Key Insights

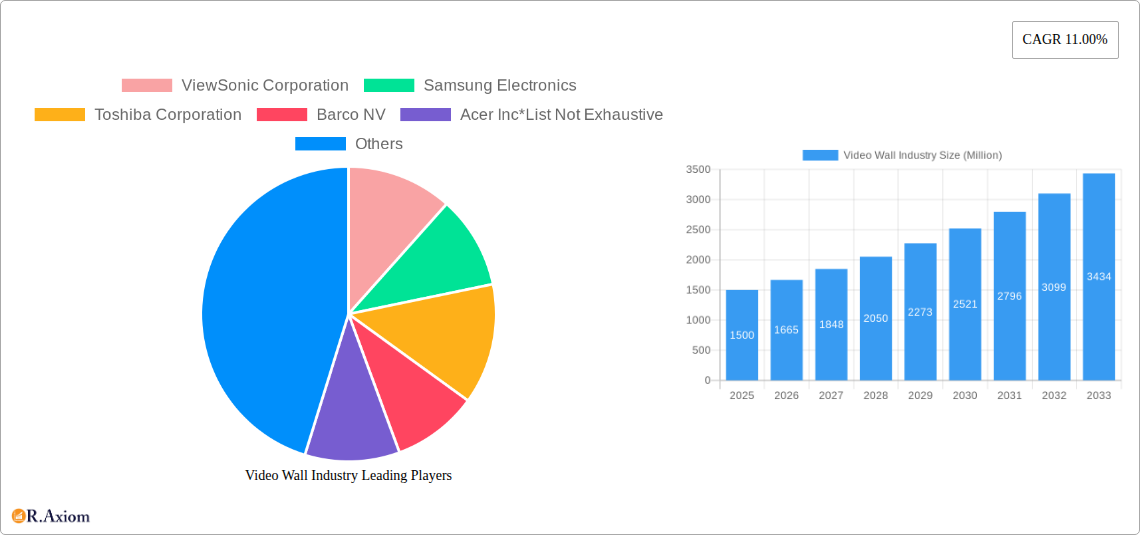

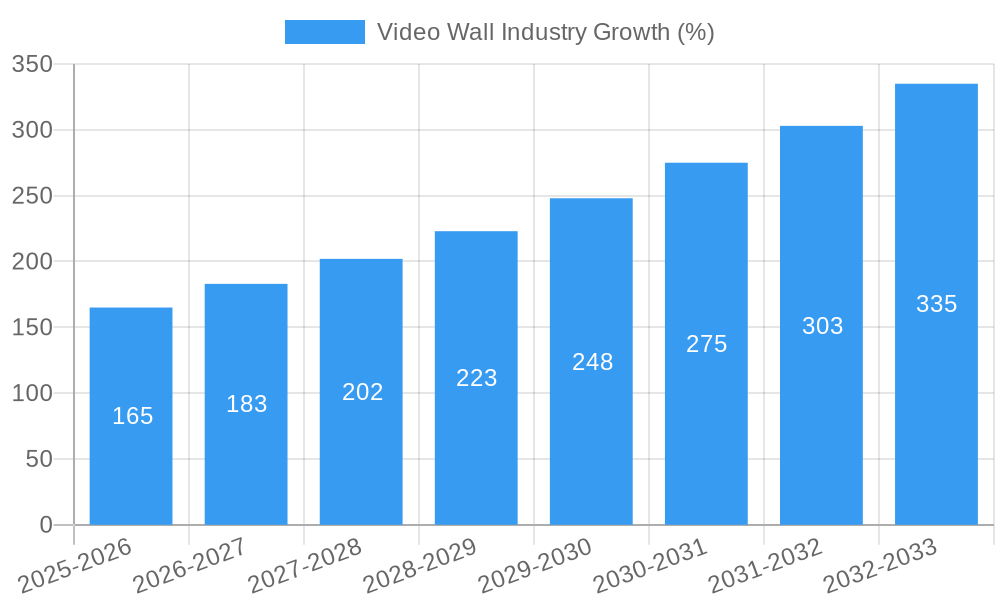

The global video wall market is experiencing robust growth, driven by increasing demand across diverse sectors. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising adoption of digital signage in retail environments for enhanced customer engagement and improved brand visibility is a significant driver. Secondly, the transportation sector's increasing use of video walls for real-time monitoring and information dissemination in airports, train stations, and public transportation systems contributes substantially to market growth. Furthermore, governments and corporate entities are increasingly deploying video walls for control rooms, command centers, and collaborative workspaces, boosting market demand. Technological advancements, particularly in LED and LCD technologies, are also contributing to the market's expansion, with LED technology gaining traction due to its superior image quality, energy efficiency, and longer lifespan. The hospitality industry's adoption of video walls for enhancing guest experience and providing engaging entertainment further propels market growth.

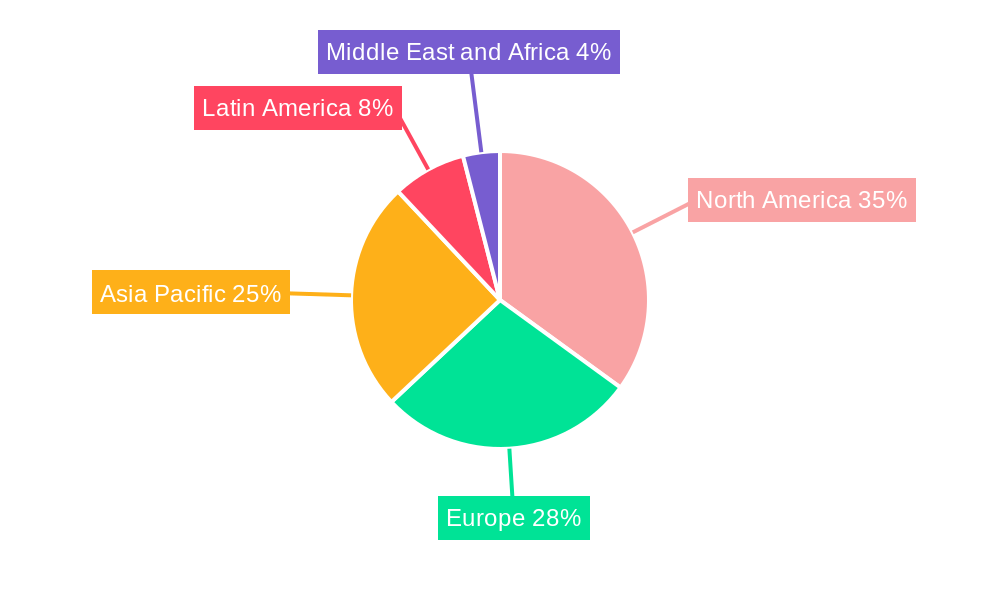

While the market presents significant opportunities, certain restraints exist. High initial investment costs associated with video wall installations can hinder adoption, especially for small businesses. Furthermore, the need for specialized technical expertise for installation and maintenance can present a challenge. However, the ongoing technological advancements, decreasing costs of components, and increasing availability of cost-effective maintenance solutions are gradually mitigating these restraints. Market segmentation reveals a strong preference for LED technology over LCD, while the retail, transportation, and corporate sectors represent the largest end-user segments. Key players like Samsung, LG, and ViewSonic are aggressively competing through product innovation and strategic partnerships to gain market share. Geographic analysis suggests that the Asia-Pacific region, driven by rapid urbanization and economic growth, is expected to experience the fastest growth during the forecast period. North America and Europe, while having established markets, continue to contribute significantly to overall market revenue.

Video Wall Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global video wall industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing historical data from 2019 to 2024. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The total market value in 2025 is estimated at $xx Million.

Video Wall Industry Market Concentration & Innovation

The video wall industry exhibits a moderately concentrated market structure, with several key players holding significant market share. While precise market share figures for each company are unavailable, companies like Samsung Electronics, LG Electronics, and Barco NV are considered major players, commanding a substantial portion of the overall market. The industry is characterized by continuous innovation, driven by advancements in display technologies (LED, Mini-LED, Micro-LED), processing power, and software solutions for seamless content management. Regulatory frameworks, particularly those concerning energy efficiency and safety standards, influence product development and market access. The emergence of alternative display technologies, while posing some threat, also fosters innovation as companies strive to improve the video wall experience. Mergers and acquisitions (M&A) activity has been moderate, with deal values in the $xx Million range annually over the past few years, primarily focused on expanding product portfolios and market reach.

- Key Players: Samsung Electronics, LG Electronics, Barco NV, ViewSonic Corporation, Toshiba Corporation, Acer Inc, Koninklijke Philips N V, Planar Systems Inc, Panasonic Corporation, Sony Corporation.

- M&A Activity (2019-2024): Approximately $xx Million annually.

- Innovation Drivers: Technological advancements in display technologies, software solutions, and content management systems.

Video Wall Industry Industry Trends & Insights

The global video wall market is experiencing robust growth, fueled by rising demand across diverse sectors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, driven by several factors. Increased adoption of digital signage in retail and corporate environments, particularly for enhancing customer experience and internal communications, is a primary growth driver. The transportation sector is also witnessing significant adoption, with video walls being implemented in airports, train stations, and public transportation systems for information dissemination and advertising. Technological advancements, such as higher resolutions, improved brightness, and thinner designs, are further enhancing market appeal. However, competitive pressures from other display technologies and fluctuations in raw material prices pose challenges. Market penetration in developing economies is still relatively low, presenting significant growth potential.

Dominant Markets & Segments in Video Wall Industry

The North American region currently holds a dominant position in the video wall market, driven by high adoption rates in the corporate and retail sectors. Within the technology segment, LED video walls are experiencing higher growth compared to LCD due to their superior picture quality and adaptability to various sizes and configurations. In terms of end-users, the corporate segment exhibits the highest growth, followed by retail and transportation.

- Leading Region: North America

- Dominant Technology Segment: LED

- Fastest-Growing End-User Segment: Corporate

- Key Drivers: Strong economic growth in North America, increased focus on digital signage, technological advancements, and government investments in infrastructure.

Video Wall Industry Product Developments

Recent product innovations highlight a trend towards larger, higher-resolution displays with improved brightness and energy efficiency. Many manufacturers are focusing on modular designs to offer flexibility and scalability. All-in-one solutions are gaining traction, simplifying installation and reducing costs. The integration of advanced features, such as touchscreens and interactive capabilities, enhances the user experience. These innovations cater to the growing demand for immersive and engaging visual experiences across diverse applications. Examples include ViewSonic's foldable LED display solution and Philips X-Line videowall displays.

Report Scope & Segmentation Analysis

This report segments the video wall market by technology (LED and LCD) and end-user (Retail, Transportation, Governments, Corporate, Hospitality, Others). Each segment is analyzed in detail, including growth projections, market size, and competitive dynamics. The LED segment is expected to exhibit stronger growth than the LCD segment over the forecast period due to its superior performance. The corporate segment is projected as the largest end-user segment, followed by retail, with significant growth opportunities anticipated in the transportation and government sectors.

Key Drivers of Video Wall Industry Growth

The video wall market is propelled by several key factors:

- Technological advancements: Higher resolutions, improved brightness and contrast, thinner designs, and modular configurations.

- Increased adoption of digital signage: Enhanced customer experience, efficient information dissemination, and effective advertising.

- Government initiatives: Investments in smart city infrastructure and public transportation systems.

- Economic growth: Rising disposable incomes in developing economies boosting demand for advanced display solutions.

Challenges in the Video Wall Industry Sector

The video wall market faces several challenges:

- High initial investment costs: This can deter adoption, especially among small and medium-sized businesses.

- Supply chain disruptions: Raw material shortages and geopolitical uncertainties impact production and pricing.

- Intense competition: Numerous players vie for market share, leading to price wars and margin compression.

Emerging Opportunities in Video Wall Industry

The video wall industry presents several promising opportunities:

- Expansion into new markets: Developing economies offer significant growth potential.

- Integration with other technologies: Combining video walls with artificial intelligence (AI) and Internet of Things (IoT) devices.

- Demand for specialized applications: Growth in healthcare, education, and command & control centers.

Leading Players in the Video Wall Industry Market

- ViewSonic Corporation

- Samsung Electronics

- Toshiba Corporation

- Barco NV

- Acer Inc

- Koninklijke Philips N V

- Planar Systems Inc

- LG Electronics

- Panasonic Corporation

- Sony Corporation

Key Developments in Video Wall Industry Industry

- September 2022: ViewSonic introduced the first 135”, all-in-one, direct-view LED Display Solution Kit with a foldable screen, significantly reducing transportation costs and logistical complexity.

- June 2022: PPDS launched its enhanced range of Philips X-Line videowall displays, emphasizing high picture performance and clarity for professional and commercial environments.

Strategic Outlook for Video Wall Industry Market

The video wall industry is poised for continued growth, driven by technological advancements, rising demand across diverse sectors, and the increasing adoption of digital signage. The focus on developing energy-efficient and cost-effective solutions, combined with strategic partnerships and expansion into new markets, will shape the future landscape of this dynamic industry. The market is expected to reach $xx Million by 2033.

Video Wall Industry Segmentation

-

1. Technology

- 1.1. LED

- 1.2. LCD

-

2. End-User

- 2.1. Retail

- 2.2. Transportation

- 2.3. Governments

- 2.4. Corporate

- 2.5. Hospitality

- 2.6. Others

Video Wall Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Video Wall Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Innovative Technologies at Airports For Displaying Relevant Information; Increase Shift Towards Digital Advertisement

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments

- 3.4. Market Trends

- 3.4.1. Transportation Industry Offers Potential Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. LED

- 5.1.2. LCD

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Retail

- 5.2.2. Transportation

- 5.2.3. Governments

- 5.2.4. Corporate

- 5.2.5. Hospitality

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. LED

- 6.1.2. LCD

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Retail

- 6.2.2. Transportation

- 6.2.3. Governments

- 6.2.4. Corporate

- 6.2.5. Hospitality

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. LED

- 7.1.2. LCD

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Retail

- 7.2.2. Transportation

- 7.2.3. Governments

- 7.2.4. Corporate

- 7.2.5. Hospitality

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. LED

- 8.1.2. LCD

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Retail

- 8.2.2. Transportation

- 8.2.3. Governments

- 8.2.4. Corporate

- 8.2.5. Hospitality

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. LED

- 9.1.2. LCD

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Retail

- 9.2.2. Transportation

- 9.2.3. Governments

- 9.2.4. Corporate

- 9.2.5. Hospitality

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. LED

- 10.1.2. LCD

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Retail

- 10.2.2. Transportation

- 10.2.3. Governments

- 10.2.4. Corporate

- 10.2.5. Hospitality

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Video Wall Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ViewSonic Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Samsung Electronics

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Toshiba Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Barco NV

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Acer Inc*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Koninklijke Philips N V

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Planar Systems Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 LG Electronics

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Panasonic Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Sony Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 ViewSonic Corporation

List of Figures

- Figure 1: Global Video Wall Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Video Wall Industry Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America Video Wall Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America Video Wall Industry Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America Video Wall Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Video Wall Industry Revenue (Million), by Technology 2024 & 2032

- Figure 19: Europe Video Wall Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 20: Europe Video Wall Industry Revenue (Million), by End-User 2024 & 2032

- Figure 21: Europe Video Wall Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 22: Europe Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Video Wall Industry Revenue (Million), by Technology 2024 & 2032

- Figure 25: Asia Pacific Video Wall Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 26: Asia Pacific Video Wall Industry Revenue (Million), by End-User 2024 & 2032

- Figure 27: Asia Pacific Video Wall Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 28: Asia Pacific Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Video Wall Industry Revenue (Million), by Technology 2024 & 2032

- Figure 31: Latin America Video Wall Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 32: Latin America Video Wall Industry Revenue (Million), by End-User 2024 & 2032

- Figure 33: Latin America Video Wall Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 34: Latin America Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Video Wall Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Video Wall Industry Revenue (Million), by Technology 2024 & 2032

- Figure 37: Middle East and Africa Video Wall Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Middle East and Africa Video Wall Industry Revenue (Million), by End-User 2024 & 2032

- Figure 39: Middle East and Africa Video Wall Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Middle East and Africa Video Wall Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Video Wall Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Video Wall Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Video Wall Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Video Wall Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Video Wall Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Video Wall Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Video Wall Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Video Wall Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Video Wall Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Video Wall Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Video Wall Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Global Video Wall Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Video Wall Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 19: Global Video Wall Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Video Wall Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: Global Video Wall Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 23: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Video Wall Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Global Video Wall Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 26: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Video Wall Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: Global Video Wall Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 29: Global Video Wall Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Video Wall Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Video Wall Industry?

Key companies in the market include ViewSonic Corporation, Samsung Electronics, Toshiba Corporation, Barco NV, Acer Inc*List Not Exhaustive, Koninklijke Philips N V, Planar Systems Inc, LG Electronics, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Video Wall Industry?

The market segments include Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Innovative Technologies at Airports For Displaying Relevant Information; Increase Shift Towards Digital Advertisement.

6. What are the notable trends driving market growth?

Transportation Industry Offers Potential Growth.

7. Are there any restraints impacting market growth?

Higher Initial Investments.

8. Can you provide examples of recent developments in the market?

September 2022 - Viewsonic introduced the first 135, all-in-one, direct-view LED Display Solution Kit with a foldable screen, reducing the packaging size by nearly 50% compared with previous designs. This makes it easier and cheaper to transport, as it can fit into traditional freight and large passenger elevators. The solution kit is suitable for events, exhibitions, or short-term usage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Video Wall Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Video Wall Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Video Wall Industry?

To stay informed about further developments, trends, and reports in the Video Wall Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence