Key Insights

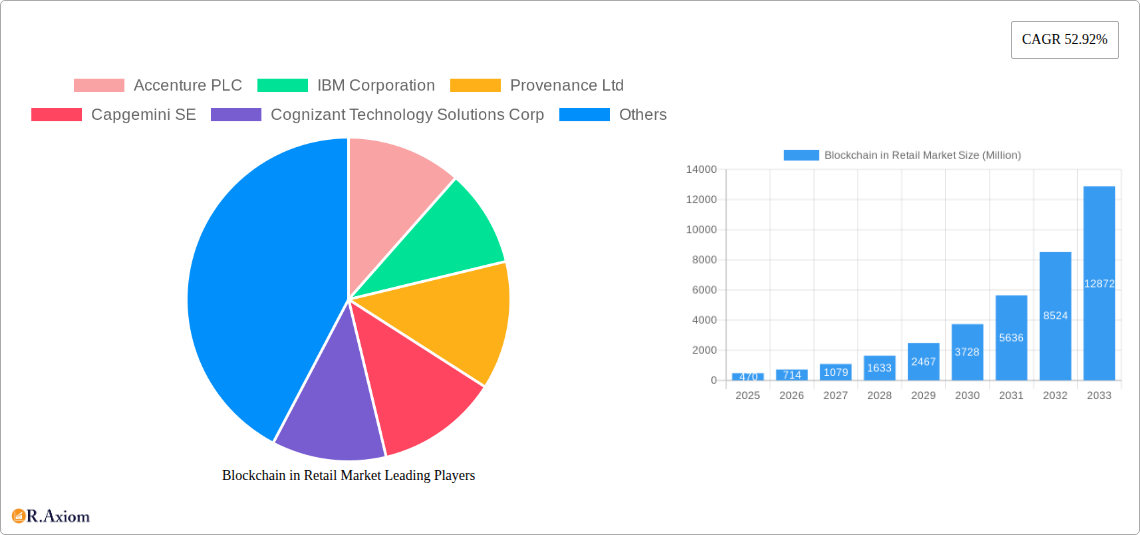

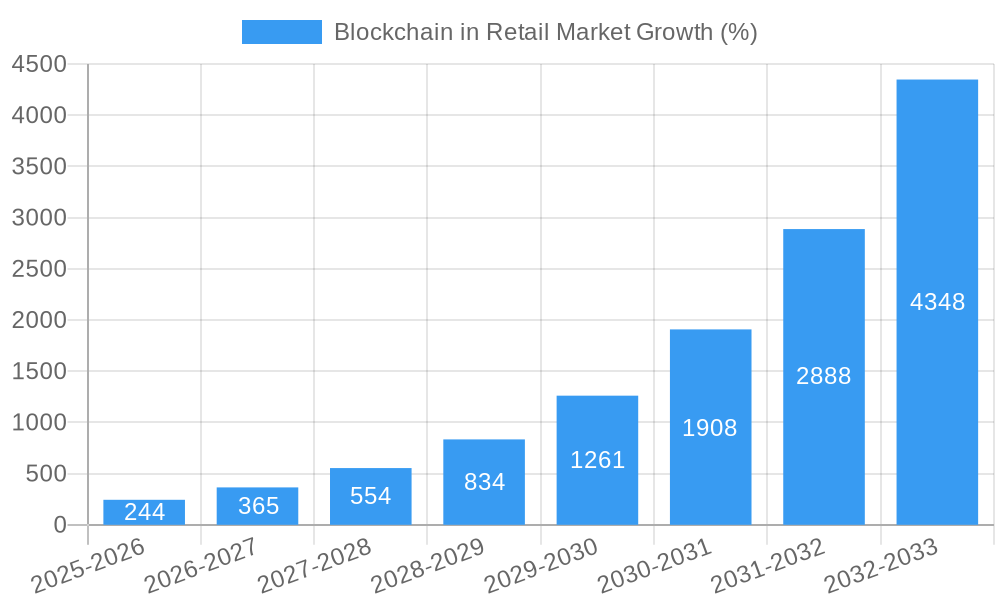

The blockchain in retail market is experiencing explosive growth, projected to reach a market size of $470 million in 2025, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 52.92%. This surge is driven by several key factors. Increasing consumer demand for enhanced transparency and security in supply chains is a primary catalyst. Blockchain's inherent ability to track products from origin to shelf, combating counterfeiting and ensuring authenticity, significantly benefits retailers and consumers alike. Furthermore, the rise of smart contracts automates processes like payments and logistics, streamlining operations and reducing costs. The integration of blockchain into loyalty programs and identity management systems also contributes to market expansion, enhancing customer engagement and data security. While regulatory hurdles and the need for widespread adoption represent challenges, the potential for blockchain to revolutionize various aspects of retail is undeniable.

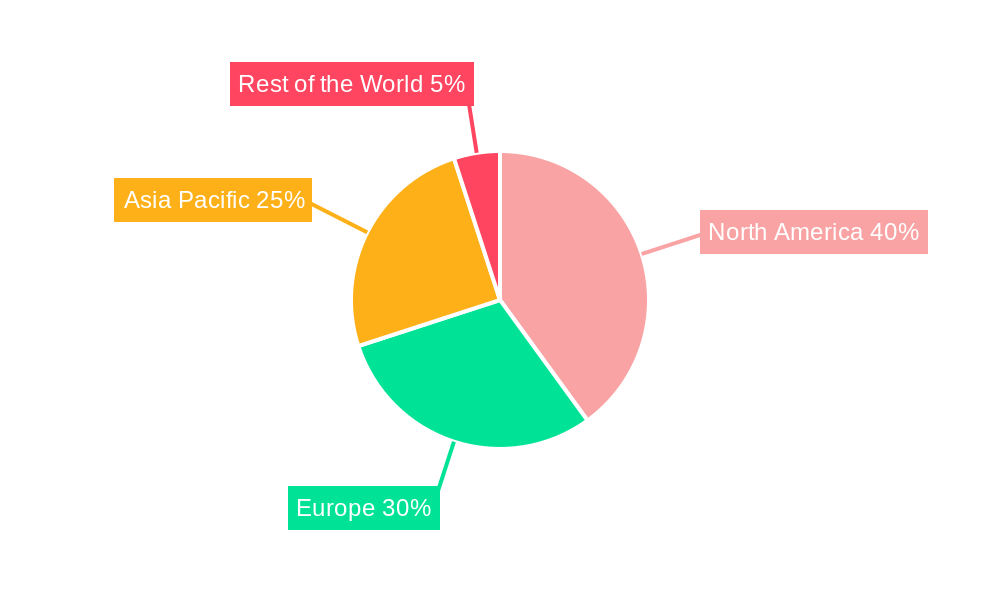

The market segmentation highlights the diverse applications of blockchain technology. Compliance management, leveraging blockchain's immutability for regulatory reporting, is a significant segment. Smart contracts are driving efficiency in agreements and transactions. Supply chain and inventory management benefit from improved traceability and reduced fraud. Automated customer service, powered by secure and transparent data management, improves customer experience. Identity management solutions ensure secure and private customer data handling. Leading companies like Accenture, IBM, and Amazon Web Services are actively investing in and developing blockchain solutions for the retail sector, further fueling market expansion. North America currently holds a substantial market share, but the Asia-Pacific region is expected to experience significant growth due to increasing digitalization and e-commerce adoption. The forecast period (2025-2033) anticipates continued rapid expansion, driven by technological advancements and broader industry acceptance.

Blockchain in Retail Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Blockchain in Retail Market, covering market size, growth drivers, challenges, key players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing the historical period of 2019-2024. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders.

Blockchain in Retail Market Concentration & Innovation

The Blockchain in Retail Market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the market is also characterized by a high level of innovation, driven by the development of new blockchain applications and technologies. Accenture PLC, IBM Corporation, and Capgemini SE, along with other prominent players like Amazon Web Services Inc. and Microsoft Corp., currently command a substantial portion of the market. The market share held by these companies is estimated at approximately 60% in 2025, with the remaining 40% distributed among numerous smaller players. This concentration is likely to remain relatively stable in the forecast period, although increased innovation and new entrants could shift the balance slightly.

Several factors drive innovation within the market. The need for enhanced security and transparency in supply chains is a major motivator, pushing the development of solutions for tracking goods and verifying their authenticity. Regulatory frameworks, while still evolving, play a crucial role in shaping technological development and adoption. Moreover, the emergence of new blockchain platforms and the increasing integration of blockchain with other technologies like IoT and AI contribute to a dynamic and innovative market environment. M&A activities are relatively frequent; while precise deal values are confidential, the average value of M&A deals in the last five years has been estimated at approximately $XX Million, reflecting the strategic importance of blockchain in retail. These acquisitions often involve established companies acquiring smaller, more specialized blockchain firms to integrate their technologies and expand their service offerings. Consumer trends towards more sustainable and ethical consumption also influence the adoption of blockchain-based solutions that provide greater transparency in sourcing and production processes.

Blockchain in Retail Market Industry Trends & Insights

The Blockchain in Retail Market is experiencing significant growth, driven by several key factors. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of $XX Million by 2033. This growth is fueled by increasing consumer demand for transparency and traceability, a growing need for improved supply chain efficiency and security, and the rising adoption of blockchain technology across various retail applications. The increasing adoption of smart contracts is streamlining transactions and reducing operational costs for businesses. Moreover, technological advancements, such as the development of more scalable and efficient blockchain platforms, are contributing to wider adoption. Market penetration is expected to increase significantly, with an estimated xx% of retail businesses adopting blockchain technology by 2033. However, challenges such as scalability issues, regulatory uncertainty, and the need for enhanced interoperability between different blockchain systems remain. The competitive landscape is dynamic, with both established technology companies and new entrants vying for market share. Companies are focusing on developing innovative solutions, expanding their partnerships, and investing heavily in research and development to maintain their competitive edge. This intense competition is driving innovation and ultimately benefiting consumers through improved products and services.

Dominant Markets & Segments in Blockchain in Retail Market

North America is currently the dominant region in the Blockchain in Retail Market, followed by Europe and Asia Pacific. This dominance is driven by several factors, including early adoption of blockchain technology, strong technological infrastructure, and supportive regulatory environments. However, the Asia Pacific region is expected to witness the fastest growth rate during the forecast period, fueled by rising technological advancements, a burgeoning e-commerce sector, and significant government investments in blockchain technology.

By Application, the Supply Chain and Inventory Management segment holds the largest market share, followed by Compliance Management and Transaction Management.

Key Drivers for Supply Chain and Inventory Management:

- Improved tracking and traceability of goods.

- Enhanced security and reduced counterfeiting.

- Optimized inventory management and reduced waste.

- Increased efficiency and reduced costs.

Key Drivers for Compliance Management:

- Enhanced data security and privacy.

- Simplified regulatory reporting and compliance.

- Reduced risk of non-compliance and associated penalties.

- Increased transparency and accountability.

The dominance of these segments stems from their direct impact on operational efficiency, cost reduction, and risk mitigation within the retail sector. The increasing focus on supply chain resilience and enhanced security is further propelling their growth. Economic policies encouraging digitalization and technological advancements contribute to the growth of the market, while robust infrastructure in developed economies supports broader adoption.

Blockchain in Retail Market Product Developments

The Blockchain in Retail Market is witnessing rapid product innovation, driven by the need for more efficient, secure, and transparent solutions. Recent developments include the integration of blockchain with IoT devices for real-time tracking and monitoring of goods, the development of decentralized applications (dApps) for managing customer loyalty programs, and the creation of blockchain-based platforms for facilitating secure and transparent payments. These innovations offer significant competitive advantages by enhancing efficiency, security, and trust within the retail ecosystem. This trend is likely to continue, with a focus on developing user-friendly and scalable solutions that are easily integrated into existing retail systems.

Report Scope & Segmentation Analysis

This report comprehensively segments the Blockchain in Retail Market by application:

Compliance Management: This segment focuses on utilizing blockchain for regulatory compliance, with a projected CAGR of xx% and a market size of $XX Million by 2033. Competition is intense, with established players and new entrants vying for market share.

Smart Contract: The smart contract segment is poised for significant growth, driven by automation and efficiency improvements. It is projected to reach $XX Million by 2033, with a CAGR of xx%. Competition is largely driven by the development of user-friendly and interoperable platforms.

Supply Chain and Inventory Management: This segment holds the largest market share currently, expected to grow at a CAGR of xx% and reach $XX Million by 2033. The competitive landscape is characterized by both large technology providers and niche players focusing on specific supply chain applications.

Transaction Management: This segment is driven by the need for secure and transparent transactions, with projected growth reaching $XX Million by 2033 at a CAGR of xx%. Competition is intense, with established payment processors and new blockchain-based platforms vying for market share.

Automated Customer Service: This emerging segment leverages blockchain for improved customer service interactions and is expected to show significant growth in the coming years, reaching $XX Million by 2033 at a CAGR of xx%. Competition is driven by the development of innovative chatbot and customer support solutions.

Identity Management: This segment focuses on secure identity management solutions, with projected growth to $XX Million by 2033 at a CAGR of xx%. Competition is characterized by a mix of established identity management providers and blockchain-focused startups.

Key Drivers of Blockchain in Retail Market Growth

Several key factors are driving the growth of the Blockchain in Retail Market. These include increasing consumer demand for transparency and traceability in supply chains, a growing need for enhanced security and reduced fraud, the rising adoption of smart contracts for automating business processes, and ongoing technological advancements making blockchain solutions more scalable and affordable. Regulatory changes promoting the adoption of blockchain technology are also playing a significant role. For example, several governments are actively investing in blockchain infrastructure and developing supportive regulatory frameworks, further accelerating market growth. The increasing integration of blockchain with other technologies such as IoT and AI further enhances its capabilities and opens up new opportunities for innovation.

Challenges in the Blockchain in Retail Market Sector

Despite its significant potential, the Blockchain in Retail Market faces several challenges. Scalability issues, particularly with regard to handling large transaction volumes, remain a major hurdle. Regulatory uncertainty in various jurisdictions can create obstacles to adoption, and the lack of standardization across different blockchain platforms creates interoperability challenges. High initial implementation costs and the need for specialized expertise can deter smaller businesses from adopting blockchain technology. Moreover, ensuring consumer trust and understanding of blockchain technology remains an ongoing challenge. These factors can collectively hinder the widespread adoption of blockchain solutions within the retail sector. For example, regulatory hurdles have led to delays in the implementation of blockchain solutions in certain regions, while high initial investment costs have made adoption challenging for smaller retail businesses.

Emerging Opportunities in Blockchain in Retail Market

The Blockchain in Retail Market presents several promising opportunities. The increasing use of blockchain in supply chain management, specifically for tracking products from origin to consumer, presents a large market opportunity. The emergence of new blockchain platforms that address scalability and interoperability challenges will create wider adoption. Growing consumer interest in sustainable and ethical retail practices offers significant opportunities for companies utilizing blockchain to enhance transparency and traceability in their products. Moreover, exploring the integration of blockchain technology with other emerging trends, such as the metaverse and Web3, could open new avenues for growth and innovation within the retail sector.

Leading Players in the Blockchain in Retail Market Market

- Accenture PLC

- IBM Corporation

- Provenance Ltd

- Capgemini SE

- Cognizant Technology Solutions Corp

- Amazon Web Services Inc

- Oracle Corporation

- Microsoft Corp

- BlockVerify

- SAP SE

Key Developments in Blockchain in Retail Market Industry

February 2023: Flipkart and Polygon partnered to establish a Blockchain-eCommerce Centre of Excellence (CoE) in India, focusing on Web3 and metaverse commerce. This significantly boosts the adoption of blockchain in the Indian e-commerce market.

January 2023: Lowe's launched Project Unlock, using blockchain and RFID chips to combat retail theft, improving security and enhancing inventory management. This demonstrates the practical application of blockchain for solving retail challenges.

Strategic Outlook for Blockchain in Retail Market Market

The Blockchain in Retail Market holds immense potential for future growth. The ongoing development of more efficient and scalable blockchain solutions, coupled with increasing consumer demand for transparency and security, will drive wider adoption across the retail sector. Strategic partnerships and collaborations between technology companies and retailers will be crucial for accelerating innovation and market penetration. The integration of blockchain with other emerging technologies, such as AI and IoT, will open new avenues for growth and create new opportunities for businesses to enhance customer experiences and improve operational efficiency. The market is poised for substantial expansion, particularly in developing economies with a growing e-commerce sector and supportive government policies.

Blockchain in Retail Market Segmentation

-

1. Application

- 1.1. Compliance Management

- 1.2. Smart Contract

- 1.3. Supply Chain and Inventory Management

- 1.4. Transaction Management

- 1.5. Automated Customer Service

- 1.6. Identity Management

Blockchain in Retail Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Blockchain in Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 52.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Retail Frauds Prevention and Detection is Driving the Market Growth; Improved Transactions Transparency is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Industry Standardisation for Blockchain is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Supply Chain and Inventory Management segment is expected to acquire major share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Compliance Management

- 5.1.2. Smart Contract

- 5.1.3. Supply Chain and Inventory Management

- 5.1.4. Transaction Management

- 5.1.5. Automated Customer Service

- 5.1.6. Identity Management

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Compliance Management

- 6.1.2. Smart Contract

- 6.1.3. Supply Chain and Inventory Management

- 6.1.4. Transaction Management

- 6.1.5. Automated Customer Service

- 6.1.6. Identity Management

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Compliance Management

- 7.1.2. Smart Contract

- 7.1.3. Supply Chain and Inventory Management

- 7.1.4. Transaction Management

- 7.1.5. Automated Customer Service

- 7.1.6. Identity Management

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Compliance Management

- 8.1.2. Smart Contract

- 8.1.3. Supply Chain and Inventory Management

- 8.1.4. Transaction Management

- 8.1.5. Automated Customer Service

- 8.1.6. Identity Management

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Compliance Management

- 9.1.2. Smart Contract

- 9.1.3. Supply Chain and Inventory Management

- 9.1.4. Transaction Management

- 9.1.5. Automated Customer Service

- 9.1.6. Identity Management

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Blockchain in Retail Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Accenture PLC

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 IBM Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Provenance Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Capgemini SE

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Cognizant Technology Solutions Corp

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Amazon Web Services Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Oracle Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Microsoft Corp

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BlockVerify*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 SAP SE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Accenture PLC

List of Figures

- Figure 1: Global Blockchain in Retail Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Blockchain in Retail Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Rest of the World Blockchain in Retail Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Rest of the World Blockchain in Retail Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Blockchain in Retail Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blockchain in Retail Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Blockchain in Retail Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Blockchain in Retail Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Blockchain in Retail Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Blockchain in Retail Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain in Retail Market?

The projected CAGR is approximately 52.92%.

2. Which companies are prominent players in the Blockchain in Retail Market?

Key companies in the market include Accenture PLC, IBM Corporation, Provenance Ltd, Capgemini SE, Cognizant Technology Solutions Corp, Amazon Web Services Inc, Oracle Corporation, Microsoft Corp, BlockVerify*List Not Exhaustive, SAP SE.

3. What are the main segments of the Blockchain in Retail Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Retail Frauds Prevention and Detection is Driving the Market Growth; Improved Transactions Transparency is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Supply Chain and Inventory Management segment is expected to acquire major share..

7. Are there any restraints impacting market growth?

Lack of Industry Standardisation for Blockchain is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

In Feb 2023, E-commerce giant Flipkart and blockchain platform Polygon entered a strategic partnership to set up a Blockchain-eCommerce Centre of Excellence (CoE). The CoE will work on research and development of Web3 and metaverse commerce use cases in India to accelerate the adoption of Web3.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain in Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain in Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain in Retail Market?

To stay informed about further developments, trends, and reports in the Blockchain in Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence