Key Insights

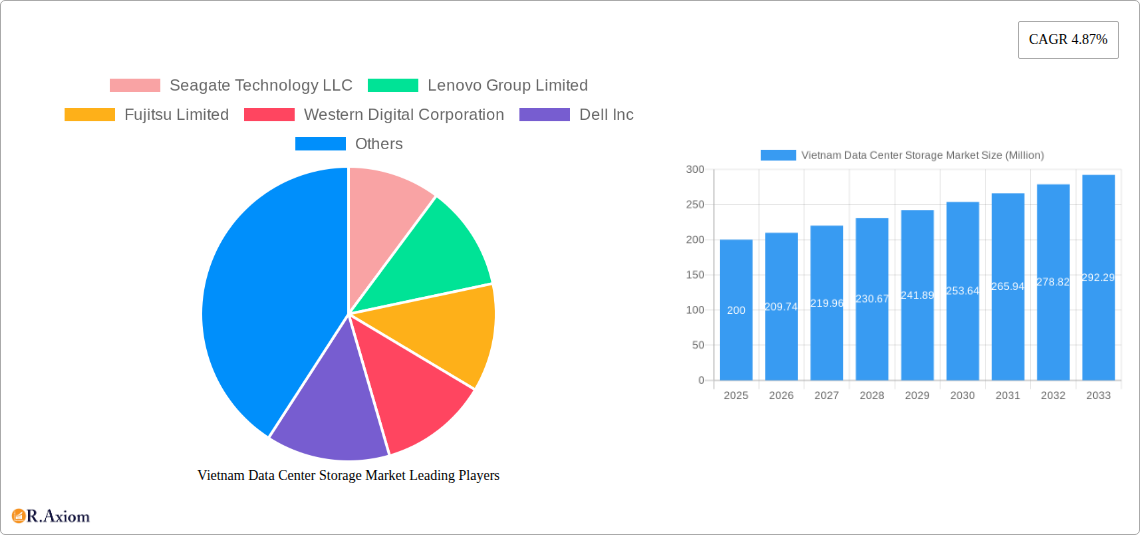

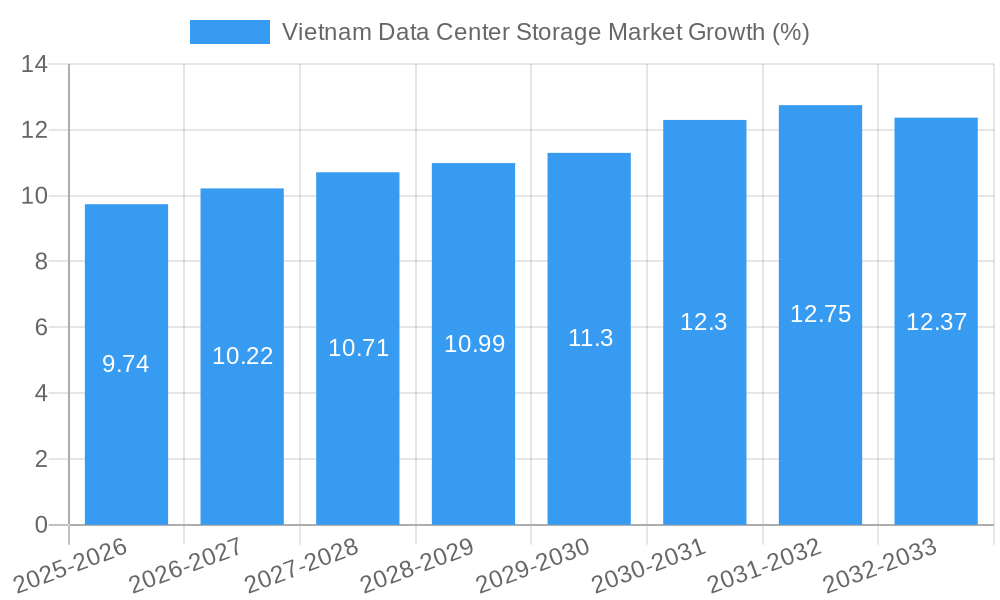

The Vietnam data center storage market, valued at $200 million in 2025, is projected to experience robust growth, driven by increasing digital transformation initiatives across various sectors and the rising adoption of cloud computing and big data analytics. The market's Compound Annual Growth Rate (CAGR) of 4.87% from 2025 to 2033 indicates a steady expansion, with anticipated market value exceeding $300 million by 2033. Key drivers include the government's investments in digital infrastructure, the burgeoning IT and telecommunications sector, and the growing need for secure and reliable data storage solutions across industries like BFSI (Banking, Financial Services, and Insurance) and Media & Entertainment. The increasing adoption of All-Flash storage solutions, offering faster speeds and improved performance compared to traditional storage, is a significant trend shaping the market. While challenges such as high initial investment costs for advanced storage technologies and cybersecurity concerns exist, the overall market outlook remains positive, fueled by the country's economic growth and expanding digital footprint. The market segmentation reveals that Network Attached Storage (NAS) and Storage Area Network (SAN) solutions hold substantial market share within the storage technology segment, while All-Flash storage is rapidly gaining traction within the storage type segment. Leading vendors like Seagate, Western Digital, and NetApp are well-positioned to capitalize on this growth, offering a range of solutions tailored to the specific needs of different end-user sectors.

The Vietnam data center storage market is expected to witness significant growth spurred by the increasing demand for data storage and management solutions within the country's expanding digital ecosystem. This growth is fueled by the expanding IT infrastructure, supportive government policies, and the rise of data-intensive applications across various industries. While the market is currently dominated by traditional storage technologies, the adoption of advanced technologies such as All-Flash storage is accelerating, offering benefits such as enhanced performance and efficiency. The competitive landscape is marked by the presence of both global and regional players, with companies continuously innovating to cater to evolving customer needs and providing comprehensive data storage solutions. The forecast period of 2025-2033 presents significant opportunities for market participants, particularly those focused on providing scalable, secure, and cost-effective solutions to meet the growing demands of the Vietnam data center market.

Vietnam Data Center Storage Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Vietnam data center storage market, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections, to offer a nuanced understanding of market dynamics. Key segments analyzed include Storage Technology (NAS, SAN, DAS, Other), Storage Type (Traditional, All-Flash, Hybrid), and End-User (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other). Leading players such as Seagate Technology LLC, Lenovo Group Limited, Fujitsu Limited, Western Digital Corporation, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Intel Corporation, Oracle Corporation, and Infortrend Technology Inc are thoroughly profiled. The report’s findings are presented across several key sections, offering granular insights and actionable recommendations.

Vietnam Data Center Storage Market Market Concentration & Innovation

The Vietnam data center storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is witnessing increasing competition from both domestic and international vendors. Innovation is a key driver, with companies continually investing in research and development to improve storage capacity, speed, and efficiency. The regulatory framework in Vietnam, while evolving, is generally supportive of technological advancements in the data center sector. Product substitutes, such as cloud storage solutions, are gaining traction, presenting both challenges and opportunities for traditional storage vendors. End-user trends indicate a growing preference for high-performance, scalable, and secure storage solutions. Mergers and acquisitions (M&A) activity in the sector is relatively modest; however, strategic partnerships are becoming more prevalent. The average M&A deal value in the recent past is estimated at approximately xx Million. Market share data reveals that the top three players collectively hold approximately xx% of the market. This concentration, however, is anticipated to decline slightly by 2033 as smaller players leverage innovation and partnerships to secure market positions.

Vietnam Data Center Storage Market Industry Trends & Insights

The Vietnam data center storage market is experiencing robust growth, driven by factors such as increasing data generation across various sectors, the rising adoption of cloud computing, and government initiatives promoting digital transformation. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, including the widespread adoption of all-flash storage and software-defined storage (SDS), are reshaping the market. Consumer preferences are shifting towards solutions that offer higher performance, improved security, and greater scalability. The competitive dynamics are marked by intense rivalry among established players and the emergence of new entrants offering innovative solutions. Market penetration of all-flash storage is projected to increase from xx% in 2025 to xx% by 2033. This trend reflects the growing demand for high-speed data access across various applications.

Dominant Markets & Segments in Vietnam Data Center Storage Market

Leading Region/Segment: The IT & Telecommunication sector currently dominates the market, representing approximately xx% of total revenue in 2025. This is primarily driven by the need for robust storage infrastructure to support the growing demand for data services and applications.

Key Drivers for IT & Telecommunication:

- Rapid growth of internet penetration and smartphone usage.

- Increasing adoption of cloud-based services.

- Government investments in digital infrastructure.

Storage Technology: Network Attached Storage (NAS) holds a significant market share, driven by its ease of use and cost-effectiveness, particularly for smaller businesses. However, the demand for high-performance storage solutions is fueling the growth of Storage Area Networks (SAN). Direct Attached Storage (DAS) remains relevant for specific applications requiring direct connectivity.

Storage Type: The market is witnessing a significant shift towards all-flash storage, driven by its superior performance and efficiency. However, hybrid storage continues to maintain a considerable share due to its cost-effectiveness. Traditional storage is gradually declining in market share.

Other End-Users: The BFSI and government sectors are also exhibiting strong growth, driven by the increasing need for secure and reliable data storage to support their critical operations.

Vietnam Data Center Storage Market Product Developments

Recent product innovations are focused on enhancing storage capacity, performance, and security. Companies are leveraging technologies such as NVMe (Non-Volatile Memory Express) and NVMe-oF (NVMe over Fabrics) to boost data transfer speeds. Software-defined storage solutions are gaining traction, offering greater flexibility and scalability. The focus is on developing solutions that meet the specific needs of various industries, incorporating features such as data encryption, deduplication, and compression to improve efficiency and security. This alignment with specific industry demands translates into a strong market fit for these innovative solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the Vietnam data center storage market by storage technology (NAS, SAN, DAS, Other), storage type (Traditional, All-Flash, Hybrid), and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the all-flash storage segment is anticipated to experience the fastest growth due to its superior performance capabilities, while the IT & Telecommunication sector is expected to remain the dominant end-user segment owing to increasing data traffic. The competitive landscape within each segment is analyzed, highlighting key players, their strategies, and market share.

Key Drivers of Vietnam Data Center Storage Market Growth

Several factors contribute to the growth of the Vietnam data center storage market. Firstly, the rapid expansion of the country's digital economy is driving the demand for robust storage solutions. Secondly, increasing government investments in digital infrastructure are creating favorable conditions for market expansion. Thirdly, technological advancements, such as the development of high-performance storage technologies, are enhancing the capabilities of data centers. Finally, the rising adoption of cloud computing and big data analytics is fueling the need for scalable and secure storage solutions.

Challenges in the Vietnam Data Center Storage Market Sector

The Vietnam data center storage market faces several challenges. High initial investment costs for advanced storage solutions can hinder adoption, particularly for smaller companies. Supply chain disruptions and geopolitical uncertainties can impact the availability of components and equipment. Competition from both domestic and international vendors is fierce, leading to price pressures. Furthermore, regulatory complexities surrounding data privacy and security can create compliance hurdles for companies. The combined effect of these factors could negatively impact market growth by an estimated xx% if not properly addressed.

Emerging Opportunities in Vietnam Data Center Storage Market

The growing adoption of edge computing presents a significant opportunity for data center storage providers. The increasing demand for AI and machine learning applications is driving the need for high-performance storage solutions. The government's focus on digital transformation initiatives presents considerable opportunities for companies specializing in secure and scalable storage solutions. Furthermore, the development of new technologies such as hyperconverged infrastructure (HCI) and containerization presents exciting opportunities for growth.

Leading Players in the Vietnam Data Center Storage Market Market

- Seagate Technology LLC (Seagate Technology LLC)

- Lenovo Group Limited (Lenovo Group Limited)

- Fujitsu Limited (Fujitsu Limited)

- Western Digital Corporation (Western Digital Corporation)

- Dell Inc (Dell Inc)

- NetApp Inc (NetApp Inc)

- Kingston Technology Company Inc (Kingston Technology Company Inc)

- Intel Corporation (Intel Corporation)

- Oracle Corporation (Oracle Corporation)

- Infortrend Technology Inc (Infortrend Technology Inc)

Key Developments in Vietnam Data Center Storage Market Industry

August 2023: Lenovo unveiled the Lenovo ThinkSystem D4390 Direct, featuring storage expansion capabilities enriched with powerful 24Gbps SAS direct-attached drives. This launch enhances Lenovo's position in the high-capacity application storage market.

October 2023: Dell Technologies enhanced its PowerFlex software-defined infrastructure platform. This upgrade improves the platform’s flexibility and management capabilities, strengthening Dell's competitiveness in the SDS market.

Strategic Outlook for Vietnam Data Center Storage Market Market

The Vietnam data center storage market is poised for continued growth, driven by increasing data volumes, technological advancements, and government initiatives. Opportunities exist for companies that can offer innovative, secure, and scalable solutions tailored to the specific needs of various industries. The focus on digital transformation, coupled with the rising adoption of cloud computing and big data analytics, will further propel market expansion. Companies that can adapt to evolving technological trends and effectively address the challenges of market competition will be best positioned for success.

Vietnam Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-Users

Vietnam Data Center Storage Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost To Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Seagate Technology LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Western Digital Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NetApp Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Infortrend Technology Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology LLC

List of Figures

- Figure 1: Vietnam Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Vietnam Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Vietnam Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 8: Vietnam Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 9: Vietnam Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Vietnam Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Storage Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Vietnam Data Center Storage Market?

Key companies in the market include Seagate Technology LLC, Lenovo Group Limited, Fujitsu Limited, Western Digital Corporation, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Intel Corporation, Oracle Corporation, Infortrend Technology Inc.

3. What are the main segments of the Vietnam Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.2 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment Cost To Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Lenovo unveiled the Lenovo ThinkSystem D4390 Direct, featuring storage expansion capabilities enriched with powerful 24Gbps SAS direct-attached drives. This design is crafted to offer density, speed, scalability, security, and high availability for high-capacity applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence