Key Insights

The Asia-Pacific wall covering market, including wallpaper, wall panels, metal, and ceramic tiles, is poised for significant growth. This expansion is driven by rapid urbanization, rising disposable incomes, and increased home renovation and construction activities. Evolving interior design trends, favoring diverse textures and aesthetics, are further accelerating market development. Key segments, particularly residential applications and e-commerce, are experiencing robust demand, reflecting consumer preference for personalized spaces and convenient online purchasing.

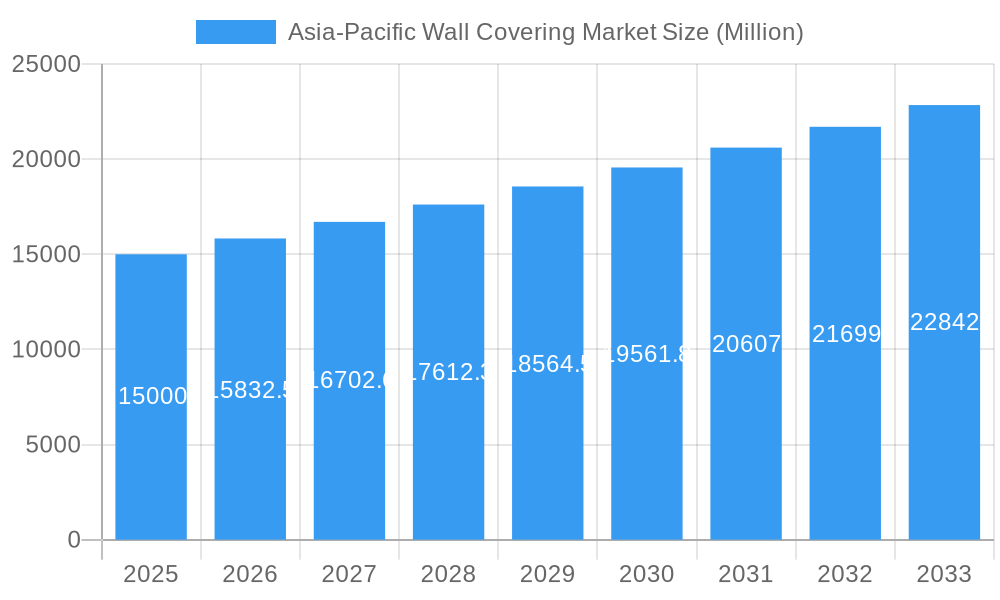

Asia-Pacific Wall Covering Market Market Size (In Billion)

China, Japan, India, and South Korea remain the primary markets, while emerging economies within the "Rest of Asia-Pacific" demonstrate considerable potential due to economic progress and the adoption of modern design styles. The competitive landscape is dynamic, featuring established global and local manufacturers. A significant emerging trend is the growing demand for sustainable and eco-friendly materials, influencing product innovation and consumer choices. Challenges include volatile raw material prices and potential economic slowdowns impacting discretionary spending.

Asia-Pacific Wall Covering Market Company Market Share

The distribution network is transforming, with e-commerce platforms gaining prominence alongside traditional channels like specialty stores and home centers. This shift necessitates strategic adaptation for manufacturers and distributors. The market is projected to experience sustained growth throughout the forecast period (2025-2033). While a slight moderation in growth rate is anticipated compared to historical figures due to segment maturity, the Asia-Pacific wall covering market is set for substantial long-term expansion. Detailed segmentation by product type and country will offer deeper market insights.

This report delivers a comprehensive analysis of the Asia-Pacific wall covering market, providing critical insights for stakeholders, investors, and businesses. The study period covers 2019-2033, with 2025 as the base year. The market size was valued at 6743 million in 2025 and is projected to reach substantial figures by 2033, exhibiting a CAGR of 5.2% during the forecast period (2025-2033).

Asia-Pacific Wall Covering Market Concentration & Innovation

This section analyzes the competitive landscape of the Asia-Pacific wall covering market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately fragmented structure, with several key players holding significant market share. However, smaller players and regional brands also contribute significantly to overall market volume.

Market Concentration: The top five players collectively hold an estimated xx% market share in 2025, indicating a relatively competitive landscape. This is primarily due to the presence of both international and local players. Increased competition is observed in the wallpaper segment, due to lower barriers to entry for smaller players.

Innovation Drivers: Key innovation drivers include the introduction of eco-friendly materials, technologically advanced manufacturing processes (e.g., digital printing), and the development of innovative designs and textures catering to evolving consumer preferences.

Regulatory Frameworks: Government regulations concerning building materials and environmental standards significantly influence market dynamics. Stringent environmental regulations are driving the adoption of sustainable wall coverings.

Product Substitutes: The market faces competition from alternative wall finishes such as paint, concrete, and textured plaster. However, the demand for aesthetically appealing and durable wall coverings remains strong.

End-User Trends: The rising preference for customized and personalized home decor is driving demand for unique and designer wall coverings. Commercial applications are increasingly focusing on practicality and hygiene.

M&A Activities: The Asia-Pacific wall covering market has witnessed several M&A activities in recent years. The total deal value for such activities in the historical period (2019-2024) was estimated at xx Million. These acquisitions primarily aimed at expanding market reach and product portfolios. Examples include [mention specific examples if available, otherwise use "several smaller acquisitions aimed at expanding product lines"].

Asia-Pacific Wall Covering Market Industry Trends & Insights

The Asia-Pacific wall covering market is experiencing robust growth, driven by several factors. The construction boom across various nations in the region, coupled with rising disposable incomes and increasing urbanization, fuels the demand for improved home aesthetics and commercial spaces. Technological advancements, including digital printing and the introduction of smart wall coverings, are further enhancing market appeal.

Consumer preferences are shifting towards sustainable and eco-friendly materials, leading manufacturers to focus on developing products with reduced environmental impact. Furthermore, the rising popularity of online shopping platforms and e-commerce is reshaping distribution channels. The market is witnessing intensified competition, with existing players expanding their product portfolios and entering new market segments, and new entrants seeking to establish a foothold. The market penetration rate of premium wall coverings is increasing gradually, driven by growing consumer disposable incomes in key economies like China and India.

Dominant Markets & Segments in Asia-Pacific Wall Covering Market

Dominant Regions/Countries:

- China: China holds the largest market share in the Asia-Pacific wall covering market, driven by rapid urbanization, extensive construction activity, and a growing middle class with increased disposable income. Key drivers include government infrastructure projects and robust economic growth.

- Japan: Japan exhibits a relatively mature market, characterized by a preference for high-quality and sophisticated wall coverings. The country's focus on aesthetics and design drives premium segment growth.

- India: India is witnessing rapid growth in the wall covering market, spurred by rising urbanization, construction projects, and a growing young population that values home improvement. Increasing disposable income levels are a major contributor to growth.

Dominant Product Segments:

- Wallpaper: This segment maintains the largest market share, owing to its versatility, affordability, and wide range of designs and patterns. The segment is witnessing growth in digitally printed wallpapers.

- Wallpanels: The wall panel segment is experiencing growth due to its durability, ease of installation, and suitability for both residential and commercial applications.

Dominant Distribution Channels:

- Specialty Stores: Specialty stores continue to dominate the distribution channels, offering specialized advice and a wide range of products.

- e-Commerce: The growing preference for online shopping is leading to increased adoption of e-commerce platforms by both manufacturers and consumers.

Dominant Application Segments:

- Residential: The residential segment holds the largest market share, driven by increased home improvement activities and a growing middle class.

- Commercial: The commercial sector is expanding its usage of high-quality wall coverings, reflecting a greater emphasis on aesthetics and brand image.

Asia-Pacific Wall Covering Market Product Developments

Recent product developments focus on incorporating sustainable materials, improving durability, and enhancing aesthetic appeal. This includes the use of recycled materials, innovative textures, and digital printing technologies to create customized and personalized wall coverings. Manufacturers are also emphasizing ease of installation and maintenance to cater to consumer preferences. The market is witnessing the introduction of smart wall coverings with integrated functionalities such as soundproofing and temperature regulation.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific wall covering market based on product type (Wallpaper, Wallpanel, Metal Wall Coverings, Ceramic Tile, Other Products), distribution channel (Specialty Store, Home Centre, Building Material Dealer, Furniture Store, Mass Merchandizer, e-Commerce), application (Residential, Commercial), and country (China, Japan, India, Malaysia, South Korea, Rest of Asia Pacific). Each segment is analyzed in detail, providing market size, growth projections, and competitive dynamics. The market is expected to show significant growth across all segments during the forecast period.

Key Drivers of Asia-Pacific Wall Covering Market Growth

Key growth drivers include:

- Rising Disposable Incomes: Increased purchasing power is boosting demand for home improvement and interior design products.

- Urbanization: Rapid urbanization and new construction projects drive demand for wall coverings.

- Technological Advancements: Innovations in materials, designs, and manufacturing processes enhance product appeal and expand market opportunities.

- Government Initiatives: Infrastructure development projects and supportive government policies stimulate market expansion.

Challenges in the Asia-Pacific Wall Covering Market Sector

The Asia-Pacific wall covering market faces challenges including:

- Fluctuating Raw Material Prices: Price volatility can impact production costs and profitability.

- Intense Competition: The market's competitive nature necessitates continuous product innovation and cost optimization.

- Supply Chain Disruptions: Global supply chain challenges can affect timely product delivery and market availability.

Emerging Opportunities in Asia-Pacific Wall Covering Market

Emerging opportunities lie in:

- Sustainable and Eco-Friendly Products: Growing consumer awareness of environmental concerns is driving demand for sustainable wall coverings.

- Smart Wall Coverings: Integrating smart technologies into wall coverings presents a promising avenue for growth.

- Expansion into Untapped Markets: Further market penetration in less developed regions offers significant potential.

Leading Players in the Asia-Pacific Wall Covering Market Market

- Marshalls Wallpapers

- Guilin Wellmax wallcovering Co Ltd

- Supreme Interior Design

- Beitai Wallpaper

- Wallpapersifu com

- Elegant Haus International

- Sungreen Co Ltd

- Ritz Wallcovering Sdn Bhd

- JC Maison Malaysia

- LAMEX Wall

- Shinhan Wallcoverings Co Ltd

- Guangdong Yulan Group Co Ltd

- A S Création (A S Création Tapeten AG)

Key Developments in Asia-Pacific Wall Covering Market Industry

- [Insert specific examples of key developments, including dates, e.g., "March 2023: Company X launched a new line of eco-friendly wallpapers."]

Strategic Outlook for Asia-Pacific Wall Covering Market Market

The Asia-Pacific wall covering market is poised for significant growth in the coming years, driven by continued urbanization, rising disposable incomes, and ongoing technological advancements. The focus on sustainability, innovation in design and materials, and expansion into new markets will shape future market dynamics. Companies that adapt to evolving consumer preferences and invest in research and development will be best positioned to capitalize on the market's growth potential.

Asia-Pacific Wall Covering Market Segmentation

-

1. Product

- 1.1. Wallpaper

- 1.2. Wallpanel

- 1.3. Metal Wall Coverings

- 1.4. Ceramic Tile

- 1.5. Other Products

-

2. Distribution Channel

- 2.1. Specialty Store

- 2.2. Home Centre

- 2.3. Building Material Dealer

- 2.4. Furniture Store

- 2.5. Mass Merchandizer

- 2.6. e-Commerce

-

3. Application

- 3.1. Residential

- 3.2. Commercial

Asia-Pacific Wall Covering Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Wall Covering Market Regional Market Share

Geographic Coverage of Asia-Pacific Wall Covering Market

Asia-Pacific Wall Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Home Furnishing

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Residential Sector is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Wall Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wallpaper

- 5.1.2. Wallpanel

- 5.1.3. Metal Wall Coverings

- 5.1.4. Ceramic Tile

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Store

- 5.2.2. Home Centre

- 5.2.3. Building Material Dealer

- 5.2.4. Furniture Store

- 5.2.5. Mass Merchandizer

- 5.2.6. e-Commerce

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marshalls Wallpapers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guilin Wellmax wallcovering Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Supreme Interior Design

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beitai Wallpaper*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wallpapersifu com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elegant Haus International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sungreen Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ritz Wallcovering Sdn Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JC Maison Malaysia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LAMEX Wall

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shinhan Wallcoverings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Guangdong Yulan Group Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 A S Création (A S Création Tapeten AG)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Marshalls Wallpapers

List of Figures

- Figure 1: Asia-Pacific Wall Covering Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Wall Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Wall Covering Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Wall Covering Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Wall Covering Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Wall Covering Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Wall Covering Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Asia-Pacific Wall Covering Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Wall Covering Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Wall Covering Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Wall Covering Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia-Pacific Wall Covering Market?

Key companies in the market include Marshalls Wallpapers, Guilin Wellmax wallcovering Co Ltd, Supreme Interior Design, Beitai Wallpaper*List Not Exhaustive, Wallpapersifu com, Elegant Haus International, Sungreen Co Ltd, Ritz Wallcovering Sdn Bhd, JC Maison Malaysia, LAMEX Wall, Shinhan Wallcoverings Co Ltd, Guangdong Yulan Group Co Ltd, A S Création (A S Création Tapeten AG).

3. What are the main segments of the Asia-Pacific Wall Covering Market?

The market segments include Product, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6743 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Home Furnishing.

6. What are the notable trends driving market growth?

Residential Sector is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Wall Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Wall Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Wall Covering Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Wall Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence