Key Insights

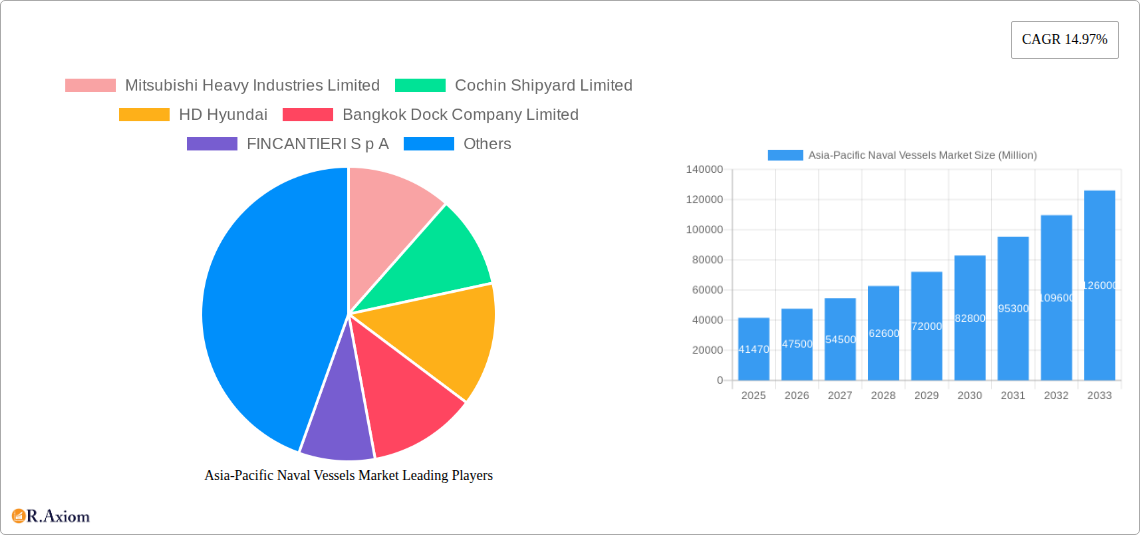

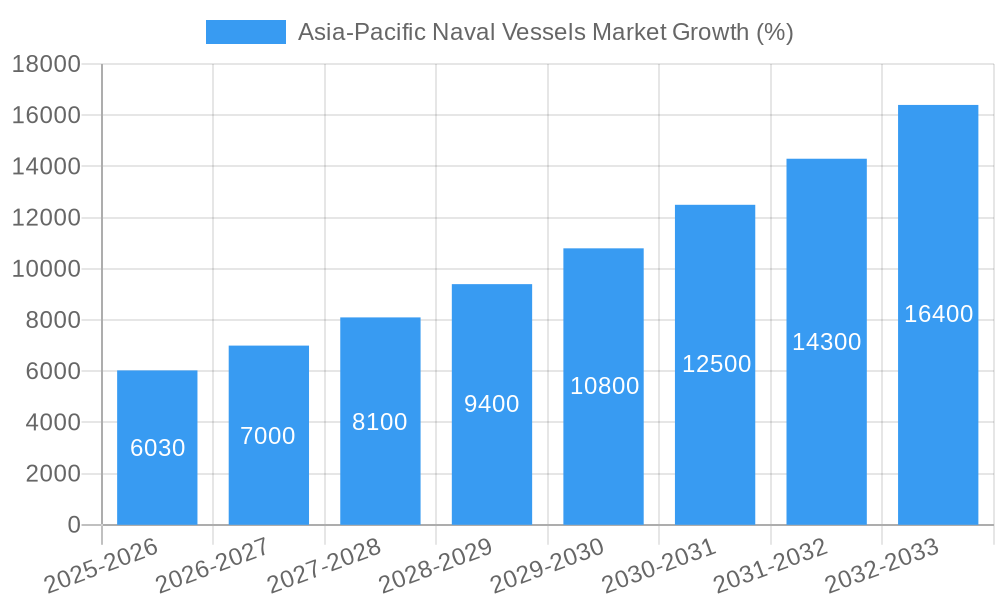

The Asia-Pacific naval vessels market is experiencing robust growth, projected to reach a market value exceeding $41.47 billion by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 14.97% from 2025 to 2033. This expansion is driven by several key factors. Rising geopolitical tensions in the region necessitate increased naval capabilities for many nations, leading to significant investments in modernizing and expanding their fleets. Furthermore, technological advancements in naval vessel design and construction, such as the incorporation of advanced sensors, weaponry, and autonomous systems, are fueling market growth. The increasing focus on maritime security and anti-piracy measures further contributes to the demand for sophisticated naval vessels. This market is segmented by vessel type, encompassing submarines, frigates, corvettes, aircraft carriers, destroyers, and other vessel types. Major players like Mitsubishi Heavy Industries, Cochin Shipyard, HD Hyundai, and others are competing intensely, driving innovation and efficiency in the sector. The Asia-Pacific region, specifically countries like China, Japan, India, South Korea, and Australia, are leading contributors to this market growth, fueled by their substantial defense budgets and strategic maritime interests. The market's future trajectory suggests continued expansion, driven by ongoing geopolitical uncertainties and the sustained demand for technologically superior naval assets.

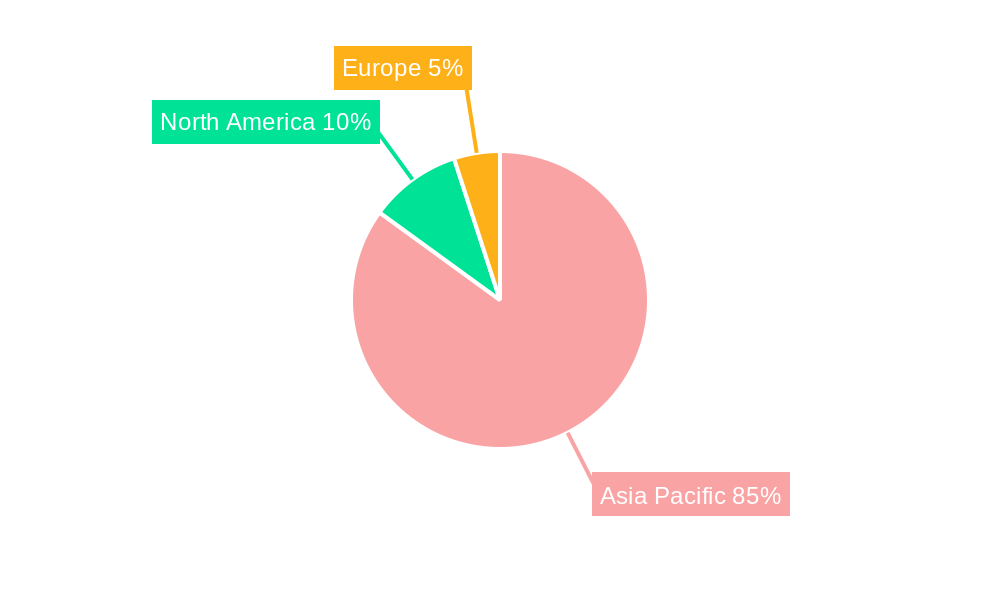

The regional dominance of the Asia-Pacific market is primarily due to significant defense spending by several key nations in the region. China’s substantial investments in modernizing its navy and increasing its maritime presence play a crucial role. Similarly, India and other nations are undertaking ambitious naval expansion programs to safeguard their strategic interests. The competition among major shipbuilders in the region, both state-owned and private, further contributes to market dynamism and innovation. The market is expected to witness further consolidation as companies strategically expand their capabilities and collaborate to meet the growing demands for sophisticated naval platforms. The ongoing focus on technological advancements, specifically in areas like unmanned underwater vehicles (UUVs) and artificial intelligence (AI) integration into naval vessels, is poised to significantly impact the market's future.

Asia-Pacific Naval Vessels Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific naval vessels market, offering actionable insights for industry stakeholders. With a focus on market trends, segment performance, competitive landscape, and future growth prospects, this report is an indispensable resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024.

Asia-Pacific Naval Vessels Market Concentration & Innovation

The Asia-Pacific naval vessels market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors such as technological capabilities, government support, and historical expertise. While precise market share figures for individual companies require confidential data from the full report, key players like Mitsubishi Heavy Industries Limited and HD Hyundai command substantial portions. The market is characterized by continuous innovation, driven by the need for advanced technologies like AI-integrated systems, improved stealth capabilities, and autonomous features. Regulatory frameworks, varying across nations, significantly impact market dynamics. Stringent export controls and national security concerns influence procurement decisions. Substitutes are limited, largely confined to repurposed civilian vessels, which lack the specialized capabilities of purpose-built naval vessels. End-user trends favor multi-role vessels and modular designs to enhance operational flexibility and cost-effectiveness. M&A activity remains relatively modest, with deal values typically in the range of xx Million to xx Million. Recent mergers and acquisitions have primarily focused on strengthening existing capabilities or expanding into new geographical markets.

- Key Factors: Technological advancements, government policies, geopolitical stability, and economic growth influence market concentration.

- M&A Activity: While specific deal values remain confidential, M&A activity in this sector is characterized by strategic partnerships and acquisitions to gain competitive advantage.

Asia-Pacific Naval Vessels Market Industry Trends & Insights

The Asia-Pacific naval vessels market is experiencing robust growth, fueled by rising geopolitical tensions, escalating maritime security concerns, and increasing defense budgets across the region. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by modernization efforts by several naval forces in the region aiming to upgrade their fleets with advanced capabilities. Technological disruptions, including the integration of unmanned systems and AI, are transforming naval warfare, creating new market opportunities. Consumer preferences (in this context, government procurement agencies) are shifting towards advanced features, enhanced survivability, and improved interoperability. Competitive dynamics are intense, with both established players and emerging shipbuilders vying for contracts. Market penetration rates for specific vessel types vary significantly, with frigates and corvettes experiencing comparatively higher demand.

Dominant Markets & Segments in Asia-Pacific Naval Vessels Market

The Asia-Pacific naval vessels market is dominated by several key nations, including India, China, and South Korea, reflecting their significant defense expenditures and active modernization programs.

- India: A large and growing market driven by the "Make in India" initiative and a focus on indigenously building naval assets. Key drivers include robust economic growth, increasing maritime security concerns and the need to protect its vast coastline.

- China: A significant player, exhibiting high spending on naval vessels, including carriers and destroyers. Drivers include expanding maritime claims, regional power projection ambitions, and a modernization drive for its naval forces.

- South Korea: A technologically advanced nation, actively exporting naval vessels. Key drivers are a strong shipbuilding industry and technological capabilities.

- Segment Dominance: Frigates and corvettes currently constitute the largest segments by volume due to their versatility and cost-effectiveness. The aircraft carrier segment exhibits slower growth due to the high capital expenditure involved, while submarines and destroyers maintain steady but more controlled growth based on specific national strategies.

Detailed analysis of each region and segment's growth trajectories and competitive dynamics is presented in the full report.

Asia-Pacific Naval Vessels Market Product Developments

Recent years have witnessed significant product innovations in the Asia-Pacific naval vessels market, including the incorporation of advanced sensor systems, improved stealth technology, and the integration of unmanned systems. These advancements enhance operational capabilities, improve survivability, and extend the range of naval platforms. The focus is on developing multi-role vessels capable of performing diverse missions. The market is witnessing a growing preference for modular designs, allowing for adaptable configurations to meet changing operational needs. These advancements provide significant competitive advantages to manufacturers and enhance the strategic capabilities of naval forces.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific naval vessels market by vessel type: Submarines, Frigates, Corvettes, Aircraft Carriers, Destroyers, and Other Vessel Types. Each segment is analyzed based on its market size, growth projections, and competitive dynamics. For example, the frigate segment demonstrates strong growth potential driven by its versatility and affordability, while the aircraft carrier segment experiences slower, but still significant, growth due to the high cost of development and maintenance. Each segment has unique market characteristics and competitive dynamics; detailed analysis of each is provided in the complete report.

Key Drivers of Asia-Pacific Naval Vessels Market Growth

Several key factors propel the growth of the Asia-Pacific naval vessels market. These include increasing defense budgets across the region, escalating geopolitical tensions, the need to protect vital maritime trade routes, and technological advancements leading to the development of more advanced and capable naval vessels. Further, the rise in maritime security concerns and the need for counter-terrorism capabilities are significant driving forces. Government initiatives promoting indigenous shipbuilding and modernization programs further accelerate market growth.

Challenges in the Asia-Pacific Naval Vessels Market Sector

The Asia-Pacific naval vessels market faces several challenges. These include fluctuating global economic conditions impacting defense spending, supply chain disruptions affecting the procurement of critical components, and intense competition among global shipbuilders. Furthermore, complex regulatory environments and stringent export controls can pose obstacles to market entry and expansion. The high cost of developing and maintaining advanced naval vessels also presents a significant hurdle for some countries.

Emerging Opportunities in Asia-Pacific Naval Vessels Market

The Asia-Pacific naval vessels market presents exciting emerging opportunities. The adoption of autonomous systems, artificial intelligence, and advanced sensor technologies offers significant potential for growth. The demand for multi-role vessels capable of undertaking diverse missions will continue to drive market expansion. Furthermore, exploration of new materials and propulsion systems could lead to significant advancements in naval vessel technology. The growing focus on sustainability and environmental protection will shape the design and operation of future naval vessels, creating additional opportunities.

Leading Players in the Asia-Pacific Naval Vessels Market Market

- Mitsubishi Heavy Industries Limited

- Cochin Shipyard Limited

- HD Hyundai

- Bangkok Dock Company Limited

- FINCANTIERI S p A

- Garden Reach Shipbuilders and Engineers Limited

- thyssenkrupp AG

- Singapore Technologies Engineering Limited

- ASC Pty Ltd

- Mazagon Dock Shipbuilders Limited

- LARSEN & TOUBRO LIMITED

- Navantia S A SM E

- China State Shipbuilding Corporation

- Boustead Heavy Industries Corporation Berhad

- Kawasaki Heavy Industries Ltd

- PT PAL Indonesia

Key Developments in Asia-Pacific Naval Vessels Market Industry

- September 2022: India’s first indigenously built aircraft carrier, INS Vikrant, was commissioned into service under the Make in India initiative. This development significantly boosted domestic shipbuilding capabilities and showcased India's commitment to naval modernization.

- April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. This launch signifies the continued advancement of frigate technology and the strengthening of South Korea's position as a major naval vessel exporter.

Strategic Outlook for Asia-Pacific Naval Vessels Market Market

The Asia-Pacific naval vessels market is poised for sustained growth, driven by escalating geopolitical tensions, modernization efforts by regional navies, and technological advancements. Emerging opportunities in autonomous systems, AI integration, and sustainable shipbuilding practices will further shape market dynamics. Companies that invest in R&D, embrace technological innovations, and adapt to evolving geopolitical landscapes will be well-positioned to capitalize on future growth opportunities. The market's long-term outlook remains positive, with significant potential for expansion and innovation.

Asia-Pacific Naval Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Submarines

- 1.2. Frigates

- 1.3. Corvettes

- 1.4. Aircraft Carrier

- 1.5. Destroyers

- 1.6. Other Vessel Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Singapore

- 2.1.7. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Naval Vessels Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Singapore

- 1.7. Rest of Asia Pacific

Asia-Pacific Naval Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Destroyers to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Submarines

- 5.1.2. Frigates

- 5.1.3. Corvettes

- 5.1.4. Aircraft Carrier

- 5.1.5. Destroyers

- 5.1.6. Other Vessel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Singapore

- 5.2.1.7. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. China Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Heavy Industries Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cochin Shipyard Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HD Hyundai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bangkok Dock Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 FINCANTIERI S p A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Garden Reach Shipbuilders and Engineers Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 thyssenkrupp AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Singapore Technologies Engineering Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ASC Pty Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mazagon Dock Shipbuilders Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LARSEN & TOUBRO LIMITED

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Navantia S A SM E

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 China State Shipbuilding Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Boustead Heavy Industries Corporation Berhad

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kawasaki Heavy Industries Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 PT PAL Indonesia

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: Asia-Pacific Naval Vessels Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Naval Vessels Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 3: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Naval Vessels Market?

The projected CAGR is approximately 14.97%.

2. Which companies are prominent players in the Asia-Pacific Naval Vessels Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, Cochin Shipyard Limited, HD Hyundai, Bangkok Dock Company Limited, FINCANTIERI S p A, Garden Reach Shipbuilders and Engineers Limited, thyssenkrupp AG, Singapore Technologies Engineering Limited, ASC Pty Ltd, Mazagon Dock Shipbuilders Limited, LARSEN & TOUBRO LIMITED, Navantia S A SM E, China State Shipbuilding Corporation, Boustead Heavy Industries Corporation Berhad, Kawasaki Heavy Industries Ltd, PT PAL Indonesia.

3. What are the main segments of the Asia-Pacific Naval Vessels Market?

The market segments include Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Destroyers to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. The Chungnam is the first of six vessels that comprise the Ulsan-class FFX Batch III, which will be inducted into the Republic of Korea (ROK) Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Naval Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Naval Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Naval Vessels Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Naval Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence