Key Insights

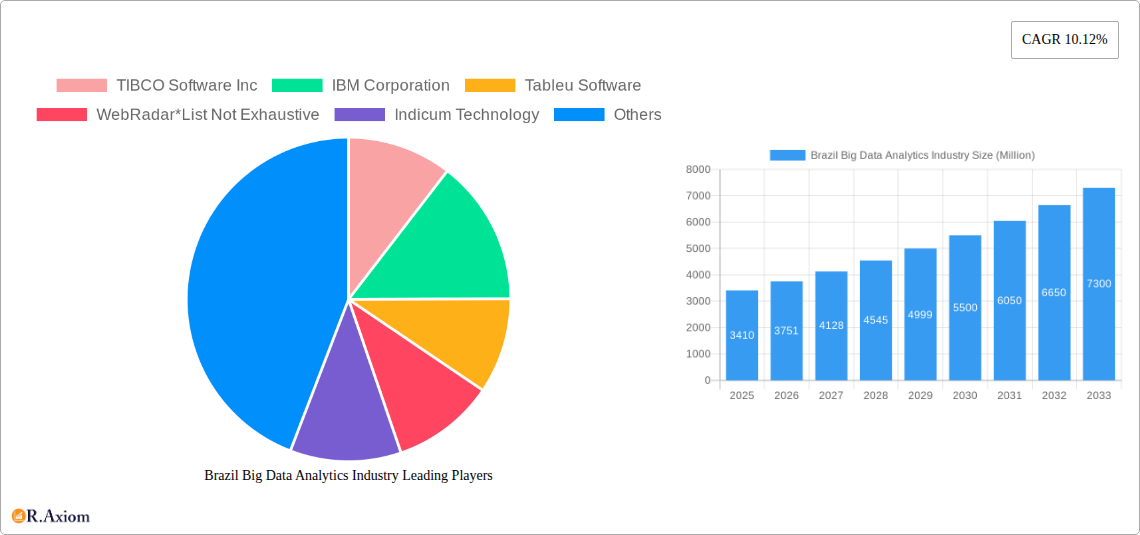

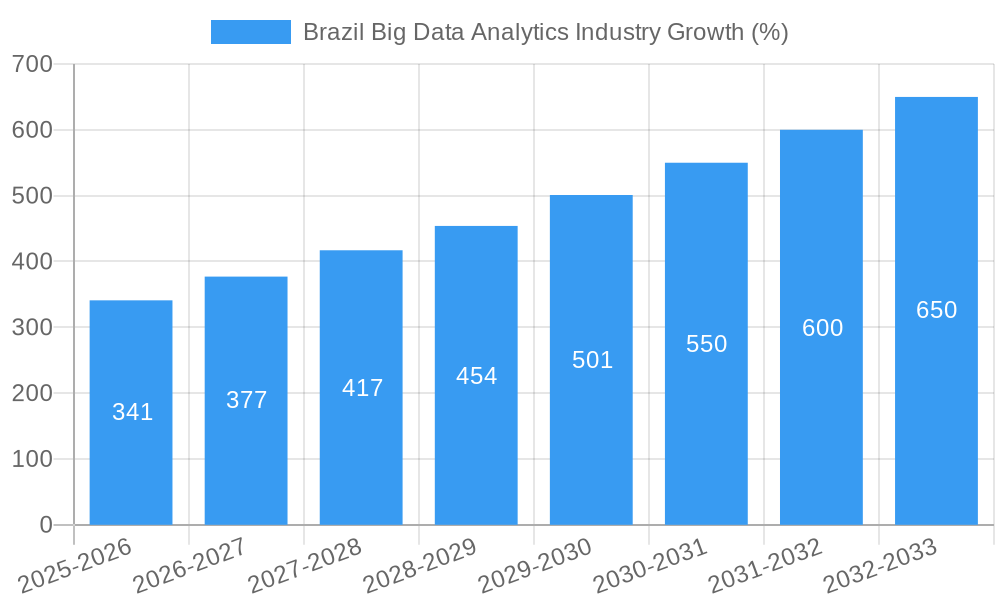

The Brazilian Big Data Analytics market, valued at $3.41 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.12% from 2025 to 2033. This robust expansion is fueled by several key drivers. The increasing adoption of cloud computing and the growing need for data-driven decision-making across various sectors are primary contributors. Furthermore, the Brazilian government's initiatives to promote digitalization and technological advancements are creating a favorable environment for the market's expansion. Strong growth is anticipated across segments, with the IT & Telecom, BFSI (Banking, Financial Services, and Insurance), and Retail & Consumer Goods sectors leading the charge. Large-scale organizations are expected to dominate the market due to their greater resources and capacity to invest in sophisticated analytics solutions. However, the market faces challenges, including concerns about data security and privacy, as well as a potential skills gap in the workforce required to effectively utilize big data technologies. Despite these constraints, the overall market trajectory remains strongly positive, driven by the increasing availability of data, advanced analytics techniques, and the burgeoning digital economy in Brazil.

The competitive landscape features both established global players like IBM, TIBCO, and SAS, and emerging local companies, indicating a dynamic and evolving market. The success of these companies depends on their ability to offer tailored solutions to address the specific needs of Brazilian businesses across diverse sectors. Future growth will be heavily influenced by the pace of digital transformation within key industries, the development of robust data infrastructure, and the continued investment in big data skills development within the Brazilian workforce. The forecast for 2033 suggests a substantial market expansion, driven by the ongoing digital revolution and the increasing strategic importance of data analytics across all sectors of the Brazilian economy. This makes Brazil a compelling market for both established and emerging players in the big data analytics space.

Brazil Big Data Analytics Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Brazil Big Data Analytics industry, covering market size, growth drivers, challenges, and opportunities from 2019 to 2033. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. This in-depth analysis is crucial for businesses seeking to understand the dynamic landscape of Brazil’s burgeoning Big Data Analytics market.

Brazil Big Data Analytics Industry Market Concentration & Innovation

The Brazilian Big Data Analytics market exhibits a moderately concentrated landscape, with a few large multinational players commanding significant market share, alongside several rapidly growing local and regional companies. Key players like TIBCO Software Inc, IBM Corporation, Tableau Software, and Splunk Inc. hold substantial positions, though the exact market share figures are proprietary and unavailable for public disclosure. However, we estimate that the top 5 players hold approximately xx% of the market share in 2025. The market is characterized by continuous innovation driven by the increasing volume of data generated across various sectors. The regulatory framework in Brazil, while evolving, generally supports the adoption of Big Data technologies. However, data privacy regulations are becoming increasingly stringent, impacting data collection and usage. Product substitutes, such as traditional Business Intelligence (BI) tools, continue to exist but their market share is shrinking due to limitations in handling large datasets and advanced analytics capabilities. The market witnesses considerable M&A activity, with deal values ranging from xx Million to xx Million, mostly driven by larger players acquiring smaller specialized companies to enhance their capabilities and expand their market reach. Recent acquisitions have focused on bolstering cloud-based solutions and enhancing AI/ML integrations.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025 estimate).

- Innovation Drivers: Increasing data volume, advancements in AI/ML, cloud computing, and government initiatives.

- Regulatory Framework: Evolving, with a focus on data privacy and security.

- M&A Activity: Significant activity with deal values ranging from xx Million to xx Million.

- End-user trends: Increasing demand for real-time analytics, predictive modeling, and cloud-based solutions.

Brazil Big Data Analytics Industry Industry Trends & Insights

The Brazilian Big Data Analytics market is experiencing robust growth, propelled by factors like the increasing digitalization of businesses, government initiatives promoting data-driven decision-making, and the expanding adoption of cloud-based analytics solutions. The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration remains relatively low compared to developed economies, presenting substantial untapped potential. Technological disruptions, primarily from advancements in AI, Machine Learning, and the Internet of Things (IoT), are driving the demand for sophisticated analytical tools. Consumer preferences are shifting towards personalized experiences, thereby fueling the demand for advanced analytics capable of providing real-time insights and customer segmentation. The competitive landscape is dynamic, with established players facing challenges from agile startups and niche providers. The market is also witnessing the increasing adoption of open-source technologies and platforms. Market penetration is projected to reach xx% by 2033.

Dominant Markets & Segments in Brazil Big Data Analytics Industry

The Brazilian Big Data Analytics market demonstrates strong growth across all segments, though the large-scale organization segment displays the highest growth trajectory.

By Organization Size:

- Large Scale Organizations: Dominates the market due to higher budgets, sophisticated data infrastructure, and strategic focus on data-driven decision-making. Key drivers include increasing investments in digital transformation and the adoption of advanced analytics for operational efficiency and competitive advantage.

- Small and Medium Scale Organizations: Demonstrating significant growth, driven by the decreasing cost of Big Data solutions and the availability of cloud-based services. Challenges include limited resources and technical expertise.

By End-User Vertical:

- BFSI (Banking, Financial Services, and Insurance): A leading segment due to the heavy reliance on data for fraud detection, risk management, and customer relationship management. Strong regulatory compliance requirements also drive adoption.

- IT & Telecom: High data generation and the need for network optimization and customer churn prediction propel significant growth in this sector.

- Retail & Consumer Goods: Companies are increasingly using Big Data Analytics for customer segmentation, targeted marketing, and supply chain optimization.

- Manufacturing: Adoption is driven by the need for predictive maintenance, quality control, and process optimization.

- Healthcare & Lifesciences: Growing adoption is evident due to the need for improved patient care, drug discovery, and clinical trials management. Data privacy and security regulations play a vital role in the selection of vendors.

- Government: Governmental bodies are increasingly adopting Big Data Analytics for policy development, citizen services improvement, and resource allocation.

Other verticals (including energy, transportation, and education) are showing gradual but promising growth as awareness and digitalization progresses.

Brazil Big Data Analytics Industry Product Developments

The Brazilian Big Data Analytics market shows a trend towards cloud-based solutions, integrated AI/ML capabilities, and real-time analytics dashboards. Products are increasingly focusing on user-friendly interfaces and easy data integration with existing systems. Companies are emphasizing the competitive advantage of improved operational efficiency, reduced costs, and enhanced decision-making capabilities through their offerings.

Report Scope & Segmentation Analysis

This report segments the Brazil Big Data Analytics market by organization size (Small and Medium Scale, Large Scale Organizations) and end-user vertical (IT & Telecom, BFSI, Retail & Consumer Goods, Manufacturing, Healthcare & Lifesciences, Government, Other End-User Verticals). Each segment's growth projections, market sizes, and competitive dynamics are extensively analyzed throughout the report. For example, the BFSI segment is projected to witness significant growth due to its strong reliance on data analytics for risk management and regulatory compliance. In contrast, the small and medium-sized enterprise segment shows a growing adoption rate of cloud-based solutions to overcome infrastructure limitations.

Key Drivers of Brazil Big Data Analytics Industry Growth

Several factors fuel the growth of the Brazilian Big Data Analytics market. These include the increasing adoption of cloud computing, which reduces infrastructure costs and provides scalability; government initiatives supporting digital transformation and data-driven decision-making; the growing need for real-time insights in various sectors; and continuous advancements in AI and machine learning technologies, enabling more sophisticated analytics and predictive modeling.

Challenges in the Brazil Big Data Analytics Industry Sector

Despite the promising growth trajectory, challenges remain. These include the high cost of implementation for some organizations, particularly SMEs; a shortage of skilled professionals; concerns about data privacy and security; and the need for robust data infrastructure across the country. These challenges create significant barriers to entry for smaller players and require substantial investment from larger firms to overcome. This restricts market expansion and potentially increases the cost of Big Data services.

Emerging Opportunities in Brazil Big Data Analytics Industry

Significant opportunities exist for companies in the Brazilian Big Data Analytics market. The expansion of 5G networks and the growth of the IoT present immense data generation possibilities. The increased focus on digital transformation across sectors opens new markets for Big Data analytics applications. The need for advanced analytics solutions tailored to specific industry verticals also presents significant growth potential for specialized providers.

Leading Players in the Brazil Big Data Analytics Industry Market

- TIBCO Software Inc

- IBM Corporation

- Tableau Software

- WebRadar

- Indicum Technology

- Cotex Intelligence

- SAS Institute

- TAIL DMP

- QlikTech

- Precifica

- Splunk Inc

Key Developments in Brazil Big Data Analytics Industry Industry

- March 2023: TIBCO Software Inc announced enhancements to its analytics suite, improving real-time analytics and accelerating time-to-decision. This development strengthens their market position by offering more efficient and user-friendly solutions.

- December 2022: Splunk Inc. extended its collaboration with AWS, enhancing security data lake capabilities and simplifying data access for customers. This strategic move broadens Splunk’s reach and increases its competitiveness in the cloud-based security analytics market.

Strategic Outlook for Brazil Big Data Analytics Industry Market

The future of the Brazilian Big Data Analytics market appears exceptionally promising. Continued investments in digital infrastructure, growing adoption of cloud services, and increasing demand for AI-driven insights will fuel considerable growth. Companies that adapt to evolving technological trends, prioritize data security and privacy, and cultivate skilled talent will be well-positioned to capitalize on the vast potential of this market. The market is poised for sustained expansion in the coming years, driven by both domestic demand and global interest in Brazil’s developing economy.

Brazil Big Data Analytics Industry Segmentation

-

1. Organization Size

- 1.1. Small and Medium Scale

- 1.2. Large Scale Organizations

-

2. End-user Vertical

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and Consumer Goods

- 2.4. Manufacturing

- 2.5. Healthcare and Lifesciences

- 2.6. Government

- 2.7. Other End-user Verticals

Brazil Big Data Analytics Industry Segmentation By Geography

- 1. Brazil

Brazil Big Data Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Higher Emphasis on Use of Analytics Tools to Empower Decision Making Among Large-Scale Enterprises; Rapid Increase in the Generation of Data Coupled with Availability of Several End-User Specific Tools Due to the Growth in Local Landscape; Growing Demand in Enterprise

- 3.2.2 Government and Telecom Verticals; Emerging Trends Such as Social Media Analytics to Witness the Growth

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Concerns

- 3.4. Market Trends

- 3.4.1. Retail & Consumer Goods is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Big Data Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium Scale

- 5.1.2. Large Scale Organizations

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Manufacturing

- 5.2.5. Healthcare and Lifesciences

- 5.2.6. Government

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TIBCO Software Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tableu Software

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WebRadar*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indicum Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cotex Intelligence

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAS Institute

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TAIL DMP

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 QlikTech

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Precifica

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Splunk Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 TIBCO Software Inc

List of Figures

- Figure 1: Brazil Big Data Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Big Data Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Big Data Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Big Data Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: Brazil Big Data Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Brazil Big Data Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Big Data Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Big Data Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 7: Brazil Big Data Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 8: Brazil Big Data Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Big Data Analytics Industry?

The projected CAGR is approximately 10.12%.

2. Which companies are prominent players in the Brazil Big Data Analytics Industry?

Key companies in the market include TIBCO Software Inc, IBM Corporation, Tableu Software, WebRadar*List Not Exhaustive, Indicum Technology, Cotex Intelligence, SAS Institute, TAIL DMP, QlikTech, Precifica, Splunk Inc.

3. What are the main segments of the Brazil Big Data Analytics Industry?

The market segments include Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Emphasis on Use of Analytics Tools to Empower Decision Making Among Large-Scale Enterprises; Rapid Increase in the Generation of Data Coupled with Availability of Several End-User Specific Tools Due to the Growth in Local Landscape; Growing Demand in Enterprise. Government and Telecom Verticals; Emerging Trends Such as Social Media Analytics to Witness the Growth.

6. What are the notable trends driving market growth?

Retail & Consumer Goods is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

High Costs and Operational Concerns.

8. Can you provide examples of recent developments in the market?

March 2023: TIBCO Software Inc announced a series of enhancements to its analytics suite, delivering immersive, smart, and real-time analytics that empower customers to take action and benefit from faster, smarter insights. Game-changing updates to TIBCO Spotfire and other scalable analytics solutions close the gap between understanding and action, building on existing capabilities to accelerate time-to-decision and lower operations costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Big Data Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Big Data Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Big Data Analytics Industry?

To stay informed about further developments, trends, and reports in the Brazil Big Data Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence