Key Insights

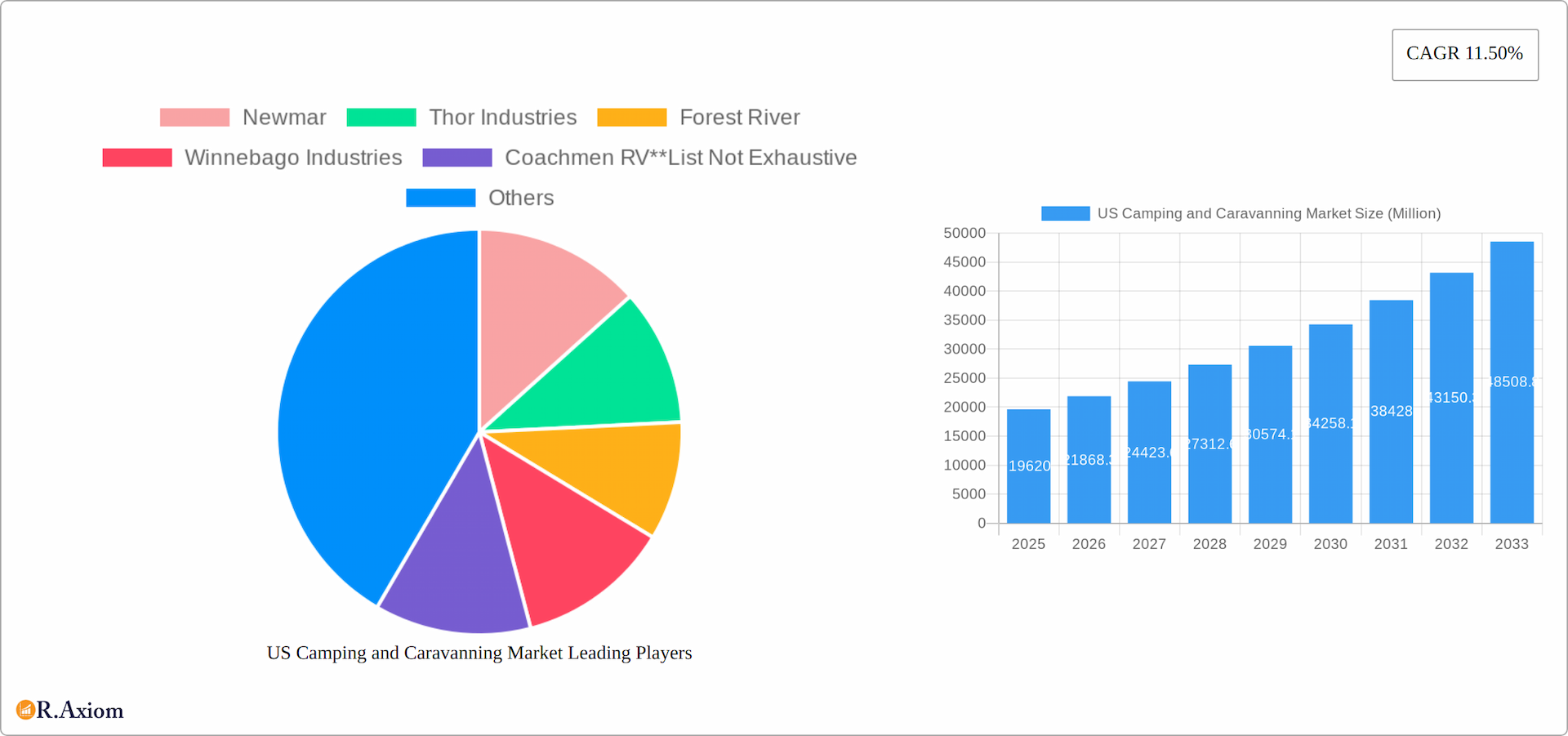

The US camping and caravanning market, valued at $19.62 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of outdoor recreation and adventure tourism among millennials and Gen Z, coupled with a growing preference for experiential travel, significantly contributes to market growth. Increased disposable incomes and a desire for unique travel experiences, away from traditional hotel accommodations, further propel demand. Moreover, continuous advancements in RV technology, offering greater comfort and amenities, are attracting a wider range of consumers. The market is segmented by destination type (e.g., national parks, private campgrounds), camper type (RV, car camping, backpacking), and distribution channel (direct sales, online travel agencies). While the increasing cost of fuel and potential campground booking limitations could present challenges, the overall market outlook remains positive due to the enduring appeal of outdoor recreation and the evolving preferences of travelers seeking unique and immersive experiences.

US Camping and Caravanning Market Market Size (In Billion)

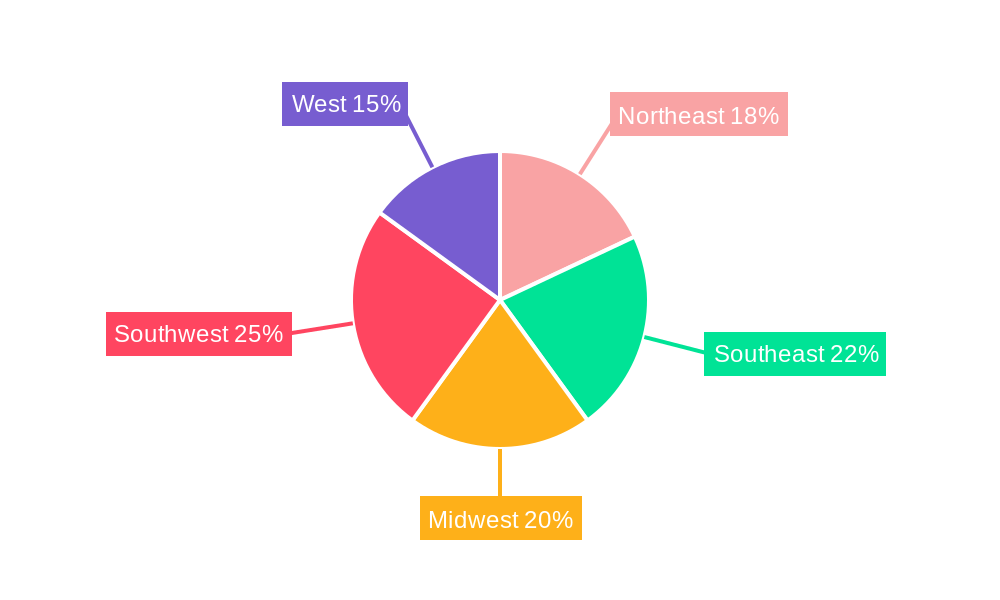

The geographic distribution of the US camping and caravanning market shows considerable variation across regions. The West and Southwest regions, with their abundant national parks and scenic landscapes, likely command significant market share. However, the Northeast and Midwest also contribute substantially, driven by established campgrounds and the growing popularity of regional camping trips. Growth strategies for market players involve enhancing campground amenities, investing in sustainable tourism practices, and leveraging digital marketing to reach a wider audience. Partnerships with national park services and outdoor recreation organizations can also create valuable synergies. The continued focus on enhancing the camping experience, making it accessible and convenient for diverse customer segments, will be crucial in sustaining the market's impressive growth trajectory.

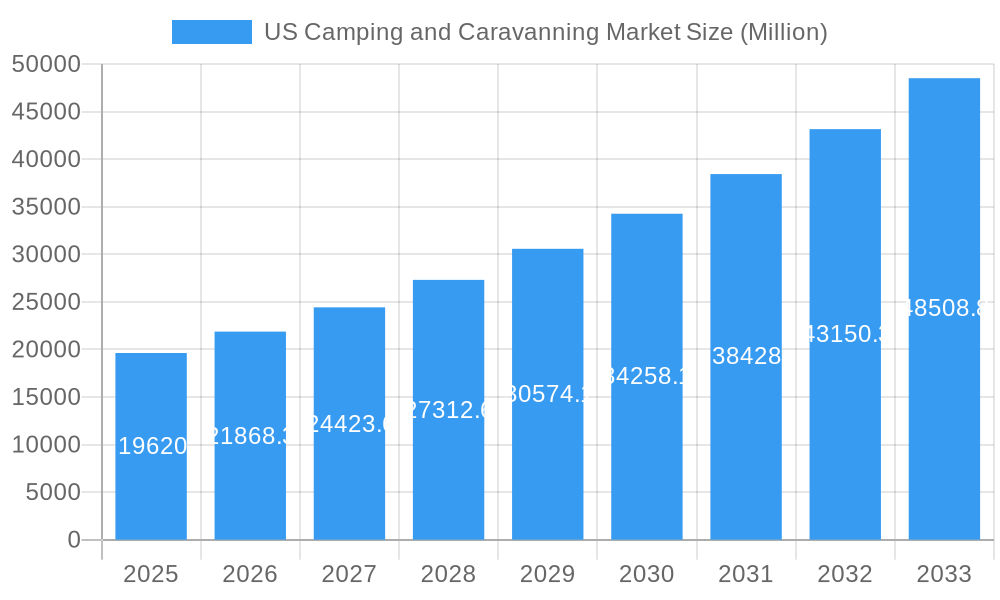

US Camping and Caravanning Market Company Market Share

This detailed report provides a comprehensive analysis of the US camping and caravanning market, covering market size, segmentation, key players, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology incorporating historical data (2019-2024) and forecasts (2025-2033) to deliver actionable insights for industry stakeholders.

US Camping and Caravanning Market Market Concentration & Innovation

This section analyzes the dynamic competitive landscape of the US camping and caravanning market, focusing on market concentration, innovation drivers, regulatory influences, substitute products, evolving end-user trends, and significant mergers and acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with several major players commanding substantial market share. However, a considerable number of smaller players and regional operators contribute to a fragmented landscape.

Market Concentration: In 2025, the top five players—Newmar, Thor Industries, Forest River, Winnebago Industries, and Coachmen RV—held an estimated xx% of the market share. While this concentration is projected to remain relatively stable throughout the forecast period, intensified competition from smaller, agile players and niche brands specializing in innovative designs or sustainable practices is anticipated to gradually reshape the market dynamics.

Innovation Drivers: The industry's growth is fueled by several key innovations. The integration of advanced technologies, such as Starlink internet connectivity (highlighted by THOR Industries' collaboration with SpaceX), is transforming the RV experience. Improvements in design and materials enhance comfort, durability, and energy efficiency, attracting environmentally conscious consumers. Furthermore, a strong focus on enhanced safety features and an improved user experience is driving demand. The development and adoption of eco-friendly camping products and practices are also gaining traction, aligning with growing sustainability concerns.

Regulatory Frameworks: Federal and state regulations significantly influence the market, encompassing safety standards, environmental protection measures, and land use policies. These regulations directly impact RV design, campground development, and operational costs, requiring continuous adaptation and compliance from market participants.

Product Substitutes: Alternative vacation options, such as hotels, resorts, and short-term rentals, present competitive pressures. However, the unique appeal of camping and caravanning—offering freedom, affordability, and immersive experiences in nature—continues to attract a large and growing customer base, particularly those seeking distinctive and personalized travel experiences.

End-User Trends: The surging popularity of outdoor recreation and sustainable travel is a pivotal growth driver. Consumers increasingly prioritize unique and immersive travel experiences, fostering demand for diverse camping and caravanning options catering to various preferences and budgets. This trend is particularly pronounced among younger demographics, such as Millennials and Gen Z, who value authentic and nature-based experiences.

M&A Activities: Recent years have witnessed considerable M&A activity, exemplified by Camping World's acquisition of Ashley Outdoors in November 2022. This consolidation trend among RV dealerships and campground operators aims to expand market reach, optimize operational efficiency, and leverage economies of scale. The total value of M&A deals in 2022 is estimated at $xx Million, indicating a strong appetite for strategic acquisitions and market consolidation.

US Camping and Caravanning Market Industry Trends & Insights

The US camping and caravanning market is experiencing robust growth, driven by various factors including a surge in outdoor recreation, an increasing preference for experiential travel, and technological advancements in RV manufacturing and camping equipment. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, expanding from an estimated value of $xx Million in 2025 to $xx Million by 2033.

This growth is fueled by several key factors. The rising disposable incomes of the middle class, coupled with the increasing popularity of outdoor activities among millennials and Gen Z, has resulted in a significant surge in demand for camping and caravanning experiences. Technological advancements have improved the comfort, convenience and safety of RV camping, making it a more appealing option for a wider range of consumers. The rise of online travel agencies (OTAs) has also facilitated market growth by enabling easier booking and greater access to diverse camping options. However, challenges remain, including potential increases in fuel costs, campground reservation availability and concerns around environmental sustainability which may somewhat temper market expansion. The increasing market penetration of RV camping, currently estimated at xx%, is projected to grow to xx% by 2033.

Dominant Markets & Segments in US Camping and Caravanning Market

The US camping and caravanning market is geographically diverse, with significant variations in popularity across regions. However, western states with extensive national parks and scenic landscapes generally exhibit higher market concentration.

By Destination Type:

- Privately Owned Campgrounds: This segment dominates the market due to its wide range of amenities, convenience, and accessibility. Key drivers include investments in campground infrastructure and increased marketing efforts.

- State or National Park Campgrounds: This segment offers a more affordable and nature-immersive experience, attracting budget-conscious consumers. However, limited availability and advance booking requirements can constrain growth.

- Public or Privately Owned Land Other Than a Campground: This segment offers dispersed camping opportunities, appealing to adventurers seeking solitude and self-sufficiency. However, this segment is less organized and has less infrastructure.

- Backcountry, National Forest or Wilderness Areas: This segment is dominated by experienced backpackers and adventurers, with growth constrained by regulations and accessibility.

- Others: This segment encompasses unique niche options that will grow due to their specialization and uniqueness.

By Type of Camper:

- RV Camping: This segment is the largest and fastest growing, fueled by advancements in RV technology and infrastructure.

- Car Camping: This segment remains popular due to its affordability and accessibility.

- Backpacking: This niche segment demonstrates steady growth driven by increased participation in outdoor adventure activities.

By Distribution Channel:

- Direct Sales: This channel is crucial for RV manufacturers and large campground operators.

- Online Travel Agencies (OTAs): The increasing use of OTAs is facilitating market expansion by providing greater visibility and accessibility to various camping options.

- Traditional Travel Agencies: This channel is gradually declining but still holds significance for specific niche markets.

US Camping and Caravanning Market Product Developments

Recent product innovations include lightweight and fuel-efficient RVs, enhanced connectivity features (e.g., Starlink integration), improved safety technologies, and eco-friendly camping equipment. These advancements cater to evolving consumer preferences for comfort, convenience, connectivity, and sustainability. The focus on market fit is towards offering diverse RV options to cater to the varied needs of budget conscious consumers and luxury travellers alike.

Report Scope & Segmentation Analysis

This report segments the US camping and caravanning market by destination type, type of camper, and distribution channel. Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The report provides detailed insights into the factors driving growth and challenges faced by each segment. Future market size projections for each segment consider historical growth, present market conditions, expected technological advancements and consumer behavior predictions. The competitive dynamics within each segment are examined to identify key players and their market shares.

Key Drivers of US Camping and Caravanning Market Growth

Growth is primarily driven by rising disposable incomes, increased interest in outdoor recreation and experiential travel, technological advancements in RV manufacturing and camping equipment, and the expansion of campground infrastructure. Government initiatives promoting national park visitation also contribute to market growth.

Challenges in the US Camping and Caravanning Market Sector

Challenges include increasing fuel costs, limited campground availability in popular locations, environmental concerns regarding waste management, and potential regulatory changes that may influence operations. These factors can impact overall market growth and profitability. Supply chain disruptions can also negatively affect the availability and pricing of RVs and camping equipment, impacting overall growth.

Emerging Opportunities in US Camping and Caravanning Market

Emerging opportunities include the development of sustainable camping practices, the integration of advanced technologies (e.g., smart RVs and autonomous navigation systems), the growth of glamping (glamorous camping), and the expansion of RV parks and campgrounds in under-served regions.

Leading Players in the US Camping and Caravanning Market Market

- Newmar

- Thor Industries

- Forest River

- Winnebago Industries

- Coachmen RV

- Kampgrounds of America (KOA)

- Thousand Trails

- Road Bear RV

- Grand Design RV

- Camping World Holdings

Key Developments in US Camping and Caravanning Market Industry

- November 2022: Camping World Holdings, Inc. acquired Ashley Outdoors, expanding its presence in Alabama. This acquisition demonstrates consolidation within the RV dealership sector.

- January 2023: THOR Industries partnered with SpaceX's Starlink to integrate high-speed internet into select RVs. This innovation significantly enhances the RV camping experience and demonstrates the increasing role of technology in the sector.

Strategic Outlook for US Camping and Caravanning Market Market

The US camping and caravanning market presents significant growth opportunities driven by increasing consumer demand, technological innovation, and expanding infrastructure. Continued investment in sustainable practices and the development of innovative products and services will be crucial for long-term market success. The market is poised for continued expansion as consumer preferences shift toward outdoor recreation and experiential travel.

US Camping and Caravanning Market Segmentation

-

1. Destination Type

- 1.1. State or National Park Campgrounds

- 1.2. Privately Owned Campgrounds

- 1.3. Public o

- 1.4. Backcountry, National Forest or Wilderness Areas

- 1.5. Parking Lots

- 1.6. Others

-

2. Type of Camper

- 2.1. Car Camping

- 2.2. RV Camping

- 2.3. Backpacking

- 2.4. Others

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Online Travel Agencies

- 3.3. Traditional Travel Agencies

US Camping and Caravanning Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Camping and Caravanning Market Regional Market Share

Geographic Coverage of US Camping and Caravanning Market

US Camping and Caravanning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rise of RV and Van Life in the United States is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination Type

- 5.1.1. State or National Park Campgrounds

- 5.1.2. Privately Owned Campgrounds

- 5.1.3. Public o

- 5.1.4. Backcountry, National Forest or Wilderness Areas

- 5.1.5. Parking Lots

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Camper

- 5.2.1. Car Camping

- 5.2.2. RV Camping

- 5.2.3. Backpacking

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Online Travel Agencies

- 5.3.3. Traditional Travel Agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination Type

- 6. North America US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination Type

- 6.1.1. State or National Park Campgrounds

- 6.1.2. Privately Owned Campgrounds

- 6.1.3. Public o

- 6.1.4. Backcountry, National Forest or Wilderness Areas

- 6.1.5. Parking Lots

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type of Camper

- 6.2.1. Car Camping

- 6.2.2. RV Camping

- 6.2.3. Backpacking

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Online Travel Agencies

- 6.3.3. Traditional Travel Agencies

- 6.1. Market Analysis, Insights and Forecast - by Destination Type

- 7. South America US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination Type

- 7.1.1. State or National Park Campgrounds

- 7.1.2. Privately Owned Campgrounds

- 7.1.3. Public o

- 7.1.4. Backcountry, National Forest or Wilderness Areas

- 7.1.5. Parking Lots

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type of Camper

- 7.2.1. Car Camping

- 7.2.2. RV Camping

- 7.2.3. Backpacking

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Online Travel Agencies

- 7.3.3. Traditional Travel Agencies

- 7.1. Market Analysis, Insights and Forecast - by Destination Type

- 8. Europe US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination Type

- 8.1.1. State or National Park Campgrounds

- 8.1.2. Privately Owned Campgrounds

- 8.1.3. Public o

- 8.1.4. Backcountry, National Forest or Wilderness Areas

- 8.1.5. Parking Lots

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type of Camper

- 8.2.1. Car Camping

- 8.2.2. RV Camping

- 8.2.3. Backpacking

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Online Travel Agencies

- 8.3.3. Traditional Travel Agencies

- 8.1. Market Analysis, Insights and Forecast - by Destination Type

- 9. Middle East & Africa US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination Type

- 9.1.1. State or National Park Campgrounds

- 9.1.2. Privately Owned Campgrounds

- 9.1.3. Public o

- 9.1.4. Backcountry, National Forest or Wilderness Areas

- 9.1.5. Parking Lots

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type of Camper

- 9.2.1. Car Camping

- 9.2.2. RV Camping

- 9.2.3. Backpacking

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Online Travel Agencies

- 9.3.3. Traditional Travel Agencies

- 9.1. Market Analysis, Insights and Forecast - by Destination Type

- 10. Asia Pacific US Camping and Caravanning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Destination Type

- 10.1.1. State or National Park Campgrounds

- 10.1.2. Privately Owned Campgrounds

- 10.1.3. Public o

- 10.1.4. Backcountry, National Forest or Wilderness Areas

- 10.1.5. Parking Lots

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type of Camper

- 10.2.1. Car Camping

- 10.2.2. RV Camping

- 10.2.3. Backpacking

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Online Travel Agencies

- 10.3.3. Traditional Travel Agencies

- 10.1. Market Analysis, Insights and Forecast - by Destination Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Newmar

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thor Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forest River

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Winnebago Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coachmen RV**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kampgrounds of America (KOA)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thousand Trails

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Road Bear RV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Grand Design RV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Camping World Holdings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Newmar

List of Figures

- Figure 1: Global US Camping and Caravanning Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 3: North America US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 4: North America US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 5: North America US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 6: North America US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 11: South America US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 12: South America US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 13: South America US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 14: South America US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 19: Europe US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 20: Europe US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 21: Europe US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 22: Europe US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 27: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 28: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 29: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 30: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Destination Type 2025 & 2033

- Figure 35: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Destination Type 2025 & 2033

- Figure 36: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Type of Camper 2025 & 2033

- Figure 37: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Type of Camper 2025 & 2033

- Figure 38: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific US Camping and Caravanning Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Camping and Caravanning Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 2: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 3: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Camping and Caravanning Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 6: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 7: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 13: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 14: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 20: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 21: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 33: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 34: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Camping and Caravanning Market Revenue Million Forecast, by Destination Type 2020 & 2033

- Table 43: Global US Camping and Caravanning Market Revenue Million Forecast, by Type of Camper 2020 & 2033

- Table 44: Global US Camping and Caravanning Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global US Camping and Caravanning Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Camping and Caravanning Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Camping and Caravanning Market?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the US Camping and Caravanning Market?

Key companies in the market include Newmar, Thor Industries, Forest River, Winnebago Industries, Coachmen RV**List Not Exhaustive, Kampgrounds of America (KOA), Thousand Trails, Road Bear RV, Grand Design RV, Camping World Holdings.

3. What are the main segments of the US Camping and Caravanning Market?

The market segments include Destination Type, Type of Camper, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Rise of RV and Van Life in the United States is Driving the Market.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

January 2023: THOR Industries (THO) agreed with SpaceX's Starlink to integrate flat high-performance Starlinks. Even in motion, it provides high-speed, low-latency internet into select motorized RVs in the United States across the THOR family of companies in 2023. THOR will also explore opportunities to bring Starlink's innovative connectivity solutions to additional RVs made by their operating companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Camping and Caravanning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Camping and Caravanning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Camping and Caravanning Market?

To stay informed about further developments, trends, and reports in the US Camping and Caravanning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence