Key Insights

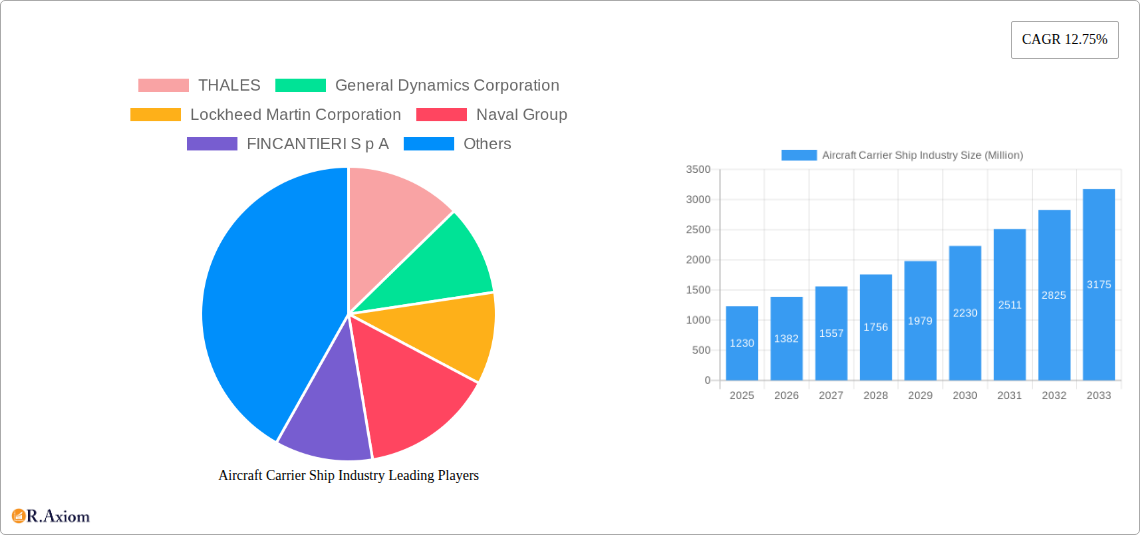

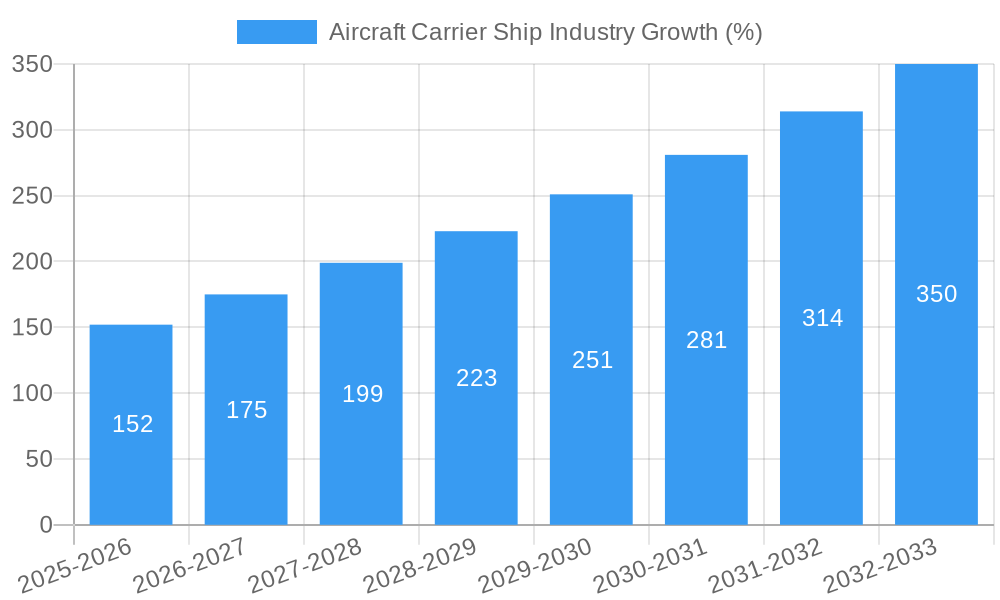

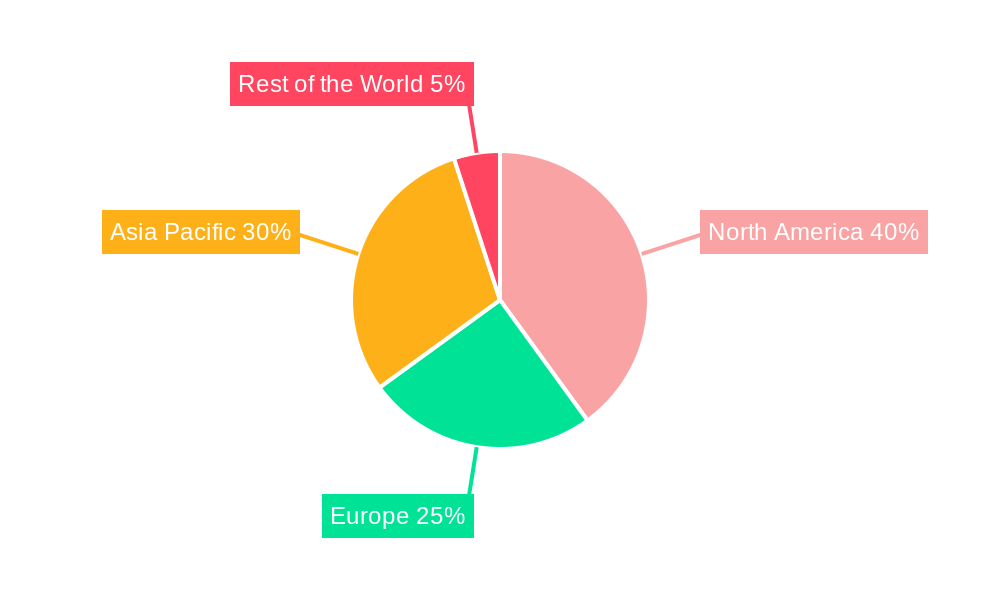

The global aircraft carrier ship market, valued at $1.23 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions and the increasing need for naval power projection among major global players. A compound annual growth rate (CAGR) of 12.75% from 2025 to 2033 suggests a significant expansion of this market to approximately $4.2 billion by 2033. Key drivers include modernization and expansion of existing naval fleets, technological advancements in propulsion systems (nuclear and conventional), and the integration of advanced aircraft and weapon systems. The market is segmented by ship type (Amphibious Assault Ship, Helicopter Carrier, Fleet Carrier), propulsion technology (Conventional, Nuclear), and launch/recovery configuration (CATOBAR, STOBAR, STOVL). Competition is fierce, with major players like Thales, General Dynamics, Lockheed Martin, and Naval Group vying for market share through innovation and strategic partnerships. While potential restraints include high initial investment costs and the complexities of designing and constructing these sophisticated vessels, the long-term strategic importance of aircraft carriers is likely to outweigh these challenges, ensuring continued market expansion. The Asia-Pacific region, particularly countries like India, China, and Japan, is expected to exhibit significant growth due to increased defense spending and naval modernization initiatives. North America, fueled by the US Navy's ongoing modernization programs, will also remain a key market. The market's future trajectory is strongly linked to global defense budgets and international relations.

Technological advancements are fundamentally shaping the market's evolution. The shift towards more advanced launch and recovery systems, such as Electromagnetic Aircraft Launch Systems (EMALS), coupled with the integration of unmanned aerial vehicles (UAVs) and improved command and control systems, is driving demand for technologically superior vessels. The development of next-generation nuclear propulsion systems also plays a crucial role in enhancing operational capabilities and range, further contributing to market growth. Different vessel configurations cater to specific strategic needs, influencing regional demand patterns. For example, STOVL carriers are favored by nations seeking more versatile platforms, while CATOBAR carriers provide optimal launch capacity for heavier aircraft. Understanding these regional variations and technological trends is vital for navigating this dynamic and high-value market.

Aircraft Carrier Ship Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Aircraft Carrier Ship industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a complete view of this dynamic sector. The report leverages extensive primary and secondary research to provide actionable insights for industry stakeholders, including manufacturers, suppliers, government agencies, and investors.

Aircraft Carrier Ship Industry Market Concentration & Innovation

The Aircraft Carrier Ship industry exhibits a high degree of market concentration, with a handful of major players dominating global production and sales. These companies, including THALES, General Dynamics Corporation, Lockheed Martin Corporation, Naval Group, FINCANTIERI S p A, NAVANTIA S A, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, and HUNTINGTON INGALLS INDUSTRIES INC, collectively hold an estimated xx% market share in 2025. Market share distribution varies significantly across different segments (e.g., nuclear-powered carriers vs. conventionally powered carriers) and geographic regions.

Innovation in the industry is driven by the need for enhanced capabilities, improved operational efficiency, and technological advancements in propulsion systems, aircraft launch and recovery systems (CATOBAR, STOBAR, STOVL), and onboard weapon systems. Stringent regulatory frameworks, particularly concerning environmental regulations and safety standards, impact both design and manufacturing. The lack of readily available substitutes for aircraft carriers further contributes to the high market concentration. End-user preferences, primarily driven by national defense strategies and geopolitical considerations, strongly influence technological development and investment decisions.

Mergers and acquisitions (M&A) play a significant role in shaping the industry landscape. Over the period 2019-2024, the total value of M&A deals in the sector reached approximately $xx Million. These transactions are primarily aimed at expanding production capacity, enhancing technological capabilities, and securing access to new markets.

- Key Market Players: THALES, General Dynamics Corporation, Lockheed Martin Corporation, Naval Group, FINCANTIERI S p A, NAVANTIA S A, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, HUNTINGTON INGALLS INDUSTRIES INC

- Key Innovation Drivers: Advanced propulsion systems, improved launch and recovery systems, integrated combat systems, automation & AI.

- Regulatory Influence: Environmental regulations (emissions, waste disposal), safety standards (operational safety, crew protection).

- M&A Activity: Consolidation amongst key players to enhance competitiveness and market share.

Aircraft Carrier Ship Industry Industry Trends & Insights

The Aircraft Carrier Ship industry is characterized by a relatively slow but steady growth trajectory, influenced by various factors. The global market size is projected to reach $xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by increased defense spending by major global powers, coupled with the continuous modernization and replacement of aging fleets. Technological advancements, such as the adoption of electromagnetic aircraft launch systems (EMALS), are transforming operational capabilities and influencing procurement decisions.

Consumer preferences, represented primarily by the needs of national navies, are leaning towards increased operational flexibility, improved survivability, and enhanced information warfare capabilities. Competitive dynamics are marked by intense rivalry amongst major players, vying for contracts through technological differentiation and cost optimization. Market penetration of new technologies, like EMALS, is gradual due to the high capital investment and long procurement cycles involved. The industry is also witnessing the emergence of new technologies, such as advanced materials and unmanned systems, offering opportunities for future growth.

Dominant Markets & Segments in Aircraft Carrier Ship Industry

The dominant market for aircraft carriers is currently North America, followed by Asia-Pacific. The US Navy, with its sizable fleet of Nimitz-class and Ford-class carriers, significantly contributes to this dominance. China's increasing naval capabilities and its recent launch of the Fujian, its third aircraft carrier, suggest growing influence within the Asia-Pacific region.

- Type: Fleet carriers currently represent the largest segment, followed by amphibious assault ships and helicopter carriers. The market share for each segment is estimated to be: Fleet Carriers (xx%), Amphibious Assault Ships (xx%), Helicopter Carriers (xx%). Nuclear-powered carriers maintain a strong position due to their extended operational range and endurance.

- Technology: Nuclear-powered carriers command a premium segment due to their superior operational capabilities, but the conventionally powered segment remains sizable due to lower acquisition and operational costs. Market share: Nuclear Powered (xx%), Conventional Powered (xx%).

- Configuration: CATOBAR configurations are predominant in larger, fleet carriers, while STOBAR and STOVL are more prevalent in smaller carriers and amphibious assault ships. The market is distributed as follows: CATOBAR (xx%), STOBAR (xx%), STOVL (xx%).

Key Drivers of Dominance:

- Economic Policies: High defense budgets in major nations significantly fuel demand.

- Geopolitical Factors: Regional conflicts and power dynamics shape procurement priorities.

- Technological Advancements: The continuous improvement in carrier design and capabilities ensures market growth.

Aircraft Carrier Ship Industry Product Developments

Recent product innovations center around increased automation, improved stealth capabilities, and the integration of advanced sensor and weapon systems. Electromagnetic aircraft launch systems (EMALS) offer significant advantages in terms of launch efficiency and aircraft life extension. These advancements significantly enhance operational effectiveness and broaden the application range of aircraft carriers in various operational scenarios. The integration of unmanned systems also represents a key competitive advantage.

Report Scope & Segmentation Analysis

This report segments the aircraft carrier market by type (Amphibious Assault Ship, Helicopter Carrier, Fleet Carrier), technology (Conventional Powered, Nuclear Powered), and configuration (CATOBAR, STOBAR, STOVL). Each segment is analyzed based on its market size, growth projections, and competitive dynamics. Growth projections vary across segments, with nuclear-powered fleet carriers expected to maintain a premium position but face competition from advancements in conventionally powered and STOVL designs. Competitive dynamics are shaped by the varying technological and operational capabilities offered by each segment.

Key Drivers of Aircraft Carrier Ship Industry Growth

Several factors drive growth in the aircraft carrier ship industry, including rising global defense spending, geopolitical tensions driving naval modernization, technological advancements improving operational efficiency and capabilities (e.g., EMALS), and the need for power projection in various strategic regions. Government procurement programs and investments in new technologies represent significant growth catalysts.

Challenges in the Aircraft Carrier Ship Industry Sector

The industry faces significant challenges including the high cost of developing and maintaining aircraft carriers, the complexity of integrating advanced technologies, lengthy procurement cycles, supply chain vulnerabilities, and fluctuating global defense budgets. These factors can impact project timelines and potentially inflate costs. The environmental impact of carrier operations also constitutes a growing concern.

Emerging Opportunities in Aircraft Carrier Ship Industry

Emerging opportunities include the development of unmanned and autonomous systems for use on carriers, advancements in propulsion technologies for greater efficiency and reduced environmental impact, and the integration of advanced cyber warfare capabilities to protect against growing cyber threats. The potential for increased international collaboration on carrier technology also represents a significant opportunity.

Leading Players in the Aircraft Carrier Ship Industry Market

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- Naval Group

- FINCANTIERI S p A

- NAVANTIA S A

- Leonardo S p A

- BAE Systems plc

- Northrop Grumman Corporation

- HUNTINGTON INGALLS INDUSTRIES INC

Key Developments in Aircraft Carrier Ship Industry Industry

- June 2022: China launched its third advanced aircraft carrier, Fujian, featuring an advanced electromagnetic catapult system. This significantly enhances China's naval capabilities and influences regional power dynamics.

- March 2023: The US Navy announced the extension of the Nimitz's maintenance availability until May 2026. This highlights the ongoing commitment to maintaining existing carrier fleets and the significant time and resources required for their upkeep.

Strategic Outlook for Aircraft Carrier Ship Industry Market

The future of the Aircraft Carrier Ship industry is promising, driven by continuous technological advancements and the evolving geopolitical landscape. The market will witness further consolidation through M&A activities, increased emphasis on collaborative international programs, and the adoption of innovative technologies like unmanned systems. The long-term outlook hinges on the balance between defense budgets, technological innovation, and global security concerns.

Aircraft Carrier Ship Industry Segmentation

-

1. Type

- 1.1. Amphibious Assault Ship

- 1.2. Helicopter Carrier

- 1.3. Fleet Carrier

-

2. Technology

- 2.1. Conventional Powered

- 2.2. Nuclear Powered

-

3. Configuration

- 3.1. Catapult

- 3.2. Short Take-off but Arrested Recovery (STOBAR)

- 3.3. Short Take-off but Vertical Recovery (STOVL)

Aircraft Carrier Ship Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Aircraft Carrier Ship Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Nuclear Powered Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Amphibious Assault Ship

- 5.1.2. Helicopter Carrier

- 5.1.3. Fleet Carrier

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Conventional Powered

- 5.2.2. Nuclear Powered

- 5.3. Market Analysis, Insights and Forecast - by Configuration

- 5.3.1. Catapult

- 5.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 5.3.3. Short Take-off but Vertical Recovery (STOVL)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Amphibious Assault Ship

- 6.1.2. Helicopter Carrier

- 6.1.3. Fleet Carrier

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Conventional Powered

- 6.2.2. Nuclear Powered

- 6.3. Market Analysis, Insights and Forecast - by Configuration

- 6.3.1. Catapult

- 6.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 6.3.3. Short Take-off but Vertical Recovery (STOVL)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Amphibious Assault Ship

- 7.1.2. Helicopter Carrier

- 7.1.3. Fleet Carrier

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Conventional Powered

- 7.2.2. Nuclear Powered

- 7.3. Market Analysis, Insights and Forecast - by Configuration

- 7.3.1. Catapult

- 7.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 7.3.3. Short Take-off but Vertical Recovery (STOVL)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Amphibious Assault Ship

- 8.1.2. Helicopter Carrier

- 8.1.3. Fleet Carrier

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Conventional Powered

- 8.2.2. Nuclear Powered

- 8.3. Market Analysis, Insights and Forecast - by Configuration

- 8.3.1. Catapult

- 8.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 8.3.3. Short Take-off but Vertical Recovery (STOVL)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Amphibious Assault Ship

- 9.1.2. Helicopter Carrier

- 9.1.3. Fleet Carrier

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Conventional Powered

- 9.2.2. Nuclear Powered

- 9.3. Market Analysis, Insights and Forecast - by Configuration

- 9.3.1. Catapult

- 9.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 9.3.3. Short Take-off but Vertical Recovery (STOVL)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Rest of Europe

- 12. Asia Pacific Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 South Korea

- 12.1.4 Japan

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 THALES

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 General Dynamics Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Lockheed Martin Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Naval Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 FINCANTIERI S p A

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 NAVANTIA S A

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Leonardo S p A

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 BAE Systems plc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Northrop Grumman Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 HUNTINGTON INGALLS INDUSTRIES INC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 THALES

List of Figures

- Figure 1: Global Aircraft Carrier Ship Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Aircraft Carrier Ship Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Aircraft Carrier Ship Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Aircraft Carrier Ship Industry Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2024 & 2032

- Figure 15: North America Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2024 & 2032

- Figure 16: North America Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Aircraft Carrier Ship Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Aircraft Carrier Ship Industry Revenue (Million), by Technology 2024 & 2032

- Figure 21: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Europe Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2024 & 2032

- Figure 23: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2024 & 2032

- Figure 24: Europe Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Technology 2024 & 2032

- Figure 29: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 30: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2024 & 2032

- Figure 31: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2024 & 2032

- Figure 32: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Technology 2024 & 2032

- Figure 37: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2024 & 2032

- Figure 39: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2024 & 2032

- Figure 40: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2019 & 2032

- Table 5: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2019 & 2032

- Table 26: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United States Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 31: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2019 & 2032

- Table 32: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Germany Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Kingdom Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: France Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Russia Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 40: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2019 & 2032

- Table 41: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: India Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: China Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 49: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2019 & 2032

- Table 50: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Carrier Ship Industry?

The projected CAGR is approximately 12.75%.

2. Which companies are prominent players in the Aircraft Carrier Ship Industry?

Key companies in the market include THALES, General Dynamics Corporation, Lockheed Martin Corporation, Naval Group, FINCANTIERI S p A, NAVANTIA S A, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, HUNTINGTON INGALLS INDUSTRIES INC.

3. What are the main segments of the Aircraft Carrier Ship Industry?

The market segments include Type, Technology, Configuration.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Nuclear Powered Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2023: The US Navy announced its plan to extend Nimitz as part of a five-and-a-half-month maintenance availability that will carry the carrier into May 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Carrier Ship Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Carrier Ship Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Carrier Ship Industry?

To stay informed about further developments, trends, and reports in the Aircraft Carrier Ship Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence