Key Insights

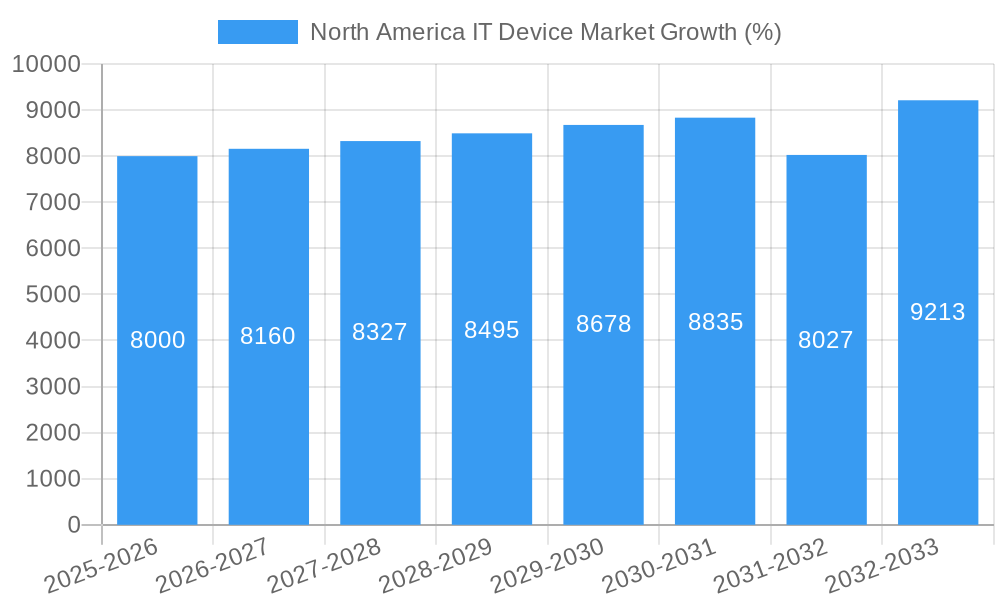

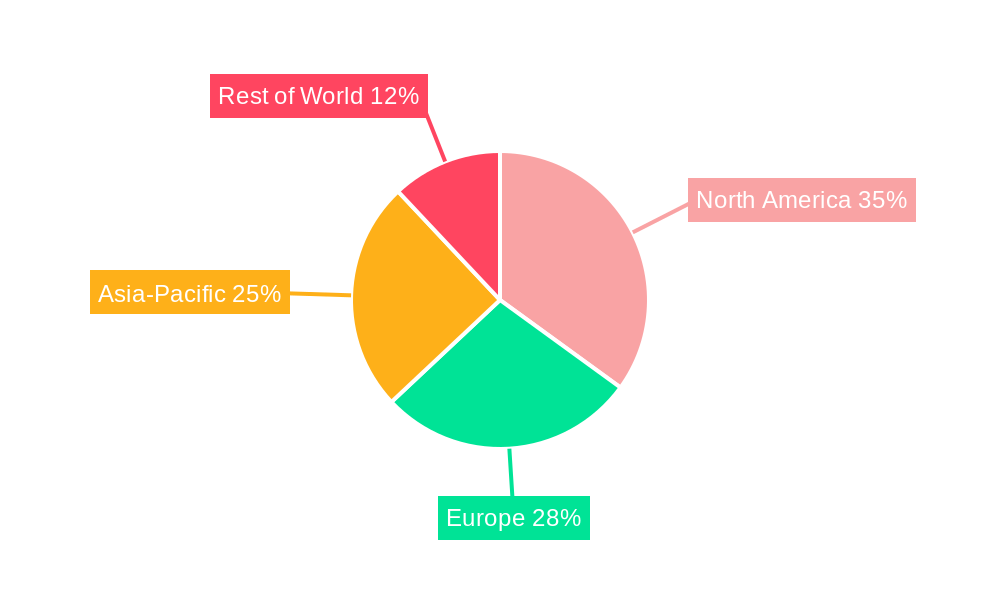

The North American IT device market, encompassing PCs, tablets, and phones, is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 1.60% from 2025 to 2033. This growth is driven by several factors. The increasing adoption of cloud computing and remote work models fuels demand for high-performance laptops and tablets, particularly in the United States, which constitutes the largest segment of the North American market. Furthermore, continuous technological advancements, including the release of improved processors and enhanced software, stimulate upgrades and replacement cycles. The strong presence of major technology companies like Apple, Microsoft, Dell, and Samsung within North America ensures a competitive landscape and fosters innovation. However, factors such as economic fluctuations and the potential for saturation in certain device segments could act as restraints on market expansion. The market is segmented by device type, with PCs retaining a significant market share due to their versatility in both professional and personal contexts. Tablets and smartphones are witnessing growth driven by increasing consumer demand for mobile computing and entertainment options. Mexico and Canada, while smaller than the US market, contribute to the overall North American growth, with Canada showing slightly higher growth due to its advanced technological infrastructure and higher per capita income.

The forecast period (2025-2033) suggests a continuation of the current growth trajectory, with a gradual increase in market value. Specific growth within segments will likely be influenced by pricing strategies, new product launches, and evolving consumer preferences. While the PC segment might experience moderate growth, the tablet and phone markets are poised for consistent, albeit potentially slower, expansion as the market matures. Technological innovations such as foldable devices and enhanced augmented/virtual reality capabilities will likely shape future growth, attracting a new wave of consumers and driving demand for more sophisticated and higher-priced devices. Competition among established giants and the emergence of innovative players will continue to define the North American IT device landscape, shaping the pricing and market share dynamics within this dynamic sector.

North America IT Device Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America IT device market, covering the period from 2019 to 2033. It delves into market dynamics, competitive landscapes, technological advancements, and future growth prospects, offering actionable insights for industry stakeholders. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides estimations for the estimated year (2025) and forecasts for the period 2025-2033. Market values are expressed in Millions.

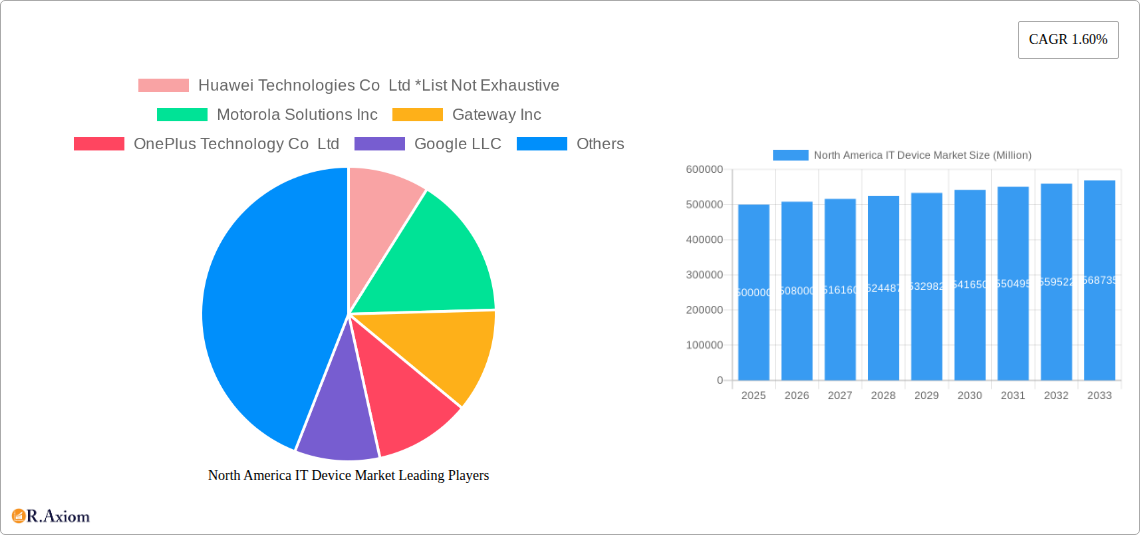

North America IT Device Market Concentration & Innovation

The North America IT device market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Apple, Samsung, and Dell consistently rank among the top players, though their precise market shares fluctuate yearly. Smaller players carve out niches through innovation and specialized offerings. The market is characterized by intense competition, driving continuous innovation in areas such as processing power, battery life, connectivity, and user experience. Regulatory frameworks, particularly concerning data privacy and cybersecurity, influence product development and market access. Product substitutes, such as cloud-based services, present both challenges and opportunities. End-user trends towards portability, increased functionality, and sustainability shape product design and marketing strategies. M&A activities are sporadic but significant, impacting market consolidation and technological advancements. Recent deals have involved valuations ranging from xx Million to xx Million, signifying consolidation in specific segments. For example, the acquisition of [Insert hypothetical company] by [Insert hypothetical acquirer] in 2024 resulted in a xx Million deal. This activity is expected to continue as larger companies seek to expand their market share and diversify their portfolios.

North America IT Device Market Industry Trends & Insights

The North America IT device market is experiencing robust growth, driven by several key factors. The CAGR for the period 2025-2033 is projected at xx%, significantly influenced by increased smartphone and tablet penetration, particularly in emerging markets. Technological disruptions, including the rise of 5G, advancements in artificial intelligence (AI), and the growth of the Internet of Things (IoT), are reshaping consumer preferences. Consumers are increasingly demanding devices with enhanced connectivity, powerful processors, and longer battery lives. The market witnesses a continuous evolution of operating systems, application ecosystems, and user interfaces, impacting consumer adoption and loyalty. Competitive dynamics are intense, with established players constantly vying for market share and new entrants challenging the status quo through innovative product offerings and aggressive pricing strategies. Market penetration of smartphones is predicted to reach xx% by 2033, while tablet penetration should stabilize around xx%. The market's growth is also fueled by the continuous evolution of business models, which is changing from ownership to subscription models, influencing user behavior and device lifecycle management.

Dominant Markets & Segments in North America IT Device Market

The United States remains the dominant market within North America, driven by strong economic growth, high consumer spending, and advanced technological infrastructure. However, Canada is also a significant market exhibiting strong growth.

By Type:

- PC's: The PC segment is witnessing a gradual decline in growth, as smartphones and tablets become more capable substitutes. However, high-performance gaming PCs and professional workstations continue to drive sales.

- Tablets: The tablet market has plateaued in recent years, with growth primarily driven by the increasing adoption of tablets for entertainment and educational purposes.

- Phones: The smartphone segment remains the fastest-growing segment within the IT device market, primarily fueled by technological innovations such as improved cameras and faster processors.

Key drivers for the dominance of the US market include:

- Robust economic growth and high disposable incomes.

- High consumer spending on electronics.

- Advanced technological infrastructure and high internet penetration.

- Favorable government policies promoting technological advancements.

North America IT Device Market Product Developments

Recent product innovations focus on enhancing user experience, improving performance, and integrating advanced technologies. For example, the introduction of foldable smartphones and improved battery technologies have significantly impacted the market. Key trends include increased use of AI, improved camera technology, and enhanced security features. This has resulted in many companies emphasizing product differentiation through unique design, premium materials, and enhanced software capabilities to create a competitive advantage in a crowded market.

Report Scope & Segmentation Analysis

This report segments the North America IT device market by type: PCs, tablets, and phones. Each segment is analyzed based on historical data, current market size, growth projections, and competitive dynamics. The PC segment is expected to witness a moderate growth, while the smartphone segment is projected to maintain its leading position with significant growth throughout the forecast period. The tablet segment is expected to experience relatively slower growth due to saturation in several markets.

Key Drivers of North America IT Device Market Growth

Several factors drive the growth of the North America IT device market:

- Technological advancements in processing power, connectivity, and user experience are constantly driving demand for newer and faster devices.

- Rising disposable incomes, particularly among younger demographics, fuel consumer demand for electronic devices.

- Government initiatives to promote digital inclusion and technological advancements contribute to market expansion.

Challenges in the North America IT Device Market Sector

The North America IT device market faces several challenges:

- Intense competition among established players and new entrants puts continuous pressure on margins and pricing strategies.

- Supply chain disruptions and component shortages can significantly impact production and availability, increasing costs.

- Stringent regulatory requirements regarding data privacy and cybersecurity impact product development and marketing.

Emerging Opportunities in North America IT Device Market

Several opportunities exist within the North America IT device market:

- Growth in the Internet of Things (IoT) opens up new opportunities for devices that connect to and control various aspects of the home, workplace, and personal life.

- Demand for high-performance devices in niche markets, such as gaming and professional applications, creates growth prospects for specialized products.

- The increasing adoption of cloud computing and mobile-first services is driving demand for enhanced mobile device capabilities and connectivity.

Leading Players in the North America IT Device Market Market

- Huawei Technologies Co Ltd

- Motorola Solutions Inc

- Gateway Inc

- OnePlus Technology Co Ltd

- Google LLC

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Xiaomi Corporation

- Dell Inc

- The International Business Machines Corporation (IBM)

- Intel Corp

- Oracle Corp

- Apple Inc

- LG Corporation

Key Developments in North America IT Device Market Industry

- November 2022: Apple launched a satellite-enabled SOS service in the US and Canada for iPhone 14 users, enhancing emergency response capabilities even without cellular coverage. This significantly improved user safety and device utility, potentially increasing iPhone sales.

- April 2022: Microsoft expanded its collaboration with MediaKind, aiming to streamline the digital video transition for content owners and broadcasters. This partnership enhances video streaming capabilities and cloud integration, influencing the market for devices supporting advanced video streaming.

Strategic Outlook for North America IT Device Market Market

The North America IT device market is poised for continued growth, driven by technological innovation, increasing consumer spending, and expanding application ecosystems. Emerging technologies like AI, 5G, and IoT present substantial growth opportunities. Companies must focus on innovation, strategic partnerships, and effective marketing to capture market share in this dynamic and competitive landscape. The market is expected to be further shaped by sustainability concerns, influencing the use of recycled materials and energy efficiency in device manufacturing.

North America IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

North America IT Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand for Smartphones; Signidicant 5G Coverage in the Region

- 3.3. Market Restrains

- 3.3.1. Shortage of Semiconductor (Chip)

- 3.4. Market Trends

- 3.4.1. Stellar Smart Phone Penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Motorola Solutions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gateway Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 OnePlus Technology Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Google LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lenovo Group Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Microsoft Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Xiaomi Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dell Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 The International Business Machines Corporation(IBM)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corp

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Oracle Corp

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Apple Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 LG Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: North America IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: North America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America IT Device Market?

The projected CAGR is approximately 1.60%.

2. Which companies are prominent players in the North America IT Device Market?

Key companies in the market include Huawei Technologies Co Ltd *List Not Exhaustive, Motorola Solutions Inc, Gateway Inc, OnePlus Technology Co Ltd, Google LLC, Lenovo Group Limited, Samsung Electronics Co Ltd, Microsoft Corporation, Xiaomi Corporation, Dell Inc, The International Business Machines Corporation(IBM), Intel Corp, Oracle Corp, Apple Inc, LG Corporation.

3. What are the main segments of the North America IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand for Smartphones; Signidicant 5G Coverage in the Region.

6. What are the notable trends driving market growth?

Stellar Smart Phone Penetration.

7. Are there any restraints impacting market growth?

Shortage of Semiconductor (Chip).

8. Can you provide examples of recent developments in the market?

November 2022: Apple, the leading telephone brand in the world, introduced a satellite-enabled SOS service in the United States and Canada. Only iPhone 14 owners may utilize the service, which enables the device to transmit SOS signals in an emergency from a distance even if cellular networks are not accessible.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America IT Device Market?

To stay informed about further developments, trends, and reports in the North America IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence