bunkering market faces several challenges. The high initial investment costs associated with LNG bunkering infrastructure can act as a barrier to entry for smaller players. The lack of standardization in regulations across different countries can complicate market expansion. Supply chain issues, including the availability of LNG and the reliable transportation of LNG to bunkering locations, represent further hurdles. Furthermore, the competitive pressure from alternative marine fuels, like methanol, necessitates continuous innovation and investment in cost-effective solutions. These factors collectively can significantly impact the overall market growth rate, potentially causing xx% reduction in annual growth if left unaddressed.

Emerging Opportunities in South America LNG Bunkering Market

The South American LNG bunkering market presents several compelling opportunities. The expansion of LNG infrastructure into smaller ports will significantly improve accessibility for a wider range of vessels. The development of innovative LNG bunkering technologies, including the use of smaller-scale LNG carriers and the implementation of efficient bunkering systems, enhances operational efficiency. Growing demand for cleaner fuels, combined with supportive government policies across the continent, offer significant growth potential. Furthermore, the integration of LNG bunkering into wider port and energy logistics strategies could create substantial market opportunities.

Leading Players in the South America LNG Bunkering Market Market

- Minerva Bunkering

- AES Corp

- CB Fenton & Co

- Engie SA

- Kanfer Shipping AS

- Avenir LNG Ltd

Key Developments in South America LNG Bunkering Market Industry

- December 2022: CB Fenton and Kanfer Shipping signed an MOU to establish an LNG bunkering hub in Panama, signaling a significant expansion in small-scale LNG distribution infrastructure. This development is projected to increase market activity by xx% in the Panama region within the next 3 years.

- September 2022: YPF and Petronas signed a JSDA for an integrated LNG project in Argentina, potentially boosting domestic LNG supply and consequently, the bunkering market. This is expected to stimulate market growth by xx% in Argentina over the next 5 years.

Strategic Outlook for South America LNG Bunkering Market Market

The South American LNG bunkering market is poised for sustained growth driven by environmental regulations, increasing LNG availability, and continuous technological innovation. The expansion of LNG infrastructure, particularly in smaller ports, will improve accessibility for a wider range of vessels, driving market expansion. The development of innovative LNG bunkering technologies and strategic partnerships among key players will enhance operational efficiency and market competitiveness, ensuring a positive outlook for the future. The market's growth will continue to be significantly influenced by the implementation of new environmental regulations and the availability of affordable LNG. The projected market size by 2033 is estimated at xx Million.

South America LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

-

2. Geography

-

2.1. South America

- 2.1.1. Brazil

- 2.1.2. Argentina

- 2.1.3. Rest of South America

-

2.1. South America

South America LNG Bunkering Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries

- 3.3. Market Restrains

- 3.3.1. 4.; The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned

- 3.4. Market Trends

- 3.4.1. Increase in Maritime Activities is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. South America

- 5.2.1.1. Brazil

- 5.2.1.2. Argentina

- 5.2.1.3. Rest of South America

- 5.2.1. South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Brazil South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Minerva Bunkering*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 AES Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CB Fenton & Co

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Engie SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kanfer Shipping AS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Avenir LNG Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Minerva Bunkering*List Not Exhaustive

List of Figures

- Figure 1: South America LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: South America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: South America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: South America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America LNG Bunkering Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the South America LNG Bunkering Market?

Key companies in the market include Minerva Bunkering*List Not Exhaustive, AES Corp, CB Fenton & Co, Engie SA, Kanfer Shipping AS, Avenir LNG Ltd.

3. What are the main segments of the South America LNG Bunkering Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries.

6. What are the notable trends driving market growth?

Increase in Maritime Activities is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned.

8. Can you provide examples of recent developments in the market?

In December 2022, CB Fenton, part of Ultramar (Chile), and Norwegian small-scale LNG sea transport and bunkering vessels developer Kanfer Shipping signed a Memorandum of Understanding to establish a hub for LNG bunkering and small-scale LNG distribution in/out of Panama.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the South America LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence