Key Insights

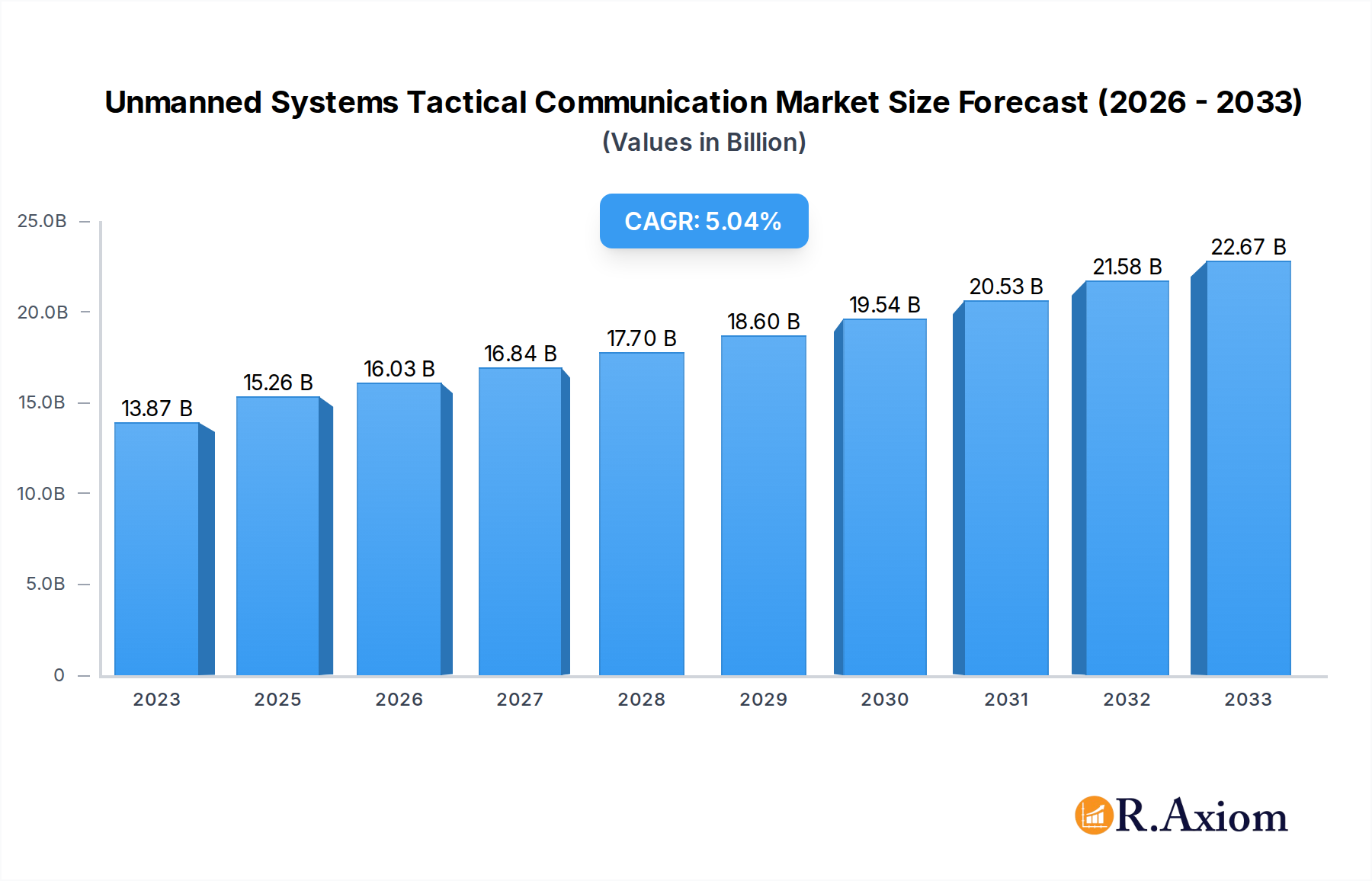

The Unmanned Systems Tactical Communication market is poised for significant expansion, driven by the escalating global demand for enhanced battlefield awareness, precision targeting, and secure communication in complex operational environments. With a projected market size of approximately $13,869.1 million in 2023, this sector is experiencing robust growth, anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033. Key applications such as Command & Control, Intelligence, Surveillance & Reconnaissance (ISR), and Combat are fueling this upward trajectory. The increasing integration of Unmanned Aerial Vehicles (UAVs) and Unmanned Ground Vehicles (UGVs) into military operations, coupled with advancements in secure, resilient, and high-bandwidth communication technologies, are fundamental growth drivers. Defense modernization initiatives worldwide, aimed at equipping forces with superior situational awareness and operational efficiency, are also contributing to sustained market demand.

Unmanned Systems Tactical Communication Market Size (In Billion)

This dynamic market is shaped by a confluence of technological advancements and evolving defense strategies. The drive towards networked warfare and the proliferation of smart technologies in military hardware necessitate sophisticated tactical communication systems that can reliably connect and coordinate diverse unmanned platforms. While the increasing adoption of unmanned systems presents substantial opportunities, challenges such as cybersecurity threats, spectrum congestion, and the high cost of advanced technology integration could potentially restrain market expansion. However, the continuous innovation in areas like artificial intelligence for data processing, advanced encryption, and resilient communication protocols are expected to mitigate these restraints, ensuring a strong and sustained growth phase for the Unmanned Systems Tactical Communication market across major regions like North America and Asia Pacific.

Unmanned Systems Tactical Communication Company Market Share

This in-depth report provides a detailed examination of the Unmanned Systems Tactical Communication market, a critical and rapidly evolving sector within defense and security operations. Spanning from 2019 to 2033, this analysis offers unparalleled insights into market concentration, technological innovations, dominant segments, growth drivers, challenges, and emerging opportunities. With a base year of 2025 and a robust forecast period from 2025 to 2033, this report leverages historical data (2019-2024) to paint a clear picture of past performance and future potential. The report focuses on key applications including Command & Control, Intelligence, Surveillance & Reconnaissance (ISR), Communication, and Combat, as well as vital unmanned system types such as Unmanned Ground Vehicles (UGVs), Unmanned Aerial Vehicles (UAVs), and Underwater Vehicles. Industry stakeholders, including defense contractors, technology providers, government agencies, and investors, will find actionable intelligence to inform strategic decision-making, identify competitive advantages, and navigate the complex landscape of unmanned systems tactical communication.

Unmanned Systems Tactical Communication Market Concentration & Innovation

The Unmanned Systems Tactical Communication market exhibits a moderate to high concentration, with a few key players holding significant market share. Major contributors like General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Leonardo, BAE Systems, L3Harris Technologies, and Honeywell International are at the forefront of innovation and deployment. Market share figures are dynamic, with leading companies often holding over 15% of the overall market in specific niches. Mergers and acquisitions (M&A) play a crucial role in shaping market dynamics, with deal values in the hundreds of millions to over a billion dollars frequently observed as larger entities acquire specialized capabilities or expand their portfolios.

- Innovation Drivers:

- Increasing demand for real-time, secure, and resilient communication for remote and dismounted operations.

- Advancements in artificial intelligence (AI) and machine learning (ML) for autonomous mission planning and data dissemination.

- Development of multi-band, multi-mission communication systems supporting diverse platforms.

- Focus on miniaturization, power efficiency, and enhanced range for tactical deployments.

- Regulatory Frameworks:

- Strict adherence to national and international spectrum allocation policies.

- Evolving regulations around drone operations, data security, and electronic warfare mitigation.

- Product Substitutes:

- Traditional manned communication systems, though increasingly supplemented by unmanned solutions.

- Commercial off-the-shelf (COTS) communication hardware, often requiring integration and hardening for tactical environments.

- End-User Trends:

- Growing preference for networked warfare capabilities and enhanced situational awareness.

- Demand for interoperable systems capable of seamless integration across different branches of service and allied forces.

- M&A Activities:

- Strategic acquisitions of startups with novel communication technologies (e.g., software-defined radios, advanced encryption).

- Consolidation among established players to enhance end-to-end solution offerings.

Unmanned Systems Tactical Communication Industry Trends & Insights

The Unmanned Systems Tactical Communication market is experiencing robust growth, driven by the escalating need for advanced battlefield awareness, real-time intelligence, and seamless command and control in modern military operations. The projected Compound Annual Growth Rate (CAGR) for this sector is estimated to be between 8% and 12% over the forecast period (2025-2033). This significant expansion is fueled by several interconnected trends, including the increasing complexity of geopolitical landscapes, the rise of asymmetric warfare, and the continuous technological advancements in both unmanned systems and communication technologies. Market penetration is rapidly increasing as defense forces worldwide prioritize the integration of unmanned assets into their tactical doctrines.

Technological disruptions are a constant feature of this market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming how tactical communication operates, enabling intelligent routing, adaptive spectrum utilization, and predictive maintenance of communication links. The development of Software-Defined Radios (SDRs) is offering unprecedented flexibility, allowing communication systems to be reconfigured on the fly to adapt to changing mission requirements and enemy electronic warfare tactics. Furthermore, the miniaturization of communication payloads, driven by advancements in microelectronics and antenna design, is enabling smaller, more agile unmanned platforms to carry sophisticated communication capabilities. This trend is particularly impactful for Unmanned Aerial Vehicles (UAVs) and Unmanned Ground Vehicles (UGVs), allowing for more pervasive ISR and C2 capabilities.

Consumer preferences, in this context, refer to the evolving demands of end-users, primarily military and security agencies. There is a pronounced shift towards networked-centric operations, where seamless, secure, and resilient communication is paramount. End-users are seeking solutions that offer end-to-end encryption, robust anti-jamming capabilities, and high data throughput to support the massive amounts of data generated by modern unmanned systems. Interoperability between different communication systems and platforms is also a critical demand, fostering a collaborative operational environment. The need for reduced Size, Weight, and Power (SWaP) requirements in communication payloads is also a significant factor, enabling longer endurance and greater operational flexibility for unmanned platforms.

Competitive dynamics within the Unmanned Systems Tactical Communication market are characterized by intense innovation and strategic partnerships. Major defense contractors like General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Leonardo, BAE Systems, L3Harris Technologies, and Honeywell International are vying for market share through both in-house development and strategic acquisitions. The market is also seeing the rise of specialized technology companies focusing on niche communication solutions. Partnerships between unmanned system manufacturers and communication system providers are becoming increasingly common, aiming to offer integrated solutions that address the full spectrum of tactical communication needs for unmanned platforms. The emphasis on secure and resilient communication, particularly in the face of evolving threats, is driving a continuous cycle of product development and market evolution.

Dominant Markets & Segments in Unmanned Systems Tactical Communication

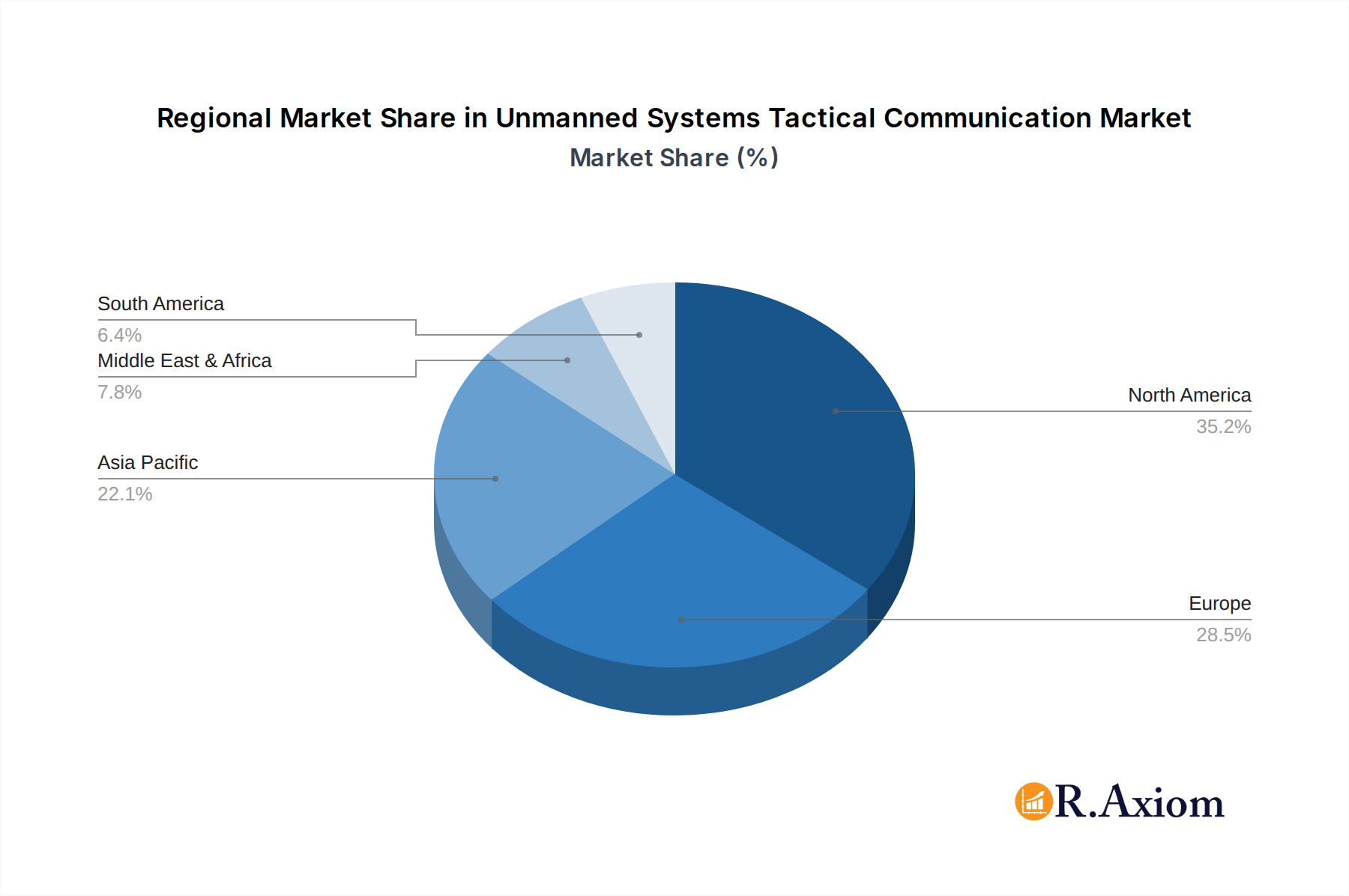

The Unmanned Systems Tactical Communication market is experiencing significant growth and evolution across various regions and segments. North America, particularly the United States, currently holds a dominant position, driven by substantial defense spending, a highly advanced technological ecosystem, and ongoing modernization initiatives for its armed forces. This dominance is further amplified by extensive research and development investments in unmanned technologies and tactical communication systems. The region's proactive approach to adopting cutting-edge solutions and its significant procurement requirements for defense applications make it a key market for unmanned systems tactical communication.

- Leading Regions and Countries:

- North America (USA, Canada): High defense budgets, continuous R&D, and widespread adoption of advanced technologies.

- Europe (UK, France, Germany): Increasing investment in defense modernization, collaborative defense projects, and a growing interest in ISR capabilities.

- Asia-Pacific (China, India, South Korea): Rapid military modernization, growing regional security concerns, and a burgeoning defense industry.

Within the application segments, Intelligence, Surveillance & Reconnaissance (ISR) is emerging as the most dominant area for tactical communication in unmanned systems. The insatiable demand for real-time battlefield awareness, threat detection, and target identification necessitates highly robust and secure communication links to transmit vast amounts of sensor data from unmanned platforms back to command centers. This segment is experiencing substantial investment and innovation.

- Dominant Application Segment: Intelligence, Surveillance & Reconnaissance (ISR)

- Key Drivers:

- The growing need for persistent surveillance and reconnaissance capabilities in complex operational environments.

- The increasing volume and complexity of data generated by advanced sensor payloads (e.g., electro-optical, infrared, synthetic aperture radar).

- The requirement for real-time dissemination of actionable intelligence to decision-makers.

- Advancements in AI and ML for processing and analyzing ISR data onboard unmanned systems.

- Detailed Dominance Analysis: Unmanned platforms, especially UAVs, are ideally suited for ISR missions due to their ability to loiter over target areas for extended periods, providing continuous situational awareness. The communication systems enabling these missions must be capable of handling high-bandwidth data transmission, ensuring data integrity, and maintaining secure links against jamming and interception. This has led to significant demand for advanced satellite communication, line-of-sight radio, and increasingly, integrated communication suites that can dynamically switch between communication modes for optimal performance. The integration of these communication systems directly impacts the effectiveness and reach of ISR operations, making it a primary driver of market growth.

- Key Drivers:

Among the types of unmanned systems, Unmanned Aerial Vehicles (UAVs) are leading the market in terms of integration with tactical communication systems. The inherent versatility, wide range of operational altitudes and ranges, and diverse payload capacities of UAVs make them ideal platforms for various communication-dependent missions.

- Dominant Unmanned System Type: Unmanned Aerial Vehicles (UAVs)

- Key Drivers:

- Versatility across ISR, C2, communication relay, and combat support roles.

- Increasingly sophisticated sensor payloads requiring high-bandwidth communication.

- The development of smaller, more affordable UAVs, expanding deployment possibilities.

- The strategic importance of aerial intelligence gathering and communication relay.

- Detailed Dominance Analysis: UAVs, ranging from small tactical drones to large endurance platforms, are increasingly being equipped with advanced communication modules. These modules facilitate not only the transmission of sensor data but also act as airborne communication relays, extending the range and improving the robustness of ground-based tactical networks. The ability of UAVs to provide persistent aerial presence for communication makes them invaluable assets in contested or geographically challenging environments. The ongoing miniaturization of communication hardware further enhances their capabilities, allowing for longer flight times and greater payload flexibility. The demand for secure, jam-resistant, and high-bandwidth communication for UAV operations is a significant market driver.

- Key Drivers:

Unmanned Systems Tactical Communication Product Developments

Recent product developments in Unmanned Systems Tactical Communication are focused on enhancing connectivity, security, and intelligence dissemination. Innovations include the integration of AI-powered communication management systems that dynamically optimize signal routing and spectrum utilization, ensuring resilient links even in contested electromagnetic environments. We are witnessing the development of multi-band, multi-mission radios that can seamlessly switch between different waveforms and frequency bands, supporting interoperability across diverse platforms and allied forces. Furthermore, advancements in miniaturization and power efficiency are enabling smaller, more agile unmanned systems to carry sophisticated communication payloads, thereby expanding their operational reach and effectiveness. These developments are crucial for supporting real-time command and control, high-definition ISR data transmission, and secure data exfiltration from the tactical edge.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Unmanned Systems Tactical Communication market, segmented by Application and Type.

Application Segments:

- Command & Control: Focusing on systems enabling remote direction and management of unmanned assets, with projected market sizes in the high hundreds of millions to over a billion dollars by 2033.

- Intelligence, Surveillance & Reconnaissance (ISR): Dominant segment driven by data transmission needs, with significant growth and market value expected to reach several billion dollars.

- Communication: Encompassing relay and communication extension capabilities, with steady growth driven by network-centric warfare requirements.

- Combat: Integrating communication for targeting, weapon guidance, and battlefield coordination, exhibiting robust growth as unmanned combat systems evolve.

Type Segments:

- Unmanned Ground Vehicles (UGVs): Communication solutions for tactical mobility and ground-based ISR, with market value projected in the hundreds of millions of dollars.

- Unmanned Aerial Vehicles (UAVs): Leading segment for communication integration, with market value expected to reach multi-billion dollar figures due to their widespread deployment.

- Underwater Vehicles: Specialized communication needs for subsea operations, representing a niche but growing segment with unique technological demands.

Key Drivers of Unmanned Systems Tactical Communication Growth

The growth of the Unmanned Systems Tactical Communication market is propelled by several interconnected factors. The escalating global security challenges and the rise of asymmetric warfare demand pervasive and resilient communication capabilities at the tactical edge. Technological advancements, particularly in artificial intelligence, machine learning, and software-defined radios, are enabling more intelligent, adaptive, and secure communication systems for unmanned platforms. Furthermore, a significant driver is the increasing adoption of networked-centric warfare doctrines by defense forces worldwide, emphasizing the need for seamless data flow and interoperability. Government initiatives and substantial defense spending aimed at modernizing military capabilities and enhancing situational awareness are also providing a strong impetus for market expansion.

Challenges in the Unmanned Systems Tactical Communication Sector

Despite robust growth, the Unmanned Systems Tactical Communication sector faces several significant challenges. Regulatory hurdles, including spectrum allocation complexities and evolving air traffic management for unmanned systems, can impede rapid deployment and integration. Supply chain issues, particularly for specialized electronic components and secure communication modules, can lead to production delays and increased costs. Competitive pressures from both established defense giants and agile technology startups necessitate continuous innovation and cost-effectiveness. Moreover, ensuring end-to-end cybersecurity and resilience against advanced electronic warfare threats remains a paramount concern, requiring substantial investment in protective technologies and protocols.

Emerging Opportunities in Unmanned Systems Tactical Communication

The Unmanned Systems Tactical Communication market presents numerous emerging opportunities. The expansion of unmanned systems into new domains, such as urban warfare and humanitarian assistance/disaster relief (HADR) operations, will create demand for specialized communication solutions. The increasing reliance on AI and edge computing for onboard data processing will drive the development of advanced communication protocols and high-bandwidth links. Furthermore, the growing trend towards multi-domain operations and the integration of unmanned systems with manned platforms offer significant opportunities for developing interoperable and secure communication architectures. Collaboration between defense organizations and commercial technology providers will also unlock new avenues for innovation and cost-effective solutions.

Leading Players in the Unmanned Systems Tactical Communication Market

- General Dynamics Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Leonardo

- BAE Systems

- L3Harris Technologies

- Honeywell International

Key Developments in Unmanned Systems Tactical Communication Industry

- 2023/08: Launch of a new software-defined radio platform offering enhanced anti-jamming capabilities for UAVs.

- 2023/11: Major defense contractor announces successful integration of a secure, high-bandwidth communication module into a new generation of UGVs.

- 2024/01: Acquisition of a specialized satellite communication solutions provider by a leading defense technology company, strengthening its airborne communication portfolio.

- 2024/03: Demonstration of a networked swarm of UAVs coordinating via advanced tactical communication links for enhanced ISR coverage.

- 2024/05: Introduction of a new encryption standard designed specifically for resilient unmanned systems communication.

Strategic Outlook for Unmanned Systems Tactical Communication Market

The strategic outlook for the Unmanned Systems Tactical Communication market is overwhelmingly positive, driven by continuous technological advancements and increasing global demand for advanced defense capabilities. The future will see a greater integration of AI and machine learning, enabling highly autonomous and resilient communication networks. The emphasis on interoperability and secure data exfiltration will fuel the development of sophisticated, multi-band communication solutions. Investments in miniaturization and power efficiency will broaden the range of unmanned platforms capable of sophisticated communication, while also extending their operational endurance. Strategic partnerships and a focus on end-to-end security will be crucial for companies aiming to capitalize on the significant growth potential within this vital market.

Unmanned Systems Tactical Communication Segmentation

-

1. Application

- 1.1. Command & Control

- 1.2. Intelligence, Surveillance & Reconnissance

- 1.3. Communication

- 1.4. Combat

-

2. Types

- 2.1. Unmanned Ground Vehicles (UGVs)

- 2.2. Unmanned Aerial Vehicles (UAVs)

- 2.3. Underwater Vehicles

Unmanned Systems Tactical Communication Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Unmanned Systems Tactical Communication Regional Market Share

Geographic Coverage of Unmanned Systems Tactical Communication

Unmanned Systems Tactical Communication REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unmanned Systems Tactical Communication Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Command & Control

- 5.1.2. Intelligence, Surveillance & Reconnissance

- 5.1.3. Communication

- 5.1.4. Combat

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Unmanned Ground Vehicles (UGVs)

- 5.2.2. Unmanned Aerial Vehicles (UAVs)

- 5.2.3. Underwater Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Unmanned Systems Tactical Communication Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Command & Control

- 6.1.2. Intelligence, Surveillance & Reconnissance

- 6.1.3. Communication

- 6.1.4. Combat

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Unmanned Ground Vehicles (UGVs)

- 6.2.2. Unmanned Aerial Vehicles (UAVs)

- 6.2.3. Underwater Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Unmanned Systems Tactical Communication Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Command & Control

- 7.1.2. Intelligence, Surveillance & Reconnissance

- 7.1.3. Communication

- 7.1.4. Combat

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Unmanned Ground Vehicles (UGVs)

- 7.2.2. Unmanned Aerial Vehicles (UAVs)

- 7.2.3. Underwater Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Unmanned Systems Tactical Communication Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Command & Control

- 8.1.2. Intelligence, Surveillance & Reconnissance

- 8.1.3. Communication

- 8.1.4. Combat

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Unmanned Ground Vehicles (UGVs)

- 8.2.2. Unmanned Aerial Vehicles (UAVs)

- 8.2.3. Underwater Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Unmanned Systems Tactical Communication Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Command & Control

- 9.1.2. Intelligence, Surveillance & Reconnissance

- 9.1.3. Communication

- 9.1.4. Combat

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Unmanned Ground Vehicles (UGVs)

- 9.2.2. Unmanned Aerial Vehicles (UAVs)

- 9.2.3. Underwater Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Unmanned Systems Tactical Communication Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Command & Control

- 10.1.2. Intelligence, Surveillance & Reconnissance

- 10.1.3. Communication

- 10.1.4. Combat

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Unmanned Ground Vehicles (UGVs)

- 10.2.2. Unmanned Aerial Vehicles (UAVs)

- 10.2.3. Underwater Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Northrop Grumman Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonardo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L3harris Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Unmanned Systems Tactical Communication Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Unmanned Systems Tactical Communication Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Unmanned Systems Tactical Communication Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Unmanned Systems Tactical Communication Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Unmanned Systems Tactical Communication Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Unmanned Systems Tactical Communication Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Unmanned Systems Tactical Communication Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Unmanned Systems Tactical Communication Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Unmanned Systems Tactical Communication Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Unmanned Systems Tactical Communication Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Unmanned Systems Tactical Communication Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Unmanned Systems Tactical Communication Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Unmanned Systems Tactical Communication Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Unmanned Systems Tactical Communication Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Unmanned Systems Tactical Communication Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Unmanned Systems Tactical Communication Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Unmanned Systems Tactical Communication Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Unmanned Systems Tactical Communication Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Unmanned Systems Tactical Communication Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Unmanned Systems Tactical Communication Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Unmanned Systems Tactical Communication Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Unmanned Systems Tactical Communication Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Unmanned Systems Tactical Communication Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Unmanned Systems Tactical Communication Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Unmanned Systems Tactical Communication Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Unmanned Systems Tactical Communication Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Unmanned Systems Tactical Communication Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Unmanned Systems Tactical Communication Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Unmanned Systems Tactical Communication Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Unmanned Systems Tactical Communication Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Unmanned Systems Tactical Communication Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Unmanned Systems Tactical Communication Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Unmanned Systems Tactical Communication Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unmanned Systems Tactical Communication?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Unmanned Systems Tactical Communication?

Key companies in the market include General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Leonardo, BAE Systems, L3harris Technologies, Honeywell International.

3. What are the main segments of the Unmanned Systems Tactical Communication?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unmanned Systems Tactical Communication," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unmanned Systems Tactical Communication report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unmanned Systems Tactical Communication?

To stay informed about further developments, trends, and reports in the Unmanned Systems Tactical Communication, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence