Key Insights

The African Satellite-based Earth Observation market is experiencing robust growth, projected to reach $71.15 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.78% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government investments in infrastructure development and initiatives focused on sustainable agriculture, urban planning, and resource management are fueling demand for high-resolution satellite imagery and geospatial analytics. Secondly, the rising adoption of value-added services, such as data processing, analysis, and customized solutions tailored to specific industry needs, is significantly contributing to market growth. The availability of various satellite orbits (Low Earth Orbit, Medium Earth Orbit, and Geostationary Orbit) provides diverse data acquisition capabilities, catering to a wide range of applications across different sectors. Key end-user segments, including agriculture, urban development, climate services, and energy, are major contributors to market demand, leveraging satellite data for improved efficiency, resource optimization, and informed decision-making. While challenges such as the high cost of satellite data and limited technological infrastructure in some regions exist, the overall market outlook remains optimistic due to ongoing technological advancements and increased private sector investment.

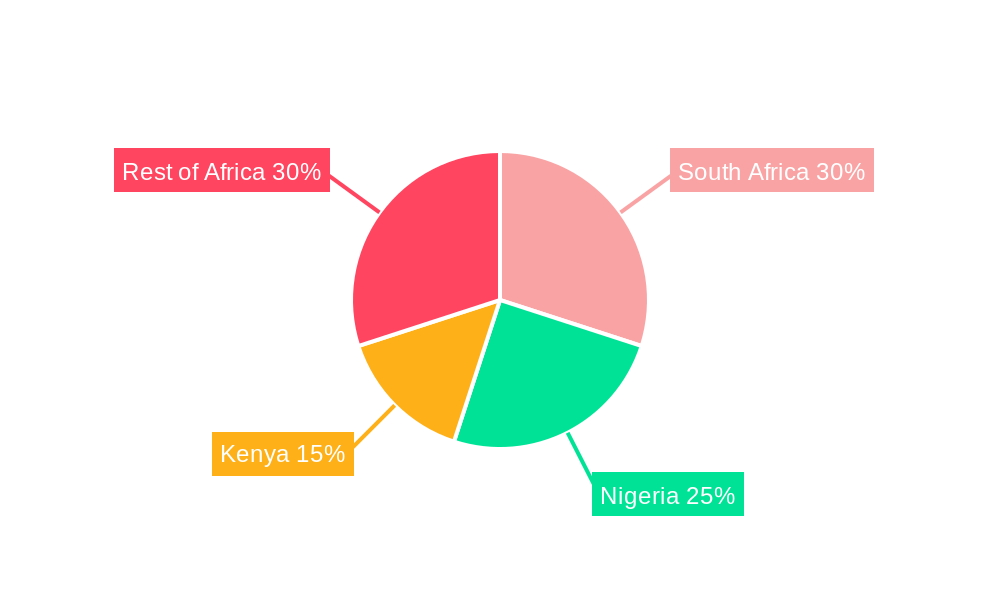

The market's segmentation reveals valuable insights. South Africa, Nigeria, and Kenya represent the largest national markets, reflecting their relatively advanced technological infrastructure and economic activity. Earth Observation data itself constitutes a major market segment, with value-added services rapidly gaining traction as businesses and governments seek comprehensive, actionable intelligence. The dominance of Low Earth Orbit (LEO) satellites suggests a preference for high-resolution imagery crucial for detailed analysis in diverse applications. Further growth will be fuelled by collaborations between government agencies like the Kenya Space Agency (KSA), Ethiopian Space Science and Technology Institute (ESSTI), and South African National Space Agency (SANSA), and private sector companies like EOSDA and eHealth Africa, who are pushing for the development of innovative applications and expanding data accessibility. The expansion into the Rest of Africa region holds significant potential, particularly as more countries invest in space technology and digital infrastructure.

This detailed report provides a comprehensive analysis of the Africa Satellite-based Earth Observation market, offering actionable insights for industry stakeholders. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. This report is meticulously researched and provides in-depth data and analysis without the need for any further modification.

Africa Satellite-based Earth Observation Market Market Concentration & Innovation

The African satellite-based Earth Observation (EO) market exhibits a moderately concentrated landscape, with a few dominant players alongside a growing number of smaller, specialized firms. Market share is largely influenced by the capabilities and reach of satellite operators, data processing expertise, and the strength of partnerships with government agencies and end-users. While precise market share figures for individual companies are unavailable (xx%), major players like Airbus and SANSA hold significant influence due to their established infrastructure and technological advancements. Smaller players like eHealth Africa and GeoApps Plus specialize in niche applications, often focusing on specific sectors or geographic regions.

Innovation Drivers:

- Technological advancements: Improvements in satellite technology (higher resolution, improved sensors, faster data transmission) are crucial drivers.

- Growing demand for data-driven solutions: Across various sectors, there's increasing reliance on EO data for informed decision-making.

- Government initiatives: Several African nations are actively investing in their space programs, creating opportunities for growth.

- Rise of cloud computing: Enhanced data storage, processing, and accessibility through cloud platforms are fostering innovation.

Regulatory Frameworks: Harmonization of regulations across African countries is crucial for market expansion. Currently, regulations vary significantly, potentially hindering cross-border data sharing and collaboration.

Product Substitutes: While there are no direct substitutes for the unique capabilities of satellite-based EO, alternative data sources like drones and aerial photography pose some competition, particularly for localized applications.

End-User Trends: The demand for EO data and services is growing significantly across sectors like agriculture, urban planning, and resource management. This growth is driven by increasing awareness of the value of geospatial intelligence and the need for sustainable development.

M&A Activities: While specific M&A deal values are not publicly available for this market (xx Million), the industry witnesses periodic mergers and acquisitions, primarily involving smaller companies being acquired by larger players or partnerships forming to access complementary technologies or expand market reach.

Africa Satellite-based Earth Observation Market Industry Trends & Insights

The African satellite-based Earth Observation market is experiencing robust growth, driven by several key factors. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, fueled by increased government investment in space technology, rising demand across various sectors, and technological advancements in satellite imagery and data analytics. Market penetration remains relatively low, leaving substantial room for future growth, particularly in areas with limited access to traditional data collection methods.

Technological disruptions, such as the increasing availability of high-resolution imagery from constellations of small satellites and advancements in artificial intelligence (AI) for data processing and analysis, are significantly impacting market dynamics. Consumer preferences are shifting towards tailored solutions, with demand growing for specialized data products and value-added services like data analysis, modeling, and predictive analytics.

The competitive landscape is characterized by a mix of international players with established infrastructure and expertise and local companies specializing in niche applications or regional markets. This dynamic environment fosters innovation and promotes collaboration between companies across the value chain, driving the overall market growth.

Dominant Markets & Segments in Africa Satellite-based Earth Observation Market

Dominant Regions/Countries:

- South Africa: South Africa holds a leading position due to its advanced space infrastructure, skilled workforce, and strong government support for the sector. Key drivers include robust economic policies fostering technological development, well-established research institutions, and a relatively developed infrastructure supporting data processing and analysis.

- Nigeria: Nigeria's expanding economy and significant investment in space technology are driving market growth. The establishment of GEO-Nigeria further enhances the potential for increased market activity.

- Kenya: Kenya also demonstrates significant potential owing to its focus on utilizing EO for agricultural development and environmental monitoring.

Dominant Segments:

- By Type: Value-added services are a rapidly growing segment as users increasingly need more than raw EO data; they seek processed insights and tailored analytics.

- By Satellite Orbit: Low Earth Orbit (LEO) satellites are the dominant segment due to their high-resolution capabilities, but the use of GEO and MEO satellites is growing for specific applications.

- By End-user: Agriculture is currently a significant driver of demand due to the potential of EO data for precision farming, crop monitoring, and yield prediction. Urban development is another quickly expanding area of application, given the need for data on urban sprawl, infrastructure planning, and disaster management.

Other Factors Driving Dominance:

- Economic growth: Rapid economic growth in several African countries is driving demand for infrastructure development, resource management, and environmental monitoring.

- Government initiatives: Governments across the continent are increasingly investing in space technology and actively promoting the use of EO data for sustainable development.

- Investment in infrastructure: Improvements in digital infrastructure, such as broadband connectivity and cloud computing, are essential for supporting the growth of the EO market.

Africa Satellite-based Earth Observation Market Product Developments

Recent product innovations focus on delivering higher-resolution imagery, improved data processing algorithms, and cloud-based platforms for easier access to data and services. Technological trends such as AI and machine learning are enhancing data analysis capabilities, providing users with valuable insights for decision-making. The market's focus is shifting from raw data provision to offering integrated, value-added solutions specifically addressing the needs of diverse industries. These solutions emphasize data accessibility and user-friendliness.

Report Scope & Segmentation Analysis

This report segments the African satellite-based Earth Observation market across several key parameters:

By Country: South Africa, Nigeria, Kenya, and Others (including countries like Ethiopia, Senegal, and others with developing space programs). Growth projections vary by country based on their economic development, investment in space technology, and regulatory environment.

By Type: Earth Observation Data (raw satellite imagery and related data) and Value-Added Services (data processing, analysis, modeling, and tailored solutions). The Value-Added Services segment is projected to show higher growth due to increasing demand for actionable insights.

By Satellite Orbit: Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). LEO is the dominant segment but MEO and GEO are finding applications in specific areas needing continuous monitoring.

By End-user: Urban Development and Cultural Heritage, Agriculture, Climate Services, Energy and Raw Materials, Infrastructure, and Others. Agriculture and Urban Development are major sectors driving growth, followed by increasing demand from the energy and infrastructure sectors.

Key Drivers of Africa Satellite-based Earth Observation Market Growth

The growth of the African satellite-based Earth Observation market is driven by several factors. Technological advancements, especially in satellite technology and data analytics, are leading to higher-resolution imagery and more sophisticated processing capabilities. This, combined with expanding internet penetration and increasing government investments in space programs across several nations, creates a favorable environment. Further driving growth is the increasing demand for data-driven decision-making across various sectors, from agriculture to urban planning, driven by the need for efficient resource management and sustainable development. This demand is pushing innovation in the development of affordable, accessible, and user-friendly EO data solutions and services.

Challenges in the Africa Satellite-based Earth Observation Market Sector

The African satellite-based Earth Observation market faces several challenges. These include limited access to advanced technologies and expertise in some regions, hindering the wider adoption of EO solutions. Varying regulatory frameworks across different countries can complicate data sharing and hinder cross-border collaboration. Furthermore, high initial investment costs for satellite technology and data processing infrastructure, as well as dependence on global supply chains for certain components, present potential barriers to entry for some players. Finally, the need to build strong partnerships and collaborations across industries and governments remains a crucial challenge to accelerate market growth.

Emerging Opportunities in Africa Satellite-based Earth Observation Market

The African satellite-based Earth Observation market presents significant opportunities. There's a rising demand for customized solutions, offering tailored data processing, analysis, and interpretation services across various end-user sectors. The increasing adoption of AI and machine learning in EO data analytics is creating new possibilities for generating actionable insights. Moreover, the emergence of new satellite constellations, providing more frequent and higher-resolution imagery, will further enhance the market's capabilities. In the long term, the growth of micro-satellites, alongside advancements in data processing and cloud computing technologies, provides significant scope for innovation and expansion.

Leading Players in the Africa Satellite-based Earth Observation Market Market

- eHealth Africa

- EOSDA (EOS Data Analytics)

- Kenya Space Agency (KSA)

- Ethiopian Space Science and Technology Institute (ESSTI)

- Astrofica

- NASRDA (National Space Research and Development Agency)

- GeoApps Plus

- Airbus

- SANSA (South African National Space Agency)

Key Developments in Africa Satellite-based Earth Observation Market Industry

- May 2023: Nigeria's entry into the Group on Earth Observations (GEO), following South Africa, signifies enhanced data accessibility and international collaboration, significantly boosting the market's potential for growth. This will facilitate broader partnerships and collaborations, particularly through the National Space Research and Development Agency (NASRDA).

- February 2022: The strengthened collaborations between Digital Earth Africa and five key organizations across the continent—AFRIGIST (Nigeria), AGRHYMET Regional Centre (Niger), RCMRD (Kenya), CSE (Senegal), and OSS (Tunisia)—represent a significant boost for the sector, focusing on infrastructure, capacity building, and improved country-level involvement. This consolidation will be crucial for Digital Earth Africa's transition to African operations.

Strategic Outlook for Africa Satellite-based Earth Observation Market Market

The African satellite-based Earth Observation market is poised for substantial growth, driven by increasing demand for data-driven solutions across various sectors, coupled with ongoing technological advancements and government support. The market's expansion will be influenced by continued investments in space infrastructure, data analytics capabilities, and the development of user-friendly platforms. Further collaborations and partnerships across the industry will be key to unlocking the full potential of the market. The strategic focus should be on providing cost-effective and accessible EO solutions tailored to specific user needs and addressing the challenges associated with data availability, processing, and interpretation.

Africa Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-user

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

Africa Satellite-based Earth Observation Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Investments; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Budget Constraints and Technological Limitations

- 3.4. Market Trends

- 3.4.1. Government initiatives and investments is analyzed to drive the market during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 eHealth Africa

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 EOSDA (EOS Data Analytics)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kenya Space Agency(KSA)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ethiopian Space Science and Technology Institute (ESSTI)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Astrofica

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NASRDA (National Space Research and Development Agency)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GeoApps Plus

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Airbus*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SANSA (South African National Space Agency)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 eHealth Africa

List of Figures

- Figure 1: Africa Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Satellite-based Earth Observation Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 4: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 15: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 16: Africa Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Satellite-based Earth Observation Market?

The projected CAGR is approximately 7.78%.

2. Which companies are prominent players in the Africa Satellite-based Earth Observation Market?

Key companies in the market include eHealth Africa, EOSDA (EOS Data Analytics), Kenya Space Agency(KSA), Ethiopian Space Science and Technology Institute (ESSTI), Astrofica, NASRDA (National Space Research and Development Agency), GeoApps Plus, Airbus*List Not Exhaustive, SANSA (South African National Space Agency).

3. What are the main segments of the Africa Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Investments; Technological Advancements.

6. What are the notable trends driving market growth?

Government initiatives and investments is analyzed to drive the market during the forecast period.

7. Are there any restraints impacting market growth?

Budget Constraints and Technological Limitations.

8. Can you provide examples of recent developments in the market?

May 2023: To enhance access to data and information, Nigeria joined South Africa as the second nation on the continent to join the Group on Earth Observations (GEO) GEO-Nigeria. Nigeria is represented internationally through the National Space Research and Development Agency (NASRDA). The organization is an intergovernmental cooperation that increases the accessibility, usability, and availability of Earth Observations data for a sustainable planet. It will offer all interested parties a national intergovernmental platform for partnerships and collaborations and take the lead in NASRDA activities, emphasizing EO initiatives and missions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the Africa Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence