Key Insights

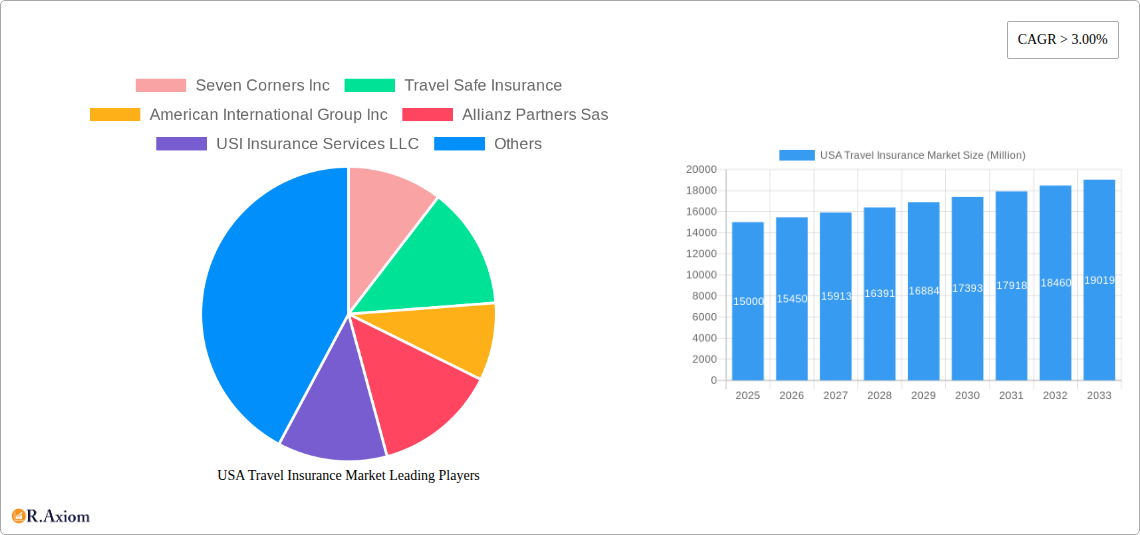

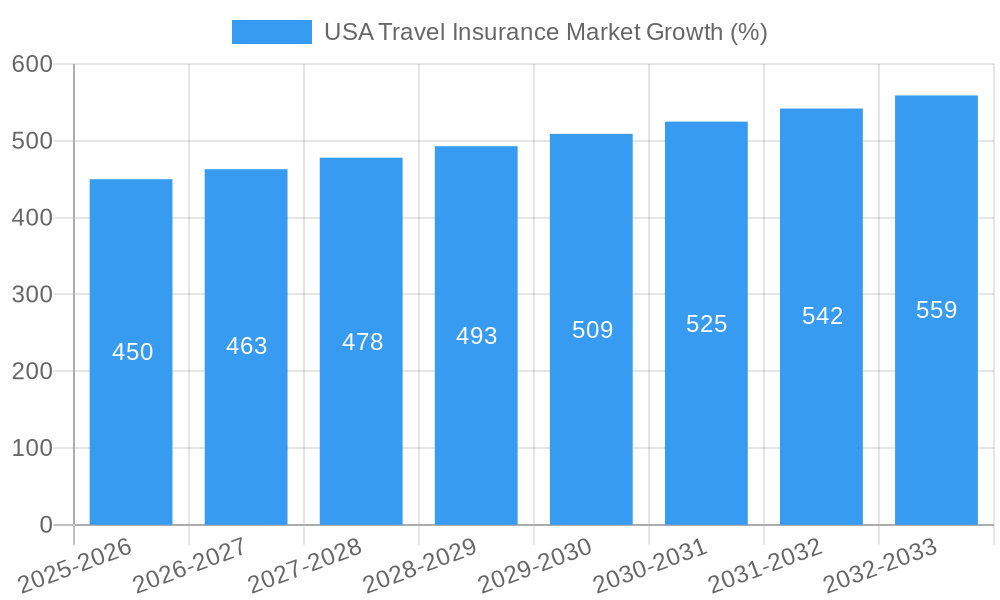

The USA travel insurance market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.00%, presents a robust and expanding landscape. Driven by factors such as increasing international travel, rising concerns about health emergencies abroad, and the growing popularity of adventure tourism, the market is projected to experience substantial growth from 2025 to 2033. The increasing awareness of unforeseen travel disruptions, including flight cancellations, lost luggage, and medical emergencies, further fuels the demand for comprehensive travel insurance plans. This demand is met by a diverse range of providers, including established players like Seven Corners Inc, Allianz Partners, and American Express, alongside specialized travel insurance companies. Market segmentation likely exists along several lines, including trip type (leisure vs. business), coverage level (basic vs. comprehensive), and target demographic (families, individuals, seniors). The market's competitive nature necessitates continuous innovation in product offerings, pricing strategies, and customer service to maintain a competitive edge. Future growth is contingent upon factors such as economic stability, evolving travel patterns, and the overall health of the travel industry.

The historical period from 2019 to 2024 witnessed significant fluctuations influenced by global events, primarily the COVID-19 pandemic. However, with the resurgence of travel post-pandemic, the market is showing strong recovery signs. The forecast period (2025-2033) projects continued expansion, fueled by increasing disposable incomes, particularly within the millennial and Gen Z demographics who are known for their frequent travel habits. The market’s success hinges on effective communication of the value proposition of travel insurance and addressing consumer concerns about policy complexities and affordability. Competitive pricing, innovative product features tailored to specific travel needs (e.g., adventure travel insurance, family travel packages), and strong customer support are crucial for sustaining market growth and dominance. Regional variations in travel patterns and insurance regulations within the USA also influence market dynamics.

This comprehensive report provides a detailed analysis of the USA Travel Insurance Market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market.

USA Travel Insurance Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the US travel insurance market. The market is moderately concentrated, with several major players holding significant market share, but also showing considerable room for smaller niche players to operate successfully.

Market Share: While precise market share figures for individual companies are proprietary information and unavailable for public disclosure, a preliminary assessment indicates that the top five players likely command over 50% of the total market share in 2025. This estimate needs to be validated by further in-depth research and detailed company information which is not available at this time.

M&A Activity: The past five years have seen moderate M&A activity in the travel insurance sector, with deal values ranging from xx Million to xx Million. These acquisitions have primarily focused on expanding geographic reach and service offerings. Future M&A activities are likely to involve consolidation and expansion into specialized segments of the market.

Innovation Drivers: Technological advancements, particularly in digital platforms and data analytics, are significantly impacting the market. The increasing use of mobile applications for purchasing and managing policies, personalized risk assessment, and claims processing contributes to this.

Regulatory Framework: The regulatory landscape in the US travel insurance market is complex, varying by state and impacting product offerings. Compliance requirements are crucial aspects that must be considered carefully by all participants.

Product Substitutes: Other financial products, such as credit card travel insurance or bundled packages, present some level of substitution, though these often come with limitations compared to dedicated travel insurance policies. End-user demand will vary for each.

USA Travel Insurance Market Industry Trends & Insights

The US travel insurance market exhibits consistent growth driven by several key factors. The increasing popularity of international travel and domestic leisure trips fuels demand for comprehensive coverage. The rising middle class and a growing preference for experiential travel also play a significant role. Consumer preferences are shifting towards personalized and digital-first experiences.

CAGR: The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). The historic CAGR (2019-2024) sits at xx%.

Market Penetration: Market penetration remains relatively low compared to other developed nations, suggesting significant growth potential. The exact figure is not publicly available but it can be expected to increase over the forecast period.

Competitive Dynamics: The market is characterized by both intense competition and opportunities for differentiation. Companies are increasingly focusing on developing niche products and services, such as adventure travel insurance or specialized coverage for specific medical conditions.

Technological Disruptions: The rise of Insurtech companies is changing the landscape through innovations in digital distribution, automated underwriting, and sophisticated risk modeling.

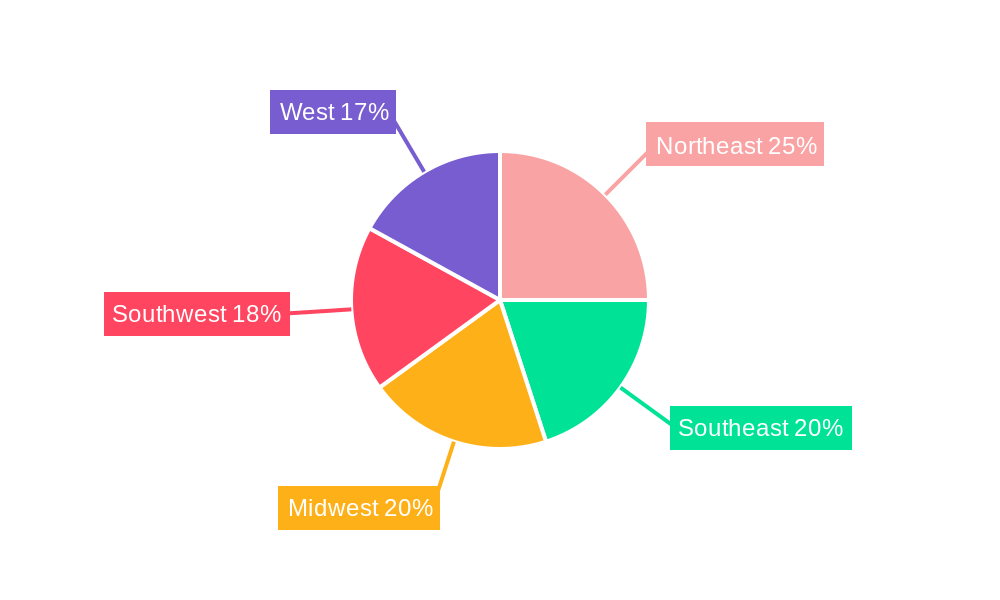

Dominant Markets & Segments in USA Travel Insurance Market

The report identifies specific key geographic regions and segments exhibiting significant market strength, which are expected to continue to grow at a high rate over the forecast period (2025-2033).

Key Drivers:

- Economic Factors: Strong economic conditions within the US drive growth because disposable income facilitates increased travel.

- Infrastructure: The availability of robust travel infrastructure in major cities and tourist destinations supports the growth of the market.

- Government Regulations: A well-regulated insurance sector builds consumer confidence and encourages wider insurance adoption.

Dominance Analysis: While precise segment dominance data is not available at this time, preliminary analysis suggests that the domestic leisure travel segment constitutes a significant portion of the overall market. Further insights regarding regional or specific segment dominance is subject to ongoing research.

USA Travel Insurance Market Product Developments

Recent years have seen a marked increase in the sophistication of travel insurance products. Companies are incorporating enhanced features and customizing offerings based on the specific needs and preferences of travelers. This includes the integration of technological solutions, allowing for digital interaction with policies and quick claims handling. This reflects a response to market demand for improved convenience and personalized service.

Report Scope & Segmentation Analysis

This report segments the USA Travel Insurance Market based on various parameters to provide a granular understanding of market dynamics. Specific details on the exact market sizes for each segment are unavailable for public disclosure. However, the forecast and analysis presented in the report would benefit from the addition of such specific data.

Key Drivers of USA Travel Insurance Market Growth

Several factors contribute to the growth of the USA Travel Insurance Market. The rising disposable incomes and increased spending on leisure activities create opportunities for the market. The growing trend of international and domestic travel fuels demand for insurance solutions. Lastly, the enhancement of insurance technologies contributes to customer acquisition and improved efficiency.

Challenges in the USA Travel Insurance Market Sector

The US travel insurance market faces challenges, including evolving customer expectations, increased competition, and regulatory complexities. Fluctuations in the global economy and unforeseen events like pandemics can dramatically impact travel patterns and insurance claims, causing market volatility. Addressing these challenges requires strategic adaptation and innovative solutions.

Emerging Opportunities in USA Travel Insurance Market

Emerging opportunities within the market are linked to technological innovation. The increasing adoption of Insurtech solutions opens up opportunities for developing new and improved products and services. The rise of personalized insurance products based on individual risk profiles represents a significant growth avenue. Further market research would confirm this.

Leading Players in the USA Travel Insurance Market Market

- Seven Corners Inc

- Travel Safe Insurance

- American International Group Inc

- Allianz Partners SAS

- USI Insurance Services LLC

- MH Ross Travel Insurance Services Inc

- Travel Insured International

- Travelex Insurance Services Inc

- Berkshire Hathaway Travel Protection

- American Express Company

Key Developments in USA Travel Insurance Market Industry

May 2022: International Medical Group (IMG) launched iTravelInsured Essential, a cost-effective travel insurance product. This launch signifies a response to the need for affordable yet reliable travel protection, shaping the competitive landscape.

April 2022: USI Affinity introduced Road Trip Insure, a new travel protection plan, emphasizing tailored offerings for specific travel needs, enhancing product diversity.

Strategic Outlook for USA Travel Insurance Market Market

The future of the USA Travel Insurance Market appears promising. Continued growth is anticipated, driven by sustained consumer demand and technological advancements. Strategic partnerships, product innovation, and effective risk management will be crucial for companies to succeed in this evolving landscape. Opportunities abound for specialized insurance, personalized coverage, and utilization of technological enhancements.

USA Travel Insurance Market Segmentation

-

1. Insurance Coverage

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Intermediaries

- 2.2. Insurance Companies

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Others

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Business Travelers

- 3.3. Family Travelers

- 3.4. Others (Education Travelers, etc)

USA Travel Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Travel Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Focus on Travel Safety and Insurance is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Intermediaries

- 5.2.2. Insurance Companies

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Business Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others (Education Travelers, etc)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6. North America USA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-trip Travel Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Insurance Intermediaries

- 6.2.2. Insurance Companies

- 6.2.3. Banks

- 6.2.4. Insurance Brokers

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Senior Citizens

- 6.3.2. Business Travelers

- 6.3.3. Family Travelers

- 6.3.4. Others (Education Travelers, etc)

- 6.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 7. South America USA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-trip Travel Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Insurance Intermediaries

- 7.2.2. Insurance Companies

- 7.2.3. Banks

- 7.2.4. Insurance Brokers

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Senior Citizens

- 7.3.2. Business Travelers

- 7.3.3. Family Travelers

- 7.3.4. Others (Education Travelers, etc)

- 7.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 8. Europe USA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-trip Travel Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Insurance Intermediaries

- 8.2.2. Insurance Companies

- 8.2.3. Banks

- 8.2.4. Insurance Brokers

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Senior Citizens

- 8.3.2. Business Travelers

- 8.3.3. Family Travelers

- 8.3.4. Others (Education Travelers, etc)

- 8.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 9. Middle East & Africa USA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-trip Travel Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Insurance Intermediaries

- 9.2.2. Insurance Companies

- 9.2.3. Banks

- 9.2.4. Insurance Brokers

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Senior Citizens

- 9.3.2. Business Travelers

- 9.3.3. Family Travelers

- 9.3.4. Others (Education Travelers, etc)

- 9.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 10. Asia Pacific USA Travel Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-trip Travel Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Insurance Intermediaries

- 10.2.2. Insurance Companies

- 10.2.3. Banks

- 10.2.4. Insurance Brokers

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Senior Citizens

- 10.3.2. Business Travelers

- 10.3.3. Family Travelers

- 10.3.4. Others (Education Travelers, etc)

- 10.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Seven Corners Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Travel Safe Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 American International Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allianz Partners Sas

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 USI Insurance Services LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MH Ross Travel Insurance Services Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Travel Insured International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Travelex Insurance Services Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berkshire Hathaway Travel Protection

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 American Express Company**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Seven Corners Inc

List of Figures

- Figure 1: Global USA Travel Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America USA Travel Insurance Market Revenue (Million), by Insurance Coverage 2024 & 2032

- Figure 3: North America USA Travel Insurance Market Revenue Share (%), by Insurance Coverage 2024 & 2032

- Figure 4: North America USA Travel Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America USA Travel Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America USA Travel Insurance Market Revenue (Million), by End-User 2024 & 2032

- Figure 7: North America USA Travel Insurance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 8: North America USA Travel Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America USA Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America USA Travel Insurance Market Revenue (Million), by Insurance Coverage 2024 & 2032

- Figure 11: South America USA Travel Insurance Market Revenue Share (%), by Insurance Coverage 2024 & 2032

- Figure 12: South America USA Travel Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America USA Travel Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America USA Travel Insurance Market Revenue (Million), by End-User 2024 & 2032

- Figure 15: South America USA Travel Insurance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 16: South America USA Travel Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 17: South America USA Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe USA Travel Insurance Market Revenue (Million), by Insurance Coverage 2024 & 2032

- Figure 19: Europe USA Travel Insurance Market Revenue Share (%), by Insurance Coverage 2024 & 2032

- Figure 20: Europe USA Travel Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe USA Travel Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe USA Travel Insurance Market Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe USA Travel Insurance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe USA Travel Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe USA Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa USA Travel Insurance Market Revenue (Million), by Insurance Coverage 2024 & 2032

- Figure 27: Middle East & Africa USA Travel Insurance Market Revenue Share (%), by Insurance Coverage 2024 & 2032

- Figure 28: Middle East & Africa USA Travel Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Middle East & Africa USA Travel Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Middle East & Africa USA Travel Insurance Market Revenue (Million), by End-User 2024 & 2032

- Figure 31: Middle East & Africa USA Travel Insurance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Middle East & Africa USA Travel Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa USA Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific USA Travel Insurance Market Revenue (Million), by Insurance Coverage 2024 & 2032

- Figure 35: Asia Pacific USA Travel Insurance Market Revenue Share (%), by Insurance Coverage 2024 & 2032

- Figure 36: Asia Pacific USA Travel Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 37: Asia Pacific USA Travel Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 38: Asia Pacific USA Travel Insurance Market Revenue (Million), by End-User 2024 & 2032

- Figure 39: Asia Pacific USA Travel Insurance Market Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Asia Pacific USA Travel Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific USA Travel Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global USA Travel Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global USA Travel Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 3: Global USA Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global USA Travel Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Global USA Travel Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global USA Travel Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 7: Global USA Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Global USA Travel Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 9: Global USA Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global USA Travel Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 14: Global USA Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global USA Travel Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Global USA Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global USA Travel Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 21: Global USA Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Global USA Travel Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 23: Global USA Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global USA Travel Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 34: Global USA Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global USA Travel Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Global USA Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global USA Travel Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 44: Global USA Travel Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 45: Global USA Travel Insurance Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 46: Global USA Travel Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific USA Travel Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Travel Insurance Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the USA Travel Insurance Market?

Key companies in the market include Seven Corners Inc, Travel Safe Insurance, American International Group Inc, Allianz Partners Sas, USI Insurance Services LLC, MH Ross Travel Insurance Services Inc, Travel Insured International, Travelex Insurance Services Inc, Berkshire Hathaway Travel Protection, American Express Company**List Not Exhaustive.

3. What are the main segments of the USA Travel Insurance Market?

The market segments include Insurance Coverage, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Focus on Travel Safety and Insurance is Driving the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, the International Medical Group (IMG), a leading insurance benefits and assistance services company, introduced iTravelInsured Essential. iTravelInsured Essential is a cost-effective travel insurance product that offers the most necessary travel protection benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Travel Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Travel Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Travel Insurance Market?

To stay informed about further developments, trends, and reports in the USA Travel Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence