Key Insights

The North American strategic consulting market, encompassing the United States and Canada primarily, exhibits robust growth potential. Driven by increasing business complexity, the need for digital transformation, and a surge in regulatory changes across sectors like finance, healthcare, and retail, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This translates to significant market expansion, with substantial revenue generation anticipated throughout the forecast period. Key players, including Deloitte, McKinsey, Bain, and others, are well-positioned to capitalize on this growth through their extensive expertise in various industry verticals and a broad range of consulting services. The strong presence of major corporations in North America fuels the demand for strategic advice on issues like mergers and acquisitions, operational efficiency, and risk management. Furthermore, government initiatives focused on economic development and infrastructure projects create additional opportunities for strategic consulting firms.

While the market is experiencing positive momentum, certain factors could influence growth. Competition amongst established firms and emerging players remains intense. Fluctuations in the overall economic climate and the potential for reduced business investment in times of uncertainty can pose challenges. Nevertheless, the ongoing digital disruption and the persistent need for businesses to adapt to evolving market dynamics are expected to underpin consistent demand for strategic consulting services. The increasing adoption of data analytics and advanced technologies within consulting practices will further contribute to overall market expansion, allowing firms to deliver more efficient and impactful solutions to their clients. Growth will likely be concentrated in areas experiencing rapid technological change and increased regulatory scrutiny.

This in-depth report provides a comprehensive analysis of the North America strategic consulting industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including consulting firms, investors, and businesses seeking strategic guidance.

North America Strategic Consulting Industry Market Concentration & Innovation

The North America strategic consulting industry is characterized by a high degree of concentration, with a handful of multinational giants dominating the market. Deloitte Touche Tohmatsu Limited, Ernst & Young Global Limited, Accenture plc, PricewaterhouseCoopers International Limited, KPMG International Limited, Bain & Company, McKinsey & Company, The Boston Consulting Group, A.T. Kearney, and Roland Berger LLC collectively hold an estimated xx% market share in 2025. Market concentration is further amplified by frequent mergers and acquisitions (M&A) activity. Recent deals, such as the xx Million acquisition of Harwell Management by CGI in April 2022 and the acquisition of Boldr Strategic Consulting by Yes& in October 2021, demonstrate this trend. These acquisitions significantly impact market share and competitive dynamics. Innovation in the industry is driven by advancements in data analytics, AI, and digital transformation services. Regulatory frameworks, such as those related to data privacy and cybersecurity, significantly influence service offerings. The industry witnesses increasing competition from specialized niche players and technology providers offering substitute solutions. End-user trends, such as the growing demand for sustainable and ESG-focused consulting, shape service development. The average M&A deal value in the industry is estimated to be around xx Million in 2025.

- Market Share (2025): Top 10 firms hold approximately xx%

- Average M&A Deal Value (2025): xx Million

- Key Innovation Drivers: Data analytics, AI, digital transformation.

- Regulatory Influences: Data privacy, cybersecurity.

North America Strategic Consulting Industry Industry Trends & Insights

The North America strategic consulting industry is projected to experience significant growth during the forecast period (2025-2033), with a compound annual growth rate (CAGR) of xx%. This growth is fueled by several factors, including the increasing complexity of business environments, the rising adoption of digital technologies, and the growing need for data-driven decision-making. Technological disruptions, like the widespread adoption of cloud computing and AI, are transforming how strategic consulting services are delivered, leading to increased efficiency and improved analytical capabilities. Consumer preferences are shifting towards more agile and collaborative consulting models, demanding greater transparency and measurable results. Competitive dynamics are characterized by consolidation through M&A activity and increased competition from technology firms offering specialized consulting services. Market penetration of digital transformation consulting services is projected to reach xx% by 2033, showcasing the growing demand for these specialized services. The market growth is also influenced by factors such as increasing government spending on infrastructure projects and growing investments by private sector players in research and development.

Dominant Markets & Segments in North America Strategic Consulting Industry

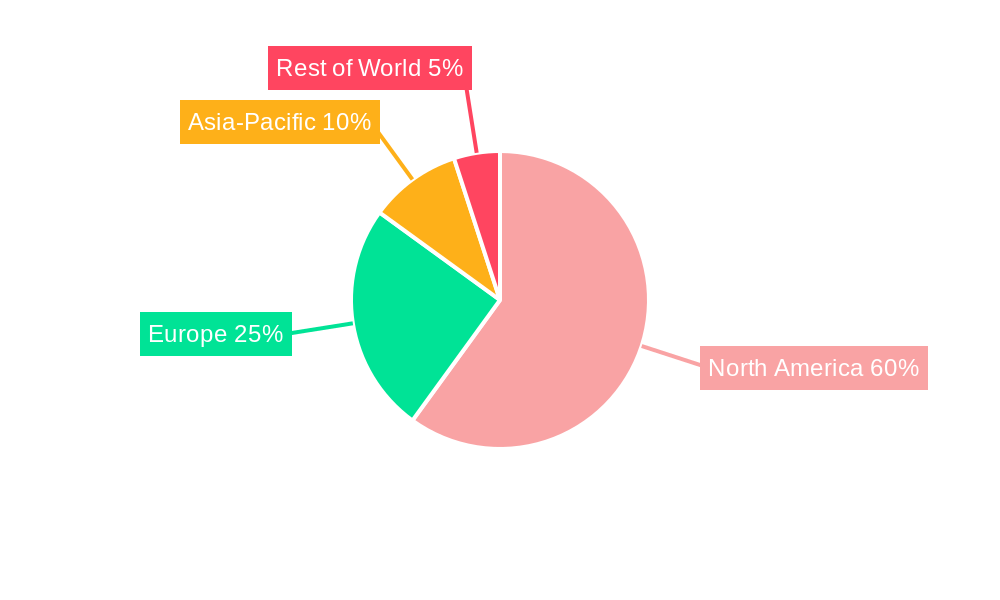

The United States constitutes the largest market for strategic consulting services in North America, driven by factors such as a large and diverse economy, a robust technology sector, and high levels of business investment. Canada represents a significant but smaller market, with considerable opportunities in sectors like natural resources and financial services. Within the end-user industries, Financial Services commands the largest segment due to the complexity of regulatory compliance, evolving market trends, and the constant need for strategic adaptation.

United States Dominance Drivers:

- Large and diverse economy

- High level of business investment

- Robust technology sector

- Favorable regulatory environment for business

Canada Market Drivers:

- Natural resources sector growth

- Financial services sector expansion

- Government initiatives for infrastructure development

Dominant End-User Industries:

- Financial Services: High regulatory pressure, digital transformation needs, and ongoing market volatility drive significant demand.

- Life Sciences and Healthcare: Complexity of R&D, regulatory compliance, and market dynamics creates a high demand for strategic guidance.

- Other End-User Industries: This diverse segment demonstrates consistent growth across various sectors, showing healthy demand for strategic consulting.

North America Strategic Consulting Industry Product Developments

Recent product innovations in the strategic consulting industry focus on integrating advanced analytics, AI, and machine learning capabilities into service offerings. This allows for data-driven insights and predictions, enabling more effective strategic decision-making for clients. The development of specialized industry-focused solutions and the expansion of digital transformation services enhance client value proposition and competitive advantage. This focus on technological trends and market fit is essential for retaining and acquiring clients in a dynamic market landscape.

Report Scope & Segmentation Analysis

This report segments the North America strategic consulting market by end-user industry (Financial Services, Life Sciences and Healthcare, Retail, Government, Energy, Other End-User Industries) and by country (United States, Canada). Each segment’s growth projections, market sizes, and competitive dynamics are comprehensively analyzed. The Financial Services sector is expected to witness the highest growth rate, driven by increasing regulatory changes and digital transformation initiatives. The Life Sciences and Healthcare sector’s growth is attributed to R&D investments and increasing focus on personalized medicine. The Retail sector exhibits moderate growth due to the need for efficient supply chain management and digital transformation. The Government sector experiences steady growth fueled by increased public sector spending on various development projects. The Energy sector's growth reflects increased focus on sustainability and renewable energy sources. The "Other End-User Industries" segment shows consistent growth across several diverse sectors.

Key Drivers of North America Strategic Consulting Industry Growth

The growth of the North America strategic consulting industry is primarily driven by technological advancements, economic factors, and regulatory changes. Technological advancements like AI and big data analytics are revolutionizing the industry, enabling more precise forecasts and data-driven decision-making. Economic growth and expansion in key sectors fuel demand for strategic guidance. Regulatory changes, such as increased compliance requirements, drive demand for specialized consulting services. The combination of these factors provides a strong foundation for sustained industry growth.

Challenges in the North America Strategic Consulting Industry Sector

The North America strategic consulting industry faces challenges such as intense competition from both established players and new entrants, high client acquisition costs, and talent acquisition and retention difficulties. Supply chain disruptions can impact project delivery timelines and costs. The industry also faces pressure to deliver measurable results and justify their fees in a price-sensitive market. These challenges, if not addressed effectively, could potentially impede industry growth in the future. The estimated negative impact of these challenges on annual revenue is approximately xx Million.

Emerging Opportunities in North America Strategic Consulting Industry

Emerging opportunities lie in specialized niche consulting areas, leveraging AI and data analytics for enhanced decision-making, and catering to the growing demand for sustainability and ESG (Environmental, Social, and Governance) consulting services. The increasing adoption of cloud computing and the rise of the metaverse also present new opportunities for consulting firms to provide guidance to clients navigating these evolving technologies. These emerging opportunities promise considerable potential for growth and market expansion.

Leading Players in the North America Strategic Consulting Industry Market

- Deloitte Touche Tohmatsu Limited

- Roland Berger LLC

- Bain & Company

- Ernst & Young Global Limited

- Accenture plc

- Marsh & McLennan Companies Inc

- PricewaterhouseCoopers International Limited

- KPMG International Limited

- The Boston Consulting Group

- McKinsey & Company

- A.T. Kearney

Key Developments in North America Strategic Consulting Industry Industry

- April 2022: CGI acquires Harwell Management, expanding its presence in the French financial services consulting market. This acquisition highlights the ongoing consolidation within the industry and the focus on strengthening expertise in specific sectors.

- October 2021: Yes& acquires Boldr Strategic Consulting, bolstering its digital capabilities and strategic consulting offerings. This illustrates the trend of larger firms acquiring smaller, specialized firms to enhance their service portfolios and expand their client base.

Strategic Outlook for North America Strategic Consulting Industry Market

The North America strategic consulting industry is poised for continued growth, driven by technological innovation, economic expansion, and evolving regulatory landscapes. Opportunities in specialized niches, leveraging AI and data analytics, and providing ESG consulting services will continue to shape industry dynamics. Companies that embrace technological advancements, develop specialized expertise, and provide measurable value to clients will be well-positioned for success in this competitive market. The long-term growth outlook remains positive, with projections indicating a sustained increase in market size and revenue generation over the forecast period.

North America Strategic Consulting Industry Segmentation

-

1. End-User Industry

- 1.1. Financial Services

- 1.2. Life Sciences and Healthcare

- 1.3. Retail

- 1.4. Government

- 1.5. Energy

- 1.6. Other End-User Industries

North America Strategic Consulting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Strategic Consulting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategy and Operations to Drive the market; SMEs to Exhibit a Strong Growth Rate

- 3.3. Market Restrains

- 3.3.1. Issues Related to Transformation and Integration of Processes by Organization

- 3.4. Market Trends

- 3.4.1. Healthcare Industry to drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Financial Services

- 5.1.2. Life Sciences and Healthcare

- 5.1.3. Retail

- 5.1.4. Government

- 5.1.5. Energy

- 5.1.6. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. United States North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Deloitte Touche Tohmatsu Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Roland Berger LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bain & Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ernst & Young Global Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Accenture plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Marsh & McLennan Companies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PricewaterhouseCoopers International Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KPMG International Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 The Boston Consulting Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 McKinsey & Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 A T Kearney

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: North America Strategic Consulting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Strategic Consulting Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Strategic Consulting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Strategic Consulting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Strategic Consulting Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: North America Strategic Consulting Industry Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Strategic Consulting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Strategic Consulting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: North America Strategic Consulting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North America Strategic Consulting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United States North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Canada North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Rest of North America North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of North America North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: North America Strategic Consulting Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 18: North America Strategic Consulting Industry Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 19: North America Strategic Consulting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: North America Strategic Consulting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United States North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Canada North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Mexico North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mexico North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Strategic Consulting Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Strategic Consulting Industry?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Roland Berger LLC, Bain & Company, Ernst & Young Global Limited, Accenture plc, Marsh & McLennan Companies Inc, PricewaterhouseCoopers International Limited, KPMG International Limited, The Boston Consulting Group, McKinsey & Company, A T Kearney.

3. What are the main segments of the North America Strategic Consulting Industry?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strategy and Operations to Drive the market; SMEs to Exhibit a Strong Growth Rate.

6. What are the notable trends driving market growth?

Healthcare Industry to drive the Market.

7. Are there any restraints impacting market growth?

Issues Related to Transformation and Integration of Processes by Organization.

8. Can you provide examples of recent developments in the market?

April 2022 - CGI disclosed that it had reached an agreement to purchase all of the shares of Harwell Management holding and its affiliates through its subsidiary CGI France SAS. A management consulting company called Harwell Management primarily serves the French market and has a focus on the financial services sector. With the help of about 150 consultants, Harwell Management helps major financial organizations, such as banks and insurers, define and carry out mission-driven strategies, abide by constantly changing rules, create competitive advantage, and promote the sustainable value and long-term growth. In order to support clients along the whole financial services value chain, the company anticipates a need for business and strategic IT consulting skills, regulatory know-how, and end-to-end creative digital services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Strategic Consulting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Strategic Consulting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Strategic Consulting Industry?

To stay informed about further developments, trends, and reports in the North America Strategic Consulting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence