Key Insights

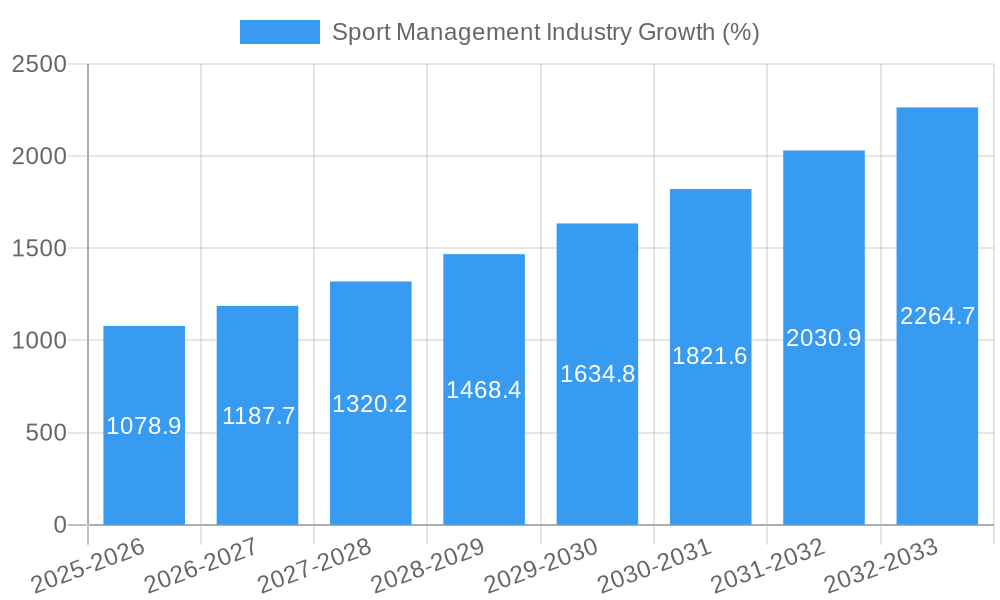

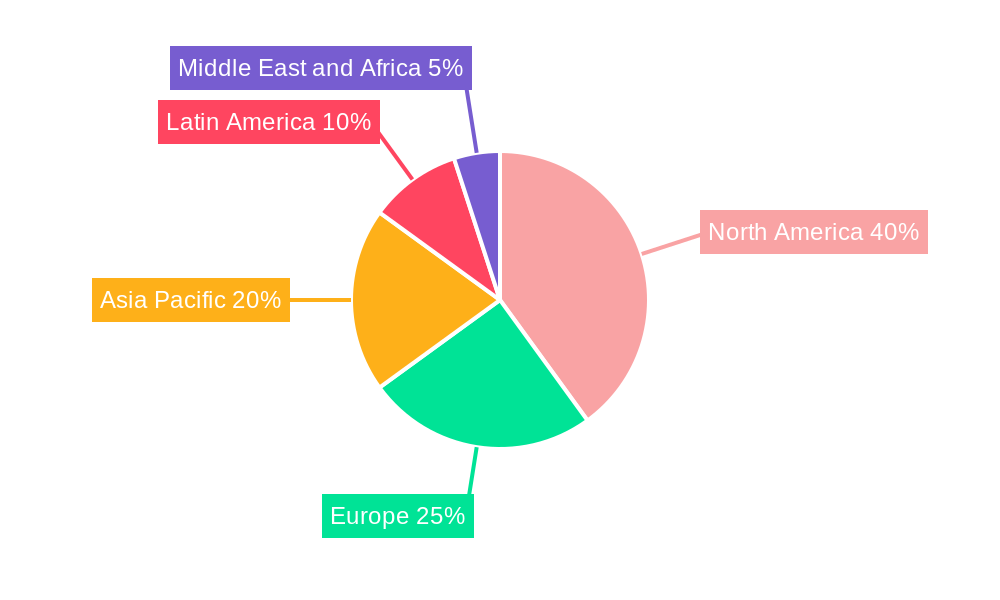

The global sports management software market, valued at $9.15 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of digital technologies within the sports industry and a rising demand for efficient management solutions. The market's Compound Annual Growth Rate (CAGR) of 11.46% from 2025 to 2033 indicates a significant expansion, fueled by several key factors. The shift towards cloud-based solutions offers scalability and accessibility, benefiting organizations of all sizes. Furthermore, the incorporation of advanced analytics and data-driven insights empowers sports teams, leagues, and clubs to make more informed decisions regarding player performance, marketing strategies, and fan engagement. Growing professionalization across various sports levels necessitates sophisticated software for managing registrations, scheduling, ticketing, and communication, further stimulating market expansion. The segmentation into on-premise and cloud deployments, coupled with applications focused on event management, marketing, and client relationship management, caters to diverse needs within the sports ecosystem. Leading vendors like TeamSideline, Jonas Club Software, SAP SE, and others are actively contributing to this growth through continuous innovation and product development. The North American market currently holds a significant share, driven by the well-established professional sports leagues and robust technological infrastructure. However, the Asia-Pacific region is poised for substantial growth due to the rising popularity of sports and increasing investment in sports infrastructure.

The competitive landscape is dynamic, with both established players and emerging startups vying for market share. Strategic partnerships, mergers, and acquisitions are expected to shape the market's future trajectory. The restraints on growth primarily involve the high initial investment costs associated with implementing new software solutions and the need for adequate technical expertise to manage and maintain these systems. However, ongoing technological advancements and the increasing affordability of cloud-based solutions are mitigating these challenges. The overall outlook for the sports management software market remains positive, with significant growth potential throughout the forecast period, particularly as the industry embraces digital transformation and data-driven decision-making.

This comprehensive report provides a detailed analysis of the Sport Management Industry, encompassing market size, growth drivers, key players, and future trends. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report uses data from various sources, including company financial statements, industry publications, and expert interviews, to present a holistic view of this dynamic sector. The total market size is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033.

Sport Management Industry Market Concentration & Innovation

The Sport Management Industry exhibits a moderately concentrated market structure, with several large players holding significant market share. While precise market share figures for individual companies are proprietary information and not publicly available, key players like SAP SE, Sports Engine Inc, and Stack Sports command considerable influence. Market concentration is further influenced by factors such as the high cost of entry, significant technological investments, and the need for extensive industry expertise. The market concentration ratio (CR4) for the industry is estimated at xx%.

Several factors drive innovation in the Sport Management Industry. These include:

- Technological advancements: Cloud computing, mobile technologies, and AI-driven analytics are transforming how sports organizations operate and engage with fans.

- Data analytics: The ability to leverage data to improve performance, enhance fan experience, and optimize marketing strategies drives innovation.

- Regulatory changes: Evolving regulations relating to data privacy and competition shape industry practices and fuel innovation in compliance technologies.

Mergers and acquisitions (M&A) play a crucial role in shaping the market landscape. Recent years have witnessed significant M&A activity, with deal values totaling $XX Million in the past five years. These activities typically involve strategic acquisitions of smaller companies with specialized technologies or geographical reach by larger players aiming for market expansion and diversification.

Sport Management Industry Industry Trends & Insights

The Sport Management Industry is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. Market penetration is increasing across various segments due to rising smartphone usage, increased digital engagement, and a growing demand for efficient management solutions. Technological disruptions, such as the adoption of cloud-based solutions and the increasing use of mobile applications, are fundamentally changing how sports events are managed and how fans interact with teams and leagues.

Consumer preferences are shifting toward personalized experiences and enhanced digital engagement. This demands that sports organizations adapt their strategies to cater to these evolving expectations. Competitive dynamics are characterized by increasing competition, particularly among software providers specializing in event management, scheduling, and marketing. This competition drives innovation and pushes companies to offer superior products and services. The industry's growth is also impacted by factors such as sponsorship deals, media rights revenues, and overall economic growth. The global market for sports management software is projected to surpass $XX Million by 2033.

Dominant Markets & Segments in Sport Management Industry

The North American region currently holds the largest market share in the Sport Management Industry, primarily due to the robust sports ecosystem, high adoption of advanced technologies, and increased investment in sports infrastructure. Within the industry, the Cloud deployment model is experiencing the most significant growth, primarily due to its scalability, flexibility, and cost-effectiveness. Furthermore, the Event Management and Scheduling application segment commands the largest market share, as it addresses a core need for efficient organization and administration within the industry.

Key drivers contributing to regional dominance include:

- Strong economic growth: Higher disposable income fuels increased spending on sports-related activities and technologies.

- Well-developed sports infrastructure: Availability of advanced facilities and arenas fosters a vibrant sports industry.

- Supportive government policies: Favorable regulations and investments stimulate market growth.

The dominance of the Cloud deployment and Event Management and Scheduling application segments reflects the industry’s shift towards digitalization and the critical need for efficient operational management.

Sport Management Industry Product Developments

Recent product developments emphasize improved user interfaces, AI-powered analytics dashboards, enhanced data security features, and seamless integration with existing sports management systems. New solutions are focusing on optimizing fan engagement through personalized mobile apps and social media integration. These developments reflect the industry's responsiveness to technological advancements and evolving consumer preferences. The success of new products hinges on their ability to streamline processes, provide actionable insights, and enhance the overall user experience.

Report Scope & Segmentation Analysis

This report segments the Sport Management Industry by deployment (On-Premise, Cloud) and application (Event Management and Scheduling, Marketing Management, Client Management, Other Applications).

Deployment:

- On-Premise: This segment is characterized by slower growth due to higher initial investment costs and limited scalability, despite providing higher levels of security and control. It is estimated to be worth $XX million in 2025.

- Cloud: This is the fastest-growing segment, driven by the increasing adoption of cloud-based solutions for their cost-effectiveness, scalability, and accessibility. Market size in 2025 is estimated to be $XX million.

Application:

- Event Management and Scheduling: This segment is the largest, owing to the critical need for efficient event management across all sports. Growth is driven by the increasing number of sports events and the demand for robust management tools. The 2025 market size is estimated at $XX million.

- Marketing Management: This segment is experiencing rapid growth due to the growing importance of targeted marketing campaigns and fan engagement strategies. The 2025 market size is estimated to be $XX million.

- Client Management: This segment focuses on improving relationships with athletes, sponsors, and other stakeholders. It’s estimated at $XX million in 2025.

- Other Applications: This includes various niche applications, such as performance analysis tools and player tracking systems. The 2025 market size is estimated to be $XX million.

Key Drivers of Sport Management Industry Growth

The Sport Management Industry's growth is propelled by several factors:

- Technological advancements: Cloud computing, AI, and mobile technologies are transforming operations and fan engagement.

- Increased digitalization: The rising adoption of digital platforms for ticketing, broadcasting, and marketing is driving growth.

- Growing interest in sports: Globally, increased participation and viewership in sporting events create substantial demand for efficient management solutions.

Challenges in the Sport Management Industry Sector

The industry faces challenges including:

- High initial investment costs: Implementing new technologies and software can be expensive, particularly for smaller organizations.

- Data security concerns: Protecting sensitive athlete and fan data is paramount and requires significant investment in security measures.

- Intense competition: The market is becoming increasingly competitive, with new players entering the field regularly. This competition places pressure on prices and profit margins.

Emerging Opportunities in Sport Management Industry

Emerging opportunities include:

- Expansion into new markets: Untapped markets in developing countries offer significant potential.

- Integration of wearable technology: Leveraging data from wearables to enhance athlete performance and fan engagement.

- Development of personalized fan experiences: Tailored content and offers can drive increased fan loyalty and revenue.

Leading Players in the Sport Management Industry Market

- TeamSideline.com

- Jonas Club Software

- SAP SE

- SquadFusion Inc

- Sports Engine Inc

- Stack Sports

- Omnify Inc

- Active Network LLC

- Jersey Watch

- LeagueApps

- CourtReserve.com

Key Developments in Sport Management Industry Industry

- July 2022: Wasserman's acquisition of Jet Sports Management signals a major expansion into MLB, showcasing the ongoing consolidation within the sports management sector.

- September 2022: Sport:80's app for the AKC Agility League demonstrates the growing use of technology to streamline various aspects of sports management, including registration, scoring, and information dissemination.

Strategic Outlook for Sport Management Industry Market

The Sport Management Industry is poised for sustained growth, driven by ongoing technological advancements, increasing digitalization, and a rising global passion for sports. Strategic investments in AI-powered analytics, personalized fan engagement platforms, and innovative solutions catering to emerging markets will be crucial for success. The industry's future hinges on its ability to leverage data effectively, improve fan experiences, and adapt to evolving consumer expectations.

Sport Management Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. Application

- 2.1. Event Management and Scheduling

- 2.2. Marketing Management

- 2.3. Client Management

- 2.4. Other Applications

Sport Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Sport Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Sports Industry; Growing Inclination of Sports League Among Women

- 3.3. Market Restrains

- 3.3.1. Data Security Issue

- 3.4. Market Trends

- 3.4.1. Growing Inclination of Sports League Among Women

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Event Management and Scheduling

- 5.2.2. Marketing Management

- 5.2.3. Client Management

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-Premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Event Management and Scheduling

- 6.2.2. Marketing Management

- 6.2.3. Client Management

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-Premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Event Management and Scheduling

- 7.2.2. Marketing Management

- 7.2.3. Client Management

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-Premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Event Management and Scheduling

- 8.2.2. Marketing Management

- 8.2.3. Client Management

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-Premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Event Management and Scheduling

- 9.2.2. Marketing Management

- 9.2.3. Client Management

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-Premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Event Management and Scheduling

- 10.2.2. Marketing Management

- 10.2.3. Client Management

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. North America Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Sport Management Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 TeamSideline com

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Jonas Club Software

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 SAP SE*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SquadFusion Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Sports Engine Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Stack Sports

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Omnify Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Active Network LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Jersey Watch

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 LeagueApps

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 CourtReserve com

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 TeamSideline com

List of Figures

- Figure 1: Global Sport Management Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Sport Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 13: North America Sport Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 14: North America Sport Management Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Sport Management Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Sport Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 19: Europe Sport Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 20: Europe Sport Management Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Sport Management Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Sport Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Asia Pacific Sport Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Asia Pacific Sport Management Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sport Management Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Sport Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Latin America Sport Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Latin America Sport Management Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Sport Management Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Sport Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Sport Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Middle East and Africa Sport Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Middle East and Africa Sport Management Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Sport Management Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Sport Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Sport Management Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sport Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sport Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Sport Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Sport Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sport Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Sport Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Sport Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Sport Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Sport Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Sport Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Global Sport Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Sport Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 19: Global Sport Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Sport Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 22: Global Sport Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Sport Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Sport Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Sport Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: Global Sport Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Sport Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sport Management Industry?

The projected CAGR is approximately 11.46%.

2. Which companies are prominent players in the Sport Management Industry?

Key companies in the market include TeamSideline com, Jonas Club Software, SAP SE*List Not Exhaustive, SquadFusion Inc, Sports Engine Inc, Stack Sports, Omnify Inc, Active Network LLC, Jersey Watch, LeagueApps, CourtReserve com.

3. What are the main segments of the Sport Management Industry?

The market segments include Deployment, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Sports Industry; Growing Inclination of Sports League Among Women.

6. What are the notable trends driving market growth?

Growing Inclination of Sports League Among Women.

7. Are there any restraints impacting market growth?

Data Security Issue.

8. Can you provide examples of recent developments in the market?

September 2022 - Sport:80 develop a new app solution to support American Kennel Club (AKC) in their online AKC Agility League. Through the app, Agility competitors can create and register their teams, access and download course information to set up local courses at their convenience and upload their scores upon completion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sport Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sport Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sport Management Industry?

To stay informed about further developments, trends, and reports in the Sport Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence