Key Insights

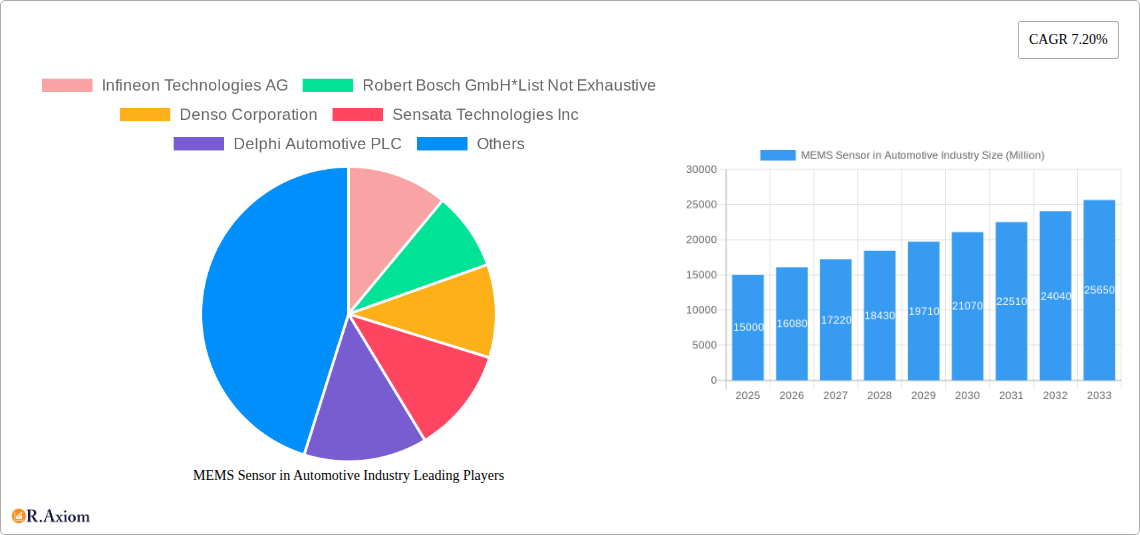

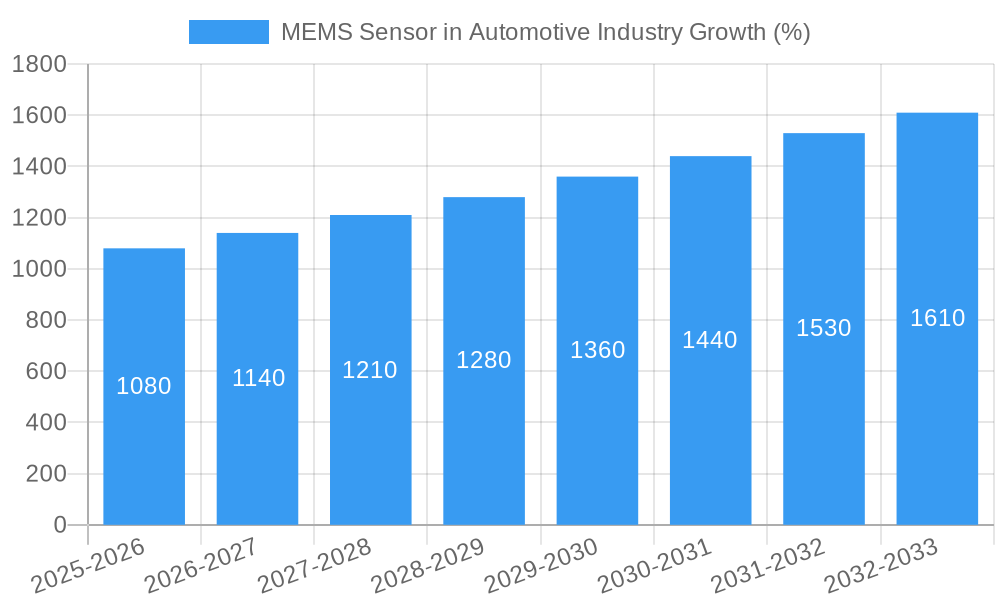

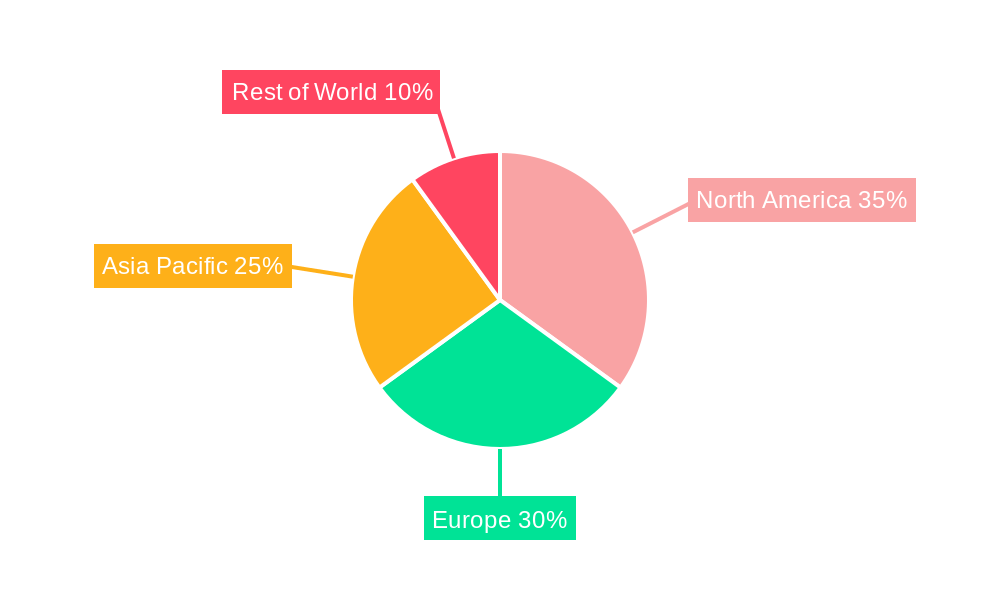

The automotive MEMS sensor market is experiencing robust growth, driven by increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving capabilities. The market's Compound Annual Growth Rate (CAGR) of 7.20% from 2019 to 2024 indicates a significant upward trajectory, projected to continue into the forecast period (2025-2033). This growth is fueled by several factors, including stringent government regulations mandating safety features like Electronic Stability Control (ESC) and airbag deployment systems, the rising adoption of electric and hybrid vehicles requiring more sophisticated sensor technologies, and the increasing integration of connectivity features that leverage sensor data. Key sensor types driving this expansion include tire pressure monitoring sensors, engine oil sensors, and various safety-critical sensors such as airbag deployment and roll-over detection sensors. The market's segmentation by type reflects this diversity, with tire pressure sensors and engine oil sensors currently holding significant market shares, while other types, particularly those supporting autonomous driving functionalities, are showing rapid growth. Leading players like Infineon Technologies, Bosch, Denso, and STMicroelectronics are heavily investing in R&D to innovate and capture market share in this competitive landscape. The geographic distribution of this market is spread across North America, Europe, and Asia-Pacific, with North America and Europe currently holding larger market shares due to higher vehicle ownership and advanced technology adoption, while Asia-Pacific is expected to witness significant growth in the coming years fueled by increasing automotive production and rising consumer demand.

The competitive landscape is characterized by both established players and emerging companies vying for market dominance through technological advancements, strategic partnerships, and mergers and acquisitions. While the dominance of established players like Bosch and Infineon is evident, the market also presents opportunities for specialized sensor manufacturers focusing on niche applications within the automotive sector. The continued miniaturization of MEMS sensors, improvement in performance metrics, and reduction in costs are expected to further accelerate market penetration. Challenges remain, including ensuring high reliability and long-term durability in harsh automotive environments, as well as addressing data security and privacy concerns related to the increasing amount of sensor data being collected. However, the overall outlook for the automotive MEMS sensor market remains positive, with considerable growth potential driven by the ongoing technological advancements in the automotive industry.

MEMS Sensor in Automotive Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the MEMS Sensor market in the automotive industry, covering the period from 2019 to 2033. It offers actionable insights into market size, growth drivers, challenges, and emerging opportunities, equipping stakeholders with the knowledge needed to navigate this rapidly evolving landscape. The report features detailed segmentation by sensor type, regional analysis, and competitive profiling of key players, including Infineon Technologies AG, Robert Bosch GmbH, Denso Corporation, Sensata Technologies Inc, Delphi Automotive PLC, Freescale Semiconductors Ltd, General Electric Co, STMicroelectronics NV, Analog Devices Inc, and Panasonic Corporation. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The base year for this analysis is 2025.

MEMS Sensor in Automotive Industry Market Concentration & Innovation

The automotive MEMS sensor market exhibits a moderately concentrated landscape, dominated by a few large players with significant market share. Infineon Technologies AG, Robert Bosch GmbH, and Denso Corporation collectively account for approximately xx% of the global market share in 2025, reflecting their extensive product portfolios and strong OEM relationships. However, several smaller players are actively innovating and competing for market share, particularly in specialized sensor segments.

Innovation Drivers:

- Increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles.

- Stringent government regulations mandating safety features.

- Advancements in MEMS technology, enabling smaller, more efficient, and cost-effective sensors.

- Growing integration of sensors within connected car ecosystems.

Regulatory Frameworks:

Stringent safety and emission regulations worldwide are driving the adoption of MEMS sensors in automotive applications. Compliance requirements necessitate the use of reliable and accurate sensors for various functions, propelling market growth.

Product Substitutes: Other sensor technologies, such as optical and magnetic sensors, exist, but MEMS sensors often offer a superior combination of cost, size, and performance.

End-User Trends: The increasing preference for fuel-efficient and safe vehicles is a significant end-user trend fueling the adoption of advanced MEMS sensors.

M&A Activities: The automotive MEMS sensor market has witnessed several mergers and acquisitions in recent years, with deal values exceeding xx Million in the period 2019-2024. These activities reflect the strategic consolidation within the industry and the pursuit of technological leadership.

MEMS Sensor in Automotive Industry Industry Trends & Insights

The automotive MEMS sensor market is experiencing robust growth, driven by several key factors. The rising adoption of ADAS and autonomous driving technologies is a primary catalyst, as these systems rely heavily on a wide array of MEMS sensors for accurate perception and control. The increasing demand for enhanced vehicle safety features, such as airbags, electronic stability control, and tire pressure monitoring, further fuels market expansion. Technological advancements, including the development of more sensitive, reliable, and cost-effective MEMS sensors, are also contributing to the market's growth trajectory. Consumer preferences for improved fuel efficiency and vehicle performance drive the demand for sophisticated engine management systems, increasing the utilization of MEMS sensors. The competitive landscape is highly dynamic, with major players focusing on innovation, strategic partnerships, and acquisitions to secure a stronger market position. The market is expected to grow at a CAGR of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. Market penetration for MEMS sensors in key automotive applications is steadily increasing, with xx% penetration in ADAS and xx% in engine management systems by 2025.

Dominant Markets & Segments in MEMS Sensor in Automotive Industry

The Asia Pacific region is currently the dominant market for automotive MEMS sensors, driven by the rapid growth of the automotive industry and increasing demand for advanced vehicle features in countries like China, Japan, and India. Within the various sensor types, Tire Pressure Monitoring Systems (TPMS) constitute the largest segment, followed by airbag deployment sensors and engine oil sensors.

Key Drivers for Dominant Segments:

- Tire Pressure Sensors: Stringent safety regulations mandating TPMS in many countries.

- Airbag Deployment Sensors: Increasing safety standards and consumer demand for enhanced safety features.

- Engine Oil Sensors: Essential for engine health monitoring and preventative maintenance.

Dominance Analysis: The dominance of the Asia Pacific region stems from factors such as large-scale vehicle production, favorable government policies supporting automotive manufacturing, and growing consumer purchasing power. The significant growth of the tire pressure sensor segment is linked to mandatory TPMS regulations globally. These factors, coupled with technological innovation in sensor design and manufacturing, are driving market growth. Europe and North America represent significant markets as well, characterized by high vehicle ownership rates and technological advancements.

MEMS Sensor in Automotive Industry Product Developments

Recent product innovations focus on miniaturization, improved accuracy, enhanced durability, and lower power consumption. The integration of advanced signal processing capabilities within MEMS sensors is improving their performance and reliability. New applications include advanced driver-assistance systems (ADAS), autonomous driving, and improved vehicle diagnostics. Competitive advantages are achieved through superior sensor performance, cost-effective manufacturing, and strong relationships with major automotive OEMs.

Report Scope & Segmentation Analysis

This report segments the MEMS sensor market in the automotive industry by sensor type:

- Tire Pressure Sensors: This segment is expected to experience substantial growth due to increasing regulatory mandates and rising safety concerns. The market size is projected to reach xx Million by 2033.

- Engine Oil Sensors: This segment is driven by the need for accurate engine health monitoring. The market size is projected to reach xx Million by 2033.

- Combustion Sensors: Crucial for optimizing engine performance and reducing emissions. Market size is projected to reach xx Million by 2033.

- Fuel Injection and Fuel Pump Sensors: This segment is closely linked to engine efficiency and fuel economy. Market size is projected to reach xx Million by 2033.

- Air Bag Deployment Sensors: A vital component of vehicle safety systems. Market size is projected to reach xx Million by 2033.

- Gyroscopes: Used in vehicle stabilization and navigation systems. Market size is projected to reach xx Million by 2033.

- Fuel Rail Pressure Sensors: Essential for precise fuel injection control. Market size is projected to reach xx Million by 2033.

- Other Types (Airflow Control, Crank Shaft Position Sensors, Roll-over Detection Sensors, and Automatic Door Lock Sensors): This segment encompasses a variety of sensors with growing applications. Market size is projected to reach xx Million by 2033. The competitive landscape in each segment varies; however, key players mentioned previously compete across many categories.

Key Drivers of MEMS Sensor in Automotive Industry Growth

Several factors fuel the growth of the automotive MEMS sensor market: The increasing adoption of ADAS and autonomous driving features is a major driver, demanding more sophisticated and accurate sensing capabilities. Stringent government regulations concerning vehicle safety and emissions also promote higher sensor integration. Technological advancements in MEMS technology lead to smaller, more efficient, and cost-effective sensors, enhancing their attractiveness to manufacturers. Lastly, the rising demand for fuel-efficient vehicles necessitates more precise engine management systems, further contributing to market growth.

Challenges in the MEMS Sensor in Automotive Industry Sector

The automotive MEMS sensor market faces challenges including stringent quality and reliability standards, necessitating rigorous testing and validation procedures. Supply chain disruptions can impact production and delivery timelines, leading to potential delays and increased costs. Intense competition among established players and emerging companies exerts downward pressure on pricing. The need to meet ever-evolving automotive standards presents a continuous challenge for manufacturers to remain competitive.

Emerging Opportunities in MEMS Sensor in Automotive Industry

Emerging opportunities include the growth of electric vehicles (EVs), which present new applications for MEMS sensors in battery management and motor control. The development of advanced sensor fusion technologies allows for the integration of multiple sensor types for improved performance and reliability. The increasing demand for connected car functionalities creates opportunities for MEMS sensors in communication and infotainment systems. Furthermore, the development of next-generation sensor materials and manufacturing techniques opens avenues for improved sensor performance and cost reduction.

Leading Players in the MEMS Sensor in Automotive Industry Market

- Infineon Technologies AG

- Robert Bosch GmbH

- Denso Corporation

- Sensata Technologies Inc

- Delphi Automotive PLC

- Freescale Semiconductors Ltd

- General Electric Co

- STMicroelectronics NV

- Analog Devices Inc

- Panasonic Corporation

Key Developments in MEMS Sensor in Automotive Industry Industry

- October 2022: MicroVision, Inc. announced that its MAVIN DR dynamic view lidar system is supported by the NVIDIA DRIVE AGX platform, enhancing ADAS capabilities. This development highlights the integration of MEMS-based lidar in high-performance ADAS solutions.

- February 2022: TDK Corporation's InvenSense Product Longevity Program (PLP) ensures long-term availability of high-performance MEMS sensors for automotive and industrial applications. This initiative provides OEMs with critical supply chain assurances, particularly relevant in long-life applications.

Strategic Outlook for MEMS Sensor in Automotive Industry Market

The future of the automotive MEMS sensor market appears promising, driven by the continued growth of ADAS and autonomous driving technologies, the increasing demand for enhanced vehicle safety and fuel efficiency, and ongoing innovations in sensor technology. The market is poised for expansion as vehicles become more connected and sophisticated. New applications and technological advancements are expected to drive further market growth, creating opportunities for both established players and new entrants. The integration of artificial intelligence (AI) and machine learning (ML) in sensor data processing promises to improve the accuracy and reliability of automotive MEMS sensor systems, further enhancing their value proposition in the years to come.

MEMS Sensor in Automotive Industry Segmentation

-

1. Type

- 1.1. Tire Pressure Sensors

- 1.2. Engine Oil Sensors

- 1.3. Combustion Sensors

- 1.4. Fuel Injection and Fuel Pump Sensors

- 1.5. Air Bag Deployment Sensors

- 1.6. Gyroscopes

- 1.7. Fuel Rail Pressure Sensors

- 1.8. Other Ty

MEMS Sensor in Automotive Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of World

MEMS Sensor in Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Passenger Safety and Security Regulations

- 3.2.2 and Increased Focus on Compliance; Increased Automation Features and Performance Improvements Preferred by Customers

- 3.3. Market Restrains

- 3.3.1. Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations

- 3.4. Market Trends

- 3.4.1. Gyroscope to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tire Pressure Sensors

- 5.1.2. Engine Oil Sensors

- 5.1.3. Combustion Sensors

- 5.1.4. Fuel Injection and Fuel Pump Sensors

- 5.1.5. Air Bag Deployment Sensors

- 5.1.6. Gyroscopes

- 5.1.7. Fuel Rail Pressure Sensors

- 5.1.8. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tire Pressure Sensors

- 6.1.2. Engine Oil Sensors

- 6.1.3. Combustion Sensors

- 6.1.4. Fuel Injection and Fuel Pump Sensors

- 6.1.5. Air Bag Deployment Sensors

- 6.1.6. Gyroscopes

- 6.1.7. Fuel Rail Pressure Sensors

- 6.1.8. Other Ty

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tire Pressure Sensors

- 7.1.2. Engine Oil Sensors

- 7.1.3. Combustion Sensors

- 7.1.4. Fuel Injection and Fuel Pump Sensors

- 7.1.5. Air Bag Deployment Sensors

- 7.1.6. Gyroscopes

- 7.1.7. Fuel Rail Pressure Sensors

- 7.1.8. Other Ty

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tire Pressure Sensors

- 8.1.2. Engine Oil Sensors

- 8.1.3. Combustion Sensors

- 8.1.4. Fuel Injection and Fuel Pump Sensors

- 8.1.5. Air Bag Deployment Sensors

- 8.1.6. Gyroscopes

- 8.1.7. Fuel Rail Pressure Sensors

- 8.1.8. Other Ty

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of World MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tire Pressure Sensors

- 9.1.2. Engine Oil Sensors

- 9.1.3. Combustion Sensors

- 9.1.4. Fuel Injection and Fuel Pump Sensors

- 9.1.5. Air Bag Deployment Sensors

- 9.1.6. Gyroscopes

- 9.1.7. Fuel Rail Pressure Sensors

- 9.1.8. Other Ty

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 UK

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 Rest of Asia Pacific

- 13. Rest of World MEMS Sensor in Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Infineon Technologies AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Robert Bosch GmbH*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Denso Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Sensata Technologies Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Delphi Automotive PLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Freescale Semiconductors Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 General Electric Co

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 STMicroelectronics NV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Analog Devices Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Panasonic Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Infineon Technologies AG

List of Figures

- Figure 1: MEMS Sensor in Automotive Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MEMS Sensor in Automotive Industry Share (%) by Company 2024

List of Tables

- Table 1: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: UK MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United States MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Germany MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: UK MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: China MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Japan MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: India MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific MEMS Sensor in Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: MEMS Sensor in Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEMS Sensor in Automotive Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the MEMS Sensor in Automotive Industry?

Key companies in the market include Infineon Technologies AG, Robert Bosch GmbH*List Not Exhaustive, Denso Corporation, Sensata Technologies Inc, Delphi Automotive PLC, Freescale Semiconductors Ltd, General Electric Co, STMicroelectronics NV, Analog Devices Inc, Panasonic Corporation.

3. What are the main segments of the MEMS Sensor in Automotive Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Passenger Safety and Security Regulations. and Increased Focus on Compliance; Increased Automation Features and Performance Improvements Preferred by Customers.

6. What are the notable trends driving market growth?

Gyroscope to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations.

8. Can you provide examples of recent developments in the market?

October 2022: MicroVision, Inc., a leader in MEMS-based solid-state automotive lidar and advanced driver-assistance systems (ADAS) solutions, announced that the MAVIN DR dynamic view lidar system is supported by the NVIDIA DRIVE AGX platform. In order to achieve superior highway pilot functionality with low latency and high performance, MicroVision's solution utilizes high-fidelity lidar sensors and unique perception software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEMS Sensor in Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEMS Sensor in Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEMS Sensor in Automotive Industry?

To stay informed about further developments, trends, and reports in the MEMS Sensor in Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence