Key Insights

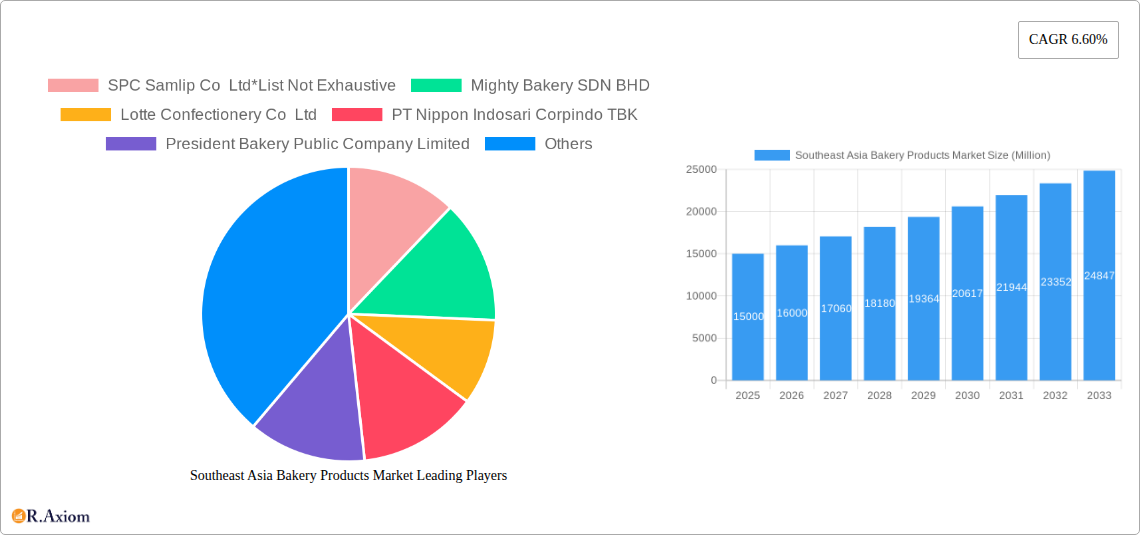

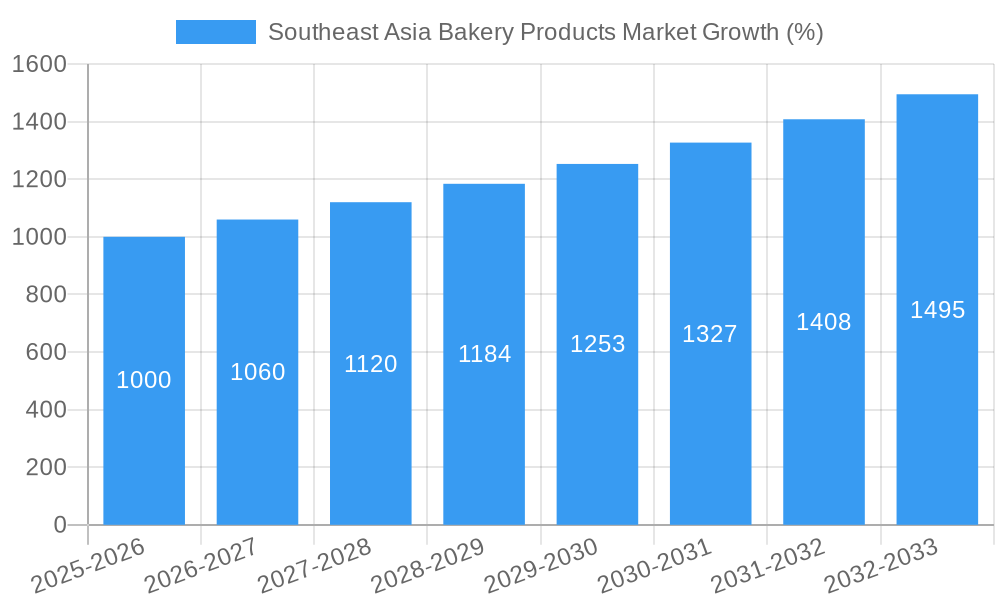

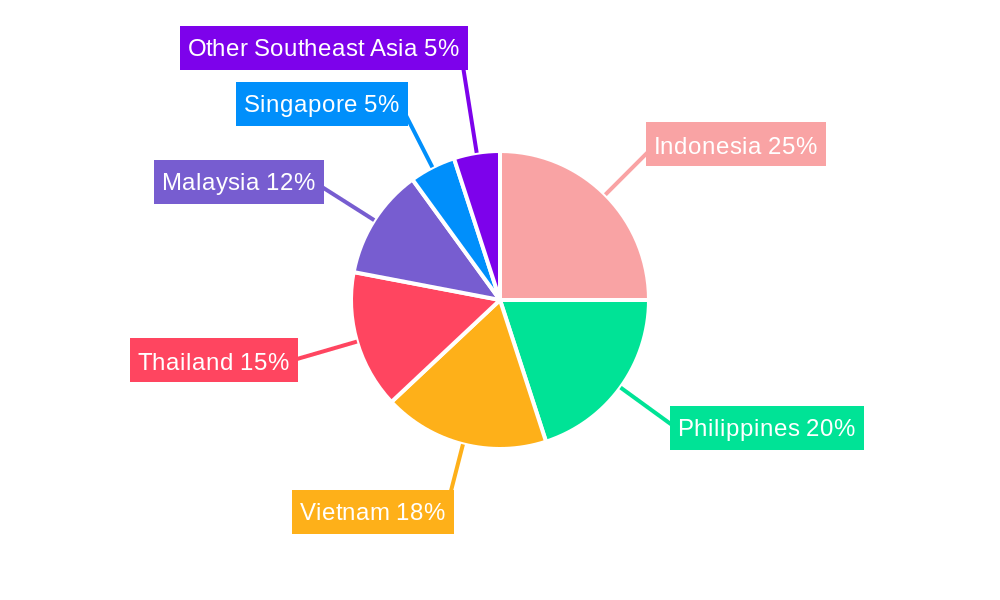

The Southeast Asia bakery products market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for convenient and ready-to-eat foods. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.60% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the burgeoning middle class in Southeast Asia is increasingly seeking premium bakery products, leading to higher spending on bakery items. Secondly, changing lifestyles and busy schedules are boosting the demand for convenient options like pre-packaged breads, pastries, and biscuits. Furthermore, the expansion of modern retail channels, including supermarkets, hypermarkets, and online stores, provides wider access and distribution for bakery products, facilitating market penetration. Significant growth is seen across various product segments, including bread, biscuits (both sweet and savory), cakes, pastries, and morning goods. However, fluctuating raw material prices and intense competition among established players and emerging brands present challenges to sustained market expansion. The competitive landscape is characterized by a mix of both local and multinational players, all vying for market share. Specific regional variations exist, with countries like Indonesia, Philippines, and Vietnam showing particularly strong growth potential.

The dominance of supermarkets and hypermarkets as the primary distribution channel underscores the importance of strategic partnerships with major retail chains. The rise of e-commerce platforms presents a significant opportunity for expansion, with online retailers offering convenient home delivery and wider product variety. Looking ahead, innovations in product offerings, such as healthier options and unique flavor profiles, are anticipated to drive further growth. The focus on premiumization, coupled with increased investment in product development and marketing, will be crucial factors shaping the future of the Southeast Asia bakery products market. Furthermore, companies are likely focusing on expanding their product portfolio and focusing on sustainable and ethical sourcing to appeal to the increasingly conscious consumer. The market will continue its upward trajectory, driven by a confluence of demographic, economic, and technological shifts.

This detailed report provides a comprehensive analysis of the Southeast Asia bakery products market, covering the period from 2019 to 2033. It offers invaluable insights into market trends, competitive dynamics, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis, encompassing historical performance (2019-2024), current market estimates (2025), and future projections (2025-2033) to paint a complete picture of this dynamic market. Key segments analyzed include product type (bread, sweet biscuits, crackers & savory biscuits, cakes, pastries & sweet pies, morning goods) and distribution channels (supermarkets/hypermarkets, specialty stores, convenience/grocery stores, online retail stores, other channels).

Southeast Asia Bakery Products Market Concentration & Innovation

The Southeast Asia bakery products market exhibits a moderately concentrated landscape, with several multinational and regional players vying for market share. Market leaders such as Mondelez International Inc. and SPC Samlip Co Ltd. command significant portions of the market, benefiting from established brand recognition and extensive distribution networks. However, numerous smaller, local players also contribute significantly, particularly in specific product segments and geographical regions. The market is characterized by continuous innovation, driven by evolving consumer preferences, technological advancements, and increasing health consciousness.

- Market Concentration: The top 5 players account for approximately xx% of the total market revenue in 2025 (estimated). Market share data for individual players will be detailed within the full report.

- Innovation Drivers: Rising demand for convenient, healthy, and premium bakery products fuels innovation. This includes the development of gluten-free, low-sugar, and organic options, alongside the introduction of novel flavors and product formats.

- Regulatory Framework: Government regulations regarding food safety and labeling influence product formulations and marketing strategies. Varying regulations across Southeast Asian countries create challenges for standardized product offerings.

- Product Substitutes: The availability of substitutes like snacks, confectionery, and ready-to-eat meals presents competitive pressure. Bakery product producers must innovate to maintain market relevance.

- End-User Trends: Growing urbanization, increasing disposable incomes, and changing lifestyles drive demand for convenient and ready-to-eat bakery products.

- M&A Activities: Consolidation is likely to continue, with larger players acquiring smaller firms to expand their product portfolios and market reach. The full report will detail past M&A activities and projected future deals with estimated values.

Southeast Asia Bakery Products Market Industry Trends & Insights

The Southeast Asia bakery products market is projected to experience robust growth during the forecast period (2025-2033), driven by a confluence of factors. The region’s burgeoning population, coupled with rising disposable incomes and shifting consumer preferences towards convenience and premiumization, are key growth catalysts. Technological advancements in production and packaging enhance efficiency and product quality, further fueling market expansion. However, the industry faces challenges such as fluctuating raw material prices, intense competition, and the need to adapt to evolving health and wellness trends. The market’s Compound Annual Growth Rate (CAGR) is estimated to be xx% during 2025-2033. Market penetration of various product segments (e.g., premium bread, organic biscuits) is steadily increasing. Competitive dynamics are characterized by product differentiation, branding strategies, and efficient supply chain management.

Dominant Markets & Segments in Southeast Asia Bakery Products Market

Indonesia and the Philippines are expected to dominate the Southeast Asia bakery products market due to their large populations, rapid economic growth, and increasing urbanization. Within the product type segment, bread and sweet biscuits consistently hold the largest market shares due to high consumption rates and wide accessibility.

- Key Drivers for Dominant Markets:

- Indonesia: Large population, rising disposable incomes, and a strong preference for sweet bakery items.

- Philippines: Similar to Indonesia, combined with a robust local bakery industry.

- Key Drivers for Dominant Segments:

- Bread: Affordable, staple food item consumed daily by a large population segment.

- Sweet Biscuits: Popular snack food, favored across various age groups.

- Distribution Channel Dominance: Supermarkets/hypermarkets and convenience/grocery stores currently hold the largest market share due to their widespread presence and accessibility. However, online retail is witnessing significant growth, driven by the increasing popularity of e-commerce platforms and online grocery delivery services.

Southeast Asia Bakery Products Market Product Developments

Recent innovations in the Southeast Asia bakery products market include the introduction of healthier options like gluten-free bread and low-sugar biscuits, reflecting growing consumer demand for healthier choices. The adoption of advanced technologies in production processes aims to enhance efficiency, reduce waste, and improve product quality. Furthermore, co-branding and partnerships with popular food and beverage brands result in product diversification and increased market appeal. This is reflected in recent product launches such as President Bakery's collaboration with Ovaltine. The overall trend points toward increased product diversification tailored to specific consumer segments.

Report Scope & Segmentation Analysis

This report segments the Southeast Asia bakery products market based on product type and distribution channel.

Product Type:

- Bread: This segment is expected to witness steady growth, driven by its consistent demand as a staple food item. Market size projections, and competitive dynamics within this segment are detailed in the full report.

- Sweet Biscuits, Crackers and Savory Biscuits: This segment’s growth is projected to be driven by the snacking trend and increased consumer demand for varied flavors and textures. Growth projections and competitive landscape are discussed extensively in the report.

- Cakes, Pastries, and Sweet Pies: This segment’s performance is influenced by special occasions and evolving dessert preferences, with detailed analysis of growth trajectory included in the report.

- Morning Goods: This segment is characterized by high growth potential, driven by increasing demand for convenient breakfast options. The report provides a comprehensive breakdown of the market size and growth.

Distribution Channel:

- Supermarkets/Hypermarkets: This segment is expected to retain a significant market share due to its broad reach and established distribution networks. The report details the market size and growth projections.

- Specialty Stores: This segment offers opportunities for specialized bakery products, with a complete overview available within the report.

- Convenience/Grocery Stores: This segment benefits from its widespread accessibility, offering detailed analysis within the report.

- Online Retail Stores: This fast-growing segment’s impact on market dynamics is thoroughly discussed in the report, including growth projections.

- Other Distribution Channels: This segment includes wholesale and direct-to-consumer channels, with a complete analysis in the report.

Key Drivers of Southeast Asia Bakery Products Market Growth

Several key factors fuel the growth of the Southeast Asia bakery products market:

- Rising Disposable Incomes: Increased purchasing power allows consumers to spend more on premium and convenient bakery products.

- Changing Lifestyles: Busy lifestyles lead to higher demand for ready-to-eat and convenient options.

- Urbanization: Concentrated populations in urban areas drive increased demand for bakery products.

- Technological Advancements: Efficient production technologies and innovative packaging solutions enhance efficiency and product quality.

- Government Initiatives: Policies supporting the food and beverage industry promote market expansion.

Challenges in the Southeast Asia Bakery Products Market Sector

The Southeast Asia bakery products market faces certain challenges, including:

- Fluctuating Raw Material Prices: Price volatility of ingredients like wheat and sugar impacts production costs and profitability.

- Intense Competition: The presence of many large multinational and local players creates a competitive landscape.

- Health and Wellness Trends: Growing preference for healthier alternatives necessitates product reformulation and innovation.

- Supply Chain Disruptions: Global events and regional uncertainties can disrupt the supply chain, impacting product availability.

Emerging Opportunities in Southeast Asia Bakery Products Market

The Southeast Asia bakery products market presents several emerging opportunities:

- Healthier Product Offerings: Demand for gluten-free, low-sugar, and organic products is increasing, creating opportunities for innovation.

- Premiumization: Growing affluence is driving demand for premium, artisanal bakery products.

- E-commerce Growth: Expansion of online grocery delivery platforms creates opportunities for increased market penetration.

- Expansion into Underserved Markets: Reaching new consumer segments in rural areas holds significant potential for growth.

Leading Players in the Southeast Asia Bakery Products Market Market

- SPC Samlip Co Ltd

- Mighty Bakery SDN BHD

- Lotte Confectionery Co Ltd

- PT Nippon Indosari Corpindo TBK

- President Bakery Public Company Limited

- PPB Group Bhd

- QAF Limited (Gardenia Bakery KL SDN BHD)

- CP All Public Company Limited

- Mondelēz International Inc

- Variety Foods International Company Limited

- JG Summit Holdings (Universal Robina Corporation)

Key Developments in Southeast Asia Bakery Products Market Industry

- June 2021: SPC Group opened its first Paris Baguette franchise in Cambodia, signifying market expansion.

- July 2021: President Bakery collaborated with Ovaltine to launch co-branded products, showcasing strategic partnerships.

- February 2022: Mondelez invested USD 23 Million in expanding its Oreo production line in Indonesia, highlighting investment in capacity and technology.

- July 2022: SPC Samlip introduced domestic wheat bakeries in accordance with a government agreement, reflecting responsiveness to national policies.

Strategic Outlook for Southeast Asia Bakery Products Market Market

The Southeast Asia bakery products market holds significant future potential. Continued growth in disposable incomes, coupled with the increasing popularity of convenient and premium bakery options, will drive market expansion. Innovations in product development, supported by technological advancements, will be critical for sustaining competitive advantage. Companies focusing on health-conscious options and leveraging effective distribution channels, particularly e-commerce, are likely to experience robust growth in the coming years. The market is poised for sustained growth, presenting substantial opportunities for both established players and emerging companies.

Southeast Asia Bakery Products Market Segmentation

-

1. Product Type

- 1.1. Bread

- 1.2. Sweet Biscuit

- 1.3. Crackers and Savory Biscuits

- 1.4. Cakes, Pastries and Sweet Pies

- 1.5. Morning Goods

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Specialty Stores

- 2.3. Convenience/Grocery Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Indonesia

- 3.2. Malaysia

- 3.3. Vietnam

- 3.4. Thailand

- 3.5. Philippines

- 3.6. Myanmar

- 3.7. Singapore

- 3.8. Rest of Southeast Asia

Southeast Asia Bakery Products Market Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Vietnam

- 4. Thailand

- 5. Philippines

- 6. Myanmar

- 7. Singapore

- 8. Rest of Southeast Asia

Southeast Asia Bakery Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Specialty and Healthy Bakery Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bread

- 5.1.2. Sweet Biscuit

- 5.1.3. Crackers and Savory Biscuits

- 5.1.4. Cakes, Pastries and Sweet Pies

- 5.1.5. Morning Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Convenience/Grocery Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Malaysia

- 5.3.3. Vietnam

- 5.3.4. Thailand

- 5.3.5. Philippines

- 5.3.6. Myanmar

- 5.3.7. Singapore

- 5.3.8. Rest of Southeast Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Vietnam

- 5.4.4. Thailand

- 5.4.5. Philippines

- 5.4.6. Myanmar

- 5.4.7. Singapore

- 5.4.8. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Indonesia Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bread

- 6.1.2. Sweet Biscuit

- 6.1.3. Crackers and Savory Biscuits

- 6.1.4. Cakes, Pastries and Sweet Pies

- 6.1.5. Morning Goods

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Convenience/Grocery Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Malaysia

- 6.3.3. Vietnam

- 6.3.4. Thailand

- 6.3.5. Philippines

- 6.3.6. Myanmar

- 6.3.7. Singapore

- 6.3.8. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Malaysia Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bread

- 7.1.2. Sweet Biscuit

- 7.1.3. Crackers and Savory Biscuits

- 7.1.4. Cakes, Pastries and Sweet Pies

- 7.1.5. Morning Goods

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Convenience/Grocery Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Malaysia

- 7.3.3. Vietnam

- 7.3.4. Thailand

- 7.3.5. Philippines

- 7.3.6. Myanmar

- 7.3.7. Singapore

- 7.3.8. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Vietnam Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bread

- 8.1.2. Sweet Biscuit

- 8.1.3. Crackers and Savory Biscuits

- 8.1.4. Cakes, Pastries and Sweet Pies

- 8.1.5. Morning Goods

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Convenience/Grocery Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Malaysia

- 8.3.3. Vietnam

- 8.3.4. Thailand

- 8.3.5. Philippines

- 8.3.6. Myanmar

- 8.3.7. Singapore

- 8.3.8. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Thailand Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bread

- 9.1.2. Sweet Biscuit

- 9.1.3. Crackers and Savory Biscuits

- 9.1.4. Cakes, Pastries and Sweet Pies

- 9.1.5. Morning Goods

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Convenience/Grocery Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Malaysia

- 9.3.3. Vietnam

- 9.3.4. Thailand

- 9.3.5. Philippines

- 9.3.6. Myanmar

- 9.3.7. Singapore

- 9.3.8. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Philippines Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bread

- 10.1.2. Sweet Biscuit

- 10.1.3. Crackers and Savory Biscuits

- 10.1.4. Cakes, Pastries and Sweet Pies

- 10.1.5. Morning Goods

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/ Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Convenience/Grocery Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Malaysia

- 10.3.3. Vietnam

- 10.3.4. Thailand

- 10.3.5. Philippines

- 10.3.6. Myanmar

- 10.3.7. Singapore

- 10.3.8. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Myanmar Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Bread

- 11.1.2. Sweet Biscuit

- 11.1.3. Crackers and Savory Biscuits

- 11.1.4. Cakes, Pastries and Sweet Pies

- 11.1.5. Morning Goods

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/ Hypermarkets

- 11.2.2. Specialty Stores

- 11.2.3. Convenience/Grocery Stores

- 11.2.4. Online Retail Stores

- 11.2.5. Other Distribution Channels

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Malaysia

- 11.3.3. Vietnam

- 11.3.4. Thailand

- 11.3.5. Philippines

- 11.3.6. Myanmar

- 11.3.7. Singapore

- 11.3.8. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Singapore Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Bread

- 12.1.2. Sweet Biscuit

- 12.1.3. Crackers and Savory Biscuits

- 12.1.4. Cakes, Pastries and Sweet Pies

- 12.1.5. Morning Goods

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/ Hypermarkets

- 12.2.2. Specialty Stores

- 12.2.3. Convenience/Grocery Stores

- 12.2.4. Online Retail Stores

- 12.2.5. Other Distribution Channels

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Indonesia

- 12.3.2. Malaysia

- 12.3.3. Vietnam

- 12.3.4. Thailand

- 12.3.5. Philippines

- 12.3.6. Myanmar

- 12.3.7. Singapore

- 12.3.8. Rest of Southeast Asia

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Southeast Asia Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Bread

- 13.1.2. Sweet Biscuit

- 13.1.3. Crackers and Savory Biscuits

- 13.1.4. Cakes, Pastries and Sweet Pies

- 13.1.5. Morning Goods

- 13.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.2.1. Supermarkets/ Hypermarkets

- 13.2.2. Specialty Stores

- 13.2.3. Convenience/Grocery Stores

- 13.2.4. Online Retail Stores

- 13.2.5. Other Distribution Channels

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. Indonesia

- 13.3.2. Malaysia

- 13.3.3. Vietnam

- 13.3.4. Thailand

- 13.3.5. Philippines

- 13.3.6. Myanmar

- 13.3.7. Singapore

- 13.3.8. Rest of Southeast Asia

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. China Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 15. Japan Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 16. India Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 17. South Korea Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 18. Taiwan Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 19. Australia Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 20. Rest of Asia-Pacific Southeast Asia Bakery Products Market Analysis, Insights and Forecast, 2019-2031

- 21. Competitive Analysis

- 21.1. Market Share Analysis 2024

- 21.2. Company Profiles

- 21.2.1 SPC Samlip Co Ltd*List Not Exhaustive

- 21.2.1.1. Overview

- 21.2.1.2. Products

- 21.2.1.3. SWOT Analysis

- 21.2.1.4. Recent Developments

- 21.2.1.5. Financials (Based on Availability)

- 21.2.2 Mighty Bakery SDN BHD

- 21.2.2.1. Overview

- 21.2.2.2. Products

- 21.2.2.3. SWOT Analysis

- 21.2.2.4. Recent Developments

- 21.2.2.5. Financials (Based on Availability)

- 21.2.3 Lotte Confectionery Co Ltd

- 21.2.3.1. Overview

- 21.2.3.2. Products

- 21.2.3.3. SWOT Analysis

- 21.2.3.4. Recent Developments

- 21.2.3.5. Financials (Based on Availability)

- 21.2.4 PT Nippon Indosari Corpindo TBK

- 21.2.4.1. Overview

- 21.2.4.2. Products

- 21.2.4.3. SWOT Analysis

- 21.2.4.4. Recent Developments

- 21.2.4.5. Financials (Based on Availability)

- 21.2.5 President Bakery Public Company Limited

- 21.2.5.1. Overview

- 21.2.5.2. Products

- 21.2.5.3. SWOT Analysis

- 21.2.5.4. Recent Developments

- 21.2.5.5. Financials (Based on Availability)

- 21.2.6 PPB Group Bhd

- 21.2.6.1. Overview

- 21.2.6.2. Products

- 21.2.6.3. SWOT Analysis

- 21.2.6.4. Recent Developments

- 21.2.6.5. Financials (Based on Availability)

- 21.2.7 QAF Limited (Gardenia Bakery KL SDN BHD)

- 21.2.7.1. Overview

- 21.2.7.2. Products

- 21.2.7.3. SWOT Analysis

- 21.2.7.4. Recent Developments

- 21.2.7.5. Financials (Based on Availability)

- 21.2.8 CP All Public Company Limited

- 21.2.8.1. Overview

- 21.2.8.2. Products

- 21.2.8.3. SWOT Analysis

- 21.2.8.4. Recent Developments

- 21.2.8.5. Financials (Based on Availability)

- 21.2.9 Mondelēz International Inc

- 21.2.9.1. Overview

- 21.2.9.2. Products

- 21.2.9.3. SWOT Analysis

- 21.2.9.4. Recent Developments

- 21.2.9.5. Financials (Based on Availability)

- 21.2.10 Variety Foods International Company Limited

- 21.2.10.1. Overview

- 21.2.10.2. Products

- 21.2.10.3. SWOT Analysis

- 21.2.10.4. Recent Developments

- 21.2.10.5. Financials (Based on Availability)

- 21.2.11 JG Summit Holdings (Universal Robina Corporation)

- 21.2.11.1. Overview

- 21.2.11.2. Products

- 21.2.11.3. SWOT Analysis

- 21.2.11.4. Recent Developments

- 21.2.11.5. Financials (Based on Availability)

- 21.2.1 SPC Samlip Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: Southeast Asia Bakery Products Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Southeast Asia Bakery Products Market Share (%) by Company 2024

List of Tables

- Table 1: Southeast Asia Bakery Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Southeast Asia Bakery Products Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Southeast Asia Bakery Products Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 39: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Southeast Asia Bakery Products Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 43: Southeast Asia Bakery Products Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Southeast Asia Bakery Products Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 45: Southeast Asia Bakery Products Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Bakery Products Market?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the Southeast Asia Bakery Products Market?

Key companies in the market include SPC Samlip Co Ltd*List Not Exhaustive, Mighty Bakery SDN BHD, Lotte Confectionery Co Ltd, PT Nippon Indosari Corpindo TBK, President Bakery Public Company Limited, PPB Group Bhd, QAF Limited (Gardenia Bakery KL SDN BHD), CP All Public Company Limited, Mondelēz International Inc, Variety Foods International Company Limited, JG Summit Holdings (Universal Robina Corporation).

3. What are the main segments of the Southeast Asia Bakery Products Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Surge in Demand for Specialty and Healthy Bakery Products.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

July 2022: In accordance with the "Agreement on the Promotion of Domestic Wheat Consumption signed with the Ministry of Agriculture Food and Rural Affairs," SPC Samlip introduced four different types of domestic wheat bakeries. The new item is available in Nonghyup Hanaromat and e-mart locations nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Bakery Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Bakery Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Bakery Products Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Bakery Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence