Key Insights

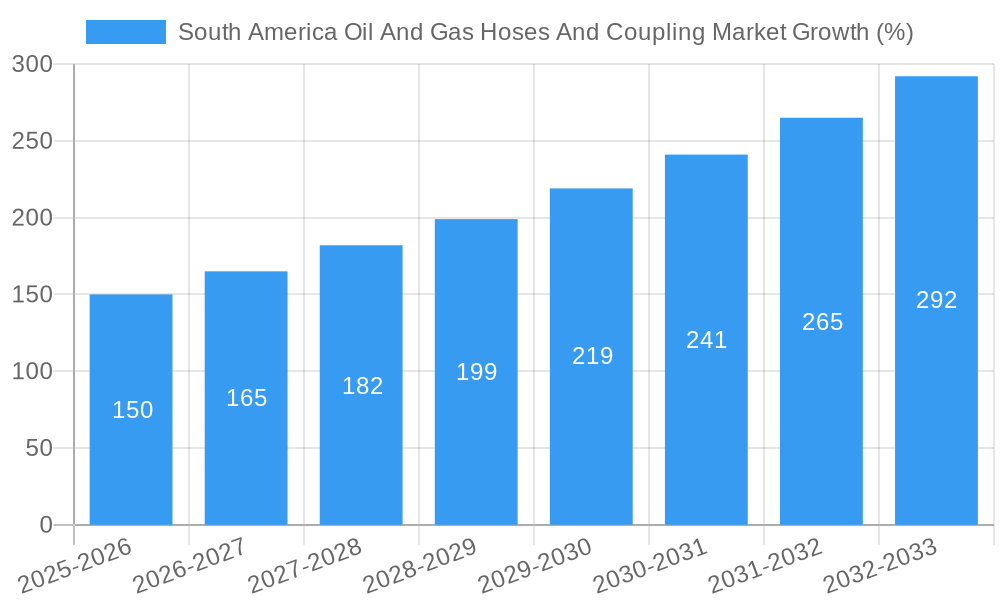

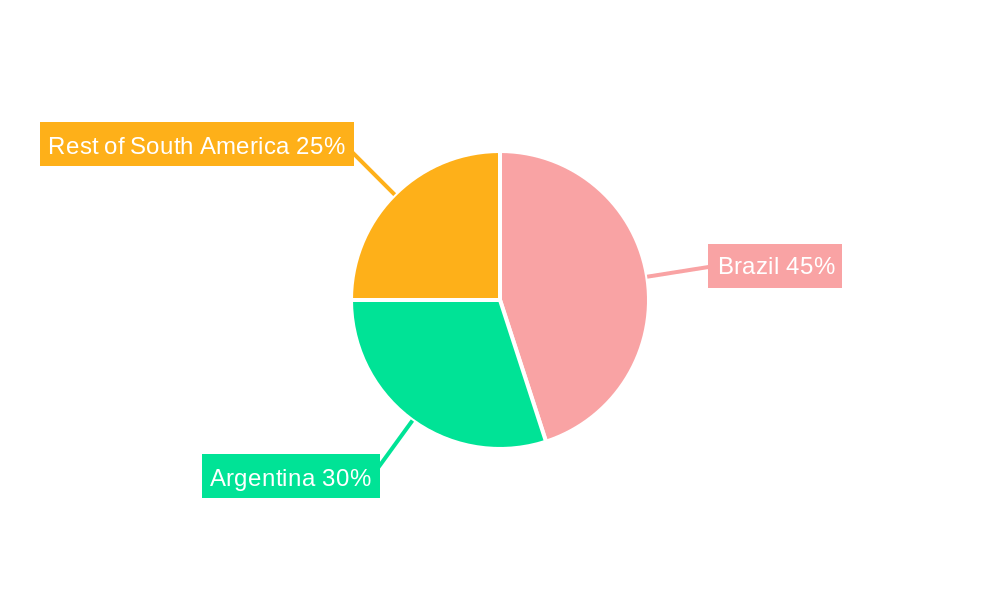

The South American oil and gas hoses and coupling market is experiencing robust growth, driven by increasing upstream activities, expanding midstream infrastructure development, and a growing downstream refining and petrochemical sector. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019 to 2024 indicates significant expansion, projected to continue through 2033. Key drivers include rising oil and gas production in countries like Brazil and Argentina, coupled with substantial investments in pipeline networks and refinery upgrades. Furthermore, stringent safety regulations and the need for reliable equipment are fostering demand for high-quality hoses and couplings. While challenges such as fluctuating oil prices and economic volatility in some regions exist, the overall market outlook remains positive. The market segmentation reveals significant opportunities within the upstream sector, driven by exploration and production activities, and the downstream sector, fueled by processing and distribution needs. Leading players like Trelleborg AB, ParkerHannifin Corporation, and Continental AG are actively competing through product innovation, strategic partnerships, and expansion into promising regional markets. The market's growth is particularly prominent in Brazil and Argentina, which are expected to remain leading consumers of oil and gas hoses and couplings in South America due to significant resource reserves and infrastructure development.

The growth trajectory is underpinned by governmental initiatives promoting energy independence and infrastructure modernization. The competitive landscape is dynamic, with both global and regional players vying for market share. Companies are increasingly focusing on providing specialized solutions tailored to the unique needs of the oil and gas industry, including enhanced durability, corrosion resistance, and improved safety features. Technological advancements in materials science and manufacturing techniques are further driving market growth by enabling the development of more efficient and reliable products. While the market faces economic headwinds and potential supply chain disruptions, the long-term growth prospects remain strong due to the continued demand for oil and gas across South America. Strategic partnerships, technological innovation, and localized manufacturing will likely play a significant role in shaping future market dynamics.

South America Oil And Gas Hoses and Coupling Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the South America Oil and Gas Hoses and Coupling market, covering the period from 2019 to 2033. It offers actionable insights into market trends, competitive dynamics, and growth opportunities, enabling stakeholders to make informed strategic decisions. The report incorporates extensive data and analysis, including market sizing, segmentation, and key player profiles. The base year for this report is 2025, with estimates for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

South America Oil And Gas Hoses and Coupling Market Concentration & Innovation

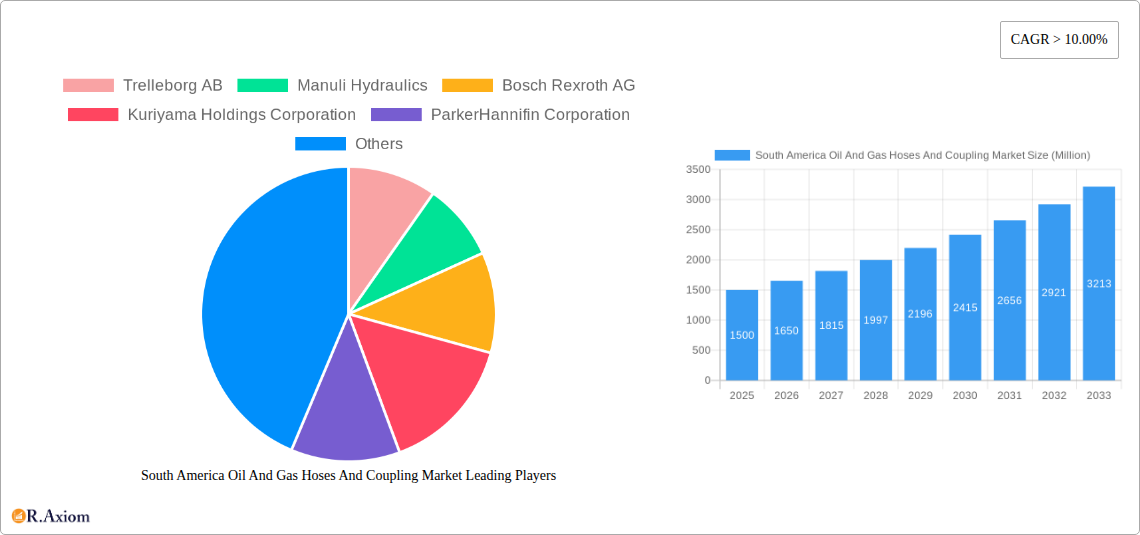

This section analyzes the market concentration, examining the market share of key players such as Trelleborg AB, Manuli Hydraulics, Bosch Rexroth AG, Kuriyama Holdings Corporation, ParkerHannifin Corporation, Continental AG, W W Grainger Inc, Gates Corporation, Jason Industrial Inc, Eaton Corporation Plc (list not exhaustive). We assess the level of competition, identify potential mergers and acquisitions (M&A) activities, and quantify their impact on the market structure. The report also explores innovation drivers, including advancements in material science, coupling designs, and hose technology. Regulatory frameworks influencing product development and safety standards are also examined, alongside analysis of product substitutes and their impact on market share. End-user trends, such as the increasing demand for high-performance hoses in harsh environments, are explored, alongside a detailed examination of M&A activities, including deal values and their influence on market consolidation. We estimate that the total M&A deal value in the period 2019-2024 was approximately xx Million, with a projected value of xx Million for 2025-2033. Market share data for key players is provided, illustrating the competitive landscape and potential for future market consolidation.

South America Oil And Gas Hoses and Coupling Market Industry Trends & Insights

This section delves into the key trends shaping the South America Oil and Gas Hoses and Coupling market. We analyze market growth drivers, including the expansion of oil and gas exploration and production activities across the region, particularly in Brazil and Colombia. Technological disruptions, such as the adoption of advanced materials and smart technologies for hose management and monitoring, are thoroughly examined. The report assesses consumer preferences, focusing on the demand for enhanced durability, reliability, and safety features. Competitive dynamics are scrutinized, analyzing strategies employed by leading players to gain market share, including product differentiation, strategic partnerships, and geographic expansion. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The analysis considers factors such as fluctuating oil prices, government regulations, and infrastructure development in shaping market growth.

Dominant Markets & Segments in South America Oil And Gas Hoses and Coupling Market

This section identifies the dominant regions, countries, and application segments within the South America Oil and Gas Hoses and Coupling market. Brazil is expected to remain the dominant market due to its significant oil and gas reserves and ongoing investments in infrastructure development. Colombia is identified as another key market owing to its expanding hydrocarbon sector.

- Upstream Segment Dominance: This segment is projected to hold the largest market share due to the high demand for hoses and couplings in exploration, drilling, and production activities.

- Key Drivers: Significant investments in upstream projects, expansion of offshore drilling activities, and increasing demand for robust and reliable equipment in challenging environments.

- Midstream Segment Growth: Steady growth is projected in the midstream segment, driven by the need for efficient transportation and storage of oil and gas.

- Key Drivers: Expansion of pipeline networks, increased capacity utilization of existing infrastructure, and implementation of advanced pipeline monitoring systems.

- Downstream Segment Potential: The downstream segment shows potential for growth, driven by increasing refining capacity and petrochemical production.

- Key Drivers: Growing domestic demand for refined petroleum products, expanding petrochemical industry, and government initiatives to promote downstream sector development.

The report provides a detailed analysis of each segment's growth trajectory, identifying market size and competitive dynamics.

South America Oil And Gas Hoses and Coupling Market Product Developments

Recent product innovations focus on improving hose durability, flexibility, and resistance to harsh environmental conditions. This includes the adoption of advanced materials, such as high-performance polymers and specialized alloys, and the integration of smart sensors for real-time monitoring and leak detection. These innovations offer significant competitive advantages, enhancing product lifecycle and reducing operational downtime. The market trend is towards lightweight, yet robust, designs which reduce transportation and handling costs, enhancing overall efficiency.

Report Scope & Segmentation Analysis

This report segments the South America Oil and Gas Hoses and Coupling market by application: Upstream, Midstream, and Downstream.

Upstream: This segment encompasses hoses and couplings used in exploration, drilling, and production operations. Growth is projected to be driven by increasing offshore activities and investments in deep-water drilling technologies. Market size is estimated at xx Million in 2025, and xx Million in 2033. Competition is intense with major players striving for technological differentiation.

Midstream: This segment covers hoses and couplings used in pipelines and storage facilities. Steady growth is expected, driven by the expansion of pipeline networks and increased capacity utilization. Market size is estimated at xx Million in 2025 and xx Million in 2033. Competitive dynamics are characterized by a focus on efficiency, safety, and reliability.

Downstream: This segment focuses on hoses and couplings used in refineries and petrochemical plants. Growth will be driven by increased refining capacity and expansion of the petrochemical industry. Market size is estimated at xx Million in 2025 and xx Million in 2033. Competitive pressure is moderate with a focus on specialized applications.

Key Drivers of South America Oil And Gas Hoses and Coupling Market Growth

The South America Oil and Gas Hoses and Coupling market's growth is driven by several factors: the expansion of oil and gas exploration and production activities; growing investments in infrastructure development, including pipelines and refineries; increasing demand for advanced hose and coupling technologies offering improved safety and efficiency; and supportive government policies aimed at promoting the development of the oil and gas sector. Furthermore, the increasing adoption of smart technologies for hose management is a significant driver.

Challenges in the South America Oil And Gas Hoses and Coupling Market Sector

The South America Oil and Gas Hoses and Coupling market faces challenges such as fluctuating oil prices, impacting investment decisions and demand. Supply chain disruptions can lead to material shortages and increased production costs. Stricter environmental regulations and safety standards increase the cost of compliance. Intense competition among established players and new entrants presents a significant challenge. Finally, economic instability and political uncertainties in some regions hinder growth.

Emerging Opportunities in South America Oil And Gas Hoses and Coupling Market

Emerging opportunities include the growing demand for high-performance hoses capable of withstanding extreme pressures and temperatures. The adoption of lighter, more flexible materials is another area of opportunity. The increasing focus on sustainability and environmental responsibility opens doors for eco-friendly hose and coupling solutions. Furthermore, expansion into new markets in less-developed regions presents significant opportunities for growth.

Leading Players in the South America Oil And Gas Hoses and Coupling Market Market

- Trelleborg AB

- Manuli Hydraulics

- Bosch Rexroth AG

- Kuriyama Holdings Corporation

- ParkerHannifin Corporation

- Continental AG

- W W Grainger Inc

- Gates Corporation

- Jason Industrial Inc

- Eaton Corporation Plc

Key Developments in South America Oil and Gas Hoses and Coupling Industry

- September 2022: Enauta, a Brazilian oil and gas company, experienced a production interruption at the Atlanta field due to a hose problem, highlighting the critical role of reliable hoses and couplings in maintaining operational efficiency.

Strategic Outlook for South America Oil And Gas Hoses and Coupling Market Market

The South America Oil and Gas Hoses and Coupling market is poised for continued growth, driven by increasing oil and gas exploration and production activities and the ongoing expansion of downstream infrastructure. Technological advancements, coupled with a focus on safety and efficiency, will shape market evolution. Companies that invest in innovation and adapt to changing regulatory landscapes will be best positioned for success. The market presents significant opportunities for both established players and new entrants, focusing on niche applications and emerging technologies.

South America Oil And Gas Hoses And Coupling Market Segmentation

-

1. Application

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Oil And Gas Hoses And Coupling Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Oil And Gas Hoses And Coupling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Midstream is Expected to Become a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Brazil South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Argentina South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Colombia South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of South America South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Brazil South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Trelleborg AB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Manuli Hydraulics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bosch Rexroth AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Kuriyama Holdings Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ParkerHannifin Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Continental AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 W W Grainger Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gates Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Jason Industrial Inc *List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Eaton Corporation Plc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Trelleborg AB

List of Figures

- Figure 1: South America Oil And Gas Hoses And Coupling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Oil And Gas Hoses And Coupling Market Share (%) by Company 2024

List of Tables

- Table 1: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 7: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Oil And Gas Hoses And Coupling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Oil And Gas Hoses And Coupling Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Oil And Gas Hoses And Coupling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Oil And Gas Hoses And Coupling Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Oil And Gas Hoses And Coupling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Oil And Gas Hoses And Coupling Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 19: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 21: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 23: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 31: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 37: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Oil And Gas Hoses And Coupling Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the South America Oil And Gas Hoses And Coupling Market?

Key companies in the market include Trelleborg AB, Manuli Hydraulics, Bosch Rexroth AG, Kuriyama Holdings Corporation, ParkerHannifin Corporation, Continental AG, W W Grainger Inc, Gates Corporation, Jason Industrial Inc *List Not Exhaustive, Eaton Corporation Plc.

3. What are the main segments of the South America Oil And Gas Hoses And Coupling Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Midstream is Expected to Become a Significant Segment.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2022: Enauta, a Brazilian oil and gas company, resumed production through well 7-ATL-2HP-RJS at the Atlanta field in the Santos Basin offshore Brazil. Enauta resumed output from the field in August following a planned downtime. However, on August 26, it announced that a hose problem had preventively interrupted production in the field.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Oil And Gas Hoses And Coupling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Oil And Gas Hoses And Coupling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Oil And Gas Hoses And Coupling Market?

To stay informed about further developments, trends, and reports in the South America Oil And Gas Hoses And Coupling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence