Key Insights

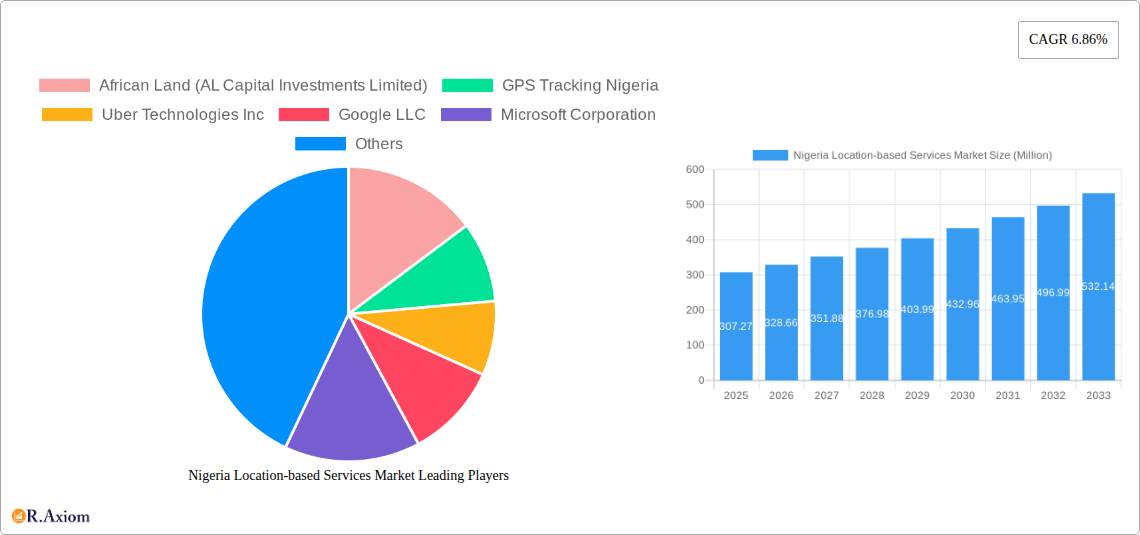

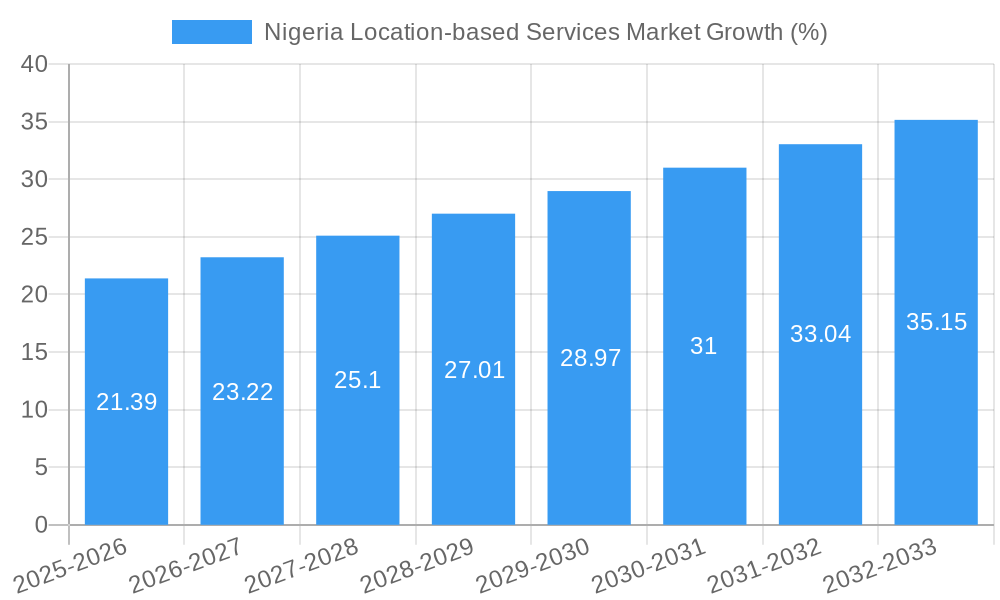

The Nigeria location-based services (LBS) market, valued at $307.27 million in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising adoption of navigation apps, and the expanding e-commerce sector. The market's Compound Annual Growth Rate (CAGR) of 6.86% from 2025 to 2033 signifies substantial potential. Key growth drivers include the burgeoning logistics and transportation industries requiring efficient route optimization and delivery tracking, the increasing demand for location-aware advertising and marketing strategies by businesses, and government initiatives promoting digitalization and smart city development. The market is segmented by service type (professional vs. managed), end-user industry (transportation, manufacturing, retail, automotive, healthcare, others), and location (indoor vs. outdoor). Competition is intensifying with both international tech giants like Google, Apple, and Uber, and local players such as African Land Capital Investments Limited and GPS Tracking Nigeria vying for market share. The professional services segment, benefiting from specialized expertise in mapping and location intelligence, is expected to show significant growth. Similarly, the transportation and logistics sector, a significant user of LBS for fleet management and delivery optimization, will continue driving market expansion. Challenges include infrastructure limitations affecting GPS accuracy in certain areas, data privacy concerns, and the need for wider digital literacy among the population.

The forecast period (2025-2033) will likely see a shift towards more sophisticated LBS applications such as augmented reality (AR) and virtual reality (VR) integration, and the increased use of location data for personalized services and urban planning. The growing adoption of IoT devices and the increasing availability of high-speed internet are further expected to fuel market expansion. While the outdoor segment currently dominates, the rising popularity of indoor navigation and location-aware services within malls and buildings suggests significant growth potential for this segment as well. The market's future success will hinge on overcoming infrastructure gaps, fostering public trust regarding data security, and promoting the integration of LBS into various aspects of daily life and business operations within Nigeria.

Nigeria Location-based Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nigeria Location-based Services Market, offering invaluable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period from 2019 to 2033, with a focus on the year 2025 as the base and estimated year. The study period encompasses the historical period (2019-2024), and the forecast period (2025-2033). The report utilizes a combination of quantitative data and qualitative analysis to deliver actionable intelligence.

Nigeria Location-based Services Market Market Concentration & Innovation

The Nigerian location-based services market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. While precise market share figures for each company require further detailed research (xx%), key players like Uber Technologies Inc, Google LLC, and Microsoft Corporation are driving significant innovation through continuous product development and strategic partnerships. African Land (AL Capital Investments Limited), GPS Tracking Nigeria, Huawei Technologies Co Ltd, Auto Tracker Nigeria, HERE Technologies (HERE Global B V), Apple Inc, and GapMaps Pty Ltd also contribute meaningfully to the market.

Market concentration is influenced by several factors:

- Technological advancements: Continuous improvements in GPS technology, mapping capabilities, and data analytics are lowering barriers to entry for new players but simultaneously favoring established companies with access to advanced resources.

- Regulatory frameworks: Government regulations concerning data privacy, security, and the use of location data affect market concentration. A robust and clear regulatory environment could stimulate more competition, while restrictive regulations could reinforce the positions of existing players.

- Product substitutes: Alternative methods for navigation and location-based services, such as traditional maps or reliance on personal knowledge, act as indirect substitutes. The extent to which these substitutes compete depends on the specific application and user needs.

- End-user trends: The growing adoption of smartphones and increased reliance on mobile applications for navigation, information access, and service delivery contribute to market expansion and shape competitive dynamics.

- M&A activities: Although specific M&A deal values in the Nigerian location-based services sector are not readily available (xx Million), merger and acquisition activity could potentially increase market concentration. Strategic acquisitions of smaller firms by larger players could lead to market consolidation.

Nigeria Location-based Services Market Industry Trends & Insights

The Nigerian location-based services market is experiencing robust growth, driven by factors like rising smartphone penetration, increasing internet connectivity, and a burgeoning digital economy. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at xx%. Market penetration is also steadily increasing, with a larger proportion of the population using location-based services for various purposes including navigation, ride-hailing, delivery services, and finding local businesses.

Technological disruptions are significantly shaping market dynamics. The adoption of 5G technology, for instance, is paving the way for faster data transmission speeds and more efficient location-based applications. Artificial Intelligence (AI) and machine learning are also playing key roles in enhancing the accuracy and functionality of location services. Consumer preferences increasingly favor personalized and context-aware location-based experiences, pushing companies to innovate to meet these expectations. Competitive dynamics are characterized by continuous investment in research and development, strategic partnerships, and the pursuit of new market segments.

Dominant Markets & Segments in Nigeria Location-based Services Market

The Transportation and Logistics sector dominates the Nigerian location-based services market, accounting for the largest share of revenue. Outdoor location services also hold a dominant position compared to indoor location services.

Key Drivers for Dominant Segments:

- Transportation and Logistics: Rapid growth in e-commerce and delivery services, coupled with the increasing use of ride-hailing apps, fuels high demand for location-based services in this sector.

- Outdoor Location Services: The majority of location-based service applications operate outdoors, catering to navigation, logistics, and general location awareness.

Dominance Analysis:

The dominance of the Transportation and Logistics segment stems from its strong correlation with the country's growing urbanization, expansion of e-commerce platforms, and increasing reliance on mobile applications for transportation needs. The dominance of outdoor services reflects the wider applications and availability of outdoor location technology compared to indoor location-based services, which often require more specific infrastructure and technology.

Nigeria Location-based Services Market Product Developments

Recent product innovations have focused on enhancing accuracy, improving user experience, and integrating with other technologies. For instance, several providers are incorporating AI to predict traffic patterns and optimize routes. The development of high-precision indoor mapping technology is also gaining traction, opening new possibilities for applications in shopping malls, hospitals, and other indoor environments. Companies are focusing on improving user interfaces to make location-based services more intuitive and user-friendly.

Report Scope & Segmentation Analysis

This report segments the Nigerian location-based services market based on:

By Service Type:

- Professional Services: This segment comprises high-end, customized location-based solutions designed for specific business needs. The market is expected to grow at a CAGR of xx% during the forecast period. Competitive dynamics are influenced by high barriers to entry and the importance of specialized skills.

- Managed Services: This segment focuses on providing comprehensive location-based service solutions, including ongoing maintenance and support. The CAGR for this segment is projected at xx% during the forecast period. Competitive pressures are relatively high due to several providers offering similar solutions.

By End-User Industry:

- Transportation and Logistics: This sector is the largest revenue generator.

- Manufacturing: Location-based services are used for asset tracking and supply chain management.

- Retail and Consumer Goods: Location-based marketing, store locator services, and proximity-based advertising.

- Automotive: In-car navigation systems and connected car technologies.

- Healthcare: Patient tracking and emergency response systems.

- Other End-User Industries: Various other sectors use location-based services.

By Location:

- Indoor: This segment is growing as technologies improve.

- Outdoor: This is the dominant segment, with a major presence of various services.

Key Drivers of Nigeria Location-based Services Market Growth

Several factors contribute to the growth of this market, notably increasing smartphone penetration and the growth of the mobile internet, increasing government investments in infrastructure development improving digital connectivity and supporting technological innovation. The expansion of e-commerce and the rise of on-demand services also fuel demand for location-based services.

Challenges in the Nigeria Location-based Services Market Sector

Challenges include: limited infrastructure in certain areas hindering reliable service delivery, data privacy concerns, and the need to improve digital literacy among the population, impacting adoption rates. The competition within the sector also presents a significant challenge. Insufficient power supply in some regions can also be a problem.

Emerging Opportunities in Nigeria Location-based Services Market

Opportunities lie in the expanding reach of mobile technology and improving internet connectivity; development of innovative location-based applications tailored to specific Nigerian needs, such as hyperlocal services; and the potential for growth in sectors beyond transportation and logistics.

Leading Players in the Nigeria Location-based Services Market Market

- African Land (AL Capital Investments Limited)

- GPS Tracking Nigeria

- Uber Technologies Inc

- Google LLC

- Microsoft Corporation

- Huawei Technologies Co Ltd

- Auto Tracker Nigeria

- HERE Technologies (HERE Global B V)

- Apple Inc

- GapMaps Pty Ltd

Key Developments in Nigeria Location-based Services Market Industry

- July 2023: The Lagos State government commended Uber for its new in-trip emergency app feature, signaling support for the e-hailing industry's growth. This positive regulatory engagement demonstrates a supportive environment for location-based service providers.

- February 2023: NAMA's collaboration with NIGCOMSAT to enhance Nigeria's satellite-based navigation system (SBAS) signifies a commitment to improving airspace safety and navigational accuracy, boosting the reliability of location-based technologies in aviation and other sectors.

Strategic Outlook for Nigeria Location-based Services Market Market

The Nigerian location-based services market holds significant future potential, driven by continued technological advancements, expanding internet penetration, and a growing digital economy. Investment in infrastructure and improvements in digital literacy will play critical roles in realizing this potential. The market's growth will likely be fueled by increased adoption across various sectors and the development of innovative, hyperlocal services that meet the unique needs of the Nigerian market.

Nigeria Location-based Services Market Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Service Type

- 2.1. Professional

- 2.2. Managed

-

3. End-User Industry

- 3.1. Transportation and Logistics

- 3.2. Manufacturing

- 3.3. Retail and Consumer Goods

- 3.4. Automotive

- 3.5. Healthcare

- 3.6. Other End-User Industries

Nigeria Location-based Services Market Segmentation By Geography

- 1. Niger

Nigeria Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce and On-demand Delivery Services in the Country; Rapid Increase in Smartphone Adoption

- 3.3. Market Restrains

- 3.3.1. Concerns about Data Privacy and Security; Limited Access to high-speed internet in Some Regions

- 3.4. Market Trends

- 3.4.1. Rapid Increase in Smartphone Adoption to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Professional

- 5.2.2. Managed

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Transportation and Logistics

- 5.3.2. Manufacturing

- 5.3.3. Retail and Consumer Goods

- 5.3.4. Automotive

- 5.3.5. Healthcare

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 African Land (AL Capital Investments Limited)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GPS Tracking Nigeria

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uber Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Auto Tracker Nigeri

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HERE Technologies (HERE Global B V)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GapMaps Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 African Land (AL Capital Investments Limited)

List of Figures

- Figure 1: Nigeria Location-based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Nigeria Location-based Services Market Share (%) by Company 2024

List of Tables

- Table 1: Nigeria Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Nigeria Location-based Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Nigeria Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: Nigeria Location-based Services Market Volume K Unit Forecast, by Location 2019 & 2032

- Table 5: Nigeria Location-based Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: Nigeria Location-based Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 7: Nigeria Location-based Services Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Nigeria Location-based Services Market Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 9: Nigeria Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Nigeria Location-based Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Nigeria Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Nigeria Location-based Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Nigeria Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: Nigeria Location-based Services Market Volume K Unit Forecast, by Location 2019 & 2032

- Table 15: Nigeria Location-based Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 16: Nigeria Location-based Services Market Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 17: Nigeria Location-based Services Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 18: Nigeria Location-based Services Market Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 19: Nigeria Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Nigeria Location-based Services Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Location-based Services Market?

The projected CAGR is approximately 6.86%.

2. Which companies are prominent players in the Nigeria Location-based Services Market?

Key companies in the market include African Land (AL Capital Investments Limited), GPS Tracking Nigeria, Uber Technologies Inc, Google LLC, Microsoft Corporation, Huawei Technologies Co Ltd, Auto Tracker Nigeri, HERE Technologies (HERE Global B V), Apple Inc, GapMaps Pty Ltd.

3. What are the main segments of the Nigeria Location-based Services Market?

The market segments include Location, Service Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce and On-demand Delivery Services in the Country; Rapid Increase in Smartphone Adoption.

6. What are the notable trends driving market growth?

Rapid Increase in Smartphone Adoption to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Concerns about Data Privacy and Security; Limited Access to high-speed internet in Some Regions.

8. Can you provide examples of recent developments in the market?

July 2023: The Lagos State government commended Uber for introducing an in-trip emergency app help option for both drivers and passengers in the e-hailing industry. Speaking at the launch of Uber's new safety features in Lagos, Mr. Lanre Mojola, the Director General of the Lagos State Safety Commission, affirmed the commitment of Governor Babajide Sanwo-Olu's administration to foster an enabling environment for the e-hailing industry's growth in line with the THEMES agenda.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Location-based Services Market?

To stay informed about further developments, trends, and reports in the Nigeria Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence