Key Insights

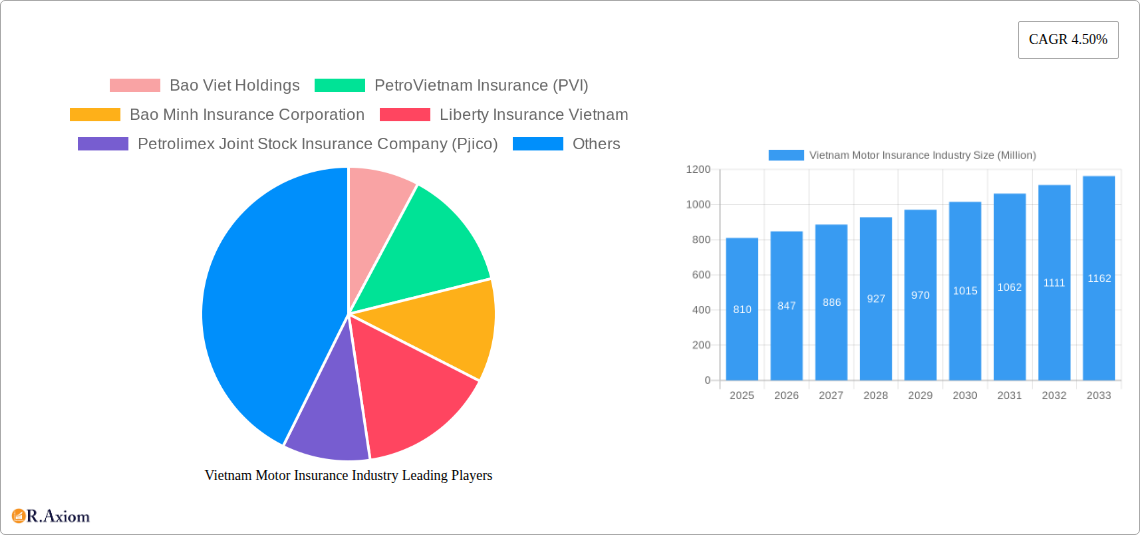

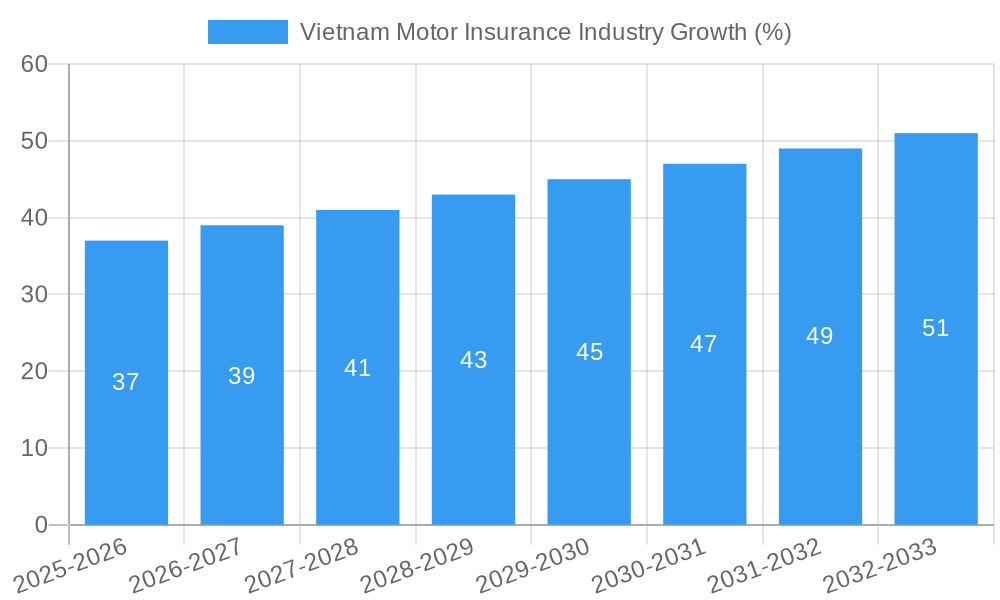

The Vietnam motor insurance market, valued at $810 million in 2025, is projected to experience robust growth, driven by a burgeoning middle class, rising vehicle ownership, and increasing awareness of insurance benefits. A compound annual growth rate (CAGR) of 4.5% from 2025 to 2033 indicates a significant expansion potential. Key drivers include government regulations mandating minimum insurance coverage, improving road infrastructure stimulating vehicle usage, and the expanding reach of insurance companies through digital platforms and partnerships. This growth is further fueled by evolving consumer preferences toward comprehensive coverage and add-on services, such as roadside assistance and accident management. However, challenges remain, including penetration rates that are lower compared to regional peers, uneven distribution of insurance products across the country, and competition from a multitude of both domestic and international players vying for market share. The increasing adoption of telematics and data analytics by insurance providers is expected to refine risk assessment and pricing strategies, contributing to market expansion. Furthermore, the government's focus on improving road safety and reducing accidents will positively impact the demand for motor insurance.

While the market is dominated by established players like Bao Viet Holdings, PetroVietnam Insurance (PVI), and Bao Minh Insurance Corporation, smaller insurers are also playing a significant role, especially in niche segments. The market is expected to consolidate slightly over the forecast period as larger insurers acquire smaller ones to increase their market share. However, the growth of digital channels and evolving consumer expectations are likely to support the emergence of innovative insurance products and services, creating a dynamic market landscape. Factors like fluctuating fuel prices and economic uncertainties could pose challenges, but the overall trajectory points towards a steadily expanding market for motor insurance in Vietnam.

This comprehensive report provides an in-depth analysis of the Vietnam motor insurance industry, covering market size, growth drivers, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report incorporates data from the historical period (2019-2024) and projects market trends up to 2033. All monetary values are expressed in Millions.

Vietnam Motor Insurance Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, substitute products, end-user trends, and mergers & acquisitions (M&A) activities within the Vietnamese motor insurance sector.

The Vietnamese motor insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Bao Viet Holdings, PetroVietnam Insurance (PVI), and Bao Minh Insurance Corporation collectively hold an estimated xx% market share in 2025. Smaller players like Liberty Insurance Vietnam, Petrolimex Joint Stock Insurance Company (Pjico), and others compete fiercely for the remaining market share. Innovation is driven by increasing customer demand for digital solutions, personalized products, and value-added services. The regulatory framework, while evolving, presents both opportunities and challenges. The emergence of Insurtech companies and the increasing adoption of telematics are key innovation drivers. Substitute products, such as self-insurance or alternative risk transfer mechanisms, are currently limited in the Vietnamese market, but their potential impact warrants further observation. End-user trends show a growing preference for digital channels, convenient payment methods, and comprehensive coverage options. M&A activity has been relatively moderate in recent years, with deal values totaling approximately xx Million in the past five years. Specific deals included [mention specific M&A deals if available with deal value; otherwise state "Specific deal details are not publicly available"].

- Market Share (2025 Estimate):

- Bao Viet Holdings: xx%

- PetroVietnam Insurance (PVI): xx%

- Bao Minh Insurance Corporation: xx%

- Others: xx%

- M&A Deal Value (2020-2024): Approximately xx Million

Vietnam Motor Insurance Industry Industry Trends & Insights

This section explores the key trends and insights shaping the Vietnamese motor insurance market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing robust growth, driven by rising vehicle ownership, increasing urbanization, and a growing middle class. The compound annual growth rate (CAGR) is projected at xx% from 2025 to 2033. Market penetration remains relatively low compared to regional peers, presenting significant untapped potential. Technological advancements, such as the adoption of telematics and AI-powered risk assessment, are disrupting traditional business models and creating new opportunities. Consumer preferences are shifting towards digital platforms, personalized services, and value-added benefits. Competitive dynamics are intense, with established players facing increasing competition from both domestic and international insurers. The market is seeing increased focus on customer experience, personalized offers, and bundled insurance products.

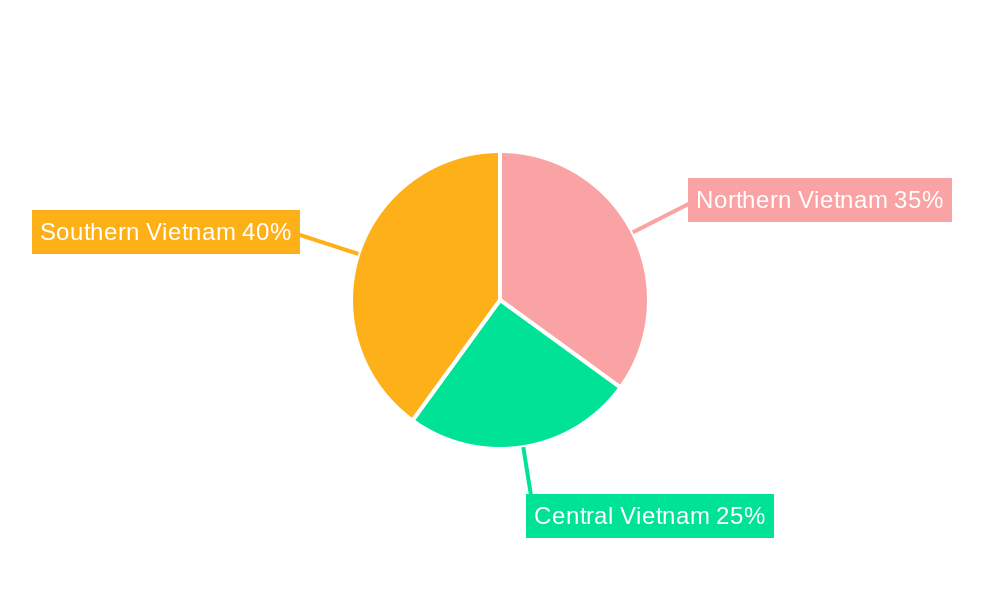

Dominant Markets & Segments in Vietnam Motor Insurance Industry

This section analyzes the dominant regions, countries, or segments within the Vietnamese motor insurance market. While data specifics are unavailable for regional dominance, the market is expected to be dominated by urban areas due to higher vehicle density and purchasing power.

- Key Drivers of Dominance:

- Rapid Urbanization: The concentration of vehicles in urban centers leads to higher demand for motor insurance.

- Economic Growth: Rising disposable incomes fuel higher spending on insurance products.

- Government Policies: Favorable government regulations supporting the insurance industry contribute to market growth. Improved infrastructure in urban areas further supports the motor insurance market.

Vietnam Motor Insurance Industry Product Developments

The Vietnamese motor insurance market is witnessing the emergence of innovative products tailored to specific customer segments and needs. Telematics-based insurance programs are gaining traction, offering personalized premiums based on driving behavior. Digital platforms are becoming increasingly prominent, offering convenient online purchase and claims processing. The integration of AI and machine learning is enhancing risk assessment and fraud detection capabilities. Product development focuses on value-added services, including roadside assistance, emergency medical services, and legal support. This ensures competitiveness and market relevance by responding to evolving consumer expectations and digital transformation within the industry.

Report Scope & Segmentation Analysis

This report segments the Vietnamese motor insurance market based on [Specify segmentation parameters, e.g., vehicle type (cars, motorcycles, commercial vehicles), insurance type (compulsory, comprehensive, third-party liability), distribution channels (online, offline), and region]. Growth projections vary across segments, reflecting different market dynamics. Competitive dynamics also differ, with some segments characterized by higher concentration and others exhibiting more fragmentation. Detailed market size and growth projections are provided for each segment in the main report.

Key Drivers of Vietnam Motor Insurance Industry Growth

Several factors are driving the growth of the Vietnam motor insurance industry. Rapid economic growth is leading to increased vehicle ownership and consequently, higher demand for insurance. The government's initiatives to promote financial inclusion and expand the insurance sector are also contributing to market expansion. Technological advancements are transforming how insurance is sold, delivered, and managed. This is further supported by favorable government policies and increased investments in infrastructure.

Challenges in the Vietnam Motor Insurance Industry Sector

The Vietnam motor insurance industry faces challenges, including a relatively low insurance penetration rate, high competition, and the need to improve insurance awareness and financial literacy among the population. Regulatory hurdles can also slow down market development. Fraudulent claims represent another significant operational challenge, impacting profitability and the sustainable growth of the sector. The relatively underdeveloped infrastructure in certain regions presents operational challenges for insurance providers.

Emerging Opportunities in Vietnam Motor Insurance Industry

The Vietnam motor insurance market presents several emerging opportunities. The expansion of digital insurance platforms provides access to under-served customers. Growth in the commercial vehicle segment offers considerable potential. Furthermore, government initiatives to improve infrastructure and promote road safety create significant opportunities to expand insurance penetration. Developments such as telematics-based insurance and other innovative products are presenting further opportunities for growth.

Leading Players in the Vietnam Motor Insurance Industry Market

- Bao Viet Holdings

- PetroVietnam Insurance (PVI)

- Bao Minh Insurance Corporation

- Liberty Insurance Vietnam

- Petrolimex Joint Stock Insurance Company (Pjico)

- AAA Assurance Corporation

- BIDV Insurance Corporation

- Fubon Insurance Company

- Phu Hung Assurance Corporation

- Samsung Vina Insurance Company

- List Not Exhaustive

Key Developments in Vietnam Motor Insurance Industry Industry

- November 2023: Vietnam joined the ASEAN Compulsory Motor Insurance Scheme (ACMI), mandating third-party liability insurance for vehicles traveling within ASEAN. This significantly impacts market dynamics by requiring greater cross-border insurance coordination and potentially increasing the market size.

- December 2023: Cathay Insurance Vietnam launched a "Dual Finance" initiative with SAWAD, offering bundled financial assistance and insurance, and introduced a personal injury insurance scheme, diversifying its product offerings and expanding its customer base. This demonstrates the innovation in product design and bundled insurance products.

Strategic Outlook for Vietnam Motor Insurance Industry Market

The Vietnam motor insurance market is poised for substantial growth over the forecast period, driven by factors like increasing vehicle ownership, economic development, and supportive government policies. Opportunities exist in expanding insurance penetration, especially in underserved areas, through digital channels and innovative product offerings. Focusing on customer experience, leveraging technological advancements, and effective risk management will be crucial for success in this dynamic and competitive market.

Vietnam Motor Insurance Industry Segmentation

-

1. Policy Type

- 1.1. Compulsory Third-Party Liability Insurance (CTPL)

- 1.2. Comprehensive Insurance

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Banks

- 3.4. Online

- 3.5. Other Distribution Channels

Vietnam Motor Insurance Industry Segmentation By Geography

- 1. Vietnam

Vietnam Motor Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government

- 3.3. Market Restrains

- 3.3.1. Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government

- 3.4. Market Trends

- 3.4.1. Surge in Vehicle Ownership Generating Major Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Motor Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Compulsory Third-Party Liability Insurance (CTPL)

- 5.1.2. Comprehensive Insurance

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Banks

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bao Viet Holdings

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PetroVietnam Insurance (PVI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bao Minh Insurance Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Liberty Insurance Vietnam

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrolimex Joint Stock Insurance Company (Pjico)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AAA Assurance Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BIDV Insurance Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fubon Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Phu Hung Assurance Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Vina Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bao Viet Holdings

List of Figures

- Figure 1: Vietnam Motor Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Motor Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Motor Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Motor Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Vietnam Motor Insurance Industry Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 4: Vietnam Motor Insurance Industry Volume Billion Forecast, by Policy Type 2019 & 2032

- Table 5: Vietnam Motor Insurance Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Vietnam Motor Insurance Industry Volume Billion Forecast, by Vehicle Type 2019 & 2032

- Table 7: Vietnam Motor Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Vietnam Motor Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Vietnam Motor Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Vietnam Motor Insurance Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Vietnam Motor Insurance Industry Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 12: Vietnam Motor Insurance Industry Volume Billion Forecast, by Policy Type 2019 & 2032

- Table 13: Vietnam Motor Insurance Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Vietnam Motor Insurance Industry Volume Billion Forecast, by Vehicle Type 2019 & 2032

- Table 15: Vietnam Motor Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Vietnam Motor Insurance Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: Vietnam Motor Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Vietnam Motor Insurance Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Motor Insurance Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Vietnam Motor Insurance Industry?

Key companies in the market include Bao Viet Holdings, PetroVietnam Insurance (PVI), Bao Minh Insurance Corporation, Liberty Insurance Vietnam, Petrolimex Joint Stock Insurance Company (Pjico), AAA Assurance Corporation, BIDV Insurance Corporation, Fubon Insurance Company, Phu Hung Assurance Corporation, Samsung Vina Insurance Company**List Not Exhaustive.

3. What are the main segments of the Vietnam Motor Insurance Industry?

The market segments include Policy Type, Vehicle Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government.

6. What are the notable trends driving market growth?

Surge in Vehicle Ownership Generating Major Demand in the Market.

7. Are there any restraints impacting market growth?

Increasing Vehicle Ownership; Mandatory Motor Insurance Rules by Government.

8. Can you provide examples of recent developments in the market?

December 2023: Cathay Insurance Vietnam joined hands with SAWAD to unveil an all-inclusive "Dual Finance" initiative. This program empowers customers to seek financial assistance while securing mandatory insurance coverage seamlessly. To cater to its clientele's diverse needs, Cathay has set to roll out a personal injury insurance scheme in December, complementing its existing financial support and automobile insurance offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Motor Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Motor Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Motor Insurance Industry?

To stay informed about further developments, trends, and reports in the Vietnam Motor Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence