Key Insights

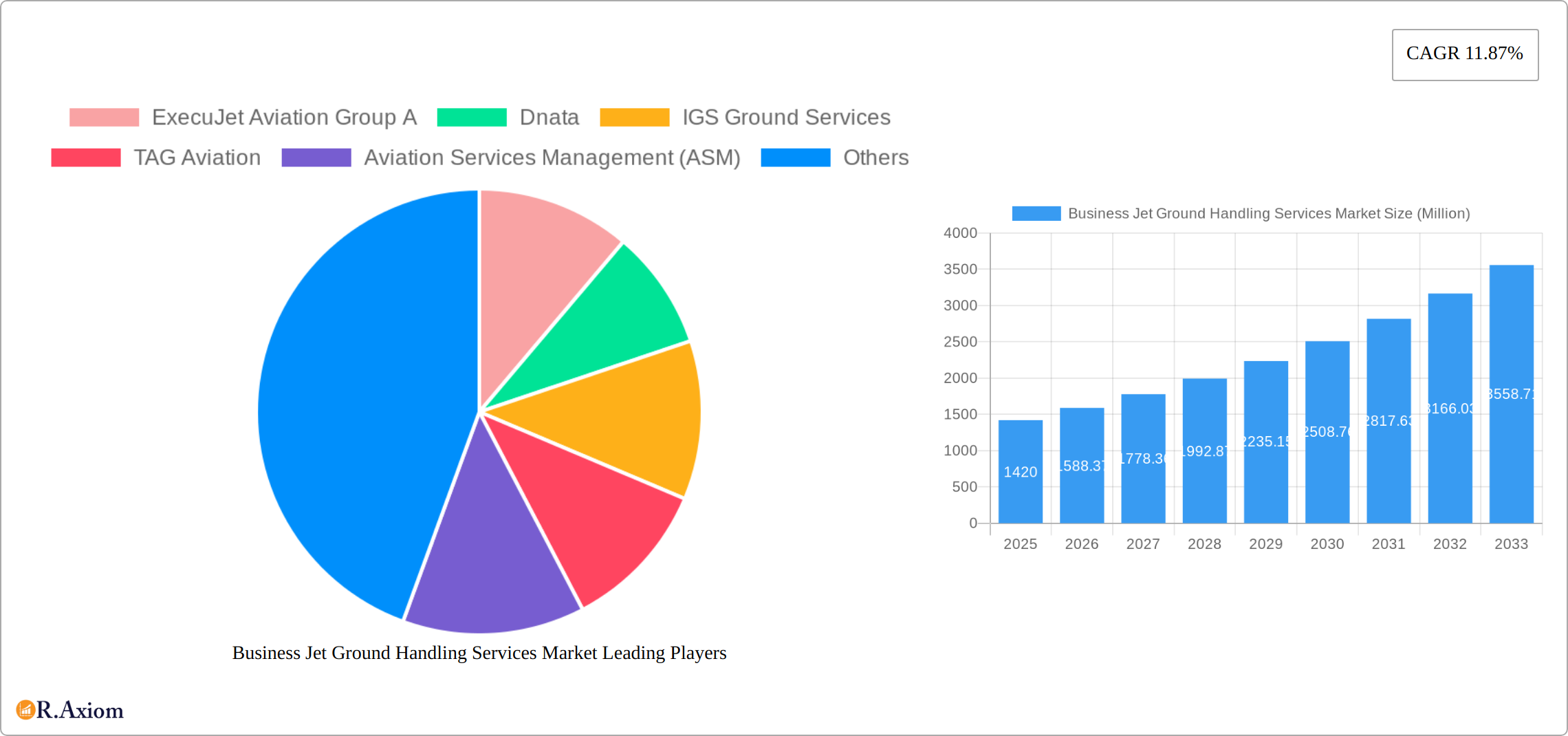

The Business Jet Ground Handling Services market is experiencing robust growth, projected to reach a market size of $1.42 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.87% from 2025 to 2033. This expansion is driven by several key factors. The increasing number of high-net-worth individuals and corporations owning and utilizing private jets fuels demand for efficient and reliable ground handling services. Furthermore, the rise in business travel, particularly among executives and high-profile individuals, contributes significantly to market growth. Technological advancements in ground handling equipment and software solutions, such as improved baggage handling systems and real-time tracking capabilities, enhance operational efficiency and customer satisfaction, thereby attracting further investment. The growing focus on passenger experience and safety standards within the aviation industry also acts as a major driver, pushing service providers to enhance their offerings and consequently increasing overall market value. The market is segmented into aircraft handling, passenger handling, and cargo and baggage handling, with each segment contributing significantly to the overall growth. Competition is fierce, with major players like ExecuJet Aviation Group, dnata, and Jet Aviation AG vying for market share through strategic partnerships, service expansions, and technological innovations.

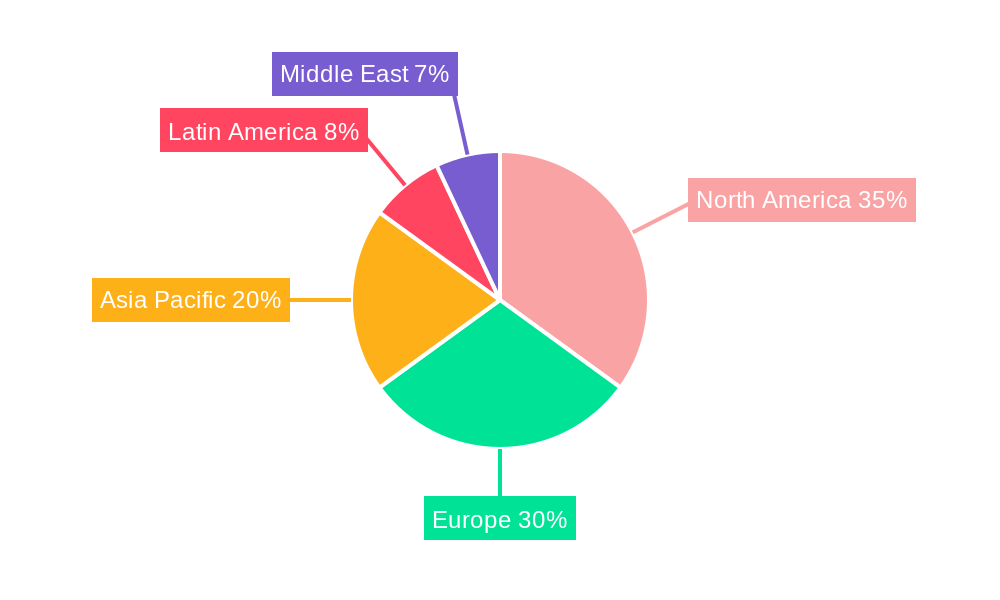

Geographical distribution of the market indicates strong regional variations in growth. North America and Europe currently hold significant market shares due to the established presence of major players and a high concentration of business aviation activity. However, the Asia-Pacific region is poised for rapid expansion, driven by increasing disposable incomes, economic growth, and rising demand for luxury travel services. The Middle East and Latin America are also experiencing moderate growth, driven by investments in airport infrastructure and increasing business travel in these regions. While regulatory hurdles and potential economic downturns present potential restraints, the overall growth trajectory of the Business Jet Ground Handling Services market remains positive, supported by the ongoing expansion of the business aviation sector and sustained demand for premium services.

Business Jet Ground Handling Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Business Jet Ground Handling Services Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, and future growth potential. The study period (2019-2024) provides a historical perspective, while the forecast period (2025-2033) projects future market expansion. The report includes detailed segmentation by service type (Aircraft Handling, Passenger Handling, Cargo and Baggage Handling), offering granular insights into each segment's growth trajectory. Leading players like ExecuJet Aviation Group, dnata, IGS Ground Services, and others are profiled, offering a comprehensive understanding of the competitive landscape.

Business Jet Ground Handling Services Market Concentration & Innovation

The Business Jet Ground Handling Services market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary information within the full report, the market is characterized by a blend of large multinational corporations and regional operators. The market's innovation is driven by the need for enhanced efficiency, safety, and sustainability. Advancements in technology, such as automated baggage handling systems and digitalized ground support equipment (GSE), are key drivers of innovation. Furthermore, regulatory frameworks, focusing on safety and environmental concerns, significantly influence the market. The increasing demand for seamless and efficient ground handling processes contributes to ongoing consolidation through mergers and acquisitions (M&A). Recent M&A activity suggests deal values exceeding USD xx Million, demonstrating industry consolidation trends. Product substitutes are limited, as specialized ground handling equipment and expertise are essential for this niche market. End-user trends focus on reduced turnaround times, enhanced security, and improved customer experience.

Business Jet Ground Handling Services Market Industry Trends & Insights

The Business Jet Ground Handling Services market is experiencing robust growth, fueled by the burgeoning business aviation sector and a surge in demand for premium ground support services. This expansion is projected to continue at a significant Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is being driven by several key factors, including:

- Technological Advancements: The adoption of digital solutions, such as real-time tracking and resource management systems, is streamlining operations, improving efficiency, and enhancing the overall customer experience. The integration of data analytics allows for better forecasting, optimized resource allocation, and proactive problem-solving.

- Evolving Customer Preferences: Demand for personalized and customized services is on the rise. Ground handlers are responding by offering tailored solutions that cater to the unique needs of individual business jet operators and passengers, enhancing customer loyalty and driving growth.

- Sustainability Initiatives: The industry is increasingly focused on reducing its environmental impact. The adoption of advanced technologies like electric de-icing systems is gaining traction, reflecting a broader commitment to sustainable practices and appealing to environmentally conscious clientele.

- Competitive Landscape: The market is characterized by intense competition, with companies vying for market share through superior service quality, competitive pricing strategies, and operational excellence. Strategic partnerships and mergers and acquisitions are also shaping the competitive dynamics.

Dominant Markets & Segments in Business Jet Ground Handling Services Market

North America currently holds the leading position in the Business Jet Ground Handling Services Market. This dominance is attributable to a large business aviation fleet, robust infrastructure, a high concentration of business jet operators, and favorable regulatory environments that encourage growth. Within the market, Aircraft Handling remains the largest segment due to its critical role in ensuring the safe and efficient movement of business jets.

- Key Drivers for North American Dominance:

- Extensive network of well-equipped airports with dedicated business aviation terminals.

- High concentration of high-net-worth individuals and corporations utilizing business aviation.

- Favorable regulatory environment that fosters competition and innovation.

- Strong economic growth and a thriving business environment.

While North America maintains its leading position, other regions are demonstrating promising growth potential. The report provides a comprehensive analysis of these regional dynamics, including detailed market forecasts and contributing factors.

Business Jet Ground Handling Services Market Product Developments

Recent product innovations focus on improving efficiency, sustainability, and safety. This includes the development of electric ground support equipment (GSE), such as de-icers and pushback tractors, reducing carbon emissions and noise pollution. The integration of advanced technologies like AI and IoT into ground handling operations enhances real-time data monitoring, predictive maintenance, and resource optimization, leading to improved operational efficiency and reduced costs. This focus on technological advancements and enhanced operational efficiency offers significant competitive advantages.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Business Jet Ground Handling Services Market by service type, offering granular insights into the dynamics of each segment:

Aircraft Handling: Encompassing all services related to aircraft operations, including pre-flight inspections, pushback, towing, and other ground maneuvers. The market is expected to grow at a xx% CAGR, primarily driven by increasing business jet traffic and the demand for swift and efficient turnaround times. Competition is fierce, with key players prioritizing service quality and operational efficiency.

Passenger Handling: This segment covers passenger-related services, such as check-in, baggage handling, and VIP assistance. Anticipated to grow at a xx% CAGR, driven by rising passenger numbers and expectations for personalized, high-quality service. Competition is a mix of large operators and specialized providers focusing on premium services.

Cargo and Baggage Handling: Focuses on the handling of cargo and passenger baggage, including loading, unloading, and transportation. Projected to expand at a xx% CAGR, boosted by the growth of e-commerce and increased business travel. This segment is highly competitive, with operators emphasizing secure and reliable service delivery.

Key Drivers of Business Jet Ground Handling Services Market Growth

The growth of the Business Jet Ground Handling Services Market is fueled by several key factors. The expansion of the global business aviation industry, increased demand for premium and specialized ground handling services, and the ongoing technological advancements in ground support equipment are major drivers. Furthermore, favorable government regulations and policies supporting the business aviation sector contribute to this market's growth. The adoption of sustainable practices, such as the use of electric GSE, further boosts growth by attracting environmentally conscious operators.

Challenges in the Business Jet Ground Handling Services Market Sector

The Business Jet Ground Handling Services Market faces several challenges. Fluctuations in fuel prices significantly impact operational costs. Stringent safety and security regulations necessitate substantial investments in compliance measures. Competition within the industry is fierce, with established players and new entrants vying for market share. These challenges necessitate continuous operational efficiency improvements and innovation to maintain profitability and competitive edge. Supply chain disruptions can also lead to delays and increased costs.

Emerging Opportunities in Business Jet Ground Handling Services Market

Emerging opportunities exist in several areas. The increasing adoption of digital technologies presents opportunities for enhancing operational efficiency and customer experience. Expansion into new and developing markets with growing business aviation sectors offers significant potential. The focus on sustainable practices, such as the use of electric GSE, opens doors for ground handling operators to showcase their commitment to environmental responsibility, gaining a competitive advantage.

Leading Players in the Business Jet Ground Handling Services Market Market

- ExecuJet Aviation Group

- dnata

- IGS Ground Services

- TAG Aviation

- Aviation Services Management (ASM)

- Jet Aviation AG

- Signature Aviation Limited

- Atlantic Aviation

- RoyalJet LLC

- World Fuel Services Corporation

- Dassault Falcon Service

- Universal Weather and Aviation LLC

Key Developments in Business Jet Ground Handling Services Market Industry

- August 2023: Menzies Aviation invested USD 1 Million in new ground handling equipment at Entebbe International Airport, Uganda, significantly enhancing its operational capabilities and capacity.

- April 2022: Airpro's EUR 4 Million investment in electric de-icing equipment positions the company as a leader in sustainable ground handling practices, demonstrating commitment to environmental responsibility.

- April 2022: Amsterdam Airport Schiphol's implementation of digital declarations streamlined cargo processes, improving efficiency and reducing processing times.

Strategic Outlook for Business Jet Ground Handling Services Market Market

The Business Jet Ground Handling Services Market is poised for continued growth, driven by technological innovation, expansion into new markets, and a focus on sustainability. The increasing demand for efficient and high-quality services, coupled with a favorable regulatory environment, creates a positive outlook for market expansion. Opportunities for consolidation and strategic partnerships will further shape the market landscape in the coming years.

Business Jet Ground Handling Services Market Segmentation

-

1. Type

- 1.1. Aircraft Handling

- 1.2. Passenger Handling

- 1.3. Cargo and Baggage Handling

Business Jet Ground Handling Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Business Jet Ground Handling Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Aircraft Handling Services to Dominate the Market During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Aircraft Handling

- 5.1.2. Passenger Handling

- 5.1.3. Cargo and Baggage Handling

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Aircraft Handling

- 6.1.2. Passenger Handling

- 6.1.3. Cargo and Baggage Handling

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Aircraft Handling

- 7.1.2. Passenger Handling

- 7.1.3. Cargo and Baggage Handling

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Aircraft Handling

- 8.1.2. Passenger Handling

- 8.1.3. Cargo and Baggage Handling

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Aircraft Handling

- 9.1.2. Passenger Handling

- 9.1.3. Cargo and Baggage Handling

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Aircraft Handling

- 10.1.2. Passenger Handling

- 10.1.3. Cargo and Baggage Handling

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ExecuJet Aviation Group A

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Dnata

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 IGS Ground Services

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 TAG Aviation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Aviation Services Management (ASM)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Jet Aviation AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Signature Aviation Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Atlantic Aviation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 RoyalJet LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 World Fuel Services Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Dassault Falcon Service

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Universal Weather and Aviation LLC

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 ExecuJet Aviation Group A

List of Figures

- Figure 1: Global Business Jet Ground Handling Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Business Jet Ground Handling Services Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Business Jet Ground Handling Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Business Jet Ground Handling Services Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Business Jet Ground Handling Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Business Jet Ground Handling Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Business Jet Ground Handling Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Business Jet Ground Handling Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Business Jet Ground Handling Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Jet Ground Handling Services Market?

The projected CAGR is approximately 11.87%.

2. Which companies are prominent players in the Business Jet Ground Handling Services Market?

Key companies in the market include ExecuJet Aviation Group A, Dnata, IGS Ground Services, TAG Aviation, Aviation Services Management (ASM), Jet Aviation AG, Signature Aviation Limited, Atlantic Aviation, RoyalJet LLC, World Fuel Services Corporation, Dassault Falcon Service, Universal Weather and Aviation LLC.

3. What are the main segments of the Business Jet Ground Handling Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Aircraft Handling Services to Dominate the Market During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: Menzies, a ground handling operator at the Entebbe International Airport in Uganda acquired new ground handling equipment worth USD 1 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Jet Ground Handling Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Jet Ground Handling Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Jet Ground Handling Services Market?

To stay informed about further developments, trends, and reports in the Business Jet Ground Handling Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence