Key Insights

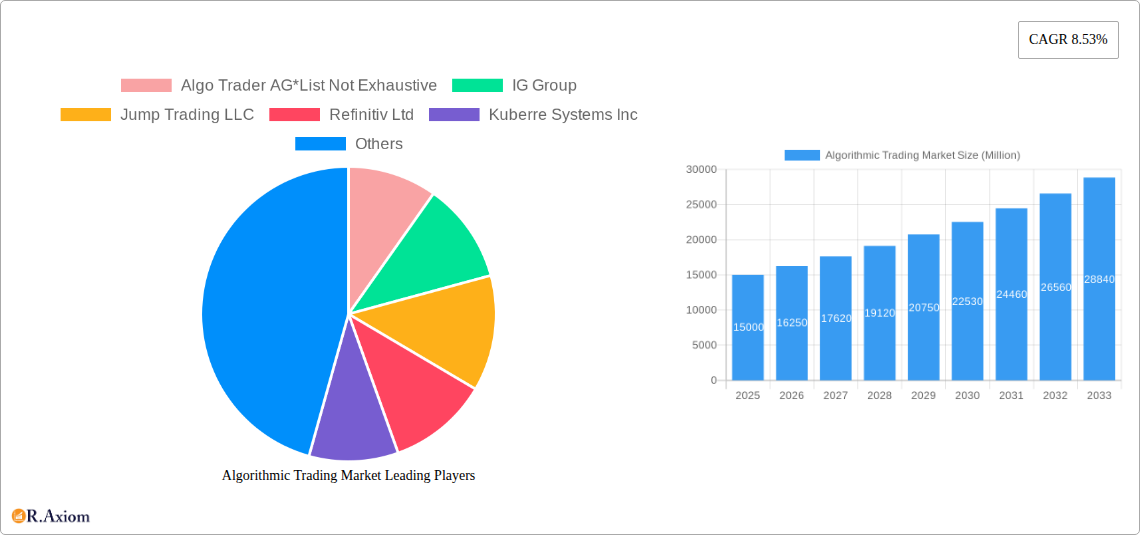

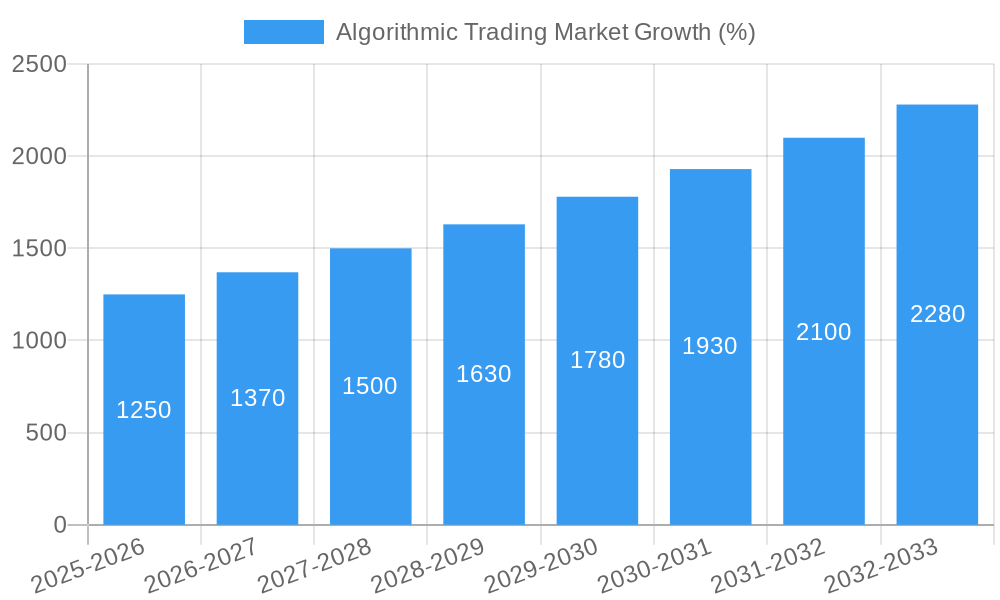

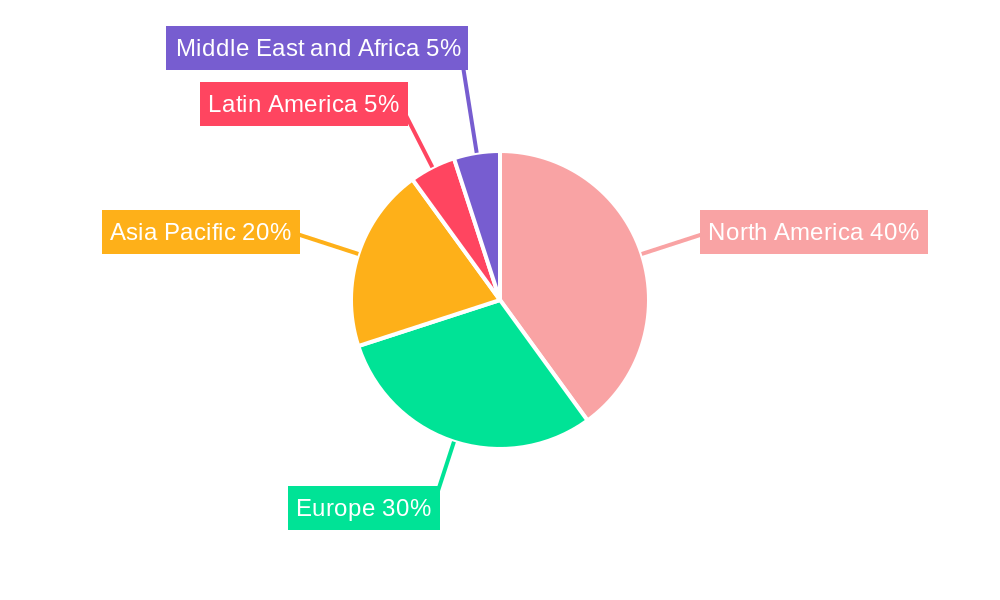

The algorithmic trading market is experiencing robust growth, driven by the increasing adoption of sophisticated trading strategies and the need for enhanced speed and efficiency in financial markets. The market's Compound Annual Growth Rate (CAGR) of 8.53% from 2019 to 2024 suggests a significant expansion, and this momentum is expected to continue through 2033. Several factors contribute to this growth. The rise of high-frequency trading (HFT) necessitates algorithmic solutions for optimal execution. Furthermore, the increasing availability of advanced analytical tools and data-driven insights empowers traders to make more informed decisions, further fueling market expansion. Institutional investors, particularly hedge funds and asset management firms, are significant drivers, leveraging algorithmic trading for portfolio optimization, risk management, and arbitrage opportunities. The market is segmented by trader type (institutional, retail, long-term, short-term), component (solutions, software, services), deployment (on-cloud, on-premise), and organization size (SMEs, large enterprises). The on-cloud deployment model is gaining traction due to its scalability and cost-effectiveness. Growth is geographically diverse, with North America and Europe holding significant market shares currently, while the Asia-Pacific region demonstrates considerable potential for future expansion due to increasing technological adoption and rising investment in financial markets. However, regulatory hurdles and cybersecurity concerns pose challenges to the market's continued growth.

The competitive landscape is characterized by a mix of established players and emerging fintech companies. Established firms like Refinitiv and Thomson Reuters offer comprehensive solutions, while newer entrants focus on specialized software and services. The market is witnessing increased competition and innovation, leading to the development of more sophisticated and user-friendly algorithmic trading platforms. This evolution is expected to further democratize access to algorithmic trading, expanding its reach beyond large institutional investors to smaller firms and even individual retail investors. The continuous development of artificial intelligence (AI) and machine learning (ML) is likely to further reshape the market, creating opportunities for advanced predictive modeling and automated trading strategies. Despite challenges, the long-term outlook for the algorithmic trading market remains positive, driven by technological advancements and the evolving needs of the financial industry. Market size estimations for the forecast period (2025-2033) would require further data, but given the 8.53% CAGR, a substantial increase is anticipated.

Algorithmic Trading Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Algorithmic Trading Market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Algorithmic Trading Market Concentration & Innovation

This section analyzes the competitive landscape of the algorithmic trading market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits a moderately concentrated structure, with a few large players holding significant market share. However, the entry of new fintech companies and the increasing adoption of open-source technologies are fostering competition.

Market Concentration:

- Top 5 players hold approximately xx% of the market share in 2025.

- Average market share of the top 10 players is approximately xx%.

Innovation Drivers:

- Advancements in artificial intelligence (AI) and machine learning (ML) are driving the development of sophisticated trading algorithms.

- The rising adoption of cloud-based solutions is improving accessibility and scalability.

- The increasing availability of alternative data sources is enhancing the predictive power of algorithms.

Regulatory Frameworks:

- Stringent regulations regarding data privacy and security are shaping the market's trajectory. Compliance costs are impacting smaller players disproportionately.

- The evolving regulatory landscape across different jurisdictions presents both challenges and opportunities.

- Increased scrutiny of algorithmic trading practices necessitates robust risk management frameworks.

Product Substitutes:

- Traditional, human-driven trading strategies pose a degree of competition, though their efficiency is often lower.

- The increasing sophistication of algorithmic trading is likely to further reduce the reliance on traditional methods.

End-User Trends:

- Institutional investors are leading the adoption of algorithmic trading, driven by the need for increased efficiency and reduced transaction costs.

- Retail investor participation is growing, spurred by the availability of user-friendly platforms and robo-advisors.

M&A Activities:

- The market has witnessed significant M&A activity in recent years, driven by the need for consolidation and access to new technologies.

- Total M&A deal value in the algorithmic trading sector reached approximately xx Million in 2024. Significant deals are expected to continue throughout the forecast period. The average deal size in 2024 was xx Million.

Algorithmic Trading Market Industry Trends & Insights

The Algorithmic Trading market is experiencing robust growth, fueled by technological advancements, evolving investor preferences, and the increasing complexity of financial markets. The market's expansion is driven by several key factors including:

- Technological Advancements: The continuous development of AI, ML, and high-frequency trading (HFT) technologies is leading to more sophisticated algorithms, capable of processing vast quantities of data and executing trades at unparalleled speeds.

- Increased Market Volatility: Periods of high market volatility often lead to increased adoption of algorithmic strategies as investors seek to mitigate risk and capitalize on market fluctuations.

- Growing Demand for Automation: Institutional and retail investors are increasingly seeking automated trading solutions to reduce operational costs, improve efficiency, and gain a competitive edge.

- Data Availability and Analytics: The proliferation of alternative data sources, coupled with advancements in data analytics, is enabling the development of more accurate and effective trading algorithms.

- Competitive Dynamics: The competitive landscape is marked by both established players and emerging fintech companies, driving innovation and efficiency. Price wars and feature improvements are anticipated to remain key competitive aspects.

The market penetration of algorithmic trading strategies is steadily increasing across various asset classes, with expectations for continued growth throughout the forecast period.

Dominant Markets & Segments in Algorithmic Trading Market

This section analyzes the dominant segments and geographies within the algorithmic trading market.

By Types of Traders:

- Institutional Investors: This segment dominates the market due to high trading volumes and the need for sophisticated risk management tools. Key drivers include: Stringent regulatory compliance requirements, the need for high-speed execution, and access to advanced analytics.

- Retail Investors: This segment is experiencing rapid growth driven by the availability of user-friendly platforms and the increasing democratization of algorithmic trading. Key drivers are ease of use, lower entry barriers, and access to educational resources.

- Long-term Traders: This segment is characterized by a focus on fundamental analysis and long-term investment strategies, using algorithms for portfolio optimization and risk management. Key drivers are long-term asset growth, passive investment strategies, and risk diversification.

- Short-term Traders: This segment, heavily reliant on technical analysis and short-term market trends, actively uses algorithms for high-frequency trading and arbitrage opportunities. Key drivers include short-term profit opportunities, high transaction volumes, and rapid order execution capabilities.

By Component:

- Solutions: This segment holds the largest market share owing to the demand for comprehensive algorithmic trading platforms.

- Software Tools: Growing adoption of specialized software tools for backtesting, strategy development, and order management fuels this segment's expansion.

- Services: This segment is driven by the demand for consulting, implementation, and support services associated with algorithmic trading systems.

By Deployment:

- On-cloud: This segment is experiencing rapid growth due to its scalability, cost-effectiveness, and accessibility.

- On-premise: This segment remains relevant for institutions with high security and regulatory requirements.

By Organization Size:

- Large Enterprises: This segment is the major adopter of algorithmic trading solutions due to the resources and expertise required.

- Small and Medium Enterprises (SMEs): This segment's growth is fueled by the availability of affordable and user-friendly algorithmic trading platforms.

Dominant Regions: North America holds the largest market share, followed by Europe and Asia Pacific. Key drivers in North America include strong financial infrastructure, high technology adoption rates, and a large pool of institutional investors. Europe's growth is driven by the increasing adoption of regulatory technology (RegTech) solutions. Asia Pacific's expansion is fueled by rapid economic growth and increasing investment in fintech.

Algorithmic Trading Market Product Developments

Recent product innovations in algorithmic trading include the development of AI-powered algorithms capable of adapting to changing market conditions in real-time, improvements in backtesting methodologies to validate strategy effectiveness, and integration of alternative data sources for enhanced predictive analytics. These advancements are enabling traders to enhance performance, manage risk more effectively, and gain a competitive edge. The market is witnessing a trend towards cloud-based, scalable platforms offering user-friendly interfaces, particularly attracting retail investors.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the algorithmic trading market by type of traders (Institutional Investors, Retail Investors, Long-term Traders, Short-term Traders), component (Solutions, Software Tools, Services), deployment (On-cloud, On-premise), and organization size (Small and Medium Enterprises, Large Enterprises). Each segment’s market size, growth projections, and competitive dynamics are analyzed, providing a granular understanding of the market landscape. Growth projections vary by segment, reflecting differing adoption rates and market dynamics. Competitive pressures are influenced by factors such as technological innovation, pricing strategies, and regulatory changes.

Key Drivers of Algorithmic Trading Market Growth

The algorithmic trading market's growth is primarily driven by several key factors: the increasing availability of sophisticated trading algorithms fueled by AI and ML advancements; the growing need for automation and efficiency in financial markets; the proliferation of alternative data sources enhancing predictive capabilities; and the continuous evolution of trading strategies to adapt to market dynamics. Regulations, while posing challenges, also drive innovation and adoption of compliant solutions.

Challenges in the Algorithmic Trading Market Sector

Significant challenges confronting the algorithmic trading market include the complexity and cost associated with implementing and maintaining sophisticated trading systems; the inherent risks associated with algorithmic trading, including flash crashes and unexpected market movements; the increasing regulatory scrutiny of algorithmic trading practices, necessitating substantial compliance efforts; and the ever-present threat of cyberattacks targeting trading platforms and infrastructure. These challenges can potentially impact market growth and investor confidence. The total cost of regulatory compliance is estimated to be xx Million annually in 2025.

Emerging Opportunities in Algorithmic Trading Market

Emerging opportunities include the expansion of algorithmic trading into new asset classes such as cryptocurrencies and decentralized finance (DeFi) products; the increasing integration of blockchain technology for enhanced security and transparency in trading; the development of more sophisticated risk management tools to mitigate the risks associated with algorithmic trading; and the growing demand for customized algorithmic trading solutions catering to the unique needs of different investor segments. These opportunities present significant growth potential for market participants.

Leading Players in the Algorithmic Trading Market Market

- Algo Trader AG

- IG Group

- Jump Trading LLC

- Refinitiv Ltd

- Kuberre Systems Inc

- MetaQuotes Software Corp

- 63 Moons Technologies Limited

- ARGO SE

- Thomson Reuters

- Symphony Fintech Solutions Pvt Ltd

- Info Reach Inc

- Virtu Financial Inc

Key Developments in Algorithmic Trading Market Industry

- June 2023: DoubleVerify launched DV Algorithmic Optimizer with Scibids, improving digital advertising ROI through AI-powered optimization. This enhances the effectiveness of programmatic advertising, a key application for algorithmic trading.

- June 2023: KuCoin Futures partnered with Kryll, integrating automated trading bots and TradingView signals. This development improves accessibility and functionality for retail traders, boosting market participation.

Strategic Outlook for Algorithmic Trading Market Market

The Algorithmic Trading market is poised for continued expansion driven by technological advancements, evolving investor preferences, and increasing market complexity. The integration of AI and ML, the rise of alternative data sources, and the expansion into new asset classes will shape future growth. Companies that successfully adapt to evolving regulatory landscapes and invest in robust risk management strategies are expected to capture significant market share. The market's long-term potential is substantial, with significant opportunities for innovation and expansion across various segments and geographies.

Algorithmic Trading Market Segmentation

-

1. Types of Traders

- 1.1. Institutional Investors

- 1.2. Retail Investors

- 1.3. Long-term Traders

- 1.4. Short-term Traders

-

2. Component

-

2.1. Solutions

- 2.1.1. Platforms

- 2.1.2. Software Tools

- 2.2. Services

-

2.1. Solutions

-

3. Deployment

- 3.1. On-cloud

- 3.2. On-premise

-

4. Organization Size

- 4.1. Small and Medium Enterprises

- 4.2. Large Enterprises

Algorithmic Trading Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Algorithmic Trading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Demand for Fast

- 3.2.2 Reliable

- 3.2.3 and Effective Order Execution; Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs

- 3.3. Market Restrains

- 3.3.1. Instant Loss of Liquidity

- 3.4. Market Trends

- 3.4.1. On-cloud Deployment Segment is expected to drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types of Traders

- 5.1.1. Institutional Investors

- 5.1.2. Retail Investors

- 5.1.3. Long-term Traders

- 5.1.4. Short-term Traders

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Solutions

- 5.2.1.1. Platforms

- 5.2.1.2. Software Tools

- 5.2.2. Services

- 5.2.1. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. On-cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by Organization Size

- 5.4.1. Small and Medium Enterprises

- 5.4.2. Large Enterprises

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Types of Traders

- 6. North America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Types of Traders

- 6.1.1. Institutional Investors

- 6.1.2. Retail Investors

- 6.1.3. Long-term Traders

- 6.1.4. Short-term Traders

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Solutions

- 6.2.1.1. Platforms

- 6.2.1.2. Software Tools

- 6.2.2. Services

- 6.2.1. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. On-cloud

- 6.3.2. On-premise

- 6.4. Market Analysis, Insights and Forecast - by Organization Size

- 6.4.1. Small and Medium Enterprises

- 6.4.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Types of Traders

- 7. Europe Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Types of Traders

- 7.1.1. Institutional Investors

- 7.1.2. Retail Investors

- 7.1.3. Long-term Traders

- 7.1.4. Short-term Traders

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Solutions

- 7.2.1.1. Platforms

- 7.2.1.2. Software Tools

- 7.2.2. Services

- 7.2.1. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. On-cloud

- 7.3.2. On-premise

- 7.4. Market Analysis, Insights and Forecast - by Organization Size

- 7.4.1. Small and Medium Enterprises

- 7.4.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Types of Traders

- 8. Asia Pacific Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Types of Traders

- 8.1.1. Institutional Investors

- 8.1.2. Retail Investors

- 8.1.3. Long-term Traders

- 8.1.4. Short-term Traders

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Solutions

- 8.2.1.1. Platforms

- 8.2.1.2. Software Tools

- 8.2.2. Services

- 8.2.1. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. On-cloud

- 8.3.2. On-premise

- 8.4. Market Analysis, Insights and Forecast - by Organization Size

- 8.4.1. Small and Medium Enterprises

- 8.4.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Types of Traders

- 9. Latin America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Types of Traders

- 9.1.1. Institutional Investors

- 9.1.2. Retail Investors

- 9.1.3. Long-term Traders

- 9.1.4. Short-term Traders

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Solutions

- 9.2.1.1. Platforms

- 9.2.1.2. Software Tools

- 9.2.2. Services

- 9.2.1. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. On-cloud

- 9.3.2. On-premise

- 9.4. Market Analysis, Insights and Forecast - by Organization Size

- 9.4.1. Small and Medium Enterprises

- 9.4.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Types of Traders

- 10. Middle East and Africa Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Types of Traders

- 10.1.1. Institutional Investors

- 10.1.2. Retail Investors

- 10.1.3. Long-term Traders

- 10.1.4. Short-term Traders

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Solutions

- 10.2.1.1. Platforms

- 10.2.1.2. Software Tools

- 10.2.2. Services

- 10.2.1. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment

- 10.3.1. On-cloud

- 10.3.2. On-premise

- 10.4. Market Analysis, Insights and Forecast - by Organization Size

- 10.4.1. Small and Medium Enterprises

- 10.4.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Types of Traders

- 11. North America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Algo Trader AG*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IG Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Jump Trading LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Refinitiv Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kuberre Systems Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 MetaQuotes Software Corp

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 63 Moons Technologies Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ARGO SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Thomson Reuters

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Symphony Fintech Solutions Pvt Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Info Reach Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Virtu Financial Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Algo Trader AG*List Not Exhaustive

List of Figures

- Figure 1: Global Algorithmic Trading Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 13: North America Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 14: North America Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 17: North America Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 18: North America Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 19: North America Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 20: North America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 23: Europe Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 24: Europe Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 25: Europe Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 26: Europe Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 29: Europe Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 30: Europe Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 33: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 34: Asia Pacific Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 35: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 36: Asia Pacific Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Asia Pacific Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Asia Pacific Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 43: Latin America Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 44: Latin America Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Latin America Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Latin America Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Latin America Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Latin America Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 49: Latin America Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 50: Latin America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 53: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 54: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 55: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 56: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 57: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 58: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 59: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 60: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Algorithmic Trading Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 3: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 5: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: Global Algorithmic Trading Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 18: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 20: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 21: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 23: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 28: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 30: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 31: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 33: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 34: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 35: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 36: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 38: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 39: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 40: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 41: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algorithmic Trading Market?

The projected CAGR is approximately 8.53%.

2. Which companies are prominent players in the Algorithmic Trading Market?

Key companies in the market include Algo Trader AG*List Not Exhaustive, IG Group, Jump Trading LLC, Refinitiv Ltd, Kuberre Systems Inc, MetaQuotes Software Corp, 63 Moons Technologies Limited, ARGO SE, Thomson Reuters, Symphony Fintech Solutions Pvt Ltd, Info Reach Inc, Virtu Financial Inc.

3. What are the main segments of the Algorithmic Trading Market?

The market segments include Types of Traders, Component, Deployment, Organization Size.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Fast. Reliable. and Effective Order Execution; Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs.

6. What are the notable trends driving market growth?

On-cloud Deployment Segment is expected to drive the Market Growth.

7. Are there any restraints impacting market growth?

Instant Loss of Liquidity.

8. Can you provide examples of recent developments in the market?

June 2023: DoubleVerify, one of the leading software platforms for digital media measurement, data, and analytics, announced the launch of DV Algorithmic Optimizer, an advanced measure and optimization offering with Scibids, one of the global leaders in artificial intelligence (AI) for digital marketing. The combination of DV's proprietary attention signals and Scibids' AI-powered ad decisioning enables advertisers to identify the performing inventory that maximizes business outcomes and advertising ROI without sacrificing scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algorithmic Trading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algorithmic Trading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algorithmic Trading Market?

To stay informed about further developments, trends, and reports in the Algorithmic Trading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence