Key Insights

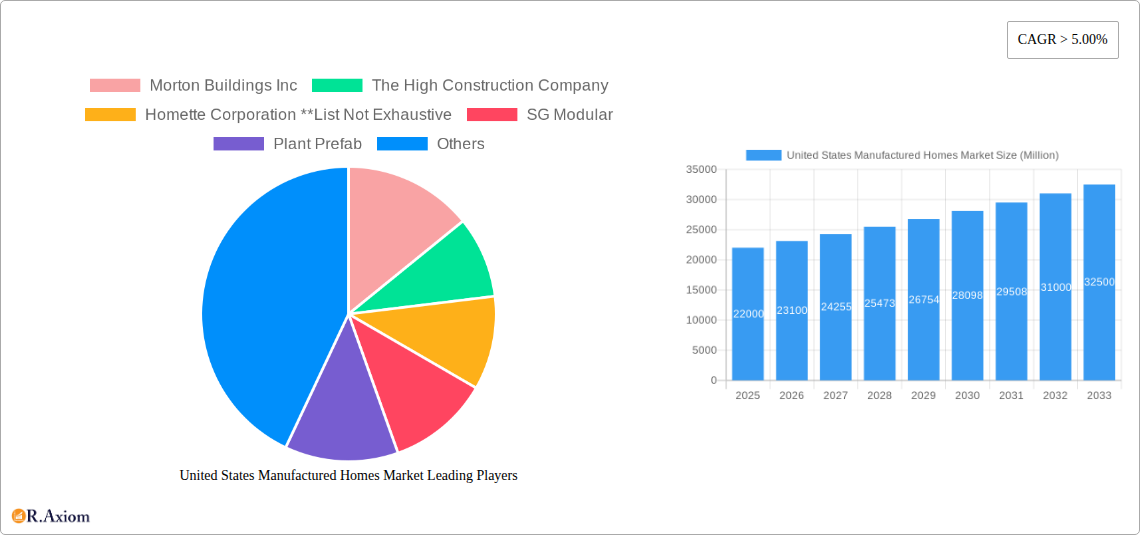

The United States manufactured homes market is experiencing robust growth, driven by increasing demand for affordable housing and the rising popularity of sustainable building practices. With a market size exceeding $20 billion in 2025 and a Compound Annual Growth Rate (CAGR) of over 5%, the market is projected to reach approximately $30 billion by 2033. Key drivers include the persistent housing shortage, particularly in affordable segments, lower construction costs compared to traditional site-built homes, and shorter construction timelines. Furthermore, advancements in design and technology are enhancing the appeal and quality of manufactured homes, blurring the lines between traditional and manufactured housing. The market is segmented by type, with single-family homes dominating the market share due to higher demand from individual homebuyers. However, the multi-family segment is also witnessing significant growth fueled by the need for affordable rental housing options. Leading companies like Morton Buildings Inc., Skyline Champion Corporation, and others are investing in innovation and expanding their product portfolios to cater to the evolving market demands. These improvements include energy-efficient features, enhanced aesthetics, and improved durability, leading to increased consumer confidence in manufactured homes. While regulatory hurdles and potential material cost fluctuations pose some challenges, the overall market outlook remains positive, driven by persistent strong fundamentals.

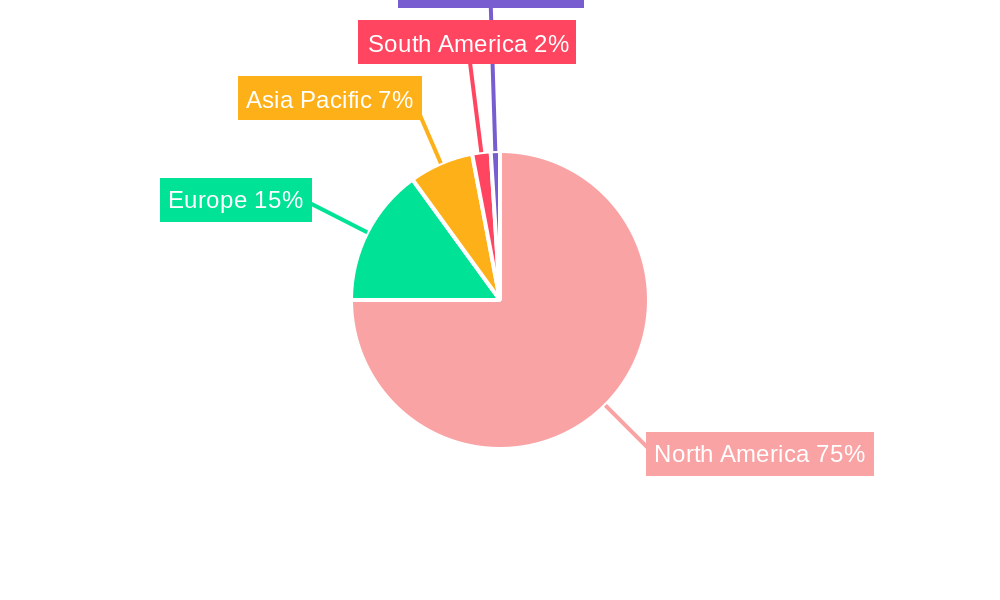

The market’s regional distribution shows North America holding the largest share, reflecting its established manufacturing base and high demand. Europe and Asia-Pacific are also experiencing growth, though at a slower pace compared to North America. The forecast period (2025-2033) promises continued expansion, propelled by government initiatives aimed at addressing housing affordability challenges and the ongoing appeal of eco-friendly construction methods within the manufactured housing sector. Competitive pressures among manufacturers are likely to drive innovation and efficiency gains, further bolstering market growth. Despite potential economic uncertainties, the long-term prospects for the US manufactured homes market remain highly promising, with substantial growth potential in both single-family and multi-family segments.

This in-depth report provides a comprehensive analysis of the United States manufactured homes market, covering market size, growth projections, key segments, leading players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses looking to navigate this dynamic sector.

United States Manufactured Homes Market Market Concentration & Innovation

The US manufactured homes market exhibits a moderately concentrated landscape, with several large players holding significant market share. However, the presence of numerous smaller regional manufacturers contributes to a competitive environment. Market share data for the key players will be detailed in the full report. Innovation is driven by advancements in building materials, energy-efficient technologies, and design aesthetics, catering to evolving consumer preferences for sustainability and affordability. Regulatory frameworks, including building codes and zoning regulations, significantly influence market dynamics, alongside product substitutes like traditional site-built homes and other affordable housing options. End-user trends favor customizable designs, smart home features, and sustainable building practices. The market has witnessed notable M&A activity in recent years, with deal values ranging from USD 10 Million to xx Million, as highlighted by the acquisition of Manis Custom Builders Inc. by Champion Home Builders in May 2022. This activity demonstrates consolidation and a push for market expansion.

- Key Metrics: Market share of top players (detailed in the full report), M&A deal values (USD 10 Million and above), average selling prices.

- Competitive Landscape: Analysis of competitive strategies, including pricing, product differentiation, and market penetration.

- Regulatory Landscape: Impact of building codes, zoning regulations, and environmental standards.

United States Manufactured Homes Market Industry Trends & Insights

The US manufactured homes market is characterized by steady growth, driven by factors such as increasing affordability concerns, a growing rental market, and the demand for efficient and faster construction solutions. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of smart home technologies and the use of prefabricated components, are transforming manufacturing processes and enhancing product appeal. Consumer preferences are shifting towards customizable designs, environmentally friendly materials, and energy-efficient features. The competitive dynamics are shaped by factors such as pricing pressures, technological innovation, and brand recognition. Market penetration of manufactured homes continues to increase in both rural and suburban areas, particularly among first-time homebuyers and those seeking budget-friendly options.

Dominant Markets & Segments in United States Manufactured Homes Market

The single-family segment dominates the US manufactured homes market, accounting for a larger market share compared to the multi-family segment. This dominance is largely attributed to the strong demand for affordable single-family housing across various regions.

Key Drivers for Single-Family Dominance:

- Strong demand for affordable housing.

- Preference for individual ownership among a large segment of the population.

- Faster construction time compared to site-built homes.

- Government incentives and financing options for single-family homes.

Multi-Family Segment Analysis: While smaller, the multi-family segment is poised for growth due to increased demand for rental units and affordable multi-family housing solutions.

United States Manufactured Homes Market Product Developments

Recent product innovations focus on enhanced energy efficiency, improved aesthetics, and greater customization options. This includes the incorporation of sustainable materials, smart home technology integration, and modular design approaches that cater to diverse architectural preferences and site constraints. These developments enhance the competitiveness of manufactured homes by bridging the gap between affordability and desirable living standards.

Report Scope & Segmentation Analysis

This report segments the US manufactured homes market by type: Single-Family and Multi-Family. The single-family segment is projected to experience faster growth compared to the multi-family segment during the forecast period (2025-2033). Both segments show healthy growth, with their sizes and competitive dynamics detailed within the full report.

Key Drivers of United States Manufactured Homes Market Growth

The US manufactured homes market's growth is fueled by several key factors:

- Affordability: Manufactured homes offer a significantly lower price point compared to traditional site-built homes, making them an attractive option for budget-conscious buyers.

- Faster Construction: The factory-built nature of these homes leads to significantly reduced construction times.

- Government Support: Government incentives and financing programs facilitate the purchase of manufactured homes.

- Technological Advancements: Improvements in materials, designs, and energy efficiency enhance the appeal of these homes.

Challenges in the United States Manufactured Homes Market Sector

The market faces challenges, including:

- Negative Perceptions: Some consumers still hold negative perceptions of manufactured homes, impacting demand.

- Financing Challenges: Securing financing can sometimes prove more difficult compared to traditional mortgages.

- Supply Chain Issues: Fluctuations in material costs and availability can affect production and pricing.

Emerging Opportunities in United States Manufactured Homes Market

Several emerging opportunities exist:

- Sustainable Building Practices: The increasing focus on environmental sustainability offers opportunities for manufacturers to adopt eco-friendly materials and technologies.

- Smart Home Integration: Integrating smart home features can enhance the appeal of manufactured homes among tech-savvy buyers.

- Customization Options: Offering broader customization options allows manufacturers to cater to diverse consumer preferences.

Leading Players in the United States Manufactured Homes Market Market

- Morton Buildings Inc

- The High Construction Company

- Homette Corporation

- SG Modular

- Plant Prefab

- Skyline Champion Corporation

- Westchester Modular Homes Inc

- Varco Pruden

- Affinity Building Systems

- Z Modular

Key Developments in United States Manufactured Homes Market Industry

- July 2022: Skyline Champion Corporation's Champion Retail Housing acquired the assets and management of 12 Factory Expo Home Centers.

- May 2022: Champion Home Builders acquired Manis Custom Builders Inc. for approximately USD 10 Million, expanding its North Carolina operations.

Strategic Outlook for United States Manufactured Homes Market Market

The US manufactured homes market is poised for continued growth, driven by affordability, technological advancements, and evolving consumer preferences. The focus on sustainability, smart home integration, and enhanced design will further enhance the market's appeal and attract new segments of buyers. The industry's strategic response to challenges, such as addressing negative perceptions and improving financing options, will be crucial in realizing the market's full potential.

United States Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

United States Manufactured Homes Market Segmentation By Geography

- 1. United States

United States Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for prefab buildings; Surge in demand from residential segment

- 3.3. Market Restrains

- 3.3.1. Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas

- 3.4. Market Trends

- 3.4.1. States in the US Spending the Most on Manufactured Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. South America United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Morton Buildings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The High Construction Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Homette Corporation **List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SG Modular

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Plant Prefab

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Skyline Champion Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Westchester Modular Homes Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Varco Pruden

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Affinity Building Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Z Modular

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Morton Buildings Inc

List of Figures

- Figure 1: United States Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: United States Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Manufactured Homes Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the United States Manufactured Homes Market?

Key companies in the market include Morton Buildings Inc, The High Construction Company, Homette Corporation **List Not Exhaustive, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc, Varco Pruden, Affinity Building Systems, Z Modular.

3. What are the main segments of the United States Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for prefab buildings; Surge in demand from residential segment.

6. What are the notable trends driving market growth?

States in the US Spending the Most on Manufactured Housing.

7. Are there any restraints impacting market growth?

Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas.

8. Can you provide examples of recent developments in the market?

July 2022: The Factory Expo Home Centers are situated at 12 Skyline Champion manufacturing plants around the United States. Champion Retail Housing, a subsidiary of Skyline Champion Corporation, agreed with Alta Cima Corporation to purchase the assets and take over the management of the Factory Expo Home Centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the United States Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence