Key Insights

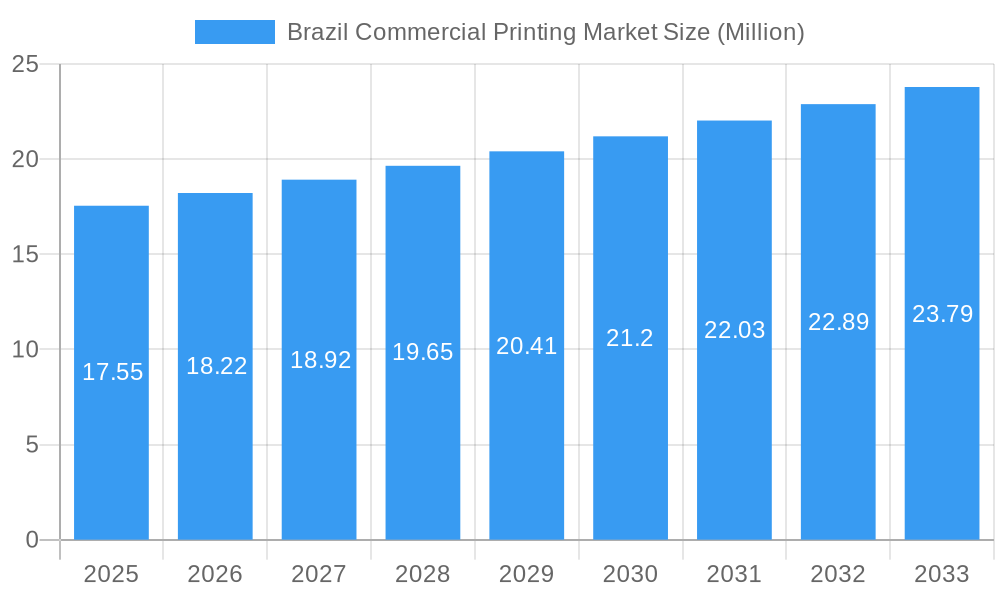

The Brazil commercial printing market, valued at $17.55 million in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 3.64% from 2025 to 2033. This growth is fueled by several key factors. The expanding Brazilian economy, particularly in sectors like consumer goods and retail, necessitates increased packaging and marketing materials, thereby stimulating demand for commercial printing services. Furthermore, the rising adoption of digital printing technologies, such as inkjet and digital offset, offers greater flexibility, faster turnaround times, and personalized print solutions, attracting businesses seeking efficient and cost-effective printing solutions. While the market faces challenges like the increasing popularity of digital marketing and the fluctuation of the Brazilian real, these are offset by the growing need for high-quality printed materials for brand building and targeted marketing campaigns, especially among smaller and medium-sized enterprises (SMEs) that appreciate the tangible and impactful nature of printed collateral. The market segmentation by technology (Offset Lithography, Inkjet, Flexographic, Screen, Gravure, and Other Technologies) reveals a dynamic landscape with ongoing technology shifts, creating opportunities for companies that can adapt quickly and offer innovative solutions. Key players like Heidelberger Druckmaschinen AG, Pancrom Indústria Gráfica Ltda, and Avery Dennison are well-positioned to capitalize on this growth, although intense competition among established and emerging players is expected.

Brazil Commercial Printing Market Market Size (In Million)

The forecast period (2025-2033) suggests a gradual but consistent expansion of the Brazilian commercial printing market. This is contingent upon continued economic growth in Brazil, sustained investment in printing infrastructure by industry players, and a balance between traditional printing methods and the increasing uptake of digital printing technologies. The market's growth trajectory hinges on successful adaptation to evolving consumer preferences, effective cost management in response to economic fluctuations, and targeted marketing efforts to showcase the continued relevance and value proposition of high-quality commercial printing services. Market players who invest in innovation, sustainability practices, and skilled workforce development are expected to secure a competitive edge in this evolving market landscape.

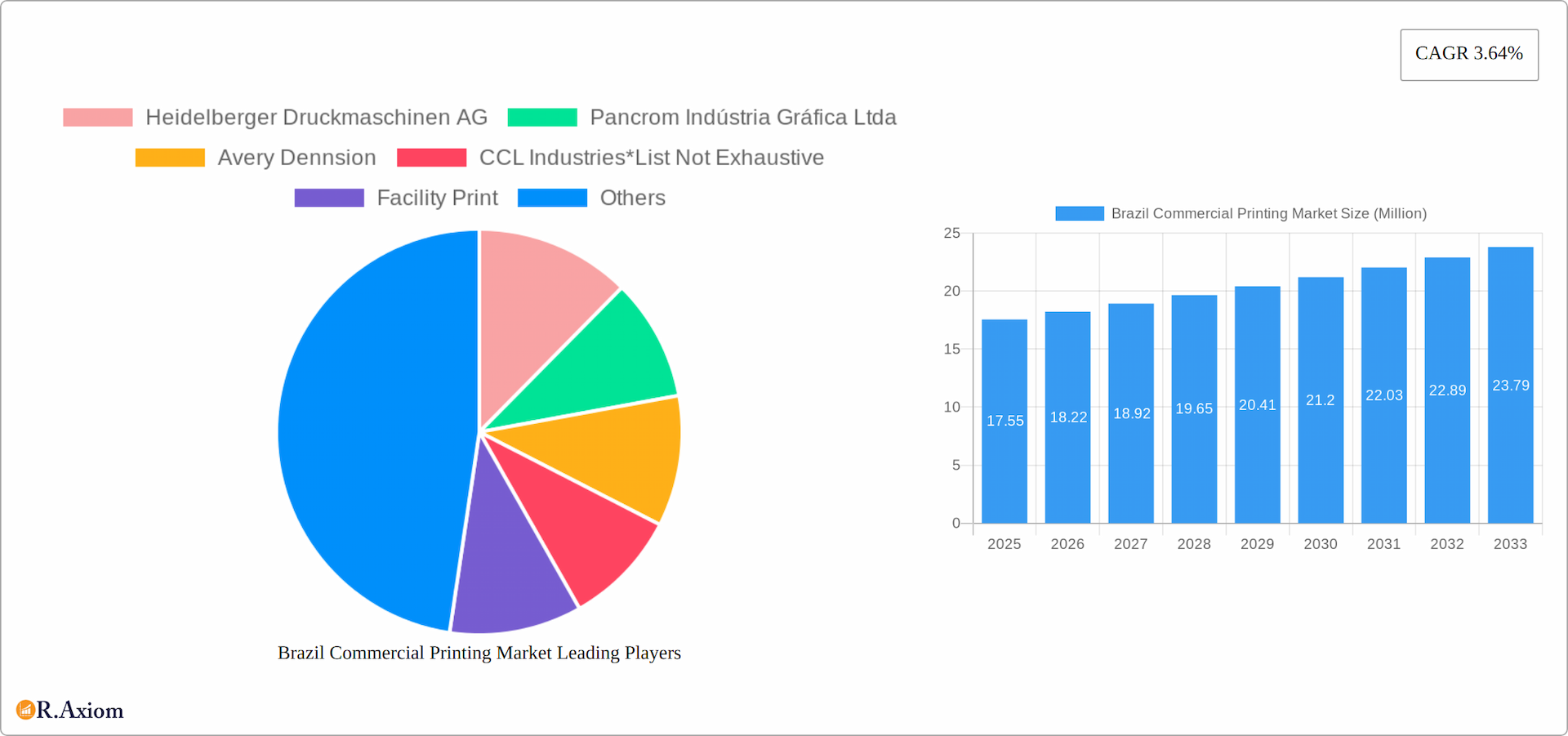

Brazil Commercial Printing Market Company Market Share

Brazil Commercial Printing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil Commercial Printing Market, covering market size, segmentation, growth drivers, challenges, and key players. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project market trends up to 2033. The study period is 2019-2033, with a forecast period of 2025-2033.

Brazil Commercial Printing Market Concentration & Innovation

The Brazilian commercial printing market exhibits a moderately concentrated landscape, with several large players and a significant number of smaller, specialized printers. Market share data for 2024 indicates that the top five players hold approximately XX% of the market, while the remaining share is distributed amongst numerous smaller firms. This fragmented nature allows for niche specialization and responsiveness to evolving customer demands. Innovation is driven by the adoption of advanced technologies, such as inkjet and digital printing, coupled with a growing demand for personalized and customized print solutions. Stringent environmental regulations are also pushing innovation towards sustainable printing practices. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging approximately XX Million in the past five years. This activity primarily focuses on consolidation within specific segments like packaging printing.

- Market Concentration: Top 5 players hold approximately XX% market share (2024).

- Innovation Drivers: Advanced printing technologies, sustainable practices, personalized printing.

- M&A Activity: Average deal value approximately XX Million (2019-2024).

- Regulatory Framework: Focus on environmental sustainability influencing technology adoption.

- Product Substitutes: Digital media, online marketing materials pose a competitive threat.

- End-user Trends: Increasing demand for short-run, personalized prints and packaging solutions.

Brazil Commercial Printing Market Industry Trends & Insights

The Brazilian commercial printing market is poised for significant growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This expansion is driven by several key factors. The rise of e-commerce is fueling demand for packaging and labeling solutions, significantly impacting the market's trajectory. Increased consumer spending, particularly within these segments, further contributes to this positive outlook. Technological advancements are revolutionizing the industry, with the integration of Industry 4.0 technologies and the increasing adoption of digital printing solutions leading to enhanced efficiency and greater customization capabilities. The penetration of digital printing is expected to reach approximately XX% by 2033, reshaping the competitive landscape and creating new opportunities. While established players navigate this evolving market, agile, digitally-native print providers are emerging as significant competitors. Furthermore, a growing consumer preference for sustainable and eco-friendly printing practices is driving demand for solutions that minimize environmental impact, including eco-conscious inks and materials. This focus on sustainability presents both challenges and opportunities for market participants.

Dominant Markets & Segments in Brazil Commercial Printing Market

The packaging segment holds the largest market share within the Brazil Commercial Printing Market, driven by robust growth in the food and beverage, consumer goods, and pharmaceutical sectors. Offset lithography remains the dominant printing technology, although inkjet printing is rapidly gaining traction, particularly in short-run and personalized print applications. The Southeast region of Brazil holds the largest market share due to high economic activity and a large concentration of businesses.

- Leading Segment: Packaging (by application)

- Dominant Technology: Offset Lithography (with growing inkjet adoption).

- Leading Region: Southeast Brazil

- Key Drivers (Southeast Region): High economic activity, substantial business concentration, advanced infrastructure.

Brazil Commercial Printing Market Product Developments

Recent product innovations focus on increasing efficiency, enhancing print quality, and incorporating sustainability features. The launch of new inks with lower consumption, Industry 4.0 connectivity in flexo presses, and the development of sustainable printing materials are prominent examples. These innovations are aimed at enhancing cost-effectiveness, improving productivity, and meeting the increasing demand for eco-friendly printing solutions, aligning perfectly with market requirements for improved efficiency and sustainability.

Report Scope & Segmentation Analysis

This report segments the Brazil Commercial Printing Market by technology:

Offset Lithography: The largest segment, experiencing moderate growth, driven by its cost-effectiveness for large-volume printing. Market size in 2025 is estimated at XX Million, with a projected growth to XX Million by 2033. Competitive dynamics are characterized by established players.

Inkjet: The fastest-growing segment, fueled by rising demand for personalized and short-run printing. Market size in 2025 is estimated at XX Million, projected to reach XX Million by 2033. Strong competitive pressure exists due to many entrants.

Flexographic: Significant segment driven by demand in flexible packaging. Market size in 2025 is estimated at XX Million, with a projected growth to XX Million by 2033.

Screen: A niche segment focused on specialized applications. Market size in 2025 is estimated at XX Million, with a projected growth to XX Million by 2033.

Gravure: Another niche segment, primarily serving packaging applications. Market size in 2025 is estimated at XX Million, with a projected growth to XX Million by 2033.

Other Technologies: This category includes a variety of emerging and specialized printing technologies. Market size in 2025 is estimated at XX Million, with a projected growth to XX Million by 2033.

Key Drivers of Brazil Commercial Printing Market Growth

The growth of the Brazilian commercial printing market is driven by several factors: a growing economy, rising consumer spending, increasing demand for packaging solutions tied to e-commerce expansion, and the adoption of innovative printing technologies to enhance efficiency and personalization. Government initiatives supporting small and medium-sized enterprises (SMEs) also contribute positively to market growth.

Challenges in the Brazil Commercial Printing Market Sector

Despite its growth potential, the Brazilian commercial printing market faces considerable hurdles. Intense competition from digital media necessitates continuous adaptation and innovation. Fluctuating raw material prices directly impact profitability, requiring careful cost management and strategic sourcing. Significant investment in advanced technologies is essential for maintaining competitiveness in a rapidly evolving market. Furthermore, economic volatility and increasingly stringent environmental regulations pose significant challenges for market players, demanding proactive strategies to navigate these complexities.

Emerging Opportunities in Brazil Commercial Printing Market

Significant growth opportunities exist for businesses capable of adapting to the changing market dynamics. The increasing demand for personalized printing services caters to the growing need for unique and customized solutions. The strong emphasis on sustainability presents an opportunity for businesses to capitalize on the demand for eco-friendly printing solutions and materials. The expansion of the e-commerce sector presents significant potential for growth in packaging-related printing services. Moreover, the development and adoption of innovative printing technologies offer substantial opportunities for market expansion and differentiation.

Leading Players in the Brazil Commercial Printing Market Market

- Heidelberger Druckmaschinen AG

- Pancrom Indústria Gráfica Ltda

- Avery Dennsion

- CCL Industries

- Facility Print

- Gráfica Gonçalves

- Nilpeter

- FastPrint

- Copy House a Gráfica Digital do Rio

- 3M Company

Key Developments in Brazil Commercial Printing Market Industry

June 2023: Etirama's launch of its new SPS3 flexo press, incorporating Industry 4.0 connectivity and promising a high return on investment (ROI), signifies a move towards greater efficiency and streamlined remote technical support.

May 2023: Agfa's introduction of new inks for its Onset and Avinci inkjet printers highlights advancements in print quality, a broader color gamut, and notably, a reduction in ink consumption of up to 20%, improving both the quality and cost-effectiveness of printing operations.

Strategic Outlook for Brazil Commercial Printing Market Market

The Brazilian commercial printing market presents a promising outlook, driven by sustained economic growth, expanding e-commerce, and increasing demand for personalized and sustainable printing solutions. Companies that adopt innovative technologies, embrace sustainability, and cater to evolving consumer preferences are poised for significant growth and market leadership in the coming years.

Brazil Commercial Printing Market Segmentation

-

1. Technology

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Other Technologies

Brazil Commercial Printing Market Segmentation By Geography

- 1. Brazil

Brazil Commercial Printing Market Regional Market Share

Geographic Coverage of Brazil Commercial Printing Market

Brazil Commercial Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand-side Driver Analysis; Supply-side Driver Analysis

- 3.3. Market Restrains

- 3.3.1. Barriers to Adoption and Industry Challenges

- 3.4. Market Trends

- 3.4.1. Supply-side Drivers to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Heidelberger Druckmaschinen AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pancrom Indústria Gráfica Ltda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avery Dennsion

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CCL Industries*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Facility Print

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gráfica Gonçalves

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nilpeter

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FastPrint

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Copy House a Gráfica Digital do Rio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3M Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Heidelberger Druckmaschinen AG

List of Figures

- Figure 1: Brazil Commercial Printing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Commercial Printing Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Brazil Commercial Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Brazil Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Brazil Commercial Printing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Commercial Printing Market?

The projected CAGR is approximately 3.64%.

2. Which companies are prominent players in the Brazil Commercial Printing Market?

Key companies in the market include Heidelberger Druckmaschinen AG, Pancrom Indústria Gráfica Ltda, Avery Dennsion, CCL Industries*List Not Exhaustive, Facility Print, Gráfica Gonçalves, Nilpeter, FastPrint, Copy House a Gráfica Digital do Rio, 3M Company.

3. What are the main segments of the Brazil Commercial Printing Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand-side Driver Analysis; Supply-side Driver Analysis.

6. What are the notable trends driving market growth?

Supply-side Drivers to Boost the Market.

7. Are there any restraints impacting market growth?

Barriers to Adoption and Industry Challenges.

8. Can you provide examples of recent developments in the market?

June 2023 - Etirama, a flexographic printing manufacturer based in Brazil, launched its new SPS3 flexo press. The press has Industry 4.0 connectivity, with remote technical assistance and the ability to inform about its production in real time. According to the Brazilian CEO of the manufacturing company, like all other Etirama presses in general, the SPS3 has a high rate of return on investment (ROI) built into its DNA. The modular configuration of the SPS3 gives flexibility to converters willing to invest less upfront.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Commercial Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Commercial Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Commercial Printing Market?

To stay informed about further developments, trends, and reports in the Brazil Commercial Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence