Key Insights

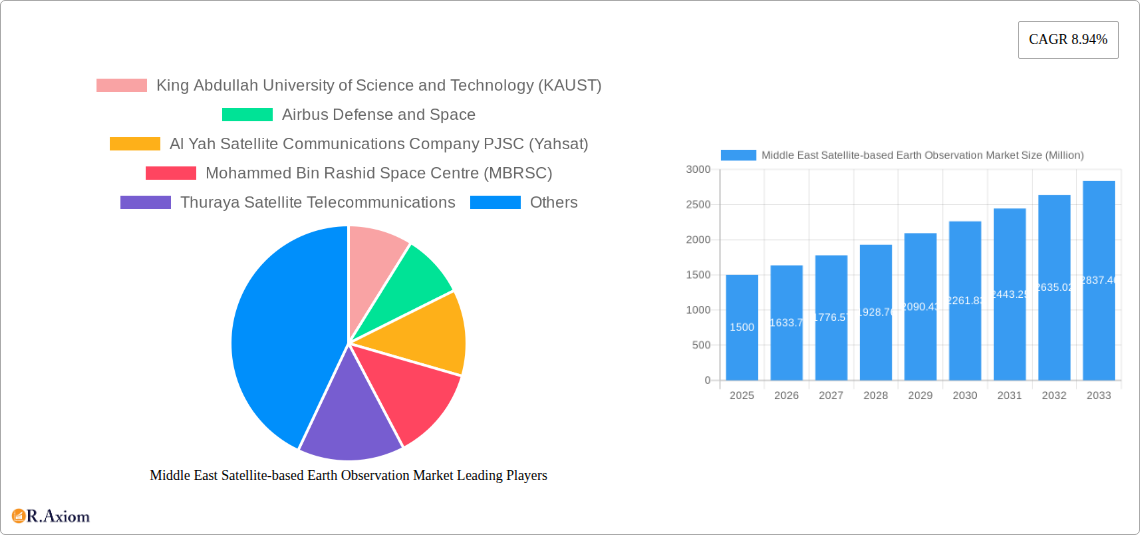

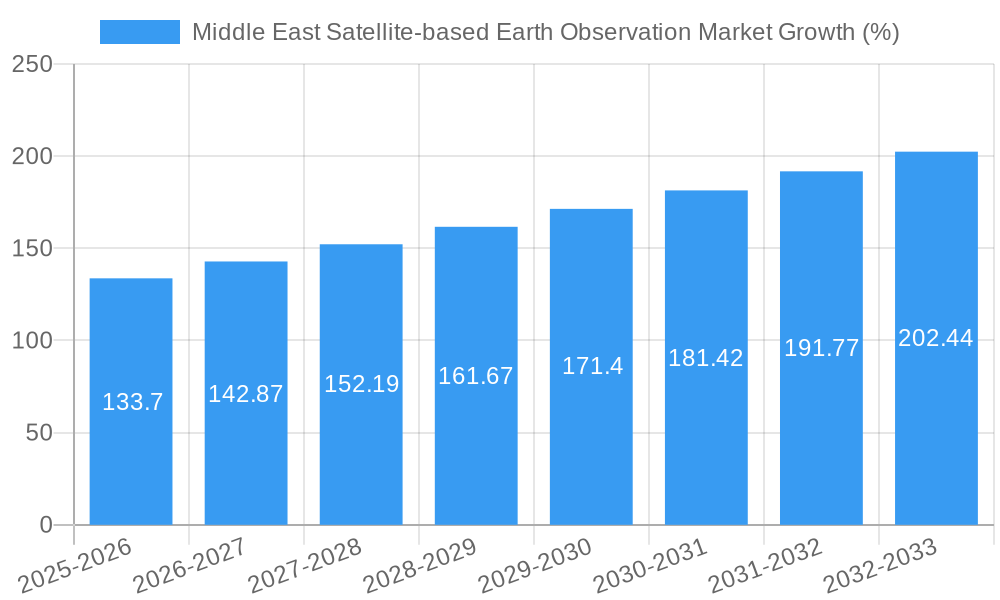

The Middle East Satellite-based Earth Observation market is experiencing robust growth, driven by significant investments in infrastructure development, the burgeoning need for efficient resource management, and a heightened focus on environmental sustainability across the region. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8.94% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, governments in countries like the UAE and Saudi Arabia are prioritizing large-scale infrastructure projects, including smart city initiatives and urban development, creating a strong demand for precise and timely Earth observation data. Secondly, the agricultural sector is increasingly adopting satellite technology for precision farming, crop monitoring, and efficient water resource management, contributing to market growth. Thirdly, the increasing awareness of climate change and its impact on the region is driving demand for climate services utilizing satellite data for environmental monitoring, disaster management, and sustainable resource planning. Key players such as Airbus Defense and Space, Yahsat, and MBRSC are actively contributing to market expansion through technological advancements and strategic partnerships. The market is segmented by end-use (urban development, agriculture, etc.), country (UAE, Saudi Arabia, etc.), data type (Earth observation data, value-added services), and satellite orbit.

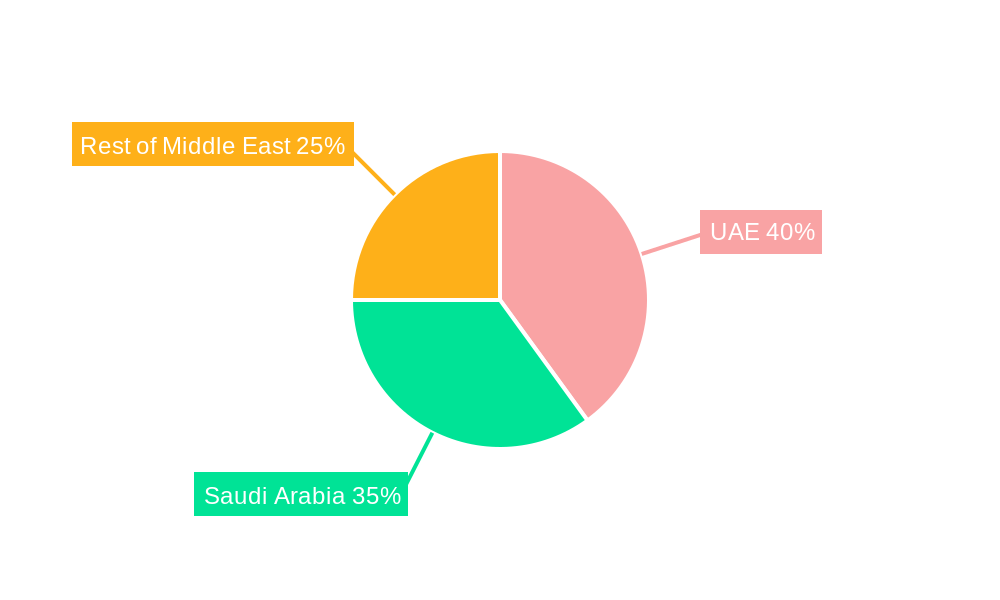

The segment showing the most significant growth is likely the value-added services segment, which encompasses data analytics, processing, and interpretation. This is because raw Earth observation data requires sophisticated processing to be usable for decision-making in various sectors. Furthermore, the UAE and Saudi Arabia are expected to dominate the market due to their substantial investments in space technology and their focus on diversifying their economies. However, challenges remain, including the high initial investment costs for satellite technology and data acquisition, and potential regulatory hurdles for data access and usage. Despite these restraints, the long-term outlook for the Middle East Satellite-based Earth Observation market remains highly positive, driven by continued government support, technological innovation, and the growing need for sustainable and efficient resource management across the region. The market is ripe for further innovation in areas such as AI-powered data analytics and the integration of satellite data with other sources of information for more comprehensive insights.

This in-depth report provides a comprehensive analysis of the Middle East satellite-based Earth observation market, covering the period from 2019 to 2033. It delves into market dynamics, key players, technological advancements, and future growth prospects, offering valuable insights for industry stakeholders, investors, and researchers. The report utilizes rigorous data analysis and forecasts, providing actionable intelligence for strategic decision-making.

Middle East Satellite-based Earth Observation Market Market Concentration & Innovation

The Middle East satellite-based Earth observation market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the emergence of innovative startups and increasing government investment is fostering competition. Key players such as Airbus Defence and Space and Yahsat dominate the market, but smaller companies are making inroads with niche technologies. The market share for the top three players is approximately xx%, with the remaining share distributed among numerous smaller companies. Recent years have witnessed a significant increase in M&A activity, with deals valued at approximately USD xx Million. These activities are driven by the need for technological advancements, geographical expansion, and the consolidation of market share. Regulatory frameworks vary across the region, with some countries having more advanced policies than others. This variation influences market access and investment decisions. The increasing adoption of cloud-based solutions and AI-driven analytics is transforming the market. Furthermore, product substitutes, such as aerial imagery and ground-based sensors, are also impacting market dynamics, though satellite-based observation remains the leading technology for comprehensive, large-scale data collection. End-user trends show increasing demand for high-resolution imagery, real-time data processing, and value-added services.

- Market Concentration: Moderately concentrated with top three players holding xx% market share.

- M&A Activity: Significant increase in recent years, with total deal values at approximately USD xx Million.

- Innovation Drivers: Cloud-based solutions, AI-driven analytics, and high-resolution imagery demand.

- Regulatory Frameworks: Vary across the region, influencing market access and investment.

- Product Substitutes: Aerial imagery and ground-based sensors exert some competitive pressure.

Middle East Satellite-based Earth Observation Market Industry Trends & Insights

The Middle East satellite-based Earth observation market is experiencing robust growth, driven by increasing government investments in space programs, rapid urbanization, and the need for effective resource management. The market is estimated to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, including the development of higher-resolution sensors and improved data processing capabilities. Consumer preferences are shifting toward more accurate, reliable, and timely data, driving the demand for value-added services. Market penetration is increasing across various end-use segments, particularly in agriculture, urban development, and climate services. However, competitive dynamics are also intensifying, with both established players and new entrants vying for market share. The ongoing technological disruptions, such as the advent of small satellite constellations and the integration of AI and machine learning, are reshaping the industry landscape. Further driving growth is the increasing need for climate change monitoring and the effective management of natural resources. The market is projected to reach USD xx Million by 2033.

Dominant Markets & Segments in Middle East Satellite-based Earth Observation Market

The UAE and Saudi Arabia are the dominant markets in the Middle East satellite-based Earth observation sector, driven by significant investments in space infrastructure and technology. The "Urban Development and Cultural Heritage" segment demonstrates the highest growth within the end-use category. This is closely followed by the "Agriculture" and "Energy and Raw Materials" segments, reflecting the region's focus on sustainable development and resource management. The "Earth Observation Data" segment currently holds the largest market share in terms of type, though the "Value-Added Services" segment is experiencing faster growth. Geostationary Orbit satellites currently dominate, due to their continuous coverage of a specific area.

Key Drivers for UAE & Saudi Arabia:

- Significant investments in space infrastructure and technology.

- Government initiatives promoting the development of the space sector.

- Growing demand for geospatial data across various sectors.

Dominant End-Use Segment: Urban Development and Cultural Heritage (driven by urbanization and preservation efforts).

Dominant Type Segment: Earth Observation Data (although Value-Added Services are growing rapidly).

Dominant Satellite Orbit: Geostationary Orbit (offers continuous coverage).

Middle East Satellite-based Earth Observation Market Product Developments

The Middle East satellite-based Earth observation market is witnessing rapid product innovations, with a focus on higher resolution imagery, advanced analytics, and value-added services tailored to specific industry needs. Technological advancements such as AI-powered image processing and the use of hyperspectral sensors are enhancing the capabilities of Earth observation systems, delivering more precise and actionable insights. This improves efficiency and effectiveness across various applications, making the technology more accessible and beneficial for various users. The market is also witnessing increased adoption of cloud-based platforms, which are facilitating data sharing and collaboration.

Report Scope & Segmentation Analysis

This report segments the Middle East satellite-based Earth observation market by:

- End-Use: Urban Development and Cultural Heritage, Agriculture, Climate Services, Energy and Raw Materials, Infrastructure, Others. Growth is projected to be fastest in Urban Development and Climate Services.

- Country: UAE, Saudi Arabia, Others. The UAE and Saudi Arabia hold the largest market shares.

- Type: Earth Observation Data, Value-Added Services. Value-Added Services are expected to show higher growth.

- Satellite Orbit: Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Orbit (GEO). GEO currently dominates, but LEO and MEO are expanding.

Each segment's competitive landscape and market size are detailed within the report with projections until 2033.

Key Drivers of Middle East Satellite-based Earth Observation Market Growth

Several factors fuel the growth of the Middle East satellite-based Earth observation market. Significant government investment in space programs, such as the UAE's National Space Fund (USD 816 Million), significantly boosts technological advancements and infrastructure development. The increasing demand for accurate data in sectors like urban planning, agriculture, and resource management drives market expansion. Furthermore, technological advancements, particularly in sensor technology and data analytics, significantly enhance the value and applications of Earth observation data.

Challenges in the Middle East Satellite-based Earth Observation Market Sector

Challenges facing the Middle East satellite-based Earth observation market include the high initial investment costs for satellite technology and data processing infrastructure. Data security and privacy concerns also pose significant challenges. Competitive pressures from established international players and the emergence of new entrants require strong strategic responses. Furthermore, the regulatory landscape varies across the region, which presents hurdles for seamless operation and market access.

Emerging Opportunities in Middle East Satellite-based Earth Observation Market

Significant opportunities exist in the market for companies offering innovative solutions. The growing demand for climate change monitoring and mitigation creates substantial opportunities for providers of climate-related data and services. The increased focus on sustainable development and resource management opens doors for applications in precision agriculture and water resource management. The region’s rapid urbanization presents substantial potential for smart city applications.

Leading Players in the Middle East Satellite-based Earth Observation Market Market

- King Abdullah University of Science and Technology (KAUST)

- Airbus Defence and Space

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Mohammed Bin Rashid Space Centre (MBRSC)

- Thuraya Satellite Telecommunications

- SARsat Arabia

- Ayn Astra

- Perigon AI

- DigitalGlobe (now part of Maxar)

- Geomap

Key Developments in Middle East Satellite-based Earth Observation Market Industry

- July 2022: The UAE Space Agency launched the AED 3 billion (USD 816 Million) National Space Fund, stimulating substantial investment in the sector, and initiating construction of a new SAR satellite constellation.

- December 2022: The UAE Space Agency and Bayanat partnered to create a geospatial analytics platform for the Space Data Centre, improving data access for various stakeholders and fostering the development of Earth observation applications.

Strategic Outlook for Middle East Satellite-based Earth Observation Market Market

The Middle East satellite-based Earth observation market holds immense potential for growth, driven by continued investment in space technology, the increasing demand for data-driven insights across various sectors, and the ongoing technological advancements in data analytics and sensor technologies. The focus on sustainable development and resource management within the region presents lucrative opportunities for companies offering innovative solutions. The market is poised for significant expansion in the coming years, presenting attractive prospects for both established players and new entrants.

Middle East Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

Middle East Satellite-based Earth Observation Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Investments; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Budget Constraints and Technological Limitations

- 3.4. Market Trends

- 3.4.1. Urban Development and Cultural Heritage is analyzed to hold significant share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 King Abdullah University of Science and Technology (KAUST)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Airbus Defense and Space

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Al Yah Satellite Communications Company PJSC (Yahsat)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mohammed Bin Rashid Space Centre (MBRSC)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Thuraya Satellite Telecommunications

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SARsat Arabia

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ayn Astra

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Perigon AI

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DigitalGlobe

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Geomap

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 King Abdullah University of Science and Technology (KAUST)

List of Figures

- Figure 1: Middle East Satellite-based Earth Observation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Satellite-based Earth Observation Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 4: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 5: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Satellite Orbit 2019 & 2032

- Table 16: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by End-use 2019 & 2032

- Table 17: Middle East Satellite-based Earth Observation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kuwait Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Bahrain Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Jordan Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Lebanon Middle East Satellite-based Earth Observation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Satellite-based Earth Observation Market?

The projected CAGR is approximately 8.94%.

2. Which companies are prominent players in the Middle East Satellite-based Earth Observation Market?

Key companies in the market include King Abdullah University of Science and Technology (KAUST), Airbus Defense and Space, Al Yah Satellite Communications Company PJSC (Yahsat), Mohammed Bin Rashid Space Centre (MBRSC), Thuraya Satellite Telecommunications, SARsat Arabia, Ayn Astra, Perigon AI, DigitalGlobe, Geomap.

3. What are the main segments of the Middle East Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Investments; Technological Advancements.

6. What are the notable trends driving market growth?

Urban Development and Cultural Heritage is analyzed to hold significant share in the market.

7. Are there any restraints impacting market growth?

Budget Constraints and Technological Limitations.

8. Can you provide examples of recent developments in the market?

December 2022 - The UAE Space Agency and Bayanat have inked a collaboration agreement to create and manage a geospatial analytics platform for the Space Data Centre, one of the UAE government's transformational projects. According to the terms of the agreement, Bayanat will take advantage of large-scale data handling and processing capabilities and provide analytical reports based on Earth observation satellites to develop an innovative environment for Earth observation apps. The UAE Space Agency indicates using the platform to improve access to satellite data for scientists, researchers, government and private institutions, startups, and community members to develop solutions that support national and global challenges in the form of space data apps and value-added services (VAS). In addition to its function in fostering worldwide collaboration and alliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the Middle East Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence