Key Insights

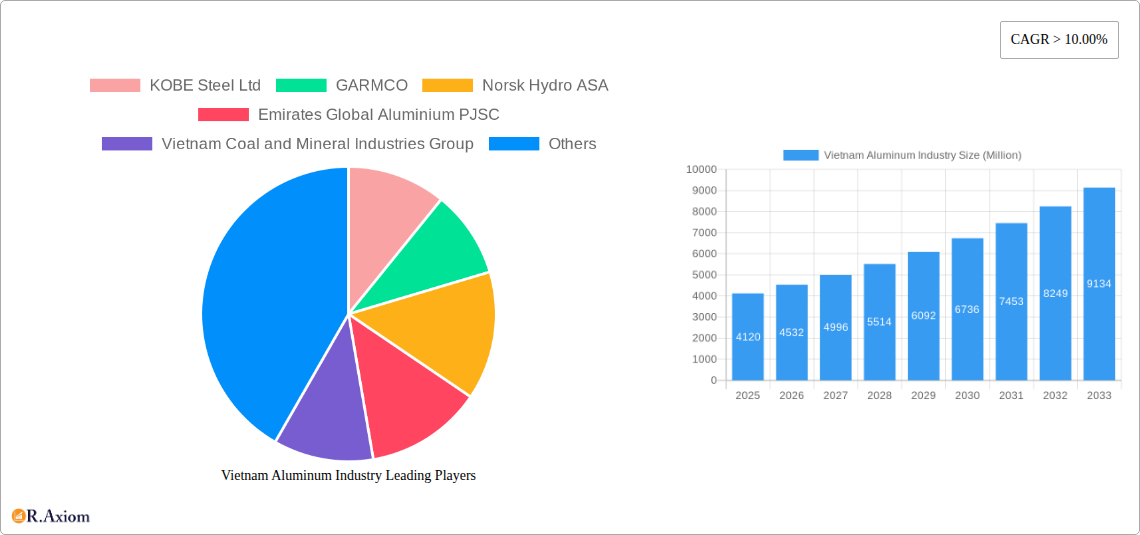

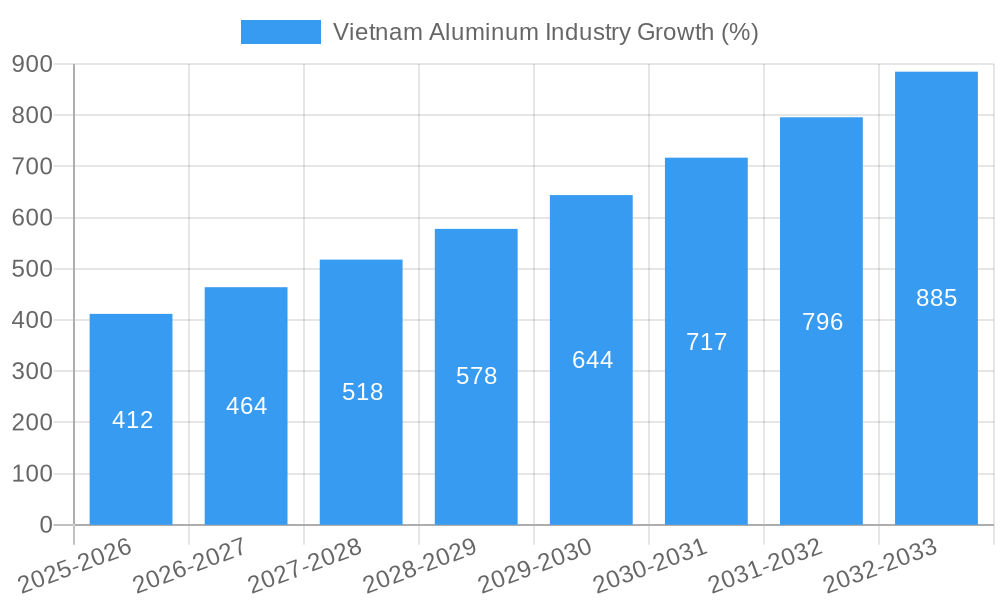

The Vietnam aluminum industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 10% from 2025 to 2033. This expansion is driven by several factors. Firstly, the nation's burgeoning construction sector, fueled by rapid urbanization and infrastructure development, is a significant consumer of aluminum products, particularly in building and construction applications. Secondly, the increasing demand for lightweight materials in the automotive and aerospace industries further boosts aluminum consumption. Vietnam's strategic location and growing manufacturing base also attract foreign investment, stimulating the aluminum industry's growth. The expanding electrical and electronics sectors, requiring advanced aluminum alloys for components, also contribute to market expansion. While challenges such as fluctuating raw material prices and global economic uncertainties exist, the long-term outlook remains positive. The diversification of end-user industries, including packaging and industrial applications, adds resilience to the market. Key players like Kobe Steel Ltd, GARMCO, and Norsk Hydro ASA are actively involved, leveraging Vietnam's potential. The dominance of specific processing types like castings, extrusions, and flat-rolled products underscores the industry's maturity and adaptability to diverse application needs.

The segmented nature of the Vietnam aluminum market offers growth opportunities for specialized players. Castings and extrusions, for instance, are likely to see significant demand growth driven by the construction and automotive sectors. The flat-rolled product segment also benefits from growth across several end-user industries. While precise market segmentation data for Vietnam isn't available, given the overall market size of $4.12 billion in 2025 and a projected CAGR exceeding 10%, a reasonable estimate would show significant contributions from each segment. The automotive and construction sectors will likely remain the largest end-users, but growth in the electronics and packaging industries is expected to boost demand for specialized aluminum products in the coming years. Continued government support for infrastructure projects and foreign direct investment will play a vital role in shaping the future trajectory of the Vietnamese aluminum market.

Vietnam Aluminum Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam aluminum industry, offering invaluable insights for stakeholders, investors, and businesses operating within this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025, this study forecasts market trends, identifies key players, and analyzes the factors driving growth and presenting challenges. The report leverages extensive data analysis to provide actionable intelligence for strategic decision-making. The total market size in 2025 is estimated at $XX Million, with a projected CAGR of XX% from 2025 to 2033.

Vietnam Aluminum Industry Market Concentration & Innovation

This section delves into the competitive landscape of the Vietnam aluminum industry, analyzing market concentration, innovation drivers, and regulatory influences. The report examines the market share held by key players such as KOBE Steel Ltd, GARMCO, Norsk Hydro ASA, Emirates Global Aluminium PJSC, Vietnam Coal and Mineral Industries Group, Rusal, Daiki Aluminium Industry Co Ltd, and Alcoa Corporation. We analyze the impact of mergers and acquisitions (M&A) activities, evaluating deal values and their influence on market structure. The analysis includes:

- Market Concentration: Assessment of market share distribution among major players, utilizing the Herfindahl-Hirschman Index (HHI) to quantify market concentration. The report will reveal if the market is fragmented or dominated by a few large players.

- Innovation Drivers: Examination of factors stimulating innovation, including technological advancements in processing techniques, the development of lightweight aluminum alloys, and the increasing demand for sustainable aluminum production.

- Regulatory Framework: Analysis of government policies, environmental regulations, and trade agreements impacting the industry’s growth and investment decisions. This includes scrutiny of import/export duties and environmental compliance standards.

- Product Substitutes: Evaluation of alternative materials (e.g., steel, plastics, composites) and their potential impact on aluminum demand. The report quantifies the market share of these substitutes and analyzes their competitive advantages and disadvantages.

- End-User Trends: Analysis of shifting demands from key end-user industries (automotive, construction, packaging, etc.), considering factors like lightweighting trends and sustainable building practices.

- M&A Activities: Detailed overview of recent mergers, acquisitions, and joint ventures within the Vietnam aluminum industry, including deal values and their strategic implications. This includes analysis of the impact on market share and competition. The estimated value of M&A deals during the historical period (2019-2024) was $XX Million.

Vietnam Aluminum Industry Industry Trends & Insights

This section provides a detailed analysis of the Vietnam aluminum market’s growth trajectory, identifying key drivers, challenges, and emerging trends. We examine market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. This analysis includes:

- Market Growth Drivers: Examination of factors like increasing infrastructure development, rising automotive production, expanding construction sector, and growing demand from the electronics industry.

- Technological Disruptions: Assessment of the impact of new technologies on aluminum production and processing, such as advancements in casting, extrusion, and forging techniques. This includes discussions around automation, additive manufacturing, and improved recycling processes.

- Consumer Preferences: Analysis of shifts in consumer demand toward lighter, stronger, and more sustainable aluminum products, influencing the development of new alloys and processing methods.

- Competitive Dynamics: Assessment of the competitive landscape, considering the strategies of major players, including pricing strategies, product differentiation, and market expansion initiatives. The report includes a detailed Competitive Analysis Matrix, comparing players based on factors like market share, product portfolio, and technological capabilities.

Dominant Markets & Segments in Vietnam Aluminum Industry

This section pinpoints the leading regions, countries, and segments within the Vietnam aluminum industry, offering a detailed analysis of their dominance.

- Dominant Processing Types: The report identifies the dominant processing type(s) based on market size and growth projections, analyzing factors driving their growth. Potential dominant segments could include Flat-rolled Products or Extrusions, given their broad application. Detailed analysis of each processing type—Castings, Extrusions, Forgings, Flat-rolled Products, Pigments and Powders—will be provided, including market size estimations for each segment.

- Dominant End-User Industries: This section identifies the leading end-user industry (e.g., Building and Construction, Automotive) based on current market share and growth potential. A detailed analysis for each end-user segment—Automotive, Aerospace and Defense, Building and Construction, Electrical and Electronics, Packaging, Industrial, Other End-user Industries (Marine, Power, and Others)—will be presented, including individual market size and projections.

Key Drivers for Dominant Segments: This section outlines the key economic policies, infrastructure projects, and technological advancements driving the growth of the dominant segments. This will include specific examples such as government initiatives supporting sustainable building practices or the expansion of domestic automotive manufacturing.

Vietnam Aluminum Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the Vietnam aluminum industry. It highlights the technological trends driving these developments and their market fit. This will cover new alloy formulations, improved surface treatments, and advancements in processing technologies that enhance product performance and reduce costs. The impact on market competitiveness will be assessed.

Report Scope & Segmentation Analysis

This report comprehensively segments the Vietnam aluminum industry by processing type (Castings, Extrusions, Forgings, Flat-rolled Products, Pigments and Powders) and end-user industry (Automotive, Aerospace and Defense, Building and Construction, Electrical and Electronics, Packaging, Industrial, Other End-user Industries). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed, providing a granular understanding of the market structure.

Key Drivers of Vietnam Aluminum Industry Growth

Several key factors propel the growth of the Vietnam aluminum industry. These include robust economic growth fueling infrastructure development and industrialization. Government incentives for sustainable manufacturing practices stimulate investment in advanced processing techniques and efficient recycling processes. Technological advancements in alloy development and production efficiency also drive growth.

Challenges in the Vietnam Aluminum Industry Sector

The Vietnam aluminum industry faces challenges including volatile raw material prices (bauxite and alumina), potential supply chain disruptions, and competition from imported aluminum products. Environmental regulations and the need for sustainable production practices present further challenges. The industry also faces increasing energy costs that impact production efficiency.

Emerging Opportunities in Vietnam Aluminum Industry

Emerging opportunities include growing demand for lightweight aluminum components in automotive and aerospace sectors. Increased investment in sustainable building practices expands the application of aluminum in construction. The growing popularity of electric vehicles fuels the demand for aluminum in batteries and electric motors. Further opportunities exist in the development of specialized aluminum alloys for niche applications.

Leading Players in the Vietnam Aluminum Industry Market

- KOBE Steel Ltd

- GARMCO

- Norsk Hydro ASA

- Emirates Global Aluminium PJSC

- Vietnam Coal and Mineral Industries Group

- Rusal

- Daiki Aluminium Industry Co Ltd

- Alcoa Corporation

Key Developments in Vietnam Aluminum Industry Industry

- 2022 Q4: Alcoa Corporation announces a new investment in a state-of-the-art aluminum recycling facility in Vietnam.

- 2023 Q1: Norsk Hydro ASA secures a major contract to supply aluminum for a large-scale infrastructure project.

- 2023 Q2: Emirates Global Aluminium PJSC partners with a Vietnamese company to establish a joint venture for aluminum extrusion. (Further key developments will be detailed in the full report).

Strategic Outlook for Vietnam Aluminum Industry Market

The Vietnam aluminum industry exhibits significant growth potential driven by a combination of factors. Continued economic growth, infrastructure development, and industrial expansion will boost aluminum demand. Technological innovations and rising consumer preference for sustainable materials will further fuel market growth. Strategic investments in new technologies and capacity expansion are likely to shape future market dynamics.

Vietnam Aluminum Industry Segmentation

-

1. Processing Type

- 1.1. Castings

- 1.2. Extrusions

- 1.3. Forgings

- 1.4. Flat-rolled Products

- 1.5. Pigments and Powders

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Building and Construction

- 2.4. Electrical and Electronics

- 2.5. Packaging

- 2.6. Industrial

- 2.7. Other En

Vietnam Aluminum Industry Segmentation By Geography

- 1. Vietnam

Vietnam Aluminum Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Substitution of Stainless Steel with Aluminum by Automotive Companies; Growing Construction and Infrastructure Activities in the Country; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Unfavorable Conditions Arising Due to the COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growth in Demand from the Building and Construction Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Aluminum Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Processing Type

- 5.1.1. Castings

- 5.1.2. Extrusions

- 5.1.3. Forgings

- 5.1.4. Flat-rolled Products

- 5.1.5. Pigments and Powders

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Building and Construction

- 5.2.4. Electrical and Electronics

- 5.2.5. Packaging

- 5.2.6. Industrial

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Processing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 KOBE Steel Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GARMCO

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Norsk Hydro ASA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emirates Global Aluminium PJSC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vietnam Coal and Mineral Industries Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rusal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daiki Aluminium Industry Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alcoa Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 KOBE Steel Ltd

List of Figures

- Figure 1: Vietnam Aluminum Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Aluminum Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Aluminum Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Aluminum Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Vietnam Aluminum Industry Revenue Million Forecast, by Processing Type 2019 & 2032

- Table 4: Vietnam Aluminum Industry Volume K Tons Forecast, by Processing Type 2019 & 2032

- Table 5: Vietnam Aluminum Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Vietnam Aluminum Industry Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 7: Vietnam Aluminum Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Aluminum Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Vietnam Aluminum Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Vietnam Aluminum Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Vietnam Aluminum Industry Revenue Million Forecast, by Processing Type 2019 & 2032

- Table 12: Vietnam Aluminum Industry Volume K Tons Forecast, by Processing Type 2019 & 2032

- Table 13: Vietnam Aluminum Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Vietnam Aluminum Industry Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 15: Vietnam Aluminum Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Vietnam Aluminum Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Aluminum Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Vietnam Aluminum Industry?

Key companies in the market include KOBE Steel Ltd, GARMCO, Norsk Hydro ASA, Emirates Global Aluminium PJSC, Vietnam Coal and Mineral Industries Group, Rusal, Daiki Aluminium Industry Co Ltd, Alcoa Corporation.

3. What are the main segments of the Vietnam Aluminum Industry?

The market segments include Processing Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Substitution of Stainless Steel with Aluminum by Automotive Companies; Growing Construction and Infrastructure Activities in the Country; Other Drivers.

6. What are the notable trends driving market growth?

Growth in Demand from the Building and Construction Industry is Driving the Market.

7. Are there any restraints impacting market growth?

Unfavorable Conditions Arising Due to the COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Aluminum Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Aluminum Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Aluminum Industry?

To stay informed about further developments, trends, and reports in the Vietnam Aluminum Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence