Key Insights

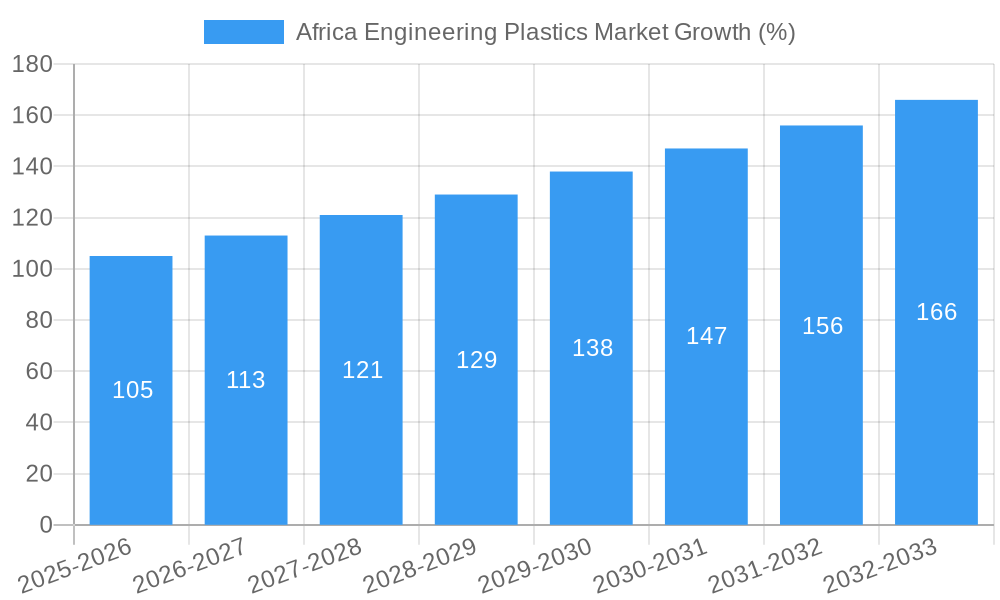

The Africa Engineering Plastics Market is experiencing robust growth, driven by the continent's expanding infrastructure development, automotive industry evolution, and increasing demand for durable consumer goods. The market's Compound Annual Growth Rate (CAGR) is estimated to be around 7% during the forecast period (2025-2033), reaching a market size of approximately $3 billion by 2033. This growth is fueled by several key factors. Firstly, substantial investments in infrastructure projects across various African nations are creating significant demand for high-performance engineering plastics in construction, transportation, and energy sectors. Secondly, the burgeoning automotive industry, particularly the growth in vehicle manufacturing and assembly plants, is significantly contributing to the rising demand for lightweight yet strong plastics in vehicle components. Finally, the expanding middle class is driving consumption of durable goods such as electronics and appliances, further boosting market growth.

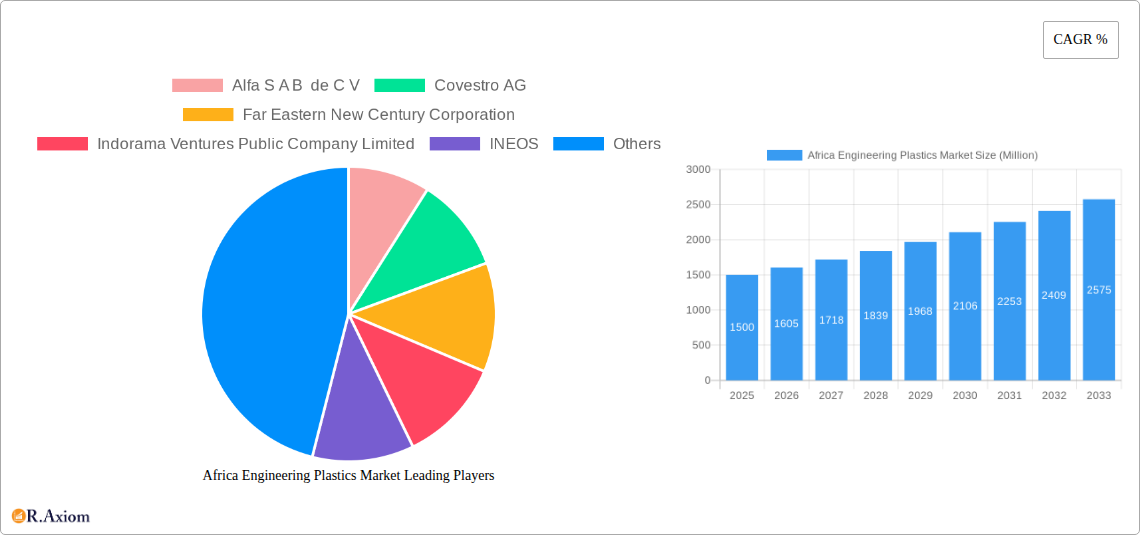

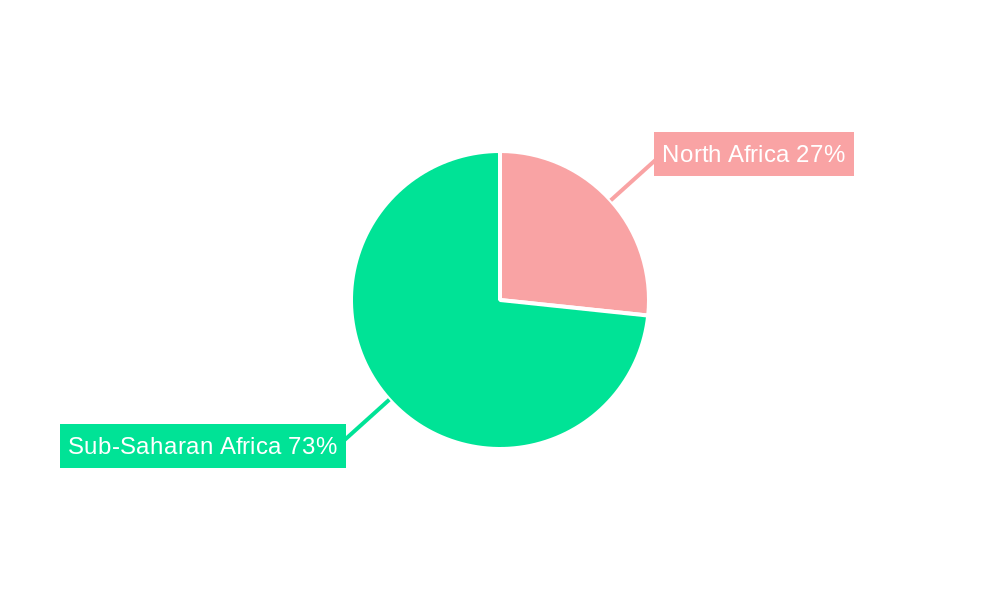

However, challenges remain. Fluctuations in raw material prices, particularly oil-based feedstocks, can impact production costs and profitability. Furthermore, the lack of advanced manufacturing facilities and skilled labor in some African regions poses a constraint on production capacity. Despite these restraints, the long-term outlook for the Africa Engineering Plastics Market remains positive. The market is segmented by material type (e.g., polyethylene, polypropylene, PVC), application (e.g., automotive, construction, packaging), and region (e.g., North Africa, Sub-Saharan Africa). Key players operating in the market include Alfa S A B de C V, Covestro AG, Far Eastern New Century Corporation, Indorama Ventures, INEOS, JBF Industries Ltd, Reliance Industries Limited, Röhm GmbH, SABIC, and Safripol. Strategic partnerships, investments in local manufacturing capabilities, and focus on sustainable and recycled materials are key strategies companies are adopting to capitalize on the market's growth potential.

Africa Engineering Plastics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Engineering Plastics Market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The report leverages extensive primary and secondary research to deliver actionable intelligence, empowering informed strategic decision-making.

Africa Engineering Plastics Market Market Concentration & Innovation

The Africa Engineering Plastics Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Precise market share figures for each company are unavailable at this time (xx%). However, companies like SABIC, INEOS, and Covestro AG are key players, driving innovation and shaping market trends. Innovation is fuelled by the demand for lightweight, high-performance materials in various applications. Regulatory frameworks, while evolving, are generally supportive of sustainable practices within the industry. The market witnesses continuous product substitution as new materials with improved properties emerge. End-user trends are largely influenced by increasing infrastructure development and industrialization across the continent. M&A activity has been moderate in recent years, with deal values averaging xx Million.

- Key Innovation Drivers: Demand for lightweight materials, stringent regulatory compliance, sustainability concerns.

- Major Players: SABIC, INEOS, Covestro AG, and others.

- M&A Activity: Moderate, with deal values averaging xx Million in recent years.

- Regulatory Landscape: Evolving, generally supportive of sustainable practices.

Africa Engineering Plastics Market Industry Trends & Insights

The Africa Engineering Plastics Market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by expanding industrialization, urbanization, and rising demand from key sectors like automotive, packaging, and construction. Technological advancements, such as the development of bio-based plastics and high-performance polymers, are further fueling market expansion. Consumer preferences are shifting towards sustainable and environmentally friendly materials, creating opportunities for manufacturers offering eco-conscious solutions. The competitive landscape is dynamic, with companies focusing on product differentiation, innovation, and strategic partnerships to gain a competitive edge. Market penetration in specific sectors, like automotive, is expected to increase significantly in coming years, reaching xx% by 2033.

Dominant Markets & Segments in Africa Engineering Plastics Market

The South African market currently holds a dominant position within the Africa Engineering Plastics Market, driven by its advanced industrial base and robust economic activity. Other key markets include Nigeria, Egypt, and Kenya, demonstrating significant growth potential.

- South Africa: Advanced infrastructure, robust industrial sector, established supply chains.

- Nigeria: Growing industrialization, expanding automotive sector, large population.

- Egypt: Investment in infrastructure projects, expanding manufacturing sector.

- Kenya: Growing middle class, increasing demand for consumer goods.

Africa Engineering Plastics Market Product Developments

Recent product developments showcase a trend towards sustainable and high-performance materials. INEOS's introduction of its sustainable Novodur range and Covestro AG's Makrolon 3638 polycarbonate for healthcare applications demonstrate the focus on both environmental responsibility and specialized functionalities. These innovations cater to growing demand across various industry segments.

Report Scope & Segmentation Analysis

This report segments the Africa Engineering Plastics Market by product type (e.g., polyethylene, polypropylene, PVC), application (e.g., automotive, packaging, construction), and geography. Each segment presents unique growth prospects, with differing market sizes and competitive intensities. Growth projections vary significantly across segments, reflecting the varying levels of industrial development and economic activity in different regions.

- By Product Type: Growth projections vary, with xx% CAGR for polyethylene and xx% for polypropylene.

- By Application: Automotive and packaging segments are expected to see the highest growth.

- By Geography: South Africa, Nigeria, and Egypt will continue to dominate.

Key Drivers of Africa Engineering Plastics Market Growth

Several key factors drive the growth of the Africa Engineering Plastics Market. The surge in infrastructure development across the continent is a significant driver. Continued industrialization and urbanization boost demand for engineering plastics in various applications. Furthermore, growing automotive production and a rising middle class with increased consumer spending are key contributors to market growth.

Challenges in the Africa Engineering Plastics Market Sector

The Africa Engineering Plastics Market faces several challenges, including fluctuating raw material prices and supply chain complexities. Infrastructure limitations in certain regions pose logistical hurdles. Furthermore, competition from cheaper, imported materials represents a significant challenge. These factors impact profitability and market access for local players.

Emerging Opportunities in Africa Engineering Plastics Market

The market presents several promising opportunities. The growing demand for sustainable and recyclable plastics creates space for eco-friendly product development. The expansion of the automotive industry in several African countries presents a significant opportunity for growth. Furthermore, exploring new applications in the renewable energy sector holds immense potential.

Leading Players in the Africa Engineering Plastics Market Market

- Alfa S A B de C V

- Covestro AG

- Far Eastern New Century Corporation

- Indorama Ventures Public Company Limited

- INEOS

- JBF Industries Ltd

- Reliance Industries Limited

- Röhm GmbH

- SABIC

- Safripol division of KAP Diversified Industrial (Pty) Lt

Key Developments in Africa Engineering Plastics Market Industry

- August 2022: INEOS launched a sustainable Novodur range, significantly reducing the product carbon footprint. This demonstrates the rising importance of sustainability.

- August 2022: INEOS expanded its Novodur line with Novodur E3TZ, targeting applications like food trays and suitcases, showcasing product diversification.

- February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare applications, highlighting the growth in specialized material demand.

Strategic Outlook for Africa Engineering Plastics Market Market

The Africa Engineering Plastics Market holds significant growth potential, driven by sustained industrialization and infrastructural development across the continent. Strategic investments in sustainable solutions and focus on specific high-growth sectors will be crucial for success. The market's future trajectory hinges on addressing supply chain challenges and capitalizing on the increasing demand for high-performance and eco-friendly materials.

Africa Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Africa Engineering Plastics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Alfa S A B de C V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Covestro AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Far Eastern New Century Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indorama Ventures Public Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 INEOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JBF Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reliance Industries Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Röhm GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SABIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Safripol division of KAP Diversified Industrial (Pty) Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Alfa S A B de C V

List of Figures

- Figure 1: Africa Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Africa Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Africa Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Africa Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 7: Africa Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Nigeria Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Africa Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Ethiopia Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Morocco Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Ghana Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Algeria Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ivory Coast Africa Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Engineering Plastics Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Africa Engineering Plastics Market?

Key companies in the market include Alfa S A B de C V, Covestro AG, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, INEOS, JBF Industries Ltd, Reliance Industries Limited, Röhm GmbH, SABIC, Safripol division of KAP Diversified Industrial (Pty) Lt.

3. What are the main segments of the Africa Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.August 2022: INEOS announced the introduction of an extension to its high-performance Novodur line of specialty ABS products. The new Novodur E3TZ is an extrusion grade that is suitable for a variety of applications, including food trays, sanitary applications, and suitcases.August 2022: INEOS announced the introduction of a comprehensive range of sustainable solutions for its specialty ABS product group Novodur addressing applications in a range of industries, including automotive, electronics, and household. The individual grades come with a significant product carbon footprint (PCF) saving of up to -71% as compared to the respective non-ECO product reference.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Africa Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence