Key Insights

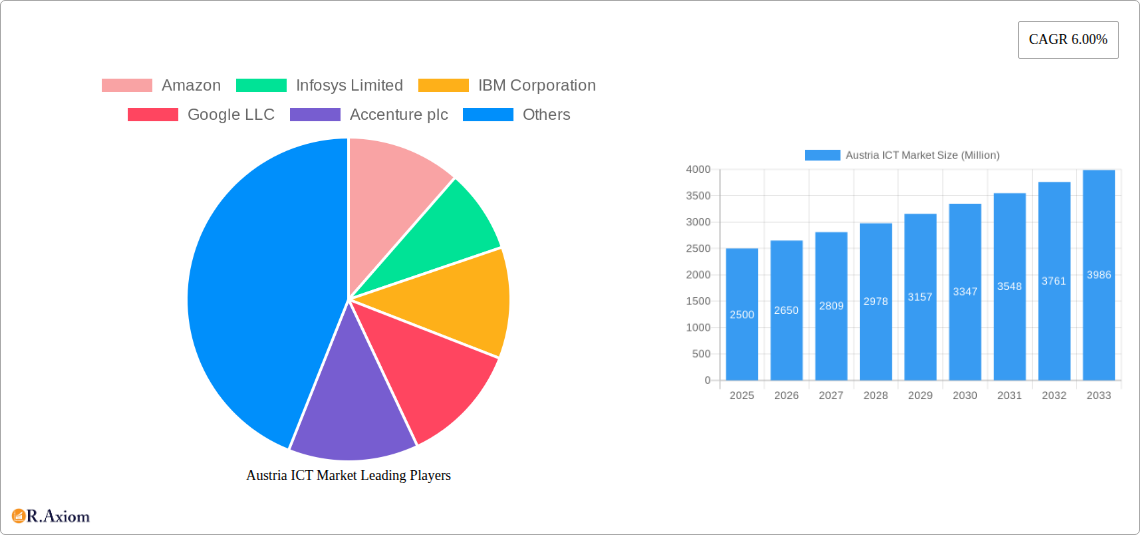

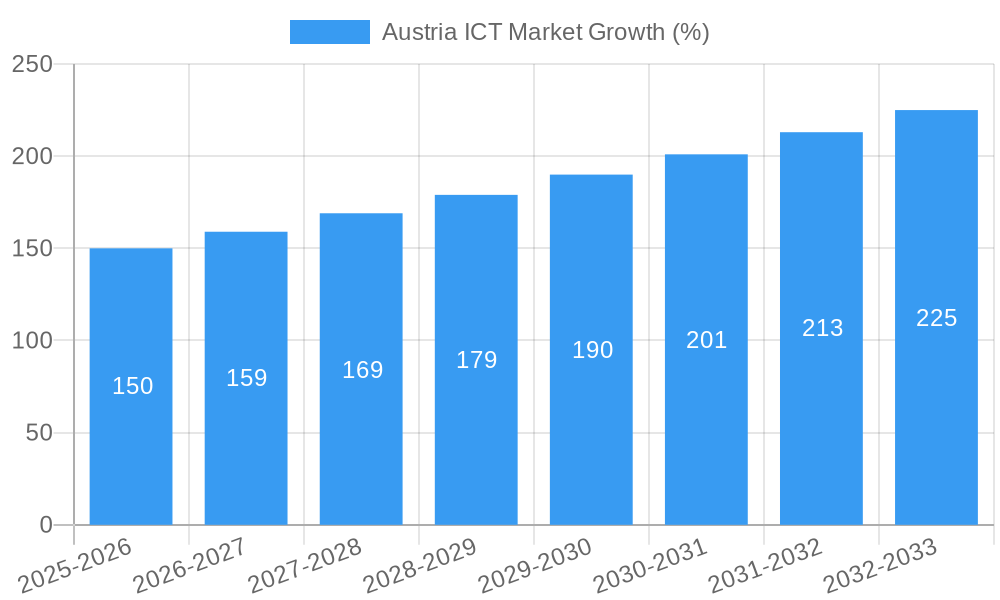

The Austrian ICT market, valued at approximately €X million in 2025 (assuming a logical estimation based on comparable European markets and the provided CAGR), is projected to experience robust growth, driven by increasing digitalization across sectors and rising government investments in infrastructure. The 6.00% CAGR suggests a consistent expansion over the forecast period (2025-2033), with the market size expected to reach approximately €Y million by 2033 (estimation based on CAGR and 2025 market size). Key drivers include the growing adoption of cloud computing, the expanding Internet of Things (IoT) ecosystem, and the increasing demand for cybersecurity solutions in both public and private sectors. Furthermore, the ongoing shift towards digital transformation across various industries, particularly BFSI, IT and Telecom, and Government, fuels this market's growth. While the market faces restraints such as potential skills shortages in the ICT workforce and data privacy concerns, these are likely to be mitigated by continued investment in education and robust cybersecurity regulations. The market is segmented by type (hardware, software, IT services, telecommunication services), enterprise size (SMEs, large enterprises), and industry vertical, reflecting the diverse applications of ICT solutions across Austria. Large enterprises are expected to contribute significantly to market revenue due to higher investments in advanced technologies.

The competitive landscape is shaped by a mix of global giants (Amazon, IBM, Google, Microsoft) and local players. These companies are vying for market share through strategic partnerships, acquisitions, and innovation, offering a wide array of ICT products and services to cater to the growing needs of Austrian businesses and consumers. The software segment is expected to exhibit strong growth, driven by the rising demand for enterprise resource planning (ERP) and customer relationship management (CRM) software, while the IT services segment is projected to maintain its significant share due to outsourcing trends and the need for specialized expertise in digital transformation projects. The strong growth potential, coupled with government support for digital infrastructure development, suggests a promising future for the Austrian ICT market.

Austria ICT Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Austria ICT market, covering market size, segmentation, growth drivers, challenges, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. The report utilizes the latest data and trends to provide accurate and actionable predictions for future market growth. Total market value predictions are in Millions.

Austria ICT Market Concentration & Innovation

The Austrian ICT market exhibits a moderately concentrated landscape, with several multinational corporations holding significant market share. Leading players such as Amazon, Infosys Limited, IBM Corporation, Google LLC, Accenture plc, Hewlett Packard Enterprise, HCL Technologies, Microsoft Corporation, Dell Inc, Cisco Systems, Capgemini, and Oracle compete fiercely, driving innovation and investment. Market share data for 2024 suggests that the top 5 players collectively hold approximately xx% of the market, with the remaining share distributed among numerous smaller players and specialized firms.

Innovation in the Austrian ICT sector is fueled by several factors:

- Government initiatives: Government funding for R&D and digital transformation projects incentivizes innovation.

- Strong talent pool: Austria boasts a skilled workforce in ICT, fostering technological advancements.

- High adoption of new technologies: Rapid uptake of cloud computing, AI, and 5G drives innovation cycles.

Mergers and acquisitions (M&A) are common, with notable transactions such as Accenture's acquisition of ARZ in June 2022, indicating a push towards expanding service offerings and consolidating market positions. The total value of M&A deals in the Austrian ICT sector in 2024 is estimated at xx Million. Regulatory frameworks, while generally supportive of technological advancement, also focus on data protection and cybersecurity, creating a need for innovative solutions in these areas. Product substitutes constantly emerge, necessitating ongoing adaptation by established players. End-user trends reveal a strong preference for cloud-based solutions and increasing demand for cybersecurity services.

Austria ICT Market Industry Trends & Insights

The Austrian ICT market is experiencing robust growth, driven by several key trends. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately xx%, and is projected to remain strong at xx% during the forecast period (2025-2033). Market penetration of advanced technologies such as 5G and cloud computing is increasing rapidly, with xx% market penetration of cloud-based solutions predicted for 2025. Government initiatives promoting digitalization further fuel this growth. Consumer preferences are shifting toward user-friendly, secure, and cost-effective solutions.

Technological disruptions are impacting market dynamics, particularly with the increasing adoption of AI, IoT, and blockchain technology. These innovations offer significant opportunities for companies capable of integrating them into their products and services. Competitive dynamics are intense, with companies focusing on differentiation through superior technology, customer service, and strategic partnerships. The expanding role of data analytics and cybersecurity further contributes to growth. The increasing adoption of digital technologies across various sectors, coupled with government investment in infrastructure projects, further accelerates market growth. Furthermore, the growing importance of data privacy and security regulations are reshaping market offerings and business strategies.

Dominant Markets & Segments in Austria ICT Market

The Austrian ICT market is segmented by type (hardware, software, IT services, telecommunication services), enterprise size (SMEs, large enterprises), and industry vertical (BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Other). While precise market share data for each segment requires further investigation, several segments stand out due to strong growth drivers:

By Type: IT services currently hold the largest share followed by Telecommunication Services and Software. The growth in IT services is driven by increasing demand for cloud-based solutions and digital transformation initiatives.

By Enterprise Size: Large enterprises dominate the market due to their higher IT budgets and complex technological needs. However, SMEs represent a significant and rapidly growing segment, driven by increased adoption of cloud-based solutions and SaaS offerings.

By Industry Vertical: The BFSI (Banking, Financial Services, and Insurance) sector is a major consumer of ICT services, owing to its reliance on secure and reliable technologies. The IT and Telecom sector, Government and Retail and E-commerce sectors are also major contributors to overall market demand.

Key drivers for the dominance of these segments include:

- Economic policies: Government support for digitalization and infrastructure development.

- Infrastructure: Austria's robust digital infrastructure enables efficient ICT deployment.

- High internet penetration: Widespread internet access fuels demand for ICT products and services.

Austria ICT Market Product Developments

Recent product innovations focus on cloud-based solutions, AI-powered services, and enhanced cybersecurity measures. Companies are concentrating on developing solutions that meet the increasing demand for data analytics and digital transformation. The competitive advantage lies in offering tailored solutions that address specific industry needs and providing exceptional customer support. The integration of AI and machine learning in software applications and IT services is shaping the landscape, resulting in improved efficiency, automation, and personalized user experiences.

Report Scope & Segmentation Analysis

This report comprehensively covers the Austrian ICT market, segmented by:

By Type: Hardware, Software, IT Services, and Telecommunication Services. Each segment's market size, growth projections, and competitive dynamics are analyzed individually.

By Size of Enterprise: Small and Medium Enterprises (SMEs) and Large Enterprises. The report assesses the unique needs and technology adoption patterns of each group.

By Industry Vertical: BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, and Other Industry Verticals. The analysis explores the specific ICT requirements of each sector.

Key Drivers of Austria ICT Market Growth

Several factors propel the growth of the Austrian ICT market:

- Government initiatives: Investment in digital infrastructure and initiatives promoting digitalization.

- Technological advancements: Adoption of cloud computing, AI, IoT, and 5G.

- Strong economic growth: A thriving economy supports increased investment in ICT.

- Rising demand for cybersecurity solutions: Growing concerns about data breaches are increasing demand for security solutions.

Challenges in the Austria ICT Market Sector

The Austrian ICT market faces challenges including:

- Cybersecurity threats: The increasing frequency and sophistication of cyberattacks pose a significant threat.

- Skills gap: A shortage of skilled IT professionals hinders growth.

- Competition: Intense competition among domestic and international players. This competition is especially intense within the IT services segment.

- Regulatory complexities: Navigating data privacy and cybersecurity regulations can be challenging.

Emerging Opportunities in Austria ICT Market

Emerging opportunities include:

- Growth of the 5G network: The rollout of 5G offers numerous opportunities for new applications and services.

- Increased adoption of AI and machine learning: These technologies offer significant potential for improving efficiency and productivity across various sectors.

- Expansion of the cloud market: Further growth in cloud computing adoption presents ample opportunities.

- Growing focus on data analytics: Increasing demand for data-driven insights creates opportunities for specialized providers.

Leading Players in the Austria ICT Market Market

- Amazon

- Infosys Limited

- IBM Corporation

- Google LLC

- Accenture plc

- Hewlett Packard Enterprise

- HCL Technologies

- Microsoft Corporation

- Dell Inc

- Cisco Systems

- Capgemini

- Oracle

Key Developments in Austria ICT Market Industry

- June 2022: Accenture acquired Allgemeines Rechenzentrum GmbH (ARZ), expanding its cloud-based banking services.

- October 2022: Google announced plans to open new cloud regions in Austria, boosting cloud computing infrastructure.

- December 2022: Nokia and A1 Austria successfully verified 3CC CA on a 5G SA network, enhancing 5G capabilities.

Strategic Outlook for Austria ICT Market Market

The Austrian ICT market is poised for continued growth, driven by government support, technological advancements, and rising demand for digital solutions. The increasing adoption of cloud computing, AI, and 5G will create significant opportunities for companies offering innovative products and services. Focusing on cybersecurity, data analytics, and customized solutions will be key to success in this competitive market. The market's long-term potential is substantial, with ongoing growth projected throughout the forecast period.

Austria ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Austria ICT Market Segmentation By Geography

- 1. Austria

Austria ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Telecommunication Network

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. Growing demand for Cloud Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infosys Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HCL Technologies*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Capgemini

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oracle

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Austria ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Austria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Austria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Austria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Austria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Austria ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Austria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Austria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Austria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Austria ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria ICT Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Austria ICT Market?

Key companies in the market include Amazon, Infosys Limited, IBM Corporation, Google LLC, Accenture plc, Hewlett Packard Enterprise, HCL Technologies*List Not Exhaustive, Microsoft Corporation, Dell Inc, Cisco Systems, Capgemini, Oracle.

3. What are the main segments of the Austria ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Telecommunication Network.

6. What are the notable trends driving market growth?

Growing demand for Cloud Technology.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

December 2022: Nokia and A1 Austria announced that they successfully verified 3 Component Carrier Aggregation (3CC CA) on a 5G Standalone (SA) experimental network in Austria, with data speeds approaching 2 Gbps. CA (Carrier Aggregation) enables mobile carriers to achieve faster throughputs and improved coverage by combining multiple spectrum frequencies to better use their spectrum assets. It will allow A1 to provide its subscribers with a better 5G experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria ICT Market?

To stay informed about further developments, trends, and reports in the Austria ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence