Key Insights

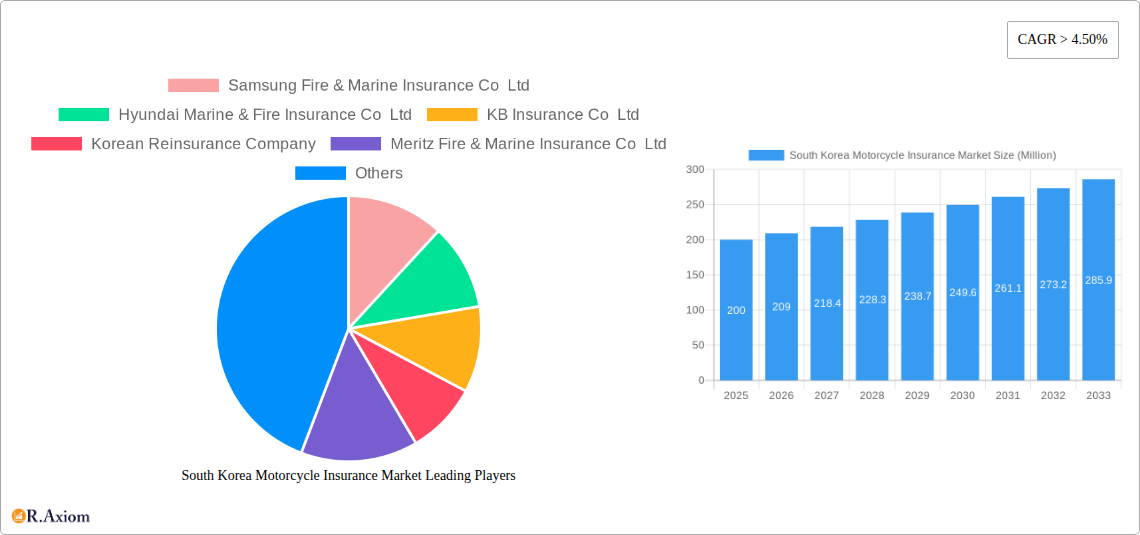

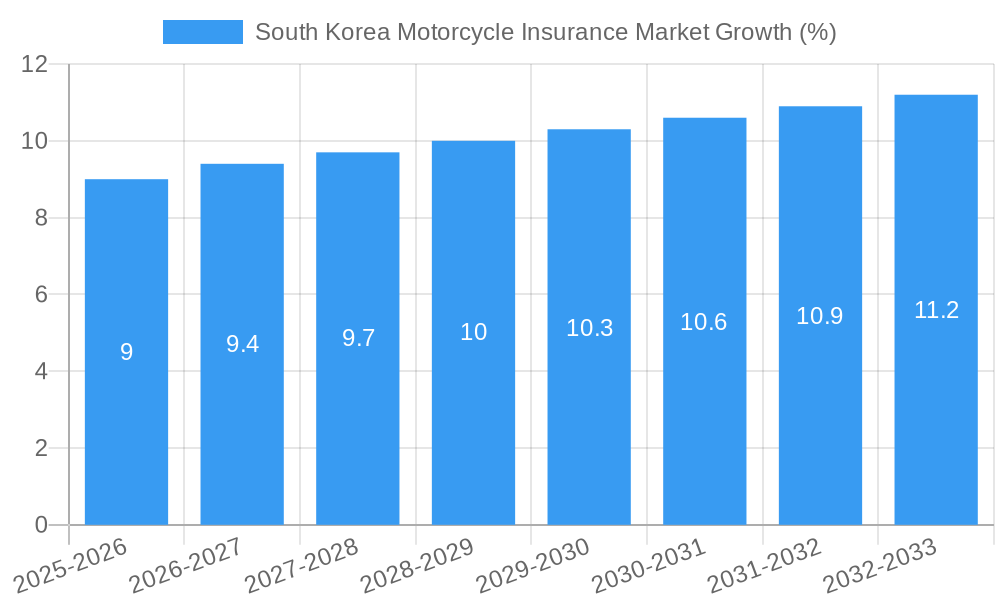

The South Korea motorcycle insurance market exhibits robust growth, driven by a rising number of registered motorcycles and increasing awareness of insurance coverage. The market's Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2019 to 2024 indicates a consistently expanding customer base. This growth is further fueled by government regulations promoting road safety, leading to higher insurance penetration. While precise market size figures for previous years are unavailable, a logical estimation based on the provided CAGR and a projected 2025 market value (assuming a market size of approximately 200 million USD in 2025), points towards a steady increase in market value over the forecast period (2025-2033). This growth trajectory is likely supported by several key factors, including increasing urbanization leading to higher motorcycle usage for commuting, the evolving preferences of younger demographics towards motorcycling, and the introduction of innovative insurance products tailored to specific rider needs.

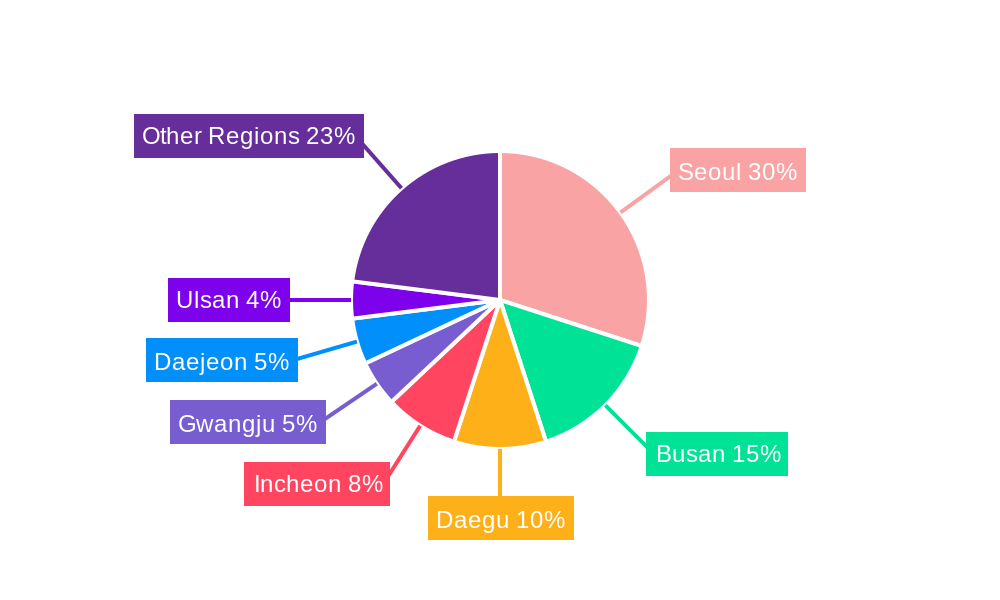

However, challenges remain. Fluctuations in the overall economic climate could influence consumer spending on insurance. Furthermore, the market may face challenges related to the increasing severity of motorcycle accidents and subsequent higher claim payouts. Competitive pressures among major players, such as Samsung Fire & Marine Insurance Co Ltd, Hyundai Marine & Fire Insurance Co Ltd, and KB Insurance Co Ltd, could also influence pricing and market share distribution. To maintain sustainable growth, insurers need to focus on product innovation, customer service improvements, and effective risk management strategies. The segment of riders opting for comprehensive coverage is likely to experience substantial growth, spurred by increasing concerns regarding liability and accident-related expenses. Geographical variations in motorcycle ownership and insurance penetration will likely also shape the market's regional dynamics across South Korea.

South Korea Motorcycle Insurance Market: Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the South Korea motorcycle insurance market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, including insurers, reinsurers, investors, and regulatory bodies. The report leverages extensive data and analysis to forecast market trends, identify key players, and unveil lucrative opportunities. With a focus on market segmentation, competitive dynamics, and regulatory landscapes, this report is an indispensable resource for navigating the complexities of this dynamic market. The report includes a detailed analysis of market concentration, innovation, trends, dominant segments, product developments, and key developments shaping the South Korean motorcycle insurance landscape.

South Korea Motorcycle Insurance Market Concentration & Innovation

This section analyzes the competitive landscape of the South Korea motorcycle insurance market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year.

The market exhibits a moderately concentrated structure, with several major players commanding significant shares. Market share data for key players like Samsung Fire & Marine Insurance Co Ltd, Hyundai Marine & Fire Insurance Co Ltd, KB Insurance Co Ltd, Korean Reinsurance Company, Meritz Fire & Marine Insurance Co Ltd, Lotte Non Life Insurance Co Ltd, DB Insurance Co Ltd, Hanwha General Insurance Co Ltd, AXA General Insurance Co Ltd, and Heungkuk Fire & Marine Insurance Co Ltd (list not exhaustive) will be provided in the full report, along with details on their respective market strategies. The report will further analyze the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market consolidation. Innovation is primarily driven by technological advancements, such as the introduction of telematics-based insurance products and digital distribution channels. The regulatory framework, including government policies and insurance regulations, significantly influences market dynamics. The report assesses the impact of these regulations on market growth and competitive dynamics, including the emergence of new players and the adoption of innovative products. Finally, the report will also explore the impact of product substitutes and end-user trends on market growth and transformation.

South Korea Motorcycle Insurance Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the South Korea motorcycle insurance market. The analysis will encompass market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive overview of the industry’s evolution. The report will provide detailed analysis of the compound annual growth rate (CAGR) and market penetration rates observed throughout the study period (2019-2033). The increasing penetration of motorcycles in South Korea, coupled with rising awareness of insurance benefits, is a crucial growth driver. Furthermore, the report will explore how technological advancements, such as the use of big data analytics and artificial intelligence (AI) in risk assessment and claims processing, are reshaping the industry. Changing consumer preferences, influenced by factors like price sensitivity, demand for customized insurance products, and preference for digital channels, will be analyzed. Lastly, the report will delve into the competitive landscape, focusing on the strategies employed by major players, including pricing strategies, product diversification, and market expansion initiatives. The report will quantify the impact of these factors on market growth and evolution.

Dominant Markets & Segments in South Korea Motorcycle Insurance Market

This section identifies the leading regions, countries, or segments within the South Korea motorcycle insurance market. The analysis will utilize both bullet points to highlight key drivers and detailed paragraphs to elaborate on the dominance analysis. While a specific region or segment dominance is not available, the report will investigate the relative strengths of different market segments, highlighting those poised for significant growth. Key factors influencing segment dominance will be explored. For instance, the report will examine the influence of economic policies, infrastructure development, and demographics on market growth in different regions/segments. The analysis will offer detailed insights into the market share of different segments within the South Korean Motorcycle insurance market. We will examine the factors driving growth in the dominant segments and regions, analyzing the impact of economic conditions, infrastructure development, and government policies on each. The influence of consumer preferences and regulatory frameworks will also be assessed.

South Korea Motorcycle Insurance Market Product Developments

This section summarizes recent product innovations, applications, and competitive advantages within the South Korea motorcycle insurance market. The increasing adoption of telematics technology enables insurers to offer usage-based insurance (UBI) programs, providing more accurate risk assessment and customized premiums. Insurers are also incorporating digital platforms and mobile applications to streamline policy purchase, claims processing, and customer service. These innovations enhance efficiency and improve customer satisfaction. Furthermore, partnerships with technology providers and data analytics companies enable insurers to leverage advanced technologies to better understand customer behavior and optimize insurance offerings. The market is seeing increasing competition in the provision of bundled motorcycle insurance products and tailored insurance solutions to niche motorcycle segments, reflecting evolving customer needs.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation analysis, detailing various market segments based on available information. Further details will be provided in the complete report. Specific segmentation criteria like insurance type (liability, comprehensive, etc.), motorcycle type (scooter, cruiser, etc.), and customer demographics will be examined. Each segment's growth projections, market sizes, and competitive dynamics will be analyzed and presented.

Key Drivers of South Korea Motorcycle Insurance Market Growth

Several factors are driving growth in the South Korea motorcycle insurance market. The increasing number of motorcycles on the road is a significant factor. Furthermore, rising consumer awareness of the importance of motorcycle insurance, combined with stricter enforcement of insurance regulations, fuels market expansion. Economic growth and increased disposable income enable more individuals to purchase motorcycles and associated insurance coverage. Government initiatives aimed at improving road safety and promoting responsible motorcycle use positively impact market growth.

Challenges in the South Korea Motorcycle Insurance Market Sector

The South Korea motorcycle insurance market faces several challenges. Competition among insurers, particularly from new entrants and digital players, creates pricing pressures and requires insurers to innovate. Fluctuating fuel prices and economic uncertainties can impact consumer demand for motorcycle insurance. Regulatory changes and compliance requirements present ongoing challenges for insurers. Furthermore, accurate risk assessment and claims management in the motorcycle insurance segment remain complex, posing operational challenges. Data limitations and the need for effective fraud prevention strategies also present obstacles to market growth.

Emerging Opportunities in South Korea Motorcycle Insurance Market

Several emerging opportunities exist in the South Korea motorcycle insurance market. The growing adoption of telematics and data analytics enables insurers to offer personalized insurance products and risk-based pricing. The expansion of digital distribution channels and online platforms creates opportunities for increased market penetration and improved customer experience. The potential for strategic alliances and partnerships with technology providers and other stakeholders presents growth opportunities. Furthermore, the development of innovative insurance products tailored to specific motorcycle segments (e.g., electric motorcycles) is an area of potential expansion.

Leading Players in the South Korea Motorcycle Insurance Market Market

- Samsung Fire & Marine Insurance Co Ltd

- Hyundai Marine & Fire Insurance Co Ltd

- KB Insurance Co Ltd

- Korean Reinsurance Company

- Meritz Fire & Marine Insurance Co Ltd

- Lotte Non Life Insurance Co Ltd

- DB Insurance Co Ltd

- Hanwha General Insurance Co Ltd

- AXA General Insurance Co Ltd

- Heungkuk Fire & Marine Insurance Co Ltd (List Not Exhaustive)

Key Developments in South Korea Motorcycle Insurance Market Industry

- December 2022: Korean Re entered into a coinsurance agreement with Samsung Life concerning the life insurer's liabilities worth KRW 500 billion on October 28, 2022. This deal showcases Korean Re's competitive advantage in the domestic market.

- May 2022: Carrot General Insurance Corp. signed an MoU with the Korea Transportation Safety Authority (TSA), aiming to improve road safety and traffic management systems. This public-private partnership demonstrates a drive toward technological innovation within the insurance sector.

Strategic Outlook for South Korea Motorcycle Insurance Market Market

The South Korea motorcycle insurance market is poised for continued growth, driven by technological advancements, increasing motorcycle penetration, and evolving consumer preferences. Opportunities exist for insurers to leverage data analytics, telematics, and digital distribution channels to improve efficiency, personalize products, and enhance customer experience. Strategic partnerships and innovations in risk assessment and claims management are crucial for success in this competitive market. The market's future will depend significantly on effective regulation and a responsive approach to technological and consumer-driven changes.

South Korea Motorcycle Insurance Market Segmentation

-

1. Insurance Product

- 1.1. Private Automobile Insurance

- 1.2. Busines Automobile Insurance

- 1.3. Commercial Automobile insurance

- 1.4. Motorcycle Insurance

-

2. Insurance Coverage

- 2.1. Compulsory

- 2.2. Voluntary

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Banks

- 3.4. Other Distribution Channels

South Korea Motorcycle Insurance Market Segmentation By Geography

- 1. South Korea

South Korea Motorcycle Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of EV Vehicles; Growing Digital Platforms

- 3.3. Market Restrains

- 3.3.1. Rise in Adoption of EV Vehicles; Growing Digital Platforms

- 3.4. Market Trends

- 3.4.1. Rises in adoption of electric vehicles is driving the growth of the motor insurance industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Motorcycle Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Product

- 5.1.1. Private Automobile Insurance

- 5.1.2. Busines Automobile Insurance

- 5.1.3. Commercial Automobile insurance

- 5.1.4. Motorcycle Insurance

- 5.2. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.2.1. Compulsory

- 5.2.2. Voluntary

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Banks

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Insurance Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Samsung Fire & Marine Insurance Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Marine & Fire Insurance Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KB Insurance Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korean Reinsurance Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Meritz Fire & Marine Insurance Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lotte Non Life Insurance Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DB Insurance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hanwha General Insurance Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AXA General Insurance Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heungkuk Fire & Marine Insurance Co Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Samsung Fire & Marine Insurance Co Ltd

List of Figures

- Figure 1: South Korea Motorcycle Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Motorcycle Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Product 2019 & 2032

- Table 3: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 4: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Product 2019 & 2032

- Table 7: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 8: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 9: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Motorcycle Insurance Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the South Korea Motorcycle Insurance Market?

Key companies in the market include Samsung Fire & Marine Insurance Co Ltd, Hyundai Marine & Fire Insurance Co Ltd, KB Insurance Co Ltd, Korean Reinsurance Company, Meritz Fire & Marine Insurance Co Ltd, Lotte Non Life Insurance Co Ltd, DB Insurance Co Ltd, Hanwha General Insurance Co Ltd, AXA General Insurance Co Ltd, Heungkuk Fire & Marine Insurance Co Ltd**List Not Exhaustive.

3. What are the main segments of the South Korea Motorcycle Insurance Market?

The market segments include Insurance Product, Insurance Coverage, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of EV Vehicles; Growing Digital Platforms.

6. What are the notable trends driving market growth?

Rises in adoption of electric vehicles is driving the growth of the motor insurance industry.

7. Are there any restraints impacting market growth?

Rise in Adoption of EV Vehicles; Growing Digital Platforms.

8. Can you provide examples of recent developments in the market?

December 2022: Korean Re entered into a coinsurance agreement with Samsung Life concerning the life insurer's liabilities worth KRW 500 billion on October 28, 2022. The agreement came after the two parties discussed and analyzed the merits and effects of the deal for about a year. The recent agreement with Samsung Life marked Korean Re's second coinsurance business following the deal with Shinhan Life in January 2022, which went to prove how much competitive edge we had in the domestic market over other global reinsurers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Motorcycle Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Motorcycle Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Motorcycle Insurance Market?

To stay informed about further developments, trends, and reports in the South Korea Motorcycle Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence