Key Insights

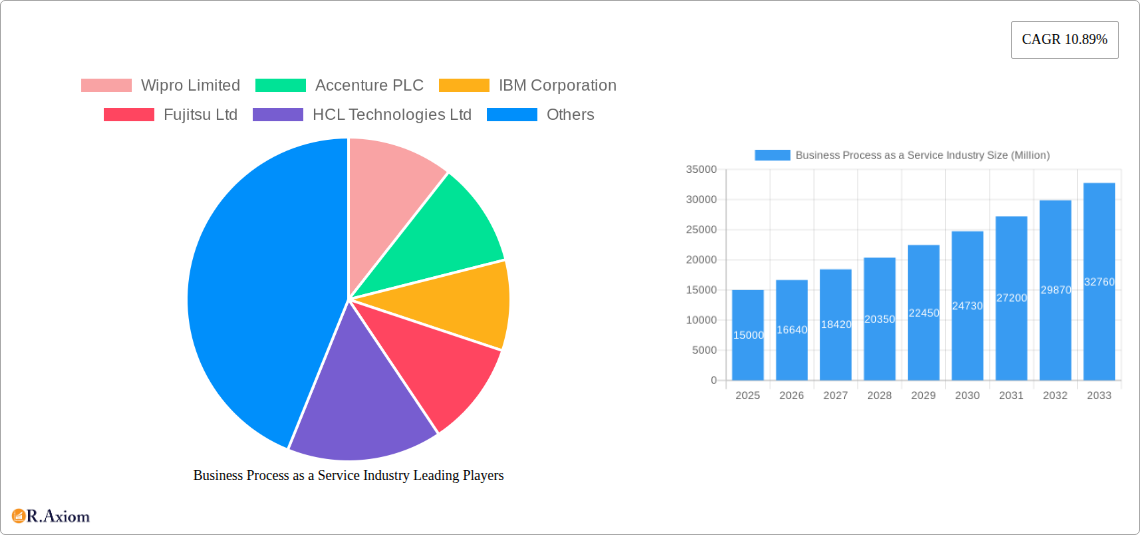

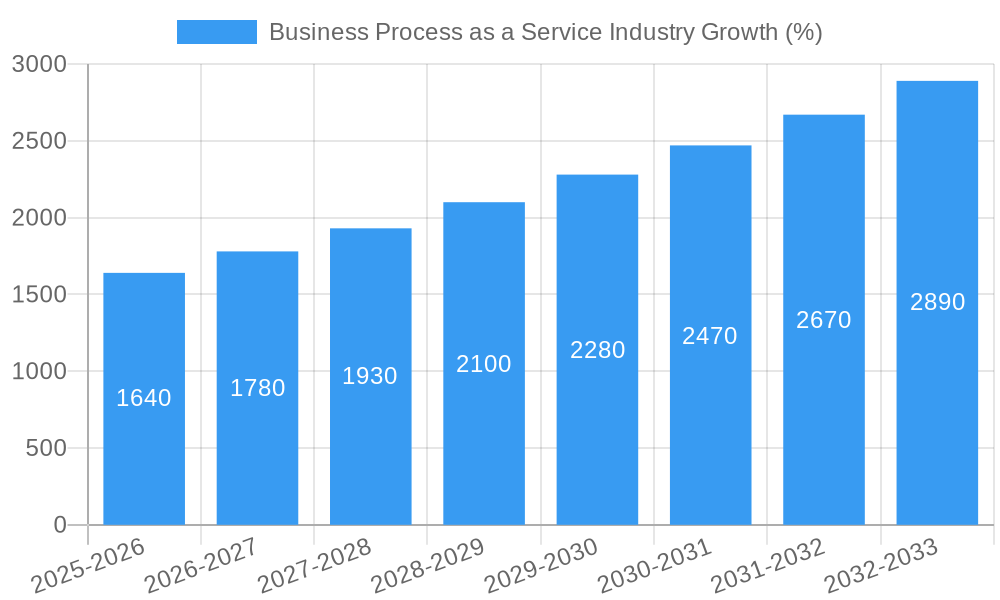

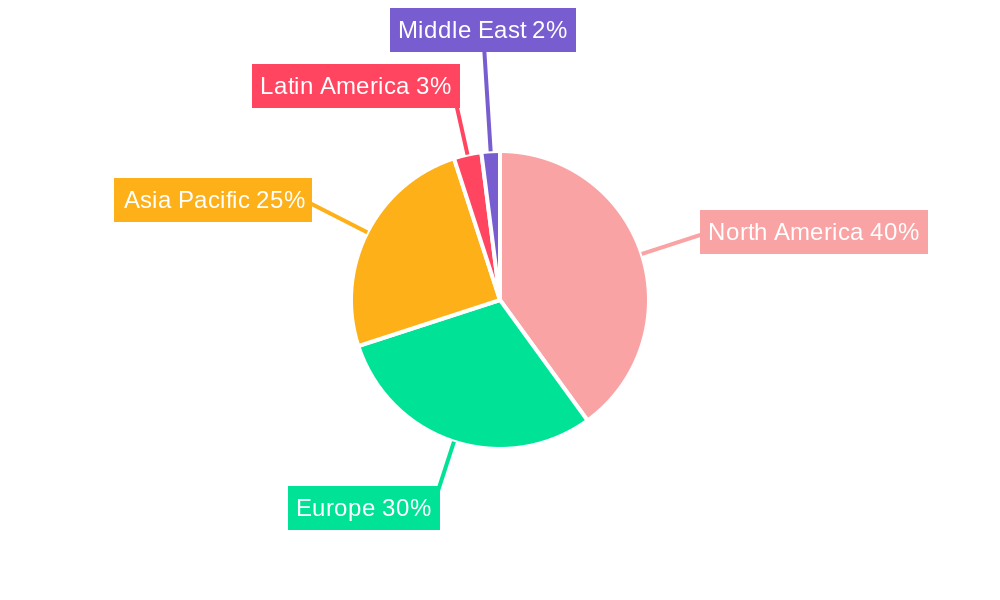

The Business Process as a Service (BPaaS) market is experiencing robust growth, driven by the increasing adoption of cloud computing, the need for enhanced operational efficiency, and the rising demand for cost-effective solutions across various industries. The market's Compound Annual Growth Rate (CAGR) of 10.89% from 2019 to 2024 suggests a significant expansion, and this momentum is expected to continue throughout the forecast period (2025-2033). Key segments contributing to this growth include the BFSI, IT and Telecommunication, and Healthcare sectors, which are increasingly outsourcing non-core functions to leverage specialized expertise and streamline operations. Large enterprises are major adopters of BPaaS, given their scale and complex operational needs. Furthermore, the growing adoption of process automation technologies within Human Resource Management, Accounting and Finance, and Supply Chain Management functions is further fueling market expansion. Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region is projected to witness substantial growth due to rising digitalization and a burgeoning IT sector.

The competitive landscape is intensely dynamic, with established players like Wipro, Accenture, IBM, and TCS competing alongside other prominent providers. These companies are continuously investing in technological advancements, expanding their service portfolios, and forging strategic partnerships to gain a competitive edge. While the market enjoys favorable growth drivers, companies must address challenges such as data security concerns, integration complexities, and the need to maintain service quality across diverse geographical locations. Future growth hinges on continued innovation, particularly in artificial intelligence (AI) and machine learning (ML)-powered automation, improved cybersecurity measures, and a focus on delivering customized solutions that cater to the specific needs of various industries and organizational sizes. The market's projected growth trajectory indicates a promising future for BPaaS providers, promising significant opportunities for those who can successfully navigate the competitive landscape and adapt to evolving market demands.

Business Process as a Service (BPaaS) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Business Process as a Service (BPaaS) industry, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The report covers a market valued at millions of dollars, encompassing key segments and significant players.

Business Process as a Service Industry Market Concentration & Innovation

The BPaaS market exhibits a moderately concentrated structure, dominated by a handful of large multinational corporations. Key players such as Wipro Limited, Accenture PLC, IBM Corporation, Fujitsu Ltd, HCL Technologies Ltd, Tata Consultancy Services Limited, Oracle Corporation, Capgemini SE, Cognizant Technology Solutions, and Genpact Limited hold significant market share, with an estimated combined market share of xx%. However, the market also features numerous smaller players, particularly in niche segments. Market share fluctuations are driven by factors such as technological innovation, strategic acquisitions, and evolving client demands. The overall market is highly innovative, characterized by continuous advancements in automation, AI, and cloud technologies.

- Innovation Drivers: AI-powered automation, cloud-based solutions, hyper-automation, and the increasing adoption of digital transformation initiatives by businesses are driving innovation.

- Regulatory Frameworks: Data privacy regulations (GDPR, CCPA) and industry-specific compliance requirements significantly impact market dynamics.

- Product Substitutes: In-house process management and open-source automation tools act as partial substitutes, but the scalability and expertise provided by BPaaS providers remain key differentiators.

- End-User Trends: A growing preference for outsourcing non-core business processes, coupled with a focus on cost optimization and efficiency improvements, fuels BPaaS adoption.

- M&A Activities: The BPaaS landscape has witnessed significant M&A activity in recent years, with deal values exceeding xx Million. These acquisitions aim to expand service portfolios, enhance technological capabilities, and strengthen market presence. For example, a recent acquisition valued at xx Million significantly altered the market landscape by consolidating multiple smaller players.

Business Process as a Service Industry Industry Trends & Insights

The BPaaS market is experiencing robust growth, driven by increasing digitalization, globalization, and the rising need for operational efficiency across various industries. The market is predicted to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is also increasing, particularly among large enterprises seeking to streamline their operations. Technological disruptions, such as the proliferation of AI and cloud technologies, are reshaping the BPaaS landscape. Consumer preferences are shifting towards flexible, scalable, and cost-effective BPaaS solutions tailored to specific business needs. Competitive dynamics are intense, with established players constantly innovating and smaller players seeking to carve out niche markets. The market demonstrates a strong correlation between investment in R&D and market success. Companies with advanced AI and automation capabilities are achieving higher market penetration.

Dominant Markets & Segments in Business Process as a Service Industry

The BPaaS market exhibits varied growth across segments.

- By End-user Industry: BFSI (Banking, Financial Services, and Insurance) remains the dominant segment, driven by stringent regulatory compliance needs and the increasing complexity of financial operations. The healthcare sector presents significant growth potential, due to the growing need for efficient healthcare management and data security. Government and defense are also important segments, driven by the increasing adoption of digital transformation initiatives.

- By Size of Organization: Large enterprises currently dominate the BPaaS market, given their larger budgets and more complex operational requirements. However, SMBs are increasingly adopting BPaaS solutions, driving segment growth.

- By Process: Human Resource Management (HRM) and accounting & finance are currently the largest segments, but growth in supply chain management and sales & marketing BPaaS solutions is significant, fueled by the growing demand for integrated supply chain solutions and enhanced marketing capabilities.

Key Drivers:

- BFSI: Stringent regulatory compliance, complex financial operations, cost optimization needs.

- Healthcare: Data security, efficient healthcare management, rising adoption of electronic health records.

- Government & Defense: Digital transformation initiatives, enhanced security needs, data analytics.

- Large Enterprises: Complex operations, larger budgets, need for scalability.

- SMBs: Cost efficiency, ease of implementation, access to advanced technologies.

Business Process as a Service Industry Product Developments

Recent product developments focus on enhancing automation capabilities, incorporating AI and machine learning (ML), and offering integrated cloud-based solutions. This has led to the development of intelligent process automation (IPA) platforms, robotic process automation (RPA) tools integrated with AI, and BPaaS solutions tailored to specific industry verticals. These developments emphasize ease of use, enhanced security, and seamless integration with existing enterprise systems, offering significant competitive advantages.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation analysis across end-user industries, organization sizes, and business processes. Each segment is characterized by unique growth projections, market sizes, and competitive dynamics. The BFSI segment is expected to experience substantial growth, driven by regulatory changes and the need for improved efficiency. Large enterprises lead in BPaaS adoption due to scale, but SMBs show promising growth potential. Similarly, HRM and finance processes dominate the BPaaS market currently, but other processes like supply chain and marketing are expanding quickly. Each segment's growth projection is carefully evaluated based on current market trends and future growth drivers, with specific market sizes provided in the full report.

Key Drivers of Business Process as a Service Industry Growth

Several key factors drive BPaaS market growth:

- Technological advancements: AI, ML, automation, cloud computing enhance efficiency and scalability.

- Cost optimization: BPaaS reduces operational costs by outsourcing non-core functions.

- Increased focus on digital transformation: Businesses are increasingly seeking to leverage technology to improve operations.

- Globalization and outsourcing: The rise of globalized business operations drives demand for BPaaS.

- Regulatory compliance: Stricter regulations necessitate robust and compliant processes.

Challenges in the Business Process as a Service Industry Sector

The BPaaS industry faces several challenges:

- Data security and privacy: Ensuring data security and adhering to privacy regulations remain crucial. Breaches can cost companies xx Million in remediation and reputational damage.

- Integration complexities: Integrating BPaaS solutions with existing IT infrastructure can be challenging.

- Talent acquisition and retention: Skilled professionals in BPaaS are in high demand, leading to talent acquisition challenges.

- Vendor lock-in: Selecting the right BPaaS provider is critical to avoid vendor lock-in.

Emerging Opportunities in Business Process as a Service Industry

Several emerging opportunities exist for BPaaS providers:

- Expansion into new markets: Untapped markets in developing economies present growth potential.

- Hyper-automation: The integration of RPA, AI, and ML for end-to-end process automation.

- AI-powered analytics: Providing businesses with real-time insights through AI-driven data analytics.

- Sustainability solutions: Integrating sustainable practices into BPaaS offerings.

Leading Players in the Business Process as a Service Industry Market

- Wipro Limited

- Accenture PLC

- IBM Corporation

- Fujitsu Ltd

- HCL Technologies Ltd

- Tata Consultancy Services Limited

- Oracle Corporation

- Capgemini SE

- Cognizant Technology Solutions

- Genpact Limited

Key Developments in Business Process as a Service Industry Industry

- November 2022: Infosys BPM and IBM launched an AI and automation center in Poland, offering cutting-edge solutions in data, AI, hyper-automation, and blockchain. This significantly enhances their capabilities in the hybrid cloud environment.

- May 2022: Oracle enhanced its cloud security capabilities with integrated threat management, strengthening its position in the market.

- April 2022: Fujitsu launched its Fujitsu Computing as a Service (CaaS), accelerating digital transformation for clients globally.

- March 2022: Oracle Cloud Infrastructure launched new services, improving customer flexibility and cost efficiency.

Strategic Outlook for Business Process as a Service Industry Market

The BPaaS market is poised for continued growth, fueled by technological advancements, increased digital adoption, and the ongoing need for process optimization across various industries. Future market potential lies in the development and deployment of innovative AI-powered solutions, hyper-automation capabilities, and customized BPaaS offerings tailored to specific business needs. The strategic focus will be on enhancing security, ensuring seamless integration, and delivering superior customer value. This translates to significant growth opportunities for both established players and emerging entrants in the market.

Business Process as a Service Industry Segmentation

-

1. Size of Organization

- 1.1. Small and Medium Organizations

- 1.2. Large Enterprises

-

2. Process

- 2.1. Human Resource Management

- 2.2. Accounting and Finance

- 2.3. Sales and Marketing

- 2.4. Supply Chain Management

- 2.5. Other Processes

-

3. End-user Industry

- 3.1. Government and Defense

- 3.2. Banking, Financial Services and Insurance (BFSI)

- 3.3. IT and Telecommunication

- 3.4. Healthcare

- 3.5. Retail

- 3.6. Manufacturing

- 3.7. Other End-user Industries

Business Process as a Service Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East

Business Process as a Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cloud Services and Standard Operating Processes; Rising Need for the Reduction of Operational Costs and Improvement of Productivity

- 3.3. Market Restrains

- 3.3.1. Managing Regulatory and Compliance Needs Across the World

- 3.4. Market Trends

- 3.4.1. Reduction of Operational Costs and Productivity Improvement to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size of Organization

- 5.1.1. Small and Medium Organizations

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Human Resource Management

- 5.2.2. Accounting and Finance

- 5.2.3. Sales and Marketing

- 5.2.4. Supply Chain Management

- 5.2.5. Other Processes

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Government and Defense

- 5.3.2. Banking, Financial Services and Insurance (BFSI)

- 5.3.3. IT and Telecommunication

- 5.3.4. Healthcare

- 5.3.5. Retail

- 5.3.6. Manufacturing

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Size of Organization

- 6. North America Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size of Organization

- 6.1.1. Small and Medium Organizations

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Human Resource Management

- 6.2.2. Accounting and Finance

- 6.2.3. Sales and Marketing

- 6.2.4. Supply Chain Management

- 6.2.5. Other Processes

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Government and Defense

- 6.3.2. Banking, Financial Services and Insurance (BFSI)

- 6.3.3. IT and Telecommunication

- 6.3.4. Healthcare

- 6.3.5. Retail

- 6.3.6. Manufacturing

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Size of Organization

- 7. Europe Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size of Organization

- 7.1.1. Small and Medium Organizations

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Human Resource Management

- 7.2.2. Accounting and Finance

- 7.2.3. Sales and Marketing

- 7.2.4. Supply Chain Management

- 7.2.5. Other Processes

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Government and Defense

- 7.3.2. Banking, Financial Services and Insurance (BFSI)

- 7.3.3. IT and Telecommunication

- 7.3.4. Healthcare

- 7.3.5. Retail

- 7.3.6. Manufacturing

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Size of Organization

- 8. Asia Pacific Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size of Organization

- 8.1.1. Small and Medium Organizations

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Human Resource Management

- 8.2.2. Accounting and Finance

- 8.2.3. Sales and Marketing

- 8.2.4. Supply Chain Management

- 8.2.5. Other Processes

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Government and Defense

- 8.3.2. Banking, Financial Services and Insurance (BFSI)

- 8.3.3. IT and Telecommunication

- 8.3.4. Healthcare

- 8.3.5. Retail

- 8.3.6. Manufacturing

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Size of Organization

- 9. Latin America Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size of Organization

- 9.1.1. Small and Medium Organizations

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Human Resource Management

- 9.2.2. Accounting and Finance

- 9.2.3. Sales and Marketing

- 9.2.4. Supply Chain Management

- 9.2.5. Other Processes

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Government and Defense

- 9.3.2. Banking, Financial Services and Insurance (BFSI)

- 9.3.3. IT and Telecommunication

- 9.3.4. Healthcare

- 9.3.5. Retail

- 9.3.6. Manufacturing

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Size of Organization

- 10. Middle East Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size of Organization

- 10.1.1. Small and Medium Organizations

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Human Resource Management

- 10.2.2. Accounting and Finance

- 10.2.3. Sales and Marketing

- 10.2.4. Supply Chain Management

- 10.2.5. Other Processes

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Government and Defense

- 10.3.2. Banking, Financial Services and Insurance (BFSI)

- 10.3.3. IT and Telecommunication

- 10.3.4. Healthcare

- 10.3.5. Retail

- 10.3.6. Manufacturing

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Size of Organization

- 11. North America Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Business Process as a Service Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Wipro Limited

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Accenture PLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 IBM Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Fujitsu Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 HCL Technologies Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tata Consultancy Services Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oracle Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Capgemini SE*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cognizant Technology Solutions

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Genpact Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Wipro Limited

List of Figures

- Figure 1: Global Business Process as a Service Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Business Process as a Service Industry Revenue (Million), by Size of Organization 2024 & 2032

- Figure 13: North America Business Process as a Service Industry Revenue Share (%), by Size of Organization 2024 & 2032

- Figure 14: North America Business Process as a Service Industry Revenue (Million), by Process 2024 & 2032

- Figure 15: North America Business Process as a Service Industry Revenue Share (%), by Process 2024 & 2032

- Figure 16: North America Business Process as a Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Business Process as a Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Business Process as a Service Industry Revenue (Million), by Size of Organization 2024 & 2032

- Figure 21: Europe Business Process as a Service Industry Revenue Share (%), by Size of Organization 2024 & 2032

- Figure 22: Europe Business Process as a Service Industry Revenue (Million), by Process 2024 & 2032

- Figure 23: Europe Business Process as a Service Industry Revenue Share (%), by Process 2024 & 2032

- Figure 24: Europe Business Process as a Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe Business Process as a Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Business Process as a Service Industry Revenue (Million), by Size of Organization 2024 & 2032

- Figure 29: Asia Pacific Business Process as a Service Industry Revenue Share (%), by Size of Organization 2024 & 2032

- Figure 30: Asia Pacific Business Process as a Service Industry Revenue (Million), by Process 2024 & 2032

- Figure 31: Asia Pacific Business Process as a Service Industry Revenue Share (%), by Process 2024 & 2032

- Figure 32: Asia Pacific Business Process as a Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Pacific Business Process as a Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Pacific Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Business Process as a Service Industry Revenue (Million), by Size of Organization 2024 & 2032

- Figure 37: Latin America Business Process as a Service Industry Revenue Share (%), by Size of Organization 2024 & 2032

- Figure 38: Latin America Business Process as a Service Industry Revenue (Million), by Process 2024 & 2032

- Figure 39: Latin America Business Process as a Service Industry Revenue Share (%), by Process 2024 & 2032

- Figure 40: Latin America Business Process as a Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America Business Process as a Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East Business Process as a Service Industry Revenue (Million), by Size of Organization 2024 & 2032

- Figure 45: Middle East Business Process as a Service Industry Revenue Share (%), by Size of Organization 2024 & 2032

- Figure 46: Middle East Business Process as a Service Industry Revenue (Million), by Process 2024 & 2032

- Figure 47: Middle East Business Process as a Service Industry Revenue Share (%), by Process 2024 & 2032

- Figure 48: Middle East Business Process as a Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Middle East Business Process as a Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Middle East Business Process as a Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East Business Process as a Service Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Business Process as a Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Business Process as a Service Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 3: Global Business Process as a Service Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Global Business Process as a Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Business Process as a Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Business Process as a Service Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 24: Global Business Process as a Service Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 25: Global Business Process as a Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United States Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Business Process as a Service Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 30: Global Business Process as a Service Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 31: Global Business Process as a Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United Kingdom Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: France Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Business Process as a Service Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 38: Global Business Process as a Service Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 39: Global Business Process as a Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 40: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Business Process as a Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Business Process as a Service Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 46: Global Business Process as a Service Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 47: Global Business Process as a Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Business Process as a Service Industry Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 50: Global Business Process as a Service Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 51: Global Business Process as a Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Business Process as a Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Process as a Service Industry?

The projected CAGR is approximately 10.89%.

2. Which companies are prominent players in the Business Process as a Service Industry?

Key companies in the market include Wipro Limited, Accenture PLC, IBM Corporation, Fujitsu Ltd, HCL Technologies Ltd, Tata Consultancy Services Limited, Oracle Corporation, Capgemini SE*List Not Exhaustive, Cognizant Technology Solutions, Genpact Limited.

3. What are the main segments of the Business Process as a Service Industry?

The market segments include Size of Organization, Process, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cloud Services and Standard Operating Processes; Rising Need for the Reduction of Operational Costs and Improvement of Productivity.

6. What are the notable trends driving market growth?

Reduction of Operational Costs and Productivity Improvement to Drive the Market.

7. Are there any restraints impacting market growth?

Managing Regulatory and Compliance Needs Across the World.

8. Can you provide examples of recent developments in the market?

November 2022: In collaboration with IBM, Infosys Business Process Management (BPM) launches a cutting-edge AI and automation center in Poland. The partnership between Infosys BPM and IBM aims to deliver client success, identify new use cases, and build solutions to enable clients to innovate in hybrid cloud environments. Customers will have access to a range of digital solution offerings across the space of data, AI, and hyper-automation, including IBM CloudPak for data, IBM Watson Assistant and IBM Watson Discovery, IBM SaferPayments, IBM Blockchain, IBM Sterling Supply Chain, IBM Risk and Fraud Detection software, and Envizi for sustainability. They will also access critical solutions from Infosys BPM, such as Infosys Intelligent Document Processing, Infosys Interaction Analytics, and Infosys.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Process as a Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Process as a Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Process as a Service Industry?

To stay informed about further developments, trends, and reports in the Business Process as a Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence