Key Insights

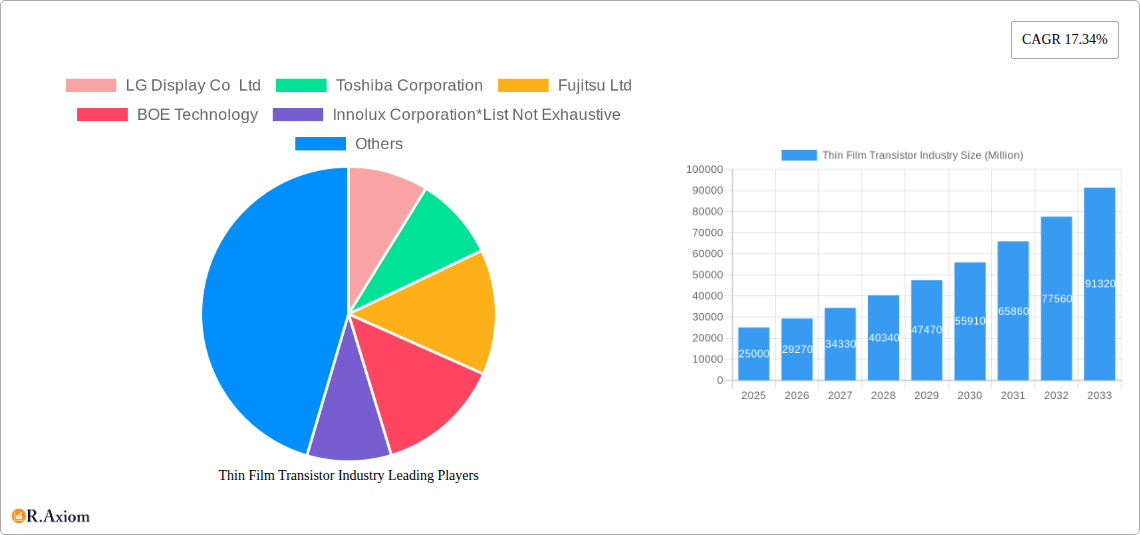

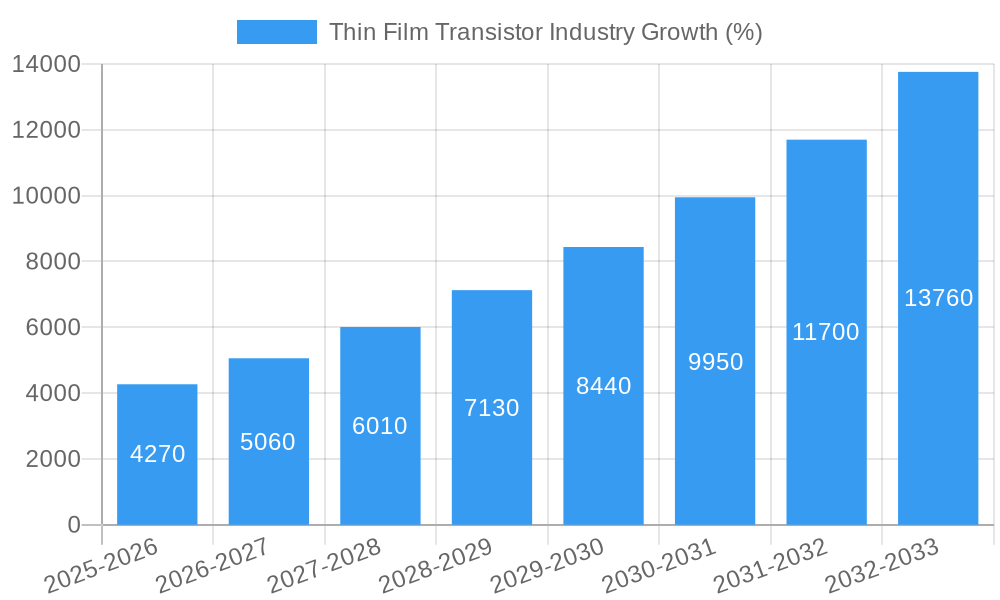

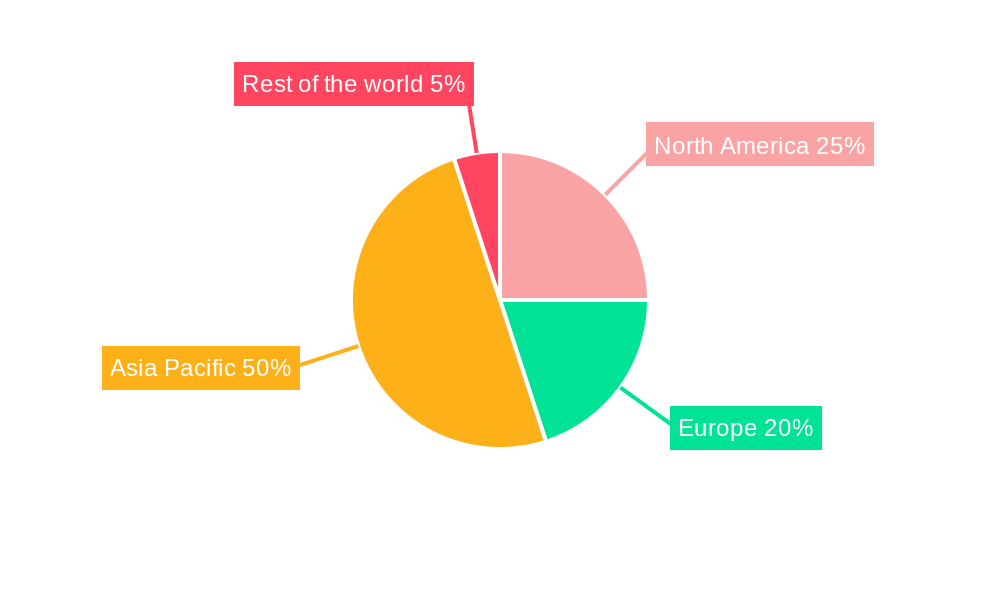

The Thin Film Transistor (TFT) market is experiencing robust growth, projected to reach a substantial size by 2033. A compound annual growth rate (CAGR) of 17.34% from 2019 to 2024 suggests a significant expansion driven by several key factors. The increasing demand for high-resolution displays in consumer electronics, particularly smartphones and tablets, is a major contributor. The automotive sector's adoption of advanced driver-assistance systems (ADAS) and in-car entertainment systems is also fueling demand for TFTs. Furthermore, the growth of the healthcare industry, with its increasing reliance on medical imaging and diagnostic equipment incorporating TFT technology, is another significant driver. The market segmentation reveals a strong preference for organic TFTs due to their flexibility and potential for cost reduction, while AMOLED displays are gaining traction due to their superior image quality and power efficiency. The Asia-Pacific region, owing to its large manufacturing base and substantial consumer electronics market, holds a significant market share, though North America and Europe also contribute substantially. While some restraints, like the cost of manufacturing advanced TFTs and the potential for supply chain disruptions, exist, the overall market outlook remains positive.

The forecast period (2025-2033) anticipates continued growth, driven by the ongoing technological advancements in display technology and the expansion of applications across various sectors. Innovations such as flexible displays and transparent TFTs are opening up new avenues for growth. Competition among key players like LG Display, Samsung, BOE Technology, and others, will likely intensify, leading to ongoing price reductions and product innovations. The continued development of high-resolution displays and the increasing integration of TFTs into various devices are expected to further propel market expansion throughout the forecast period. The strategic focus on improving energy efficiency and reducing the environmental impact of TFT manufacturing is also becoming increasingly important.

Thin Film Transistor (TFT) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Thin Film Transistor (TFT) industry, offering invaluable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The base year for this analysis is 2025. Market values are expressed in Millions.

Thin Film Transistor Industry Market Concentration & Innovation

The TFT industry is characterized by a moderately concentrated market structure with a few dominant players holding significant market share. While precise market share figures fluctuate year to year, companies like Samsung Corporation, LG Display Co Ltd, and BOE Technology consistently rank among the leading manufacturers, collectively accounting for an estimated xx% of the global market in 2025. This concentration is driven by substantial investments in R&D and manufacturing capabilities.

Innovation in TFT technology is fueled by the constant demand for improved display performance and efficiency in various applications. Key innovation drivers include advancements in materials science (e.g., development of flexible and transparent TFTs), integration of new functionalities (e.g., touch-sensitive displays), and the pursuit of higher resolutions and lower power consumption. The regulatory landscape, particularly concerning environmental regulations and material sourcing, also influences innovation trajectories. Product substitutes, such as microLED and OLED technologies, present a competitive challenge, necessitating continuous advancements in TFT technology to maintain market relevance. The industry witnesses consistent mergers and acquisitions (M&A) activity, with deal values averaging approximately xx Million annually over the past five years, reflecting strategic efforts to expand market presence and gain access to cutting-edge technologies.

- Key Metrics:

- Estimated market concentration (top 3 players): xx% in 2025

- Average annual M&A deal value: xx Million (2019-2024)

- R&D expenditure as a percentage of revenue: xx% (industry average)

Thin Film Transistor Industry Industry Trends & Insights

The global TFT market is experiencing robust growth, driven primarily by the expanding demand for high-quality displays across various end-user industries. The increasing adoption of smartphones, tablets, laptops, and large-screen TVs fuels substantial growth in the consumer electronics segment. The automotive industry also contributes significantly, with the increasing integration of TFT-based displays in instrument panels, infotainment systems, and head-up displays. The Compound Annual Growth Rate (CAGR) for the global TFT market is projected to be xx% during the forecast period (2025-2033). Market penetration in emerging economies is a key growth driver, as affordability increases and consumer demand for advanced electronics rises.

Technological disruptions, particularly the rise of flexible and foldable displays, are reshaping the competitive landscape. Consumer preferences are increasingly shifting towards larger, higher-resolution, and more energy-efficient displays, demanding continuous innovation and product upgrades from manufacturers. Competitive dynamics are intense, with manufacturers vying for market share through product differentiation, price competitiveness, and strategic partnerships.

Dominant Markets & Segments in Thin Film Transistor Industry

The Asia-Pacific region dominates the global TFT market, driven by robust manufacturing capabilities, a large consumer base, and supportive government policies promoting technological advancement. Within this region, countries like China, South Korea, and Japan are key players.

- By Fabrication Type: Inorganic TFTs currently hold the larger market share, but the organic TFT segment is experiencing faster growth due to its flexibility and cost-effectiveness.

- By Product Type: Liquid Crystal Displays (LCDs) remain the dominant product type, primarily due to their established market presence and cost-effectiveness. However, AMOLED and other advanced display technologies are witnessing increasing adoption.

- By End-user Industry: Consumer electronics is the largest end-user segment, followed by the automotive industry, which is experiencing rapid growth due to the increasing demand for advanced driver-assistance systems and in-car entertainment.

Key Drivers:

- Asia-Pacific: Strong manufacturing base, large consumer market, government support for technological advancement.

- Consumer Electronics: Rising disposable incomes, increasing demand for high-quality displays.

- Automotive: Growing adoption of advanced driver-assistance systems and in-car infotainment systems.

Thin Film Transistor Industry Product Developments

Recent product innovations focus on enhancing display performance, flexibility, and energy efficiency. Advancements in materials science have led to the development of flexible and transparent TFTs, enabling the creation of novel display designs and applications. Integration of touch-sensitive functionality and improved color reproduction are key areas of focus. These developments cater to evolving consumer preferences and open up new application possibilities across various sectors. The market fit of these innovations is largely determined by factors like cost, performance, and compatibility with existing technologies.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the TFT market across various parameters:

- By Fabrication Type: The report analyzes the market size, growth projections, and competitive dynamics of both organic and inorganic TFT technologies.

- By Product Type: The analysis encompasses LCDs, LEDs, Electronic Paper Displays (EPDs), and AMOLEDs, evaluating their market shares and future growth prospects.

- By End-user Industry: The report examines market segments based on applications across consumer electronics, automotive, BFSI, industrial, healthcare, and other end-user sectors. Each segment's growth trajectory and competitive landscape are detailed.

Key Drivers of Thin Film Transistor Industry Growth

The TFT industry’s growth is fueled by several key factors: the proliferation of smartphones and other smart devices, increasing demand for high-resolution displays in various applications (automotive, healthcare), advancements in materials science leading to more energy-efficient and flexible displays, and government initiatives promoting technological innovation and digitalization in different sectors. Economies of scale in manufacturing also contribute to cost reduction, thereby driving market expansion.

Challenges in the Thin Film Transistor Industry Sector

The TFT industry faces several challenges, including the intensifying competition from emerging display technologies (OLED, MicroLED), dependence on specific raw materials and their associated supply chain vulnerabilities (leading to price fluctuations), and stringent environmental regulations impacting manufacturing processes. These factors can significantly constrain market growth if not appropriately managed.

Emerging Opportunities in Thin Film Transistor Industry

Significant growth opportunities exist in the development of flexible and foldable displays, the integration of advanced functionalities like bio-sensing capabilities, and expansion into new applications in areas like augmented reality (AR) and virtual reality (VR). Further penetration into developing economies and the continued advancement of energy-efficient backplanes will also unlock significant future opportunities.

Leading Players in the Thin Film Transistor Industry Market

- LG Display Co Ltd

- Toshiba Corporation

- Fujitsu Ltd

- BOE Technology

- Innolux Corporation

- Winstar Display Co Ltd

- Sharp Corporation

- Samsung Corporation

- Panasonic Corporation

- Sony Corporation

Key Developments in Thin Film Transistor Industry Industry

- 2022 Q4: Samsung announced a new generation of AMOLED displays with improved power efficiency.

- 2023 Q1: BOE Technology invested xx Million in expanding its TFT production capacity.

- 2023 Q3: LG Display partnered with a leading automotive manufacturer to develop advanced displays for next-generation vehicles. (Further details of specific developments with dates will be included in the full report)

Strategic Outlook for Thin Film Transistor Industry Market

The TFT industry is poised for sustained growth, driven by ongoing technological advancements and expanding applications across various sectors. The development of flexible and transparent TFTs presents substantial opportunities, while continued innovation in materials science and manufacturing processes will be crucial for maintaining competitiveness and capturing market share. Strategic partnerships and collaborations will also play a significant role in shaping future market dynamics.

Thin Film Transistor Industry Segmentation

-

1. Fabrication Type

- 1.1. Organic

- 1.2. Inorganic

-

2. Product Type

- 2.1. Liquid Crystal Display

- 2.2. Light Emitting Diode

- 2.3. Electronic Paper Display

- 2.4. AMOLED

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. BFSI

- 3.4. Industrial

- 3.5. Healthcare

- 3.6. Other End-user Industries

Thin Film Transistor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the world

Thin Film Transistor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Demand for Liquid Crystal Displays; Innovation in TFT Technology

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Manufacturing

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Expected to Have Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 5.1.1. Organic

- 5.1.2. Inorganic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Liquid Crystal Display

- 5.2.2. Light Emitting Diode

- 5.2.3. Electronic Paper Display

- 5.2.4. AMOLED

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. BFSI

- 5.3.4. Industrial

- 5.3.5. Healthcare

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the world

- 5.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 6. North America Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 6.1.1. Organic

- 6.1.2. Inorganic

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Liquid Crystal Display

- 6.2.2. Light Emitting Diode

- 6.2.3. Electronic Paper Display

- 6.2.4. AMOLED

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Consumer Electronics

- 6.3.2. Automotive

- 6.3.3. BFSI

- 6.3.4. Industrial

- 6.3.5. Healthcare

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 7. Europe Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 7.1.1. Organic

- 7.1.2. Inorganic

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Liquid Crystal Display

- 7.2.2. Light Emitting Diode

- 7.2.3. Electronic Paper Display

- 7.2.4. AMOLED

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Consumer Electronics

- 7.3.2. Automotive

- 7.3.3. BFSI

- 7.3.4. Industrial

- 7.3.5. Healthcare

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 8. Asia Pacific Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 8.1.1. Organic

- 8.1.2. Inorganic

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Liquid Crystal Display

- 8.2.2. Light Emitting Diode

- 8.2.3. Electronic Paper Display

- 8.2.4. AMOLED

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Consumer Electronics

- 8.3.2. Automotive

- 8.3.3. BFSI

- 8.3.4. Industrial

- 8.3.5. Healthcare

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 9. Rest of the world Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 9.1.1. Organic

- 9.1.2. Inorganic

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Liquid Crystal Display

- 9.2.2. Light Emitting Diode

- 9.2.3. Electronic Paper Display

- 9.2.4. AMOLED

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Consumer Electronics

- 9.3.2. Automotive

- 9.3.3. BFSI

- 9.3.4. Industrial

- 9.3.5. Healthcare

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Fabrication Type

- 10. North America Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the world Thin Film Transistor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 LG Display Co Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Toshiba Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Fujitsu Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 BOE Technology

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Innolux Corporation*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Winstar Display Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Sharp Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Samsung Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Panasonic Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Sony Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 LG Display Co Ltd

List of Figures

- Figure 1: Global Thin Film Transistor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the world Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the world Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Thin Film Transistor Industry Revenue (Million), by Fabrication Type 2024 & 2032

- Figure 11: North America Thin Film Transistor Industry Revenue Share (%), by Fabrication Type 2024 & 2032

- Figure 12: North America Thin Film Transistor Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Thin Film Transistor Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Thin Film Transistor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Thin Film Transistor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Thin Film Transistor Industry Revenue (Million), by Fabrication Type 2024 & 2032

- Figure 19: Europe Thin Film Transistor Industry Revenue Share (%), by Fabrication Type 2024 & 2032

- Figure 20: Europe Thin Film Transistor Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe Thin Film Transistor Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe Thin Film Transistor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe Thin Film Transistor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thin Film Transistor Industry Revenue (Million), by Fabrication Type 2024 & 2032

- Figure 27: Asia Pacific Thin Film Transistor Industry Revenue Share (%), by Fabrication Type 2024 & 2032

- Figure 28: Asia Pacific Thin Film Transistor Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Thin Film Transistor Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Thin Film Transistor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Asia Pacific Thin Film Transistor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Asia Pacific Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the world Thin Film Transistor Industry Revenue (Million), by Fabrication Type 2024 & 2032

- Figure 35: Rest of the world Thin Film Transistor Industry Revenue Share (%), by Fabrication Type 2024 & 2032

- Figure 36: Rest of the world Thin Film Transistor Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Rest of the world Thin Film Transistor Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Rest of the world Thin Film Transistor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Rest of the world Thin Film Transistor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Rest of the world Thin Film Transistor Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the world Thin Film Transistor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thin Film Transistor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Thin Film Transistor Industry Revenue Million Forecast, by Fabrication Type 2019 & 2032

- Table 3: Global Thin Film Transistor Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Thin Film Transistor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Thin Film Transistor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Thin Film Transistor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Thin Film Transistor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Thin Film Transistor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Thin Film Transistor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Thin Film Transistor Industry Revenue Million Forecast, by Fabrication Type 2019 & 2032

- Table 15: Global Thin Film Transistor Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Thin Film Transistor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Thin Film Transistor Industry Revenue Million Forecast, by Fabrication Type 2019 & 2032

- Table 19: Global Thin Film Transistor Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global Thin Film Transistor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Thin Film Transistor Industry Revenue Million Forecast, by Fabrication Type 2019 & 2032

- Table 23: Global Thin Film Transistor Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Global Thin Film Transistor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 25: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Thin Film Transistor Industry Revenue Million Forecast, by Fabrication Type 2019 & 2032

- Table 27: Global Thin Film Transistor Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Thin Film Transistor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Thin Film Transistor Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Film Transistor Industry?

The projected CAGR is approximately 17.34%.

2. Which companies are prominent players in the Thin Film Transistor Industry?

Key companies in the market include LG Display Co Ltd, Toshiba Corporation, Fujitsu Ltd, BOE Technology, Innolux Corporation*List Not Exhaustive, Winstar Display Co Ltd, Sharp Corporation, Samsung Corporation, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Thin Film Transistor Industry?

The market segments include Fabrication Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Demand for Liquid Crystal Displays; Innovation in TFT Technology.

6. What are the notable trends driving market growth?

Consumer Electronics Expected to Have Significant Growth.

7. Are there any restraints impacting market growth?

; High Cost of Manufacturing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Film Transistor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Film Transistor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Film Transistor Industry?

To stay informed about further developments, trends, and reports in the Thin Film Transistor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence