Key Insights

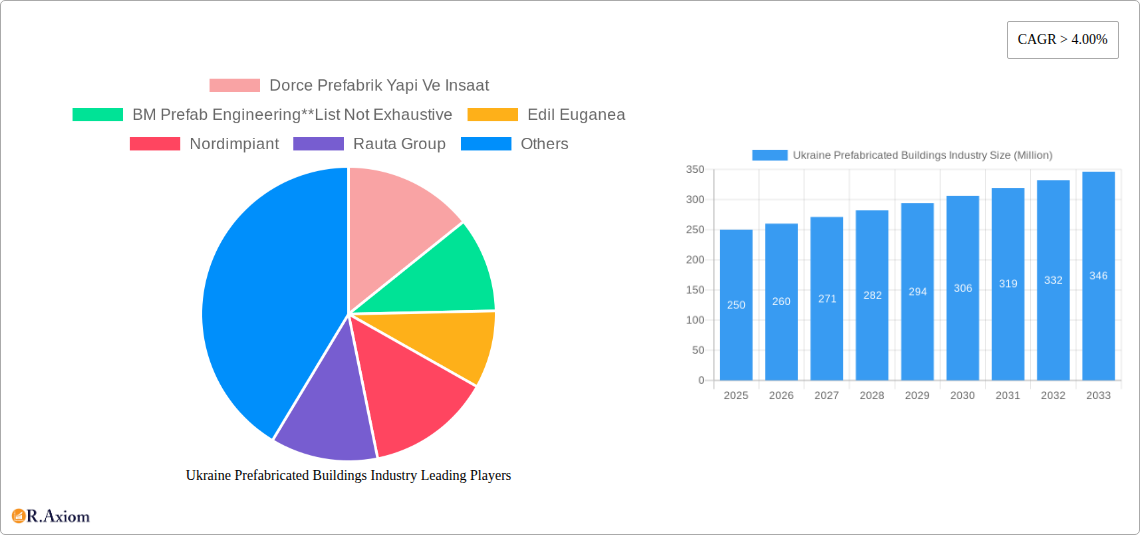

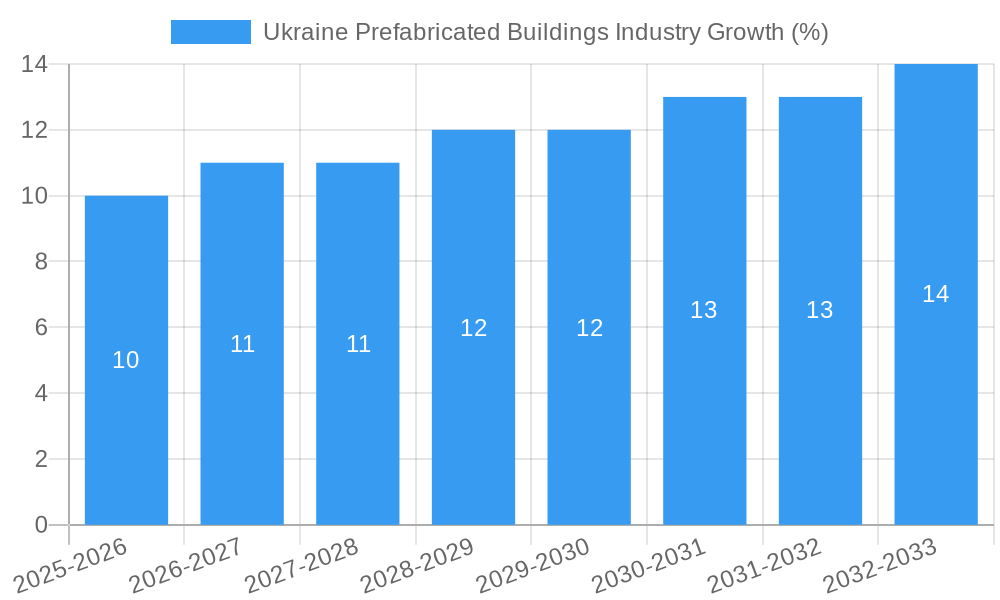

The Ukrainian prefabricated building market, valued at an estimated $250 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) exceeding 4.00% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, increasing urbanization and infrastructure development initiatives within Ukraine are creating significant demand for cost-effective and rapidly deployable construction solutions. Prefabricated buildings offer a compelling alternative to traditional construction methods, providing faster project completion times and reduced labor costs. Secondly, the government's focus on sustainable building practices is further boosting the sector. Prefabricated structures often incorporate eco-friendly materials and energy-efficient designs, aligning with national sustainability goals. Finally, the ongoing reconstruction efforts following recent conflicts are driving demand for temporary and permanent housing solutions, significantly impacting the prefabricated building market's growth trajectory. Key market segments include residential, commercial, and industrial applications, each contributing to the overall market expansion. However, challenges remain, including potential supply chain disruptions and fluctuations in material costs, which could impact project timelines and budgets. Competition in the market is relatively fragmented, with both local and international players vying for market share, including companies like Dorce Prefabrik Yapi Ve Insaat, BM Prefab Engineering, Edil Euganea, and others.

Despite these challenges, the positive outlook for the Ukrainian economy and continued investment in infrastructure development suggest that the prefabricated building market will maintain its upward trajectory in the forecast period. The market’s growth is expected to be particularly strong in the residential segment, driven by increased demand for affordable housing. The commercial and industrial segments will also see significant growth, albeit at a potentially slower pace, as businesses seek efficient and sustainable construction solutions. The ability of prefabricated building companies to adapt to changing regulations, manage supply chain risks, and innovate with new materials and designs will be crucial in determining their success within this dynamic and expanding market. The focus on utilizing sustainable and locally sourced materials will also play a pivotal role in the market's future growth and sustainability.

Ukraine Prefabricated Buildings Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Ukraine prefabricated buildings industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period, utilizing 2025 as the base year. The report leverages extensive market research, including analysis of key players such as Dorce Prefabrik Yapi Ve Insaat, BM Prefab Engineering, Edil Euganea, Nordimpiant, Rauta Group, Bianchi Casseforme SRL, Module-T, Portakabin Ltd, Containex, Oberbeton Ukraine, and Memaar Building Systems (list not exhaustive), to present a comprehensive understanding of market dynamics, trends, and future prospects. The total market size is projected to reach XX Million by 2033.

Ukraine Prefabricated Buildings Industry Market Concentration & Innovation

The Ukraine prefabricated buildings market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Dorce Prefabrik Yapi Ve Insaat and BM Prefab Engineering, for example, are estimated to hold a combined XX% market share in 2025. Innovation is driven by advancements in modular construction techniques, sustainable building materials, and the integration of smart technologies. The regulatory framework, while evolving, presents both opportunities and challenges, particularly concerning building codes and environmental regulations. Product substitutes, primarily traditional construction methods, face increasing competition due to the cost-effectiveness and speed of prefabricated solutions. End-user trends indicate a growing preference for sustainable and energy-efficient buildings, fueling demand for eco-friendly prefab options. M&A activity in the sector is expected to remain moderate, with deal values averaging XX Million per transaction in the historical period, driven by the need for expansion and technological integration.

- Market Concentration: Top 5 players account for XX% of market share in 2025.

- Innovation Drivers: Advancements in modular design, sustainable materials (e.g., cross-laminated timber), and smart building integration.

- Regulatory Landscape: Evolving building codes and environmental regulations present both opportunities and challenges.

- M&A Activity: Average deal value estimated at XX Million in 2019-2024.

Ukraine Prefabricated Buildings Industry Industry Trends & Insights

The Ukraine prefabricated buildings industry is experiencing significant growth, driven by factors such as increasing urbanization, infrastructure development initiatives, and a rising demand for affordable housing. The Compound Annual Growth Rate (CAGR) is estimated at XX% for the forecast period (2025-2033). Technological disruptions, such as 3D printing and Building Information Modeling (BIM) adoption, are transforming construction methodologies, increasing efficiency, and improving the quality of prefabricated buildings. Consumer preferences are shifting towards sustainable, energy-efficient designs with a focus on prefabricated buildings' environmental impact. Competitive dynamics are characterized by innovation, technological advancements, and strategic partnerships. Market penetration of prefabricated buildings in the residential segment is estimated to reach XX% by 2033, indicating substantial growth potential.

Dominant Markets & Segments in Ukraine Prefabricated Buildings Industry

The residential segment is the dominant market within the Ukraine prefabricated buildings industry, driven by the acute housing shortage and government initiatives aimed at affordable housing solutions. The reconstruction efforts in war-torn areas are further bolstering growth in this segment.

- Key Drivers for Residential Segment Dominance:

- Government support for affordable housing programs.

- Rapid urbanization and population growth.

- Post-conflict reconstruction needs.

- Cost-effectiveness and speed of construction compared to traditional methods.

The commercial and industrial segments also exhibit promising growth, propelled by the expanding industrial sector and the need for efficient, cost-effective construction solutions. The growth in these segments is projected to accelerate in the forecast period fueled by the government's plans for infrastructure development and industrial expansion.

Ukraine Prefabricated Buildings Industry Product Developments

Recent product innovations focus on advanced modular designs, improved thermal efficiency, and the incorporation of smart home technologies. Prefabricated buildings are increasingly being used for diverse applications, ranging from residential housing and commercial spaces to industrial facilities and temporary structures. The competitive advantage stems from the ability to offer cost-effective, sustainable, and rapidly deployable building solutions. These developments reflect broader technological trends towards sustainable and efficient construction practices that align well with evolving market demands.

Report Scope & Segmentation Analysis

This report segments the Ukraine prefabricated buildings market by application:

Residential: This segment is projected to witness the highest growth rate over the forecast period, fueled by the demand for affordable housing and the post-war reconstruction efforts. Market size is estimated at XX Million in 2025.

Commercial: Growth in this segment is driven by rising commercial activity and the increasing adoption of prefabricated solutions for office buildings, retail spaces, and other commercial establishments. Market size is estimated at XX Million in 2025.

Industrial: The industrial segment is expected to see steady growth, driven by the growing need for efficient and cost-effective industrial structures. Market size is estimated at XX Million in 2025.

Key Drivers of Ukraine Prefabricated Buildings Industry Growth

Several factors drive the growth of the Ukraine prefabricated buildings industry. Government initiatives promoting affordable housing and infrastructure development play a significant role. Technological advancements, such as improved modular construction techniques and the adoption of sustainable materials, enhance efficiency and reduce construction time. Furthermore, the increasing demand for rapid and cost-effective construction solutions fuels the adoption of prefabricated buildings across various sectors.

Challenges in the Ukraine Prefabricated Buildings Industry Sector

The industry faces challenges, including supply chain disruptions caused by the ongoing conflict, impacting material availability and increasing costs. Regulatory hurdles and bureaucratic processes can delay project implementation. Competition from traditional construction methods also poses a challenge, although the growing awareness of prefabrication's benefits is helping overcome this obstacle. The instability and uncertainty in the market caused by the ongoing war could significantly influence market growth and hinder investment.

Emerging Opportunities in Ukraine Prefabricated Buildings Industry

Significant opportunities exist in the expanding renewable energy sector, requiring specialized prefabricated structures for solar farms and wind energy installations. Moreover, the demand for modular healthcare facilities and disaster relief shelters creates a substantial market for rapidly deployable prefabricated structures. Technological advancements, such as 3D printing and automation in prefabrication, offer new avenues for innovation and efficiency gains.

Leading Players in the Ukraine Prefabricated Buildings Industry Market

- Dorce Prefabrik Yapi Ve Insaat

- BM Prefab Engineering

- Edil Euganea

- Nordimpiant

- Rauta Group

- Bianchi Casseforme SRL

- Module-T

- Portakabin Ltd

- Containex

- Oberbeton Ukraine

- Memaar Building Systems

Key Developments in Ukraine Prefabricated Buildings Industry Industry

- 2022 Q4: Increased government investment in prefabricated housing projects for displaced citizens.

- 2023 Q1: Launch of a new sustainable prefabricated building design by [Company Name], incorporating recycled materials.

- 2023 Q2: Acquisition of [Company A] by [Company B], expanding market reach.

- 2024 Q1: Introduction of 3D-printed prefabricated components by [Company Name], enhancing construction speed and efficiency. (Further details to be added as the study progresses)

Strategic Outlook for Ukraine Prefabricated Buildings Industry Market

The Ukraine prefabricated buildings market holds significant long-term potential. Ongoing reconstruction efforts, coupled with government support for affordable housing and infrastructure development, will drive considerable growth. Technological innovations and the increasing adoption of sustainable practices will shape the industry's future, fostering a more efficient, cost-effective, and environmentally friendly construction sector. The potential for increased foreign investment in the rebuilding and modernization of Ukraine's infrastructure also presents significant opportunities for growth.

Ukraine Prefabricated Buildings Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Ukraine Prefabricated Buildings Industry Segmentation By Geography

- 1. Ukraine

Ukraine Prefabricated Buildings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Labour Force is Decreasing in Ukraine

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ukraine Prefabricated Buildings Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ukraine

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dorce Prefabrik Yapi Ve Insaat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BM Prefab Engineering**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Edil Euganea

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nordimpiant

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rauta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bianchi Casseforme SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Module-T

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Portakabin Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Containex

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oberbeton Ukraine

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Memaar Building Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dorce Prefabrik Yapi Ve Insaat

List of Figures

- Figure 1: Ukraine Prefabricated Buildings Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ukraine Prefabricated Buildings Industry Share (%) by Company 2024

List of Tables

- Table 1: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ukraine Prefabricated Buildings Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Ukraine Prefabricated Buildings Industry?

Key companies in the market include Dorce Prefabrik Yapi Ve Insaat, BM Prefab Engineering**List Not Exhaustive, Edil Euganea, Nordimpiant, Rauta Group, Bianchi Casseforme SRL, Module-T, Portakabin Ltd, Containex, Oberbeton Ukraine, Memaar Building Systems.

3. What are the main segments of the Ukraine Prefabricated Buildings Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Labour Force is Decreasing in Ukraine.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ukraine Prefabricated Buildings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ukraine Prefabricated Buildings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ukraine Prefabricated Buildings Industry?

To stay informed about further developments, trends, and reports in the Ukraine Prefabricated Buildings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence